Let’s face it—none of us started a business for the thrill of preparing a balance sheet.

Yet here we are, crunching numbers to impress investors, secure loans, and determine whether we can finally afford that fancy coffee machine for the office.

Whatever your reason for preparing a balance sheet is, it’s undoubtedly the most important statement for understanding your business’s financial health.

You can’t skip it. So, let’s see how you can write a balance sheet with this blog post and we promise you won’t lose your mind.

Let’s get started.

What is a balance sheet?

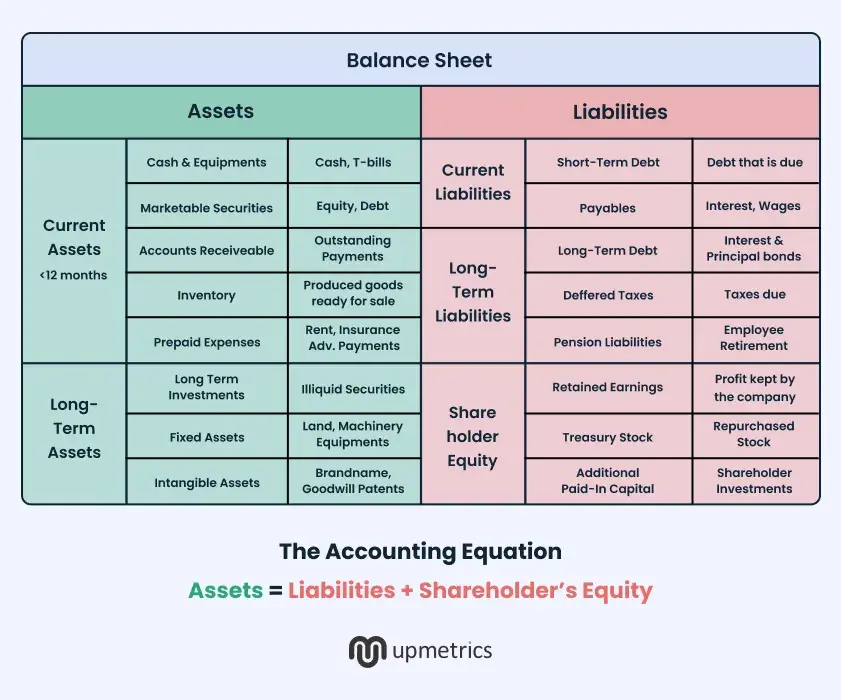

A balance sheet is a financial statement offering a snapshot of what the company owns (assets), owes (liabilities), and remains of the owners (owner’s equity).

It’s a document that communicates the business’s worth, i.e., its book value at a specific point in time.

A balance sheet is always balanced, meaning your company’s total assets equals the sum of total liability and owners’ equity.

Assets = Liabilities + shareholder’s equity

How to create a balance sheet for a business plan?

A balance sheet is crucial whether you pitch an investor or not. By understanding what your business owns, owes, and its equity, you can create a clear financial snapshot to guide your strategy.

Let’s build a balance sheet with this step-by-step guide.

1. Calculate your total assets

Assets are resources that the company owns. This includes physical items, financial investments, or intangible items.

As a first step, list down everything that the company owns. To structure it properly, divide your assets into current and long-term assets.

| Total assets = current assets + long-term assets | |

|---|---|

|

Current Assets Cash and cash equivalent |

Long-term (non-current) assets Gross long-term assets |

Current assets

These are short-term resources that can be conveniently sold, consumed, used, or exhausted through standard business operations within one year.

Since these assets can be easily converted into cash, they are also called liquid assets. Ideally, you should be placing the most liquid assets at the top.

Let’s check what you can include in current assets:

Cash and cash equivalents

Start by listing the most liquid asset—cash. This includes money in your business’s bank accounts, petty cash reserves, and any physical currency.

Here you also list down the cash equivalents, i.e. assets that are liquid and can be converted to cash immediately. This includes:

- Treasury Bills (T-Bills)

- Commercial Paper

- Money Market Funds

- Certificates of Deposit (CDs)

- Short-term bonds or notes

Accounts receivable

Now list down the amount that people owe you, but haven’t paid for yet. Usually, businesses (especially B2B) offering credit to their customers and stakeholders/vendors would have plenty of account receivables to account for.

