Here’s a lesson I learned about revenue forecasting the hard way: You can’t fix a broken revenue model with more Excel tricks.

You need better inputs, smarter systems, and live data. And all of this is possible with the right revenue forecasting software. But the tricky part is finding one that actually works without adding more work.

I’ve tested plenty. Most were either too rigid or folded under real-world complexity. This blog covers the tools that actually held up: The ones that made forecasting feel realistic.

How do we analyze these revenue forecasting tools?

After conducting thorough research and evaluation, we have compiled a list of the top revenue forecasting software.

We considered factors like user experiences, ratings, and reviews from platforms such as G2, Capterra, TrustPilot, Gartner, and TrustRadius. Additionally, we analyzed these tools based on their automation capabilities, costs, scalability, integrations, and other features.

So, this list is designed for business owners and individuals looking to ace their revenue forecasting.

Spreadsheets vs. revenue forecasting software

We’ve been forecasting revenue in spreadsheets for years. While they get the job done, they’re slow, fragile, and one formula away from total chaos.

Meanwhile, revenue and sales forecasting software like Upmetrics offer smarter features, faster results, and models that actually hold up when things change. So, is it time to move on from spreadsheets?

See and decide it for yourself:

| Feature | Spreadsheets | Revenue forecasting software |

|---|---|---|

| Data handling | Manual data entry, scattered files | Auto-syncs with live data from multiple sources |

| Forecast accuracy | Based on fixed inputs and assumptions | Adjusts dynamically using past trends and real data |

| Speed | Slower to update, needs constant manual effort | Real-time updates, faster to build and revise |

| Scenario planning | Needs separate versions for each scenario | Built-in tools for quick simulations and comparisons |

| Error risk | High, as one wrong formula can break the model | Low, as logic is built-in, fewer manual steps |

Say goodbye to old-school excel sheets & templates

Make accurate revenue forecasts using AI

Plans starting from $14/month

Now, onto the tools that actually make budgeting easier.

10 Top revenue forecasting tools for small businesses

Small businesses need tools that are quick to learn, easy to trust, and flexible enough to grow with them. These ten fit the bill.

Warning: Most tools promise “AI-powered predictions” but struggle with seasonality shifts or market changes. Test with your actual messy data, not their clean demos.

- Upmetrics: AI-powered financial forecasting and business planning tool

- Clari: Sales-focused revenue forecasting platform

- Forecastia: Simple forecasting tool

- QuickBooks: Small business accounting

- Fathom: Visual financial analysis and forecasting

- Vena Solutions Inc: Enterprise-grade forecasting and FP&A platform

- Planful: End-to-end financial planning software

- Float: Cash flow forecasting tool

- Anaplan: Connected planning platform

- Causal: Collaborative modeling tool

1. Upmetrics

Upmetrics is a renowned business and financial planning tool, best known for its AI-powered business tools and resources.

Since this comparison focuses on revenue and sales forecasting tools, we’ll look specifically at its revenue and sales forecasting features rather than its full business planning suite.

