Executive Summary

Vintner’s Lane Wine Market, LLC is acquiring Cedar & Cork Wine Shop, a neighborhood wine retailer that has operated in North Hills since 2015. The transaction transfers a functioning retail business with an existing customer base, five active distributor relationships, and a fully built-out 1,200-square-foot storefront at 1624 Lassiter Mill Road.

The buyers reviewed the seller’s financial statements, point-of-sale reports, inventory records, and the current lease as part of due diligence (can be shared on request as required).

The decision to acquire Cedar & Cork is based on its consistent historical revenue and stable operations, not on assumptions about rapid expansion or format changes. The intent is to improve execution inside an existing model.

Ownership and Management

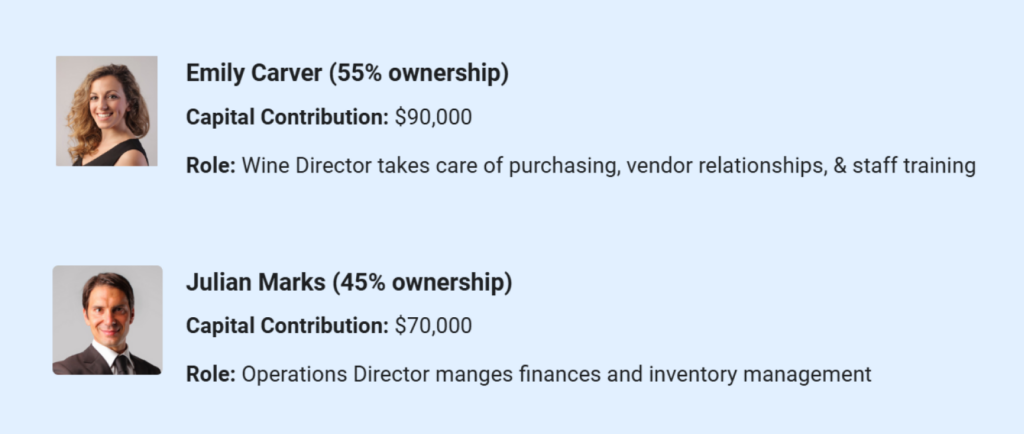

Vintner’s Lane Wine Market, LLC is owned and operated by two partners with complementary responsibilities.

| Owner | Equity | Primary Focus | Relevant Experience |

|---|---|---|---|

| Emily Carver | 55% | Wine selection, tastings, and customer engagement | 8 years as a sommelier at The Angus Barn |

| Julian Marks | 45% | Inventory controls, cash flow, and financial oversight | 5 years as a finance manager within a hospitality group |

Both partners will be actively involved in day-to-day operations during the transition period. Responsibilities are divided along functional lines rather than shared abstractly, reducing execution gaps. Owner compensation is intentionally modest in year one and increases only as profitability stabilizes.

Acquisition and Capital Structure

The total purchase price is $395,000, including approximately $85,000 of inventory at cost, refrigeration and cellar equipment, point-of-sale systems, shelving, customer records, and goodwill associated with established vendor and customer relationships. Inventory included in the purchase represents opening inventory at close; ongoing replenishment is reflected separately in the financial projections.

Total capital required is $473,500, covering the acquisition, limited interior refresh, technology upgrades, professional fees, insurance, and a three-month working capital reserve. Funding consists of owner equity, a commercial term loan, and subordinated seller financing. Seller financing includes a six-month payment deferral, reducing early cash flow pressure during the transition.

| Funding Source | Amount | Terms |

|---|---|---|

| Partner Equity (Carver) | $90,000 | At risk from day one |

| Partner Equity (Marks) | $70,000 | At risk from day one |

| TowneBank Commercial Loan | $185,000 | 7 years, 9.95% fixed |

| Seller Financing | $50,000 | 5 years, 4.5%, 6-month deferral |

Revenue Model and Break-Even

Vintner’s Lane generates revenue from four primary sources: retail bottle sales, wine club subscriptions, ticketed tastings and events, and gourmet food accessories. Retail sales remain the core driver, while wine club subscriptions provide recurring revenue that moderates seasonality.

Based on projected fixed operating costs and a blended gross margin of approximately 40 percent, monthly break-even occurs at approximately $44,000 in revenue.

| Item | Amount |

|---|---|

| Fixed operating costs | ~$17,500 |

| Blended gross margin | ~40% |

| Required gross profit | ~$17,500 |

| Monthly break-even revenue | ~$44,000 |

This level of revenue is achieved through a balanced contribution across retail sales, wine club subscriptions, and tastings rather than reliance on a single channel.

