What does a billion-dollar pitch deck look like before the billions roll in? In 2011, long before it became the most valuable car company in the world, Tesla used a 15-slide pitch deck to raise $192 million.

This wasn’t just any startup ask—this was a capital-intensive, risk-heavy, EV moonshot that needed factories, batteries, and trust. And yet, Tesla nailed it.

In this breakdown, I’ll walk you through Tesla’s pitch deck slide-by-slide—what worked, what didn’t, and the brilliant storytelling moves that made skeptical investors believe in a yet-to-exist car.

Whether you’re pitching a SaaS tool or a physical product, Tesla’s deck teaches timeless lessons on clarity, credibility, and vision.

Let’s see how they turned a dream into investor gold.

About Tesla (then vs. now)

Looking at Tesla’s original pitch deck, it’s wild to think how far they’ve come. In 2003, Tesla was just a bold idea, founded by Martin Eberhard and Marc Tarpenning, with Elon Musk joining soon after as lead investor in their Series A.

Back then, the goal wasn’t to build mass-market cars. It was to prove that electric vehicles could be fast, desirable, and worth taking seriously.

Their first bet? The Tesla Roadster, a sleek sports car built on a Lotus chassis that aimed to shatter the “golf cart” stereotype of EVs.

Fast forward to now, and the contrast is staggering. Tesla isn’t just making cars—it’s leading a global shift toward sustainable energy.

In 2024 alone, they generated over $96 billion in revenue, with a lineup that includes the Model S, 3, X, Y, and a growing ecosystem of solar and battery products.

That’s why this deck matters. It gives us a rare look at Tesla before the factories, before the fanbase, and before the numbers. Just an idea—and a slide deck trying to make it real.

Detailed Tesla pitch deck analysis (slide-by-slide)

Now let’s break down the Tesla pitch deck, slide by slide. I’ll walk you through what each slide was trying to do, what stood out to me, and why it mattered in the context of early-stage fundraising.

Slide 1: Introduction

This is Tesla’s cover slide, and right away, it sets the tone. Big white space, bold red logo, and two simple words: “Investor Presentation.” That’s it. No fluff, no tagline, no imagery of cars or people—just the brand.

I like how clean and confident it feels. It tells me, “You know who we are. Now let us show you where we’re going.” And for a company trying to position itself as the future of automobiles, that confidence matters.

But if I’m being honest, there’s room for a bit more punch. A subtitle, a vision statement, or even a one-liner about their mission could’ve anchored the presentation emotionally.

Takeaway: A clean cover slide shows confidence, but don’t miss the chance to anchor your big idea in a single, memorable line.

Slide 2: Team

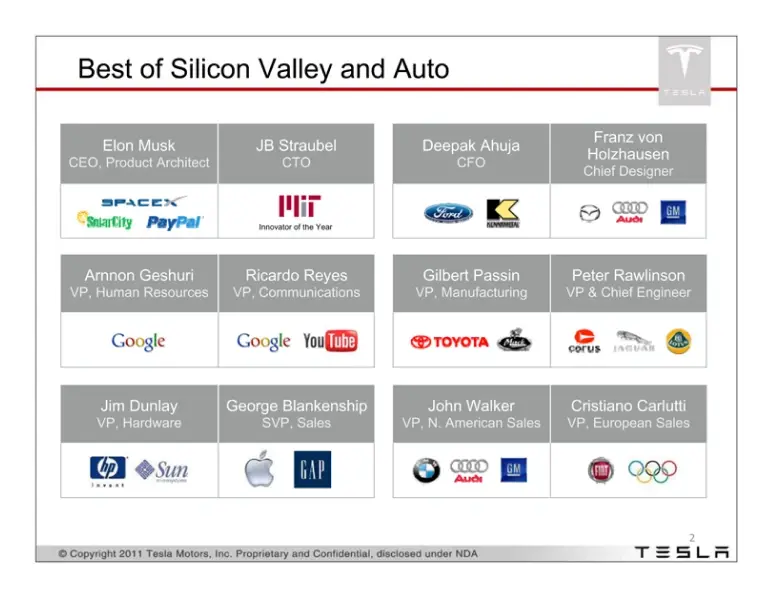

This is Tesla’s team slide, and honestly, I get why they placed it right up front as Slide 2. When you’re pitching something as ambitious as building a new kind of car company, the first question investors ask is: Who’s crazy enough and capable enough to pull this off?

