Whether you’re launching a new product, starting a new business, or seeking investors for investment—you must understand your numbers to make important decisions.

As Warren Buffet once said, “Understanding your financial health is the first step to making informed decisions. It’s not just about profits, but about sustainability and growth.”

Well, break-even analysis is one such aspect every owner must familiarize themselves with. It tells you exactly when and how you can cover your initial investment to start making a profit.

With this blog post, we will explain how to perform break-even analysis and how to reach your break-even faster with examples.

Ready to get started? Let’s dive right in.

What is break-even analysis?

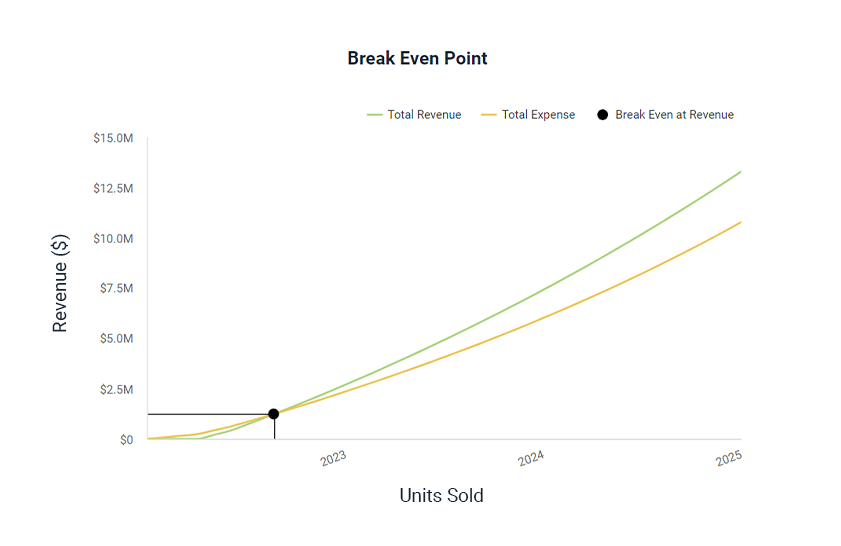

Break-even analysis is a financial calculation that helps determine the break-even point (BEP) of your business. It’s a point at which total revenue equals the total expenses of your business—a situation of no profit no loss.

Break-even analysis demonstrates how many units you must sell or the total sales you should make to reach a break-even point.

We will dive further into understanding the formula and calculation of break even. But before that, let’s evaluate…

Why knowing your break-even point is important

The break-even point acts as an internal management tool helping the businesses arrive at important decisions. While it isn’t sufficient on its own for assessing overall financial health, it does provide a clear benchmark for profitability.

I referred to the literature study prepared by the Christian University of Jakarta to understand the importance of the break-even point, especially for small and medium-scale businesses. Here’s a gist to help you get a quick overview:

Assessing risks

Break-even point analysis helps evaluate the viability and feasibility of your products and ideas before investing any time or money in them.

An idea might be exciting. However, a break-even analysis demonstrates the production or sales volume required to generate profits. This way you can evaluate whether it’s feasible or not to launch the product.

Controlling costs

Calculating break-even compels you to list down all the costs (fixed and variable) making sure you don’t miss any expenses behind. This way there will be no room for surprise expenses to falter your planning.

Additionally, this activity helps you optimize the costs by highlighting areas where you can cut down.

Strategizing pricing

Break-even analysis helps strategize your pricing, allowing reasonable room for margin. It enables you to evaluate pricing and sales under different situations, helping you set a reasonable pricing strategy for your products/services.

Acquiring funds

Businesses planning to acquire funds from investors must include a break-even analysis in their business plans. It will help lenders evaluate the feasibility of a business idea before making any financial commitments.

As for the business, entrepreneurs would learn how much investment they require to break even. This will assist them in making appropriate funding demands.

Assessing performance

Break-even analysis offers a quick snapshot of the business’s financial health. It clarifies the relationship between sales, costs, and profits enabling the businesses to set realistic targets.

Now, let’s head toward the practical aspects focusing on formulas and processes.

How to perform a break-even analysis for a business plan

The concept of break-even rests on 5 essential components: Fixed costs, variable costs, average selling price, contribution margin, and break-even point.

This step-by-step guide will demonstrate the use of these components to perform a complete break-even analysis.

1. Identify fixed and variable costs

First, list down all the fixed and variable costs for your business.

To clarify, fixed costs are the ones that remain consistent regardless of the sales volume. For instance, rent, mortgage, payroll, machinery, equipment, etc.

Variable costs, on the other hand, vary depending on the sales volume. For instance, costs for raw materials, packaging, hourly wages, etc.

We asked Upmetrics’s AI forecasting assistant to generate expense streams for a food truck business focused on healthy meal options.

