$10 million. That’s how much LinkedIn raised with their Series B pitch deck back in 2004—a time when social networks were still “fun” and not “professional.”

But Reid Hoffman had a different vision: Your network wasn’t just about friends, it was your untapped economic opportunity. And to convince investors of that, LinkedIn didn’t just tell a story; they built a thesis, slide by slide.

This wasn’t a flashy, design-first deck. It was a layered, thought-provoking pitch rooted in belief, timing, and strategy. And it worked. Because when you can make someone feel the problem, see the solution, and believe in the outcome, you win.

In this breakdown, I’ll walk you through LinkedIn’s pitch deck the way I see it: With honest reactions, insights that matter, and the takeaways you can actually use when building your own.

Let’s dive in.

About LinkedIn (then vs. now)

Back in 2003, LinkedIn was not yet a career powerhouse. It was a fledgling idea in a world where Friendster still had a buzz and MySpace ruled the social web.

Reid Hoffman, along with co-founders Allen Blue, Konstantin Guericke, Eric Ly, and Jean-Luc Vaillant, saw a gap: There was no online network designed specifically for professionals.

So they launched LinkedIn in 2002 (Officially in 2003) from Hoffman’s living room.

At the time, they had just 81,000 users. No revenue. No real playbook. Just a belief that the professional graph was the next big thing.

Fast forward to today: LinkedIn is the default home for careers. 1 billion+ users, acquired by Microsoft, generating billions in annual revenue, and quietly powering the hiring backbone of nearly every industry.

What’s wild is that the early deck doesn’t try to predict all of this. Instead, it focuses on one thing:

“We’re building the professional graph. Here’s why it matters.”

And that clarity? That’s what made investors listen.

Detailed LinkedIn pitch deck analysis (slide-by-slide)

Now that we know where LinkedIn started and what they were aiming for, let’s break down the pitch deck that sold that vision. Slide by slide:.

Slide 1: Cover slide

Right from the start, LinkedIn does something many early-stage decks get wrong; it doesn’t try to impress, it tries to land. The cover is clean, minimal, and serious. Just the essentials: Brand, date, Series, and a subtle hint at what they’re building.

It sets the tone without distractions. The only thing missing is a quick mention of the raise amount. Including that upfront gives investors immediate context.

Takeaway: Keep your cover simple and focused. Show the brand, round, and a clear signal of what you’re about.

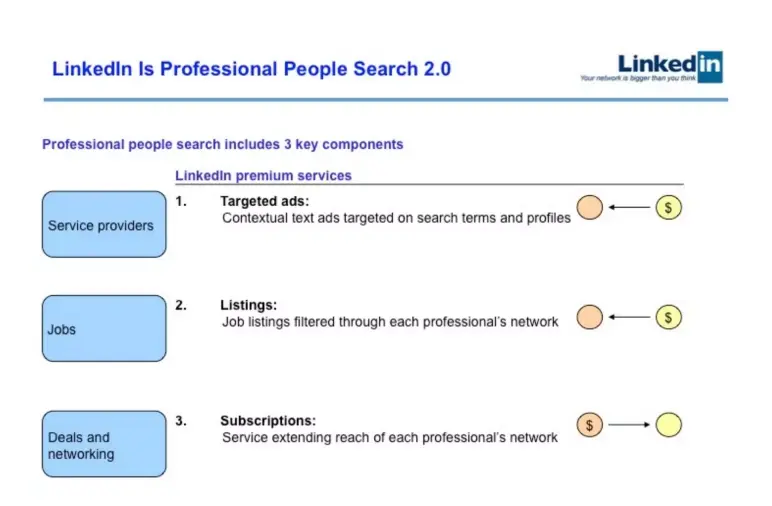

Slide 2: Elevator pitch

This slide does exactly what it should: It tells investors what LinkedIn is and how it plans to make money. The layout breaks it into three parts: the core value prop, key user needs, and matching revenue streams (ads, job listings, and subscriptions). It’s clear, structured, and aligned with business logic.

It might feel slightly text-heavy, but the simplicity of phrasing and the visual hierarchy make it work.

Takeaway: Don’t wait to talk about revenue. If it’s a concern, address it early and directly. A clear value prop + monetization model earns trust fast.

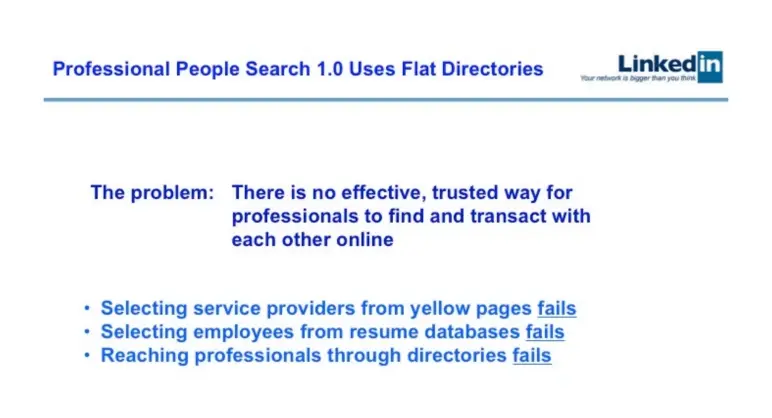

Slide 3: The problem

LinkedIn clearly outlines the gap: There’s no trusted way for professionals to find or work with each other online. It calls out outdated tools like Yellow Pages and resume databases, and labels each one as a failure. Simple, punchy, and focused.

