You know that feeling when running your business turns into a giant paperwork headache? Endless invoices, receipts, and tax forms. But guess what? AI accounting tools are here to slay that paperwork for good.

Think of them as your personal financial ninjas – they automate those tedious tasks, analyze your money moves, and even offer insights that can take your business to the next level.

So, whether you’re a freelancer juggling invoices or an accountant looking to streamline your work, AI could be the secret to boosting your finances.

With that being said, let us explore 10 such AI accounting software that can simplify your accounting work. But before that let’s cover some basics.

What is an AI accounting software?

AI accounting software uses machine learning algorithms to handle all sorts of accounting tasks. It automates things like data entry, expense tracking, and much more.

On top of that, it always keeps learning from your data. This means you get helpful insights into your business, which you can use to make better, more informed decisions.

Benefits of Using AI in Accounting Software

AI accounting software is about making your work life easier and giving you a clearer picture of your business finances. Here are some benefits that many accounting firms are getting using AI in the accounting software:

- AI handles those repetitive tasks that eat up your day, letting you focus on the big-picture stuff.

- AI is way more precise than any of us with spreadsheets. Fewer mistakes mean greater confidence in your financial data.

- AI can analyze huge amounts of data, revealing patterns and trends you might have missed. That means better decision-making all around.

- Advanced AI accounting tools can spot unusual patterns that might signal fraud, helping to protect your hard-earned money.

Ultimately, AI-powered software gives you a clear view of your finances so you can make the best decisions for your business.

How we analyze and select AI accounting tools

Our selection process involves careful evaluation of factors such as compatibility, automation capabilities, anomaly detection, predictive analytics, financial reporting support, audit assistance, tax compliance integration, pricing, scalability, and ease of use. This ensures we recommend solutions that optimize your accounting processes and drive informed decision-making.

Now that you’ve understood how we’ve analyzed each software, let’s take a closer look at those tools.

The Best AI Tools for Accounting (2026)

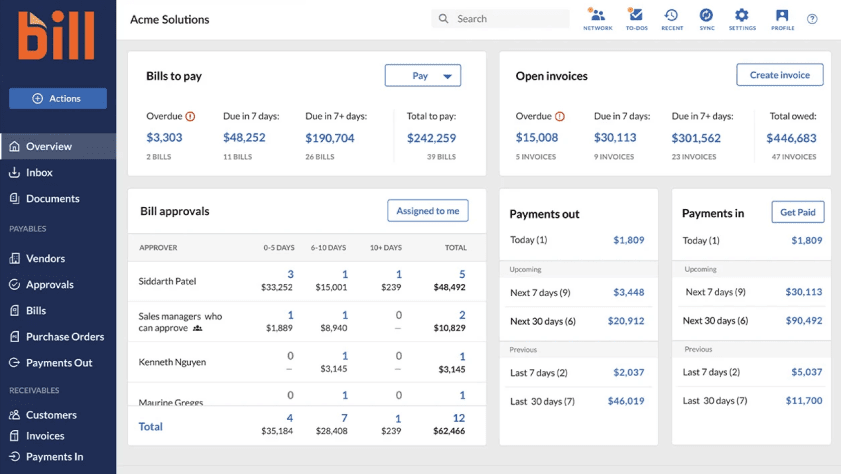

1. Bill

If managing invoices and payments feels like a never-ending chore, Bill can help. It automates those tedious tasks, freeing up your time and energy.

As a bonus, Bill has now acquired Divvy. This gives you smart spending controls, making it easier to track expenses and manage your company budget.

Best Features:

- Gain detailed visibility to control spending.

- Earn cash-back rewards on purchases.

- Protect your finances with AI-powered fraud detection.

- Effortlessly manage multiple clients.

- Automate payment routing with customizable rules.

- Set up approval workflows for efficient invoice management.

