Executive Summary

Corner Cup Coffee is a single-member LLC coffee shop that is located in Chapel Hill, North Carolina, USA. The shop will be in a rented storey of about 900 sq ft on the ground floor in a downtown walking area.

The coffee shop sits in a strategic area where students, residents, commuters, and nearby office workers pass by daily and easily notice the business.

Corner Cup operates as a neighborhood coffee shop that serves espresso-based beverages and easy-to-carry-out food products. It is structured as a daytime, counter-service coffee shop designed to serve:

- Nearby residents

- Students

- Commuters

- Local office workers

The coffee shop operates with a limited menu and minimal seating, designed for customers who prioritize quick service, convenience, and consistent quality rather than extended stays.

Mission and Objectives

Corner Cup has the mission of providing quality and uniform coffee in an efficient neighborhood facility that is established on routine and habitual visits.

Lauren Bennett, the owner, operates the business directly and oversees purchasing, scheduling, product standards, and customer experience to maintain daily consistency and reliability.

In addition, our short-term goals are focused on:

- A daily transaction of 140-160 with uniform hours and walk-ins in the initial six months of the business.

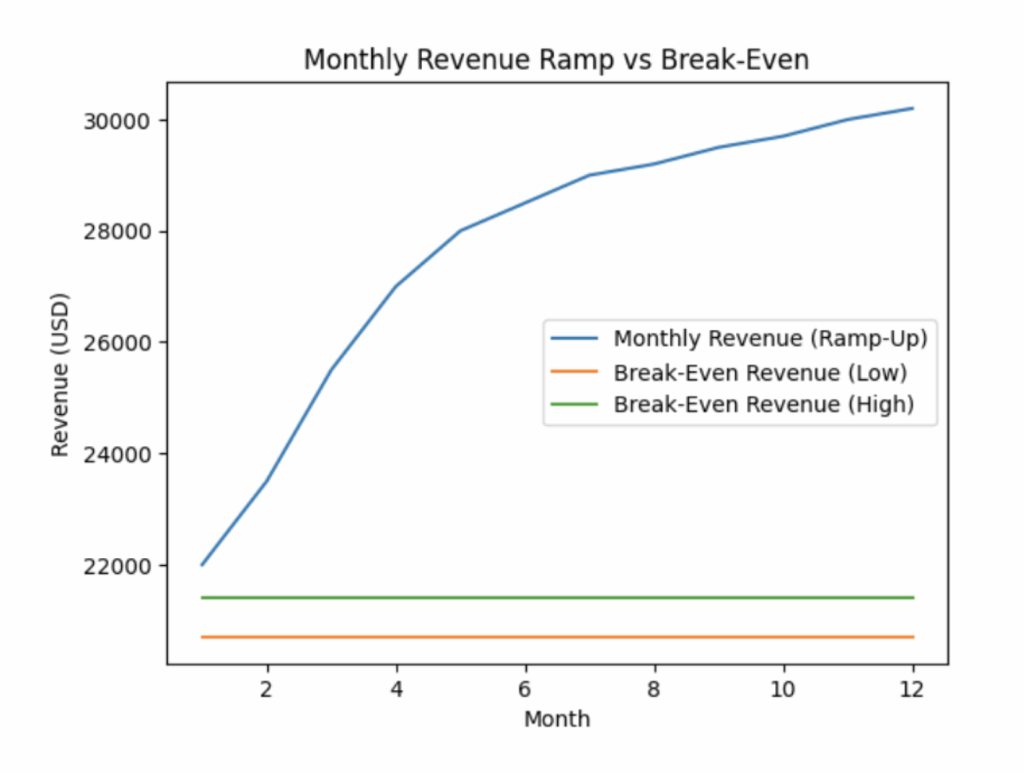

- Achieving a break-even revenue of $21,000 in Month 4 and sustaining a break-even level of coverage of at least 1.25x thereafter.

- Keeping food and beverage waste at 5% of monthly purchases by making disciplined inventory purchases and having a small menu.

- Restricting the labor expenses to the desired levels of staffing by ensuring that the total number of barista hours does not exceed the planned weekly intervals, while preserving the speed and quality of service.

This approach reflects a hands-on, execution-focused operating philosophy rather than a growth-at-all-costs model.

Revenue Model

Corner Cup Coffee LLC generates revenue through direct, in-store sales to individual customers. And we follow a simple, transaction-based model designed for consistent daily cash flow and repeat customer visits.

Espresso drinks, drip coffee, and cold brew sold regularly are the primary revenue generators in the morning and early afternoon. Secondary revenue will be tea drinks, pastries, and pre-packaged grab-and-go foods used to supplement beverage sales.

All sales take place at the counter during normal operating hours, and payments are collected immediately at the point of sale. This approach supports predictable cash inflows and eliminates credit risk.

The following is additional information regarding the structure of the revenue model:

- Business type: Business-to-consumer retailing (B2C).

- Sales channel: In-store only, counter-service only.

- Method of payment: POS payments.

- Exclusions: No B2B, no catering, no delivery platform, no subscription, no wholesale sales.

This targeted revenue strategy makes operations straightforward, minimizes overheads, and is not based on increased sales channels but recurring purchases on a daily basis.

