Running a business means knowing how your products will perform.

And, the guessing game isn’t enough to plan effectively. With sales teams spread out and markets changing quickly, forecasting has become the foundation for growth strategies.

An accurate sales forecast not only motivates you during lean times, but also assures investors of your business’s potential.

More than just numbers, it provides a framework for annual budgets and supports long-term planning.

Okay. we get that. (It’s important and all!)

But how do you do that? Forecast sales for your business? This guide has got you covered.

In this through guide, we’ll discuss:

- What is sales forecasting?

- How to forecast sales for your business?

- How to include them in your business plan?

- And, a lot more about sales predictions.

Shall we begin? Let’s start by defining “sales forecasting”.

What is sales forecasting?

A sales forecast predicts how much money a company will make in the future, usually over a set period, such as a month, three months, or a year.

It starts with looking at the numbers from the past, such as how much was sold, when, and under what conditions. Then, it factors into the present—what the sales team is capable of, what the market looks like, and what strategies the company is putting into play. It is a calculated effort to see the road ahead, whether it is a startup financial plan or one for an already established business.

How will a new product launch perform? Will a discount drive sales? Can the team deliver under pressure?

Sales forecasting answers these questions so a company can plan smartly. It could be stocking the proper inventory, setting realistic goals, and putting its money where it will count the most.

There are two kinds of sales forecasting: short-term and long-term.

Short-term forecasting

This is when a business looks at the next three months, six months, or a year. Most stick to the one-year mark. It’s practical. The time frame depends on the type of business. If demand swings wildly month-to-month, they focus on shorter periods.

Long-term forecasting

This kind of forecasting stretches out to five, ten, or even twenty years. Industries with significant investments and extended timelines, like shipbuilding, rely on long-term forecasts to plan for growth, equipment, and workforce training.

Sales forecasting methods, short or long, are about being prepared. That’s all.

Why is sales forecasting important?

A sales forecast is the foundation for financial planning, cash flow projections and decision-making, regardless of size or industry. For small businesses, it can mean the difference between staying afloat and sinking under poor planning. For larger companies, the forecasts help refine strategies and maintain growth.

Here are some key benefits of sales forecasting:

1. Establishes financial framework

With a good sales prediction, your finance team can estimate revenue streams accurately and plan for upcoming costs, whether it’s payroll, production, or marketing expenses. When they know what income to expect, they can decide where to spend, where to save, and when it’s worth taking a risk on something new.

A solid sales forecast also helps justify investments. If the numbers show potential growth, it’s easier to convince stakeholders or lenders that spending on expansion, new equipment, or marketing is a smart move.

2. Informs business goals

A sales forecast helps you set goals that are ambitious but doable. Your forecast shows you the reality behind the numbers. If you need more customers than you can realistically handle, it’s a sign to rethink your sales strategy. If the goal is achievable, it becomes a clear target to aim for.

A good forecast digs into the value of every customer. Beyond the headcount, you also get an understanding of how much they will likely spend and whether that aligns with your goals.

3. Secures funding for your business

Investors want to see that you have realistic expectations about revenue and understand the factors that will drive sales. The transparency instills confidence in the business’s viability.

Investors are looking for opportunities where their money can yield returns, and a solid sales forecast indicates that you are capable of delivering on those expectations. On top of just asking for money, you are providing a roadmap on how that money will be used to achieve growth and sustainability, too.

4. Optimizes resource allocation

You can avoid unnecessary expenses in areas that aren’t likely to bring returns. If you misjudge where your sales will come from, you might end up investing too much in the wrong projects or marketing efforts.

Efficient resource allocation also enhances productivity as it aligns your workforce with expected demand and prevents overstaffing during slow periods. Or under-resourcing during busy times, for that matter.

Plus, knowing where to invest in technology is vital. With a clear forecast, you can also identify the tools and systems that will catalyze your growth.

