Most small business owners don’t realize there’s a cash problem until it’s too late.

Sales are shooting. Customers are happy. The revenue looks promising. But the bank balance tells a different story.

You see, 67% of small business owners say they’re comfortable with their cash flow. Yet, cash shortage remains one of the top reasons businesses shut down.

That says something.

Growth doesn’t always equal healthy cash flow. You might be growing—and still struggle to pay your bills on time.

To avoid being in a cash crunch situation, you need more than a general sense of how things are going. You need a clear view of what’s coming in, what’s going out, and when it’s happening.

That’s what cash flow forecasting gives you.

With this blog post, let’s understand what a cash flow forecast is, its different types, best practices, and examples.

What is a cash flow forecast?

A cash flow forecast is a financial planning tool that demonstrates the future cash position of your business. It estimates the cash inflows and outflows over a specific period based on the business’s current and expected activity.

Cash forecasts help you see whether you’ll have enough cash to stay afloat, pay debts, and handle upcoming costs—or if quick action is needed.

Depending on your goals, you can forecast your cash position for the next day, week, month, quarter, or even the next year. However, the further out you go, the less reliable the forecast becomes.

Sales vs. cash flow forecasting

Sales forecasting estimates how much revenue your business expects to bring in over a specific period. It uses historical data, market trends, seasonality, and current pipeline activity to build a realistic view of future sales performance.

Cash flow forecasting, on the other hand, tracks actual cash—when money will enter your bank account and when it will leave. It factors in timing delays, payment terms, receivables, payables, payroll, and everything else that affects your cash position.

While sales forecasts show potential income, a cash forecast tells you if that money will be there when you need it—to pay bills, cover expenses, and keep operations running.

In short, a sales forecast shows what you expect to earn, and a cash flow forecast shows what you can actually spend.

Direct vs indirect cash flow forecasting process

There are two methods to forecast cash flow: direct and indirect forecasting.

The direct forecasting method estimates cash flow based on actual cash inflows and cash outflows. It uses recently updated daily or weekly data—like cash receipts from customers, payments to suppliers, and payroll—to project short-term cash positions and net cash flow.

The indirect method, however, starts with net profit from the income statement and pulls figures from the balance sheet. It adjusts for non-cash items and changes in working capital to estimate future cash flow.

While direct forecasting helps monitor your cash balance and manage short-term liquidity, indirect forecasting is better for long-term planning and budgeting.

Businesses don’t choose one cash forecasting model over the other. They use both together to get a more complete and accurate cash flow forecast.

Types of cash flow forecast

Determine how far into the future you want your forecast to be. Is it next week, next quarter, or the cash situation a year from now that you really want to understand?

To decide that, you need to look at your business needs and the availability of reliable data.

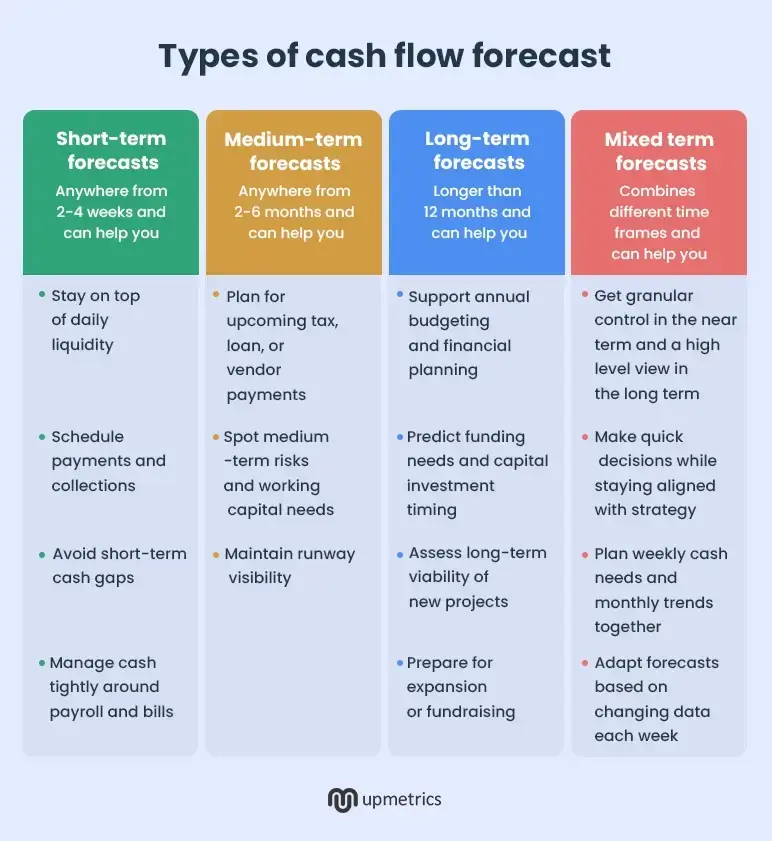

Well, you would be requiring one of these different types of forecasts for your small business:

Short-term forecasts (2-4 weeks)

Short-term forecasts are perfect for short-term cash management and liquidity planning.

