There are two types of entrepreneurs—those who prefer business budgeting software over spreadsheets and those who don’t.

Sure. Using spreadsheets for budgeting may sound like a good idea, but it’s also a recipe for chaos and scratched-up keyboards.

Many business owners still use spreadsheets as their primary budgeting tool; however, it takes time, and there is always the risk of human error down the road.

On the other hand, business budgeting software makes budgeting less intimidating, helping you ensure your business meets its financial goals. Luckily, many small business budgeting tools are available to make things easier and hassle-free for you.

Wondering which one to choose for your business? Here you go.

We have researched and compiled the best business budgeting software that will help you in making your decision firm.

As we dive right into the topic, let’s know what exactly are these business budgeting tools:

What is a business budgeting software?

business budgeting software is a type of accounting software that helps individuals and businesses create, manage, and monitor their budgets. It empowers users to plan their finances smoothly by estimating income, forecasting expenses, and allocating resources across various categories.

With features like automated calculations and customization options, users can streamline the budgeting process, ensuring accuracy and efficiency.

How do we analyze these small business budgeting software?

When evaluating small business budgeting software, we focus on key features like ease of use, integration with other financial tools, and flexible budgeting options.

We also consider user reviews and ratings to gauge real-world performance, alongside the cost to ensure the software provides value for money. Our only goal is to help you find out the most suitable budgeting software that aligns with your needs.

Let’s discuss all the budgeting tools in detail now:

Best business budgeting software Tools

- Upmetrics: Startup financial planning tool

- Xero: All-in-one business budgeting software

- Zoho Books: All-in-one business budgeting software

- QuickBooks: All-in-one business budgeting software

- PlanGuru: In-depth forecasting

- FreshBooks: User-friendly accounting and budgeting

- Wave: Accounting software with budgeting features

- Sage Accounting: Comprehensive financial management

- Float: Cash flow forecasting tool

- Futrli: For software integrations

- Datarails: Financial data analysis tool

- Centage: Budgeting and forecasting for SMBs

1. Upmetrics

Upmetrics is a popular AI-powered business and financial planning software that helps startups and small business owners write and prepare their financial budgets, statements, and business plans.

Isn’t that all basic business budgeting or planning software provided?

Well, with Upmetrics, you get AI-powered revenue and expense stream suggestions.

Well, that’s not all, this tool also helps you write the entire business plan with guidance at each step.

It comes with an AI business assistant that reads and comprehends your entire business plan and answers any questions you have regarding your finances, budgets, or business plan.

For instance, you may ask when my business will break even or ask to help you prepare a revenue-and-expense statement forecast for 5 years. You may ask anything and get answers.

If you don’t know much about how to plan your budget, then this is the must-try software. Some other features of Upmetrics include:

Best Features

- Supports in planning and managing cash flow statements.

- Provides a clear and accurate financial dashboard.

- Financial forecast calculators up to 7 years.

- AI-powered revenue and expense stream suggestions.

- AI writing assistant to help you write your business plan.