And this slide answers that loud and clear. I saw names backed by logos like Google, Apple, Toyota, YouTube, Ford, and PayPal. It’s not just a team, it’s a dream lineup from both Silicon Valley and the auto industry.

Could it be cleaner? Maybe. It feels dense, and some logos overlap in meaning. But the message is solid: This isn’t a rookie garage project.

Takeaway: If your idea sounds impossible, lead with the team that makes it believable.

Slide 3: Engineering team growth

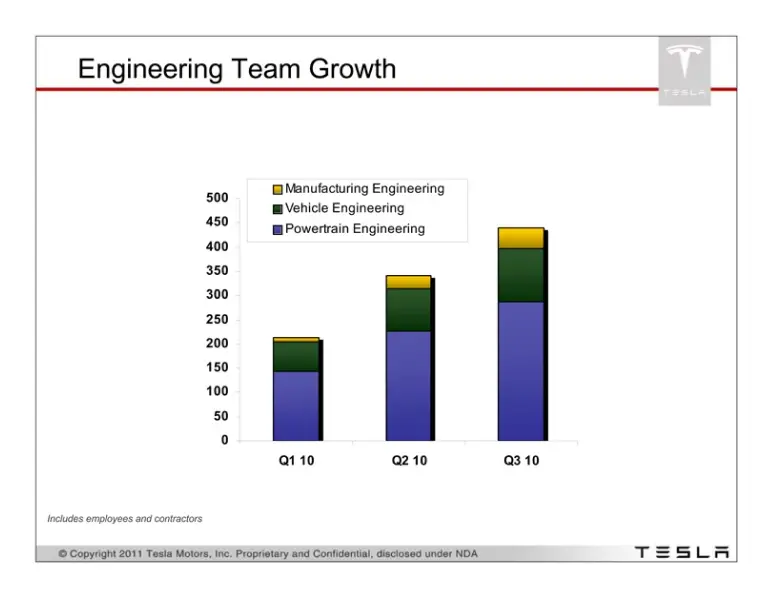

I like seeing this kind of chart in a pitch, especially for a company that’s building hardware at scale. It shows momentum. By tracking team growth across three quarters, Tesla made it clear: They’re not just hiring; they’re scaling intentionally across key areas like powertrain, vehicle, and manufacturing engineering.

For me, as a viewer, it reinforces two things:

1) They’re not stuck in R&D forever

2) They’re investing in real execution muscle.

Investors need that confidence; ideas are cheap, but building takes people.

It’s not flashy, but it quietly builds trust. If anything, a quick line explaining why each area matters would’ve helped non-technical investors follow along faster.

Takeaway: If team growth supports your execution story, show it; investors fund momentum, not just vision.

Slides 4-6: Business partnerships

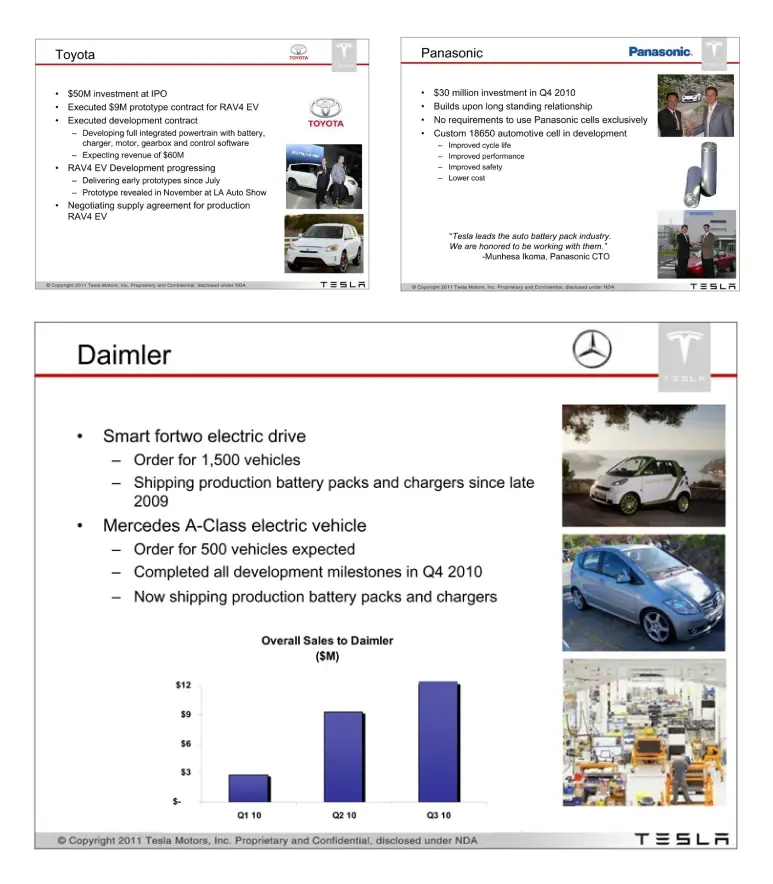

When I looked at these three slides: Toyota, Panasonic, and Daimler—it was clear they weren’t just name-dropping. Together, they tell a bigger story: Tesla had real-world traction with some of the most respected companies in the auto and energy world.