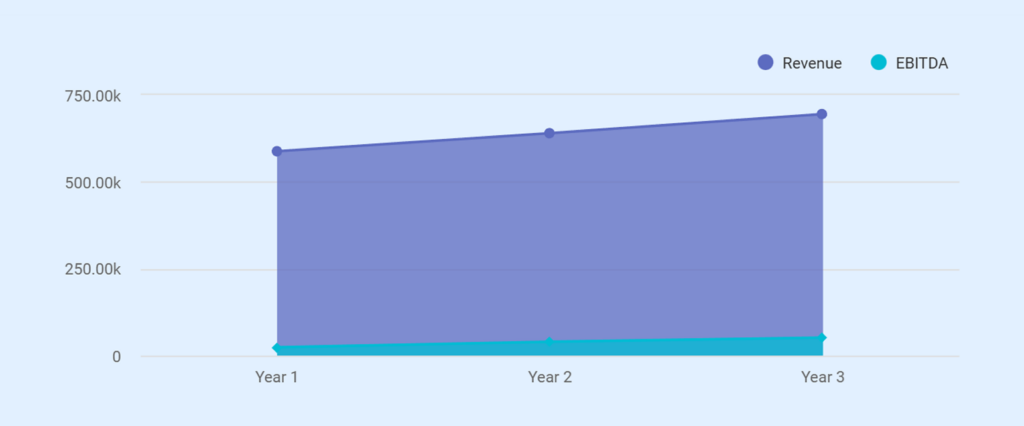

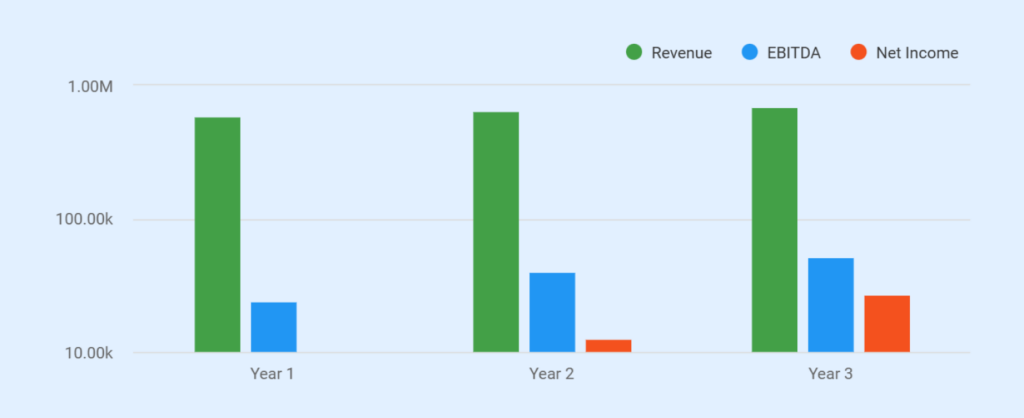

Year one revenue is projected at approximately $588,000. The business is expected to operate near break-even during the initial year as ownership transitions and systems stabilize. Year one EBITDA is projected at approximately $24,000, with profitability improving in subsequent years as wine club membership grows and operating leverage increases.

Market Position and Risk Profile

North Hills is one of Raleigh’s most affluent mixed-use districts, supporting a neighborhood-focused specialty wine retailer positioned on curation, service, and experience rather than price competition.

Key risks include discretionary spending sensitivity, inventory obsolescence, and reliance on owner involvement during early operations. These are mitigated through conservative purchasing, recurring wine club revenue, and retained staff continuity.

The acquisition represents a structured entry into an established local market with existing cash flow, stable vendor terms, and an operating platform designed for disciplined improvement rather than aggressive expansion.

Loan Request

Vintner’s Lane requests a $185,000 commercial term loan from TowneBank with a seven-year term at 9.95 percent fixed. Collateral includes refrigeration units, point-of-sale hardware, shelving, and inventory.

Don’t spend weeks on your first draft

Complete your business plan in less than an hour

Company Description

Business Overview

Vintner’s Lane Wine Market, LLC is acquiring Cedar & Cork Wine Shop, a specialty wine retailer operating continuously since 2015 at 1624 Lassiter Mill Road, Suite 118, Raleigh, NC 27609. The business transfers as a going concern with existing operations, staff, inventory, and vendor relationships intact.

Cedar & Cork operates in North Hills, a mixed-use district in Midtown Raleigh serving an affluent residential and professional population. The acquisition largely preserves the existing business model. Core operations, pricing, and vendor relationships remain unchanged at close, while branding and wine club structure are updated post-acquisition. The new entity will operate under the name Vintner’s Lane Wine Market following a July 2026 rebrand.

Financial projections reflect historical operating patterns adjusted conservatively for ownership transition.

Legal Structure and Ownership

The company is structured as a North Carolina LLC with two principals:

The ownership split reflects both capital contribution and operational responsibility. Both partners will draw modest, below-market salaries during year one, with compensation tied to profitability thresholds in subsequent years.

The LLC operating agreement establishes clear decision-making authority. Day-to-day purchasing decisions under $5,000 per order rest with the relevant partner based on function. Larger commitments require joint approval.

Location and Facilities

The shop occupies 1,200 square feet in a ground-floor retail suite. The location benefits from foot traffic generated by nearby restaurants, offices, and residential density. Parking is available in a shared adjacent lot. Rear access allows distributor deliveries without disrupting the sales floor.

The lease transfers with the acquisition. Current terms run through December 2028 with two five-year renewal options. Base rent is $2,400 monthly, subject to standard annual escalations, plus common area maintenance fees of approximately $380 monthly.

Equipment and Assets

The acquisition includes all fixtures, equipment, and technology necessary for continued operation:

| Asset | Description |

|---|---|

| Refrigeration | Two True GDM-49 commercial wine coolers |

| Climate storage | One EuroCave Professional wine cellar (55 to 58 degrees) |

| Retail fixtures | Floor-to-ceiling hardwood shelving throughout |

| Tasting bar | 16-foot custom wood bar with seating for 12 |

| Point of sale | Lightspeed Retail Pro system with inventory tracking |

| Security | ADT monitoring system with 8 cameras |

Equipment is in good working condition based on due diligence inspection. The interior refresh budget of $12,500 covers cosmetic updates only. No major capital expenditures are planned in the first 24 months.

Regulatory Standing

Wine retail in North Carolina requires an ABC Wine Retail Permit issued by the NC Alcoholic Beverage Control Commission. ABC permits do not automatically transfer to a new owner upon sale.

As required by state regulations, the buyer has applied for a new permit in their name, and the transaction closing is contingent upon permit approval. Legal counsel has advised that approval is expected for buyers without a disqualifying history.

During the transition period, the seller’s permit remains active under a management agreement until the new permit is issued. This arrangement prevents any gap in legal authority to sell wine.

Additional compliance requirements include a food handling permit, fire inspection certification, and posted occupancy limits. Liquor liability insurance with $1 million coverage is required for tasting events. General liability coverage is set at $2 million aggregate.