- Automatically generates financial statements and visual reports

- Multilingual support to translate text in 9+ languages

Pricing

| Premium | Professional |

|---|---|

| $14 | $37 |

Say goodbye to old-school excel and spreadsheets

Make business budget in minutes with AI

Plans starting from $14/month

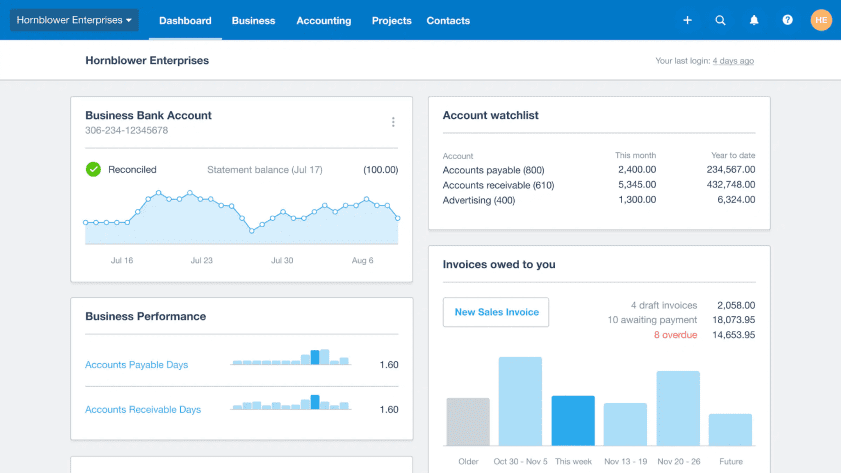

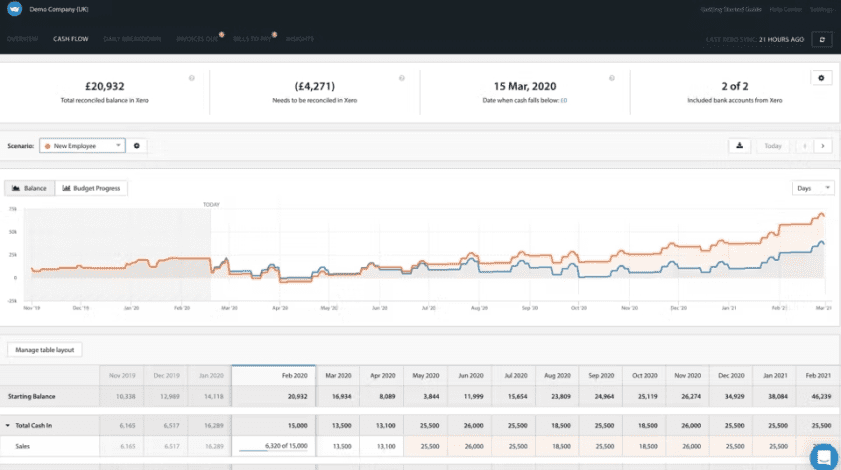

2. Xero

With the help of Xero, small businesses can make detailed budgets and plan their income & expense statements for various years. Xero facilitates expense tracking, invoicing, financial reporting, and much more.

With real-time updates, businesses can observe their financial situation continuously and make informed decisions.

Xero’s cloud-based nature also supports collaborative budget planning, allowing multiple users to work on budgets simultaneously.

With scalability in mind, Xero is suitable for growing startups, providing a robust solution encompassing various aspects of financial management, including effective budgeting.

Here is a quick overview of the features it provides:

Best Features

- Cloud-based access

- Easy invoicing

- Expense management

- Multi-currency support

- Bank reconciliation

- Financial Reporting

- Budgeting and forecasting

- Payroll management

Limitations

- The introductory plan restricts the number of bills to 5 and invoices to 20 per month.

- It is relatively more expensive than other financing tools

- Limited customer support for the starter plan

- There are customization limitations regarding specific industry needs or certain businesses

Pricing

| Starter | Standard | Premium |

|---|---|---|

| $29/month | $46/month | $62/month |

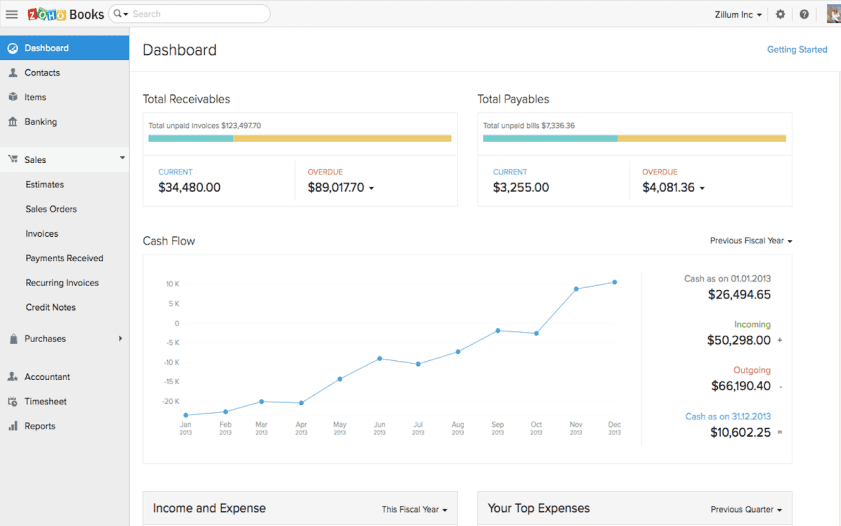

3. Zoho Books

Zoho Books is very easy to use thanks to its user-friendly interface and intuitive features.