The slide avoids selling the product too early, which is smart. It stays problem-focused and builds urgency.

Takeaway: Frame the problem before the pitch. Show exactly where existing options fall short—that’s how you create space for your solution.

Slide 4: Introducing the solution

This slide shifts from problem to concept by flipping the old model on its head. Instead of relying on outdated, flat directories, LinkedIn proposes a smarter approach: Use your network.

The visual contrast, filing cabinet vs. network cluster, makes the point instantly. No heavy text, just a clear idea: This is the new model.

It’s high-level by design, setting the stage for what’s coming next.

Takeaway: When introducing your solution, show how it’s a shift, not just an upgrade. Use visuals to make that difference obvious.

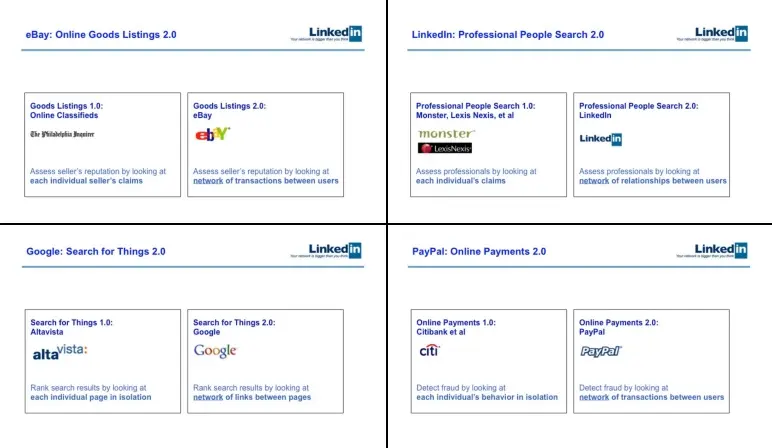

Slides 5-8: Analogy

This is where LinkedIn stops pitching and starts teaching through comparison.

eBay made classifieds safer through reputation. PayPal fought fraud using user connections. Google ranks pages based on links, not just keywords. LinkedIn? It’s applying the same network logic to professional people search.

Then they tie it all back: LinkedIn is to Monster what Google was to AltaVista. Clear, confident, and clever.

Why it works: These analogies help investors see a familiar playbook; network effects driving real value. If you’re doing something new, show them it’s not unproven, just unapplied in your space.

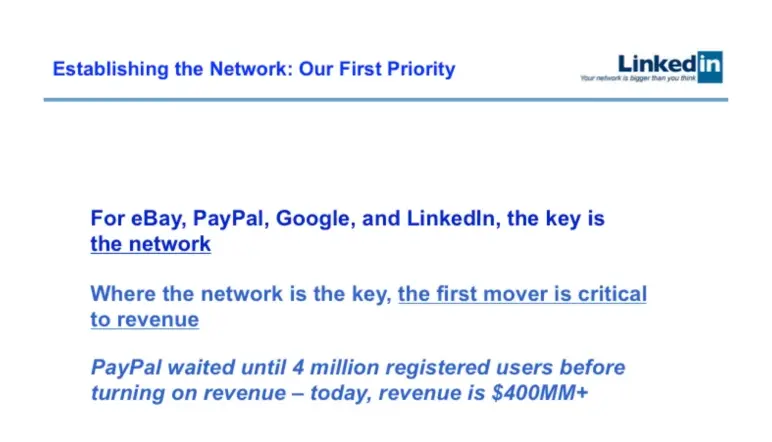

Slide 9: Investment thesis

At this point, I wasn’t being sold on revenue; I was being asked to believe in the network.

This slide (even if implicit) made it clear: the core thesis was that LinkedIn’s value would come after the network took off. I like that they didn’t hide from this; they leaned into it.

The earlier analogies primed me to trust that networks do lead to big wins. So when this slide asked me to prioritize growth over short-term revenue, it didn’t feel risky—it felt strategic.

Takeaway: If you’re betting on long-term network effects, don’t dodge it. Say it upfront, back it with proof, and help investors buy into the bigger picture; just like LinkedIn did here.