Keys to Success

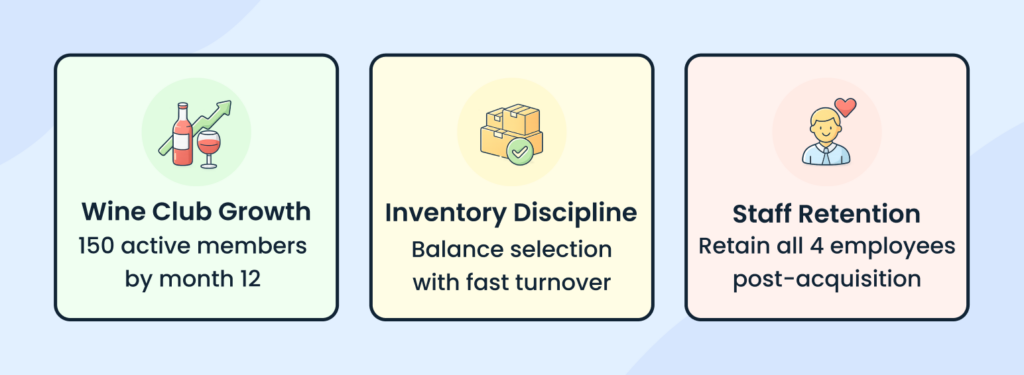

Three factors will determine whether Vintner’s Lane achieves its projections:

First, wine club growth. Recurring subscription revenue smooths seasonal volatility and reduces dependence on foot traffic. The target is approximately 150 active memberships by month 12, up from approximately 80 at acquisition.

Second, inventory discipline. Wine retail ties up significant working capital. Effective inventory management requires balancing selection breadth against turnover velocity. Slow-moving premium bottles can trap cash for months.

Third, staff retention. The acquisition retains all four current employees, preserving institutional knowledge and customer relationships. Continuity during the ownership transition reduces operational risk.

The sections that follow detail operations, market conditions, and financial expectations under this transition.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you

Market Analysis

Industry Overview

The U.S. wine retail market includes grocery stores, large-format retailers, restaurants, specialty shops, and direct-to-consumer channels.

Because Vintner’s Lane serves a defined local catchment area, market sizing is evaluated through neighborhood demographics and historical store performance rather than national wine industry totals.

Specialty wine retailers like Vintner’s Lane often compete in a narrower segment, relying on customer trust, staff knowledge, and the selection quality rather than the pricing.

These are a few trends that shape the current wine retailing landscape:

For instance, consumers at specialty shops tend to buy fewer bottles per visit but spend more per bottle. Tastings and in-store events play a meaningful role in sustaining traffic, particularly outside peak holiday periods. Interest in regional and small-production wines exists but remains selective and dependent on staff guidance.

In a nutshell, premiumization, in-store experience, and interest in local selection remain the trends for wine retailers.

Local Market Conditions

Raleigh is among the fastest-growing metropolitan areas in the Southeast. Wake County wine and spirits sales have increased approximately 7 percent year-over-year.

This reflects a steady category demand. North Hills benefits from a concentration of restaurants, offices, and higher-income residential units that support walk-in retail and evening traffic.

All in all, North Hills offers favorable conditions for specialty wine retail:

| Factor | Indicator |

|---|---|

| Population within 1 mile | Approximately 19,000 residents |

| Household income range | $110,000 to $260,000 |

| Commercial mix | Restaurants, boutiques, corporate offices |

| Foot traffic | Six restaurants within walking distance |

The walkable layout encourages browsing and impulse purchases. Evening foot traffic from restaurant diners supports extended Friday and Saturday hours.

Target Customer Segments

Vintner’s Lane serves four primary customer segments, each with distinct purchasing patterns:

| Category | Age (Years) | Income (Yearly) | Behavior |

|---|---|---|---|

| Everyday Wine Buyers | 28 to 45 | $80,000 to $150,000 | These customers typically purchase one to three bottles in the $15 to $30 range and value guidance more than brand recognition. |

| Enthusiasts and Collectors | 40 to 70 | $150,000 and above | They represent a smaller high-value segment. While crucial for credibility and occasional premium sales, they don’t drive day-to-day revenue. |

| Entertainers and Hosts | 30 to 55 | $100,000 and above | They generate larger transactions tied to social events. Purchases often include multiple bottles and food pairings. |

| Corporate and Gift Buyers | – | – | They contribute seasonal revenue, primarily in Q4. This segment can be considered incremental (not foundational). |

Competitive Landscape

The North Hills area has multiple wine retail options, each with a distinct establishment and positioning:

| Competitor | Distance | Primary Strength | Primary Weakness |

|---|---|---|---|

| Raleigh Wine Shop | 4 miles | Reputation | Location |

| Taylor’s Wine Shop | 3 miles | Established base | Limited events |

| Total Wine | 2 miles | Price, selection | Limited personalization |

| Rioja! Wine Bar | Adjacent | Experience | No retail sales |

Total Wine competes on price and breadth. Vintner’s Lane does not attempt to match either. Those customers who prefer the lowest price may choose Total Wine, and this trade-off is intentional.

Competitive Positioning

The North Hills area includes several wine retailers and wine-focused venues. Larger retailers such as Total Wine compete on price and breadth of selection. Smaller independent shops compete on service and familiarity.

Vintner’s Lane does not attempt to match big-box pricing. Customers seeking the lowest price will choose larger retailers. This tradeoff is accepted. The shop focuses on convenience for nearby residents, a curated selection under $30, and staff recommendations that simplify decision-making.

Weekly tastings and winemaker events differentiate the store from grocery and big-box options and support repeat visits rather than one-time purchases.

Market Risks

This business operates in a category where small missteps show up quickly. The risks below outline where the business is most exposed and how those exposures are actively managed.

Wine retail is discretionary and sensitive to economic conditions. During downturns, customers tend to trade down in price rather than stop purchasing entirely. Maintaining strength in the $15 to $25 range helps retain volume.

Inventory risk is persistent. Consumer preferences shift, and slow-moving bottles tie up cash. Regular inventory review and conservative purchasing reduce, but do not eliminate, this exposure.

North Hills growth could attract additional competitors over time. Early customer retention and wine club enrollment help protect against this risk but require consistent execution.

Products & Services

Product Overview

Vintner’s Lane maintains approximately 400 SKUs, a count calibrated to maximize inventory turnover while minimizing working capital trapped in slow-moving bottles. The product mix, price bands, and category allocations reflect Cedar & Cork’s historical sales patterns, not hypothetical assortment planning.

Wine Inventory

| Category | Price Range | Inventory Share | Margin Profile |

|---|---|---|---|

| Red wines | $14 to $160 | 40% | 35 to 45% |

| White wines | $12 to $80 | 25% | 35 to 42% |

| Sparkling wines | $18 to $145 | 15% | 38 to 48% |

| Rosés | $13 to $32 | 10% | 32 to 40% |

| Premium selections | $85 to $260 | 10% | 28 to 35% |

Category margins blend to approximately 40 percent overall, consistent with the gross margin projections in the Financial Plan.