Funding Request and Use of Funds

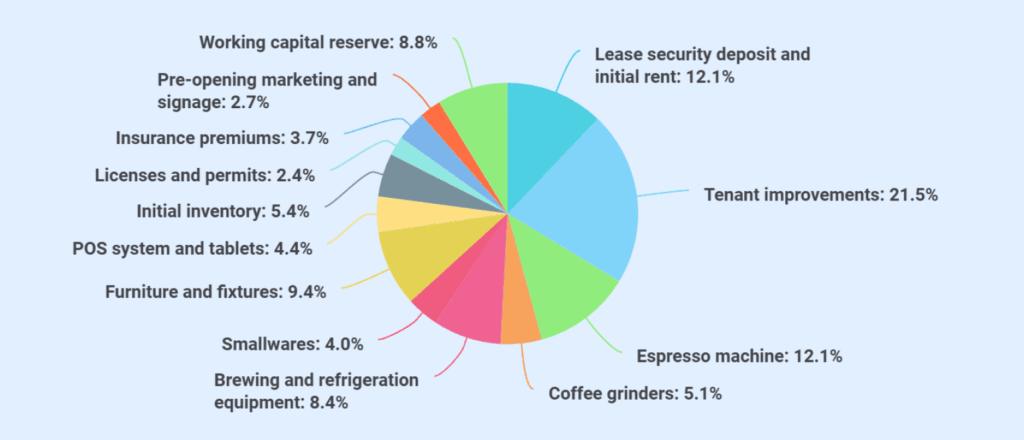

Corner Cup is requesting a bank term loan from Truist Bank (Small Business Retail Lending) amounting to $120,000. The owner will be appearing with a contribution of $30,000 in capital, which will increase the total capacity of the startup capital to $150,000.

Startup capital will be used for the following purposes:

| Category | Amount (USD) |

|---|---|

| Business registration, permits, licenses | $3,000 |

| Legal, accounting, and inspections | $4,500 |

| Branding, signage, and opening marketing | $5,500 |

| Espresso machine (2-group, refurbished) | $24,000 |

| Espresso grinders (2 units) | $8,000 |

| Brewers and hot water system | $6,500 |

| Refrigeration (reach-in and under-counter) | $9,500 |

| Ice machine | $5,500 |

| POS hardware | $4,500 |

| Smallwares and bar tools | $3,500 |

| Plumbing and electrical upgrades | $15,000 |

| Counter, bar, and cabinetry | $13,000 |

| Flooring, paint, and lighting | $9,000 |

| Furniture and fixtures | $7,000 |

| Initial coffee, milk, syrups, and pastries | $4,000 |

| Paper goods and cleaning supplies | $2,500 |

| Lease and utility deposits | $6,000 |

| Working capital (opening cash) | $9,000 |

| Total Startup Costs | $144,000 |

Note: Extra $6,000 allocated to additional deposits and prepaids (lease/utilities and prepaid insurance/permits).

Financials

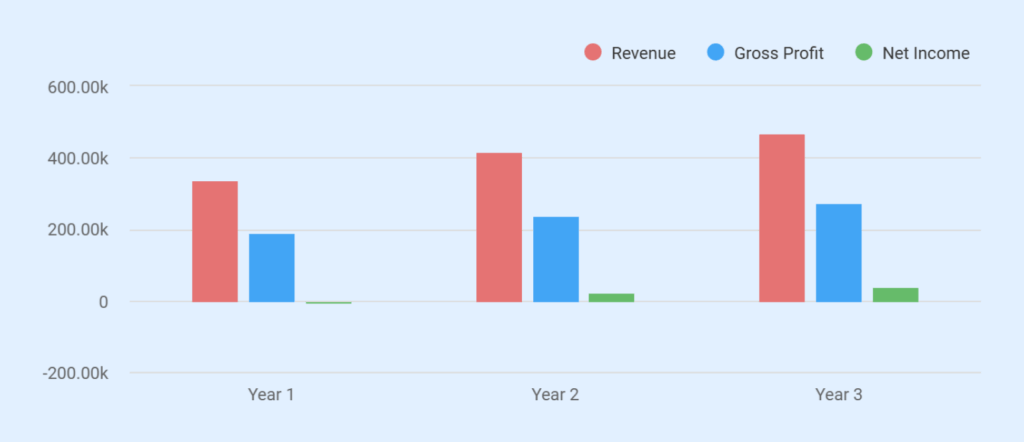

It is estimated that Corner Cup Coffee will yield revenue of $337,500 in Year 1, which will grow to $415,000 in the 2nd year and $468,000 in the 3rd year as the daily transaction volume levels up.

Our coffee shop has a gross margin of more than 56%, which is backed by a limited menu, and the input costs are controlled. Average fixed monthly operating expenses are approximately $11,600, resulting in a monthly break-even revenue of about $21,000.

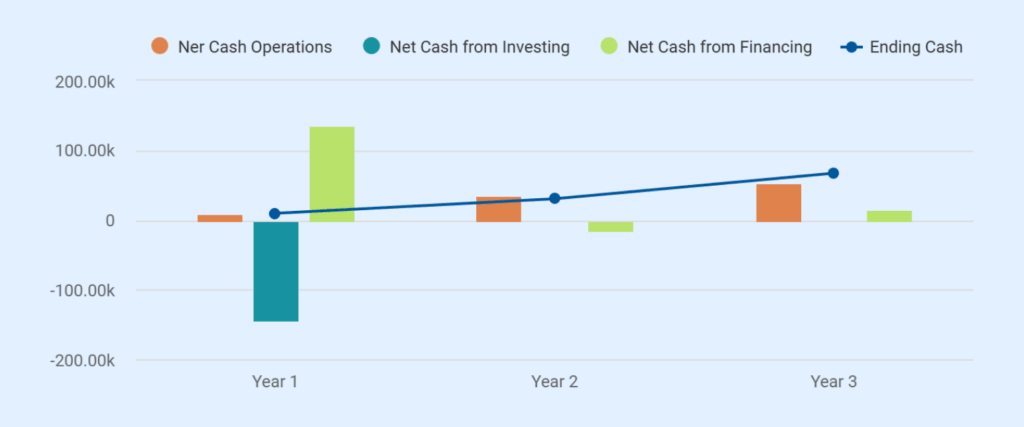

Positive operating cash flow exists throughout the years of operation of the business, with the profitability increasing with utilization, and the fixed costs do not change. EBITDA margins increase to above 12% in Year 3 as compared to 4.9% in Year 1.