Such forecasts focus on granularity. They track daily or weekly cash inflows and outflows with precision—covering things like incoming customer payments, outgoing bills, payroll, taxes, and loan repayments.

Since these cash flow projections use actual due dates and payment expectations, they offer an accurate view of your cash position in the near future.

Short-term forecasts are especially useful during periods of uncertainty and tight cash flow.

They help you answer questions like:

- Do we have enough cash to cover rent, utilities, and supplier payments due next Monday?

- Will the delayed client payment put us at risk of a negative balance by Friday?

- Should we hold off on placing that inventory order until next week?

- Are we at risk of dipping below our minimum cash balance before the month’s end?

- Should we draw on a credit line to avoid a shortfall?

Understanding cash movement at this granular level gives you the time and clarity necessary to protect your cash position.

Medium-term forecasts (2-6 months)

Medium-term forecasts span between a couple of months and are mostly structured as 13-week rolling forecasts by small businesses.

These forecasts offer more visibility than short-term weekly predictions without drifting too far into the uncertainty of long-range planning.

This extended view helps you prepare for upcoming financial events—like tax payments, debt repayments, and larger vendor obligations and also offers visibility over key reporting dates.

You can see your projected cash position ahead of board meetings, investor updates, or compliance deadlines and adjust plans if needed.

Businesses use 13-week rolling forecasts to:

- See if they’ll have enough cash to cover quarterly tax payments and payroll cycles

- Plan when to pay down a loan without hurting short-term cash needs

- Decide whether to delay or go ahead with a bulk inventory purchase next month

- Know in advance if you will have enough cash to survive a slow sales period

- Give investors or lenders a reliable cash outlook on your business

Long-term forecasts (6-12 months or longer)

Long-term forecasts look into a foreseeable future, helping you plan, strategize, and budget for larger business goals.

They cover a period of 6 to 12 months or more, focusing on overall cash trends and future funding needs.

These forecasts are less granular and rely more on assumptions—but they’re essential for making key strategic decisions.

Businesses use long-term forecasts to:

- Identify when external funding may be needed to cover projected cash shortfalls

- Time major investments such as hiring, product development, or expansion

- Align cash planning with the annual budgeting and goal-setting process

- Estimate how much cash is required to support growth over the next year

Long-term forecasts help you move forward with direction and clarity while optimizing the company’s financial health.

Mixed-period forecasts

Mixed period forecasts combine multiple time-based forecasts to help you get a nuanced yet macro overview of a business’s cash position.

Here, a business uses weekly forecasts for the near term—where precision matters most—and switches to broader monthly forecasts for periods further out.

For instance, in a quarterly forecast, a business might model the first month weekly and the next two months monthly.

This structure gives you granular visibility in the near term and a broader picture for long-term planning.

Mixed period forecasting helps businesses:

- Adjust plans quickly in the near term while keeping broader targets intact

- Create a single report that works for internal teams and external stakeholders—like investors, lenders, or board members

- Save time by avoiding the need to rebuild forecasts every few weeks as priorities shift

- Manage short-term cash needs without losing sight of long-term goals

These are different time-based forecasts that can be used by small businesses to predict their inflows and outflows with varying accuracy.

How to forecast cash flow (quick steps)

Let’s now understand the step-by-step process of creating a cash flow forecast.

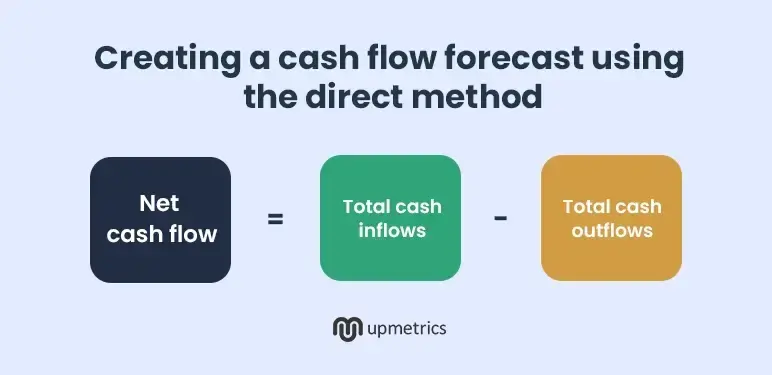

Creating a cash flow forecast using the direct method

The direct method uses actual and expected cash inflows and outflows to build a short-term forecast.

Here’s how you build a forecast:

- Decide the time-frame for the forecast

- List all expected cash inflows such as customer payments, loan proceeds, tax refunds, or other incoming cash for a specified period

- List expected cash outflows such as rent, payroll, supplier payments, taxes, insurance, and loan repayments for a specified period

- Subtract total outflows from total inflows to get your net cash flow for the period. If the difference is negative, it’s negative cash flow, i.e., your outflows are larger than inflows

- Calculate closing cash balance by adding net cash flow to the opening cash balance

Want to Take Control of Your Business Cash Flow?