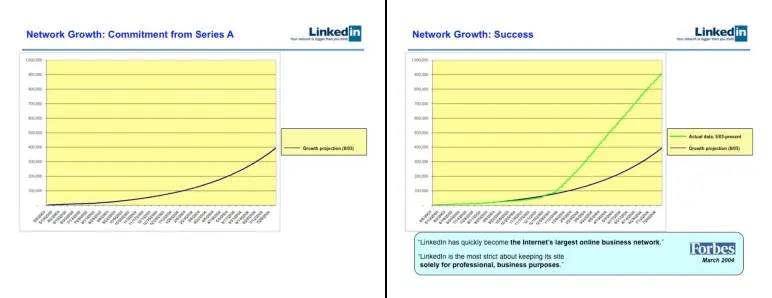

Slide 10-11: Traction- Growth chart

This is the part where I’d lean in if I were an investor.

Slide 10 sets the stage: LinkedIn reminds us of the growth targets they committed to during their Series A and shows they’re on track to hit them.

But Slide 11? That’s the punchline. Actual growth didn’t just match expectations, it blew past them. Nearly double.

I love that they didn’t just show numbers. They framed it as a promise kept, then backed it with third-party proof. Forbes is already calling them the leader. 23M+ emails uploaded? That tells me engagement is real, not just vanity signups.

Takeaway: Don’t just show growth, show that you delivered on your word. By comparing projections vs. actuals, and layering in press validation, you turn traction into trust.

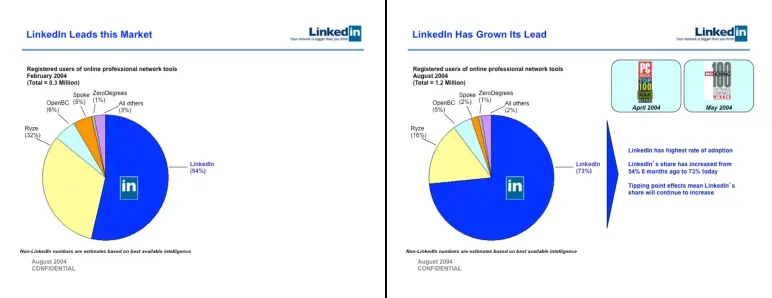

Slide 12-13: Market momentum

Slide 12 is where LinkedIn stops talking about growth and starts showing dominance. They claimed 54% of the market in Feb 2004—more than all competitors combined. It’s early, but they’re already leading. That’s a strong signal for investors in a winner-takes-most space.

Then, slide 13 takes it further: Just six months later, they’ve grown to 73%. That’s not just traction; it’s momentum. It shows the network effects kicking in. Add a few credible awards, and this feels like a category winner in motion.

Takeaway: Show market leadership early; even in a small market. If you’re pulling ahead, highlight it. Winning share builds confidence faster than just showing raw growth.

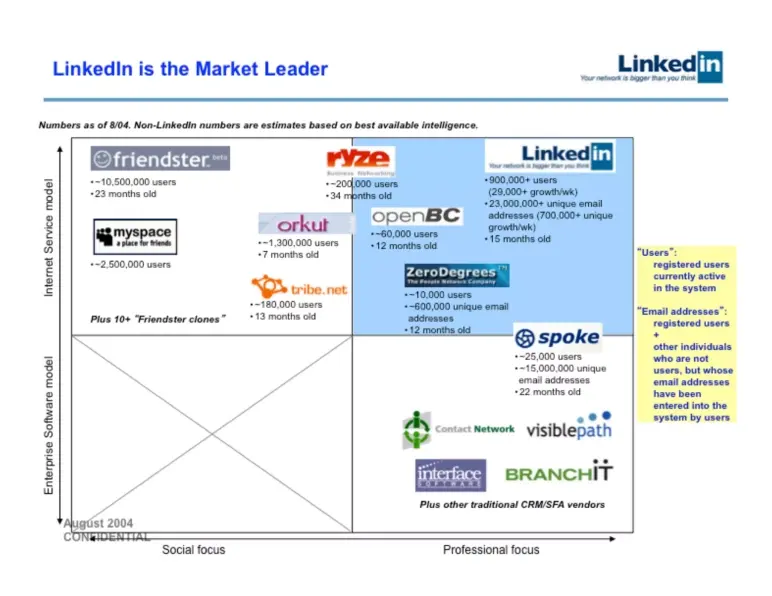

Slide 14: Competition—Landscape matrix

Slide 14 is all about positioning. LinkedIn uses a simple 2×2 to say: “We’re not just growing—we’re in a league of our own.” Social giants like Friendster and MySpace might have bigger numbers, but they’re in the social bucket. LinkedIn sits alone in the top-right—professional + internet service.

That visual separation is key. It told investors: “Don’t confuse us with party pics and friend feeds—we’re building something different.” The chart may be busy, but the point stands: In the professional networking space, LinkedIn is the clear leader.

Takeaway: Use a quadrant to your advantage. If you occupy a strategic corner with no serious competition, show it. Visual clarity builds investor confidence fast.

