What if the success or failure of your business boiled down to a few key numbers? Behind every thriving company lies a story told by data, from how leaders plan their strategies to the way startups secure funding and exit gracefully.

In this blog, we dive deep into the most common business plan statistics that many overlook but every entrepreneur must know. These insights don’t just inform—they empower you to make smarter decisions, avoid common pitfalls, and accelerate your growth.

So, are you curious to find out what separates the winners from the rest? Keep reading, because these stats might just change the way you think about your business.

Top Business Plan Statistics & Trends 2026

- Entrepreneurs with business plans are 152% more likely to launch their ventures compared to those without plans.

- Businesses that have a formal business plan grow 30% faster than those without clear objectives.

- Businesses with a formal plan secure 133% more investment capital than those without one.

- Companies with documented business strategies have a 30% higher chance of sales growth and even the potential to double their business.

- 70% of companies that survive at least five years attribute their longevity to having a comprehensive business strategy.

- Entrepreneurs with business plans are 260% more likely to start their businesses.

- 69% of venture capitalists state they never invest in new enterprises without reviewing a business plan.

- Second-time business owners seeking external funding are 19% more likely to formalize their ideas with a written plan.

- The SME sector is expected to double its use of business plan software by 2032, growing from $1.5 billion to $3.0 billion, as more small and medium businesses turn to digital tools for smarter strategic planning.

- Nearly 7 out of 10 venture capitalists refuse to invest in startups that don’t present a business plan.

Business plan statistics you need to know

In this section, we’ll cover the top business plan statistics in detail, diving into all aspects of business planning. From its success rates and failure risks to business plan software adoption and the latest trends, we’ll give you a clear picture of why having a solid plan matters now more than ever.

1) Business planning & success rates

A well-crafted business plan isn’t just paperwork—it directly impacts your chances of success. Let’s take a look at how proper planning influences business survival and growth rates.

A) Entrepreneurs who write formal business plans are 16% more likely to achieve business viability. (Source)

Even simple notes about your business idea can increase the chances you’ll move forward. Without a plan, it’s hard to show yourself, partners, or investors that you’re serious.

B) 28% of businesses with a business plan secure investment capital. (Source)

In comparison, just 12% of businesses without a plan succeed in securing investment. This highlights how having a clear, written plan can significantly improve funding opportunities.

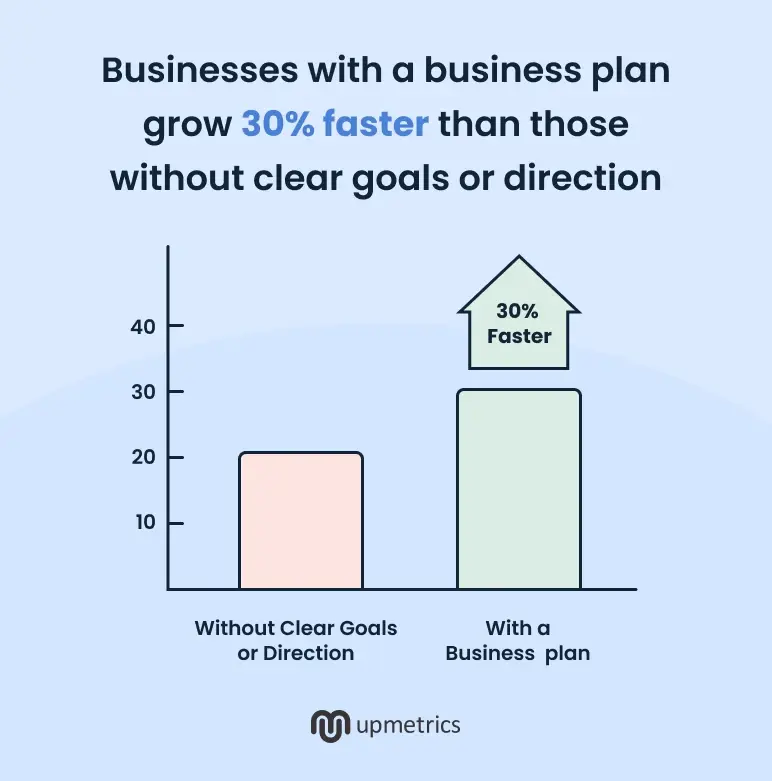

C) Businesses with a business plan grow 30% faster than those without clear goals or direction. (Source)

A business plan gives companies a clear roadmap, helping them set priorities, manage resources, and track progress. Without it, many businesses struggle with scattered efforts and missed opportunities, slowing down their growth.

