If you’re running a business, you probably have a hundred things to worry about. But here’s one that 82% of failed businesses wish they had paid more attention to—cash flow management.

A U.S. Bank study confirms this by finding that cash flow issues are the #1 reason businesses shut down.

If you’re running a business, the last thing you want is to become part of that statistic. That’s why you must have a clear strategy for tracking cash movement. A great place to start is understanding how to forecast cash flow.

And at the core of that strategy is a choice—direct vs indirect cash flow.

The direct method tracks actual cash transactions, while the indirect method adjusts net income to estimate cash flow. So which one should you choose? That’s exactly what we’re going to break down in this blog.

To begin with: What is a cash flow statement?

A company’s cash flow statement is one of three core financial statements, along with the income statement and balance sheet. While those focus on profitability and assets, this one answers the most important question: Where is your cash actually going?

It tracks cash movement in three areas:

- Operating activities: Money from sales, expenses, and everyday business operations.

- Financing activities: Cash flow from loans, stocks, and investor payouts.

- Investing and financing activities: Spending on equipment, property, and long-term growth.

That’s why financial expert Denise O’Berry emphasizes, “It is the lifeblood of your business. You’ve got to have money coming in before you can put money out,” in her book Small Business Cash Flow: Strategies for Making Your Business a Financial Success.

Even if your income statement looks great, your business can still struggle if cash balance isn’t available when you need it. That’s why monitoring cash flow is just as important as tracking profit.

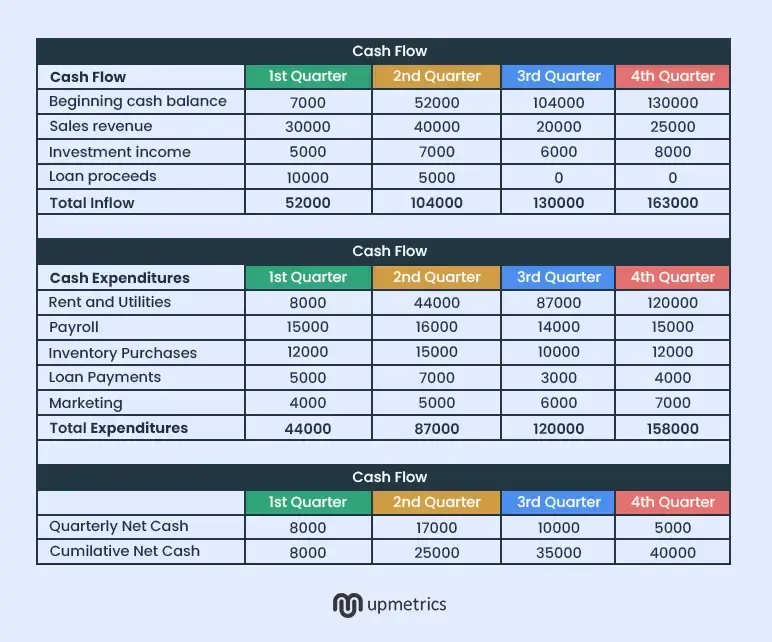

Here’s a sample company’s cash flow statement:

Since cash flow is the key to business survival, it’s important to track it the right way. Before we compare direct vs indirect method cash flow, let us understand them individually—beginning with the direct cash flow method.

What is a direct cash flow method?

The direct cash flow method tracks real cash transactions that occur as part of a business’s day-to-day operations. This includes:

- Cash received from customers

- Payments made to suppliers

- Wages paid to employees

- Purchases of inventory

This method ignores financing and investment activities, making it laser-focused on running cash flow. Why does that matter? Because it gives businesses a clear look at their liquidity, ensuring they can cover short-term financial obligations without relying on outside funding.

Since cash paid and cash flow from operating activities are directly recorded, businesses can gain a real-time view of financial data, improving working capital management and financial planning strategies. It also simplifies the process of adjusting net income to reflect real cash movements, reducing dependence on complex accrual accounting methods.

An example can be a freelance graphic designer who is paid $3,000 for a completed project. They then pay:

- $800 for software subscriptions (operating expenses)

- $200 for marketing expenses

- $400 for internet and workspace rent

The cash flow statement shows a total of $1,600, which is a direct representation of cash generated and cash spent from operating activities during the reporting period.

