Executive Summary

Paws & Play Daycare LLC operates a weekday dog daycare facility on the North Side of Chicago, serving working professionals. The business is owned and managed by Alex Morgan, who brings five years of animal care experience, including 2 years as a kennel supervisor managing 20-30 animals daily. Morgan works full-time on-site and handles all client-facing operations, staff supervision, and regulatory compliance.

Business Model and Capacity

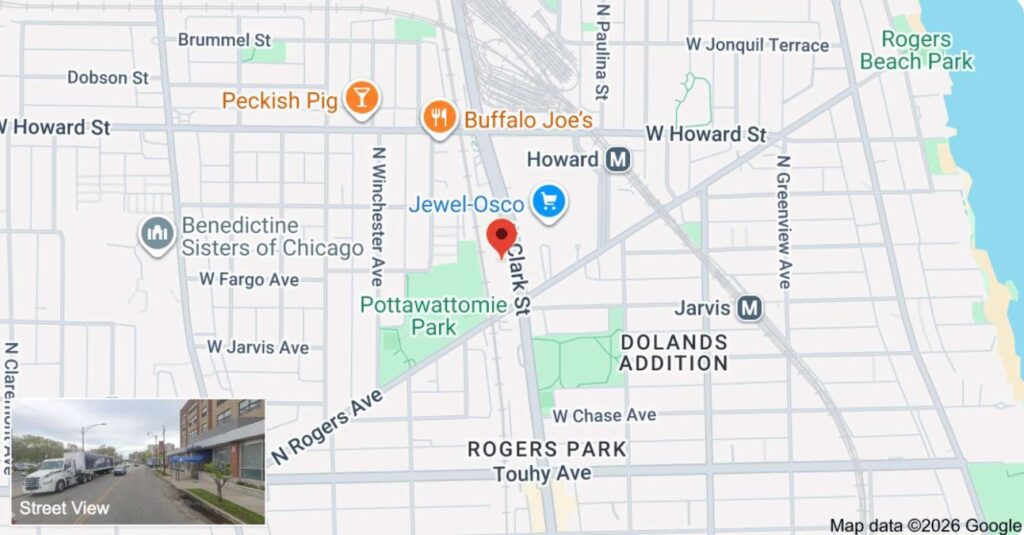

The facility operates Monday through Friday, 7:30 am-6:30 pm at 7428 North Clark Street. Daily capacity is capped at 18 dogs. This limit is tied to facility size, staffing ratios, and insurance underwriting. Growth comes from filling capacity consistently, not from exceeding it.

Revenue is generated through full-day care ($38), half-day care ($24), and multi-day pass packages that drive 70% of bookings. Add-on services, including medication administration and structured play, provide supplemental revenue. Blended realized pricing averages $34 to $36/dog-day after pass discounts.

Loan Request and Use of Funds

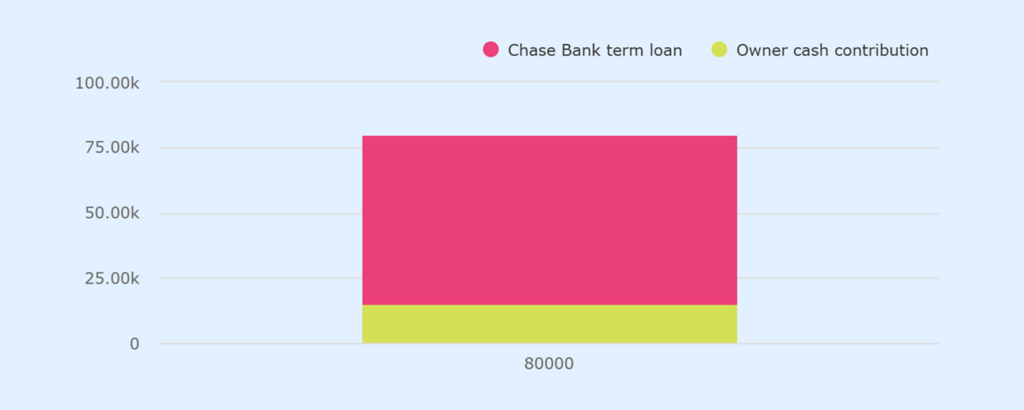

| Category | Amount ($) | Notes |

|---|---|---|

| Chase Bank Term Loan | 65,000 | Five-year amortization at 10.5% fixed interest |

| Owner Cash Contribution | 15,000 | Contributed at startup |

| Total Startup Capital | 80,000 | Combined loan and owner funds |

The loan is structured as a 5-year amortization at 10.5% fixed interest with monthly payments of $1,398. Security includes business equipment and fixtures with an estimated liquidation value of $28,000 to $32,000. Alex Morgan personally guarantees the loan.

Funds are allocated to lease deposit ($7,200), interior build-out ($18,500), equipment ($17,800), insurance and licensing ($4,200), initial cleaning supplies ($2,400), signage and marketing ($6,500), and working capital reserve ($12,500).

Repayment Mechanics and Timeline

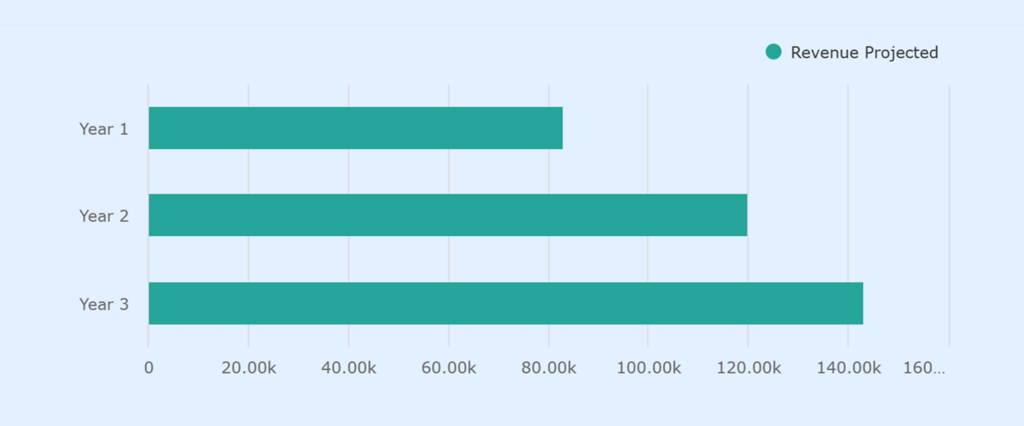

- Year 1 average attendance is projected at 9 dogs/day, generating $82,930 in revenue.

- Year 2 attendance reaches 12.5 dogs/day with revenue of $120,040.

- Year 3 attendance stabilizes at 14.5 dogs/day with revenue of $143,260.