D) The global business plan software market was valued at $3.94 billion in 2023 and is expected to reach $4.29 billion by 2024. (Source)

With expectations to reach $8.5 billion by 2032, the global business plan software market is set to grow at a CAGR of approximately 8.92% from 2025 to 2032, driven by rising demand for digital planning tools.

E) A regional analysis in the United Kingdom shows that just 38% of businesses in the Midlands have a formal business plan. (Source)

This is notably lower than the 52% of businesses in the South and East, highlighting regional gaps in business planning and areas where improvement is needed.

F) 71% of fast-growing businesses have a strategic or business plan in place. (Source)

Fast-growing companies often credit their success to a clear business plan, with 71% relying on one to stay focused and drive long-term growth.

G) 50% of businesses with business plans experienced business growth. (Source)

Half of businesses with business plans saw growth, compared to just 27% of those without plans. This clearly shows that having a plan nearly doubles the chances of expanding your business.

H) At the startup stage, businesses with business plans are 7% more likely to achieve high growth. (Source)

Startups that plan from day one consistently outperform those that don’t. Even a simple, clear business plan can turn early ideas into faster-growing, more resilient ventures.

I) A study of 135 small businesses found that those with business plans consistently outperformed those without. (Source)

These businesses not only achieved better growth but also managed their operations more efficiently. The findings clearly highlight the practical benefits of having a structured plan in place.

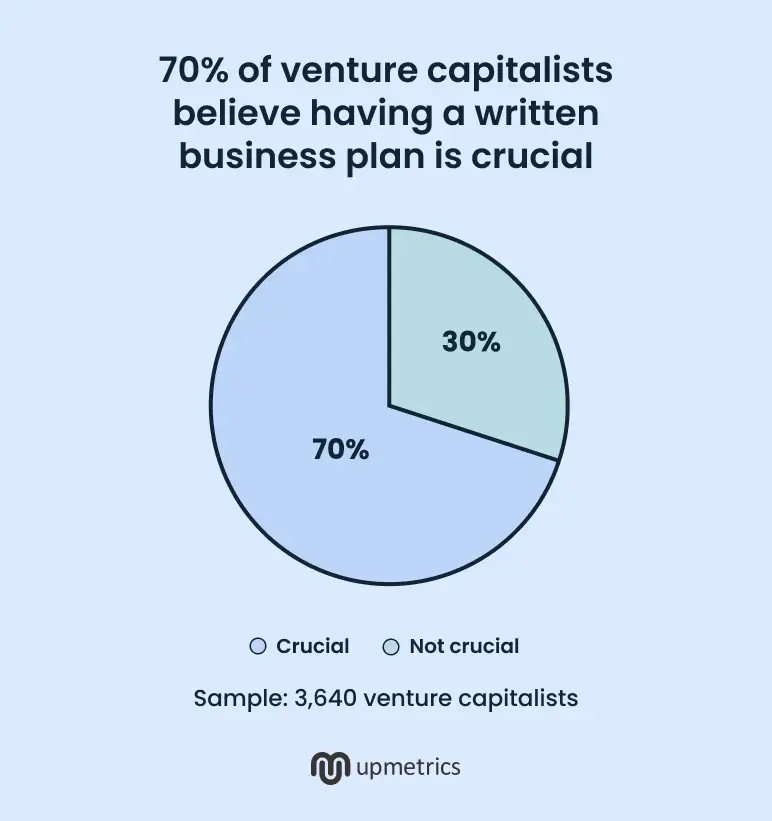

J) Out of 3,640 venture capitalists, 70% believe having a written business plan is crucial. (Source)

This highlights how a clear, well-structured plan remains a key factor in gaining investor confidence and securing funding.

