Forget fancy degrees or specialized skills. Real estate is a classic way people are building wealth in 2024.

As Andrew Carnegie once said, “Ninety percent of all millionaires become so through owning real estate.” He understood land is a limited resource, guaranteeing its value will only climb.

In fact, demand for rentals is off the charts — prices have risen 50% since 2008, and vacancy rates are shrinking.

With average rents for all apartment types in the U.S. at $1317, the real estate industry is hot, forcing many to seek the stability of rental properties.

That’s why we put together this guide — to get you in on the action and show you how to start a rental property business.

What is a rental property business?

Simply put, you buy rental properties and rent them out. Tenants pay you each month, and that’s where the fun starts.

Sure, there’s the whole finding tenants and fixing leaky faucets, but you can always hire a property manager to handle those headaches.

Now, why dive into rental properties?

Well, besides that sweet passive income, one of the biggest draws is the potential for increased property value. This means your investment grows over time.

Plus, some tax benefits are involved, and owning a rental property can be a decent way to ride out the ups and downs of inflation.

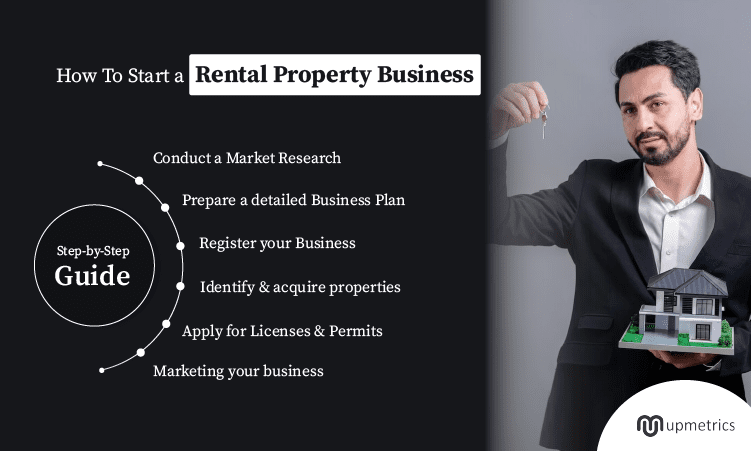

Now that you understand the basics of rental property businesses, let’s dive into the steps to start one.

How to start a rental property business?

- Conduct a market research

- Prepare a detailed business plan

- Determine financing options

- Select a location for your business

- Register your business

- Identify and acquire properties

- Source the right rental property equipment

- Obtain licensing and permits

- Get a business insurance

- Determine your rental pricing and profits

- Marketing your business

1. Conduct a market research

Before starting your rental property business, you need to do your homework. We’re not talking term papers here, but you must know your market.

First, is anyone even looking to rent in your area? Figure out how many places are empty, how much they cost, and if those trends are going up or down. Boring, we know, but this tells you if the whole idea is even worth your time!

Next, figure out who you want to rent to. College kids? Families? This is key because it changes everything — do they want a dumpy pad close to campus or a nice place with a backyard?

Scope out what else people are renting out. What kind of places are in demand? Are those places fancy or basic? This shows you where there’s room to jump into the market and outshine the competition.

Finally, picture your perfect tenant. What do they care about? What makes them tick? Once you know that, you can tailor your whole rental property experience to them and practically guarantee that those leases get signed!

2. Prepare a detailed business plan

Your rental property business plan is like the foundation of your investment empire. It’s where you strategize about the perfect rental properties, figure out how to keep tenants happy, and lay out your master plan for steady profits.

A solid rental property business plan also helps you to:

- Target the right tenants

- Set profitable rental prices

- Budget for repairs & upgrades

- Anticipate problems

- Impress investors & lenders

Not very good at writing? Need help with your plan?

Write your business plan 10X faster with Upmetrics AI

Plans starting from $14/month

3. Determine financing options

Let’s face it: buying a rental property isn’t the same as your morning coffee run. We’re talking serious investment territory.

In 2021, the average single-family home would cost you around $387,600. Apartment complex? That jumps to an average of $12.5 million. Unless you’ve got a hidden fortune, you’ll likely need a financial boost.

The good news is that today’s landlords have plenty of financing choices. You could go with a traditional bank, a private lender, or a hard money lender, or explore other options. There might even be tax benefits tied to certain loans—definitely worth looking into!

While some alternative financing routes might have slightly higher interest rates, they could offer more flexible terms. It’s all about finding what works best for your situation.