Prepaid expenses

Include any payments the business has made for the goods and services that it’ll use in the future. This includes prepaid rent, subscription fees, insurance premiums, and much more.

Inventory

Now, list down the value of goods your business has available for sale. This includes finished products, raw materials, and products in progress.

Long-term assets (Non-current assets)

Also known as fixed assets, these assets will benefit the company for several years. These assets can’t be converted into cash easily.

Now, to calculate your long-term assets, you need your gross long-term assets and accumulated depreciation.

Gross long-term assets

It’s a sum of your long-term assets such as,

- Property, plant, equipment (PPE): Include fixed assets like property, plant and equipment, land, machinery, buildings, fixtures, and vehicles

- Long-term investments: Include long-term investments such as stocks or bonds and investments made in other companies are included in this

- Intangible assets: Include intangible assets and intellectual properties like patents, trademarks, and copyright

Accumulated depreciation

Accumulated depreciation is the total amount of value a long-term asset has lost over time. It can be due to use, wear and tear, or an asset becoming outdated.

For instance:

A piece of machinery bought at $50,000 is expected to have a life of 10 years. It’s planned to depreciate the machinery using a straight-line method. This way, the value of the machine depreciates by $5,000 each year.

So after 3 years, its accumulated depreciation stands at $15,000 ($5,000*3).

This accumulated depreciation is deducted from your fixed assets recorded at the book value.

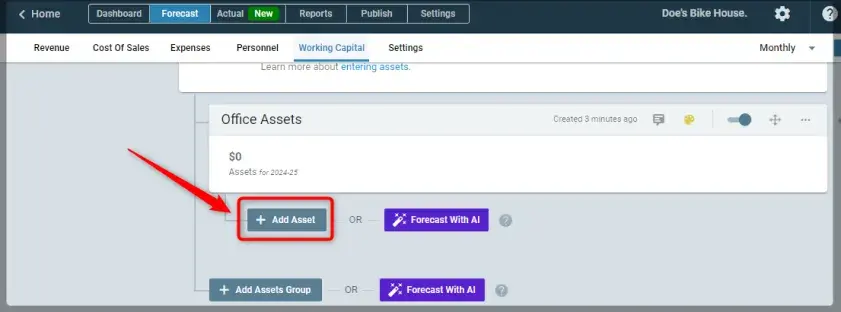

Pro-tip

With Upmetrics’ AI, you can forecast asset streams relevant to your business. It also offers various filters to categorize the assets into long term and short term, manage their purchase value, depreciation, salvage value, and much more.

2. Calculate your total liabilities

Liabilities are everything your business owes. Like assets, it can be short-term as well as long-term.

| Total liabilities = current liabilities + long-term liability | |

|---|---|

|

Current liabilities = accounts payable income tax payable + sales tax payable short-term debt |

Long-term liabilities = Sum of total long-term debts |

Current liabilities

Current liabilities are typically due within a year. These are listed in order of when each liability is due.

They usually include:

Accounts payable

List all amounts your business owes to suppliers or vendors for goods and services purchased on credit. These are all the invoices you’re supposed to pay within a year.

Income tax payable

List the income tax and sales tax your business owes. However, note that if your business pays sales tax right away, it doesn’t go into liabilities.

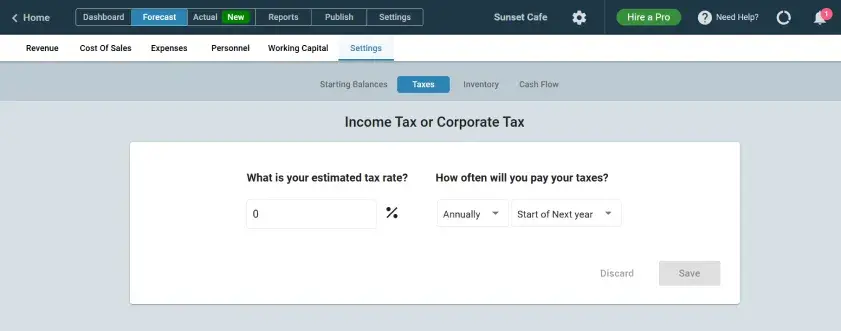

Pro-tip

With Upmetrics you can set the frequency and percentage of your income, sales, and corporate tax. This way you wouldn’t have to adjust the entries manually.

