If you’re an organized person, enjoy working with numbers, and have a passion for helping others, then a career in bookkeeping can be a perfect fit for you.

Setting up a successful bookkeeping business takes work. It’s a path that demands not only innovative business ideas but also a thorough understanding of different organizational firms.

To set up a profitable bookkeeping venture, you’ll have to navigate through financial planning, operational setup, legal requirements, and effective client relationship management.

But worry not, we’re here to simplify this journey for you. We will cover all the essentials to build your bookkeeping firm. Let’s get on this exciting journey together.

Is a bookkeeping business profitable?

Indeed, they could be a lucrative venture. The reason is that there are relatively low barriers to entry and with minimum startup costs, you can start this business.

All you need is some experience in bookkeeping, access to accounting software, and effective marketing strategies to attract bookkeeping clients.

Moreover, the demand for bookkeeping services is increasing. According to a recent report, the industry’s revenue is expected to reach $3.9 billion by 2025 which represents a growth of 3.3% from 2020.

This growth emphasizes ample opportunities for bookkeeping agency business owners to drive in an expanding market.

So it’s a great venture to begin your entrepreneurial journey with.

Now let’s have a look at the ins and outs of the bookkeeping business.

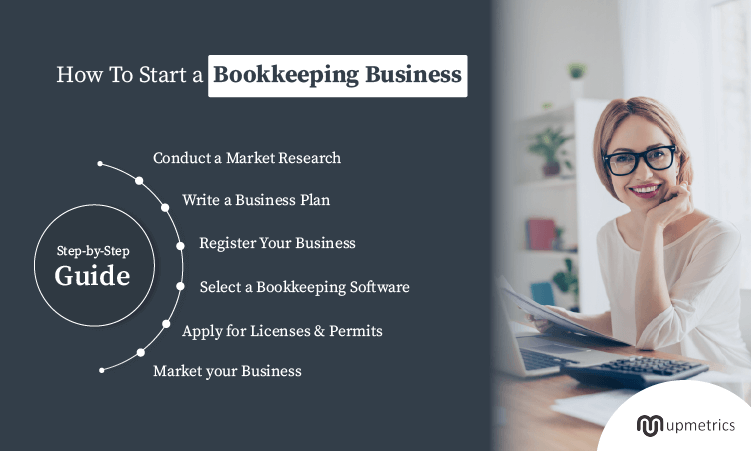

How to start a bookkeeping business: quick checklist

1. Conduct market research

Understanding your target market is important for a successful bookkeeping firm. So before entering into this field, you need to conduct thorough market research.

By doing so, you will know the demand for bookkeeping services in your area and the competition you will face ahead of your business.

You can also conduct surveys to learn more about your potential clients and their problems. The more you can find out about what your future customers are looking for, the better you’ll be able to serve them.

Moreover, market research helps you decide on a particular business niche, you want to focus on and helps you develop various marketing and sales strategies.

2. Write a bookkeeping business plan

Before getting things done ahead, take a moment to create a detailed business plan. It provides a roadmap that navigates you to a profitable business.

A well-prepared bookkeeping business plan should cover every aspect of your business, including your service offerings, pricing models, marketing strategy, and financial projections.

So ensure that you also include the following sections in your own business plan:

- Executive summary

- Company Overview

- Market analysis

- Products and services

- Sales and Marketing Strategies

- Operations plan

- Management team

- Financial plan

Writing these sections requires utmost attention and precision in detailing.

Not very good at writing? Need help with your plan?

Write your business plan 10X faster with Upmetrics AI

Plans starting from $14/month

3. Business registration and legal paperwork

For the smooth running of the bookkeeping firms, it is necessary to do all the paperwork and registration.

Every state has its unique set of regulations and requirements concerning business operations. Understanding these legal necessities is a must, as they vary widely based on the nature of your business and its geographical setting.

So to set your bookkeeping business on the path to success, it’s important to first address these legal requirements, which include:

- Registering your Business Name

- Registering your Business Structure as a Sole proprietor or Limited Liability Company, or Partnership.

- Get an EIN: Federal Tax ID Number

- Open a Business bank account

If you need any additional guidance, seeking legal counsel is always recommended.

4. Select a bookkeeping software

Choosing the correct accounting software that meets your business needs, and offers essential features like invoicing, tax compliance, and expense tracking is a must in bookkeeping businesses.

There are plenty of small business accounting software options available in the market such as QuickBooks Online, Xero, and FreshBooks.

Each of these accounting software provides you with features such as user interfaces, and pricing plans, so it’s worth exploring demos. You can consider taking free trials to find the best fit for your business.

Selecting the right bookkeeping software can simplify your financial processes, increase productivity, and hence contribute to the success of your business.

5. Get Business Insurance

First, secure business insurance to protect your bookkeeping company from any kind of risks and liabilities. So make sure that you get the insurance when you start your own bookkeeping business.

Here are some of the common insurance you may require for the bookkeeping firm:

- Professional Liability Insurance

- Commercial General Liability Insurance

- Cyber Liability Insurance

- Legal Expense Insurance

So to safeguard yourself from any unexpected circumstances, try to cover all of the above-mentioned insurance.

6. Pricing your services

Determining the right price for your accounting and bookkeeping services is a difficult task influenced by various factors such as your certifications, years of experience, the location of your business, and more.

Doing a bit of research on fellow bookkeeping businesses will give you a clear view of the current market rates. You can also refer to freelance sites, such as Zippia, and Upwork, to see what others are charging.

As per the U.S. Bureau of Labor Statistics, the median pay for bookkeeping services was $45,860 per year and $22.05 per hour in 2022.

However, you can consider the following pricing models:

- Hourly rate pricing: You can charge your clients hourly for services.

- Fixed-rate pricing: Have clients pay a fixed amount up front.

- Percentage of client’s income: Charge based on a percentage of your client’s revenue. It works well if you have a lot of different-sized clients.

- Per bank account: Charge clients based on how many bank accounts you need to manage, reconcile, etc.

- Per transaction: You can charge clients per transaction.

Including a mix of these models may be beneficial, depending on the nature of your new bookkeeping business, and help you to attract potential bookkeeping clients.

7. Consider your funding options

Funding plays an important role in establishing and growing a bookkeeping company. It provides the essential financial backbone needed to cover the estimated startup costs of the business.

However, relying on personal finances to fund your business is risky and can lead to complications down the road. So keep your personal and business finances separate and get a business credit card that can cover your basic business expenses.

Now let’s have a look at some of the funding options, you can opt for:

- Bank Loans

- SBA Loans

- Small Business Grants

- Personal Savings

- Venture Capitalists

The ideal funding option should match your business goals, providing a stable financial base for your bookkeeping firm’s growth and success.

Additionally, regularly monitor your business expenses and maintain accurate financial statements to track your cash flow and ensure financial stability.

8. Marketing your bookkeeping business

Now that you’ve built your expertise, created your own bookkeeping business, and are ready to help the organization solve its complex problems. So, it’s time for a promotion of your business.

It plays an important role in boosting your sales by attracting potential clients.

Consider these effective methods to promote your services and enhance your sales:

- Creating a website and SEO Optimization

- Social Media Marketing

- Email Marketing

- Networking

- Referral Programs

Utilizing the above channels effectively will help you reach the client base of your business.

The next step

Now you might have a pretty clear idea about how to start a bookkeeping company.

To be successful in this industry, understand what your prospective clients need. The next foremost step is to carefully price your services and spread the word about your business to attract the target market. It’s also important to have a business plan and utilizing a business plan tool can be helpful.

With all these insights into the bookkeeping industry, it’s time for you to put them into action and turn your dreams into a successful reality.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.