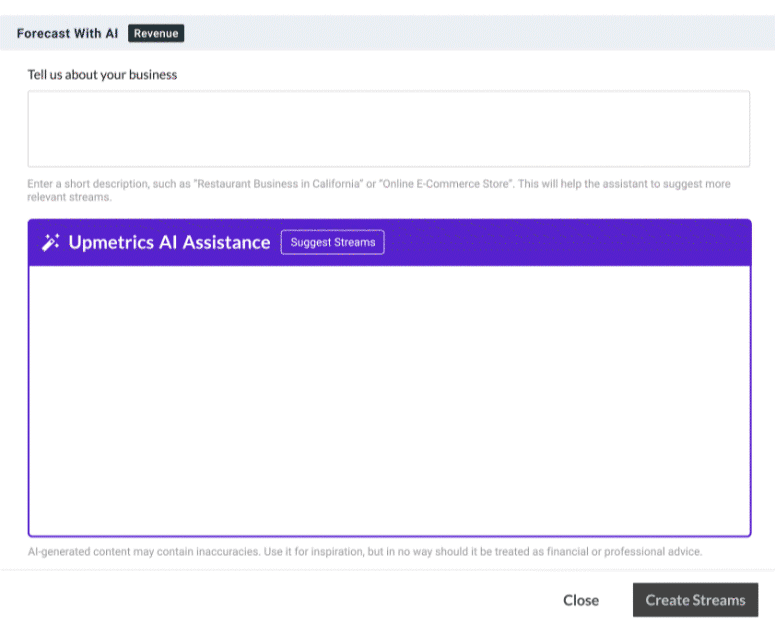

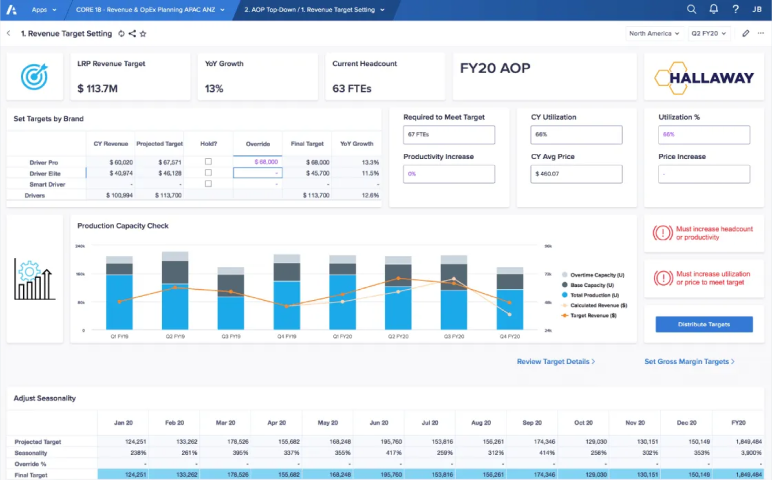

Upmetrics offers an automated, AI-assisted financial forecasting tool. Upon the basic workspace set up, you can directly start working on your forecasts.

AI forecasting assist helps you with revenue/expense stream suggestions, which you can further use to build your projections. With the built-in formulas, all you do is—simply add the numbers—and see your reports coming through.