The startup expenses are $150,000, which is comprised of a bank term loan of $120,000 and owner capital of $30,000. The loan is completely amortised in terms of 7 years and has a constant debt service, which helps to make the repayment predictable without the combination of aggressive growth assumptions.

Business Overview

Corner Cup Coffee is a small neighborhood coffee shop that is owner-run in Chapel Hill, North Carolina. The business also adheres to a narrow service concept where there is a high quality of products being served, quick service at the counter, and a high number of customers visiting the shop daily.

Legal Structure

Corner Cup Coffee operates as a single-member LLC to keep ownership, decision-making, and accountability with one operator. The structure simplifies management, supports clear financial records, and allows lenders to review performance without ownership or governance complexity.

Ownership and Management

The Corner Cup Coffee is a single-member LLC, 100% owned by Lauren Bennett, who also serves as the owner-operator. This structure simplifies management, keeps financial records clear, and allows lenders to review performance without ownership or governance complexity.

Lauren is responsible for all core business functions, including:

- Daily shop operations

- Purchasing

- Scheduling

- Quality control

- Vendor coordination

- Local marketing

This hands-on management approach allows for direct oversight of costs, service standards, and customer experience.

Concept and Operating Scope

Corner Cup is a small-footprint, counter-service concept with a limited number of seats and operates during the day. The shop is not intended as a destination coffee shop, coworking center, or nightclub.

Food items are sourced from external vendors and limited to grab-and-go offerings, allowing the shop to operate without a full kitchen or custom food preparation.

Operating scope highlights:

- Daytime-only operations focused on morning and early afternoon demand

- Limited seating designed for short visits and quick customer turnover

- Counter-service format with ordering, payment, and pickup handled at one point

- No late-night hours, events, or extended-stay use of the space

- Simplified food handling that reduces staffing, equipment, and regulatory burden

- Owner-managed model with direct oversight of daily operations and service quality

Development Stage

Corner Cup Coffee LLC is in the startup and pre-launch stage, with a secured location, defined operating plan, and fully outlined funding and cost structure. The business is structured to reach stable daily operations before considering any expansion, additional services, or changes to the core concept.

Market & Customer Analysis

Corner Cup Coffee operates in the retail coffee and café segment, a category characterized by frequent repeat purchases and strong daily customer usage. Demand is supported by broad US coffee consumption trends, sustained speciality coffee adoption, and a local customer base shaped by a large university and dense daytime activity in Chapel Hill.

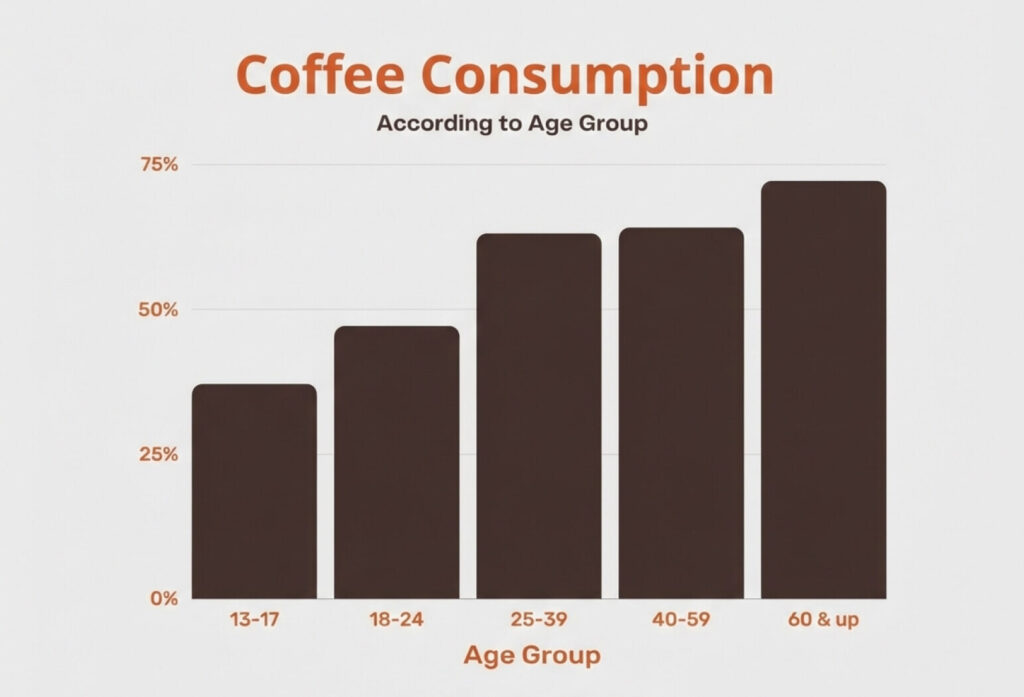

Importantly, the coffee consumption in the USA is comparatively high; according to a survey, 2 out of 3 adults drink coffee daily.

Local Market Analysis

The city of Chapel Hill, North Carolina, has an estimated population of 64,028; Hence, it is a small yet demographically rich local market that is ideal for a daytime coffee shop housed in a local neighborhood. The population composition of the town encourages the constant routine coffee demand and not the seasonal or event-oriented traffic.

This routine demand is reinforced by the presence of the University of North Carolina at Chapel Hill, which enrolls approximately 32,234 students and employs thousands of faculty and staff. Many of these individuals move daily through the Franklin Street corridor adjacent to campus.

The concentration of students, university employees, and nearby residents is within walking distance of 412 East Franklin Street. This creates a dense pool of repeat customers aligned with a daytime, counter-service coffee shop model.

Age Distribution and Consumption Relevance

The demand for coffee in Chapel Hill cuts across various age categories. And it sustains consistent demand in day-to-day routine consumption. The number of people drinking coffee among the 13-18-year-old population is about 37%; that is, young people are developing a habit and getting used to visiting the cafe, which is in many cases formed by families or a group of peers.

