Is it possible to finish writing a detailed business plan in a day or two? (research included)

I don’t want to come off as some Messiah blabbering stuff, but it can be easily done with ChatGPT and many similar tools at your disposal.

I remember talking to a friend who spent almost a week outlining his plan.

As I spoke to him, I got to the bottom of why it is so tough for entrepreneurs.

You start working on a business plan with 100% motivation, but the anxiety—fear of accuracy, poor writing skills, complexity and length of your plan, and not having enough time—comes in and forces you to rethink.

Is it really something I should do?

I can help, just as I did to my friend.

Here’s a step-by-step business planning guide with necessary tips, tool recommendations, and mistakes to avoid to help you draft your business plan in less than a week.

It’s going to be a while, so buckle up. Let’s dive right in.

Key Takeaways

- A good business plan clearly defines your business goals and strategy.

- Key sections include an executive summary, market analysis, financial projections, and more.

- Your business plan should be realistic, concise, and tailored to your audience.

- Review and update your business plan quarterly, semiannually (6 months), or annually.

What is a Business Plan?

A business plan, in simple words, is a document that highlights a company’s goals and its plan to achieve them. A well-prepared business plan outlines the company’s mission statement, purpose, future goals, market research, go-to marketing plan, and financial projections.

It may also highlight your operational plan and introduce key staff responsible for managing day-to-day operations.

A well-versed business plan is undoubtedly critical in getting any business up, running, and successful.

Likewise, It’s your business’s key to documenting business models, project financials, and securing investor funding. In short, it is your business plan that turns your business idea into reality.

However, not all business plans are the same; it all depends on the purpose of your plan. Let’s understand it before we head to our how-to guide.

Knowing the purpose of your business plan

The following are mostly the reasons why people write business plans.

Let’s understand these and what could be done differently to make business plans more relevant to serve that purpose.

1. Securing financing from Investors/lenders

Starting with the most popular one—entrepreneurs usually write a business plan because they need funds. They use it to pitch to investors or lenders seeking financing, be it investor funding, government grants, or bank loans.

To make your business plan more appealing and relevant to investors, understand what they look for before investing in a business—clarity, potential return on investment, and risk mitigation.

So, emphasizing market analysis, providing accurate and realistic financial projections, and showcasing the expertise of your management could be a few things you could do differently in your plan to appeal to your investors.

2. Attracting partners and stakeholders

Starting up and growing an entire business all by yourself, it’s a huge task! You’re just starting, you don’t know everything, funds are limited, and so are the hours in a day. That’s why you need partners.

Partners and stakeholders play a crucial role in the success and sustainability of a business. To attract partners for your business, understand why they would be interested in working with you; it could be a shared value proposition, growth opportunities, and more.

Outlining shared values and vision, demonstrating competitive advantage, and detailing partnership opportunities are some of the things you should consider focusing on while seeking a co-founder for your business.

3. Setting and documenting business goals

It’s important for a founder to set realistic business goals to provide them with direction and a benchmark for success.

So, if your primary goal of writing a business plan is setting business goals, emphasize including KPIs, setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals, and establishing milestones for realistic deadlines.

4. Business growth & operations planning roadmap

This one is mostly required by well-established entrepreneurs planning to grow, expand, or optimize their business operations.

If you need help optimizing operations planning or planning to grow your business, focus on outlining your growth strategies, like how you plan to grow or scale, and detail operational processes, including supply chain management, quality control measures, and production processes.

Furthermore, do your research and identify potential risks or unforeseen threats involved and counter-measures to mitigate them.

Now that we have discussed knowing the purpose of your plan, let’s discuss the steps to write one.

How to write a business plan (10 easy steps)

Creating the first draft of your traditional business plan may seem like a time-consuming process, but it’s not.

(Of course, only with the right steps and correct approach)

Not really sure about it? Check out the quick steps to write a comprehensive business plan in a few hours.

1. Prepare an executive summary

As the name suggests, an executive summary is a concise overview of your entire business plan. While it’s the first chapter of your plan, it is usually written at the end as a summary of all the sections.

Since your executive summary holds the weight of your 40-page plan in just a page or two, it should be written in a way that makes readers want to know more about your business and read further.