The budget feature is so simple — add the name, fiscal year, and budget period. Additionally, it can be integrated with your bank account, so you can import all the past transactions to make your budgeting smooth.

Customizable financial reports, including profit and loss statements and balance sheets, assist businesses in assessing their financial health against budgeted goals.

Some of the features it provides are

Best Features

- User-friendly interface

- Budgeting tools

- Real-time financial tracking

- Integration Capabilities

- Invoicing and payment tracking

- Bank reconciliation

- Affordability

- Multi-currency support

Limitations

- There are limited advanced features in lower-tier plans.

- It has limited payroll features which might be an issue for companies with complex payroll features.

- Users on lower-tier plans might encounter transaction limits.

- The pricing structure with various plans and add-ons is a bit complex.

Pricing

| Free | Standard | Professional | Premium | Elite | Ultimate |

|---|---|---|---|---|---|

| $0 | $15/month | $40/month | $60/month | $120/month | $240/month |

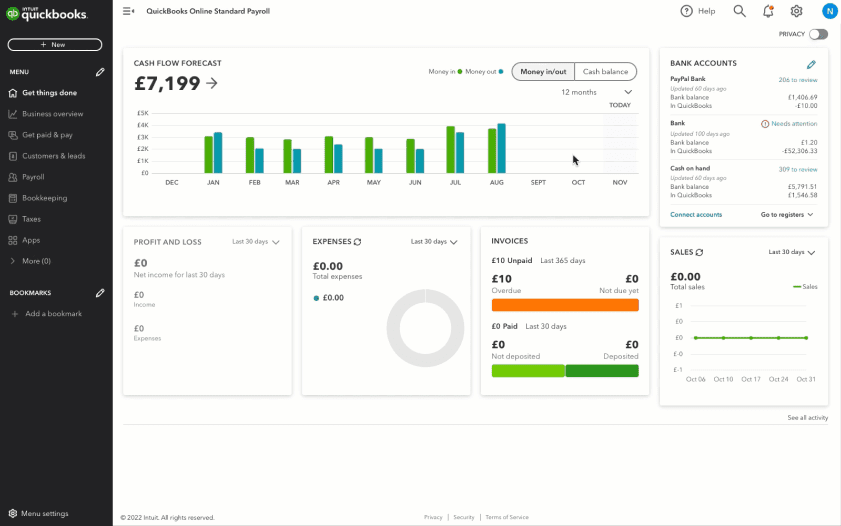

4. QuickBooks

QuickBooks is a popular accounting and business budgeting software. It has features that handle everything you need for budgeting, and it also provides tools for basic needs and integrations with other apps for more detailed cash flow predictions.

It provides a structured framework for precise budgeting and profit & loss over a specific period. QuickBooks also excels in bank reconciliation, making it easy to match transactions with bank feeds for accurate financial records.

It’s widely recognized in the industry, and even beginners can take a course to learn how to use QuickBooks online and understand bookkeeping.

Here are some features it provides:

Best Features

- Automated Recurring transactions

- Integration capabilities

- Budgeting

- Multi-currency support

- Expense tracking

- Security features

- Invoicing

- Customer support

Limitations

- Some plans have transaction limits that huge businesses might need.

- The cost of advanced plans is higher for small businesses

- New users have to go through the learning curve before using the tool.

- Certain features might cost you extra or would ask you to upgrade to higher plans.

Pricing

| Simple start | Essentials | Plus | Advanced |

|---|---|---|---|

| $15/month | $30/month | $45/month | $100/month |

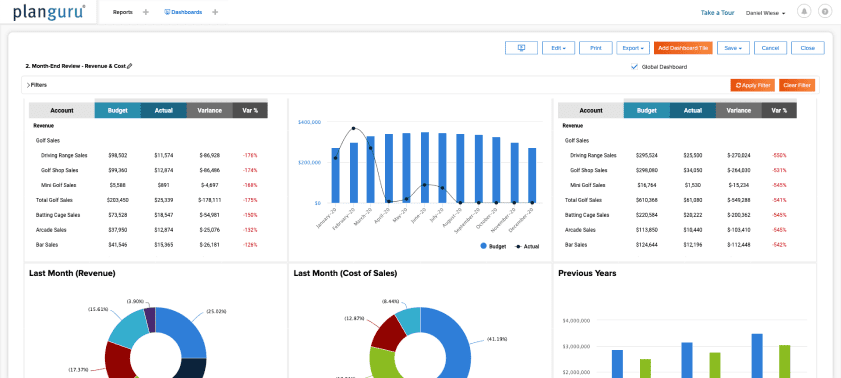

5. PlanGuru

PlanGuru is a valuable tool for a small business searching for effective budgeting solutions. It helps businesses to go beyond basic budgeting and delve into financial projections.