Conversely, the highest age distribution with the greatest rates of coffee consumption is the 65 years and above category, which forms 12.5% of the population. The older generation, aged 60 years and above, would like to buy coffee during the morning and early afternoon and spend the same hours enjoying the same environment and easy services. These aspects are consistent with day operating, small seating, and counter-service concept of Corner Cup.

Moreover, it has been identified that about 92% of the students use caffeinated drinks regularly. The demand supports the existence of a stable, daily customer base, which uses drinks regularly, in a university-orientated community such as Chapel Hill.

Target Customer Segments

Corner Cup is built for customers who buy coffee as part of a routine and want speed, consistency, and convenience. The table below outlines the primary customer segments we serve, including their typical visit times and purchasing behavior that support consistent daily traffic.

| Customer Segments | Typical Visit Times | Purchase Behavior |

|---|---|---|

| Students and university staff | Morning, between classes, early afternoon | Frequent beverage purchases, short visits, grab-and-go focused |

| Daytime workers | Weekday mornings and mid-day breaks | Take-to-go orders, consistent weekday patterns |

| Local residents | Morning routines and weekends | Repeat visits, predictable timing, familiarity-driven |

Competitive Landscape

The Chapel Hill coffee market includes both independent cafés and national chains, each serving distinct customer preferences and usage patterns. Corner Cup Coffee is positioned to compete in this environment through emphasis on speed, uniformity, and routine demand as opposed to breadth of offerings or extended stays.

| Competitor Type | Strengths | Limitations | Implication for Corner Cup |

|---|---|---|---|

| Independent cafés | Local brand recognition, unique menus, community ties | Larger menus slow service; higher staffing and food prep complexity | Opportunity to win customers seeking faster, simpler service |

| National coffee chains | Brand awareness, standardized operations, long hours | Less personal service; higher pricing in some cases | Competes on owner presence and neighborhood feel |

| Campus-area cafés | High student traffic, proximity to classes | Peak-time congestion; inconsistent service quality | Serves spillover demand and nearby non-campus traffic |

| Bakeries with coffee | Strong food draw | Coffee is secondary; limited beverage focus | Positions coffee as the core product |

Stop Googling competitors for hours

Competitive Advantages

Corner Cup does not attempt to compete by offering the widest menu, the longest hours, or a destination-style café experience. Instead, it competes through:

- Fast counter service during peak morning and early afternoon hours

- Consistent drink quality using standardized recipes and equipment

- Owner-led operations, allowing immediate oversight of service and costs

- Limited seating, encouraging quick turnover, and repeat visits

With these approaches, Corner Cup reduces operational strain while meeting the needs of customers who prioritize reliability over variety.

Market Risks

Corner Cup Coffee operates in a market where the customer demand is stable but very sensitive to convenience, consistency, and price. Small changes in operating costs or daily traffic can materially affect performance, making risk management an ongoing operational priority rather than a long-term strategic issue.

1) Competitive Density Risk

Chapel Hill has individual cafes as well as national chains. More competition may strain pricing and client retention. Corner Cup will address this threat by minimizing the menu and targeting a narrow range of service windows with a fast counter-service restaurant model that will attract routine-based traffic but not discretionary customers.

2) Foot Traffic Variability

Daily sales are influenced by academic schedules, weather, and local activity patterns. Slower periods during school breaks or inclement weather may reduce volume. This risk is managed through conservative revenue assumptions, daytime-only staffing, and flexible labor scheduling aligned with actual demand.

3) Input Cost Sensitivity

The price of coffee beans, dairy, and pastry can also vary based on the pricing of the suppliers and the general market situation. Corner Cup is restricting the exposure through a limited menu, local suppliers, and periodically reviewing pricing as opposed to absorbing sustained increases in costs.

4) Consumer Preference Shifts

Changes in beverage preferences or increased demand for non-coffee alternatives could affect the sales mix. Our menu retains basic flexibility through tea and cold beverage options without expanding into complex or equipment-heavy offerings.

5) Local Economic Conditions

Corner Cup is a neighborhood-based business, hence it is concerned with the local spending and employment trends. By serving students, residents, and daytime workers, this will decrease the dependence on one type of customer and assist in maintaining stability throughout the economy.

Overall, these market risks match the size and structure of a small, owner-run coffee shop and are managed through tight cost control, a limited operating scope, and flexible staffing.

Market Trends

The coffee shop market is increasingly shaped by cost discipline, labor constraints, and repeat-customer behavior rather than menu expansion or extended hours. The trends below reflect how successful small cafés are operating today.

| Market Trend | What Is Happening in Practice | Why It Matters for Corner Cup |

|---|---|---|

| Shift toward daytime-only models | Many independent cafés now close by mid-afternoon as sales drop sharply after lunch | Supports Corner Cup’s morning–early afternoon schedule and reduces low-yield labor hours |

| Smaller menus outperform broad menus | Operators are cutting low-selling items to reduce waste and prep time | Reinforces a focused menu built around high-turn beverages |

| Rising labor costs reshape staffing | Shops rely more on part-time staff and tighter scheduling | Aligns with Corner Cup’s lean staffing and limited overlap |

| Decline in full kitchen builds | Food prep adds cost without a consistent margin return | Supports grab-and-go sourcing and no kitchen investment |

| Dependence on repeat customers | Daily regulars now account for a larger share of revenue than new traffic | Matches Corner Cup’s neighborhood and routine-based model |

| Owner-operated units outperform absentee-run cafés | Hands-on owners control costs and service quality more closely | Validates the owner-operator structure |

Product & Services

Corner Cup Coffee LLC offers a focused menu that is easy to execute, supports fast service, and delivers consistent quality for daily customers. The menu is carefully restricted to offer foods that can be made in a short time, occupy less space in the back-of-house area, and have consistent food and beverage expenses.

Core Beverage Offerings

Beverages are the primary revenue driver and are prepared to consistent standards using commercial espresso equipment and standardized recipes.