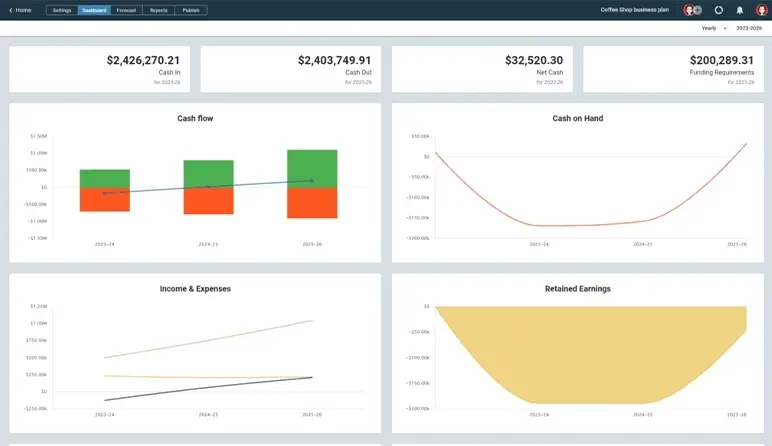

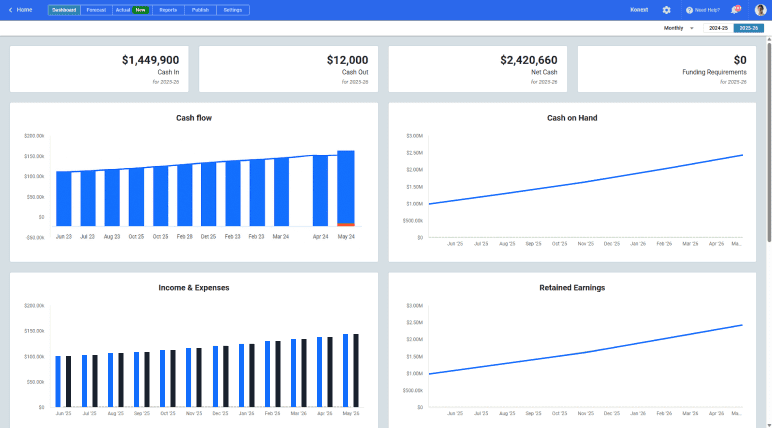

Once you’re done adding numbers, you can see your financial statements generated in the reports tab, whereas visual reports under visual dashboard.

The features I didn’t talk about, but worth a mention include plan vs. actual analysis, scenario planning, integrated financial reports and more.

All in all, it’s a great tool for revenue forecasting as well as financial planning and reporting.

Best features

Checklist

- AI-powered revenue & expense stream suggestions,

- Financial forecasting and modeling for up to 10 years

- Visual sales dashboard

- Comparison of actual vs forecast sales

- Scenario planning and growth simulations

- Profitability analysis

- Built-in Upmetrics AI assistant for real-time help

- AI-powered business plan generator

Pricing

| Premium | Professional |

|---|---|

| $14/ month | $37/ month |

The Upmetrics business plan tool stands out from the rest. Its financial forecasts are unmatched, offering detailed reports on profit, loss, earnings, and breakeven points. User-friendly with clear, impactful graphics, it adapts to any company.

2. Clari

Clari is a revenue forecasting platform that’s sales-centric and provides real-time visibility of your pipeline and predicts revenue outcomes with a surprising degree of accuracy. It integrates with your CRM, email, and calendar tools to monitor deal progress, spot risks, and fine-tune forecasts with live data and AI.

For teams where revenue forecasting starts and ends with the sales pipeline, Clari offers one of the most intuitive views of what’s likely to close and when. You can build custom roll-ups, compare rep-level projections, and monitor forecast trends across quarters.

But your revenue comes from more than just sales (like subscriptions, services, or long-term contracts); Clari may feel a bit narrow as it’s not built for modeling non-sales revenue sources.

Best features

- AI-based sales forecasting and pipeline tracking

- Live CRM integrations (Salesforce, HubSpot)

- Quota and rep performance insights

- Scenario planning and forecast comparisons

- Forecast collaboration tools for sales leaders

Limitations

- Less flexible for full financial modeling

- Interface can be overwhelming for smaller teams

- No public pricing available

Pricing

Clari doesn’t list prices on its site. You’ll need to contact their sales team for a custom quote.

Rating

- G2: 4.6

- TrustRadius: 8.8

- Gartner: 4.7

3. Forecastia

Forecastia is designed for startups that want a fast way to build revenue forecasts. It offers a step-by-step flow that simplifies the process of mapping out revenue, expenses, and growth assumptions without getting bogged down in spreadsheets.

The interface is clean and beginner-friendly, which makes it a great pick for solo founders or small teams in the early stages. It helps users stay focused on the big picture without overwhelming them with too many features at once.

The tool also offers report exports for investor decks and pitch presentations, ideal for startup users who want quick output over granular control.

For those who just need a fast, structured starting point, Forecastia hits the mark.

Best features

- Guided forecast builder for startups

- Clean, clutter-free dashboards

- Basic revenue and expense planning

- Report exports for fundraising use

- Free plan available

Limitations

- Works best for simple-to-moderate models

- Scenario planning and financial documentation support is limited

- May need to be paired with another tool for business planning or pitch writing

Pricing

Forecastia is currently in early access.