The software allows for budget creation, offering a view of your financial goals and strategies. Keep in mind that there may be a learning curve before you start using PlanGuru.

Some of the features of PlanGuru are:

Best Features

- In-depth forecasting

- Cash flow forecasting

- Flexible modeling

- Multi-year planning

- Comprehensive budget creation

- Intuitive interface

- Financial ratio analysis

- Report customization

Limitations

- Businesses with simple budgeting needs might find it complex.

- Some users have reported that PlanGuru might need a more manual approach rather than automation.

- PlanGuru has a steeper learning curve due to its advanced features.

- Some of the users have reported having more advanced collaborative options that support real-time changes.

Pricing

| Single Entity | Multi-department consolidations |

|---|---|

| $99/month | $299/month |

Note: They even offer an advisory plan for $99/month.

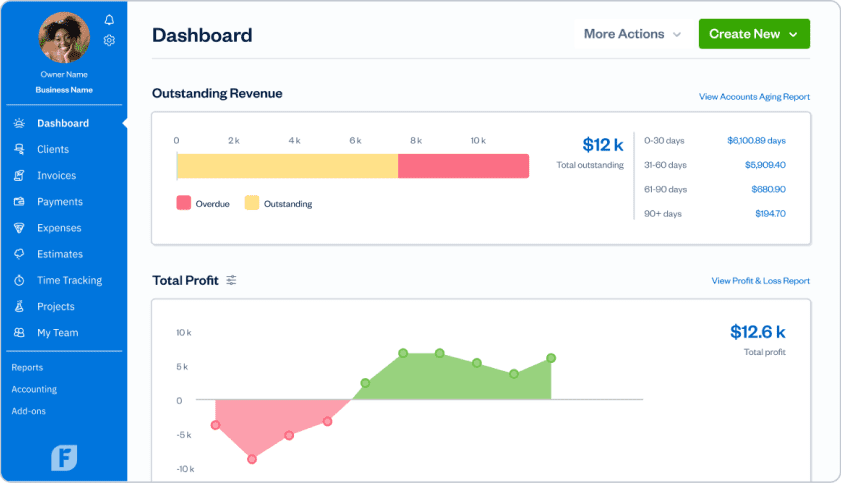

6. FreshBooks

FreshBooks is one of the excellent budgeting tools not only for small businesses but freelancers too. Its intuitive interface makes budget-making and managing smooth, even with limited accounting knowledge.

It automates many financial processes, such as recurring billing, late payment reminders, and expense categorization. This automation saves time and reduces the risk of manual errors.

This cloud-based saves time and money by integrating with over 100 apps to streamline all the tasks from invoicing to expense tracking. Additionally, using its free invoice generator tool, you can make personalized and professional-looking invoices without a hassle. This handy tool makes creating invoices easy, saving you time without signing up.

Here is an overview of certain features:

Best Features

- Invoicing

- Time tracking

- Expense tracking

- Project management

- Client Portal

- User-friendly interface

- Financial reporting

- Multi-currency support

Limitations

- Limited advanced accounting features for larger businesses or businesses that have complex accounting.

- Basic project management in comparison to other tools.

- Limited inventory management for companies that need advanced inventory management features.

- Customization options are limited compared to other tools.