Pros of direct cash flow method

✅ More accurate: Since the direct method does not rely on adjustments or estimations, reducing the chances of miscalculations.

✅ Better financial understanding insights: This method enables companies to comprehend precise cash flow, enabling efficient cash flow management.

✅ Easier for small firms: Small firms and startups with fewer transactions employ this method to track cash flow and steer clear of liquidity problems.

✅ Enhanced operating capital management: Enhanced managing of operating capital: Since the direct cash flow method emphasizes instantaneous incoming and outgoing cash, companies can better manage operating capital.

Cons of the direct cash flow method

❌ Time-consuming: This method requires tracking every cash transaction, which is tedious for businesses processing thousands of transactions each month.

❌ Difficult to scale: As a company grows, manually recording every incoming and outgoing cash becomes less practical.

❌ Higher risk of human error: If one transaction is missed, it can lead to miscalculations in the cash flow statement, making financial planning more challenging.

❌ Not always required by Accounting standards: The direct cash flow statement method is not required by all regulatory bodies, so large corporations use it less frequently.

What is an indirect cash flow method?

The indirect method of cash flow is one technique companies use to prepare their statement of cash flows, beginning with the total income and adjusting for non-cash items and changes in working cash.

This approach balances net income with operating cash flow by making adjustments for depreciation, accounts receivable, accounts payable, and inventory changes. Companies apply this method to know how net income influences operating cash flow and gives a wider perspective of monetary well-being.

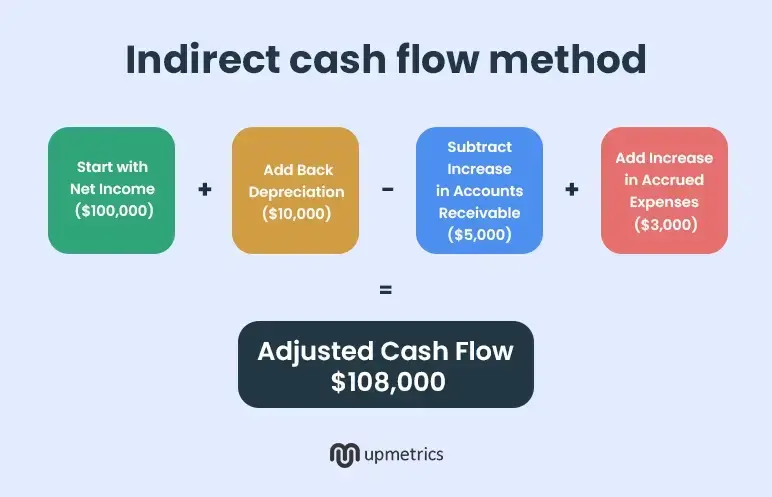

Let’s suppose a tech company reports $100,000 in net income. That doesn’t necessarily mean it has $100,000 in cash, though. The company:

- Adds on $10,000 of depreciation (a non-cash item)

- Subtracts $5,000 increase in accounts receivable (since it hasn’t collected that cash yet)

- Adds $3,000 in increased accrued expenses payable

After these adjustments, the cash flow statement will show a running cash of $108,000, which is a clearer picture of available cash.

Pros of the indirect method

✅Widely used and accepted: The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) favor this method, so most businesses use it.

✅Less time-consuming to prepare: As it takes data from current financial statements and accounts for non-cash transactions, accountants do not have to keep track of every single cash transaction, so it is quicker.

✅ Works for public companies: Publicly traded businesses are required to use this method for compliance to fulfill compliance, whether or not they apply the direct method internally.

Cons of the direct method

❌ Less detailed: This method is not clear enough to identify exactly which individual activities create real cash inflows or outflows.

As it depends upon adjustments and estimation, it may not always demonstrate the real cash position of the company.

❌ Potential for inaccuracies: As it depends upon adjustments and estimation, it may not always demonstrate the real cash position of the company.

So, you now know what direct and indirect cash flows are. But which one is better for your business? One method is simple and transparent, while the other aligns with financial reporting standards like accrual accounting.

To help you decide, let’s break down their key differences.