1) Espresso-Based Drinks

Espresso drives the highest daily demand, offers strong margins, and can be prepared quickly and consistently during peak hours. This makes Esppresso the core offering for Corner Cup Coffee.

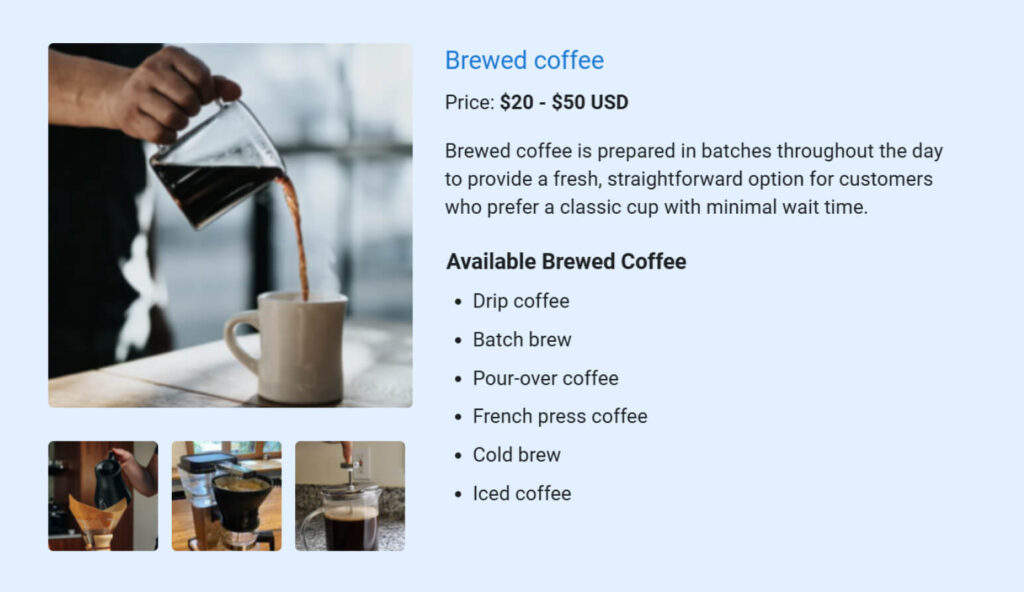

2) Brewed Coffee

Brewed coffee supports fast service during peak hours, appeals to routine daily customers, and delivers strong margins with low preparation complexity.

3) Cold Beverages

Cold beverages include cold brew and iced coffee options prepared in advance and served quickly to meet demand during warmer periods and afternoon hours.

4) Tea Selection

Tea broadens the menu to serve non-coffee drinkers while maintaining low preparation time and minimal impact on staffing or equipment.

All beverages are prepared to order at the counter and served for immediate consumption or takeaway. The limited drink menu reduces preparation errors, shortens training time for baristas, and supports steady service flow during peak hours.

Grab-and-Go Food Items

Food offerings are kept simple and sourced from external vendors to avoid the operational and regulatory complexity of a full kitchen.

- Fresh pastries supplied by a local bakery

- Packaged snacks suitable for quick add-on purchases

No food is prepared from scratch on-site. Items are selected based on shelf life, ease of storage, and compatibility with morning and mid-day coffee demand.

Service Style and Customer Experience

Corner Cup operates as a counter-service café with limited seating. Customers order, pay, and pick up their drinks at the counter. Seating is meant for short visits, not long stays, which helps keep the flow moving during busy hours.

This setup works well for commuters, students, and nearby workers who want quick service. It also allows the shop to run efficiently with a small team.

Consistency is a priority. Drink recipes, portion sizes, and preparation steps are standardized to ensure customers receive the same experience regardless of shift or staff member.

Items and Services Not Offered

To have operational transparency and control of costs, the following services are deliberately left out:

- Full service or custom-made food.

- Alcohol service

- Catering or bulk orders

- Delivery platforms or third-party marketplaces

- Subscription or office coffee programs

Product Development Philosophy

Menu changes are made carefully and only when new items can be prepared with the current equipment, staff, and space. Seasonal drinks or small specials may be added from time to time, but the main menu stays the same to control costs and keep service consistent.

This approach fits an owner-run shop that focuses on smooth daily operations, quick service, and regular customers rather than frequent menu changes or experiments.

Investors hate amateur writing errors

Instantly improve your plan w/ our AI writing assistant

Marketing & Sales Strategy

Corner Cup Coffee uses a local, everyday marketing approach focused on attracting steady foot traffic and repeat visits rather than one-time promotions. The shop spends about $700 per month on marketing. This reflects a neighborhood-based model that relies mainly on walk-in customers instead of large advertising campaigns.

Strategic Approach

At Corner Cup Coffee, our marketing activities are aimed at visibility, accuracy, and repetition. We’re not pushing away the customers in the faraway regions but are turning the passing foot traffic into regulars.

The strategy gives preference to the channels that would aid in local discovery, reinforce everyday routines, and provide low-maintenance presence. Every marketing activity is considered on the basis of facilitating a repeat visit instead of a high spike in the short term.

Marketing Channels

We will also rely on storefront exposure and pedestrian traffic as our main marketing means, which will be aided by the appropriate exterior signs and presence on the street level. The secondary marketing will target local search presence, social media updates, and easy-going loyalty programs.

| Marketing Channels | Purpose | Monthly Spend |

|---|---|---|

| Storefront signage and visibility | Capture walk-in and pass-by traffic | $200 |

| Google Maps and local search | Ensure accurate discovery and directions | $150 |

| Social media updates | Communicate hours, specials, and daily presence | $150 |

| Loyalty punch cards | Encourage repeat visits | $100 |

| Local promotions and community exposure | Flyers, small collaborations, local boards | $100 |

| Total Monthly Marketing Spend | $700 |

Sales Process

Corner Cup relies on a simple, in-person sales process. Customers discover the shop through location visibility or local search, place orders at the counter, and complete payment immediately by cash or card. The focus remains on fast service, clear pricing, and consistent product quality. Baristas reinforce the experience through friendly, efficient interaction rather than scripted upselling.