Pricing

| Lite | Plus | Premium | Select |

|---|---|---|---|

| $17/month | $30/month | $55/month | Customizable |

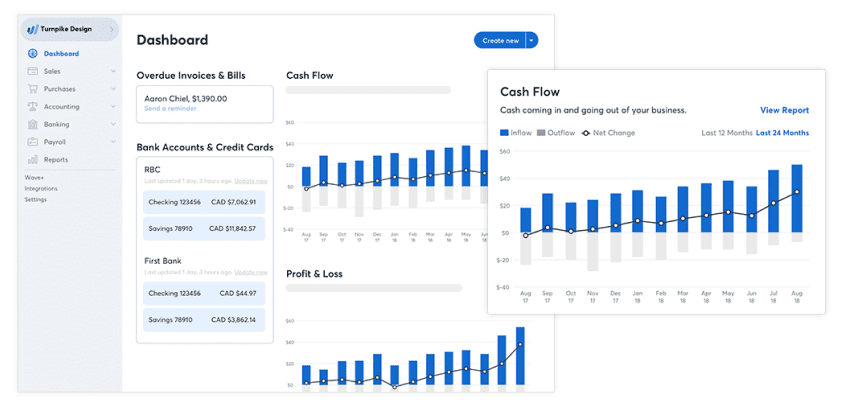

7. Wave

Wave is indeed one of the best budgeting software that provides free accounting and invoicing services.

With its intuitive interface, businesses can easily create and manage budgets, making it accessible for those navigating basic accounting tasks.

While lacking some advanced features for financial data management, Wave’s simplicity, affordability, and focus on core budgeting elements make it a practical choice for small businesses aiming to streamline their financial management.

Below are the features that Wave provides:

Best Features

- Free accounting software

- Free invoicing

- Expense management

- Payroll

- Receipt scanning

- Multi-currency support

- Integration capabilities

- Bank reconciliation

Limitations

- Wave primarily relies on community-based support and lacks live customer support.

- While Wave has some integrations, still those are not as extensive as the other advanced tools.

- It is less suitable for businesses requiring multiple-user access.

- Wave has fewer user permissions, which may not be ideal for businesses needing detailed control over user roles and access levels.

Pricing

| Invoicing | Accounting | Advisors |

|---|---|---|

| $0 | $0 | $149/month |

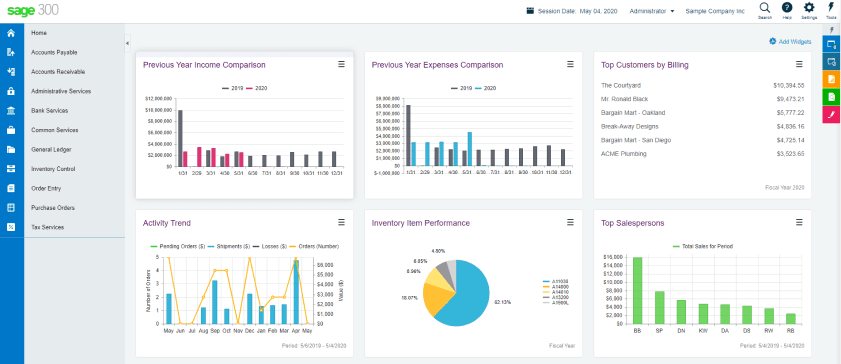

8. Sage Accounting

Sage is a helpful business budgeting software for small businesses. Its user-friendly interface and extensive features simplify the budget creation and management process.

The platform’s integrations with third-party applications help in enhancing functionality allowing businesses to connect with other tools.

In summary, Sage Accounting presents a comprehensive and user-friendly solution tailored to the needs of small businesses aiming for an efficient budgeting tool.

Here are some of the features of Sage Accounting:

Best Features

- Invoicing

- Financial reporting

- Multi-user collaboration

- Integration capabilities

- Automation of recurring transactions

- Tax calculation and compliance

- Customizable charts of accounts

- cash flow management

Limitations

- One with limited accounting knowledge will find it complex.

- Compared to other advanced accounting software, Sage Accounting has limited advanced features.

- They incur additional costs for additional users, resulting in being an expensive tool when businesses plan to expand.

- Due to its various features, new users have to go through the learning curve to use it further.

Pricing

| Pro Accounting | Premium Accounting | Quantum Accounting |

|---|---|---|

| $58.92/month | $96.58/month | $160/month |

9. Float

Float is a valuable small business budget software that offers a smooth cash flow management tool. With its intuitive features and real-time cash flow insights, it simplifies budgeting.

The automated data import feature of Float ensures accurate and up-to-date financial predictions.

Float’s functionalities are not as broad as certain other software, but it provides you with a user-friendly experience. In short, it provides all the tools for small businesses to navigate their financial landscape.