Direct vs. Indirect cash flow: Key differences

You can either track every dollar in real time with a cash flow statement that reflects actual cash transactions or adjust financial data for smoother reporting. Which one aligns with your needs? Let’s compare direct and indirect cash flow methods.

How they operate

The direct method offers a true view of a business’s operating activities and cash flow. All cash inflows from customers and cash payments to suppliers, employees, and other non-cash expenses are accounted for at once.

The indirect approach, rather than following each cash transaction, begins with net income and adjusts for non-cash charges, accrued items, and working capital changes by looking at the balance sheet.

Financial transparency

The direct method is your go-to if you want to see the exact source of incoming and outgoing cash. It tracks every cash transaction, making it easier to manage working capital and analyze operating expenses.

The indirect method is useful for companies that focus on net profit rather than cash flow visibility. While it adjusts financial data to show how income translates into cash flow from operating activities, it’s less transparent when it comes to identifying specific movements of cash.

Complexity

The direct method requires businesses to track each transaction, making it accurate but more labor-intensive. If a business has a high volume of transactions, maintaining this level of detail can be challenging.

The indirect method is simpler and more practical for businesses with complex financial structures. Since it adjusts existing total income data, making it faster and easier to prepare financial statements.

Preference

The direct method is most commonly used by small businesses, startups, and cash-heavy industries. If tracking cash equivalents and income taxes paid is important to you, this method provides better insights into short-term liquidity.

The indirect method is preferred by large corporations that follow GAAP or IFRS. Since it simplifies financial reporting, companies with complex operations and high transaction volumes typically favor this approach.

Suitability

The direct cash flow statement method is the right choice for businesses that need real-time cash insights. It’s especially useful for liquidity planning, managing total cash receipts, and forecasting short-term financial needs.

For businesses that prioritize compliance and structured reporting, the indirect method is better suited.

Many companies use both methods—direct for internal cash management, and indirect for formal financial reporting.

| Aspect | Direct Cash Flow | Indirect Cash Flow |

|---|---|---|

| Starting Point | Tracks the real cash transactions. | Starts with net income and makes adjustments. |

| Transparency | Clearly shows incoming and outgoing cash. | Less transparent due to adjustments in financial data. |

| Complexity | More detailed but requires manual tracking. | Easier to prepare as it pulls from balance sheet accounts. |

| Preference | Used by small businesses and cash-focused companies. | Commonly used by large corporations and firms following GAAP/IFRS. |

| Suitability | Best for businesses needing real-time cash flow tracking. | Ideal for financial reporting and regulatory compliance. |

Indirect vs. direct cash flow method: Which is better?

The answer depends on how much effort you want to put into tracking your cash moves, your financial goals, and your company’s financial health.

When the direct cash flow statement method works best

- You need real-time cash flow reporting and want to track net cash flow from operating activities as it happens.

- Your business depends on incoming cash, like cash receipts from customers and cash paid to suppliers.

- You want a clear cash balance at all times to manage working capital and accounts receivable.

- You’re okay with subtracting cash payments manually to ensure financial health.

When the indirect cash flow method is more suitable

- You follow GAAP or IFRS and need a cash flow statement that aligns with accrual-based accounting methods.

- Your business has high transaction volumes, making it difficult to track every cash-based payment individually.

- You prefer a method that pulls from the organization’s net income and adjusts for non-cash transactions, like depreciation and fixed assets.

- Your focus is long-term financial planning rather than monitoring actual cash flow daily.

If your priority is compliance, efficiency, and strategic financial planning, the indirect cash flow statement method is a better fit. No matter which method you choose, applying cash flow forecasting tips can help you improve accuracy and better predict future cash positions.

Forecast your cash flow with Upmetrics

Keeping your cash flow in check is non-negotiable if you’re running a business. Whether you prefer the direct method for detailed cash tracking or the indirect method for adjusting financial data, choosing a reliable one for your operation is most important.

However, manually tracking cash paid, net cash, and financing activities can be exhausting, especially as your business scales—things won’t get any easier when you go about cash flow forecasting.

That’s when Upmetrics’ cash flow forecasting feature can help. You can streamline cash flow management, reporting, and forecasting with an AI-assisted forecasting tool.

It doesn’t matter which method you choose for your cash flow forecasting, Upmetrics would still be the best option for your business.