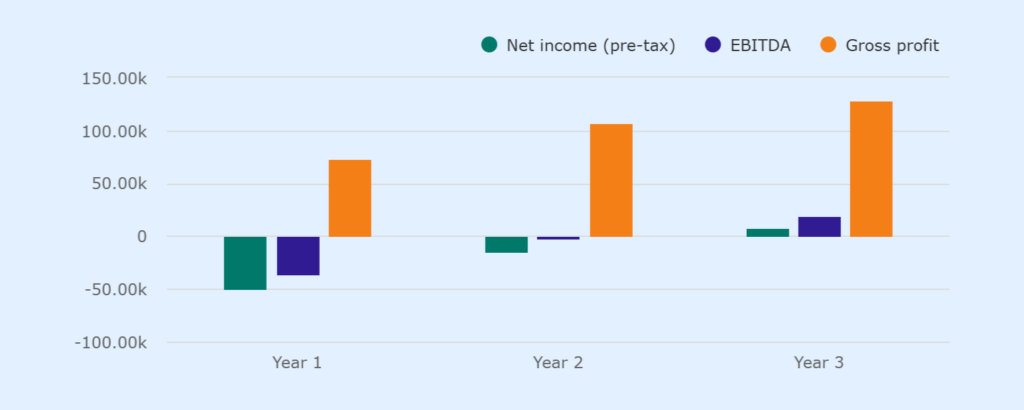

The business reaches operating break-even (before debt service) in Q3 of Year 2 at 11.8 dogs/day. Cash break-even (after debt service) occurs in Q4 of Year 2 at 13.9 dogs/day. Year 3 generates positive cash flow and 1.15x debt service coverage.

Year 3 DSCR of 1.15x is offset by pre-funded owner liquidity equal to 16 months of debt service. This liquidity backstop provides structural support during the ramp period and ensures loan repayment capacity under conservative enrollment projections.

Cumulative working capital needs through Year 2 total $36,000. This is funded through the $12,500 contingency reserve and owner liquidity injection.

Don’t spend weeks on your first draft

Complete your business plan in less than an hour

Company Description

Paws & Play Daycare is a single-member Illinois limited liability company. Alex Morgan owns 100% and manages daily operations. The business provides weekday dog daycare. No overnight boarding. No grooming. No veterinary services.

The facility is at 7428 North Clark Street, Chicago, IL 60626. Ground floor, 2,400 square feet, leased. The lease runs for 5 years with two 3-year renewal options. Rent is $3,600 monthly. Alex Morgan personally guarantees the lease.

The location sits in a residential area with high dog ownership. Most clients live within a 10-minute drive. Street parking and bus access make drop-off easier during the morning rush.

Service Boundaries

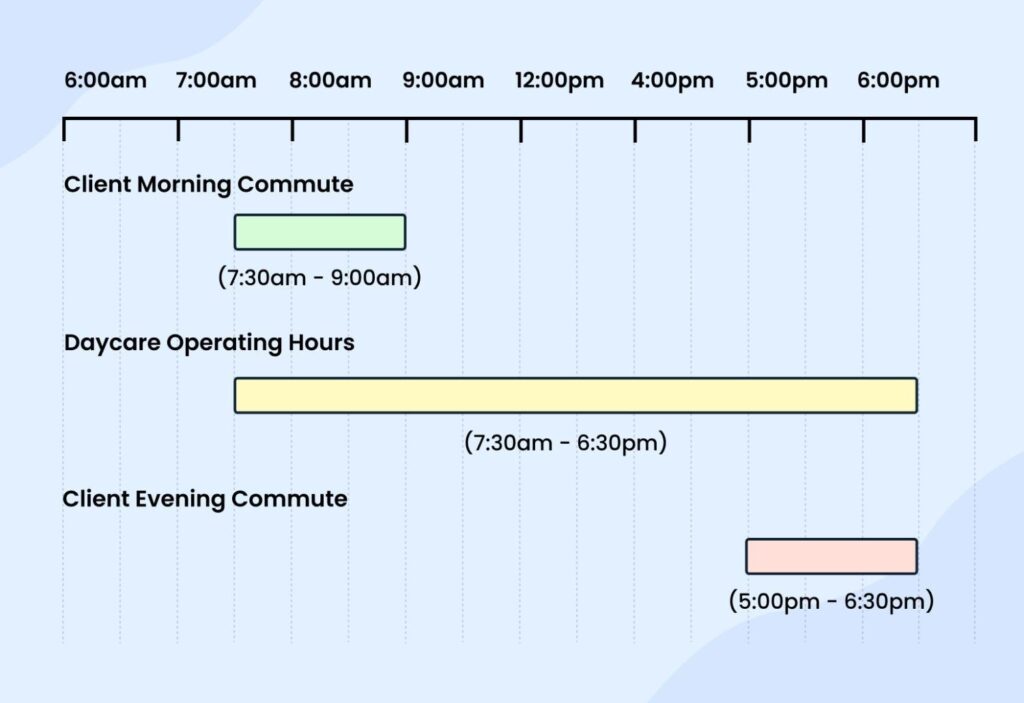

Operating hours are Monday through Friday, 7:30 am to 6:30 pm. The business accepts dogs for daytime care only. No weekends, no holidays, no overnight stays.

Capacity is capped at 18 dogs daily. This isn’t a temporary limit. The facility size, staffing ratios, and supervision model all depend on this number. Pushing past 18 would require adding a handler and would change the operating economics. That’s not the plan for Year 1 or Year 2.

Facility Layout

Interior build-out includes washable wall panels, commercial drainage flooring, and sectioned play yards. Dogs can be separated by size or temperament when needed. The owner maintains line-of-sight supervision across all play areas from the front desk. Rest crates are in a separate zone to reduce stimulation during downtime.

CCTV cameras cover play yards and entry points. Footage is retained for 30 days.

Insurance Coverage

Three policies are in place.

- General liability covers property damage and third-party injury. Limits are $1 million per occurrence, $2 million aggregate.

- Care, custody, and control insurance covers injury, illness, or death of dogs while in the facility. This coverage is required by the landlord and the City of Chicago animal care facility license.

- Workers’ compensation covers part-time staff. Illinois law requires this for any business with employees.

Annual premiums total $3,120. Coverage levels meet the requirements of lenders and landlords. Certificates have been provided to both.

Licensing and Timeline

The business operates under a City of Chicago animal care facility license. Zoning approval for animal services at this location is complete. Fire department inspection and health department clearance are scheduled for Month 3 post-loan funding. The business won’t accept clients until all inspections pass and the license is issued.

Vaccination verification is required for all enrolled dogs. Rabies, distemper, and bordetella must be current and on file. This protects both the business and the client’s dogs.