So the question here is—why would an investor want to know more?

For instance,

- Are you indicating a significant market opportunity?

- Is there a clear and exciting value proposition?

- Do you have a sound business model and promising numbers?

These are just the examples. However, you should focus on clearly providing the information investors usually seek while reviewing a formal business plan.

Your executive summary should include the following info:

- A clear description of your business concept.

- Your mission statement, long-term vision, and business goals

- Products or services you offer as well as your differentiator.

- An overview of your target market

- Your go-to-market strategy

- An overview of your management team

- Summary of your business financials

- Your funding requirements (only if raising funds)

2. Provide a company overview

Next up—it’s your company overview. If you’ve ever been to an interview, you’d know the first question an interviewer asks.

Tell me something about yourself.

The company overview is just like that question. It provides your readers with basic background information about your business, such as what you do, your business model, your value proposition, and more.

I recently had a chat with Logan Mallory, VP of marketing at Motivosity, on the importance of value propositions, and he says,

“Don’t underestimate the power of a strong value proposition. Initially, we concentrated too much on product features rather than how they solved specific problems for our customers. This error diluted our message and made it difficult to stand out.”

He further added, “We pivoted by stressing our distinct approach to employee engagement, highlighting real-world success stories and tangible results. For example, we demonstrated how our platform reduced employee turnover at a mid-sized technology company by 20% in six months.”

Logan says this adjustment was more appealing to their target audience and investors. It clearly communicated the value they provided, which eventually helped.

While you can talk about your business all day, it’s wise to know what they want to learn and emphasize simply that.

Investors are generally looking for answers to these two fundamental questions: who are you, and what do you plan to do? Besides, your company description section should also include the necessary details like:

- Your business structure (e.g. LLC, sole proprietorship, etc.)

- Your business model

- Vision, mission, and value proposition

- Your industry

- Business history and future goals

As mentioned before, with a boatload of information to tell about your business, it’s easier to distract and go sideways.

So make sure your company overview section is concise and to the point. And, of course, language to be easy to understand.

3. Perform market and industry analysis

You already knew your business inside-out when it came to writing the company description; this time, it is different. Now, you need to understand your market yourself before you go explaining it to others.

A market analysis is simply a part of your plan where you bring together all the information you have about your customers—who they are, where they live, why they will buy what you’re selling, and more.

A group of these customers is called your target market, they are the people you will sell your product or service to.

Your business can have multiple target markets, depending on your offerings.

For example: A bakery with a product line of various baked goods may target families, young professionals, as well as health-conscious consumers for their different sets of products.

Besides a specific and clear description of your target market, your market analysis should also include:

- Market size and growth potential

- Key market trends

- List of regulations and licensing requirements

Make sure you present your numbers in a way that demonstrates how your market has grown over time and how you can take advantage of it.

4. Conduct competitive analysis

Similar to how market analysis is about knowing your target market, competitive analysis is about knowing your competitors. Knowing and understanding your competitors is an aspect when it comes to defining your business opportunity.

Every business on the planet Earth has some type of competition.

(Must be from Mars if they don’t!)

If you’re seriously unable to spot any competitors, try looking for the indirect ones—indirect competitors are other alternatives available in the market for your product or service.

For instance, If you are a coffee shop owner and there isn’t any coffee shop nearby, you may consider the restaurant across the road as your indirect competitor.

Once you’ve figured out your direct and indirect competitors, research their business, product or service offerings, marketing strategies, and more.

Conduct a SWOT analysis to understand how your strengths, weaknesses, opportunities, and threats are compared with them. It’s an easy way to determine your competitive edge in the market.

After you’ve done all this, you will have a much better understanding of your business as well as your competitors, which will eventually help in developing a clear differentiator. It can be anything from competitive pricing to improved offerings.

5. List your product and service offerings

This section is at the center of your plan, and the rest revolves around it. After all, your product and service are what brings in money for your business.

Your product and services section is a clear description of the product and/or service you are selling to your customers and how it solves their problems.

You may start by describing the customer pain points and problems that exist in the market. Followed by how you plan to solve that problem with your offerings.