Rating

- G2: NA

- TrustRadius: NA

- Gartner: NA

4. Quickbooks

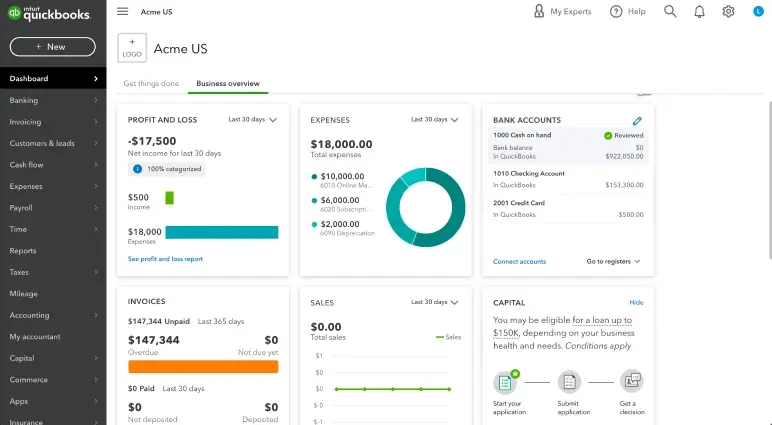

Quickbooks is one of the most widely used accounting software, and even though it’s widely used for bookkeeping purposes, it also supports simple revenue forecasting.

You can establish monthly or yearly revenue targets, base assumptions on historical data, and align them all with invoicing and banking activity.

Although the forecasting functionality is simple, it is adequate for small businesses seeking to keep tabs on short-term income projections without getting into advanced models.

QuickBooks is also compatible with a wide variety of third-party programs. For longer-term planning or more complex forecasting, users generally use it in conjunction with programs specifically created for financial modeling.

However, it’s not equipped for scenario planning or AI-driven planning, so there are boundaries to how much you can do with your forecasts using the tool itself.

Best features

- Integration with existing accounting data

- Basic budgeting and forecasting tools

- Revenue tracking and reporting

- Wide range of third-party integrations

Limitations

- Forecasting features are basic compared to specialized tools

- Limited scenario modeling capabilities

- Requires additional tools for complex forecasting needs

Pricing

- Simple Start: $1.90/month (1 user + your accountant)

- Essentials: $2.80/month (3 users + your accountant)

- Plus: $4/month (5 users + your accountant)

- Advanced: $38/month (up to 25 users)

Rating

- G2: 4.0

- TrustRadius: 8.3

- Gartner: 4.1

5. Fathom

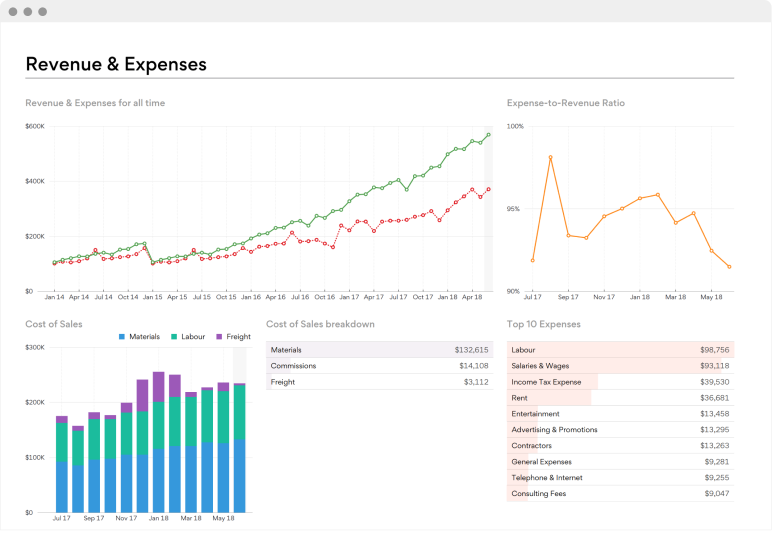

Fathom is a forecasting and reporting software designed for companies that desire clarity in their numbers. It links directly with your accounting program and converts raw data into live visual forecasts, allowing teams to have a better understanding of where their revenue is going.

One of its strongest points is driver-based forecasting. You can establish revenue goals, construct growth scenarios, adjust key inputs, and view their effects instantly on future revenues.