Each slide followed the same structure: Bullet points outlining contracts, investments, and prototype development, paired with photos to humanize the partnerships. On their own, they’re impressive.

Together, they delivered a clear message: Tesla wasn’t selling a dream, it was already building it.

For me, as a reader, it changed how I saw the risk. These weren’t just hopes—they had $50M from Toyota, $30M from Panasonic, and were actively shipping parts to Daimler.

It builds trust. It proves execution. And it signals that major players were willing to bet big on Tesla, even in the early days.

Takeaway: If your startup already has strong partnerships or early customers, group them smartly; it multiplies the credibility and shows investors that others have already said “yes.”

Slide 7: Roadster traction

When I saw this slide, it clicked: Tesla wasn’t just selling a car—they were building a global movement.

The map does the heavy lifting here. Green and red dots instantly show reach—what’s already open and what’s coming. They had stores popping up in Tokyo, Paris, Milan, Copenhagen, and more. This isn’t a startup stuck in a Silicon Valley bubble; they’re spreading fast.

But it’s not just about geography. The numbers matter too:

- 1,400+ Roadsters in 31 countries

- 8 million miles driven

That tells me the product is real, tested, and road-proven. It signals traction, trust, and scalability. Investors looking at this know Tesla isn’t fighting to prove demand anymore; they’re proving they can expand and operate globally. That’s a different level of execution.

Takeaway: If you’re trying to show scale, don’t just say it—map it, count it, show it moving. Visuals like this turn growth from abstract to undeniable. And in Tesla’s case, it makes you believe: “They’re not just leading in EVs—they’re leading everywhere.”

Slide 8: Tesla S model

This slide is where Tesla stops talking niche and starts talking scale. With the Model S, they’re projecting 20,000 units annually and aiming for 1% of the global premium market, which, let’s be honest, is no small pie.

What stood out to me wasn’t just the numbers, but the shift in tone. Tesla doesn’t want to stay a cool science project. They want to be the next BMW or Lexus—but electric. It’s ambition backed by strategy.

The sleek design, the production targets everything here says: We’re not a side project. We’re serious.

Takeaway: Tesla’s no longer pitching innovation; they’re pitching a business model that scales.

Slide 9: Model S features

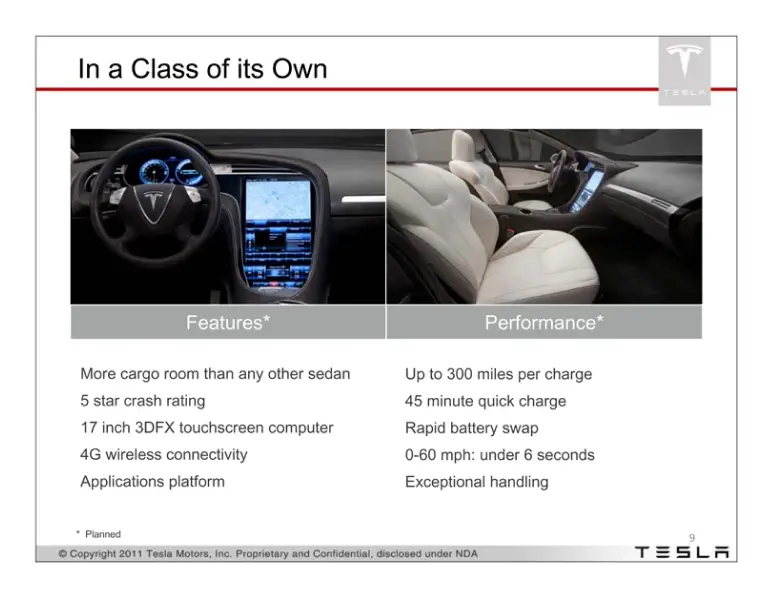

This slide is where Tesla makes its case: Model S isn’t just electric, it’s elite.