The core business centers on the $18 to $45 price band, where margins and velocity combine most consistently. Premium selections are capped at 10 percent of inventory at cost to limit capital exposure. Reorders in this category are triggered by customer requests rather than speculative stocking.

Sourcing and Vendor Relationships

The acquisition includes established relationships with five distributors:

| Distributor | Primary Focus |

|---|---|

| Tryon Distributing | Primary supplier, broad portfolio |

| Empire Distributors | California and Pacific Northwest wines |

| Advintage Fine Wine | Premium and allocated selections |

| Sour Grapes Distributors | Natural and organic wines |

| Shelton Vineyards | North Carolina regional wines |

The Shelton Vineyards partnership provides access to limited-release bottles less accessible through standard distribution, though allocation remains subject to availability. Distributor payment terms are net 30 for established accounts. The acquisition preserves Cedar & Cork’s payment history, avoiding prepayment requirements that new retailers typically face.

Pricing is adjusted selectively based on velocity data and distributor cost changes, ensuring active margin management rather than static assumptions.

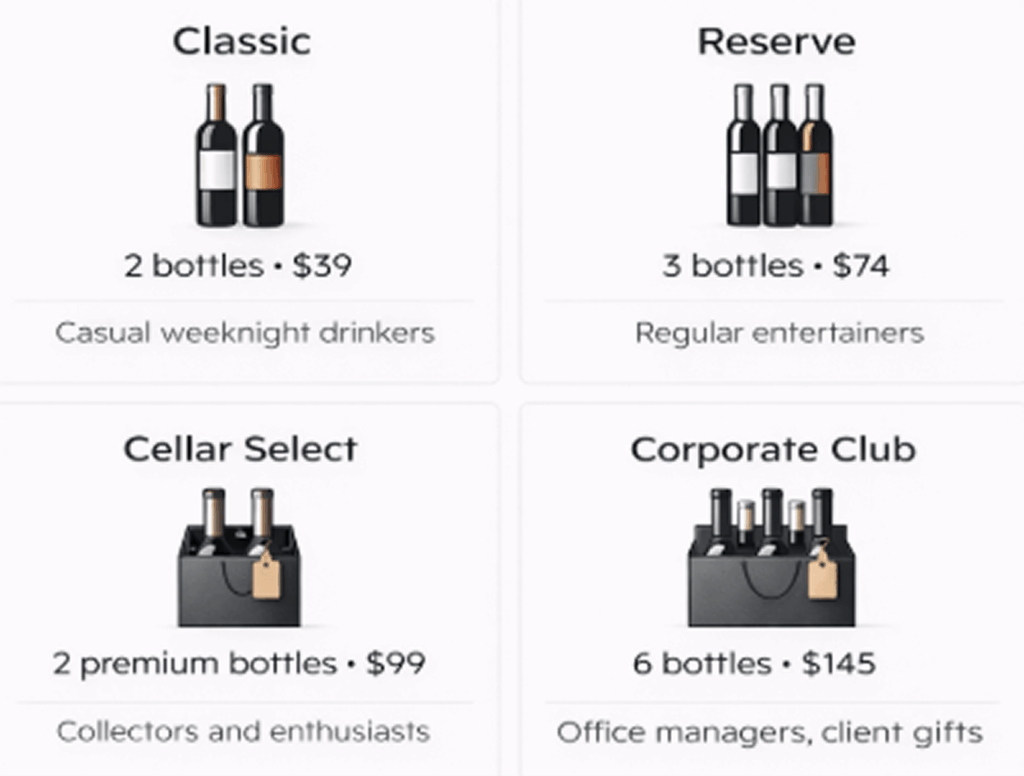

Wine Club Monthly Subscriptions

Four tiers serve different customer profiles:

Tasting and Event Services

Tastings serve dual purposes: generating direct revenue and functioning as customer acquisition channels.

| Event Type | Frequency | Price | Capacity |

|---|---|---|---|

| Weekly tasting | Up to 3 per week | $15 to $22 | 12 to 16 guests |

| Winemaker event | Monthly | $25 to $35 | 20 to 24 guests |

| Private booking | As scheduled | $200 to $420 | 8 to 20 guests |

Emily Carver will lead most weekly tastings personally during the initial transition period, reducing incremental labor expense while building customer relationships.

Gourmet Food Accessories

Food items are complementary, low-risk add-ons capped at approximately 10 percent of revenue. The selection includes cheese packs, charcuterie, crackers, olives, and chocolate pairings.

These items carry margins between 40 and 50 percent and encourage larger transaction sizes. Food inventory turns more quickly than wine, with a weekly ordering cadence matched to sales velocity. Perishable items are ordered conservatively; supplier relationships allow returns or credits on slow-moving dated products.

Pricing Strategy

The pricing is driven by margin targets, inventory turnover, and how customers actually shop, not by attempting to match big-box or online pricing.

| Category | Margins |

|---|---|

| Everyday wines ($12 to $30) | 35% to 40% |

| Mid-range wines ($30 to $75) | 38% to 45% |

| Premium wines ($75 and above) | 28% to 35% |

Pricing is tiered by product category to balance margin targets with inventory turnover. Everyday wines move quickly and drive volume, so margins are kept competitive to encourage repeat visits. Mid-range bottles benefit from staff guidance and customer trust, allowing for higher margins without slowing turnover.

Premium wines are treated more cautiously. While important for credibility and selection depth, they turn more slowly and face price pressure from online sellers. Lower margins in this tier are a deliberate tradeoff to reduce inventory risk and protect cash flow rather than chase high per-bottle returns.

The shop does not compete with Total Wine on price. The strategy assumes customers choosing Vintner’s Lane value curation, service, and convenience over discount pricing.

Marketing & Sales Strategy

Strategic Approach

Marketing capacity is constrained by ownership bandwidth. Both partners are working in the business daily, not operating as remote managers. As a result, the strategy prioritizes channels that convert reliably and support retention over labor-intensive outreach.