Spend more time researching, less writing

Make business plans in minutes with AI

Plans starting from $14/month

2) Financial planning & funding insights

Financial planning is key to attracting funding and managing growth. Businesses with clear financial plans secure more investment and make smarter money moves.

A) Around 70% of venture capitalists refuse to invest in businesses without a solid plan. (Source)

Around 69–70% of venture capitalists admit they never invest in a new startup without first reviewing its business plan. This shows investors want to see a clear plan for how the business will succeed before committing their money.

B) Startups with a complete business plan are 2.5× more likely to secure funding than those without. (Source)

The same survey, which included over 800 aspiring entrepreneurs across the United States, concluded that writing a business plan significantly increased the likelihood of actually starting a business.

C) Researchers discovered that investors were swayed more by a founder’s preparedness than by their passion. (Source)

The same study found that the quality of a business plan directly influences how prepared an entrepreneur appears and plays a major role in an investor’s decision to fund.

D) Second-time business owners seeking external funding are 19% more likely to document their business ideas than those who aren’t. (Source)

This highlights that experienced entrepreneurs recognize the value of a clear, written plan when attracting investors.

E) The average Series A funding round rose from $12.1 million in 2017 to $15 million in 2022. (Source)

This reflects the rising capital needs of startups and highlights the importance of robust business plans to secure larger investments.

F) Nearly half (47%) of Series A startups spend $400,000 or more each month. (Source)

This underscores the substantial capital demands at the Series A stage and the critical importance of thorough financial planning.

G) Startups typically take about 18 months between funding rounds, moving from Seed to Series A. (Source)

While the time between funding rounds averages 10 to 18 months from Series A to B, and about 27 months from Series B to C, highlighting the typical fundraising rhythm for fast-growing companies and the need for timely planning.

3) Business planning software market trends

The demand for business planning software is rising as more businesses embrace digital tools for smarter decision-making. This section covers the latest market trends and growth projections shaping the industry.

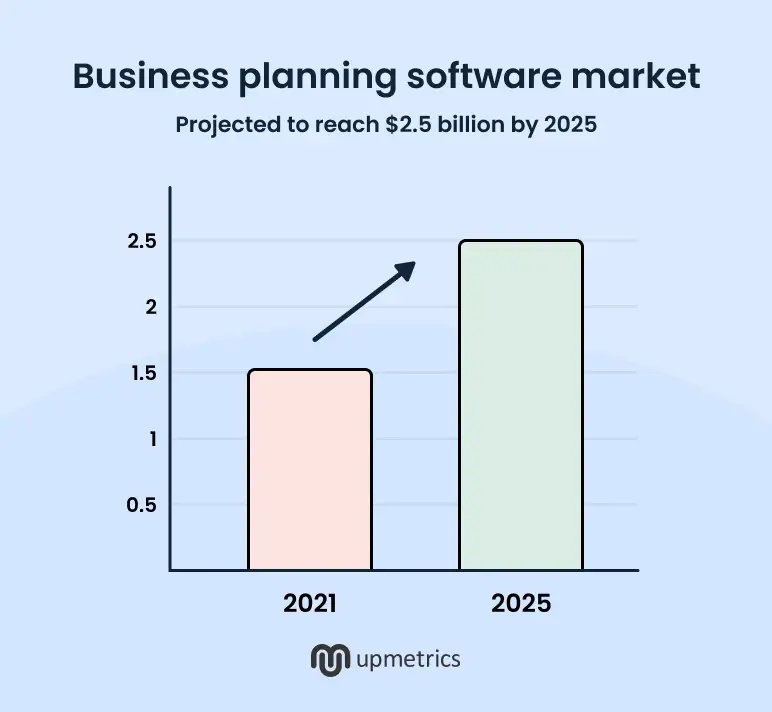

A) The business planning software market is projected to reach $2.5 billion by 2025. (Source)

It is expected to grow at a steady 12% CAGR from 2025 to 2033, with the market projected to reach around $7.8 billion by 2033.

