Executive Summary

UrbanHaven Property Rentals, LLC is acquiring and operating a six-unit furnished rental property in Charlotte’s metro area. Our business is built for steady cash flow, disciplined operations, and a clear pathway to debt repayment. We focus on long-term corporate tenants, healthcare travelers, and relocating professionals who require furnished, move-in-ready apartments located near the city’s core employment centers.

Opportunity

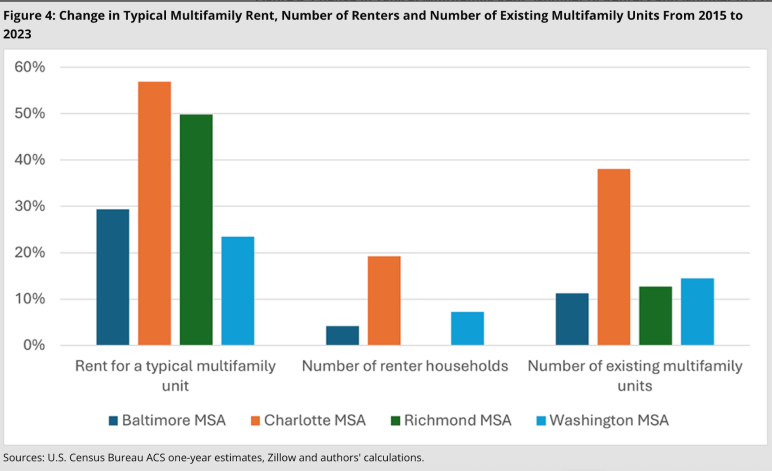

Charlotte’s metro area continues to show strong rental demand supported by population growth, diversified employers, and limited furnished mid-term housing.

The Charlotte metro population is 960,608. It’s currently growing at a rate of 1.82% annually, and its population has increased by 9.79% since the most recent census, which recorded a population of 874,948 in 2020. This means more people will need a home. Moreover, 48% of households are rental occupancy. That’s almost half the households in Charlotte.

Our research and data collected show this demand is concentrated around Uptown Charlotte and the surrounding neighborhoods, where business travelers and relocating families prefer furnished rentals that remove setup friction. UrbanHaven fills this gap with fully furnished units that provide residential comfort with corporate-friendly terms.

Business Concept

UrbanHaven will operate at 1023 Kenilworth Avenue, a six-unit multifamily building with a mix of one-bedroom, two-bedroom, and three-bedroom furnished apartments. We combine predictable monthly rental income with value-added services such as housekeeping, maintenance, utilities, Wi-Fi, and optional corporate packages.

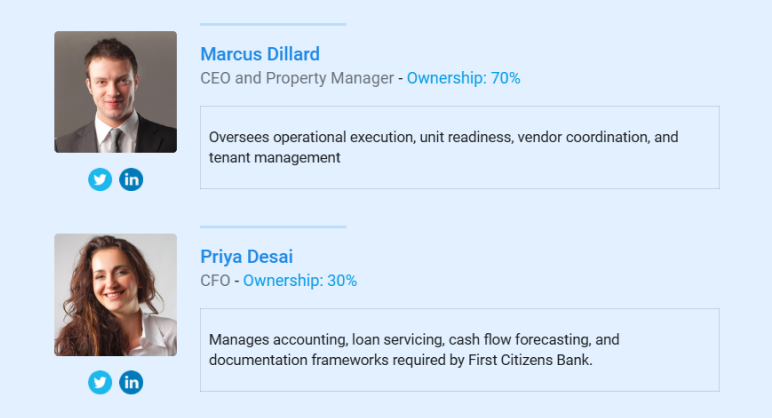

Our business operates as a North Carolina LLC with two owners: Marcus Dillard, 70% ownership, and Priya Desai, 30% ownership.