The marketing budget is $2,000 monthly, approximately 4 percent of projected revenue. Wine club conversion and tasting events serve as the primary acquisition channels. Social media, local search, and partnerships support visibility but are secondary to in-store engagement.

Channel Priorities

| Channel | Role | Effort Level |

|---|---|---|

| Tasting conversations | Primary acquisition | High |

| Wine club referrals | Primary retention | Moderate |

| Email marketing | Retention, reactivation | Moderate |

| Social media | Awareness | Low-moderate |

| Google Maps and reviews | Discovery | Low |

| Restaurant partnerships | Opportunistic | As capacity allows |

Social Media

Instagram serves as the primary awareness channel. Content focuses on new arrivals, tasting announcements, and behind-the-scenes moments.

Posting frequency targets three to four posts weekly, a sustainable pace given operational demands. Daily posting is not realistic during year one. Paid advertising is limited to event promotion with modest monthly spend. Costs vary by campaign and are treated as variable rather than fixed commitments.

Email Marketing

The existing customer database transfers with the acquisition. Email segments into three groups: active wine club members, lapsed customers, and tasting attendees who have not converted.

Communication frequency remains light: two to three emails monthly for members, one to two for other segments. The goal is a consistent presence without overwhelming inboxes.

Local Search and Reviews

Google Business Profile requires active management rather than paid spend. The strategy includes claiming the profile immediately after closing, responding to all reviews within 48 hours, and encouraging satisfied customers to leave reviews through tasteful prompts.

Review accumulation takes time. The shop inherits Cedar & Cork’s existing profile, which provides a foundation.

Tasting Conversion

Weekly tastings host 12 to 16 guests at $15 to $22 per ticket, with up to three tastings held each week. At full capacity, this produces approximately 120 to 180 guest interactions per month.

The target conversion rate is 15 to 20 percent of attendees joining the wine club within 30 days. At midpoint assumptions, this equates to roughly 25 new members per month. Results vary based on event execution and attendee mix.

Wine club members attend weekly tastings at no charge. This supports retention and typically fills unused capacity rather than displacing paid attendance.

Corporate Outreach

Corporate gifting campaigns begin in October 2026, targeting the holiday season. Julian Marks leads outreach to law firms, real estate offices, and financial practices in the North Hills area.

Corporate sales cycles are slow. Initial outreach may yield limited immediate results. Meaningful corporate account revenue is more likely to materialize in the second holiday season after relationships are established. This revenue stream is treated as upside rather than base case.

Customer Retention

The loyalty program offers 5 percent store credit on purchases. This benefit affects effective margins modestly and is factored into gross margin projections. The program encourages repeat visits without deep discounting.

Local delivery within 5 miles at $3.99 captures incremental sales and reinforces convenience positioning. Volume is expected to be modest initially.

Key Performance Indicators

Three metrics determine marketing success:

- Wine club net member growth (target: 70 net new members in year one)

- Tasting attendance rate (target: 70 percent average capacity utilization)

- Repeat purchase rate among non-members (target: 30 percent within 90 days)

Constraint Statement

Marketing activities scale only if operational capacity allows. Tasting frequency, social media cadence, and partnership development adjust based on staffing bandwidth and owner workload. Ambitious marketing serves no purpose if execution quality suffers.

Operations Plan

Operating Hours and Staffing Coverage

Vintner’s Lane maintains the operating schedule established by Cedar & Cork:

| Day | Hours | Typical Coverage |

|---|---|---|

| Monday to Thursday | 11:00 AM to 8:00 PM | 1 to 2 staff |

| Friday to Saturday | 11:00 AM to 9:00 PM | 2 to 3 staff |

| Sunday | 12:00 PM to 5:00 PM | 1 to 2 staff |

Total weekly operating hours: 62 hours. Owners are on the floor during peak periods and tasting events, particularly in year one. Slower shifts are staffed by the store manager or part-time employees.

Hours may adjust seasonally, though changes involve customer communication and staff scheduling friction. Any adjustments are evaluated against revenue impact and labor cost.

Facility Layout

The 1,200-square-foot space includes a sales floor with shelving organized by wine type and price point, a 16-foot tasting bar accommodating 12 guests, rear storage with climate control, and a small administrative workspace.

The layout supports current operations without modification. The $12,500 interior refresh covers cosmetic updates only.

Climate Control and Equipment

Wine storage requires a consistent temperature between 55 and 58 degrees. Two systems provide this: an EuroCave Professional cellar for premium bottles and allocated inventory, and two True GDM-49 commercial coolers for everyday whites, rosés, and sparkling wines.

Equipment failure could damage significant inventory. Mitigation includes quarterly maintenance, a service contract with 24-hour response, and business interruption insurance covering spoilage. These controls reduce risk but do not eliminate it.

Inventory Management

The shop maintains approximately 400 SKUs with a target inventory value between $80,000 and $95,000 at cost. This represents roughly 50 to 60 days of sales, consistent with the COGS and cash flow assumptions in the Financial Plan.

| Category | Turnover Target |

|---|---|

| Red wines | 8 to 10x annually |

| White wines | 10 to 12x annually |

| Sparkling | 8 to 10x annually |

| Rosé | 12 to 15x annually |

| Premium | 4 to 6x annually |

Emily Carver makes purchasing decisions. Inventory review occurs weekly using Lightspeed POS reporting, with reorder triggers set at minimum stock levels by SKU.

Bottles unsold beyond 90 days trigger review. Options include featuring in tastings, staff recommendation emphasis, or promotional pricing. This single threshold applies across categories, with premium bottles receiving closer attention given their capital intensity.

Vendor Relationships

Five distributor relationships transfer with the acquisition, all on net-30 payment terms. The acquisition preserves Cedar & Cork’s payment history, avoiding prepayment requirements.

If distributor terms tighten temporarily during the transition, the working capital reserve provides a buffer. Maintaining multiple distributor relationships allows shifting volume if any single supplier becomes problematic.

Technology

The Lightspeed Retail Pro system handles transactions, inventory tracking, and reporting. The $4,200 POS upgrade adds enhanced reporting for sales velocity analysis and integration with the rebuilt website for online ordering and delivery scheduling.