I see two things happening here. On one side, they’re flexing tech muscle—a 17-inch touchscreen, 4G, and an app platform. On the other hand, they’re proving it’s practical and fast; 300 miles per charge, 0–60 in under 6 seconds.

It’s smart because it calms both skeptics and enthusiasts: The ones worried about range, and the ones obsessed with specs.

Why it matters:

Tesla’s not just disrupting the industry with batteries; they’re redefining what a luxury sedan should feel like.

Takeaway: Model S isn’t competing with EVs; it’s coming for BMW, Audi, and Benz.

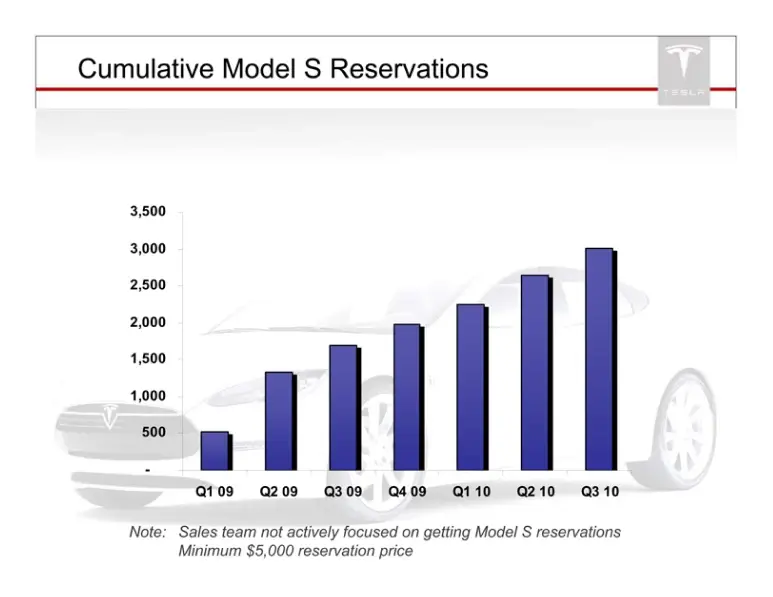

Slide 10: Model S reservation

At this point in the pitch, we’ve seen Tesla’s vision, the product, the performance; but now? Tesla proves demand is real.

Despite minimal sales effort, over 3,000 people have put down $5,000 each just to reserve the Model S in Q3. That’s over $15 million in early faith capital, and the product’s not even out yet.

Including such information in a pitch deck provides proof to investors that people will buy what Tesla is building.

Takeaway: Show real demand early; even pre-orders or deposits build investor confidence. Even small numbers work if they involve money.

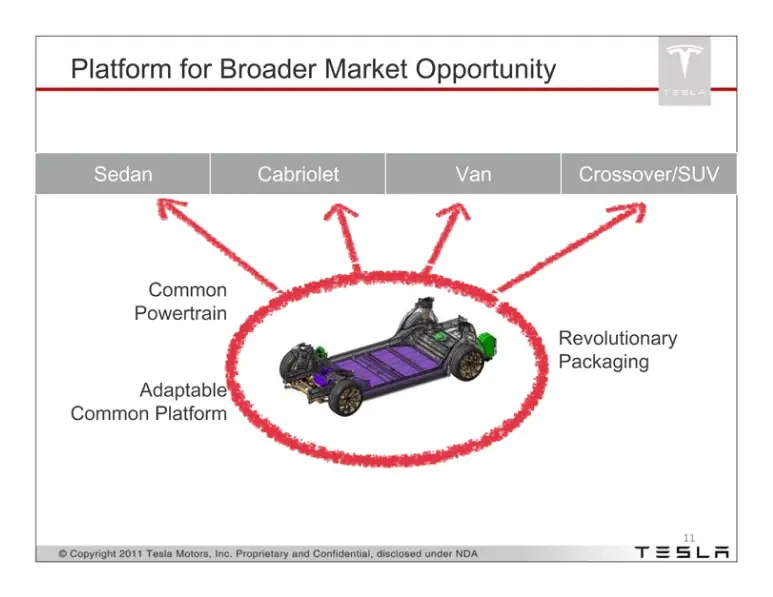

Slide 11: Market opportunity

What looks like a simple diagram of a chassis and a few car silhouettes is actually a bold promise: This isn’t a one-car company, it’s a full EV ecosystem in the making. I see this as Tesla saying, “Here’s our master plan. The same core tech can power sedans, SUVs, vans; you name it.”