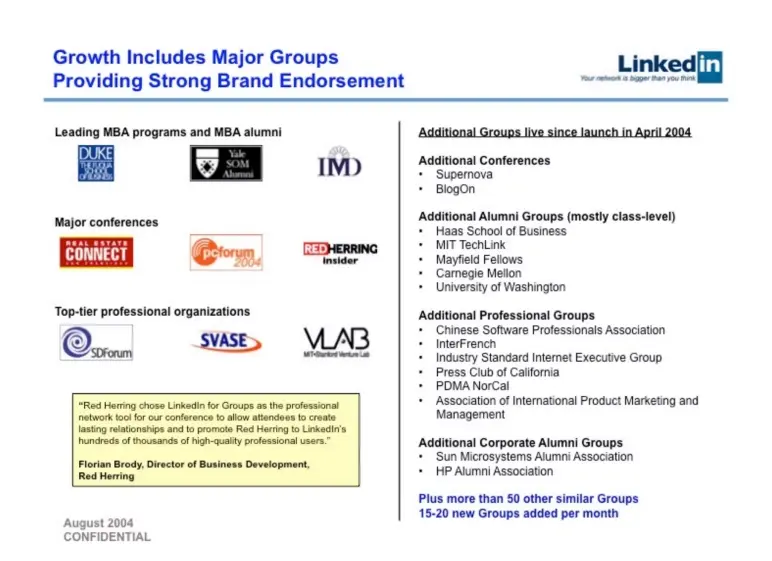

Slide 15: Brand endorsement

This slide swaps numbers for names and powerful ones.

Logos from Duke, Yale, IMD, and Red Herring tell us LinkedIn isn’t just growing fast, it’s growing in the right circles.

The slide highlights how top MBA programs, tech conferences, and elite professional groups are adopting LinkedIn Groups to connect their networks. This is strong social proof. When influential institutions adopt your platform, it signals trust, quality, and long-term staying power.

Takeaway: Early traction is good. If key players in your market are already using your product, show it off. It builds instant credibility with investors.

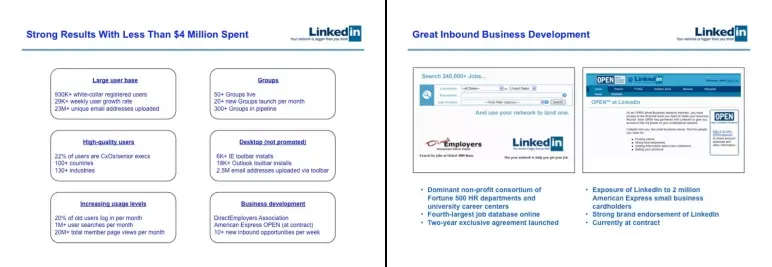

Slides 16-17: Performance metrics

These two slides come together to say one thing loud and clear: LinkedIn is delivering real results, without burning cash.

Nearly 1M users, strong weekly growth, exec-heavy profiles, 1M+ monthly searches, and tool installs show the network is scaling with quality and engagement. For under $4M spent, that’s impressive.

The follow-up? Early biz dev wins with AmEx and DirectEmployers. They didn’t become game-changers, but in the pitch, they signal validation and future monetization paths beyond user growth.

Takeaway: Don’t just show that you’re growing, show how efficiently you’re doing it and where it can go next.

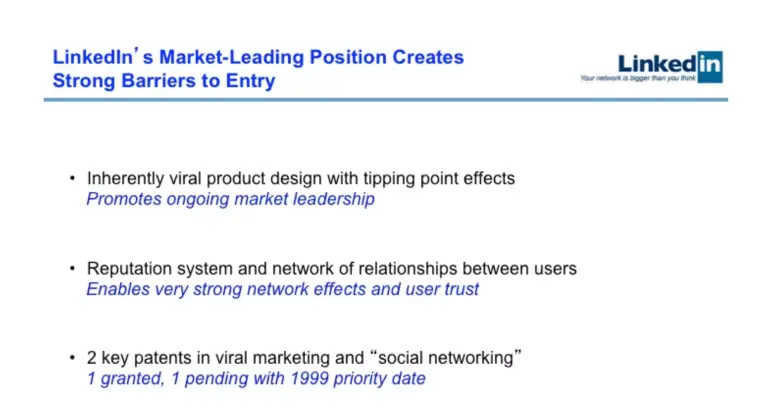

Slide 18: Barriers to entry

This slide tackles the elephant in the room: “What stops a giant from eating your lunch?” LinkedIn answers with a three-layer moat:

- Network effects: The more users join, the more value it creates—classic tipping point logic.

- Trust layer: Their reputation system isn’t just social fluff; it builds credibility that’s hard to replicate.

- Patents: Two in viral/social mechanics (one dating back to 1999), signaling they’ve locked down some core tech.

It’s a smart move. They’re not just saying “we’re big,” they’re saying “we’re sticky, trusted, and protected.”

Takeaway: Don’t assume investors see your moat; spell it out. LinkedIn does this well: Highlighting compounding advantages and IP, making it harder for any latecomer to play catch-up.