Pricing:

| Free Demo | Essential | Team | Premium | Enterprise |

|---|---|---|---|---|

| No | $45/month per user | $55/month per user | $79/month per user | Custom |

Ratings and Reviews:

- G2: 4.3/5 (600+ reviews)

- Capterra: 4.2/5 (200+ reviews)

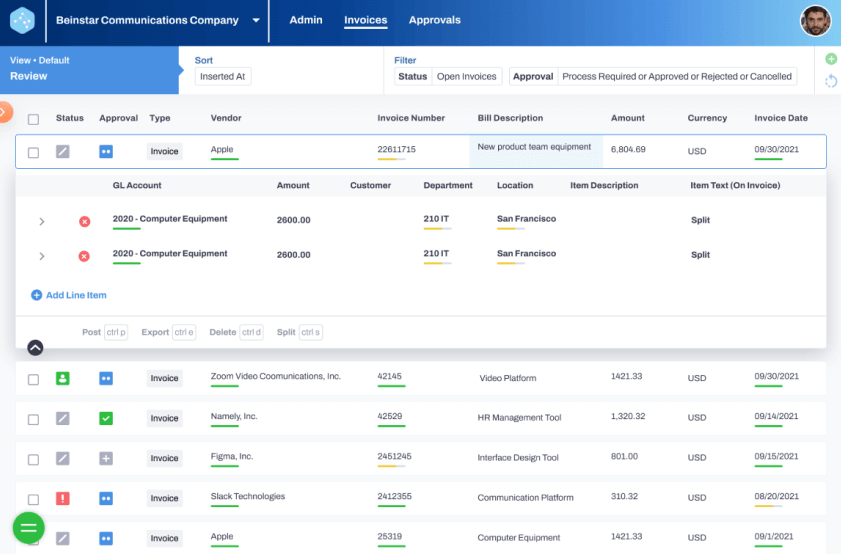

2. Vic.ai

Vic.ai can help your finance teams break free from manual errors and endless data entry. This smart tool understands the ins and outs of accounts payable, making the whole process way more streamlined.

Vic.ai uses AI to analyze your invoices and grab the important details automatically. This saves you a huge chunk of time – up to 80%! It also gives you real-time insights and helps you make sense of your financial data.

Best Features:

- Automate invoice processing (data extraction, coding, approvals).

- Generate accurate and timely financial reports.

- Ensure compliance by flagging policy violations.

- Analyze expense patterns for strategic financial decisions.

- Detects data anomalies to prevent errors and fraud.

- Simplify audit preparation with detailed records and audit trails.

Pricing:

Customers interested in Vic.ai should contact the team and provide business information to receive a price quote.

Ratings and Reviews:

- G2: 4.8/5 (20+ reviews)

- Capterra: N/A

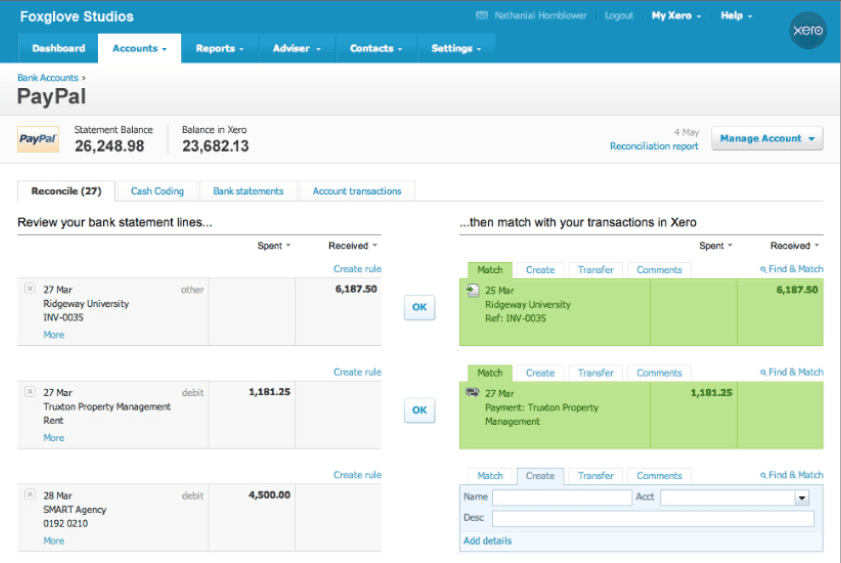

3. Xero

Xero is a cloud-based accounting software designed for businesses of all sizes, from those just starting out to the big players.

It uses AI to keep track of your expenses and bills, basically giving you a real-time look at where your money is going. This helps you see trends, plan ahead for cash flow, and make sure there are no financial surprises waiting for you.

Plus, Xero also has project management tools to help you manage projects and stay on budget.

Best Features:

- Robust reporting with customization options.

- User-friendly interface with a customizable dashboard.

- Easy sharing and audit trails for accountants.

- Basic inventory tracking in all plans.

- Scales well with unlimited users on all plans.