4. Select a location for your rental property business

Location is the real estate equivalent of a make-or-break deal! Think about it: a beachfront hotel in a landlocked town? That’s a recipe for financial disaster. Or a burger joint trying to muscle in between fast-food giants? Not going to last long. Location is just as crucial in the real estate business.

Choosing the right neighborhood is like playing a high-stakes strategy game. The rules change depending on whether you’re dealing with commercial or residential rental properties.

Cracking the commercial code means thinking like your customers:

- Can they easily reach your rental property business?

- Is there enough parking?

- Will those pesky zoning laws let you operate the way you need to?

- And don’t forget the long game — will this spot still be hot in 10 years?

5. Register your business

Okay, you’ve found your spot; now it’s time to make your rental property business official! First, choose a name that stands out. It should be memorable, web-friendly, and one that will stay visible in the crowd of competitors.

Now, let’s dive into the necessary paperwork:

- Each state has its own rules, so figure out how to register your rental property business where you’ll be operating.

- Get that federal tax ID number

- Choose your business structure

- Set up payment systems to streamline the income flow.

If legal jargon gives you a headache, consider hiring a lawyer to help navigate the complexities.

6. Identify and acquire rental properties

You don’t need fancy detective gear, but getting your first rental property right takes some smarts. Here’s how to find that perfect deal:

Step 1: Know the Turf

Before you start flipping through listings, understand the local market like the back of your hand.

What are houses selling for?

How much rent can you realistically command?

Are there neighborhoods on the rise?

This isn’t about guesswork—consult property reports, chat up local realtors, and get a sense of the market and its direction.

Step 2: Money Matters

Next, it’s crunch time with your budget. The sticker price on a property is just the start—remember those pesky closing fees, inspections, and maybe even a renovation or two.

Get those numbers down on paper before you fall in love with a place.

Step 3: The Hunt is On

Now the fun part — the property hunt! Go beyond just the online listings. A good real estate agent can tap into their network, find those hidden gems, and even give you the inside track on auctions.

Remember, sometimes the best deals aren’t even advertised.

Step 4: Is it a Money Maker?

Not every property is worth investing in. Therefore, you have to carefully analyze the financials of each potential investment.

Here’s what to consider:

- Can you charge enough rent to cover costs and turn a profit?

- How much are property taxes, insurance, and ongoing maintenance? These expenses impact your profit.

- Be realistic and thorough in your analysis.

Step 5: Perform due diligence

Found a place that you really like? Before you sign the official paperwork, it’s important to perform due diligence.

Hire inspectors to look for problems, an appraiser to ensure it’s worth the price, and maybe even a lawyer to check those confusing legal papers. Dig into the details and uncover any hidden risks.

If everything checks out, seal the deal! Your agent or lawyer will help you get the best price and handle all the paperwork.

7. Source the right rental property equipment

Before you hang that “For Rent” sign, you’ll need to consider the equipment and supplies needed to attract (and keep) the right tenants.

The kind of rental you offer will dictate a lot of your equipment needs:

Residential Rentals

With long-term residential leases, forget about tenants taking care of maintenance. Government regulations are strict — your property needs to be safe and livable.

This means working utilities, leak-free spaces, clean common areas, and all those structural basics like safe floors and railings.

Long-term tenants usually only call with significant issues; unless it’s their fault, you’re responsible for repairs.

Short-Term Rentals

Short-term rentals are a whole different ball game. You still have to meet those regulations, but now you’re also in whirlwind mode — constant cleaning and restocking between guests.

These renters expect perks like toiletries, spotless kitchens, and even those little spice packets. This is where inspections become crucial—they let you catch damage and top off supplies.

But if all this makes you break out in a sweat, hire a reliable cleaning service or even a full-blown property management company (they’ll take a cut of that rent, but peace of mind can be worth it!).

8. Obtain licensing and permits

Being a landlord means navigating some official paperwork, just like with any other business. This usually involves registering your rental properties and getting specific licenses—it ensures everything’s on the up and up.

With that being said, here are some essential licenses you might need to get started:

- Certificate of occupancy

- Housing business license

- Zoning permits

9. Get a business insurance

Insurance can be a snooze-fest. But when it comes to your rental property, it’s non-negotiable. Think of it like a force field protecting your investment from those “uh-oh” moments.

Here’s how to find the coverage that makes sense:

Step 1: Know Your Risks

Picture this: fires, floods, a lawsuit from a tenant who took a tumble… not fun, but good to keep in mind. Knowing the potential risks helps you tailor your insurance accordingly.