5. Mitigates risks

If your sales team is consistently falling short of their targets, sales managers can take proactive measures to understand why sales performance is lagging. It could be analyzing team dynamics, assessing product demand, or examining market conditions.

Spotting potential issues can also prevent larger financial consequences. If a downturn is detected early, you can adjust budgets, manage inventory levels, or reallocate resources before a crisis occurs.

The benefits of a sales forecast are numerous. Now that you know it, it is time to think – what’s next?

For an accurate prediction of sales, you must follow all the steps religiously. Let’s get into it.

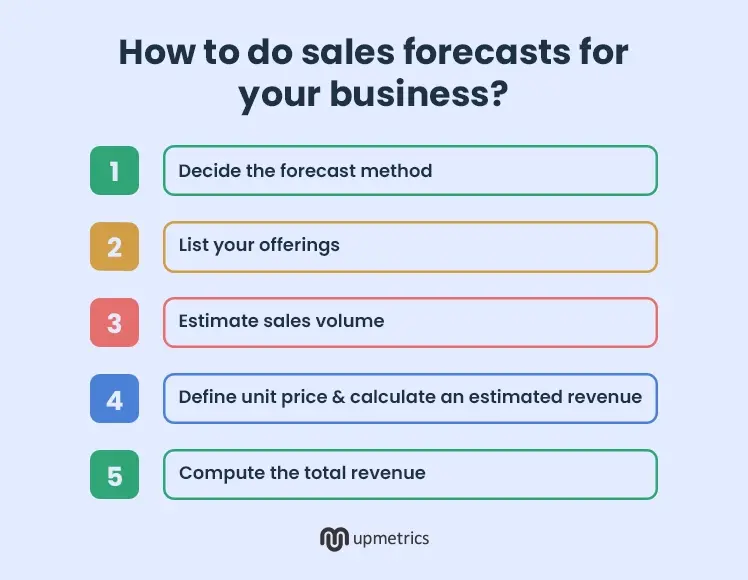

How to do sales forecasts for your business?

Your sales projections are estimates of the number of goods and services you believe you can sell over a period of time. This will also include the cost to produce and sell those goods and services (COGS) and the estimated profit you will walk away with.

1. Decide the forecast method

Before getting into the steps of creating a sales forecast, you have to choose the right sales forecasting method. There are total of 7 methods you can choose:

| Length of sales cycle forecasting | Tracks how long it takes to close deals to estimate future revenue. |

| Lead-driven forecasting | Uses past lead data and average sale value to predict sales based on conversion rates. |

| Opportunity stage forecasting | Calculates sales probability based on where a deal is in the pipeline. |

| Intuitive forecasting | Relies on sales team insights but risks errors if not backed by data. |

| Test-market analysis | Tests products or services on a small group before scaling projections. |

| Historical forecasting | Predicts sales based on past trends, useful for stable markets but limited during market changes. |

| Multivariable analysis forecasting | Combines multiple methods for detailed forecasts but needs advanced tools. |

Each method has strengths and weaknesses. Businesses with stable revenue patterns may benefit from historical forecasting, while those with fluctuating sales cycles can leverage multivariable analysis forecasting or opportunity stage forecasting to improve forecasting accuracy.

Based on what you want to gain from the sales forecast and the availability of data, you finalize the right sales forecasting method. Once finalized, you can start creating a sales forecast.

Apart from the forecasting methods above, there are two other methods businesses follow- top down and bottom-up.

- Top-down forecasting starts with the total market size and works down to estimate the share your business can capture

- Bottom-up forecasting begins with internal data like sales capacity, pricing and production limits, making it more detailed and realistic.

Many startups choose the top down approach. While this may seem credible, it fails to give you real data like what drives sales, how customers discover a product, or how many will actually buy.

On the other hand, the bottom up approach helps you build more accurate projections as it deals with relevant sales channels, customer acquisition strategies, and reasonable conversion rates.

2. List your offerings

The second step in predicting sales is everything you are selling. That means listing every product and service, no matter how big or small.