Fathom’s forecasting is visual and flexible, so sharing revenue plans with stakeholders or tracking against KPIs is easier. Fathom also supports multi-scenario planning, which enables you to compare best-case and worst-case revenue scenarios without having to construct discrete models from scratch.

Best features

- Driver-based revenue forecasting

- Real-time syncing with accounting tools

- Visual dashboards for revenue performance

- KPI tracking and performance analysis

- Multi-scenario planning capabilities

Limitations

- Requires integration with supported accounting software

- Primarily focused on analysis rather than guided planning

- May have a learning curve for users new to financial analysis

Pricing

- Starter: $53/month (1 company, +$53/extra company)

- Silver: $280/month (10 companies, +$28/extra company)

- Gold: $400/month (25 companies, +$15/extra company)

- Platinum: $720/month (50 companies, +$12/extra company)

Rating

- G2: 4.5

- TrustRadius: 9.2

- Gartner: NA

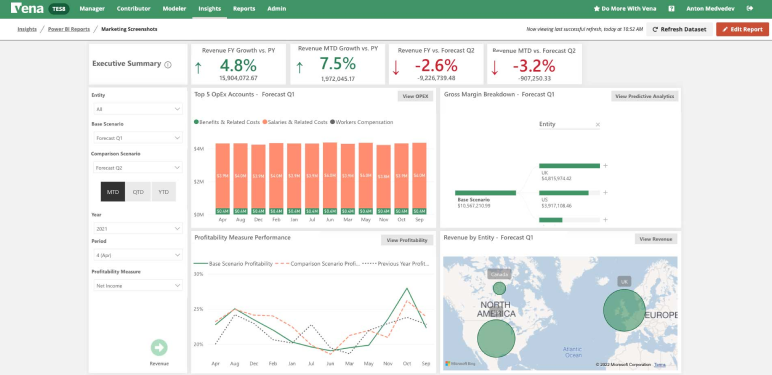

6. Vena Solutions Inc.

Vena Solutions is a comprehensive FP&A solution for mid to large-sized companies with formalized and scalable revenue forecasting features.

By combining the familiarity of Excel with a centralized database, Vena expands traditional spreadsheet workflows by offering automation, collaboration, and sophisticated modeling functionality.

For revenue forecasting, Vena offers rolling forecast, variance analysis, and multi-scenario planning. Financial teams can produce department-level forecasts, compare multiple models, and manage approvals on a single platform.

Best features

- Excel-native interface with centralized database control

- Advanced modeling capabilities

- Comprehensive reporting tools

- Multi-dimensional planning and analysis

- Workflow automation and approval processes

Limitations

- Complex implementation process (typically 8-10+ weeks)

- Requires significant training and setup

- May be overkill for smaller businesses

- Higher cost compared to simpler alternatives

Pricing

Vena offers custom pricing based on the organization’s size, user count, and specific requirements.

