If you’re passionate about supporting a noble purpose or making a meaningful impact on society, then starting a nonprofit organization could be a great idea to help communities.

However, nonprofits don’t focus on earning money or profits; they’ll still need to manage their finances carefully.

So, having a strong financial plan in place will help you keep things organized.

Don’t worry; if you’re unsure of how to create a financial plan—we’re here to help you!

This sample nonprofit financial plan covers all the fundamental steps, from calculating startup costs to managing cash flows and developing fundraising strategies.

Ready to get started? Let’s dive right in.

Key Takeaways

- A well-crafted financial plan includes these key elements—cash flow projections, revenue forecasts, financial position statements, fundraising goals, and strategies.

- Be practical and conservative about your fundraising strategies and focus on building strong relationships with donors and supporters.

- Preparing a financial plan is much easier and faster when you use a robust financial forecasting tool.

- Enhance the accuracy of your plan with a clear market & community understanding, test assumptions, regular updates, and thorough research.

- Considering “what-if” scenarios is an excellent way to develop strategies to mitigate risks and potential challenges.

Nonprofit Financial Outlook

Before diving right into financial planning, it’s crucial to explore the broader nonprofit industry.

Here are a few important points that you may consider:

- The nonprofit sector plays a significant role in the US economy, as it contributed $1.5 trillion in the third quarter of 2022.

- According to the report, more than 1.97 million nonprofit organizations are operating in the US. And these organizations earn a total annual revenue of $2.62 trillion.

- The most generous companies donate over $2 billion each year to charity, often by matching contributions made by their workers. And Microsoft is the biggest contributor of philanthropy funds.

- Nonprofit organizations provide jobs for 7.4% of the global workforce and 10% of the US workforce.

So, nonprofit organizations offer ample opportunities in various service areas, such as education, healthcare, social services, arts and humanities, or religion.

Now, let’s move ahead and get started on how to create a successful financial plan.

How to Prepare a Nonprofit Financial Plan

1. Estimate Initial Costs and Funding Needs

Once you’ve decided to start your nonprofit organization, it’s very crucial to have a clear understanding of your finances. So, you’ll need to estimate the one-time startup costs first!

You may start by identifying all the initial expenses required to establish the nonprofit. It includes legal costs, registration fees, program development expenses, and equipment purchases.

In addition to that, you may evaluate the capital funding needed to cover the above startup costs and maintain operations once the nonprofit revenue sources are established.

Here are a few financing options you may consider:

- Seed grants

- Loans or crowdfunding

- Donations from founding members

- Philanthropic contributions

Further, don’t forget to develop a budget to allocate nonprofit funds effectively and ensure adequate usage.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

2. Understand Your Non-Profit Model

Understanding the nonprofit’s organizational model and governance structure is a crucial aspect of a financial plan. So, clearly define the type of organization you are operating. For instance,

- Charitable organizations

- Educational organizations

- Healthcare organizations

- Religious organizations

When deciding on any of these nonprofit organizations, you’ll need to determine whether your organization will be structured as a corporation, association, trust, or other legal entity.

Also, tailor your financial plan that ensures alignment with the nonprofit’s mission, vision, values, and specific goals it seeks to achieve.

Remember, nonprofit organizations do not run for money or profit; still, they must be properly organized to get support or make a meaningful impact on society. So, having a nonprofit business plan can do just that for any establishment.

3. Identify Revenue Streams

Identifying and prioritizing your nonprofit’s primary revenue streams is necessary for sustaining organizational operations and supporting its mission-related activities.

So, diverse your revenue streams and explore a range of funding sources beyond donations or traditional fundraising activities, such as

- Revenue through earned income

- Membership dues

- Programs fees or service charges

- Grant funding

- Corporate sponsorships

Well, you can assess the expected revenue based on historical data, donor trends, market conditions, fundraising targets, and other applicable factors.

This will allow you to anticipate revenue projections for the short-term and long-term, guiding your financial planning and decision-making.