Here are some other features of Float to keep in mind:

Best Features

- Real-time cash flow forecasting

- Automated data import

- Scenario planning

- Customizable categories

- Multi-user collaboration

- Visual cash flow charts

- Budget vs. actual comparisons

- User-friendly interface

Limitations

- The tool is a bit complex to use, so you need to learn it before you start using it

- Integrations are still not as extensive as other tools

- Supports only single-currency forecasting

- Does not provide any kind of direct connection with banks.

Pricing

| Starter | Pro | Enterprise |

|---|---|---|

| $7.50/month | $12.50/month | Customization |

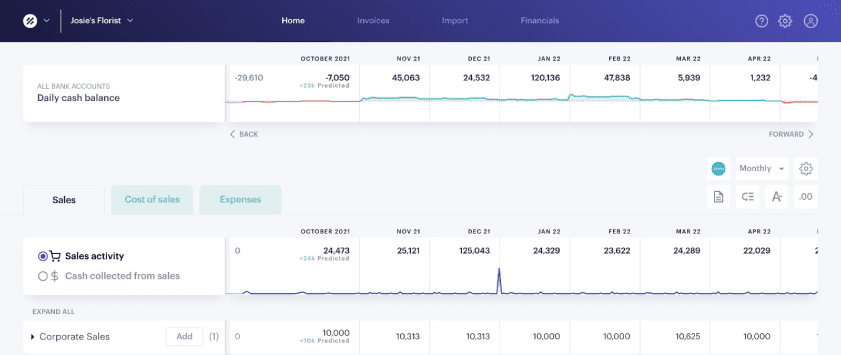

10. Futrli

Futrli is worth considering as a budgeting tool for small businesses. It offers advanced financial planning & analysis capabilities, along with budgeting.

Its real-time cash flow forecasting ensures that businesses have a broad view of their financial health while planning or maintaining their budgets.

The platform’s integration with various accounting and financial software maintains the accuracy of financial data while importing or exporting it.

In short, it is a valuable tool for businesses thinking of gaining insightful budget planning. Some of the other features are:

Best Features

- Financial forecasting

- Scenario planning

- Corporate performance management

- KPI tracking

- Business management

- Cash flow management

- Business reporting

- Goal setting and tracking

Limitations

- The pricing structure is high for small businesses in comparison to other tools providing the same solutions.

- Limited industry-specific templates, might hamper the ease of implementation for businesses with unique industry requirements.

- Some of the advanced features are complex for small businesses that require simple financial solutions.

- It lacks in providing dedicated project management features to manage project budgets.

Pricing

| Single | Starter | Professional | Practice |

|---|---|---|---|

| $35/month | $200/month | $375/month | $500/month |

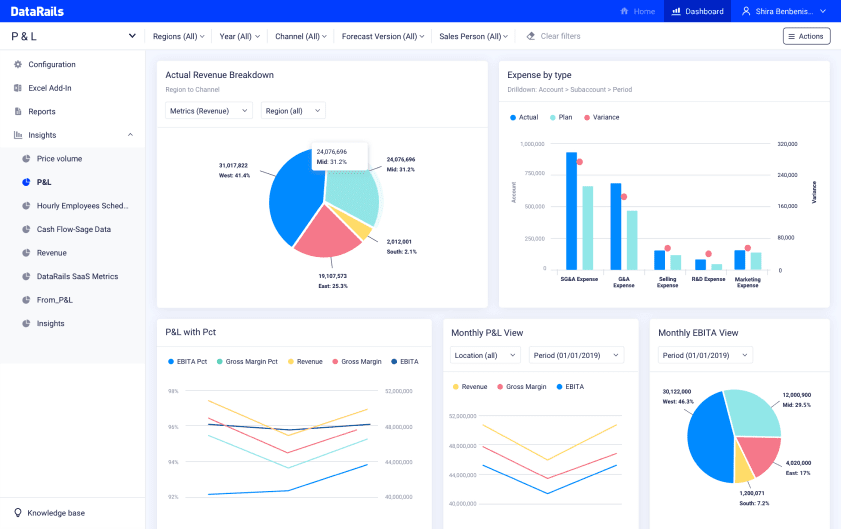

11. Datarails

Datarails is a platform that turns Excel-based financial data into actionable insights, helping businesses with financial planning and analysis.

The tool is particularly effective for budgeting, forecasting, and financial reporting, enabling finance teams to enhance their efficiency.