Compliance

Wine retail requires an ABC Wine Retail Permit, which transfers with the business, subject to new owner approval. The application has been submitted with the closing contingent on permit reissuance. During the transition, the seller’s permit remains active under a management agreement.

Additional requirements include a food handling permit, fire inspection certification, occupancy limit posting, and sales tax registration. Liquor liability insurance ($1 million per occurrence) covers tasting events. General liability coverage is set at $2 million aggregate.

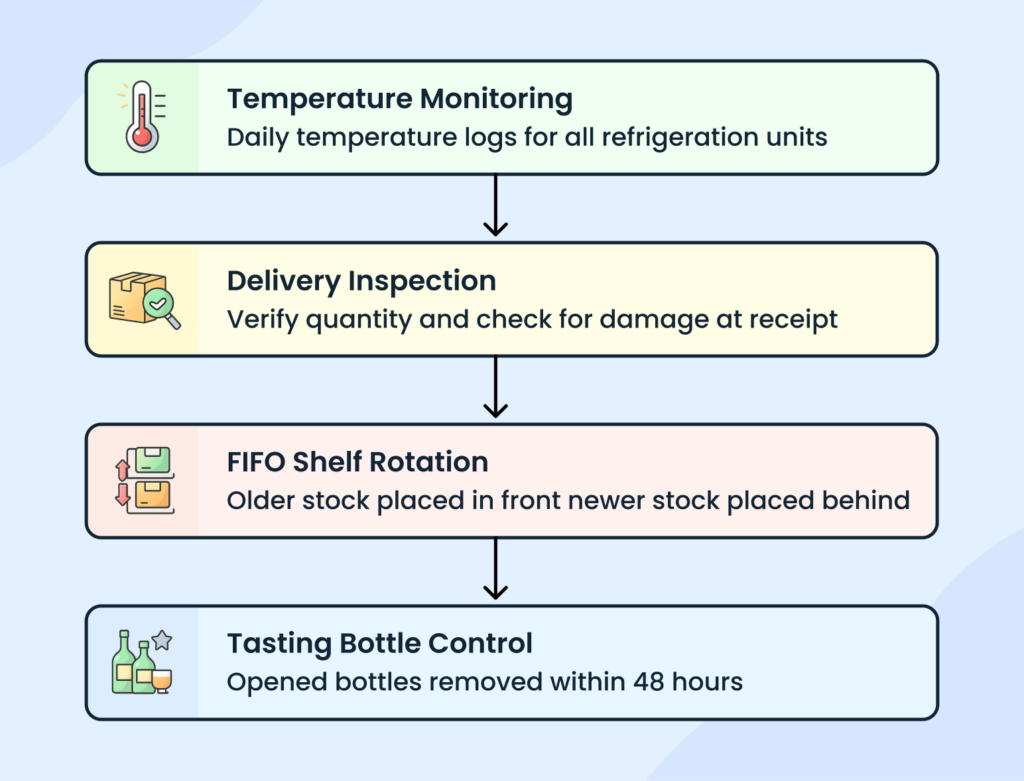

Quality Control

Quality control follows documented processes: Daily temperature logging for refrigeration units, delivery inspection for damage and quantity accuracy, first-in-first-out shelf rotation, and 48-hour limits on opened tasting bottles.

These procedures reduce spoilage and shrink but do not guarantee zero loss. Some product loss is anticipated and factored into margin assumptions.

Operational Constraint

Operational complexity is intentionally limited. The business runs a proven model in an established location with retained staff. Year one priorities are execution consistency and ownership transition, not operational expansion.

Management & Organization

Ownership and Accountability

| Owner | Role | Primary Accountability | Commitment |

|---|---|---|---|

| Emily Carver (55%) | Wine Director | Purchasing, vendor relationships, tastings, staff training | Full-time |

| Julian Marks (45%) | Operations Director | Financial controls, inventory management, and corporate sales | Full-time |

Carver’s eight years as a sommelier at a high-volume restaurant translate directly to wine retail: vendor negotiation, inventory selection across price points, and customer education under time pressure. Marks managed P&L and inventory for a multi-location hospitality group, experience directly applicable to cash flow management and working capital discipline in a retail environment.

The pairing addresses wine retail’s two core requirements: product credibility and financial control. Neither partner duplicates the other’s function.

Why This Team Fits This Business

Wine shops fail for two reasons: poor product selection that loses customer trust, or poor cash management that traps capital in unsold inventory. This partnership covers both failure modes with relevant (not theoretical) experience.

Both partners will draw modest, below-market salaries during year one, with compensation tied to profitability thresholds. This signals financial discipline and aligns owner incentives with business health.

Staff Continuity

All four Cedar & Cork employees have agreed to continue following the acquisition:

| Position | Status | Compensation |

|---|---|---|

| Store Manager | Full-time | $48,000 annually |

| Senior Wine Consultant | Part-time | $20.00/hour |

| Tasting Associate | Part-time | $17.00/hour |

| Cashier | Part-time | $15.50/hour |

Retaining experienced staff preserves customer relationships and institutional knowledge during the transition. The store manager provides day-to-day operational continuity, reporting to both owners.

Total organization: six people (two owner-operators, four employees). Total annual labor cost excluding owner draws: approximately $98,000 to $105,000, including payroll taxes.

Span of Control

Both owners work in the business. The store manager handles daily floor operations and staff scheduling. Part-time employees report to the manager for shift-level direction and to owners for training and performance matters.

No additional hires are planned for year one. Hiring decisions in year two depend on revenue growth and tasting program expansion, evaluated at month 10 based on actual performance.

Professional Advisors

| Advisor | Role |

|---|---|

| Business attorney | Operating agreement, licensing |

| CPA | Tax planning, payroll, financial statements |

| Insurance broker | Coverage review |

| Business banker | Loan relationship |

Succession Provisions

The operating agreement addresses partner departure: right of first refusal on voluntary exit, life insurance policies ($200,000 each) funding buyout on death or disability, and binding arbitration for unresolved disputes. These provisions protect business continuity without requiring a detailed explanation here.