The structure of your products and services sections may heavily vary depending on your business model.

For example: If you have a range of products, you may not require a detailed description and a long list of features. However, if you’re writing a traditional business plan for SaaS software, you need to make it as detailed as possible.

Your product or service description may include the following:

- A detailed description of how your product or service works

- Your product or service pricing model

- Details on product development or procurement

- How do you maintain quality standards

- And more.

Besides the must-add info, focus on developing a compelling narrative around your product/service offerings. How will the users use your product, and how will it make an impact in their day-to-day lives?

Have you heard the old saying, “Facts tell, but stories sell?” This is something that draws in potential investors.

6. Develop a sales and marketing plan

Your sales and marketing plan explains how you will spread the word to your potential customers to sell your products.

However, the first thing your marketing plan should do is to position your product or service in the market appropriately.

How exactly should you position yourself? It depends. You can position yourself as a premium brand with the highest pricing but top-quality service. Or focus on competitive solutions.

Market positioning varies from business type to business model, so the information you gather during your competitive analysis will be useful. Refer to how your competitors are positioned and plan accordingly.

Once you’re done positioning yourself, bring in the information you have on your target customer to develop a winning marketing strategy.

Reasons? Depending on who your customers are, do they make online purchases, and how they buy products like you, you might need to plan different strategies to target your customers. It could be promoting your business on Instagram and TikTok to affiliate marketing, anything.

While your marketing strategy includes reaching potentially interested customers, the sales process starts once a customer has already shown interest in what you have to offer.

Getting the right mix of sales and marketing strategy is crucial for acquiring more customers.

7. Introduce your management team

Of course, the first thing investors look at is a great business idea and the product. However, they also look at the founder as well as the team behind the scenes they’re taking a bet on.

And this particular chapter helps them understand who’s running the show.

You should provide a brief introduction of each management team member, their qualifications, area of expertise, and the tasks they perform at the organization.

Make sure your management and organization section answers a few questions for investors: Do you have the key people for efficient operations? Do they have relevant industry experience? What are the roles you are actively seeking (if any)? And more.

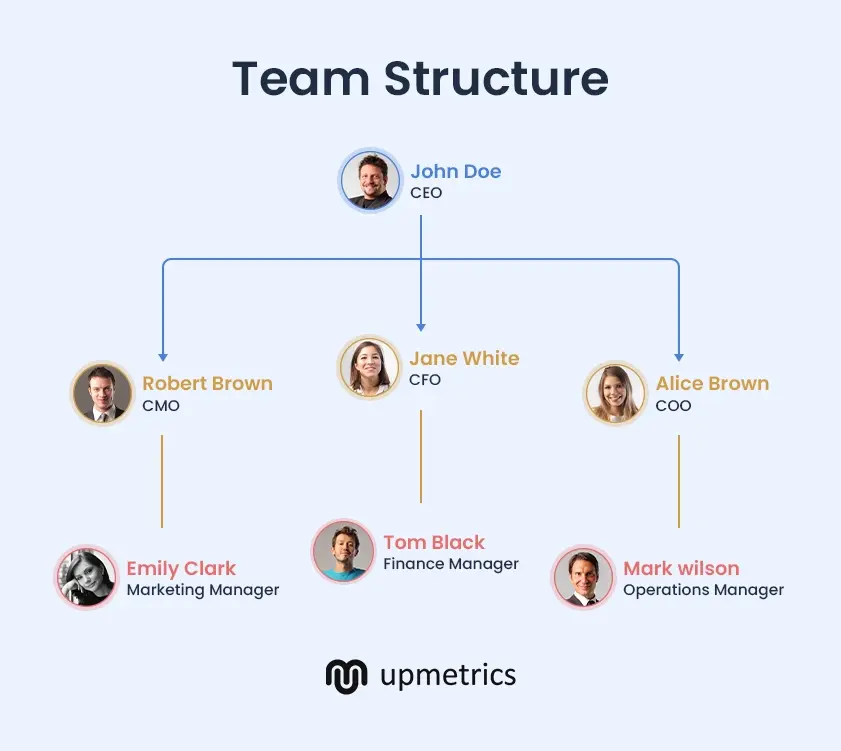

Consider including an organizational chart to show your organization’s internal structure, including employee roles, responsibilities, and hierarchy. Explain how each individual contributes to the company’s success. This will make your investors feel confident about your core team.