Rating

- G2: 4.5

- TrustRadius: 8.5

- Gartner: 4.4

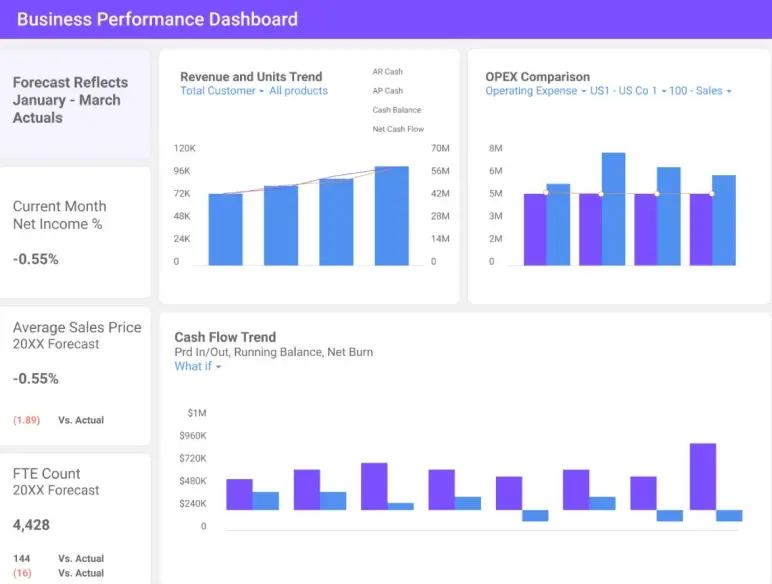

7. Planful

Planful is a next-generation FP&A platform for growing finance teams who need more control of their planning, forecasting, and reporting. Planful helps companies speed their budgeting processes, align their teams, and establish precise revenue forecasts with structured workflows.

Its forecasting is built to be adaptable. Planful allows you to compare different scenarios side by side with ease, modify assumptions on the fly, and track performance against shifting targets.

It’s also able to support rolling planning, so you can revise your revenue forecasts when new data becomes available.

Planful stands out in how it balances power with usability. That said, the platform is best suited for teams that already have some forecasting processes in place. It may feel heavy for businesses just getting started or looking for a simple, guided approach.

Best features

- Structured planning workflows

- Continuous planning capabilities

- Advanced scenario modeling

- Integration with ERP and CRM systems

- Collaborative planning features

Limitations

- Setup can be complex for smaller teams

- Requires training to utilize advanced features effectively

- It may be too sophisticated for simple forecasting needs

- Higher cost point

Pricing

Planful doesn’t list pricing publicly. Plans are tailored based on company size, user count, and feature requirements. A free demo is available upon request.

Rating

- G2: 4.3

- TrustRadius: 8.1

- Gartner: 4.5

8. Float

Float is a cash flow and revenue forecasting tool for quick financial visibility. It integrates right into accounting software such as Xero, QuickBooks, and FreeAgent to access real-time financial data.

The platform assists you in creating short- to mid-term revenue projections by linking historic patterns of income with future invoices, bills, and bank transactions. Multiple cash flow scenarios can also be generated, keeping you ready for best- and worst-case scenarios.

Yet, Float does not cater to intricate revenue models, elaborate strategic planning, or multi-year forecasting. It works best for businesses that want a clear view of the next few months, not for those planning long-term or building investor-ready forecasts.

Best features

- Cash flow-focused forecasting

- Real-time sync with accounting software

- Scenario planning for cash flow

- Visual cash flow dashboard

- Relatively quick setup

Limitations

- Primarily short-term focused (1-3 months)

- Limited long-term strategic planning capabilities

- Dependent on accounting software integration

- Not suitable for complex revenue modeling

Pricing

- Starter: $6/person/month

- Pro: $10/person/month

- Enterprise: Custom pricing

Rating

- G2: 4.4

- TrustRadius: 9.0

- Gartner: NA

9. Anaplan

Anaplan is a connected planning platform managing complex revenue models. It helps organizations forecast revenue across business units, product lines, geographies, and channels, all from a single, integrated workspace.

For finance teams dealing with multi-layered forecasts, Anaplan offers flexibility and scale. You can model recurring revenue, sales targets, pricing shifts, and channel performance, then tie those forecasts to real-time data feeds from across the company.

While Anaplan is extremely capable, it’s built with enterprise use cases in mind. It requires setup, training, and often a dedicated team to maintain models. It’s not designed for small businesses or founders who want simple forecasting or guided planning support.

Best features

- Scalable, enterprise-grade architecture

- Advanced driver-based modeling

- Real-time collaboration across departments

- Extensive integration capabilities

- Custom dashboard creation

Limitations

- Very complex implementation requiring dedicated resources

- Steep learning curve

- Expensive and typically requires multi-year commitments

- Not suitable for small businesses

Pricing

Anaplan offers custom pricing based on the use case, company size, and required modules. Enterprise clients can request a tailored demo and quote through their sales team.