Quickly analyze your income and expenses with our free Cash Flow Calculator. Get clear financial insights in minutes!

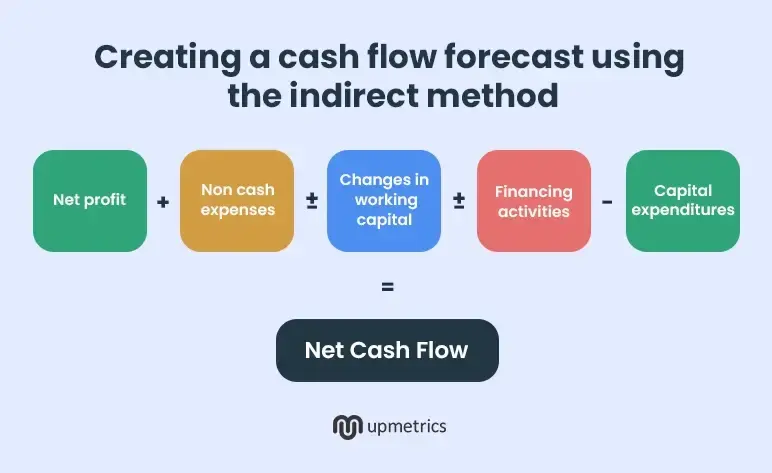

Creating a cash flow forecast using the indirect method

The indirect method starts with net profit and adjusts for non-cash items and changes in working capital. Here’s how to create a cash flow forecast using the indirect method:

- Determine the time-frame of your forecasts

- Start with the net income, i.e., net profit or net loss from your income statement for the same period

- Adjust the changes in working capital, i.e., increase or decrease in accounts payable, accounts receivable, inventory

- Subtract any planned capital expenditures and loan repayments

- Add any expected loans, equity investments, or other cash injections

- Add back non-cash expenses such as depreciation, amortization, and other non-cash charges

- Calculate your net cash flow after making these adjustments

- Calculate closing cash balance by adding net cash flow to opening cash balance

Sample small business cash flow statement

Here’s a sample 3-year annual cash flow forecast showing how a business expects to manage cash across operations, investments, and financing activities.

Cash flow forecasting best practices

Even the perfect use of spreadsheets would lead to unreliable forecasts if it’s not backed with data and reasonable assumptions. After all, forecasts are nothing but assumptions at the core.

While you can’t predict the future with 100% accuracy, here are a few cash flow forecasting practices that will take you much closer:

- Build a data-driven cash forecasting process: Rely your forecasts on clean and sizable historical data to predict future cash flows with the utmost accuracy

- Automate the forecasting process: Choose a forecasting tool that integrates with your existing accounting, ERP, and sales book to bring down manual data entry errors

- Model for different scenarios: Prepare for different aggressive and progressive situations that may affect your future cash balances

- Document your assumptions: Note down all your assumptions so that you always have a reference point to circle back to

- Align short-term forecasts with business strategy: Tie back your short-term forecasts with the long-term business strategy, instead of keeping them in vanity

- Variable thresholds: Change variance thresholds for gaps in actuals vs forecasts depending on seasonal trends, as Jeffrey Zhou, the founder of Figloans, does.

And don’t mistake forecasts to be a one-time task—building them is just step one. You have to review them regularly, track the variances, understand why they happened, and take action.

Cash flow forecasting mistakes you should avoid

Ready to build your cash flow forecast? Here are a few mistakes you should avoid:

- Not factoring in repetetive behavior: If a client always pays 10 days late, shift those cash payments by 10 days in your forecast

- Forgetting one-off or irregular expenses: Not accounting for annual software renewals or tax payments can wipe out your buffer

- Building forecasts in vacuum: Instead of forecasting in silos, talk to sales, operations, and procurement—they often have insights that don’t show up in the financials

- Overcomplicated model: Keep your forecasts simple and make it easy to maintain

- Focusing too much on precision: Focus on speed and analysis rather than precision

- Thinking in binary terms: Model partial outcomes, delays, or scaled-down versions based on probability, i.e., if a client renewing the project is 70%, add 70% of that expected revenue in the forecast

Automate your cash flow forecasting with Upmetrics

Now that you understand forecasts, imagine gathering data, organizing inflows and outflows, running calculations, and updating your forecasts—manually.

Doable? Sure.

Practical? Not really.

Automation is smart—and honestly, the only way to keep your forecasts relevant with the rapid pace of changes in cash flow.

Upmetrics is here to help. Its financial forecasting tool automates cash flow forecasting while integrating real-time data from your Xero or QuickBooks account.

Its forecasting feature lets you:

- Model different scenarios and see how each one affects your cash position

- Build full 3-way forecasts, i.e., cash flow, profit & loss, and balance sheet

- Compare your actuals vs forecasts to stay on track

- Get AI-powered financial suggestions to improve decisions and planning

- Get a visual and interactive overview of your cash position

And most importantly, with Upmetrics you can align your forecasts with the longer-term business strategy and vision.