Short-term debt

Includes any loans, credit lines, or overdrafts that are due within a year. This can also include the current portion of a long-term loan (the amount that must be repaid in the next 12 months).

Long-term liabilities

These are long-term obligations that take more than a year to pay off. These loans are often paid in installments over a specific time.

Here you include loans or other forms of long-term financing, such as:

- Capital Loans: Loans taken for business expansion, operational growth, or capital investment

- Equipment Loans: Borrowed funds used to purchase machinery, vehicles, or other long-term assets

- Mortgages: Loans secured by property or real estate

- Bonds Payable: Debt issued to investors with repayment terms typically exceeding one year

For loans older than one year, only record the remaining principal balance (i.e. due after the next 12 months). The portion of the loan due within the next year should be listed under current liabilities.

Example:

Let’s assume that you’ve already paid $6,000 from your $60,000 loan. And within the next 12 months, you have to repay $7,000 of the remaining loan.

In such a situation, $7,000 will be recorded under current liabilities and $47,000 (60000-6000-7000) will be recorded under long-term liabilities.

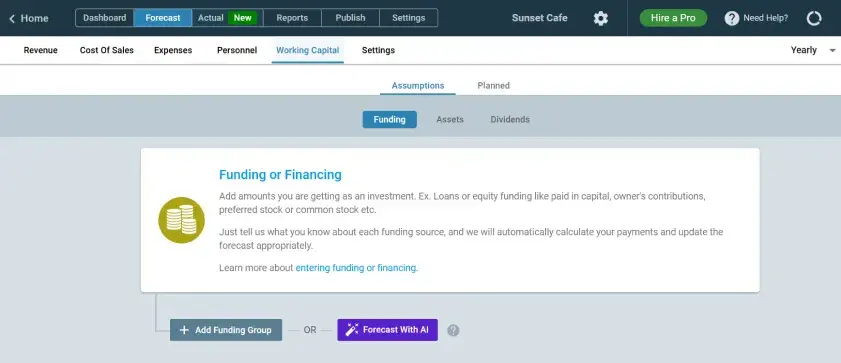

Pro-tip

Use the working capital section of Upmetrics’ forecasting tool to record your long-term and short-term credits. Here you can clarify the funding type, adjust the loan term, and manage interests and repayment with easy options.

3. Calculate the owner’s equity

Owner’s equity is what remains in your business after paying off all the liabilities. It’s the net value of your business at a given date.

In accounting terms, equity is the sum of money invested in the business by the owner or shareholder plus the accumulated profit till then.

As you calculate your equity, make sure you account for:

- Paid-in capital: The money invested into the business by owners or shareholders

- Common or preferred stock: Include the value of shares issued to investors

- Owner’s contribution: Any additional funds or assets personally contributed by the owner to support business operations

- Retained earnings: Profits that have been reinvested into the business rather than distributed as dividends, i.e. accumulated profits

Pro-tip

You can calculate your equity the same way you recorded long-term loans and lines of credit in Upmetrics’ working capital tab.

4. Tally your balance sheet

Now that you’ve calculated your assets, liabilities, and equity, it’s time to place them appropriately in a structure and balance your balance sheet.

As we discussed earlier,

Assets= Liabilities + owner’s equity

In accounting terms, your balance sheet must balance—both sides need to tally. If it doesn’t, there’s likely a calculation, recording, or factual error that needs to be fixed.

It’s important to find and correct the errors before you use your balance sheet for financial analysis or decision-making.

Using a forecasting tool like Upmetrics can save you from a headache at this stage. Its structured forecasting ensures calculative, recording, and factual accuracy, saving you hours and days of work.