Owner Role and Compensation

Alex Morgan works full-time in the business. Responsibilities include daily operations, client intake, scheduling, staff supervision, vendor management, and regulatory compliance.

The owner takes no salary in Year 1 or Year 2. This isn’t conditional. Owner draws will only begin in Year 3 if the debt service coverage ratio remains above 1.25x. Cash flow preservation during the ramp period is non-negotiable.

Services

| Service Type | Duration | Rack Price | Package-Equivalent Price | Notes |

|---|---|---|---|---|

| Full-Day Daycare | Up to 10 hours | $38/day | $33–$35/day (via passes) | Primary service. Most clients purchase multi-day passes rather than single days. |

| Half-Day Daycare | Up to 5 hours | $24/day | N/A | Scheduled within standard rotation blocks. Does not require separate staffing or workflows. |

| 10-Day Pass (Full Day) | 10 full days | $380 rack value | $350 total ($35/day) | ~8% discount. Encourages consistent attendance and upfront payment. |

| 20-Day Pass (Full Day) | 20 full days | $760 rack value | $660 total ($33/day) | ~13% discount. Largest commitment option offered. |

| Medication Administration (Add-On) | Per daycare day | $6 | $6 | Limited to oral medications and supplements administered during daycare hours. |

| Structured Play Session (Add-On) | 15 minutes | $8 | $8 | One-on-one activity offered only when staff capacity allows. Not guaranteed daily. |

| Late Pickup Fee (Add-On) | Per 15 minutes after 6:30 pm | $15 | $15 | Enforced consistently to protect staffing schedules and animal welfare. |

Capacity and Safety Limits

Daily capacity is capped at 18 dogs. The facility layout, staffing model, and insurance all assume this limit. Supervision ratios break down above 18. Incident risk increases. Staff attention gets stretched thin.

Growth comes from consistently filling the 18-dog capacity, not from exceeding it. Revenue projections assume no days with more than 18 dogs. Clients who can’t be accommodated are placed on a waitlist or referred to other facilities.

Equipment and Monitoring

The facility uses sectioned play yards with rubberized flooring. Dogs rotate between active play areas and rest crates every 90 minutes. This prevents overstimulation and reduces conflict.

CCTV cameras cover all play areas. Live feeds are visible from the front desk. Footage is retained for 30 days and reviewed if incidents occur. Equipment and monitoring standards align with insurer loss prevention requirements.

Sanitation equipment includes a commercial washer and dryer for bedding and towels. Cleaning supplies are restocked weekly. All surfaces are wiped with pet-safe disinfectant between groups.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Market Analysis

The target market is full-time working professionals in North Chicago who own dogs and need reliable weekday care. This isn’t a broad demographic play. It’s a narrow segment with specific pain points.

Why This Market Exists

Dog ownership is high in North Chicago neighborhoods like Lincoln Square, Andersonville, and Ravenswood. Many households have one or two dogs. Most are renters or condo owners without yards. Many work full-time downtown or in nearby offices. They need somewhere to leave their dogs during the workday.

The alternative is leaving the dogs home alone for 8 to 10 hours. That creates problems. Boredom leads to destructive behavior. A lack of exercise can lead to behavioral issues. These concerns, combined with animal welfare considerations, drive demand for weekday care.

This isn’t discretionary spending in the same way as a luxury purchase. For working dog owners, daycare is closer to childcare. It solves a real problem.

Local Market Characteristics

The North Clark Street location sits within a 10-minute drive of dense residential blocks. Add to that, around 65% of households own dogs in Chicago. This creates a good opportunity.

Morning drop-off traffic peaks between 7:30 am and 9:00 am. Pickup traffic peaks between 5:00 pm and 6:30 pm. These patterns align with standard commuting schedules. The business operating hours are built around this reality, not extended to capture marginal demand.

Public transit access matters. The Clark Street bus runs directly past the facility. Several clients walk dogs to daycare rather than drive. Proximity is a competitive advantage for clients within a half-mile radius.

The business doesn’t need to capture a large percentage of the addressable market to succeed. At 18 dogs/day and 260 operating days/year, full capacity equals 4,680 dog-days annually. This represents a small fraction of local demand and requires consistent penetration within the immediate trade area, not market dominance.

Customer Segments

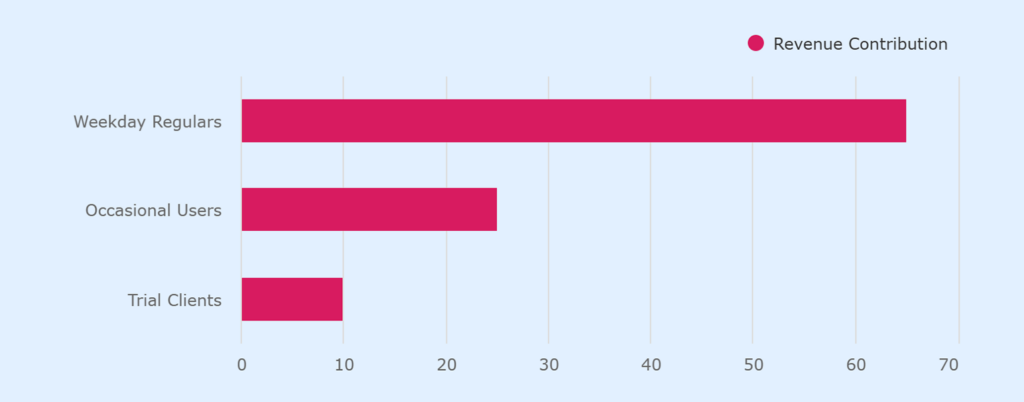

Three customer types will use the facility. They aren’t equally important.

Weekday regulars are the core. These clients book 3 to 5 days/week, every week. They buy 20-day passes. They show up consistently. They drive base revenue. Retention with this group is the single most important metric for the business.

Occasional users book 1 to 2 days/week or use daycare sporadically for specific needs like travel or long workdays. They buy 10-day passes or pay single-day rates. They fill capacity but don’t drive base revenue.

Trial clients book a single day to test the facility before committing. Conversion to weekly regulars happens about 30% of the time based on observed behavior at similar facilities. Trial days are important for acquisition but not for cash flow.

Corporate clients and event-based bookings aren’t pursued in Year 1. They introduce scheduling complexity and require customization. The business will focus on individual working professionals exclusively.

Customer Segment Revenue Contribution Chart

Competition

Large-Scale Franchise Competitor: Camp Bow Wow Evanston

- Franchise operation with approximately 50-dog capacity

- Offers outdoor play yards and webcam access for clients

- Pricing is comparable to Paws & Play

- Competes primarily on scale, amenities, and brand recognition

This competitor attracts clients seeking large facilities and feature-rich experiences rather than smaller group supervision.