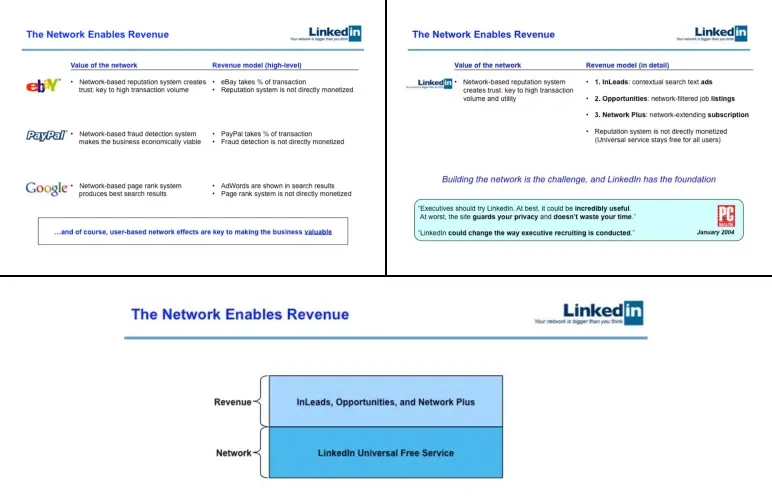

Slides 19-21: Revenue model

These three slides work together to walk investors through a crucial idea: You don’t monetize the network directly—you monetize what it enables.

Slide 19 warms up the logic using familiar examples:

- eBay monetized transactions, not trust.

- PayPal monetized payments, not fraud detection.

- Google monetized ads, not PageRank.

LinkedIn follows the same playbook. Its network-based reputation system builds trust, which is what unlocks value at scale.

Slide 20 introduces how that trust turns into dollars:

- InLeads (ads)

- Opportunities (job listings)

- Network Plus (subscriptions)

And the core network? It stays free because growth and utility depend on it.

Finally, Slide 21 wraps it up with a clean visual: Free network as the foundation, monetization layered on top. It’s a freemium flywheel; grow first, earn later.

Takeaway: If your product creates trust or utility through network effects, protect that foundation. Monetize around it, not through it. This trio of slides is a masterclass in showing how indirect monetization scales without breaking user experience.

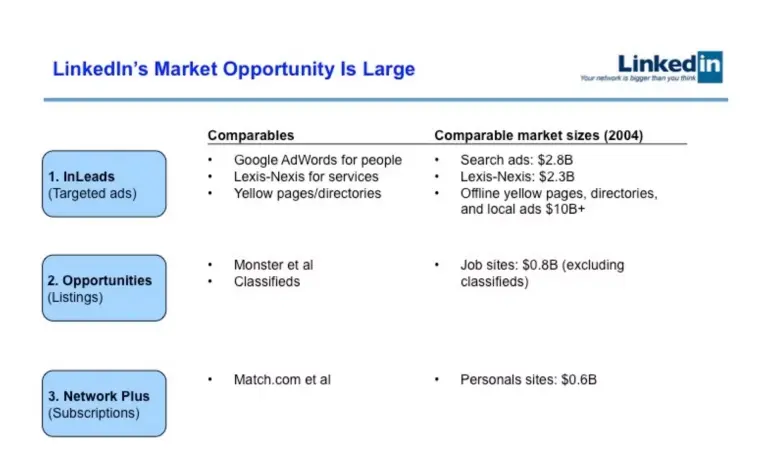

Slide 22- Market opportunity

Now that LinkedIn has explained how it will make money, this slide shows how much money is out there.

Each of the three revenue streams connects to a big, existing market:

- InLeads (ads) is like Google Ads or Yellow Pages; this market is worth over $15 billion.

- Opportunities (job listings) is like Monster.com; worth $800 million.

- Network Plus (subscriptions) is similar to Match.com; worth $600 million.

Instead of guessing, they point to real companies and real dollars. It proves LinkedIn isn’t chasing a fantasy; it’s tapping into huge, active markets.

Takeaway: If you’re building something new, show investors where the money already flows. LinkedIn made it clear: The opportunity is big, and they’re ready to grab it.