Why does this matter? Because, as an investor, I’m not just backing a single product. I’m buying into a platform. And a platform means scale, speed, and serious upside.

Takeaway: Show how your product becomes a foundation. If you’ve got a roadmap beyond v1, even a simple visual can turn a great product into a long-term vision investors want in on.

Slide 12: Development timeline

Building a car company from scratch sounds impossible until you see a plan like this. Tesla breaks down the next three years with clear milestones: Engineering, crash tests, tooling, and first deliveries. It’s not vague; it’s specific, and that’s what makes it credible.

When I saw this, I didn’t just see a timeline; I saw proof that Tesla wasn’t guessing. They knew what came next, who was responsible, and when each piece would lock into place. That structure gives investors something rare in hardware: Confidence.

Takeaway: A detailed, realistic timeline tells investors you’re not winging it—you’ve mapped the road ahead and already started driving.

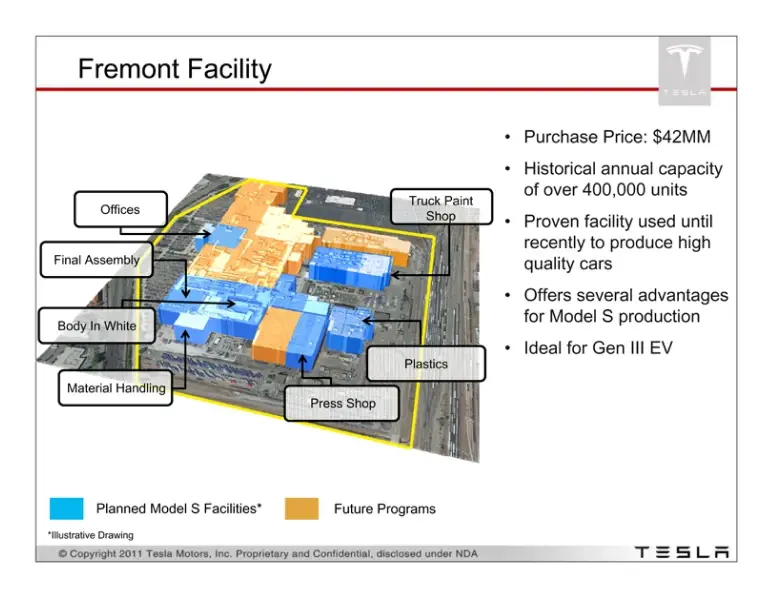

Slide 13: Factory acquisition

Placing this slide right after the execution roadmap is smart; it answers the next logical question investors will have: “Okay, you’ve got a plan—but can you build at scale?” And Tesla doesn’t just say yes; they show they’ve already solved it.

Buying the Fremont factory (a former Toyota/GM plant) for $42M isn’t just a win; it’s a signal. It tells the audience they’re not improvising. They’ve secured a proven, high-capacity facility that can support not just Model S, but future models too.

For me, this slide flips a major doubt into a solid strength. It’s not “how will they build?” anymore; it’s “they’re already set up to scale.”

Takeaway: Time your operational wins strategically in your deck. When you solve a major risk, place it right after raising the question, so it lands like an answer, not just an update.

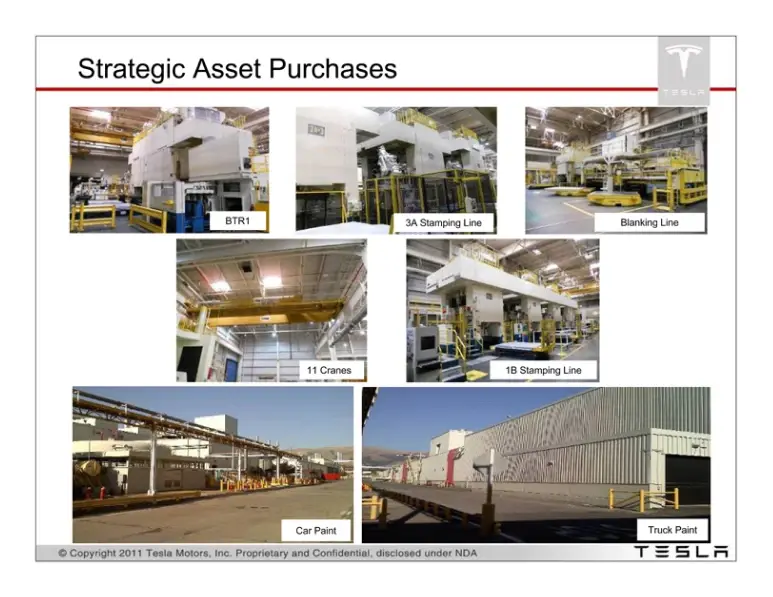

Slide 14: Strategic asset purchase

Following the factory slide, this one lands perfectly. I see it as Tesla saying, “We didn’t just buy the building—we bought the tools too.” It reinforces that they’re not starting from scratch. They’ve already secured key equipment—stamping presses, paint shops, cranes—the stuff that actually builds cars.