8. Create a logistics and operations plan

Your operations plan is where you will talk about how your day-to-day business operations will look like.

Unlike some other chapters of your plan, an operations plan is an essential one for both investors as well as your internal team. Of course, you don’t need to be super specific or detailed when writing for yourself.

The basic components to include your operational plan are:

- Vendors or suppliers

- Manufacturing process

- Supply chain management

- Equipment and machinery

- Inventory management

- Facilities, and more.

The contents of your operations plan totally depend on your industry, product/services, how your business is structured, and who it is written for—internal team or lenders.

Let’s take it from an example:

Suppose you are a candle-making company (manufacturing business).

In this case, your operations plan may include raw-material requirements, machinery requirements, production process, quality control, distribution, and more. It will require a detailed description.

On the other hand, if you own a scented candle retail shop, the processes to include in your plan would be much less.

So, there cannot be a perfect template or structure to follow. Just understand your business and try to explain best how you manage your day-to-day operations.

9. Make accurate financial projections

Here comes the elephant in the room. Most entrepreneurs consider a financial plan as the most challenging one to mark as done. While it indeed is an important one for investors to consider, it isn’t as complicated as people think.

Similar to the previous section, the level of detail here also depends on your audience and the purpose of your plan. However, a typical startup financial plan includes the following financial statements and forecasts:

- Profit and loss statement

- Balance sheet

- Cash flow statement

- Sales forecast

- Projected expenses

But how do you project financials and make these statements? Start by determining your financial requirements, followed by setting financial goals, analyzing current financials, and making future assumptions.

Preparing detailed forecasts simply using generic Excel templates can be challenging and time-consuming. You should consider using a financial forecasting tool for accurate and timely results.

10. Assemble a well-organized appendix

While the appendix cannot be considered a primary section of a business plan, this is the place for you to add additional data, charts, support documents, and other necessary information.

Although it is an optional chapter of your plan, having a well-organized appendix helps you add credibility to your plan with the necessary information and documentation backing your business idea.

Here’s a list of information or documents you should consider including:

- Legal documents—Incorporation docs, licenses, and permits, etc.

- Personnel details—organizational charts, personnel certifications, and degrees, etc.

- Additional financial documents—Credit history, past and current financial statements, business assets, etc.

- Supplementary information—sales and marketing materials, product blueprints and designs, etc.

11. Business plan cover page (optional)

Don’t judge a book by its cover.

The popularity of this metaphor doesn’t make it very accurate since most people form their perception just by looking at the “cover”. I may sound like a philosopher speaking, but that’s true.

A compelling and well-designed cover page that reflects your brand and vision is essential to form a good first impression for potential investors and stakeholders.

Besides having a good design and using brand colors, make sure you include the following information on your cover:

- Business name

- Company logo

- Tagline or motto

- Business plan title and year

- Prepared by

- Contact information

- Confidentiality statement

Remember, it’s optional to have a business plan cover page. While it is an excellent addition to your plan, don’t put extra effort into the design part; keep it simple.

Common business planning mistakes to avoid

As you’re reading this article, I suppose you’re creating a business plan for the very first time. A traditional business plan is generally a 30-40 page long document, and you’re bound to make mistakes, but we’ll help you skip the most common ones.

Here are the business planning mistakes entrepreneurs make that you should avoid:

1. Insufficient market research

Conducting thorough market research is a must before you write your business plan. Insufficient market research can result in inaccurate market understanding, wrongly defined target markets, irrelevant marketing strategies, and unrealistic financial projections.

In short, this is one mistake that can cost you your business.

2. Lack of focus on the customer

Your ultimate goal as a business owner must be to provide the best solution and meet customer needs. Lack of focus on customer requirements may result in dropped sales numbers and limited market penetration.

Keep checking on your customers, asking for their feedback, and improving your offerings to align with their requirements.

3. Overly optimistic financial projections

It’s your business, and it’s natural for you to imagine good things about it. This often leads to making unrealistic financial projections. Having overly optimistic financials can result in poor decision-making, losing investor trust, overspending cash in hand, and more.