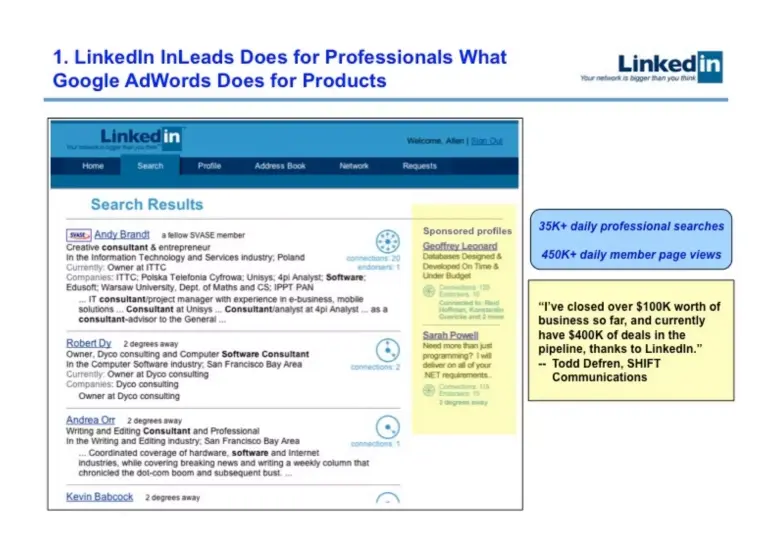

Slide 23: Inleads = Google Ads, but for People

When I saw this slide, it clicked: LinkedIn is turning profiles into ad space. Just like Google sells sponsored results for products, LinkedIn is doing the same for people.

The screenshot shows how professionals show up in search, but the real magic is on the right: sponsored profiles. That’s the business model. If you’re a consultant or freelancer, you can pay to appear at the top when someone searches for your skill set.

Plus, with 35K+ daily professional searches and 450K+ page views, there’s real volume behind it.

Takeaway: If you’re pitching a platform with search and profiles, show how it can drive real business. LinkedIn nails it here: They position InLeads as Google Ads for professionals, with proof it works and a clear monetization path investors can believe in.

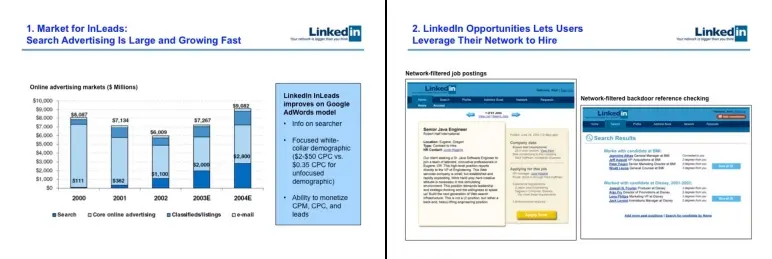

Slide 24-25: Market size to real revenue

These two slides work best when seen as one story. Slide 24 makes the business case: Search advertising is booming. It shows a growing multi-billion-dollar market and hints that LinkedIn wants a slice of it.

Then slide 25 brings that to life. It shows how LinkedIn plans to earn in that space, not through generic ads, but by letting users hire smarter through their network. One side shows a job listing filtered by your connections; the other shows how you can backdoor-reference someone through mutual contacts.

By placing these two slides together, the deck moves from market potential (slide 24) to real product value (slide 25).

Takeaway: Don’t just show there’s a big market—show how you’re uniquely positioned to win in it. LinkedIn nails this by pairing market size with real product utility. It’s not just “we could make money,” it’s “here’s how we already are.”

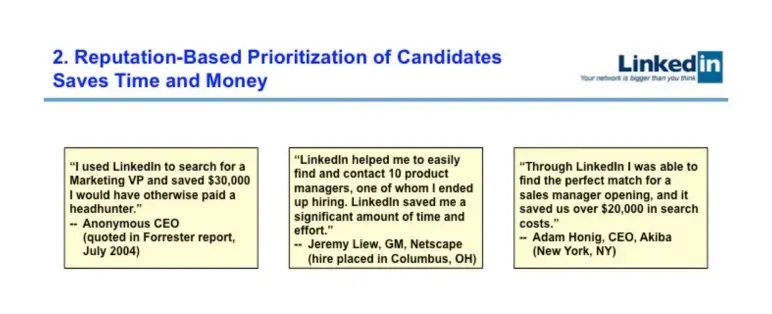

Slide 26: Testimonials

After showing the product in action, this slide smartly drops three real-world testimonials, each tying LinkedIn directly to hard-dollar savings in hiring. Instead of bragging themselves, LinkedIn lets CEOs and GMs do the talking.

I like how the quotes are kept short, specific, and financial: “saved $30,000,” “saved $20,000,” “saved time and effort.”

It gives LinkedIn’s hiring solution instant credibility—especially for investors who want proof this isn’t just a cool tool, but a business that saves companies real money.

Takeaway: LinkedIn doesn’t just make hiring easier—it makes it cheaper. And when multiple CEOs back that up with numbers, it shifts the conversation from potential to profit.