Local Independent Daycares

Two independent daycare facilities operate closer to the North Clark Street location:

- Typical capacity ranges from 20 to 25 dogs

- One facility serves small breeds only

- The other requires temperament testing and limits intake to well-socialized dogs

These businesses operate with narrower intake criteria but still maintain larger group sizes than Paws & Play.

Home-Based and App-Based Alternatives

Home-based sitters and app-based platforms such as Rover also serve the area:

- Typically care for one to three dogs at a time

- Focus on in-home supervision rather than group socialization

- Don’t provide structured group play in a commercial setting

These services are not direct substitutes for weekday group daycare.

Competitive Positioning

Paws & Play doesn’t compete on capacity or amenities. The 18-dog daily limit is smaller than all direct competitors and is intentionally enforced.

- Clients seeking large facilities, outdoor yards, or webcam access are better served elsewhere

- Paws & Play targets clients who value smaller group sizes, consistent supervision, and predictable scheduling

This positioning accepts tradeoffs upfront and avoids price- or capacity-driven competition.

Market Risks

Primary Risk: Slow Enrollment

If average daily attendance stays below 10 dogs through Month 6, cash flow pressure increases. The business has a fixed cost base that doesn’t adjust easily to low volume. Mitigation depends on referral partnerships with veterinarians and groomers, trial day promotions, and word-of-mouth.

If these channels underperform, marketing spend can be increased modestly within the contingency reserve. The owner will absorb additional sales effort personally during the first 6 months. Break-even timing may be delayed, but debt service capacity remains intact, given the loan structure and owner capital contribution.

Secondary Risk: Competitive Pricing Pressure

If Camp Bow Wow or other facilities drop prices to capture share, Paws & Play can’t match without destroying margins. The only defense is service differentiation, which depends on execution quality.

Economic downturns affect discretionary spending. Dog daycare sits somewhere between essential and optional.

Marketing & Sales Strategy

Marketing effort in Year 1 is owner-executed. Alex Morgan handles client intake, tours, and follow-up personally. The approach prioritizes channels that convert reliably without requiring daily attention.

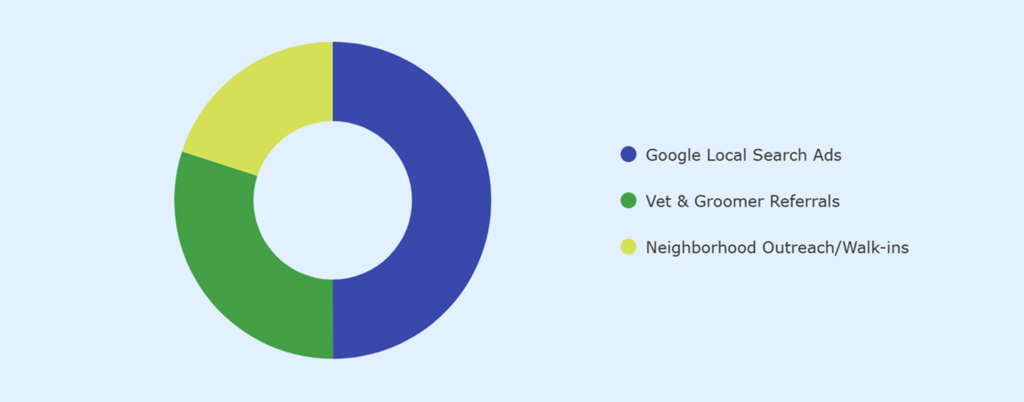

Primary Acquisition Channels

Three channels drive enrollment. Google local search ads target phrases like “dog daycare near me” and “Chicago dog daycare Lincoln Square.” Ad spend runs $400 to $500 monthly. Geographic targeting is limited to a 3-mile radius to focus spending on clients within practical driving distance.

Veterinary and groomer partnerships provide referrals. The owner will visit 8-10 local veterinary clinics and grooming shops within the first 2 months to introduce the facility. Referral cards with a trial day discount are left at front desks. This channel depends on relationship quality, not advertising spend. Referral partnerships are additive to baseline projections, not required to meet enrollment targets.

Neighborhood outreach includes flyers posted at coffee shops, pet supply stores, and community boards. This is low-cost but time-intensive. It works best in the immediate half-mile radius where walk-in traffic is realistic.

Instagram and Facebook are deprioritized in Year 1. Social media requires consistent content creation and engagement. The owner’s bandwidth doesn’t support daily posting or reliable comment response during the startup phase. Accounts will remain dormant until staffing allows regular updates, likely in Year 2.

Enrollment Funnel

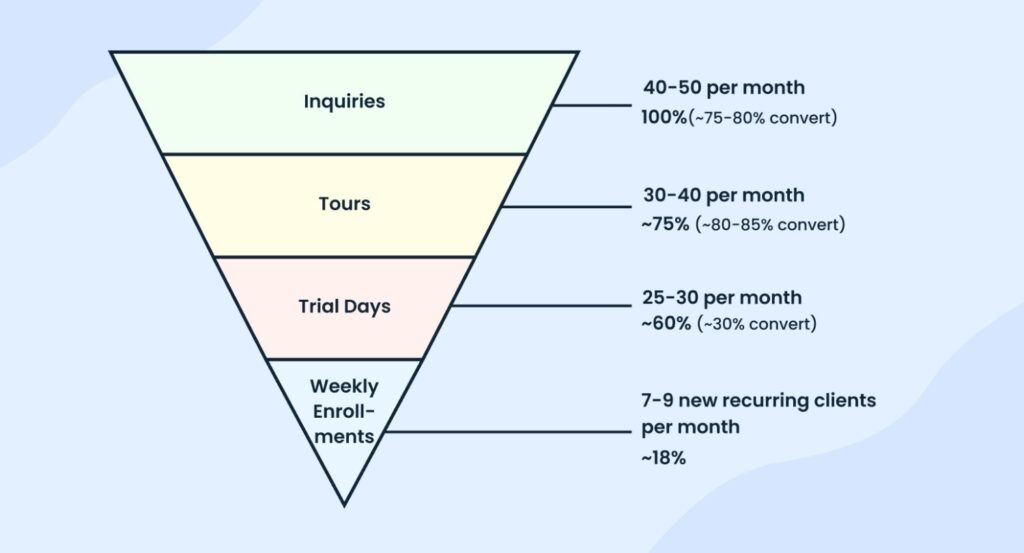

The enrollment funnel has four stages: inquiry, tour, trial day, and weekly enrollment.

Inquiries come from ads, referrals, and walk-ins. Tours are scheduled within 2 to 3 days, with an estimated 20% no-show rate. Trial days are booked at the standard $38 rate and are used to assess fit for both the dog and the client. Conversion from trial day to recurring enrollment averages about 30%, reflecting deliberate screening rather than volume intake.