- Affordable pricing

Pricing:

| Free Demo | Starter | Standard | Premium |

|---|---|---|---|

| $0 | $14.50/per month | $23/per month | $31/per month |

Ratings and Reviews:

- G2: 4.3/5 (656 reviews)

- Capterra: 4.4/5 (2871 reviews)

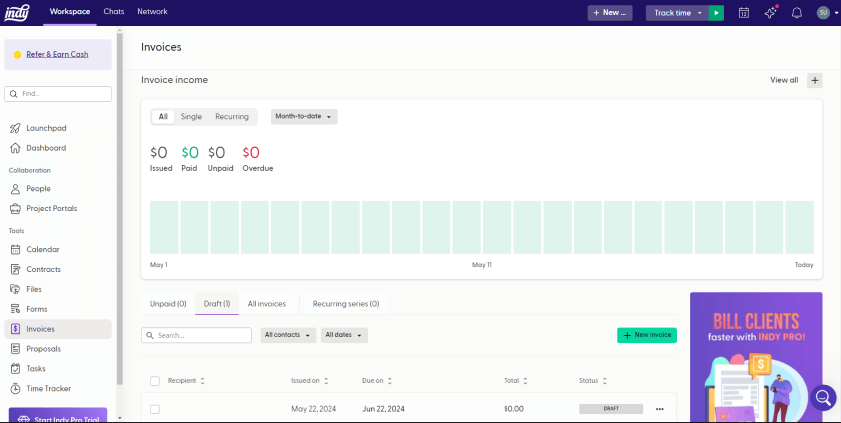

4. Indy

Indy is an AI-powered app that tackles accounting tedious chores up to 20 times faster than traditional software.

Plus, it’s way more affordable than hiring an accountant. It helps you create financial reports in no time, freeing you up to focus on the parts of your business you love.

Best features:

- Create and send professional, branded invoices easily

- Accept secure payments through multiple methods (credit cards, ACH, etc.).

- Track mileage automatically for simplified expense claims and tax deductions.

- Get AI-powered help writing contracts and proposals.

- Integrate with Zapier and Google Calendar for streamlined workflow (paid).

- Manage recurring invoices, payment options, and tax compliance.

Pricing:

| Free Demo | Starter |

|---|---|

| $0 | $9/per month |

Ratings and Reviews:

- G2: N/A

- Capterra: 4.7/5 (100+ reviews)

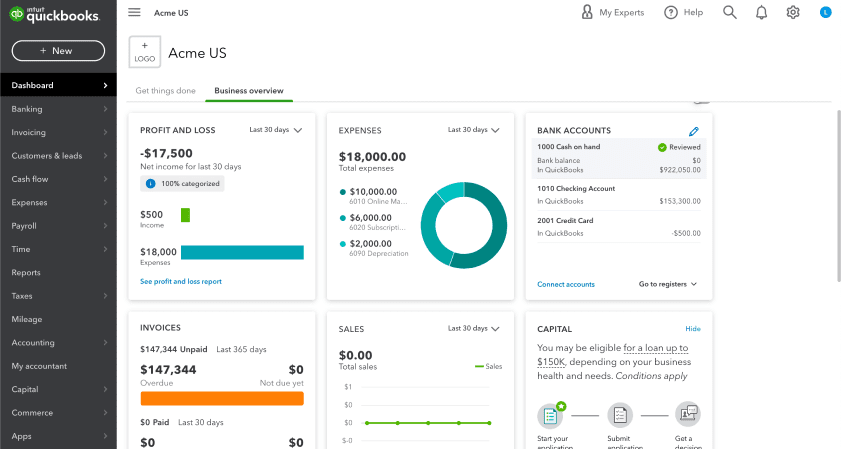

5. QuickBooks

QuickBooks is your all-in-one accounting helper in the cloud.

It helps you to tackle invoices, track expenses, and handle payroll.

This works great for lots of different businesses, whether you’re a solo entrepreneur or have a bigger team.

One of the coolest things is that you can easily share access with your accountant or bookkeeper – it makes collaboration way simpler. The platform can also automatically handle expense tracking and bank reconciliations.

Plus, they have a helpful AI chatbot that can answer your accounting questions and help you make sense of your financial data.

Best features:

- Built-in reports for essential financial insights.

- Create multiple budgets for precise financial management.

- Capture receipts easily for expense tracking.

- Extensive integrations with 750+ business apps.