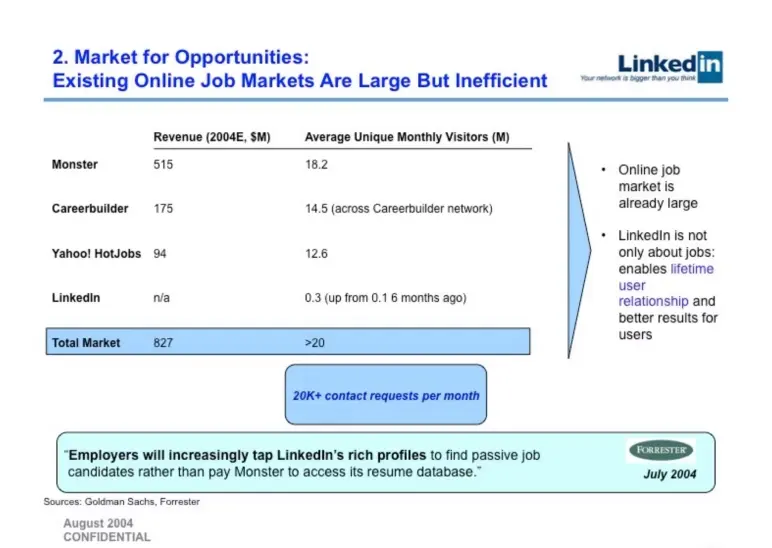

Slide 27: Market for opportunities

This slide made me pause. $827M across Monster, CareerBuilder, and HotJobs? That’s massive. But here’s the twist—despite the size, it’s inefficient.

I like how LinkedIn positions itself here: Not as another job board, but a better way altogether. Instead of static resumes, they offer living profiles and trust-based networks. It’s not just for job seekers; it’s for relationships.

They’re small now (0.3M users), but growing fast. And the Forrester quote nails it: Companies will shift from paying to search resumes to tapping LinkedIn’s network directly.

Takeaway: LinkedIn’s not just chasing the job market; it’s changing how hiring works.

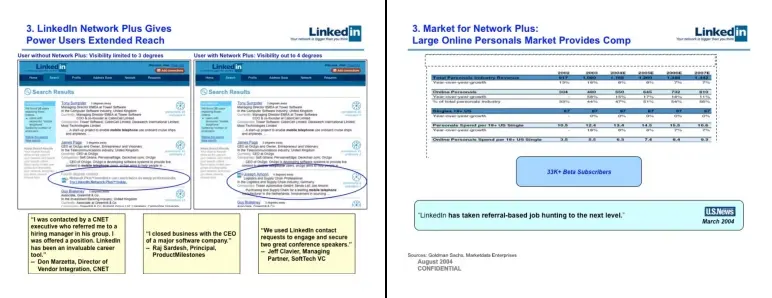

Slides 28-29: Network plus

This is LinkedIn’s early push into monetization—Network Plus. Slide 28 is the demo: Without it, your visibility stops at 3rd-degree contacts. With it, you see even more leads, opportunities, and connections.

But they don’t stop at showing the product. Slide 29 backs it up with market logic: People already pay for extended access in online personals. If they pay $8+ a year just to meet someone, why wouldn’t professionals pay to reach the right hiring manager?

Also, those three testimonials? Subtle social proof that this feature actually gets results.

Takeaway: LinkedIn’s Network Plus isn’t just extra visibility; it’s a paid unlock for deeper reach and real results. Backed by user success stories and a proven willingness in other markets to pay for access, it’s a smart first step toward monetization.

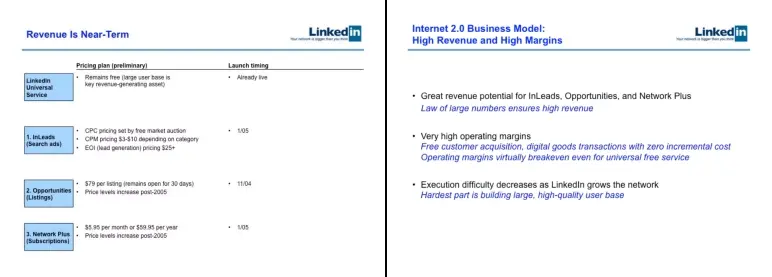

Slide 30-31: Launch timing and pricing

Until now, it’s all been about growth. But here, I finally see the switch flip—LinkedIn is ready to make money.

They lay out exactly how and when:

- Job listings at $79/post (launching Nov ’04)

- Search ads and subscriptions go live Jan ’05

- And the core service? Still free—to keep the user base growing

What I like is how specific this feels. No vague “future monetization” promise—just a clear pricing model with rollout dates. They even plan to raise prices later. That shows confidence and a smart land-grab strategy.

Then, Slide 31 seals the deal:

- Big network = big revenue

- Digital services = high margin

- The hardest part (user acquisition) is done

In short, they’re saying: “We built the foundation; now watch us scale it with almost no cost.”

And honestly, I buy it. This is the classic internet model: High fixed effort, low variable cost.

Takeaway: LinkedIn doesn’t just promise revenue; it shows it. With clear pricing, launch dates, and a scalable, high-margin model, they turn “someday we’ll monetize” into “here’s exactly how and when.”