B) Cloud-based solutions lead the business planning software market, holding a 55% share thanks to their scalability and flexibility. (Source)

By function, financial planning dominates the segment, accounting for 40% of the market. This reflects how businesses prioritize financial forecasting and budgeting when crafting their business plans.

C) North America leads the market with a 42% share. (Source)

While with strong tech adoption and thriving startup hubs, Europe and Asia-Pacific trail closely behind North America in the adoption of business plan software.

D) AI-powered features in business planning software have surged by 180%. (Source)

Meanwhile, mobile-based planning solutions have seen a 250% surge, driven by the demand for on-the-go business management and remote accessibility.

E) Since 2022, industry-specific business planning solutions have grown by 90%. (Source)

With sectors like healthcare, fintech, and technology driving the need for tailored solutions, the demand for specialized planning software is rising.

F) Large enterprises were expected to capture a business plan software market value of $1.0 billion in 2024. (Source)

Moreover, it’s expected to reach $2.0 billion by 2032, highlighting steady adoption as even established enterprises prioritize smarter, tech-driven planning processes.

G) In 2024, SMEs’ adoption of business plan software is estimated to be worth $1.5 billion. (Source)

The market is projected to hit $3.0 billion by 2032, reflecting strong growth as more SMEs turn to digital planning solutions for smarter, streamlined decision-making.

H) As of 2024, the business plan software market catering to startups is valued at $1.25 billion. (Source)

It is projected to double to $2.5 billion by 2032, highlighting the growing importance of strategic planning for startups in a highly competitive market.

I) By 2025, 67% of businesses will adopt automation solutions to enhance end-to-end visibility. (Source)

This trend in operational efficiency and strategic planning helps businesses make better decisions. Specifically, automation in sales departments can increase productivity by 14.5%

J) The SME segment is projected to experience a 100% growth in business plan software usage by 2032. (Source)

Growing from $1.5 billion to $3.0 billion, this rise reflects increased adoption of digital solutions by small and medium enterprises to improve strategic planning.

K) The global business plan software market is projected to expand at a compound annual growth rate (CAGR) of 8.92% from 2025 to 2032. (Source)

This indicates robust and sustained market growth fueled by technological advancements and the rising complexity of business environments.

Spend more time researching, less writing

Make business plans in minutes with AI

Plans starting from $14/month

4) Strategic planning & organizational impact

Strategic business planning plays a crucial role in shaping an organization’s direction, improving decision-making, and boosting overall performance. It helps companies stay focused, prioritize goals, and navigate market challenges with clarity.

A) Only 10% of organizations manage to successfully execute their strategic planning initiatives. (Source)

Meanwhile, half of leadership teams spend minimal or no time on strategic planning. This lack of focus often leads to missed opportunities and unclear business direction.

B) Nearly 70% of businesses that last 5 years credit their success to having a solid strategic plan. (Source)

Compared to companies lacking a written plan, those with one see a 7% higher chance of reaching high growth.

C) Around 85% of leadership teams dedicate less than an hour each month to discussing strategic plans. (Source)

While 70% of leaders dedicate roughly a day each month to reviewing business strategies, this shows regular strategy reviews are an integral part of businesses for sustained business growth.

D) Among companies that poorly execute their strategy, 60% fail to align their strategies with funding. (Source)

While 64% of companies that successfully implement initiatives integrate them into their budgets and limit the number of initiatives they pursue.

E) Only 22% of employees believe their leaders provide a clear direction for the organization. (Source)

While only 13% of U.S. employees strongly believe their leaders communicate effectively with the organization, this highlights how strategic planning can improve transparency and foster better communication.

F) Half of the businesses with strategic business plans (50%) reported business growth. (Source)

Compared to only 27% of those without plans, this highlights how having a clear strategy significantly boosts a business’s chances of growth and long-term success.