- Secure, up-to-date data storage across devices.

- Track inventory, and manage purchase/sales orders effectively.

Pricing:

| Free Demo | Impact | Essentials | Plus | Advanced |

|---|---|---|---|---|

| No | $18/ month | $27/ month | $38/ month | $76/month |

Ratings and Reviews:

- G2: 4/5 (3,280 reviews)

- Capterra: 4.3/5 (6,471 reviews)

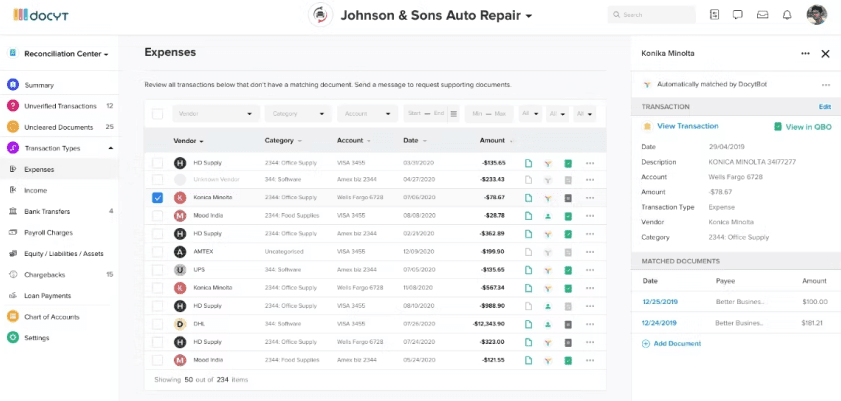

6. Docyt

Docyt is an AI-powered tool designed to keep all your financial data in one organized place. You know that headache of manually entering receipts, invoices, and all those numbers? Docyt automates a lot of that for you.

Plus, it’s constantly running the numbers in the background. This means things like your accounting software are always up-to-date and you get real-time insights into how your business is doing financially. Instead of digging for information, Docyt helps you see the bigger picture. That way, you can make quick, informed decisions to keep your business on track.

Best features:

- Automate bookkeeping tasks.

- Extract key information from receipts and invoices with AI.

- Generate personalized financial reports for insights.

- Improve collaboration with AI-powered conversation summaries.

- Accurately categorize transactions with AI assistance.

- Streamline revenue reconciliation with automated matching.

Pricing:

| Free Demo | Impact | Advanced | Advanced Plus | Enterprise | Accounting Firm & CFO |

|---|---|---|---|---|---|

| No | $299/month | $499/month | $649/month | $999/month | Custom |

Ratings and Reviews:

- G2: 4.9/5 (12 reviews)

- Capterra: 4.6/5 (30+ reviews)

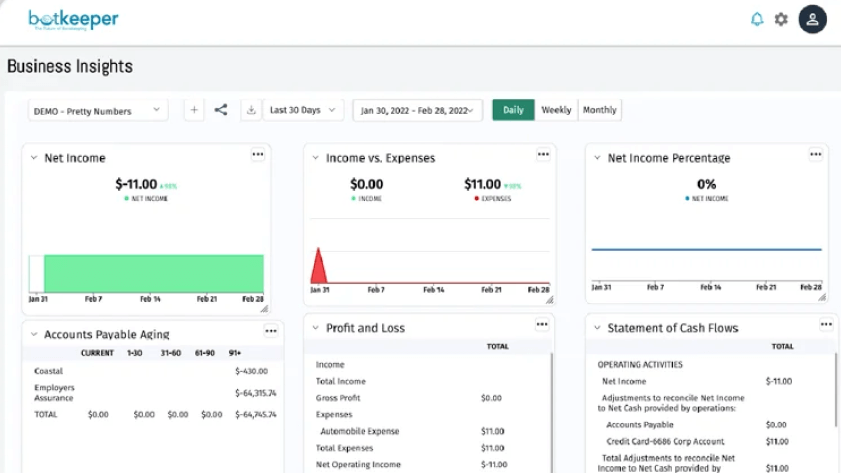

7. Botkeeper

Botkeeper uses AI to take care of all those mind-numbing accounting tasks – entering data, tracking expenses, crunching the numbers for reports… all of it.

The platform also works seamlessly with the popular accounting software you might already be using. What makes Botkeeper special is that it’s constantly analyzing your financial data. This means you get real-time insights into how your business is performing.