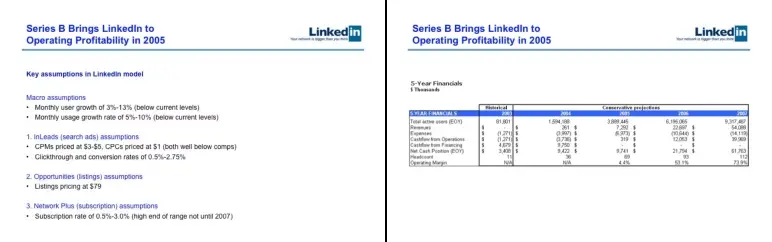

Slide 32-33: Profitability

These two slides are the financial heart of LinkedIn. Slide 32 lays out how all the assumptions—user growth, ad pricing, conversion rates, subscription uptake—everything that powers their revenue model.

They keep it conservative. Most inputs are below current levels or industry comps, which tells me they’re not trying to oversell. They’re showing their projections are grounded, not wishful.

Slide 33is where it all comes together. The five-year financial forecast shows revenue climbing from zero in 2003 to over $54M by 2007, with profitability kicking in by 2005.

Even more impressively, margins soar from just 4% to nearly 74% in two years. That’s the startup dream—scale fast, stay efficient.

Together, these slides tell a full, believable story.

Takeaway: Don’t just drop a forecast—build trust around it. By pairing grounded assumptions with a clear financial path, LinkedIn made its growth feel achievable, not hypothetical.

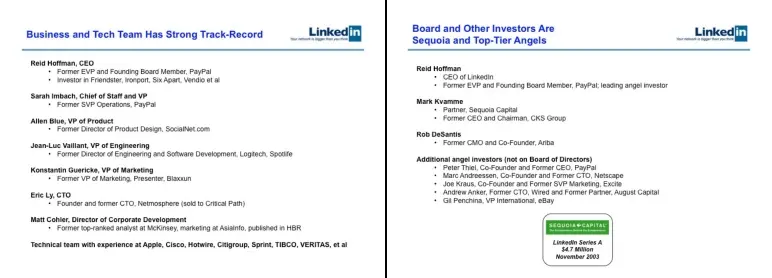

Slide 34-35: Team overview

These two slides tell investors: “You’re not betting on a risky founder team—we’ve done this before.”

Slide 34 shows a seasoned leadership lineup: Ex-PayPal, early social network builders, engineers from Logitech, marketers with community experience. Every name fits their role and connects to LinkedIn’s mission.

Slide 35 seals it with names like Sequoia, Peter Thiel, and Marc Andreessen; big signals that smart money is already in.

What I liked is that they didn’t overload the bios. Just role + relevance. And the investor list is short but powerful. No fluff, just pedigree.

Takeaway: List your team with intent; past roles should prove they can handle this role. And showcase investors who bring more than cash. These slides build instant trust.

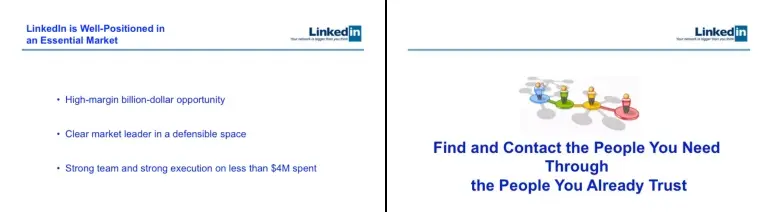

Slide 36-37: Closing message

LinkedIn didn’t end with a cluttered appendix. Instead, they brought the pitch full circle, reusing the opening vision slide as their closer. Why? Because they wanted one thing ringing in investors’ heads during Q&A: “Your network is bigger than you think.”

That move kept the spotlight on the big picture, not the financial footnotes. It also framed every follow-up question through the lens of opportunity, not risk.

No final ask, no new info. Just a confident pause and a powerful reminder of what they’re building.

Takeaway: Your last slide is still part of your pitch—use it to reinforce your core message. Let it sell for you while you talk. A well-placed vision slide can say more than a page of charts.

What did I like the most about this deck?

Here’s what stood out most to me in LinkedIn’s pitch deck—it’s a rare mix of strategy, restraint, and storytelling that many decks today still struggle to match:

- Opened with a crisp one-liner that framed the entire opportunity from slide one.

- Moved in a clean, logical flow that made the story effortless to follow.

- Backed projections with conservative, transparent assumptions—rare and effective.

- Showed traction through data, not hype or inflated vanity metrics.

- Highlighted a proven, relevant team without needing to oversell.

- Closed by circling back to the vision, keeping the investor’s focus on the big picture.

Perfect your deck and pitch using Upmetrics

LinkedIn’s series B pitch deck impressed investors not with flashy slides, but with a sharp, strategic deck that clearly laid out the problem, the timing, and their vision for massive impact. The real win? They made investors believe in what was coming next.

That’s exactly what your pitch deck should do; tell a compelling story, backed by logic, insight, and momentum.

If you’re unsure where to start or how to structure it all, Upmetrics can help you craft an investor-ready pitch deck using AI that hits all the right notes.

From refining your one-liner to mapping out your market, we guide you through each step, and yes, we also help you build a solid business plan to back it up. Pricing? Get started with just $14.

Your big idea deserves a powerful pitch. Let’s make it happen today!.