Funding Requirement

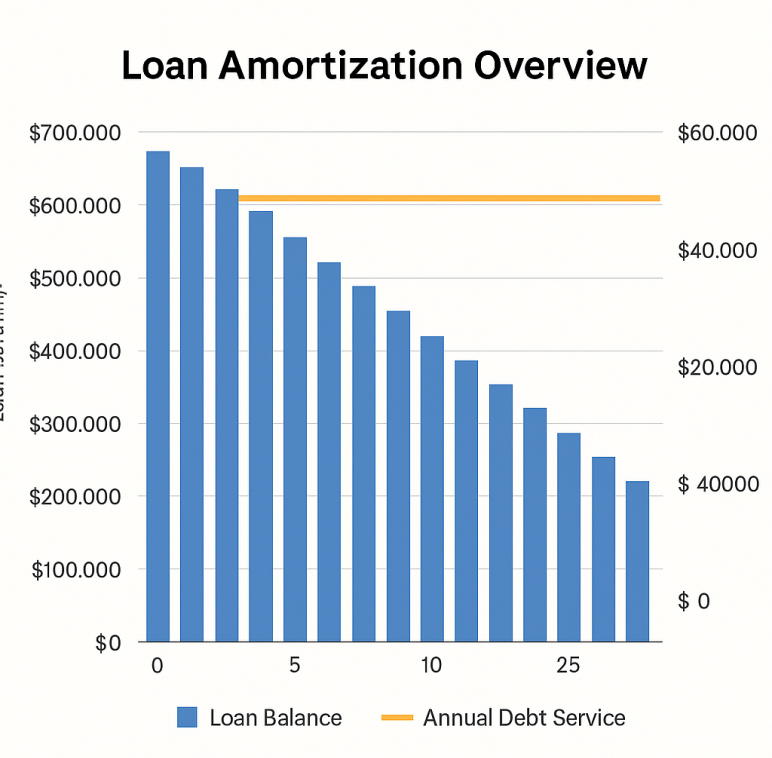

UrbanHaven is applying for a $690,000 investment property loan from First Citizens Bank at the Charlotte Uptown branch. The funds will be used for initial working, the acquisition of the six-unit property, renovations and interior furnishing, insurance, licensing, and lease-up costs.

We intend to opt for a 20-year amortized loan with an 8.1% fixed rate for the first 10 years. It shall be supported by $230,000 in owner equity contributed from savings and retained earnings.

Target Market

Our three primary tenant groups include:

- Business professionals on long-term assignments (25 to 45 years)

- Healthcare travelers and contractors

- Corporate relocation clients and small families needing furnished homes under one-year leases

Secondary groups include young couples seeking furnished rentals without the burden of buying furniture or signing long leases.

Competitive Position

Our nearby competitors include Landing, Blueground, and Reluxme. UrbanHaven differentiates through:

- Residential apartment feel rather than hotel-style units

- Full furnishings, utilities, cleaning services, and pet-friendly options

- Medium-term stability (6–12 months) that appeals to corporate clients

- A predictable maintenance and management system built around long-term occupancy rather than high-turnover stays

Financial Overview

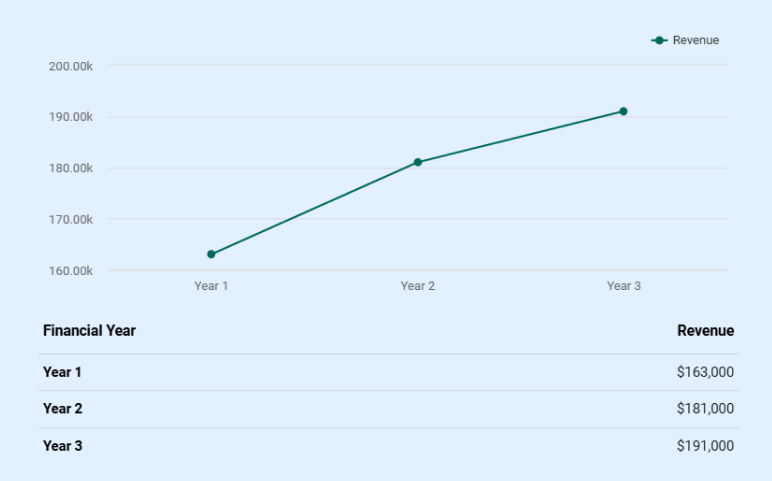

UrbanHaven’s gross potential rent based on the unit mix totals $181,200 per year. The actual modeled revenue under expected occupancy is:

- Year 1: $163,000

- Year 2: $181,000

- Year 3: $191,000

EBITDA margins range from 13%-23% across the first three years.