Rating

- G2: 4.6

- TrustRadius: 8.6

- Gartner: 4.5

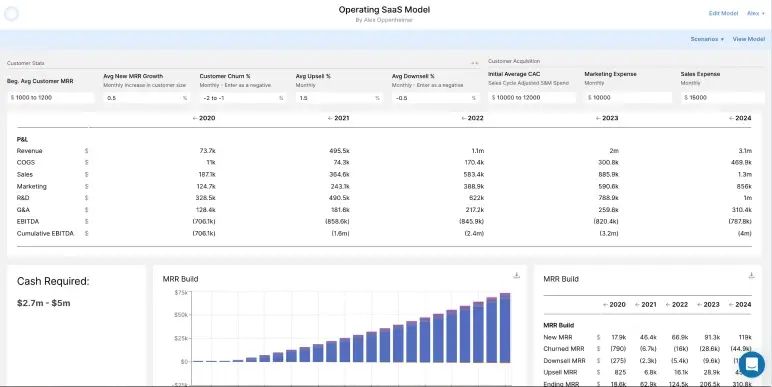

10. Causal

Causal is a new finance modeling platform designed to supplant spreadsheets with something more intelligent, quicker, and simpler to update. It’s designed for startups, finance teams, and decision-makers who want to create flexible revenue forecasts without relying on endless Excel formulas.

For revenue forecasting, you can build dynamic “what-if” scenarios, track key drivers, and share interactive dashboards with your team or investors. It’s especially useful for companies planning for different growth paths or trying to stress-test pricing strategies and acquisition spending.

But, its price point may be steep for smaller teams, and spreadsheet-first users may need time to adjust to its modeling style. It’s best suited for teams that want high control, real-time collaboration, and clean, client-ready outputs.

Best features

- Dynamic scenario modeling

- Real-time data integrations

- Interactive dashboards

- Collaborative planning features

- Clean, modern interface

Limitations

- Higher price point than basic alternatives

- May require an adjustment period for spreadsheet-native users

- Limited pre-built templates

- Best suited for teams comfortable with modeling concepts

Pricing

Causal offers two pricing plans: Lite and Growth, but their prices have not been disclosed publicly.

Rating

- G2: 4.6

- TrustRadius: 10

- Gartner: 5.0

You can also explore AI-powered financial modeling tools if you’re looking for more advanced, automation-friendly options.

That concludes our top revenue forecasting tools list. But the real question is:

How to choose the best revenue forecasting tool?

There are dozens of revenue forecasting tools out there. Most of them promise a lot. But choosing the right one comes down to five real-world questions.

1. Can it model how your business actually earns?

If your revenue is generated from subscriptions, services, or product sales, your forecasting software must be similarly structured. Seek tools that enable your model out of the box or allow you to create one with ease.

2. Does it connect to real data?

Manual entry breaks down fast. Choose a platform that connects to your accounting and sales systems so your forecast reflects what’s actually happening.

3. How flexible is the logic?

Good forecasting needs variables you can tweak.

Can you simulate a price change? A drop in retention? A new marketing channel? That’s the kind of flexibility that actually supports planning.

4. Will your team use it?

If it’s clunky or difficult to use, nobody will touch it. First, put clean design, intuitive steps, and helpful support that does more than a behemoth help centre.

5. What do real users say?

Ignore feature checklists and read what users say about the learning curve, bugs, hidden limits, or great support. If reviews say it “feels like Excel with training wheels,” that might be a win.

Plenty of software gets two or three things right. You need the one that gets everything right. So…

Make accurate financial forecasts using Upmetrics

Forecasting is only useful if it’s connected to the rest of your plan, and that’s where Upmetrics stands out. It’s a full planning platform with built-in tools for sales forecasting, revenue modeling, and scenario planning, helping you map revenue across different scenarios, markets, or business models.

The software guides you through each section of the forecast: Setting up your revenue channels, defining cost assumptions, and simulating best and worst-case outcomes. You can run multi-year projections, view your breakeven timeline, and link everything to your financial statements in real-time.

In short, Upmetrics gives you more than just a forecast. It gives you a complete financial picture to plan, present, and grow your business.