The additional considerations that keep the sales process smooth are:

- Ordering and payment are handled in a single interaction to keep service moving during peak hours

- The counter layout and menu placement are designed to reduce hesitation and speed up decisions

- Standard drink recipes allow baristas to prepare orders consistently, even during busy periods

- Regular customers benefit from a familiar process that makes repeat visits quick and predictable

- The sales flow minimizes congestion and allows staff to manage volume without compromising quality

A business plan shouldn’t take weeks

Operations & Staffing Plan

Corner Cup has a systematic and repeatable operating model that is aimed at facilitating efficient day-to-day service and a stable customer experience. The shop is structured around strict scheduling, defined procedures, and direct ownership control as opposed to quantity-based service and prolonged operation.

Facility and Location

Corner Cup is located on a leased retail store at 412 East Franklin Street in downtown Chapel Hill. It covers an area of approximately 900 sq. ft, front-of-the-house serving area, a couple of seating areas, and a small preparation area at the back.

The location was selected for its consistent foot traffic rather than the size or condition of the existing space. Before opening, the unit requires targeted tenant improvements to support coffee shop operations.

Plumbing upgrades support the installation and drainage needs of the espresso machine, while electrical work adds dedicated 220-volt circuits and increases panel capacity for commercial equipment. The buildout is completed with counter installation, shelving, and minor cosmetic finishes to prepare the space for daily service.

Seating capacity is intentionally limited to 12-14 seats across small tables and counter seating. This layout supports quick customer turnover rather than extended visits. The front counter handles ordering, payment, and drink pickup in a single transaction point. The storage space behind the counter holds backup supplies and dry goods within easy reach during service.

Operation Hours

Corner Cup will be open during the daytime in accordance with the customer demand for coffee in the morning and early afternoon. Working schedules are arranged in such a way that they attract the maximum traffic without excessive staff and expenses.

| Days | Operating Time | Notes |

|---|---|---|

| Monday – Friday | 7:00 AM – 3:00 PM | Peak morning and mid-day service |

| Saturday – Sunday | 8:00 AM – 3:00 PM | Weekend daytime hours |

| Holidays | Closed or reduced hours | Adjusted based on local demand |

Here, one thing is to note: The shop does not operate during late evening or night hours. Operating hours may be adjusted for major holidays or special local conditions.

Equipment & Technology

Corner Cup Coffee is equipped to support consistent, high-quality beverage service while keeping the physical footprint and operational complexity under control.

Here’s the list of equipment/systems Corner Cup Coffee will have for serving coffee:

| Equipment/Technology | Purpose | |

|---|---|---|

|

Two-group commercial espresso machine | Handles peak espresso volume while maintaining consistent extraction and drink quality |

|

Under-counter refrigeration | Keeps milk and perishables cold and accessible during active service periods |

|

Ice machine | Supports cold beverages and iced drinks without interrupting service flow |

|

French press and pour-over setup | Provides backup brewing capability during espresso machine downtime |

|

Tablet-based POS system | Processes payments, tracks sales by item and time, and manages staff clock-ins |

Staffing Structure

Corner Cup Coffee follows a lean staffing model designed to support efficient daytime operations without overstaffing. The structure aligns closely with operating hours, service volume, and the shop’s counter-service format.

The owner works on-site and covers operational oversight and peak service periods. Baristas are scheduled based on daily demand, with overlap during morning rush hours to maintain service speed.

| Role | Headcount | Employment Type | Typical Schedule | Hourly Wage |

|---|---|---|---|---|

| Owner-Operator | 1 | Full-time | Covers daily operations and peak hours | $0 (initial months) |

| Barista | 2–3 | Part-time | Scheduled across opening, peak, and closing shifts | $15–$17 + tips |

Suppliers and Vendors

At Corner Cup Coffee, we work with a small number of local and service-focused vendors to maintain product consistency and reduce supply chain complexity.

| Vendor Type | Purpose |

|---|---|

| Local coffee roaster | Supplies roasted coffee beans and supports consistent flavor profiles |

| Bakery partner | Provides fresh pastries without on-site food preparation |

| Dairy supplier | Supplies milk and related dairy products for beverage service |

| Equipment service technician | Handles routine maintenance and repairs for espresso and brewing equipment |

Licensing and Permits

Corner Cup Coffee LLC will be operated in accordance with the local, state, and county regulations. Licenses and other permits are taken out to be able to operate legally, meet food safety standards, and receive bank financing and insurance coverage.

| Licence/Permit | Issuing Authority | Purpose |

|---|---|---|

| City business license | City of Chapel Hill | Authorizes the legal operation of a retail business within city limits |

| State sales tax registration | North Carolina Department of Revenue | Enables the collection and remittance of sales tax on taxable items |

| Food establishment permit | Orange County Health Department | Confirms compliance with food safety and sanitation standards |

| Health inspection approval | Orange County Health Department | Verifies safe handling, storage, and preparation of food and beverages |

| Food safety training certification | County or state-approved provider | Ensures staff follow proper food handling and hygiene practices |

| Fire inspection approval | Local fire department | Confirms compliance with fire safety and occupancy requirements |

| Certificate of occupancy | City building department | Confirms the space is approved for retail food service use |

| ADA compliance review | City or county authority | Ensures accessibility standards are met for customers and staff |

Also, Corner Cup Coffee will maintain standard insurance coverage, including general liability, workers’ compensation, and property and equipment insurance. This will protect the business, employees, and key assets and meet lender and landlord requirements.

Financial Plan

The financial statement summarized the expected financial performance of our business by using specific operating assumptions, startup costs, and current expense structure. It involves the forecasted income, cash flow, and the use of funds to demonstrate how the business will run, how it will cover its costs, and how it will cover the repayment obligations over an extended period.