4. Spending too much time planning

Planning is essential, but execution is where theory meets reality. Spending too much time planning can prevent you from taking timely action, resulting in several missed opportunities.

An effective plan should lead to actionable steps implemented within a reasonable timeframe.

5. Inconsistent monitoring and updating

A business plan isn’t a one-off document you create and forget about. Inconsistent monitoring and updating your business plan can lead to strategic inconsistencies and operational inefficiencies.

On the other hand, regularly updating your business plan helps you keep up with competitors, manage customer demands, address recent market trends, and efficiently track progress.

Tips for writing a compelling business plan

While a step-by-step guide helps you stick to the process and finish the task, tips are like best practices some field experts have used to make things easier.

Here are some tips on writing a business plan that can help you save a lot of time.

1. Determine the purpose of your business plan

As I mentioned up front in the article, this feels like an extra addition to the list. Anyways, knowing the purpose of your business plan beforehand is super important.

The sole factor decides the text’s tone, what sections would be there, and what parts would be emphasized more than the others. If you fail here, I am not sure how your plan will turn out.

2. Know your audience

Knowing your audience, and the people reading your plan is essential to make your business plan specific to them. If you’re writing a business plan for your internal team, it would emphasize operations and marketing strategies more and less on the company description.

Likewise, it would point up financials if it were written for venture capitalists. The dynamics of a plan change as the audience reads it; that’s why it’s crucial to know your audience.

3. Get inspiration from sample business plans

You cannot draft the whole thing from scratch without a basic blueprint. Referring to sample business plans helps you have a basic understanding of the requirements of a business plan, and it can massively help in developing one.

Upmetrics has a library of 400+ sample business plans you can refer to. Select a business plan template and start planning.

4. Have someone review it for you

It’s common for us humans to overlook our mistakes. Having someone else review your plan would help you get a different perspective and may help you highlight a few aspects of your plan that you may have overlooked or missed.

Besides having someone else review your plan, you may also seek help from AI. AI tools like ChatGPT and Upmetrics can review your plan and give human-like feedback.

Reviewing and updating your business plan

Reality check: finishing the first draft of your business plan isn’t the end.

A business plan isn’t something you create once to keep it as it is forever. It is a dynamic document that requires timely revisions and updates to keep it relevant to the changing market trends.

Your first review will be just after you complete your first draft. Since you have just finished it, it may not require any significant changes. However, conducting a thorough review is crucial before you send it to investors.

The last thing you want is for them to reject your proposal because of a bunch of typos that could have easily been avoided.

Besides the first review, it’s suggested to follow a review cycle of 45 days to 6 months to stay relevant to the market and consumer shifts. It’s okay if you cannot have regular review meetings, but consider reassessing and updating your business plan and processes when there is a significant market shift.

How to use AI to write your business plan

The rise of generative AI tools has changed the entire business planning process. AI tools like ChatGPT and Upmetrics can help simplify business planning concepts like competitor analysis, market segmentation, and target market.

Not just simplify, but they can help reduce time spent on activities like market research, competitor analysis, and financial planning by a huge margin.

The easiest way to plan today would be to collaborate with an AI business plan generator. We are not totally relying on AI to do it for you, but handing over the manual, complex, and boring tasks to be more productive.

Talking about the planning process—AI can help you brainstorm ideas, suggest marketing strategies, write sections of your plan, help in industry and market research, develop realistic financial projections, and more.

While AI has pros and cons for business planning, understanding all the things you can outsource to AI will help you get the most out of it.

Spend more time researching, less writing

Make business plans in minutes with AI

Plans starting from $14/month

Start writing your business plan

Let’s face it—preparing a business plan that lures investors requires putting in some serious work; there’s no secret sauce. But you must take the first step to stay ahead in the cut-throat competition; there is no way around it.

So, what are you waiting for? You have the steps to get started right here. It’s time to get into details—better understand your business and the value it offers to its consumers, get the right business planning tool, and start planning.

Free business plan templates and examples

Need help getting started writing a business plan? Here are business plan templates and examples to help you get started.