As you can see, the list is exhaustive and relevant to the food truck business. You may consider this as a checklist to ensure that you don’t leave behind any important expense stream.

After you create a list, focus on gathering relevant industrial/historical data and enter correct estimates for your costs.

Continuing the previous food truck example, let’s assume the following fixed and variable costs for a food truck:

Fixed expenses

- Truck lease: $1,000

- Kitchen Equipment: $3,500

- Licenses and Permits: $250

- Fittings and remodeling: $5,000

- Marketing: $250

Total fixed expenses: $10,000

Average variable costs per unit:

- Food produce: $2

- Wages and salaries: $0.5

- Packaging materials: $0.5

Total variable cost: $3

Note: We have included minimal expenses here to explain the concept better. In reality, there would be numerous fixed and variable expenses to run a food truck.

Now, the calculation of fixed costs is pretty straightforward. However, you’ll need the help of enterprise resource planning (ERP) or financial forecasting software to simplify the calculations for variable costs.

2. Determine the sales price per unit

Next, determine the pricing for your product.

Ideally, your pricing should cover fixed and variable costs per unit. It should be higher than your total per unit expense and reasonable enough to help you get a competitive market position.

Now, instead of setting a price on a whim, gather some market data and study the competitor’s pricing. Evaluate their cost structures and see how they are pricing their products across different channels.

Determine your competitive advantage and understand how your target market would react to price changes. There’s no need to fixate on one price. One of the benefits of break-even analysis is that you get to experiment with different pricing scenarios and evaluate their effect on total sales before finalizing the decision.

In case, you’re selling multiple products across different sales channels, factor in the average pricing for your calculation.

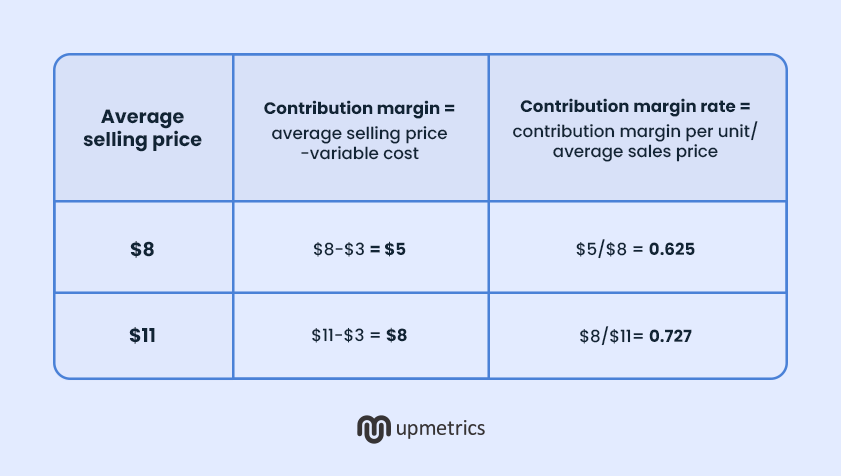

Continuing our food truck example, let’s say you want to keep your average selling price at $8 per piece. However, since your business operates in a niche healthy meal market, you contemplate setting the pricing at $11.

3. Calculate the break-even point using the formula

The break-even formula can help calculate the break-even point of your business in terms of product units or sales numbers.

Let’s check the formulas to understand better:

Break-even point (in sales unit)

This formula gives you the total number of units you should sell (sales volume) to reach a break-even point.

Here, the contribution margin represents the amount by which a product’s selling price exceeds its variable costs.

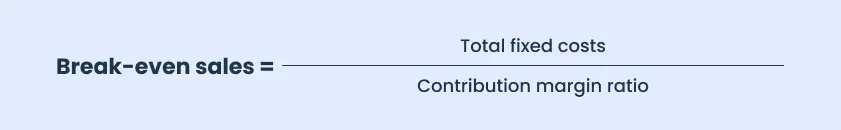

Break-even sales (in sales value)

This formula gives you the amount of sales revenue you must generate to cover all the expenses and reach a break-even point.

To get your contribution margin ratio, divide your contribution margin per unit with your average sales price. This will give you revenue in sales dollars essential to reach break-even.

Now, let’s see what break-even looks like for our food truck example by putting the formula to use.

Data fetched from step 1 and step 2:

- Fixed cost: $10,000

- Variable cost: $3

- Average selling price: $8 or $11

Before we calculate break-even, let’s calculate the contribution and contribution margin rate at $8 and $11 average selling price.