Financial Assumptions

The projections for the Corner Cup Coffee are based on the conservative operating assumptions in line with the size of the shop, service model, and daytime schedule.

These are the assumptions to be used in calculating revenues, expenses, and break-even that are presented in the sections that follow:

| Assumption Area | Key Assumption |

|---|---|

| Forecast period | 3 years (Year 1 ramp-up, Year 2 modest profitability, Year 3 stabilized operations) |

| Location size | Approximately 900 sq ft leased retail unit |

| Average operating days | 30 days per month |

| Average daily transactions (Year 1) | 150 transactions per day |

| Average ticket size | $6.25 (no pricing increase in Year 1) |

| Revenue mix | Beverages 80%; pastries and packaged food 20% |

| Cost of goods sold (COGS) | 44% of revenue |

| Owner compensation | $0 in Year 1; introduced at a modest level in Year 2 |

Startup Costs

| Category | Cost |

|---|---|

| Pre-Opening & Soft Costs | |

| Business registration, permits, licenses | $3,000 |

| Legal, accounting, inspections | $4,500 |

| Branding, signage, and opening marketing | $5,500 |

| Subtotal – Pre-Opening | $13,000 |

| Equipment (Capitalized) | |

| Espresso machine (2-group, refurbished) | $24,000 |

| Espresso grinders (2 units) | $8,000 |

| Brewers and hot water system | $6,500 |

| Refrigeration (reach-in and under-counter) | $9,500 |

| Ice machine | $5,500 |

| POS hardware | $4,500 |

| Smallwares and bar tools | $3,500 |

| Subtotal – Equipment | $65,500 |

| Buildout & Furniture (Capitalized) | |

| Plumbing and electrical upgrades | $15,000 |

| Counter, bar, cabinetry | $13,000 |

| Flooring, paint, lighting | $9,000 |

| Furniture and fixtures | $7,000 |

| Subtotal – Buildout & FF&E | $44,000 |

| Opening Inventory & Deposits | |

| Initial coffee, milk, syrups, pastries | $4,000 |

| Paper goods and cleaning supplies | $2,500 |

| Lease and utility deposits | $6,000 |

| Subtotal – Inventory & Deposits | $12,500 |

| Working Capital (Opening Cash) | $9,000 |

| Total Startup Costs | $144,000 |

Funding Source

| Source | Amount |

|---|---|

| Truist Bank Loan (Small Business Retail Lending) | $120,000 |

| Owner equity contribution | $30,000 (personal cash) |

| Total startup capital | $150,000 |

Funding surplus buffer (non-cash): $6,000 allocated to additional deposits and prepaids (lease/utilities and prepaid insurance/permits).

Monthly Revenue Statement

| Month | Avg Daily Transactions | Avg Ticket ($) | Estimated Monthly Revenue ($) |

|---|---|---|---|

| Jan | 115 | $6.25 | $21,600 |

| Feb | 125 | $6.25 | $23,400 |

| March | 135 | $6.25 | $25,300 |

| April | 145 | $6.25 | $27,200 |

| May | 150 | $6.25 | $28,100 |

| June | 152 | $6.25 | $28,500 |

| July | 155 | $6.25 | $29,100 |

| August | 155 | $6.25 | $29,100 |

| September | 158 | $6.25 | $29,600 |

| October | 162 | $6.25 | $30,600 |

| November | 162 | $6.25 | $30,600 |

| December | 184 | $6.25 | $34,400 |

| Year 1 Total | $337,500 |

Income Statement (3-Year)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | |||

| Beverage Sales | $270,000 | $332,000 | $374,000 |

| Pastry & Food Sales | $67,500 | $83,000 | $94,000 |

| Total Revenue | $337,500 | $415,000 | $468,000 |

| Cost of Goods Sold (COGS) | $146,800 | $176,800 | $195,700 |

| Coffee Beans & Ingredients | $46,000 | $55,000 | $60,500 |

| Milk, Syrups, Food Inputs | $32,000 | $38,500 | $42,000 |

| Pastry Purchases | $37,000 | $45,500 | $51,000 |

| Paper Goods & Packaging | $13,000 | $15,000 | $16,500 |

| Spoilage & Waste | $10,000 | $12,000 | $13,500 |

| Payment Processing Fees | $8,800 | $10,800 | $12,200 |

| Gross Profit | $190,700 | $238,200 | $272,300 |

| Gross Margin | 56.50% | 57.40% | 58.20% |

| Operating Expenses (OPEX) | $174,040 | $195,260 | $213,480 |

| Barista Wages (Hourly) | $82,000 | $88,000 | $92,000 |

| Payroll Taxes & Coverage | $7,500 | $8,000 | $8,500 |

| Rent & CAM | $54,000 | $54,000 | $54,000 |

| Utilities | $10,800 | $11,500 | $12,200 |

| Insurance | $5,500 | $5,800 | $6,100 |

| POS & Software | $2,640 | $2,760 | $2,880 |

| Marketing | $8,400 | $8,700 | $9,000 |

| Cleaning & Misc. | $3,200 | $4,500 | $4,800 |

| Owner Compensation | $0 | $12,000 | $24,000 |

| EBITDA | $16,660 | $42,940 | $58,820 |

| EBITDA Margin | 4.90% | 10.30% | 12.60% |

| Depreciation (Equipment + Buildout) | $13,757 | $13,757 | $13,757 |

| EBIT | $2,903 | $29,183 | $45,063 |

| Interest Expense | $8,541 | $7,489 | $6,356 |

| Net Income (Pre-Tax) | -$5,638 | $21,694 | $38,707 |

Cash Flow Statement (3-Year)