Best features:

- Gain insights with custom reports and dashboards.

- Human-led oversight ensures accuracy and expert interpretation.

- Automates data extraction, payroll, billing, reconciliation, and reporting.

- Job/Project Tracking.

- Streamline AR invoice payment application.

- Simplify credit card merchant and POS reconciliation.

Pricing:

| Free Demo | Infinite |

|---|---|

| NO | $69 per license per month |

Ratings and Reviews:

- G2: 4.4/5 (28 reviews)

- Capterra: 4.4/5 (71 reviews)

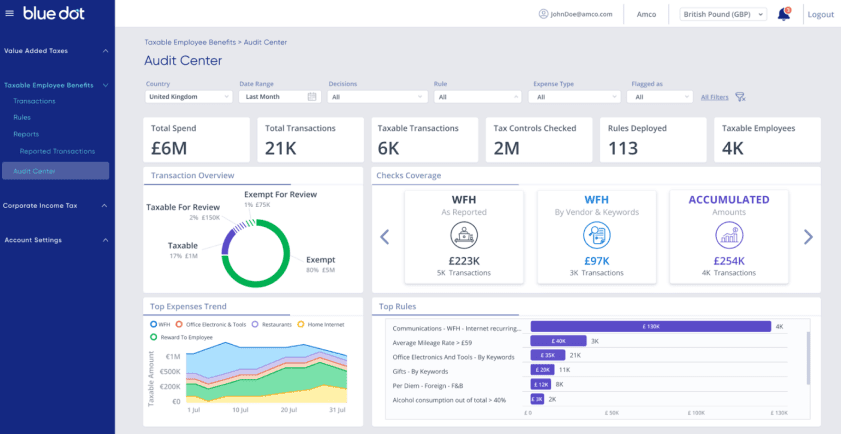

8. Blue Dot

Dealing with taxes can be a major headache, especially when it comes to those everyday employee expenses. That’s where Blue Dot steps in – it’s like a tax rulebook with a built-in artificial intelligence brain to keep you on track.

Blue Dot takes a deep dive into all those employee transactions, making sure everything is compliant and helping you spot any potential tax issues.

Plus, Blue Dot has a massive database of tax knowledge, so you can easily find the answers you need. And the coolest part? It uses natural language processing to understand complex data sources.

Best features:

- Identify and calculate eligible VAT spend.

- Detecting and analyzing taxable employee benefits with AI.

- Generate tax reports with minimal manual effort

- Automate taxable employee benefits review.

- Integrate seamlessly with expense management platforms.

- Reduce expense reporting errors and ensure data integrity.

Pricing:

- Available on request.

Ratings and Reviews:

- G2: N/A

- Capterra: N/A

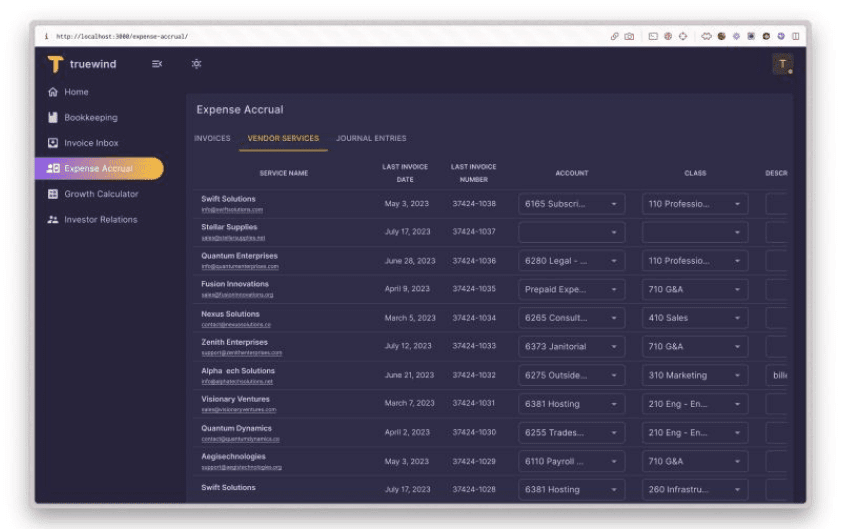

9. Truewind

Truewind uses advanced machine learning to handle all those tedious tasks, like organizing transactions, balancing your books, and generating all-important financial reports.