At steady operation, the funnel generates 40 to 50 inquiries per month, producing 30 to 40 tours, 25 to 30 trial days, and 7 to 9 new weekly enrollments. This supports the Year 1 ramp to an average of 9 dogs per day. In Year 2, the normal churn of 2 to 3 clients per month requires 6 to 10 new enrollments to maintain full utilization. If inquiries fall below 30 per month during the first 6 months, marketing spend increases modestly, and outreach to veterinary and pet retail partners expands.

Referral Incentives

Existing clients who refer a new weekly client receive a $50 account credit. This credit applies to future daycare purchases. The incentive is paid only after the referred client completes four weeks of enrollment. This prevents abuse and ensures the referral produces real revenue.

Referral incentives aren’t advertised publicly. They are mentioned during tours and included in welcome packets for new clients. The goal is to reward loyalty without creating an expectation that discounts are available to everyone.

Customer Retention

Retention depends on consistency. Dogs thrive on routine. Clients value predictability. The business will maintain the same operating hours, the same handler staff, and the same daily schedule throughout Year 1. Changes to routine create uncertainty and increase churn.

Client communication happens through email confirmations and text reminders the day before scheduled care. Phone calls are made for cancellations or behavioral issues. The owner personally handles all serious incidents and follows up with affected clients within 24 hours.

The owner monitors booking frequency weekly. Clients who reduce from 4 to 5 days per week down to 2 to 3 days receive a proactive check-in call. This outreach is prioritized during slower periods to maintain retention without disrupting daily operations.

Marketing Spend Discipline

Total marketing spend is $750/month and is expensed as incurred. This includes Google ads, printing costs for flyers and referral cards, and small promotional items for veterinary partners. Spend remains flat in Years 2 and 3 unless enrollment consistently falls short of projections.

The assumption is that word-of-mouth becomes the dominant acquisition channel by Year 2. Revenue projections do not assume viral growth, social media effects, or brand recognition beyond the immediate trade area. If organic referrals underperform, the marketing budget can be increased modestly. The owner has allocated $4,500 in the contingency reserve specifically for underperforming marketing scenarios.

Enrollment growth doesn’t trigger staffing additions until average daily attendance exceeds 14 dogs consistently. Below that threshold, the existing two-handler structure is sufficient.

Stop Googling competitors for hours

Operations Plan

Paws & Play operates Monday through Friday, 7:30 am to 6:30 pm. The facility doesn’t open on weekends or holidays. This schedule aligns with standard workweek demand and keeps staffing predictable.

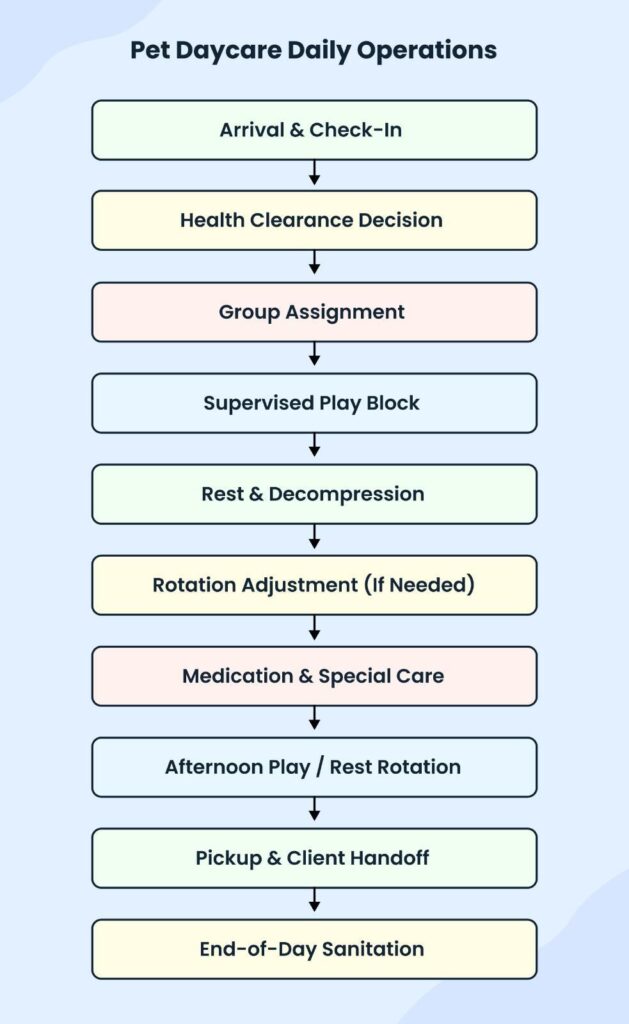

Daily Workflow

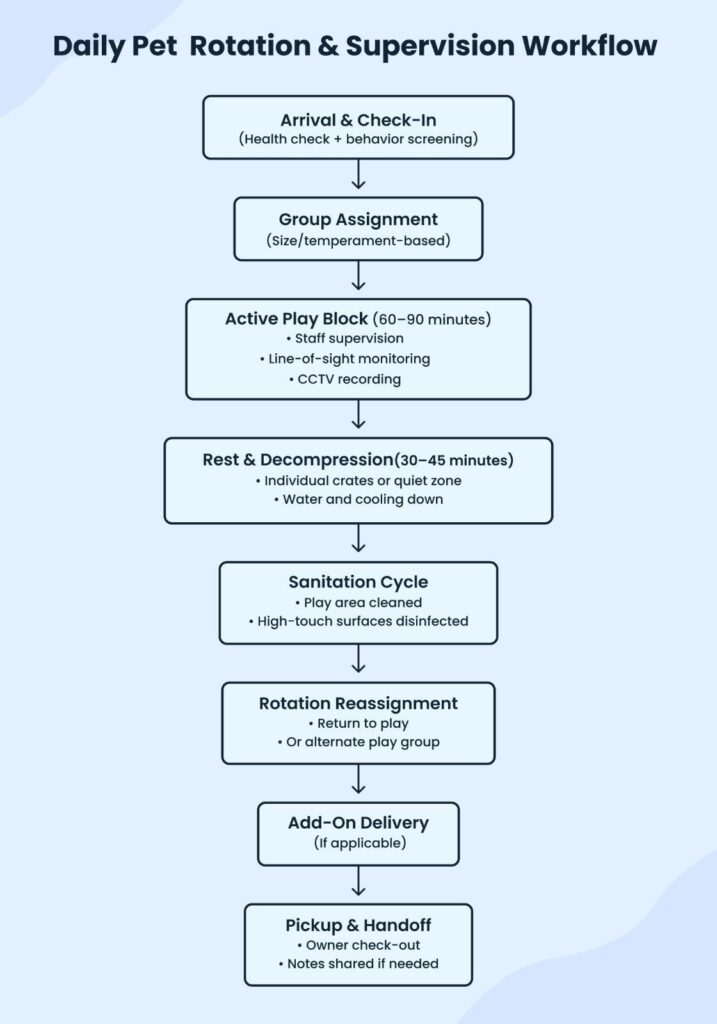

Dogs arrive between 7:30 am and 9:00 am. The owner or handler conducts a visual health check at intake. Signs of illness, injury, or distress result in immediate owner notification and refusal of care for that day. Sick dogs spread illness quickly in group settings.