4. Conduct Market and Community Analysis

Before starting any new venture, you’ll need to have a strategic roadmap to guide you. Well, that’s exactly what nonprofit market and community analysis is!

It provides a clear picture of the nonprofit landscape in your area of focus, including the target market demographics, competitors, community needs, and preferences.

This analysis helps you explore new growth opportunities in your community, areas that need your help, or perhaps you’ve spotted a gap in the existing service providers. Also, it helps you identify who will support your nonprofit’s mission and contribute to its success.

Here are a few key elements that you can determine based on market insights and industry best practices:

Fundraising Goals

After gathering all these market insights and information, it’s time to set your fundraising goals. This is where you define how much money you expect to bring in for your nonprofit organization.

So, set specific, measurable, achievable, relevant, and time-bound (SMART) fundraising goals that closely meet your organization’s significance and mission.

Likewise, it’s important to make realistic fundraising targets based on the estimated operating costs of your programs or services, as well as any growth plans or expansion initiatives.

Ultimately, it is a detailed planning of your nonprofit’s budget, helping you allocate financial resources and track income & expenses.

Expense Estimates

Generally, expense projections are estimated ongoing costs or day-to-day operating expenses that will keep your organization running smoothly.

For your nonprofit venture, you may consider budgeting for both fixed and variable costs that will help you ensure your nonprofit’s financial stability and effective resource allocation.

So, conduct a detailed analysis of your expected expenses, such as staff salaries, rent, utilities, marketing, program or administrative costs, and fundraising expenses.

Here, you should note one thing—you must account for probable cost overruns or unexpected expenses during regular operations. So, be conservative in your financial projections.

5. Develop a Fundraising Strategy

As your nonprofit organization is on a mission to help people, you’ll need to develop fundraising strategies to fuel that mission. It’s not just about donations; it’s about creating an effective plan that truly connects with your supporters.

So, you may start by developing clear and measurable fundraising goals and make sure that they align with your nonprofit’s mission, core values, and strategic priorities.

Then, identify the non-profit’s strengths and address the needs and preferences of its target audience, charity trends, communication channels, and engagement tactics.

Once you’ve determined donor/supporter demographics, develop a diversified fundraising strategy that helps you maximize the nonprofit’s income and enhance financial sustainability. It includes

- Building strong relationships with individual donors or corporate partners to explore opportunities

- Planning and implementing fundraising or charity events, campaigns, and appeals

- Pursuing grants from foundations and government agencies

- Using social media or online fundraising platforms to reach a broader audience

- Acknowledging donors and communicate the impact of their contributions

6. Make Financial Projections

Even though nonprofit organizations run with a different intention than for-profit businesses, they still need to manage their finances effectively.

So, create a comprehensive financial projection to navigate your nonprofit organization’s financial management and decision-making approaches.

Here’s a list of key financial statements you should include in your projection:

Income Statement (Statement of Activities)

For nonprofit organizations, an income statement is also referred to as a statement of activities. It outlines the nonprofit’s net income, revenues, and expenses over a specific period, typically monthly, quarterly, or annually.

This document provides valuable insights into the organization’s financial performance. It also helps you develop monthly/yearly surplus or deficit plans by looking at historical data.

Deficit plans may seem obvious, as they are needed in bad times when there’s not enough money or a shortfall to cover expenses.

Similarly, a surplus plan is equally important, as board members need it while deciding on how to utilize that extra money wisely.

Balance sheet (Statement of Financial Position)

A balance sheet provides a clear picture of your nonprofit organization’s financial position at a specific time, generally at the end of the fiscal year.

It helps you communicate what your organization owns and what it owes. So, it details the three key elements: assets, liabilities, and net assets(equity).

- Assets: Cash, donations, grants, property owned, supplies and equipment

- Liabilities: Salaries, debt, and grants to other organizations

- Net assets: Endowment funds, trust/grant funds, legacy gifts, general reserves

Ideally, it is formulated as, assets = liabilities + net assets (equity)

This will demonstrate your nonprofit organization’s net worth, liquidity, solvency, and overall monetary health.