But it’s not just about the grunt work. Truewind actually gives you easy-to-understand insights, too. It provides custom dashboards, cash flow predictions, and even tools for invoicing and budgeting. The platform also combines GPT 3 with experienced professionals to deliver accurate finance reporting.

Best features:

- AI-powered forecasts based on historical data and accounting industry trends.

- Ensure accurate books with AI and a concierge team.

- Outsource back-office tasks like R&D credits and tax filing.

- Expert advisors collaborate for accuracy and ongoing support.

- Monthly financial reports for data-driven decision-making.

- Track key metrics with essential financial statements.

Pricing:

Available on request.

Ratings and Reviews:

- G2: N/A

- Capterra: N/A

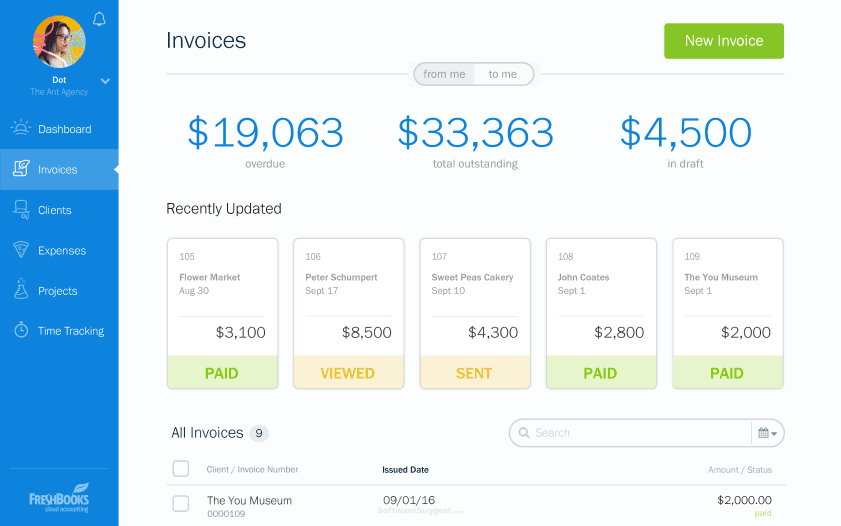

10. FreshBooks

FreshBooks is basically an all-in-one accounting assistant designed specifically for freelancers and small business owners. It handles all the nitty-gritty tasks like sending invoices, tracking what you’re owed, and keeping tabs on expenses.

Plus, it’s incredibly user-friendly, so even if you’re not a numbers person, you’ll get the hang of it quickly.

Best features:

- Customizable, branded invoices with recurring options.

- Automatic, real-time bank reconciliation.

- Supports multiple languages and currencies.

- Convert estimates and proposals directly into invoices.

- Track mileage, expenses, and time with the mobile app.

- Integrate with 100+ third-party apps.

Pricing:

| Free Demo | Lite | Plus | Premium | Select |

|---|---|---|---|---|

| $0 | $9.50/month | 16.50/month | $30/month | Custom |

Ratings and Reviews:

- G2: 4.5/5 (711 reviews)

- Capterra: 4.5/5 (4,386 reviews)

Key Considerations When Choosing AI Accounting Software

AI accounting tools can be a lifesaver, but picking the right one takes a little know-how. It’s about figuring out what you need most and finding the perfect match. Here’s the lowdown on the must-have features, no matter if you’re a solo accountant or manage a huge company’s finances:

- Automate: Top-notch AI technology software handles all the tedious bookkeeping stuff for you. Think of instant reports, better money management, and way fewer errors.

- Analyze: Good AI software practically takes care of payments and invoices, making your life a whole lot easier.

- Integrate: Your AI tool should fit right in with the programs you already use (think QuickBooks, etc.). Nobody’s got time for tech headaches.

- Smarter over time: With machine learning, your AI tool gets sharper every day. It spots patterns, anticipates problems, and finds ways to streamline your work even further.

- Simplify: Templates for bookkeeping, and payroll — you name it — are a huge bonus. Saves you precious time when you do need to take the manual route.

Conclusion

AI is completely changing the game for finance and accounting professionals. It’s making everything faster and more accurate while giving you those “aha!” insights to guide your decisions. Honestly, it’s kind of a no-brainer for anyone working with numbers.

Ready to ditch those clunky spreadsheets and level up your financial game? Time to dive into the world of AI! And hey, if you’re starting your own accounting firm, check out the business plan templates at Upmetrics—they could make the planning process way easier. 😉