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| Operating Activities | |||

| Net Income (Pre-Tax) | -$5,638 | $21,694 | $38,707 |

| Add: Depreciation (non-cash) | $13,757 | $13,757 | $13,757 |

| Change in Working Capital | $0 | $0 | $0 |

| Net Cash from Operations | $8,119 | $35,451 | $52,464 |

| Investing Activities | |||

| Equipment & Buildout Capex | -$144,000 | $0 | $0 |

| Net Cash from Investing | -$144,000 | $0 | $0 |

| Financing Activities | |||

| Bank Loan Proceeds | $120,000 | $0 | $0 |

| Owner Capital Contribution | $30,000 | $0 | $0 |

| Loan Principal Repayment (Amortized) | -$13,546 | -$14,598 | -$15,731 |

| Owner Distributions | $0 | $0 | $0 |

| Net Cash from Financing | $136,454 | -$14,598 | -$15,731 |

| Net Change in Cash | $573 | $20,853 | $36,733 |

| Beginning Cash | $9,000 | $9,573 | $30,426 |

| Ending Cash | $9,573 | $30,426 | $67,159 |

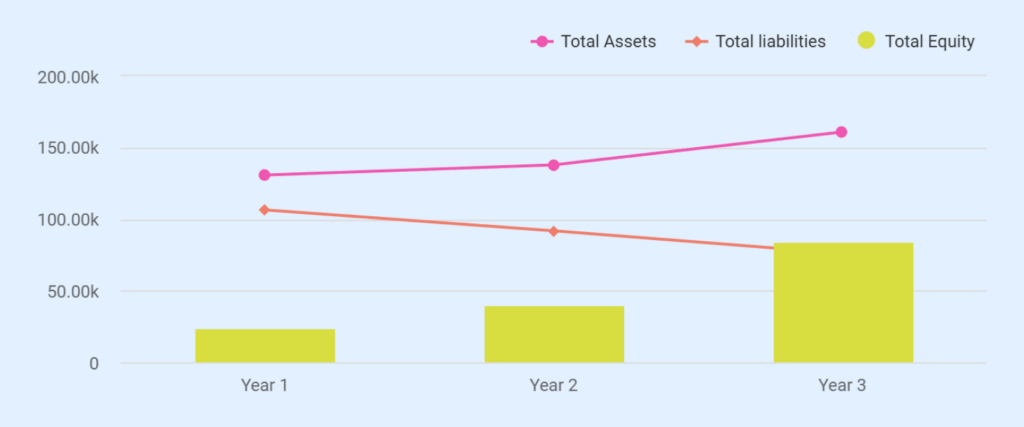

Balance Sheet (3-Year)

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| ASSETS | |||

| Cash | $9,573 | $30,426 | $67,159 |

| Inventory & Supplies | $4,000 | $4,500 | $5,000 |

| Prepaids, Deposits & Pre-Opening Costs (Other Assets) | $21,500 | $21,000 | $20,500 |

| Total Current Assets | $35,073 | $55,926 | $92,659 |

| Equipment (Gross) | $65,500 | $65,500 | $65,500 |

| Buildout & FF&E (Gross) | $44,000 | $44,000 | $44,000 |

| Accumulated Depreciation (Corrected) | -$13,757 | -$27,514 | -$41,271 |

| Net Fixed Assets | $95,743 | $81,986 | $68,229 |

| Total Assets | $130,816 | $137,912 | $160,888 |

| LIABILITIES | |||

| Term Loan (Ending Balance, Amortized) | $106,454 | $91,855 | $76,124 |

| Total Liabilities | $106,454 | $91,855 | $76,124 |

| EQUITY | |||

| Owner Capital Contribution | $30,000 | $30,000 | $30,000 |

| Retained Earnings (Cumulative) | -$5,638 | $16,056 | $54,764 |

| Total Equity | $24,362 | $46,056 | $84,764 |

| Total Liabilities + Equity | $130,816 | $137,912 | $160,888 |

Break-Even Analysis

| Metric | Value / Calculation |

|---|---|

| Monthly Fixed Operating Expenses (Non-Labor) | |

| Rent & CAM | $4,500 |

| Utilities | $900 |

| Insurance | $460 |

| POS & Software | $220 |

| Marketing | $700 |

| Cleaning & Misc. | $270 |

| Subtotal – Fixed Non-Labor OPEX | $7,050 |

| Unavoidable Fixed Labor (Minimum Coverage) | |

| Minimum Barista Wages (60 hrs/week @ $16/hr) | $4,160 |

| Payroll Taxes & Coverage (9.15% of minimum wages) | $381 |

| Subtotal – Fixed Minimum Labor | $4,541 |

| Total Fixed Monthly OPEX (Corrected) | $11,591 |

| (Conservative lender range) | $11,600 – $12,000 |

| Variable Cost Structure | |

| COGS as % of Revenue | ~44% |

| Contribution Margin | ~56% |

| Break-Even Calculation | |

| Monthly Break-Even Revenue | $20,700 – $21,400 |

| Annualized Break-Even Revenue | $248,000 – $257,000 |

| Break-even Comparison | |

| Avg. Monthly Revenue (Year 1) | $28,100 |

| Break-Even Coverage Ratio (Yr 1 Avg) | 1.3x |

Loan Repayment Plan

Loan Details (As Modeled)

- Loan Amount: $120,000

- Term: 7 years

- Repayment: Fully amortized, annualized view

- Annual Debt Service: ~$22,100

| Metric | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|

| Beginning | $120,000 | $106,454 | $91,855 | $76,124 | $59,224 | $41,069 | $21,561 |

| Principal Repaid | $13,546 | $14,598 | $15,731 | $16,900 | $18,155 | $19,508 | $21,561 |

| Interest Paid | $8,541 | $7,489 | $6,356 | $5,187 | $3,932 | $2,579 | $526 |

| Total Debt Service | $22,087 | $22,087 | $22,087 | $22,087 | $22,087 | $22,087 | $22,087 |

| Ending Balance | $106,454 | $91,855 | $76,124 | $59,224 | $41,069 | $21,561 | $0 |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.