Furthermore, UrbanHaven’s key operating expenses include:

- Cleaning, insurance, utilities, and property management: About $45,000 per year

- Mortgage payments: About $60,000 per year

- Maintenance reserve: About $10,000 per year

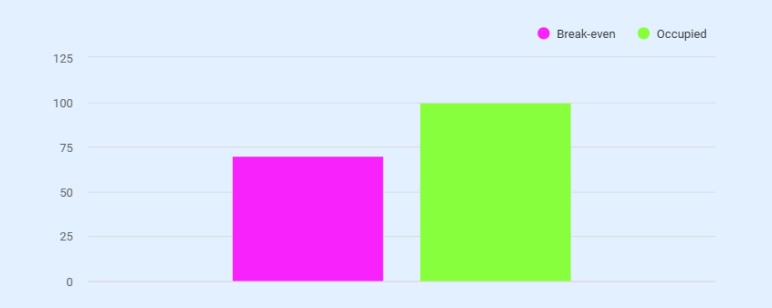

Break-even occupancy is approximately 78%, equal to leasing five out of six units at current projected rents. This is significantly below the local occupancy average of 95%.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you.

Company Overview

UrbanHaven Property Rentals is focused on residential furnished rentals in Charlotte’s core employment corridor. We operate from 416 South Tryon Street, Suite 850, Charlotte, NC 28202, placing management activity close to Uptown and within minutes of the Kenilworth Avenue asset.

Legal Structure

We’re registered as a North Carolina LLC to provide liability protection, operational flexibility, and a clear member-managed structure suitable for property ownership and loan compliance. All filings, landlord licensing, and rental permits will be maintained in accordance with Charlotte regulations and state requirements.

Ownership Breakdown and Management Commitment

| Owner | Ownership % | Title | Primary Responsibilities |

|---|---|---|---|

| Marcus Dillard | 70% | CEO and Property Manager | Oversees operational execution, unit readiness, vendor coordination, and tenant management. |

| Priya Desai | 30% | CFO | Manages accounting, loan servicing, cash flow forecasting, and documentation frameworks required by First Citizens Bank. |

Both founders bring direct, relevant backgrounds.

- Marcus has more than ten years of property management experience at Greystar Communities, including oversight of mid-tier multifamily apartments across the region.

- Priya previously worked as a financial analyst at Wells Fargo, focusing on real estate financial modeling.

Their combined track record reduces execution risk and supports the operational reliability required for furnished corporate rentals.

Business Positioning

UrbanHaven targets the mid-range furnished-housing segment, catering to tenants who want residential stability with corporate-level convenience. By narrowing the model to 6 to 12-month leases and using furnished units rather than short-stay models, we present a more predictable income stream suitable for debt repayment.

Property Acquisition and Description

UrbanHaven Property Rentals, LLC intends to acquire and operate the six-unit multifamily property located at 1023 Kenilworth Avenue, Charlotte, NC. The building’s unit mix, location, and renovation requirements support a stable income model suitable for furnished mid-term rentals and long-term corporate tenants.

Asset Description: 1023 Kenilworth Avenue

The property is a six-unit multifamily building located in Charlotte’s Dilworth–South End corridor, close to Uptown. The unit mix supports a diversified rent roll:

| Unit | Projected at |

|---|---|

| Two 1BR units at 700 sq ft | $1,900 per month |

| Three 2BR units at 950 sq ft | $2,700 per month |

| One 3BR unit at 1,200 sq ft | $3,200 per month |

All units will be delivered fully furnished with utilities and Wi-Fi included. The building’s layouts, square footage, and residential feel align with tenant groups seeking housing that’s move-in ready and suitable for multi-month assignments. Gross potential rent is $181,200 per year.