A business plan shouldn’t take weeks

Financial Plan

Historical Financial Basis

Financial projections are grounded in Cedar & Cork’s operating history, not theoretical modeling. The following seller-prepared documents were reviewed during due diligence:

- Seller profit and loss statements (trailing 36 months)

- Lightspeed POS sales reports by category and SKU

- Inventory valuation at cost

- Lease agreement and payment history

- Distributor account statements

Seller Historical Snapshot

| Metric | Historical Range (Trailing 36 Months) | Context |

|---|---|---|

| Annual revenue | $540,000 – $610,000 | Stable specialty retail performance; no expansion or contraction trend |

| Average monthly revenue | $45,000 – $51,000 | Q4 peaks offset weaker summer months |

| Gross margin | 38% – 41% | Consistent purchasing and pricing discipline |

| EBITDA (estimated) | $30,000 – $55,000 | Varies by year based on owner involvement and discretionary spend |

| Wine club members | 75 – 85 active | Stable base with limited active promotion |

| Holiday concentration | ~30% of annual revenue in Q4 | Gift-driven sales pattern |

Year one projections sit within the seller’s historical revenue range, not above peak performance. Projections reflect stabilized historical operations with modest operational improvements. Growth assumptions begin only after the transition period. Break-even revenue of approximately $44,000 per month falls within the seller’s historical monthly performance.

Pre-Acquisition vs Post-Acquisition Assumptions

| Element | Pre-Acquisition | Post-Acquisition |

|---|---|---|

| Location | Unchanged | Unchanged |

| Core pricing | Unchanged | Unchanged |

| Vendor terms | Net 30 | Net 30 (preserved) |

| Owner involvement | Absentee trending | Full-time, on-floor |

| Wine club focus | Passive | Active growth target |

| Marketing discipline | Minimal | Structured, budgeted |

| Tasting frequency | Occasional | Up to 3 weekly |

Projections assume evolution of an existing business, not reinvention.

Funding Structure

| Source | Amount | Terms |

|---|---|---|

| Partner equity | $160,000 | At risk from closing |

| TowneBank commercial loan | $185,000 | 7 years, 9.95% fixed |

| Seller financing | $50,000 | 5 years, 4.5%, 6-month deferral |

Partner equity represents 33.8 percent of the acquisition purchase price, demonstrating meaningful owner commitment.

Debt Summary

| Obligation | Amount | Rate | Term | Payments Begin | Monthly Payment |

|---|---|---|---|---|---|

| TowneBank loan | $185,000 | 9.95% fixed | 7 years | Month 1 | ~$3,100 |

| Seller note | $50,000 | 4.5% | 5 years | Month 7 | ~$930 |

The seller financing deferral reduces cash pressure during the six-month transition period. Full debt service of approximately $4,030 per month begins in month seven. Debt service obligations take priority over owner distributions.

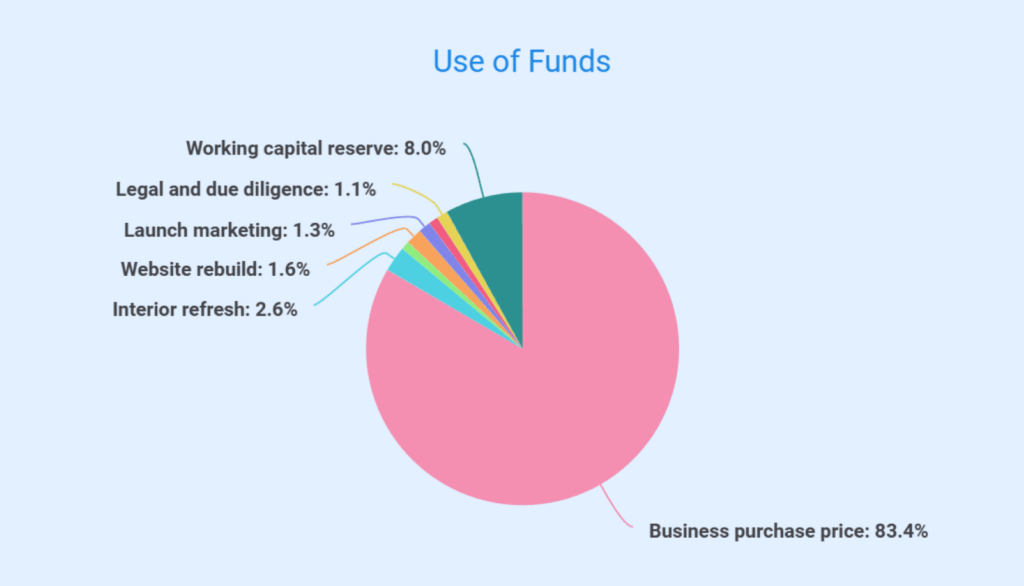

Use of Funds

| Category | Amount |

|---|---|

| Business purchase price | $395,000 |

| Interior refresh | $12,500 |

| POS system upgrade | $4,200 |

| Website rebuild | $7,800 |

| Launch marketing | $6,000 |

| Insurance | $4,600 |

| Legal and due diligence | $5,400 |

| Working capital reserve | $38,000 |

| Total | $473,500 |

Financial Summary

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | $588,000 | $640,000 | $695,000 |

| Gross Margin | 40.0% | 41.5% | 42.1% |

| EBITDA | $24,340 | $40,340 | $52,200 |

| Net Income | (-$5,860) | $12,540 | $27,000 |

The year one net loss is anticipated and funded through the working capital reserve. No additional capital injection is required.

At projected margins, year one EBITDA provides limited margin for error, reinforcing the importance of purchasing discipline and cost control. Operating performance is evaluated using EBITDA and operating cash flow, excluding financing inflows.

Break-Even Analysis

Break-even occurs at approximately $44,000 in monthly revenue, a level within the seller’s historical monthly range. Monthly results may vary, but average performance at this level supports fixed operating costs.

| Stream | Monthly Target |

|---|---|

| Retail bottle sales | $26,000 to $29,000 |

| Wine club | $8,000 to $9,000 |

| Tastings and events | $5,500 to $6,500 |

| Food and accessories | $4,500 to $5,000 |

Cash Position

| Position | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Opening Cash | $38,000 | $334,540 | $323,980 |

| Ending Cash | $334,540 | $323,980 | $323,380 |

Year one cash position reflects acquisition financing, not operating surplus. Strong ending balances result from capitalization structure, not operational outperformance. Years two and three show modest cash reduction as debt is serviced and owner distributions begin ($10,000 in year three).

