Running a business means making a hundred decisions a day! And surprise, most of them involve money.

Whether you’re just starting out or trying to scale without losing your mind (or your savings), knowing how to split your budget is everything. That’s where allocation of funds comes in.

It’s not a fancy term. It just means figuring out where your money should go so everything runs smoothly (and nothing important gets left behind).

In this post, we’ll explore what the fund allocation means, why it matters, where the money usually goes, and how to do it right.

What is the Allocation of Funds?

Allocation of funds refers to the planned distribution of available money among various business needs—whether that’s marketing, salaries, equipment, or saving for a rainy day. It’s a key part of budgeting aimed at supporting businesses to stay focused, avoid overspending, and grow faster.

Importance of Fund Allocation

The allocation of funds is the process of dividing available financial resources across different departments, projects, or business activities. It helps ensure that each area gets the money it needs to function effectively.

Whether you’re running a small business or a large company, having a clear plan for how you’ll use your money helps you stay organized and avoid cash problems.

A good fund allocation plan won’t fix everything, but it can save you from financial stress and keep things running smoothly.

Here’s why it matters:

- Helps focus on priorities and spend on what moves the needle.

- Prevents overspending and keeps you from blowing your whole budget on one thing.

- Improves planning while setting you up for growth instead of just surviving.

- Supports transparency and lets you show investors or lenders where the money goes.

- Ensures money is set aside for both regular operations and unexpected costs, reducing risks.

If you don’t have a clear plan for your funds, you might run out of money in critical areas. For instance, no marketing budget left right before a big launch.

In simple terms, proper allocation helps keep your business financially steady and moving forward.

How to Allocate Funds in a Business

It’s no brainer: Every business is different. And how much goes where depends on the business model, size, and current goals. But most small businesses divide their funds among these areas:

Marketing & sales – Ad campaigns, social media, content creation

Operations – Rent, utilities, tools, and delivery costs

Product or service development – Updates, improvements, packaging

Staffing – Salaries, hiring, training, benefits

Technology & tools – Software, platforms, automation, equipment

Emergency reserves – Emergency funds or future investments

Common Mistakes to Avoid in Fund Allocation

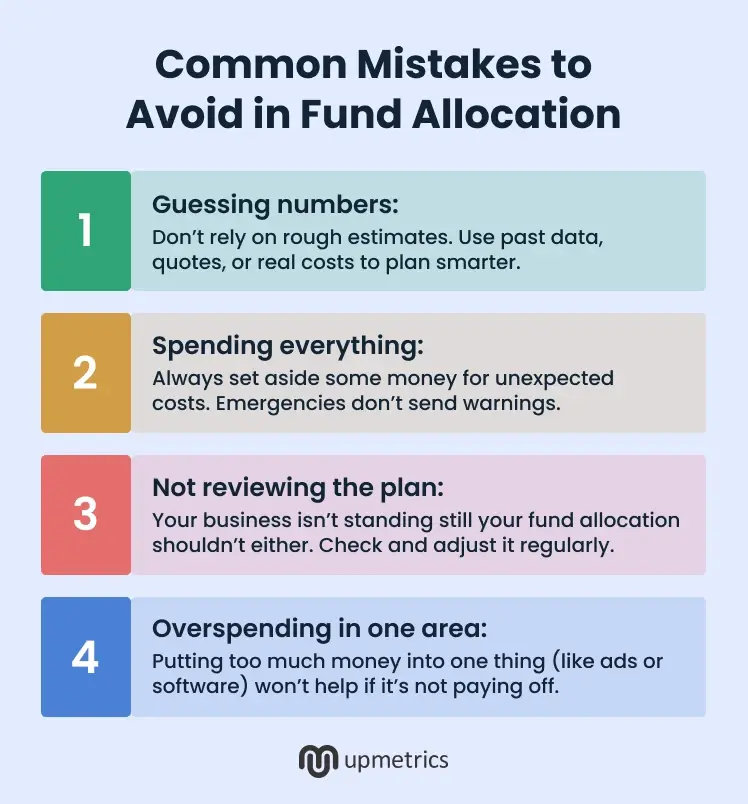

Allocating funds sounds simple, but it’s easy to make small mistakes that can cause big problems later. Here are a few things that a lot of business owners slip up on when allocating funds:

- Guessing numbers: Don’t rely on rough estimates. Use past data, quotes, or real costs to plan smarter.

- Spending everything: Always set aside some money for unexpected costs. Emergencies don’t send warnings.

- Not reviewing the plan: Your business isn’t standing still—your fund allocation shouldn’t either. Check and adjust it regularly.

- Overspending in one area: Putting too much money into one thing (like ads or software) won’t help if it’s not paying off.

Keep your plan simple, realistic, and flexible. That’s usually better than trying to get every number perfect.