Once cleared, dogs are moved to play yards based on size and temperament. Small dogs under 25 pounds are separated from larger dogs. High-energy dogs are grouped together. Timid or older dogs are placed in quieter groups. These groupings are judgment calls and adjusted based on observed behavior.

Supervised group play runs in 90-minute blocks. Dogs rotate between active play yards and rest crates to prevent overstimulation. Handlers monitor stress signals and adjust rest timing when individual dogs require longer rest periods or extended play. This flexibility is supervised and logged, not left to chance.

Water is available continuously in all play areas. Food isn’t provided except when clients supply meals or medication that requires food. Handlers administer medications at scheduled times. Insulin and other time-sensitive medications are logged and double-checked.

Pickup begins at 4:30 pm and runs through 6:30 pm. Dogs are returned to their owners at the front desk. Any behavioral issues or incidents that occurred during the day are reported verbally. Serious incidents are documented in writing and provided to the client.

Facility Layout and Supervision

The facility is 2,400 square feet. Approximately 1,600 square feet is divided into three play yards. Each yard is 500-550 square feet with rubberized flooring and 4-foot gates between zones. The front desk sits centrally with line-of-sight access to all three yards.

A separate rest area contains 20 crates ranging from small to extra-large. The two additional crates beyond the 18-dog capacity provide buffer space for emergency separation or dogs requiring isolation due to behavioral issues. Crates are spaced to reduce visual stimulation between dogs. This area isn’t visible from the front desk. Handlers must walk into the rest area to monitor dogs during downtime.

CCTV cameras cover play yards and entry points. Four cameras provide full coverage of active supervision zones. The rest area has one camera. Live feeds display on a monitor at the front desk. Footage is retained for 30 days and reviewed following any incident. This monitoring setup meets insurer loss prevention requirements and provides documentation for disputed incidents.

Storage areas hold cleaning supplies, toys, spare bedding, and client belongings. These areas are secured and not accessible to dogs.

Health Screening and Vaccination Verification

All dog owners must provide proof of current vaccinations before enrollment. Rabies, distemper, and bordetella are required. Vaccination records are verified and filed. Expired vaccinations result in suspension from care until proof of renewal is provided.

Flea and tick prevention is recommended but not required. Dogs showing signs of infestation are refused care, and the owner is notified immediately.

Dogs exhibiting aggression, excessive fear, or an inability to socialize are evaluated on a case-by-case basis. Some dogs are not suitable for group daycare. These assessments happen during trial days. Dogs that fail temperament screening are not accepted for weekly enrollment regardless of client demand.

Sanitation and Cleaning Protocols

Play yards are spot-cleaned throughout the day. Accidents, spills, and waste are removed immediately. Full sanitation of all play surfaces occurs after closing at 6:30 pm. Floors are mopped with pet-safe disinfectant. Gates, walls, and equipment are wiped down.

Bedding, towels, and blankets are laundered daily using the on-site commercial washer and dryer. High-soil items are washed twice. Cleaning supplies are restocked weekly through a janitorial supplier contract. On-site inventory includes a 2-week buffer to absorb short-term delivery delays.

Waste disposal is handled through a commercial service. Pickup occurs twice weekly. When daily attendance consistently exceeds 15 dogs, pickup frequency will increase to three times weekly. The waste service provider has confirmed availability for schedule adjustments.

Supervision Ratios and Staffing

Two part-time handlers work 20 hours per week each. Scheduling overlaps during peak hours (8:00 am-11:00 am and 3:00 pm-6:00 pm). This provides 2-person coverage when the facility is at capacity.

The owner is on-site full-time and functions as the third handler when needed. Supervision ratios aim for one handler per 9 dogs. At 18 dogs, this requires two handlers on the floor with the owner available for intake, pickup, and escalation.

When a handler is unavailable due to illness or other absence:

- Capacity is reduced proactively for that day.

- Clients scheduled for care are contacted and offered rescheduling or referral to alternate facilities.

This procedure protects supervision ratios and limits liability exposure. Same-day capacity adjustments are a defined operational protocol, not an emergency measure.

All staff receive initial safety training covering animal handling, bite prevention, and emergency procedures. Training is refreshed quarterly. Standard operating procedures are documented in a physical binder at the front desk and backed up digitally.

Emergency and Incident Response

Injuries during play are addressed immediately. Minor injuries like scratches or torn nails are cleaned and documented. The owner contacts the client and provides a written incident report at pickup.

Serious injuries requiring veterinary attention result in immediate transport to the nearest emergency clinic. The owner accompanies the dog and contacts the client en route. Veterinary costs are covered by the care, custody, and control insurance policy. The owner has the authority to authorize emergency treatment if the client can’t be reached.

Evacuation procedures are posted at exits. In case of fire or emergency, dogs are moved to the adjacent parking lot and secured using leashes stored at each exit. Handlers are trained to prioritize human safety first, then dog safety. The owner is the on-site decision authority for all emergency actions.

Incident reporting is logged in a physical binder at the front desk with digital backup stored on secure cloud storage. All incidents, including near-misses, are documented. This log is reviewed monthly and provided to the insurance carrier upon request.

Vendor Relationships

The business relies on 6 primary vendors. Alternate vendor contact information is maintained for all critical supplies.

| Service Category | Primary Vendor | Service Frequency | Backup Option | Buffer/Mitigation |

|---|---|---|---|---|

| Janitorial & Cleaning Supplies | Local janitorial distributor | Weekly delivery | Alternate local supplier identified | 2-week on-site inventory buffer maintained |

| Waste Disposal | Waste Management | 2 weekly pickup | Schedule increase confirmed with the same provider | Pickup frequency increases to 3× weekly when attendance exceeds 15 dogs |

| Laundry Services | On-site commercial washer and dryer | Daily use | Commercial laundry facility within 2 miles | Same-day off-site service available if equipment fails |

| Veterinary Emergency Care | Nearest 24-hour emergency clinic | As needed | Secondary emergency clinic identified | Owner authorized to transport and approve care |

| Internet & CCTV Monitoring | Local ISP | Continuous | Mobile hotspot for temporary outages | Short outages do not halt operations; footage is retained locally |

| Utilities (Water, Power) | City of Chicago utilities | Continuous | N/A | Short-term outages trigger capacity reduction or temporary closure |

Compliance and Record-Keeping

Daily sanitation logs are maintained and available for health department inspection. Vaccination records are filed by the client and updated annually. Incident reports are retained for three years in both physical and digital formats.