Break things down into categories that make sense. The categories should match your accounting, not perfectly, but close enough so when you sit down to compare the forecast with what actually happened, you are not stuck wondering where the numbers went wrong.

For example, if you run a coffee shop, don’t list every latte and muffin. Categorize them – hot drinks, cold drinks, pastries, and extras. So when something isn’t selling, you will see it right away.

| Revenue | Jan’24 | Feb’24 | Mar’24 |

|---|---|---|---|

| Hot Drinks | $12,000 | $12,500 | $13,000 |

| Cold Drinks | $6,000 | $6,200 | $6,500 |

| Pastries | $4,500 | $4,800 | $5,000 |

| Extras | $2,000 | $2,100 | $2,200 |

| Total | $24,500 | $25,600 | $26,700 |

If cold drinks dip one month, you will catch it early. If pastries jump, you will know to stock more. Numbers should answer your questions.

3. Estimate sales volume

Figure out how many units you are expecting to sell within a set time, like the next quarter. Look at past sales data for similar products to make the estimate more accurate.

Continuing with the same example of the coffee shop, look at past sales from the last quarter or the same quarter last year. If the shop sold 3,000 hot drinks last quarter, use that as your starting point.

Like, if January looks strong because of colder weather, expect hot drinks to sell more. If February slows down after the holidays, factor that in. The numbers need to reflect reality.

If sales fall short, figure out why. If they exceed expectations, prepare for more demand. The numbers give you something to measure, something to manage, and something to fix if it breaks.

4. Define unit price and calculate an estimated revenue

Once you know what you want to sell and how many units you are expecting to move, the next step is setting a price. The pricing needs to cover costs, make a profit, and still be reasonable enough for customers to pay.

Start by calculating how much each item costs to make, including ingredients, supplies, and labor. Then set the price per unit.

| Product | Cost per unit | Sold per unit | Units sold | Total Revenue |

|---|---|---|---|---|

| Hot Drinks | $1.50 | $4.00 | 3650 | $14,600 |

| Cold Drinks | $1.80 | $4.50 | 1650 | $7,425 |

| Pastries | $2.00 | $5.00 | 2550 | $12,750 |

| Extras | $1.00 | $3.00 | 1270 | $3,810 |

| Total | 9120 | $38,585 |

Now look at margins. The hot drinks bring in $2.50 per cup after costs. Pastries clear $3.00 each. Add it up. Does it cover rent, payroll, and utilities? If it doesn’t, you are underpriced. If it does, check how much is left for profit.

It’s basic math, but it keeps your expectations realistic.

5. Compute the total revenue

To complete a sales prediction, figure out the total income from sales, then subtract the total cost of producing the goods. This will give you the actual revenue the company might bring in, not just the sales numbers on paper.

If the coffee shop expects to sell 3,000 cups of regular coffee at $3 each, the total sales would be $9,000. But if each cup costs $1.20 to make, the production cost is $3,600. Subtract that from the sales, and the actual revenue for regular coffee is $5,400.

Repeat the process for every product – cold brew, lattes, pastries, and extras. Add up the actual revenue for all categories to get a total.

If total sales across all products add up to $39,810 and the production costs total $16,120, the actual revenue is $23,690. This number is what’s available to cover operating costs and generate profit.

That’s all. These are the 5 steps you need to follow to make accurate forecasts for your business.

While sales forecasting seems easier with this example, that’s not always the case. Businesses with complex models—multiple revenue and irregular sales cycles can truly break your spreadsheets.

Such situations call for a good financial forecasting tool like Upmetrics. It’s easier when you have tools to take care of formulas and manual number crunching.

However, not everyone gets it right. The reasons could be many. Let us go through some of it.

What does a business need to prepare accurate sales forecasts?

Sales forecasting is only as sharp as the data feeding it. It runs on data – clean, detailed, and reliable data. Without it, forecasts are just guesses, and guesses lead to costly mistakes.