Cash Flow Statement

A cash flow statement is essential to track the expected cash inflows and outflows of your organization over a specific timeframe, typically on a monthly or quarterly basis.

With accurate cash flow projections, you can ensure that you have sufficient liquidity to meet your financial obligations, day-to-day operations, and investment opportunities.

This document helps you predict any cash shortfalls or surpluses and plans strategically for both income and expenses.

Break Even Analysis

Nonprofit organizations are not working for profitability like for-profit businesses do, but conducting a break-even analysis can still be helpful.

It helps you determine the point at which your nonprofit’s total revenue equals total expenses and reach financial equilibrium.

By identifying the level of revenue needed to cover expenses, nonprofit organizations can make smart decisions about resource allocation, fees for programs & services, and fundraising goals.

7. Test Assumptions and Risk Analysis

As your entire plan is prepared based on assumptions, you’ll need to regularly review and validate your financial assumptions through research, market analysis, and consultation with stakeholders.

This will help you evaluate the reliability and relevance of revenue forecasts, expense projections, or fundraising targets. Here, don’t forget to consider several factors, such as changes in donor behavior, economic conditions, regulatory compliance, and competitive landscape.

Furthermore, you’ll have to conduct a risk analysis to identify potential risks and threats related to funding volatility, community challenges, reputational risks, or other factors.

By performing test assumptions and risk analysis, you can develop contingency plans to mitigate potential risks, diversify revenue sources, and make well-informed decisions.

8. Monitor and Update Your Plan

Once your entire plan is ready, regularly review and update your nonprofit financial plan in response to changing fundraising goals, program priorities, and external market needs.

You can also analyze and monitor financial metrics and key performance indicators(KPIs) to track progress toward your goals and make strategic decisions.

If some factors are remarkably different from actual projections, identify the causes behind them and adjust your strategies or tactics as needed.

This will allow your nonprofit organization to optimize financial outcomes and achieve mission objectives.

Now that you know how to create a solid nonprofit financial plan, it’s time to explore an example for easy understanding.

Nonprofit Financial Plan Example

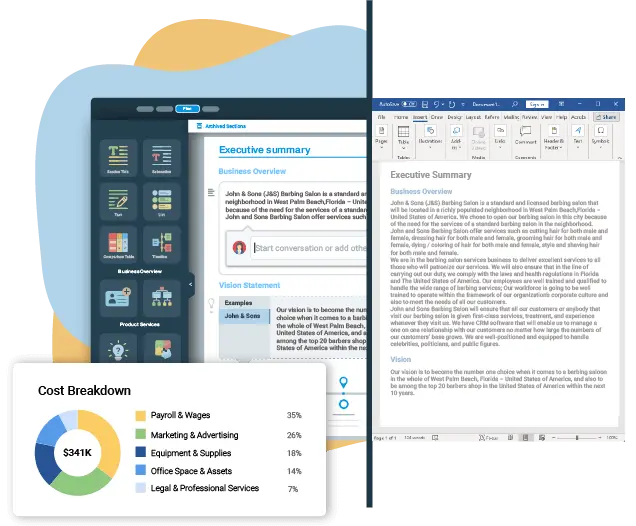

Creating a nonprofit financial plan from scratch can be a daunting task, right? But not to worry; we’re here to help you with a realistic financial plan example prepared using Upmetrics.

It includes all the key elements of a nonprofit’s financial projection, including the fundraising strategy, income statement, balance sheet, cash flow projections, and break-even analysis, making your planning process a breeze.

Start Preparing Your Nonprofit Financial Plan

And that’s a wrap—we’ve discussed all the fundamental aspects of financial planning. So, it’s time to put that knowledge into action.

But if you still feel swamped by the thought of creating a financial plan, don’t worry. Upmetrics’ robust financial forecasting software can be your savior here.

Whether you’re a skilled entrepreneur or just a beginner, Upmetrics streamlines the entire process and ensures that your plan is prime for success. Simply enter the financial assumptions and let us handle the rest.

So, what are you waiting for? It’s time to start planning for your venture!

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.