G) In 2022, AngelList experienced a 21% year-over-year increase in activity, even as pre-Series C venture capital deals across the industry declined by 1.4%. (Source)

This suggests resilience in specific investment platforms and a continued strong demand for business planning tools.

H) There are about 33.3 million small businesses in the USA. (Source)

Accounting for 99.9% of all U.S. businesses, this highlights the immense size of the small business sector and the significant potential market for business plan software.

5) Business exit planning & success statistics

Business exit planning is often overlooked, yet it plays a crucial role in ensuring a smooth, profitable transition. Companies with formal exit and success strategies are more likely to achieve higher valuations and successful handovers when the time comes.

A) About 75% of business owners in the US plan to exit within the next 10 years. (Source)

Meanwhile, 49% of business owners intend to exit within the next five years, but only half have a well-defined succession plan in place.

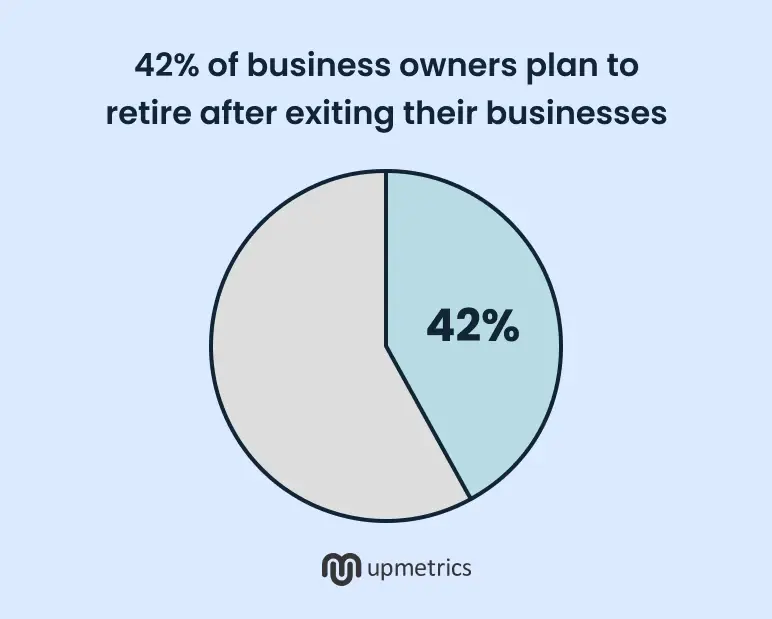

B) 42% of business owners plan to retire after exiting their businesses. (Source)

whereas 39% intend to invest in a new business and 31% plan to focus on philanthropy or civic causes, according to one study. For 70% of business owners in the same study, business income is crucial for sustaining their current lifestyle.

C) 50% of business owners have a specific, detailed succession plan in place to guide their business exit. (Source)

Having a clear succession plan helps ensure a smooth transition and preserves the business’s value. It also provides confidence to employees, customers, and potential buyers during the ownership change.

D) In 2023, 68% of business owners actively sought professional advice for their business transitions (Source)

However, 78% of them still did not have a formal transition team in place, highlighting a significant gap in structured exit planning. This lack of preparation can lead to challenges during the business handover process.

E) When selecting an exit business planning, 70% of business owners favor transferring ownership within the company. (Source)

While 17% choose to sell their business externally, 13% are still undecided about their exit plans. This highlights the varying approaches owners take when planning their business future.

F) Within a year of selling, 75% of business owners experience regret over their decision. (Source)

This striking statistic highlights why having a thorough exit plan is crucial before putting your business up for sale. In fact, 80% of businesses listed on the market never actually sell.

G) 31% of SME owners and C-suite executives in the UK intend to retire after exiting their businesses. (Source)

While retirement motivates only 13% of exits overall, nearly one-third of business owners still plan to retire once they leave their company, highlighting a mixed exit landscape.

H) Just about 20% of UK SMEs manage to achieve a successful sale. (Source)

Meaning nearly 80% of business owners struggle to sell their companies when attempting to exit the market.