Businesses might overstock products that don’t sell or run out of items customers need. Both cost money.

Here is everything you need to do for precise sales forecasting.

Endogenous data (Internal)

Endogenous data comes from within the company. It includes information directly tied to the sales process—data that is already recorded, tracked, or easy to collect if needed.

Common internal data used in sales forecasting

| Category | Details |

|---|---|

| Product details | Category, brand, packaging, and variations. |

| Pricing data | Sales prices, production costs, promotions, and price adjustments. |

| Store information | Location, size, inventory levels, and average sales |

| Sales team data | Headcount, training, and qualifications |

| Marketing inputs | Ads, catalogs, and social media campaigns |

| Sales channels | Delivery options, in-store pickups, and online platforms |

Exogenous data (External)

It includes all variables outside the company that can influence sales. These factors come from the company’s environment and are beyond its control. Unlike internal data, exogenous data is unpredictable and needs to be filtered carefully.

Common types of exogenous data include:

| Category | Details |

|---|---|

| Seasonality | Time of year, holidays, weekends, or paydays |

| Competition | Product pricing, locations, and customer targeting |

| Regulations and policies | Laws, taxes, and compliance changes |

| Consumer behavior | Buying habits, preferences, and spending patterns |

| Trends | Emerging products, services, or shifts in demand |

That’s all you need to do and know for deriving an accurate forecast.

You have all the action items now. Let’s get onto executing them and creating a full-fledged sales forecast for your business plan.

Common mistakes to avoid in sales forecasting

Even experienced professionals can make projection mistakes. You don’t want that. Read on to strengthen your forecast approach.

1. Not using historical data

Sales data from the past tells you what worked and what didn’t. It shows patterns, busy seasons, and buying habits. Businesses that skip this step lose insights that could make forecasts sharper and decisions easier.

2. Ignoring market trends

Markets change. New products show up. Competitors shift their strategies. Businesses that don’t watch these changes risk making forecasts that don’t match reality. Numbers only matter if they fit the current landscape

3. Not listening to the sales team

Sales teams talk to customers every day. They know what’s selling, what isn’t, and why. Ignoring their input disconnects forecasts from what’s actually happening. Numbers without context are just numbers.

4. Relying on one method

No single forecasting method works every time. It limits you from detecting shifts in sales performance, reducing accuracy thus leaving businesses unprepared for unexpected outcomes.

5. Not updating forecasts

Forecasts aren’t permanent. Markets shift, sales drop, trends change. Treating forecasts like fixed numbers instead of working estimates leads to poor planning, inventory issues, and missed growth opportunities.

Avoid these financial projection mistakes and you are on your way to creating an almost perfect sales prediction.

Last but not least, we have covered some of the best practices you can follow to achieve a close-to-perfect sales projections.

Best practices for accurate sales forecasting

Building a reliable and data-driven forecasting process doesn’t ask for much. You can start by following these proven practices:

- Use insights to guide decisions across different business operations.

- Involve other departments early in the planning process.

- Share forecasting insights with all key stakeholders.

- Collaborate with sales and marketing teams to gather qualitative input.

- Make use of a financial forecasting tool to to monitor sales funnel analysis, assess trends, and ensure forecasting accuracy improvement

- Review sales forecasts regularly, especially when markets change.

- Factor in historical sales data, economic conditions, and market trends for more accurate predictions.

That’s all. Accurate sales projections is all you need for an effective business strategy.

Start preparing your sales forecasts in Upmetrics

Predicting sales is just as important as running the business itself. But forecasts are not fixed. It’s not something you figure out once and forget. It takes practice, adjustments, paying attention to data, factoring in market trends, and testing your assumptions. Then, you test them against reality.

If you’re ready to make forecasting simpler and more accurate, our financial forecasting tool can help you get there. Build AI-powered financial projections that help you raise funds, secure loans, and manage operations.

Happy Forecasting!