The City of Chicago animal care facility license requires annual renewal and random inspections. Inspection readiness depends on documentation completeness and facility cleanliness. The owner is responsible for ensuring all records are current and accessible.

Insurance recommendations are reviewed annually during policy renewal to ensure operational practices align with carrier loss prevention standards.

Why the 18-Dog Capacity Limit Exists

The 18-dog cap isn’t arbitrary. It reflects three constraints.

- First, facility size limits safe movement and separation. Three play yards can accommodate 6 dogs each comfortably. Beyond this, crowding increases conflict and reduces supervision quality.

- Second, staffing ratios break down above 18. Two handlers can manage 18 dogs during play rotations. At 20 or 22 dogs, a third handler is required continuously. That changes labor costs and scheduling complexity.

- Third, insurance coverage assumes controlled capacity. The care, custody, and control policy was underwritten based on a maximum daily capacity of 18 dogs. Exceeding this regularly could void coverage or trigger premium increases.

The cap is enforced operationally through the booking system. Once 18 slots are filled for a given day, the system closes additional bookings automatically.

Management & Staffing

Alex Morgan owns and operates Paws & Play. Morgan has five years of experience in pet handling and customer-facing operations, including two years as a kennel supervisor at a veterinary clinic, managing daily animal care for 20 to 30 animals. This background covers intake procedures, health monitoring, behavioral assessment, and client communication under veterinary oversight.

Morgan also has direct experience with small business operations, including scheduling, vendor management, and regulatory compliance. Familiarity with the City of Chicago animal care regulations was developed during prior work in licensed animal care facilities.

Owner Role and Responsibilities

Morgan works full-time on-site during all operating hours in Year 1 and Year 2. Responsibilities include:

- Client intake and tour scheduling

- Daily health checks and behavioral assessments

- Staff supervision and scheduling

- Vendor management and supply ordering

- Incident response and client communication

- Regulatory compliance and documentation

- Financial record-keeping and bank reporting

The owner maintains direct oversight of all business functions during the startup phase. Standard operating procedures are documented for all critical tasks, including intake protocols, medication administration, emergency response, and sanitation. These procedures allow handlers to maintain operations during the owner’s absence of 1-2 days. Longer absences would require temporary capacity reductions. This is an intentional risk-control measure built into the operating model.

Part-Time Handler Staffing

Two part-time handlers are employed at 20 hours/week each. Handlers are scheduled with intentional overlap during peak periods.

- Handler 1 Schedule: Monday through Friday, 7:30 am to 11:30 am

- Handler 2 Schedule: Monday through Friday, 2:30 pm to 6:30 pm

This structure provides 2-person coverage from 7:30 am to 9:00 am (morning intake) and from 2:30 pm to 6:30 pm (afternoon pickup). Midday coverage from 11:30 am to 2:30 pm is handled by the owner alone. Daily attendance during this window typically falls below 12 dogs as half-day clients depart. This allows single-person supervision without ratio violations.

Handler wages are set at $16/hour, which aligns with market rates for part-time animal care positions in Chicago. All handlers must pass background checks before employment. The owner retains sole authority for hiring, disciplinary action, and termination decisions.

Coverage and Absence Protocol

Handler absences are managed through 3 methods.

- Handlers are scheduled with built-in flexibility to absorb minor delays or early departures without disrupting operations.

- The owner functions as a backup handler. If one handler is absent, the owner covers floor supervision while managing front desk responsibilities intermittently.

- Capacity is reduced proactively when both handlers are unavailable. Clients scheduled for that day are contacted and offered rescheduling.

Handlers are trained on all core operational tasks, including intake, play supervision, medication administration, cleaning procedures, and emergency response. Client-facing responsibilities such as tours, incident reporting, and financial transactions remain owner-handled. This division reflects time-of-day specialization rather than capability restrictions.

Handler Compensation and Training

Handlers are paid $16 per hour, totaling $640 in weekly wages. Payroll taxes are estimated at 10% of wages, and workers’ compensation coverage is included in the insurance expense.

New handlers complete a paid three-day training covering animal handling, safety, cleaning, and emergency procedures. Quarterly refresher training reviews procedures, incident learnings, and safety protocols.

Turnover risk is recognized. Replacement hiring typically requires two weeks, supported by relationships with local pet care training programs. Staffing levels are reviewed quarterly, and no additions are planned until average daily attendance consistently exceeds 14 dogs.

Owner Compensation

The owner takes no salary or draw in Year 1 or Year 2. This is unconditional. Owner compensation begins in Year 3 only if the debt service coverage ratio exceeds 1.25x after all operating expenses and loan payments. This threshold ensures loan repayment takes priority over owner income.

If DSCR remains below 1.25x in Year 3, owner draws are deferred to Year 4. The owner has personal savings sufficient to cover living expenses through Year 2 without business income. This financial cushion is critical to maintaining the no-draw discipline during the ramp period.

A business plan shouldn’t take weeks

Financial Plan

Startup Cost And Funding Use

Paws & Play requires $80,000 to launch. Funding comes from a $65,000 Chase Bank term loan and a $15,000 owner cash contribution.

| Category | Cost ($) |

|---|---|

| Lease security deposit + first month rent | 7,200 |

| Interior build-out (flooring, fencing, wall panels, drainage) |

18,500 |

| Play equipment (gates, crates, agility items, beds, toys) | 6,800 |

| Commercial washer and dryer | 4,200 |

| Front desk furniture and storage | 3,600 |

| Cleaning and sanitation supplies (initial stock) | 2,400 |

| HVAC adjustments and air purifiers | 3,200 |

| Software systems setup (booking, CRM, POS) | 1,900 |

| Insurance premiums (initial binding) | 3,100 |

| Licensing and permits | 1,100 |

| Signage and exterior branding | 2,000 |

| Pre-launch marketing | 4,500 |

| Working capital and contingency reserve | 12,500 |

| Total Startup Costs | 80,000 |

The $12,500 contingency reserve provides a working capital buffer for startup phase expenses and slower-than-projected enrollment scenarios.

Sources of Funding

| Source | Amount ($) |

|---|---|

| Chase Bank term loan | 65,000 |

| Owner cash contribution | 15,000 |

| Total Sources | 80,000 |

Loan Structure and Security

The Chase term loan is structured as a five-year amortization at 10.5% fixed interest. Monthly principal and interest payments are $1,398. Total interest paid over the loan term is $18,900.