I) 38% of business owners cite preserving family legacy as their top priority when planning an exit in the UK. (Source)

While 38% of owners prioritize family legacy when exiting, 21% focus on future opportunities, with most others factoring family input as vital in the decision-making process.

Spend more time researching, less writing

Make business plans in minutes with AI

Plans starting from $14/month

6) Role of founders’ gender & experience in planning

The gender and experience of founders play a crucial role in business planning and funding success. These factors often influence investor confidence and strategic decision-making throughout a startup’s growth journey.

A) In 2025, women make up only 13.7% of founders in million-dollar startups, down from 15% in 2022. (Source)

Yet, female-led teams receive 14% less VC funding than their male counterparts for identical pitches. However, startups founded by women deliver 35% higher ROI once they overcome these systemic barriers.

B) Just 25% of startups worldwide are founded by women. (Source)

While only 37% of startups have at least one woman on their board, highlighting the importance of inclusive leadership and the need for well-crafted business plans that reflect diverse perspectives to attract modern investors.

C) Female angel investors fund women-led startups at 4x the rate of their male counterparts. (Source)

Many online platforms connect over more than 800 female investors with founders globally, boosting average funding rounds by $4.9 million.

D) Just 2% of European venture capital funding is allocated to women-led startups. (Source)

The UK’s £250 million Invest in Women Taskforce aims to triple this by 2026 through gender-lens investing and founder stipends. This highlights the growing recognition that well-crafted business plans tailored to diverse founders are essential for attracting targeted investments and driving startup success.

E) In 2024, women-founded startups secured only 1.8–2.3% of total venture capital funding, despite contributing an estimated $2.1 trillion in revenue across the U.S. (Source)

In 2025, all-female founding teams secured just 2.3% of total VC funding, with a modest increase to 3.2% at the seed stage, highlighting the importance of a strong, strategic business plan to stand out early and attract critical investment.

F) Female-only founding teams captured 3.2% of capital at the Seed stage, dropping slightly to 2.7% by Series A. (Source)

Moreover, female-only founding teams secured 2.2% of capital at Series B, which declined further to 1.8% at Series C+, highlighting the widening funding gap as startups scale — and reinforcing the importance of a strong, data-driven business plan to compete for larger, later-stage investments.

G) As of early 2025, the venture capital landscape is still largely male-dominated, though it’s beginning to show signs of gradual progress. (Source)

| Metric | Percentage |

|---|---|

| Women in partner or decision-making roles at VC firms | 15.40% |

| VC firms with a majority of female partners | 4.90% |

| VC firms with at least one female partner | 23.20% |

| VC firms founded by women | 5.70% |

H) The presence of female venture capital investors differs widely across regions: (Source)

| Region | % of Female VC Partners |

|---|---|

| Leading Regions | |

| New York | 19.70% |

| London | 18.30% |

| Paris | 17.10% |

| Lagging Regions | |

| Silicon Valley | 13.20% |

| Tel Aviv | 9.80% |

| Tokyo | 7.50% |

It’s a crucial factor for founders to consider when crafting business plans and fundraising strategies tailored to investor demographics.

I) A U.S. study revealed a gender wage gap of 1.6%. (Source)

The study revealed that women working remotely often earn less than men, highlighting the importance of addressing pay gaps when creating fair and realistic financial projections in business plans.

The Bottom line

That’s it—we’ve wrapped up an insightful journey through the most important business planning statistics, showing how strategic planning, technology adoption, and leadership shape business growth and success. These numbers aren’t just data points; they reveal what works, what doesn’t, and where the biggest opportunities lie.

And if these stats have you thinking it’s time to get serious about your own business plan, platforms like Upmetrics can be a game-changer. With intuitive tools, financial forecasting, and AI-powered insights, Upmetrics makes it easier than ever to create a comprehensive, investor-ready business plan without the overwhelm.

I hope you enjoyed diving into these numbers and that they inspire you to take action, refine your strategy, and leverage the right tools like Upmetrics to confidently steer your business in the right direction.