Cash Flow Forecasting Software

Stay cash healthy with accurate cash flow forecasting

Struggling with inconsistent cash flow and unexpected shortages? Track, predict, and optimize your finances with AI-assisted cash flow forecasting.

Syncs with:

Trusted by

Upmetrics for Cash Flow Management: Fewer Challenges () Greater Rewards ()

With Spreadsheets

- Tedious & time consuming

- Manual data entry

- Outdated, complex formulas

- No scenario planning

- Lack of flexibility

With Upmetrics

- Fast & automated cash flow forecasting

- Sync accounting data and eliminate manual data entry.

- Build-in formulas and automated calculations

- Plan for multiple scenarios and stay ahead

- Ask AI for feedback and cash flow suggestions

Cash flow forecasting in spreadsheets is no fairy tale

- One wrong formula can break everything.

- They’re super tedious and prone to errors.

- Complex formulas, endless scrolling, no clarity.

Manually tracking cash flow using spreadsheets is cumbersome, switch to Upmetrics

Get in sync with your accounting data in one click

Connect Upmetrics with your accounting software (QuickBooks/ or Xero) to import real-time financial data. Say goodbye to manual entries and ensure your cash flow forecasts stay accurate and up to date.

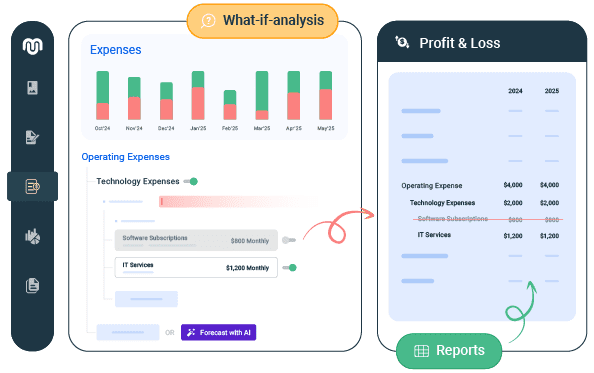

Plan multiple scenarios; even the unexpected ones

Ask AI for feedback & cash flow recommendations

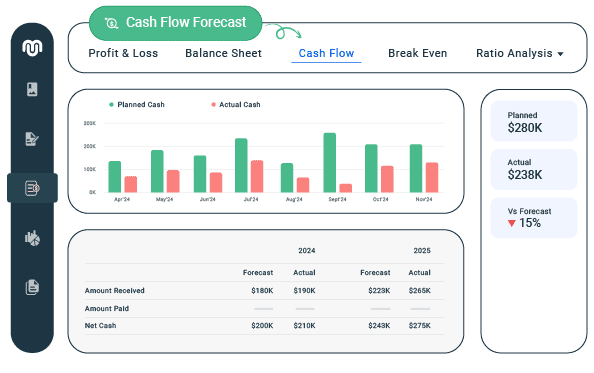

Present complex numbers with clear, intuitive visual reports

Make accurate cash flow forecasts using Upmetrics

Loved by forward-thinking entrepreneurs and business owners

Love it, people are impressed! You made my dreams come true on paper fast! AI help and team response were amazing. It's awesome to use.

Darin Leonardson

President and CEO, Transformed Culinary Solutions

This web-app simplifies the heavy lifting of thinking/planning of writing a business plan, a pitch deck and many more. I think anyone can learn how to use it immediately.

Aizat H

Founder Praxis Sdn. Bhd

Great tool, easy to use, at a great price point, the financial portion of the product is also extremely easy to use and plug + play with the combination of utilizing excel spreadsheets.

Samantha Dula

Student at University of Luxembourg

The thing that we appreciated the most is we were able to communicate with the support team on some key elements, and they were very very accommodating in all respects.

Larry Meek

Owner at Carefree Home Watch

Hands down, the best business planning software I have ever used. It is extremely easy to use, it's intuitive, incorporates AI, guides you through it step by step and it's extremely easy for others to collaborate.

Cindy Kennedy

CEO at Metabolic Terrain Omics

I loved the financial modeling capabilities of Upmetrics as they are exceptional and easy to use & understand. It simplifies the often complex process of creating financial projections and forecasts. Along with it, AI assistance worked wonders for me.

Vaibhav Kamble

Founder at CloudOptimo

I had a wonderful experience, I was able to cut down the time it takes me to write a business plan because the layout was already done and the AI feature was also really helpful.

Athena R.

Mobile Notary and Paralegal Services

Love it, people are impressed! You made my dreams come true on paper fast! AI help and team response were amazing. It's awesome to use.