For me, this slide shows serious operational foresight. Most startups talk about big ideas. Tesla’s out here snapping up manufacturing hardware at bargain prices and shortening their ramp-up time. That’s not just scrappy; it’s strategic.

It might not be flashy, but to any investor with manufacturing experience, this screams: These people know what they’re doing.

Takeaway: Show the smart, behind-the-scenes moves. If you’ve locked in assets or capabilities early, highlight them; it proves you’re thinking ahead and executing like a company that plans to win.

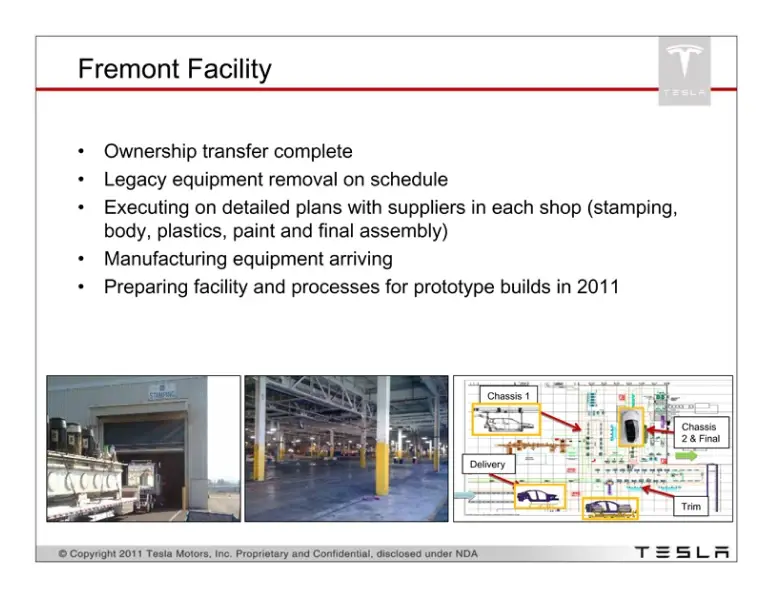

Slide 15: Factory preparation

Placing this slide right after the factory and equipment updates is spot on; it keeps the momentum going. At this stage, I’m already sold on the vision and infrastructure, and now Tesla is saying, “We’re moving fast.”

I see this as a mini progress report. Ownership is finalized, old equipment is being cleared, new installations are underway, and prototype builds are right around the corner.

It’s not a flashy slide, but it’s the kind that quietly builds confidence. As an investor, it tells me their execution isn’t theoretical; it’s happening now, and milestones are being hit.

It also signals that the money raised is already being put to work, not sitting idle. And that’s a big deal when you’re funding something this complex.

Takeaway: Show progress in motion. For anything capital-intensive, regular status updates prove you’re not just planning; you’re executing, and right on schedule.

What did I like the most about this deck?

It’s rare to see a pitch deck that blends ambition with execution so seamlessly, but Tesla’s slide deck pulled it off. Here’s what stood out to me most:

- Big vision, grounded by real traction; from Roadsters on the road to global partnerships.

- They answered tough questions before they were asked (especially around manufacturing).

- The team slide came early and hit hard, establishing credibility upfront.

- Every claim was backed by specifics: charts, contracts, and concrete milestones.

- Their roadmap wasn’t fluffy; it was detailed, timed, and already in motion.

- They didn’t just pitch a car; they pitched a scalable platform and long-term ecosystem.

Perfect your deck and pitch using Upmetrics

Tesla is a masterclass in startup storytelling—and the Tesla investor deck is proof. It shows how bold vision, backed by real execution, can turn skepticism into belief.

We walked through each slide, unpacking how Tesla combined all the slides to win investor trust. The key lesson? It’s not just what you’re building; it’s how clearly and confidently you communicate it.

If you’re building your pitch, tools like Upmetrics can help you structure your story, design a compelling deck using AI, and even craft your business plan, without starting from scratch.

Learn from Tesla, then build your version of it—with a little help from us.

All the best as you pitch your vision to the world.