There you have it—a well-structured balance sheet for your business plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $14/month

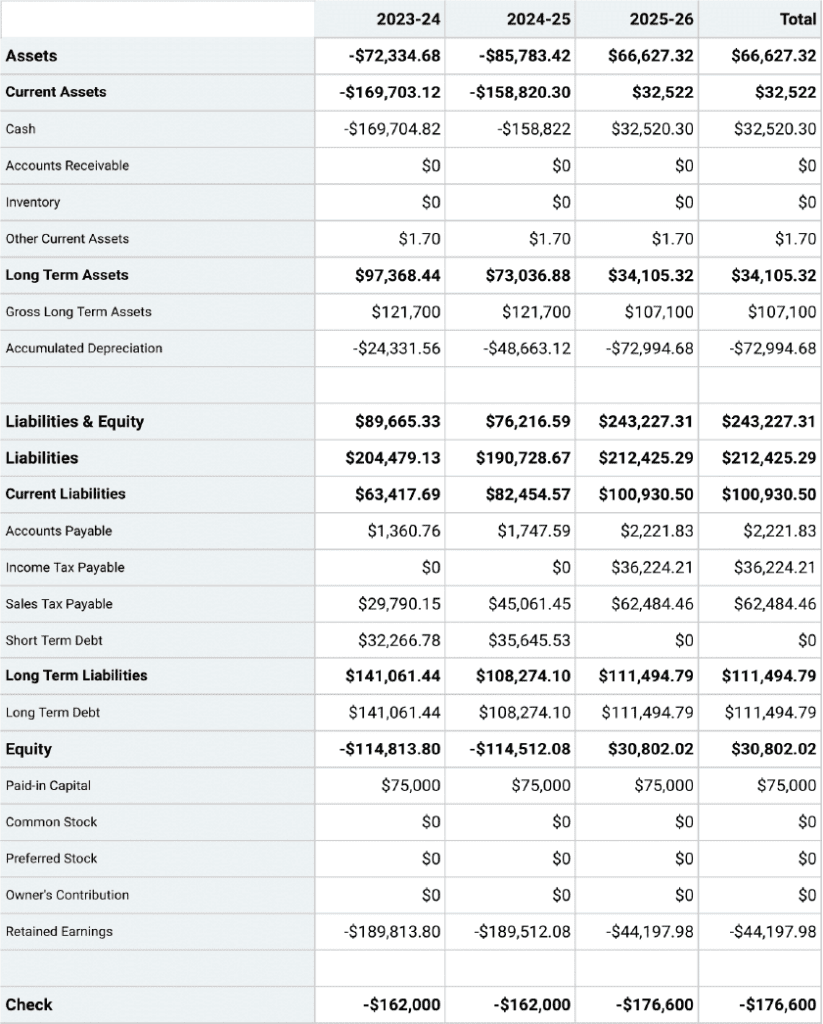

Example of a balance sheet for a business plan

Now, let’s go through a practical example of a balance sheet you would add to your business plan.

Balance sheet tips for small businesses and startups

Before you start working on your balance sheet, here are a few tips to help you develop, interpret, and review the balance sheet better.

- Analyze the balance sheet: Use the balance sheet to calculate essential ratios (i.e. debt-to-equity, liquidity)and spend time understanding the financial stability of your business

- Use it to make decisions: Leverage the balance sheet to make important business decisions regarding cash flow, profitability, loan repayment, new purchase

- Don’t forget depreciation: Determine a realistic depreciation method to gather accurate current value of the assets

- Strengthen the fundamentals: Know the difference between current (due within a year) and long-term (due after a year) assets and liabilities, thoroughly

- Update it regularly: Make it a monthly/quarterly habit to update your balance sheet for a more realistic overview

- Get a tool: Get a tool with an easy and intuitive surface to build your balance sheet. (Sadly, no brownie points for doing it manually.)

Build your balance sheet with Upmetrics

With this, you now have a fair understanding of how to write a balance sheet. However, we won’t recommend creating one without a template or a forecasting tool.

After all, why spend days and weeks of your time tallying the balance sheet when you can spend it interpreting this financial document?

Well, Upmetrics is here to help. With its financial forecasting feature, you don’t need to worry about making calculative, factual, or recording errors. This guided tool has the easiest learning curve and allows you to build projections for up to 7 years.

Simply enter your assumptions about assets, liabilities, and equity, and let this tool take care of all the calculations, formatting, and visual reports.

So stop thinking and get projecting!