Darin Leonardson

President and CEO, Transformed Culinary Solutions

This web-app simplifies the heavy lifting of thinking/planning of writing a business plan, a pitch deck and many more. I think anyone can learn how to use it immediately.

Aizat H

Founder Praxis Sdn. Bhd

Great tool, easy to use, at a great price point, the financial portion of the product is also extremely easy to use and plug + play with the combination of utilizing excel spreadsheets.

Samantha Dula

Student at University of Luxembourg

The thing that we appreciated the most is we were able to communicate with the support team on some key elements, and they were very very accommodating in all respects.

Larry Meek

Owner at Carefree Home Watch

Hands down, the best business planning software I have ever used. It is extremely easy to use, it's intuitive, incorporates AI, guides you through it step by step and it's extremely easy for others to collaborate.

Cindy Kennedy

CEO at Metabolic Terrain Omics

I loved the financial modeling capabilities of Upmetrics as they are exceptional and easy to use & understand. It simplifies the often complex process of creating financial projections and forecasts. Along with it, AI assistance worked wonders for me.

Vaibhav Kamble

Founder at CloudOptimo

I had a wonderful experience, I was able to cut down the time it takes me to write a business plan because the layout was already done and the AI feature was also really helpful.

Athena R.

Mobile Notary and Paralegal Services

Benefits of having a reliable cash flow forecasting solution

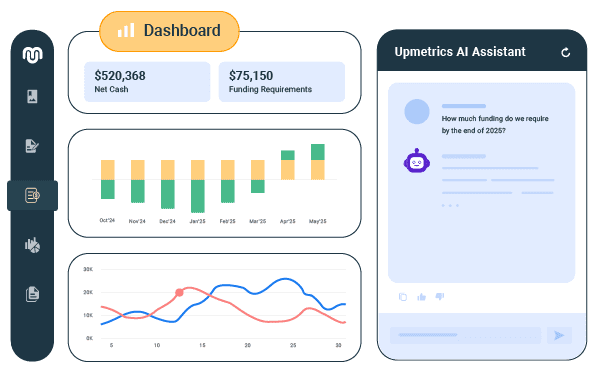

AI-Powered Suggestions

Get AI suggestions to improve cash flow efficiency and decision-making.

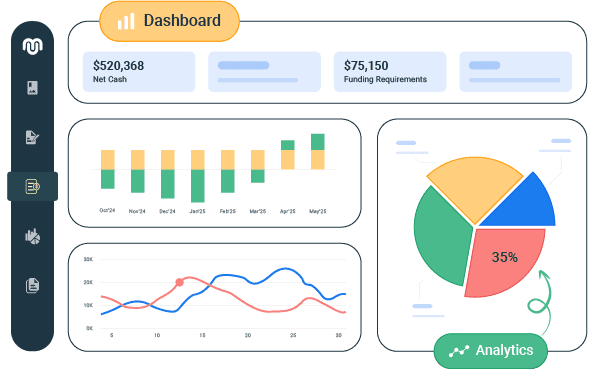

Visual Dashboard

Track cash flow trends with easy-to-read visual reports and real-time updates.

Scenario Planning

Test different financial scenarios to prepare for uncertainties.

Actual vs. Forecast

Compare real financial performance against forecasts to stay on track.

Profitability Analysis

Identify cash flow gaps and optimize margins for better profitability.

Real-time Collaboration

Share forecasts with your team and make instant updates from any device.

Multi-Purpose Cash Flow Forecasting

- Startups

- Businesses

- SaaS Businesses

- Inventory Management

Startups & Fundraising

Track cash runway & spending.

Forecast funding needs.

Monitor burn rate trends.

Small Businesses & Retailers

Plan for seasonal cash flow.

Predict revenue trends.

Manage vendor payments.

SaaS & Subscription-Based Businesses

Forecast recurring revenue.

Plan MRR/ARR growth.

Optimize pricing models.

E-commerce & Inventory Management

Balance supplier payments.

Align marketing & sales.

Improve profit margins.

Every component to Forecast your financials

Frequently Asked Questions

What is Upmetrics' cash flow forecasting software?

Can I create multiple cash flow projections and scenarios?

Is cash flow forecasting included in all Upmetrics plans?

How secure is my financial data in Upmetrics?

Does Upmetrics provide real-time cash flow tracking?

Does Upmetrics integrate with QuickBooks, Xero, or other accounting tools?

Does Upmetrics offer expert guidance on financial forecasting?

Of course. You already get access to your own personalized AI assistant and expert resources to understand and optimize your financials. While our customer support team is always there, you may also opt for professional financial forecasting services.

Is there onboarding support for new users?

Ready for automated financial forecasting?

- 15 Day money back guarantee

- Change plans anytime

- Cancel anytime