The loan is secured by business equipment, inventory, and fixtures. The estimated liquidation value of collateral is $28,000 to $32,000. The shortfall is covered by Alex Morgan’s personal guarantee and liquidity reserves. Morgan personally guarantees full loan repayment.

Owner Liquidity and Capital Commitment

Alex Morgan maintains $23,000 in personal liquid reserves separate from the $15,000 initial capital contribution. This provides coverage for 16 months of debt service if business cash flow is insufficient. These reserves are earmarked exclusively for loan repayment and working capital support.

Loan repayment takes absolute priority over growth investments, discretionary spending, and owner compensation. Owner draws remain suspended until debt service coverage reaches 1.25x.

Revenue Projections

Revenue grows as average daily attendance increases from 9 dogs in Year 1 to 14.5 dogs by Year 3.

| Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Avg dogs/day | 9.0 | 12.5 | 14.5 |

| Dog-days | 2,340 | 3,250 | 3,770 |

| Daycare revenue | $79,560 | $113,750 | $135,720 |

| Add-on revenue | $3,370 | $6,290 | $7,540 |

| Total revenue | $82,930 | $120,040 | $143,260 |

These projections assume blended realized pricing of $34 to $36 per dog-day, reflecting pass discounts. Add-on attach rates range from 18% to 25% based on observed behavior at comparable facilities. No revenue assumes exceeding the 18-dog daily capacity limit.

Profit and Loss Statement (3 Years)

| P&L Line Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Daycare revenue | 79,560 | 113,750 | 135,720 |

| Add-on services revenue | 3,370 | 6,290 | 7,540 |

| Total revenue | 82,930 | 120,040 | 143,260 |

| Treats and dog consumables (COGS) | (9,360) | (13,000) | (15,080) |

| Gross profit | 73,570 | 107,040 | 128,180 |

| Handler wages | (33,280) | (33,280) | (33,280) |

| Payroll taxes (10%) | (3,330) | (3,330) | (3,330) |

| Rent | (43,200) | (43,200) | (43,200) |

| Utilities | (5,040) | (5,040) | (5,040) |

| Insurance | (3,120) | (3,120) | (3,120) |

| Software subscriptions | (1,680) | (1,680) | (1,680) |

| Bookkeeping and payroll services | (2,640) | (2,640) | (2,640) |

| Internet and phone | (1,560) | (1,560) | (1,560) |

| Waste disposal | (2,160) | (2,160) | (2,160) |

| Cleaning supplies (variable OPEX) | (3,900) | (3,900) | (3,900) |

| Marketing | (9,000) | (9,000) | (9,000) |

| Total operating expenses | (108,910) | (108,910) | (108,910) |

| EBITDA | (35,340) | (1,870) | 19,270 |

| Depreciation | (8,400) | (8,400) | (8,400) |

| Operating income (EBIT) | (43,740) | (10,270) | 10,870 |

| Interest expense (loan) | (6,300) | (4,900) | (3,400) |

| Net income (pre-tax) | (50,040) | (15,170) | 7,470 |

Don’t waste time using spreadsheets

Cash Flow Statement (3 Years)

| Cash Flow Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Net income (pre-tax) | (50,040) | (15,170) | 7,470 |

| Depreciation (non-cash add-back) | 8,400 | 8,400 | 8,400 |

| Change in accounts receivable | (450) | (220) | (170) |

| Change in accounts payable | 1,200 | 300 | 300 |

| Cash from operations | (40,890) | (6,690) | 16,000 |

| Capital expenditures | (42,000) | 0 | 0 |

| Cash from investing | (42,000) | 0 | 0 |

| Loan proceeds | 65,000 | 0 | 0 |

| Owner cash contribution | 15,000 | 0 | 0 |

| Loan principal repayment | (12,700) | (13,900) | (15,400) |

| Cash from financing | 67,300 | (13,900) | (15,400) |

| Net change in cash | (15,590) | (20,590) | 600 |

| Beginning cash balance | 12,500 | (3,090) | (23,680) |

| Ending cash balance | (3,090) | (23,680) | (23,080) |

Balance Sheet (3 Years)

| Balance Sheet Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Assets | |||

| Cash | (3,090) | (23,680) | (23,080) |

| Accounts receivable | 450 | 670 | 840 |

| Fixed assets (gross) | 42,000 | 42,000 | 42,000 |

| Accumulated depreciation | (8,400) | (16,800) | (25,200) |

| Total assets | 30,960 | 2,190 | (5,440) |

| Liabilities | |||

| Accounts payable | 1,200 | 1,500 | 1,800 |

| Bank loan balance | 52,300 | 38,400 | 23,000 |

| Total liabilities | 53,500 | 39,900 | 24,800 |

| Equity | |||

| Owner contributed capital | 15,000 | 15,000 | 15,000 |

| Retained earnings | (37,540) | (52,710) | (45,240) |

| Total equity | (22,540) | (37,710) | (30,240) |

| Total liabilities + equity | 30,960 | 2,190 | (5,440) |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Break-Even Analysis

Paws & Play’s break-even point is driven by fixed facility costs, controlled staffing, and a capped daily capacity. Two break-even thresholds are tracked: Operating break-even and cash break-even.

Operating Break-Even

Operating break-even occurs when monthly revenue covers all operating expenses, excluding loan principal and interest.

- Monthly operating expense base: approximately $9,100

- Blended realized revenue per dog-day: approximately $35

- Operating break-even volume: ~305 dog-days/month

- Average daily attendance required: ~11.8 dogs/day

This level is reached when the facility is operating at approximately 65% of its 18-dog daily capacity. Operating break-even is achieved in Q3 of Year 2 as weekday enrollment stabilizes.

Cash Break-Even (Including Debt Service)

Cash break-even includes operating expenses plus scheduled loan principal and interest payments.

- Monthly debt service: $1,398

- Total monthly cash outflow (operations + debt): approximately $10,670

- Cash break-even volume: ~361 dog-days/month

- Average daily attendance required: ~13.9 dogs/day

Cash break-even is achieved in Q4 of Year 2, when utilization reaches approximately 77% of maximum capacity.

Margin of Safety

At full projected Year 3 utilization of 14.5 dogs/day:

- Attendance exceeds cash break-even by ~0.6 dogs/day

- Capacity headroom remains below the 18-dog limit

- No staffing additions are required at this level

This margin allows the business to absorb short-term fluctuations in attendance without impairing debt service.

Risk Sensitivity

If average attendance remains below 11 dogs/day beyond Year 2, operating losses persist, and owner liquidity support is required. However, debt service remains covered through pre-funded owner reserves. No break-even assumptions rely on exceeding facility capacity, extending operating hours, or adding higher-risk services.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.