Step 2: Coverage Options 101

Here’s the gist of landlord insurance:

- Property Insurance: Covers damage to your building and possibly belongings inside.

- General Liability Insurance: Protects against lawsuits stemming from injuries on your property.

- Loss of Income Insurance: Replaces rent if the property becomes uninhabitable.

- Umbrella Insurance: Offers extra liability coverage beyond other policies.

Step 3: Shop Around

Get quotes from different insurance companies. An agent who understands rental properties can help guide you toward the best fit for your needs.

Step 4: The Fine Print Matters

Before signing, carefully review the policy details. Understand what’s covered, what isn’t, and the process for filing a claim if necessary.

10. Determine your rental pricing and profits

Figuring out how much money you could make from a rental property isn’t complicated. It’s basically your expected rent minus all those pesky expenses.

Now, for the good part — figuring out the potential income! Check out what similar rentals in your area are going for.

Look for places with the same number of bedrooms, bathrooms, and those essential amenities. This gives you a solid idea of what the market will bear.

Once you’ve got a good grasp of both income and expenses, you can start to see how much profit you might realistically make.

Wondering what kind of returns are typical? Here’s the general idea:

- Single-Family Homes: Typically see a 1%-4% average yearly return on the price you paid.

- Commercial Rental Properties: Can offer a bigger return, generally in the 6%-12% range.

Tip: The rental market isn’t set in stone. Demand changes, the local economy shifts, and you might make upgrades. So, reevaluate your rental rate regularly to make sure you’re staying competitive and maximizing your profit.

11. Marketing your business

Getting your rental property seen by the right people takes a strategic approach. Here’s how to create a plan that works:

Step 1: Choose Your Channels Wisely

Your marketing needs to go where your potential renters are. Consider these:

- Online: Listing sites, social media, a simple website, email marketing — ensure you’re present and easy to find.

- Offline: Local newspapers, flyers, and community events can still be influential, depending on your target audience.

Step 2: Define Your Brand

What makes your rental property business unique? Is it modern, cozy, pet-friendly? Understanding your key selling points helps you craft a consistent message and look (think logo, colors, etc.).

Step 3: Spread the Word

Choose how you’ll attract your ideal tenant. Here are some ideas:

- Online Ads: Targeted campaigns can be a great way to get qualified leads.

- Grassroots Marketing: Think of partnering with local businesses, distributing flyers, or getting involved in community events that attract your type of tenant.

Remember, as a rental property business owner, your budget and timeline matter! Pick strategies that make sense for your rental property business.

Step 4: Did It Work?

Don’t just guess at what’s working—track your results. Website analytics and simple lead tracking (even just a spreadsheet!) will tell you where your renters are finding your rental property business. Focus your efforts on the strategies that bring the best results.

How profitable is a rental property business?

Being a landlord is all about the numbers. Location, the market, how much rent you charge, your costs — it all adds up to profit or loss.

That’s why smart rental property investors use the “1% rule” — a quick test for potential rentals. The idea is simple: monthly rent should at least be 1% of the purchase price.

For example, if you buy a house for $200,000, you’d aim to rent it out for at least $2,000 monthly. But the 1% rule is just the first act.

Location, market trends, repairs—you have to factor those in. It’s not a magic formula, but it cuts the deadweight fast.

Meeting the 1% rule means you’re more likely to have cash left after bills. The challenge arises when property prices are high, but rents don’t match. That’s when successful landlords need to get clever.

Features that make a rental property successful

Forget trying to reinvent the wheel in the real estate business — instead, study what works! Successful rental property businesses have some key things in common. Here’s the shortlist:

Location, location, location

This isn’t just a cliche. Where your rental property sits is everything. Near a big employer? You’ll attract reliable working folks. Good schools nearby? Families will flock. Do your homework—this decision sets the stage for your whole investment.

Property Taxes

Rental property taxes vary wildly — they can make or break your profit margin. Don’t get blindsided! A little research upfront reveals what you’re in for, letting you price your rental accordingly.

Safety Sells

Everyone wants to feel secure. Avoid areas with rising crime. Your tenants (and their stuff!) need to feel safe. A little online sleuthing paints a clear picture.

Conclusion

Managing a rental property business takes careful planning and execution. Success means mastering logistics, addressing tenant issues, and staying financially healthy.

It’s a big leap from casually renting out an extra space — if you’re serious, that means considering amenities and maybe even multiple rental properties.

So, for a rock-solid launch, explore detailed rental property business plan examples at Upmetrics. They’ll help you navigate every step of this exciting venture.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.