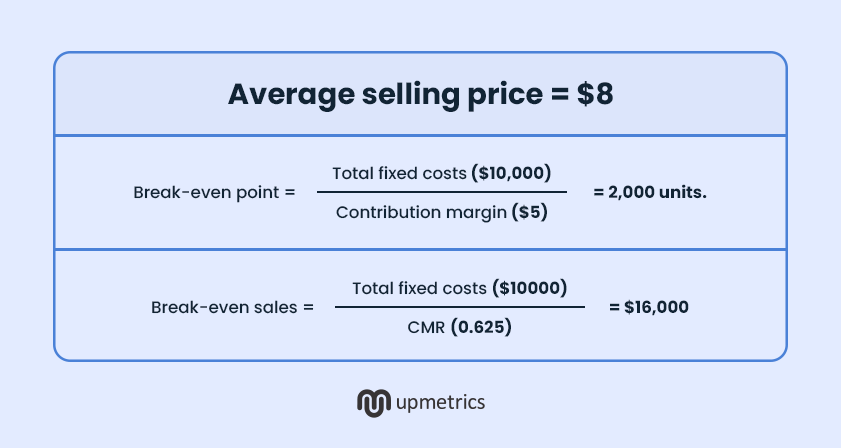

Putting the formula to use, here’s the break-even for a food truck at $8 selling price.

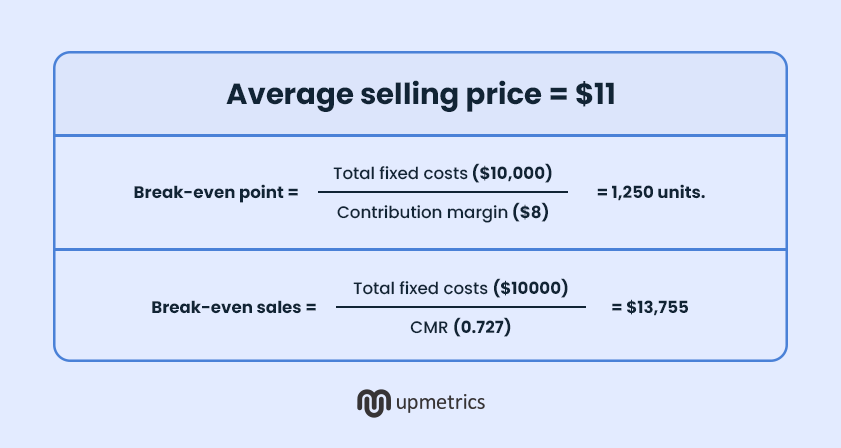

Similarly, let’s calculate break even at an average selling price of $11.

4. Analyze and interpret the results

Summarizing the results of break-even calculations, here are the two options:

At the average selling price of $8, a food truck will have to fulfill 2000 orders and generate sales revenue of $16,000.

However, if the pricing were $11, a food truck would have to fulfill 1250 orders and generate a revenue of $13,755.

Now, this is just one instance of a selling price adjustment. In reality, you’ll have to make multiple adjustments to your fixed as well as variable costs and selling price till you find a reasonable balance in the units and sales revenue.

Adjust the figures, analyze the results, and get to a break-even point that’s comfortable yet challenging for your business.

Pro-tip

Create your break-even analysis with Upmetrics in no time

Forecast your expenses, develop your revenue projections, and determine your cost of sales with its AI-powered forecasts

How to get to the break-even point faster?

There are only two ways to reach your break-even faster—reduce the costs or raise the pricing.

Let’s understand how.

Lower your total costs

Break-even is nothing but a ratio of your fixed and variable costs. If you want to reach profitability faster, you need to bring one or both of these costs down.

Now, it’s easy to lower fixed costs, especially when you’re starting a new business.

For instance, you can lease a food truck rather than buy one to bring your fixed costs down. Similarly, you can budget your remodeling costs, buy used equipment, and hire freelancers for the same.

However, if you want to bring your variable costs down, focus on enhancing operational efficiencies.

For instance, instead of purchasing expensive raw materials, you can negotiate better rates with suppliers by buying in bulk. Even better, you can source from local providers to reduce transportation costs.

Similarly, you can optimize the inventory, automate the tasks, and reduce the wastage to eventually bring down your variable costs.

Raise the prices

Another way to reach break-even faster is by raising the average selling price of your products. To do so, you need to sell fewer products and break even quickly.

However, you can’t decide to raise prices in a vacuum. This decision should be backed by sufficient data ensuring that the rise in prices won’t cause you to lose your market share or competitive edge.

Conclusion

Break-even analysis might just be a small part of a larger financial planning approach. It, however, is an important metric to help you regulate the costs, strategize the pricing, and set realistic goals.

It’s important for every business to know their time of breaking even. It’s something an investor would ask before making an investment decision.

Upmetrics business planning app helps you calculate and evaluate the break-even for your complex business processes with utmost ease. Its guided approach, AI-powered functionality, and automated detailed forecasts make it easier even for the new planners to calculate break-even.