It also offers a user-friendly interface that integrates seamlessly with existing financial processes, reducing the manual effort associated with financial planning and analysis.

Best Features

- Financial consolidation & reporting

- Real-time data integration

- Advanced analytics & visualization tools

- Scenario planning and forecasting

- Automated financial processes

- Excel compatibility with enhanced functionality

Limitations

- May require a learning curve for users unfamiliar with advanced financial tools

- The pricing can be higher compared to other budgeting tools, making it less accessible for smaller businesses

- Limited customization options for certain industry-specific needs

- Integration with non-Excel-based tools could be challenging, limiting its compatibility in diverse tech environments

Pricing

Datarails provides personalized pricing based on the specific needs and size of the business. Contact their sales team for a custom quote.

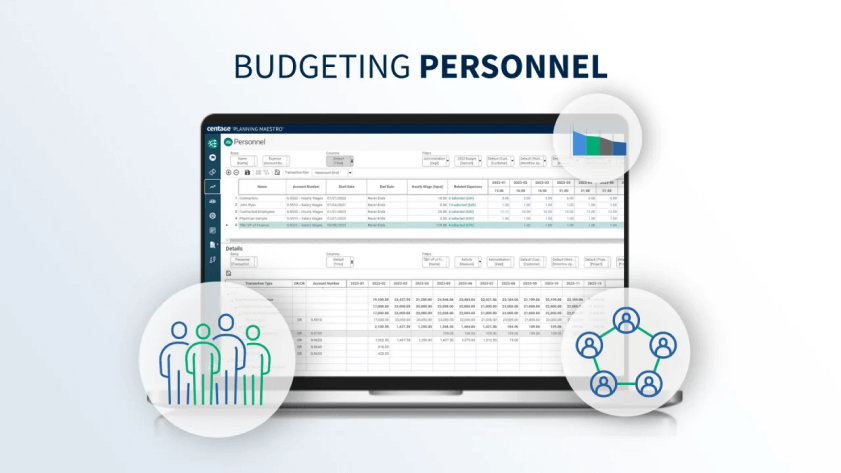

12. Centage

Centage is a comprehensive financial planning and analysis (FP&A) software tailored for small to mid-sized businesses.

It simplifies the process of budgeting, forecasting, and financial reporting by automating complex financial tasks, making it easier for businesses to make informed decisions.

The platform integrates seamlessly with existing financial data, providing real-time insights and facilitating scenario planning. This allows businesses to model various financial outcomes and understand their potential impact, which is crucial for strategic planning and risk management.

Best Features

- Automated budgeting and forecasting

- Real-time financial reporting and analysis

- Integrated scenario planning

- User-friendly interface with visual dashboards

- Customizable financial reports

- Seamless integration with accounting software

Limitations

- The platform can be complex for users with limited financial knowledge, requiring additional training

- Limited scalability for large enterprises with more extensive financial planning needs

- Customization may be limited for specific industry requirements, potentially impacting usability for niche sectors

- Pricing can be on the higher side, especially for small businesses with tight budgets

Pricing

Centage provides personalized pricing based on the specific needs and size of the business. Contact their team and request for a quote.

How to choose the best small business budgeting software?

Choosing the best small business budgeting software needs careful consideration of the various features of all the tools available. Here are some of the points you should consider:

- Understand your requirements: Firstly list out all the features you need from the software to make your process smooth. Also, mention the budget of your business. This will help you draw a line for what to choose and what not to.

- Learning curve and trial periods: One of the wise decisions will be to go through the trial period while learning the tool and hire a dedicated employee or finance team that can understand and make a decision to buy the subscription or not.

- Read reviews and consider customer support: Explore the feedback given by other users and gain insight into user experience. Consider how they support their customers and then make a decision. This will help you in making the choice.

- Financial forecasting: Along with budgeting, ensure that the tool is providing financial forecasting features that can help understand your business goals efficiently.

So, that’s it. Keep a check on your requirements before you select any software, and most importantly, check the features they provide.

Conclusion

We hope you found the perfect budgeting tool in your budget for your business. It was confusing, right? Because many tools help you with various aspects of business.

Likewise, Upmetrics is one such that not only helps in financial planning or forecasting but in writing business plans too. Isn’t that amazing and a foolproof tool for the ultimate growth of your business? Well, don’t wait and sign up right away.