Need to create solid financial projections?

Use our AI forecasting tool to build realistic, visually-appealing financials

Key Assumptions

Revenue: Year one assumes a historical baseline with modest improvement. Wine club grows from 80 to approximately 150 members by year three. Corporate gifting generates $15,000 to $20,000 annually, concentrated in Q4.

Expenses: Rent increases 3% annually per lease terms. Staff wages increase 2 to 3% annually. Gross margin improves from 40% to 42% through purchasing discipline and revenue mix shift.

Financing: Loan terms as stated. Owner distributions begin in year three at modest levels, subordinate to debt service.

Financial Risks and Constraints

- Margin sensitivity. If gross margins fall below 38%, break-even revenue increases materially. Purchasing discipline and promotional restraint are non-negotiable.

- Inventory discipline. Capital trapped in slow-moving bottles directly impairs cash flow. The 90-day aging threshold triggers mandatory review.

- Debt service priority. Loan payments take precedence over owner distributions. The owner draws flex downward before debt service is compromised.

- Seasonal exposure. Q4 strength subsidizes Q1 weakness. Poor holiday performance would stress the early-year cash position. The working capital reserve exists for this contingency.

- Wine club retention. Each lost member reduces predictable monthly revenue by $39 to $145. Churn above 5% monthly requires immediate intervention.

Detailed financial statements appear in the Appendix.

Appendix

Income (Profit & Loss) Statement

| Revenue | 2026-27 | 2027-28 | 2028-29 | Total |

|---|---|---|---|---|

| Total Revenue | 588.00k | 640.00k | 695.00k | 1,900.00k |

| Retail bottle sales | 352.80k | 384.00k | 417.00k | 1,153.80k |

| Wine club subscriptions | 105.80k | 121.00k | 138.00k | 364.80k |

| Tastings & events | 70.60k | 78.00k | 84.00k | 232.60k |

| Gourmet food & accessories | 58.80k | 57.00k | 56.00k | 171.80k |

| Cost of Sales | 352.80k | 374.40k | 402.10k | 1,129.30k |

| Wine inventory purchases | 312.00k | 331.00k | 355.00k | 998.00k |

| Event wine & supplies | 18.40k | 20.00k | 21.00k | 59.40k |

| Food product costs | 22.40k | 23.40k | 26.10k | 71.90k |

| Direct labor (events only) | 0.00k | 0.00k | 0.00k | 0.00k |

| Gross Margin | 235.20k | 265.60k | 292.90k | 793.70k |

| Gross Margin % | 40.00% | 41.50% | 42.10% | 41.30% |

| Operating Expenses | 210.86k | 225.26k | 240.70k | 676.82k |

| Payroll (owners + staff) | 108.00k | 118.00k | 128.00k | 354.00k |

| Rent & CAM | 33.36k | 34.36k | 35.40k | 103.12k |

| Marketing & promotions | 24.00k | 26.00k | 28.00k | 78.00k |

| Utilities | 12.00k | 12.60k | 13.20k | 37.80k |

| Insurance | 6.00k | 6.30k | 6.60k | 18.90k |

| POS, software & web | 9.50k | 8.50k | 8.50k | 26.50k |

| Office, supplies & misc | 18.00k | 19.50k | 21.00k | 58.50k |

| EBITDA | 24.34k | 40.34k | 52.20k | 116.88k |

| Depreciation | 14.00k | 14.00k | 14.00k | 42.00k |

| Interest expense | 16.20k | 13.80k | 11.20k | 41.20k |

| Income tax | 0.00k | 0.00k | 0.00k | 0.00k |

| Net Income | -5.86k | 12.54k | 27.00k | 33.68k |

Balance Sheet

| 2026-27 | 2027-28 | 2028-29 | |

|---|---|---|---|

| Assets | 546.04k | 528.48k | 520.88k |

| Cash | 334.54k | 323.98k | 323.38k |

| Accounts receivable | 6.50k | 7.00k | 7.50k |

| Inventory | 88.00k | 94.00k | 100.00k |

| Prepaid & other assets | 5.00k | 5.50k | 6.00k |

| Current Assets | 434.04k | 430.48k | 436.88k |

| Gross fixed assets | 140.00k | 140.00k | 140.00k |

| Accumulated depreciation | (28.00k) | (42.00k) | (56.00k) |

| Net Fixed Assets | 112.00k | 98.00k | 84.00k |

| Liabilities | 270.60k | 253.00k | 235.40k |

| Accounts payable | 42.00k | 45.00k | 48.00k |

| Accrued expenses | 9.00k | 10.00k | 11.00k |

| Short-term debt | 21.60k | 21.60k | 21.60k |

| Long-term debt | 198.00k | 176.40k | 154.80k |

| Total Equity | 275.44k | 275.48k | 285.48k |

| Owner contributions | 160.00k | 160.00k | 160.00k |

| Retained earnings | 115.44k | 115.48k | 125.48k |

Cash Flow Statement

| 2026-27 | 2027-28 | 2028-29 | |

|---|---|---|---|

| Net income | -5.86k | 12.54k | 27.00k |

| Depreciation | 14.00k | 14.00k | 14.00k |

| Inventory change | -8.00k | -6.00k | -6.00k |

| Working capital changes | -2.50k | -1.50k | -1.00k |

| Net Operating Cash Flow | -2.36k | 19.04k | 34.00k |

| Equipment & tech purchases | -24.50k | -3.00k | -3.00k |

| Net Investing Cash Flow | -24.50k | -3.00k | -3.00k |

| Owner contributions | 160.00k | 0.00k | 0.00k |

| Loan proceeds | 185.00k | 0.00k | 0.00k |

| Loan principal payments | -21.60k | -21.60k | -21.60k |

| Owner distributions | 0.00k | -5.00k | -10.00k |

| Net Financing Cash Flow | 323.40k | -26.60k | -31.60k |

| Opening cash | 38.00k | 334.54k | 323.98k |

| Net cash change | 296.54k | -10.56k | -0.60k |

| Ending Cash | 334.54k | 323.98k | 323.38k |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.