Building Condition

The building is structurally sound and requires only cosmetic and functional upgrades to meet UrbanHaven’s furnished-rental standards. Utility systems, layouts, and existing finishes provide a solid base for renovation without major structural changes. Required improvements center on flooring, paint, lighting updates, appliance refresh, bathroom fixture replacements, and furnishing upgrades. No major deferred maintenance or structural deficiencies have been identified.

Planned Improvements

UrbanHaven will execute targeted improvements immediately upon acquisition to prepare all six units for furnished occupancy:

- Interior painting and lighting updates

- Flooring replacement in selected units

- Kitchen and bathroom fixture upgrades

- Installation of furnishings, décor, kitchenware, and linens

- Wi-Fi installations and connectivity checks

- Minor exterior and curb-appeal repairs

These upgrades are designed to support rental readiness, increase tenant satisfaction, and create consistent unit standards across all six apartments.

Long-term Operating Viability

Charlotte’s corporate housing needs are unlikely to shrink because they’re tied to job relocations, consulting cycles, banking, healthcare, and regional growth. UrbanHaven’s model targets these stable segments instead of relying on tourism or short-stay travelers. This way, we improve income predictability and support a long-term amortized loan structure.

Market Analysis

Regional Overview

Charlotte’s metro area continues to show strong population and employment growth supported by financial services, healthcare, logistics, and technology employers. With a population of approximately 960,608, the region attracts relocating professionals, traveling healthcare workers, and corporate assignees who require furnished housing for periods of multiple months. This creates steady demand for mid-term rentals positioned near Uptown and major employment hubs.

According to research, 48% of Charlotte houses are rental occupancy, which is almost half. This shows tight supply and consistent absorption across professionally managed properties.

Neighborhood Fit and Demand Drivers

The Kenilworth Avenue property sits near Uptown Charlotte, Atrium Health Carolinas Medical Center, and South End’s business clusters. This corridor offers direct access to employment centers that supply consistent tenant demand, including:

- Corporate relocations

- Healthcare contractors

- Consultants and business travelers

- Small families transitioning into the area

- Couples seeking 6–12 month leases without buying furniture

The demand drivers in this area that support UrbanHaven’s stable occupancy include:

- 960,608 metro population with steady inflow

- Household rental occupancy at 48%

- Corporate housing demand is increasing at about 11% yearly

- Rent growth is rapidly increasing

The Kenilworth corridor offers fast access to major employment centers without the premium pricing of buildings inside Uptown’s densest blocks. This helps tenants secure furnished housing within budget while still staying close to work sites.

Demand for Mid-Term Furnished Rentals

The furnished rental segment is supported by tenants who require housing for periods longer than typical short stays but shorter than a standard twelve-month lease. Key demand drivers include:

- Corporate relocations tied to Charlotte’s banking and finance sector

- Healthcare staffing cycles at Atrium Health Carolinas Medical Center

- Project-based assignments in consulting and engineering firms

- Families transitioning into the region before purchasing a home

- Remote professionals who prefer furnished units with flexible terms

Corporate rental demand is growing at an estimated 11 percent annually, supported by employer relocation programs and long-term contract work. This sector favors well-located units with predictable monthly pricing and minimal setup requirements.

Submarket Positioning

The Kenilworth Avenue property sits within the Dilworth–South End corridor, a location that links Uptown’s financial district with major medical facilities and business clusters. This placement is well-suited for mid-term tenants who need proximity to work sites without choosing higher-priced high-rise buildings in the central business district. The submarket offers:

- Strong access to Uptown employers

- Immediate proximity to healthcare facilities

- Walkable neighborhoods with retail and amenities

- Steady leasing activity across one-, two-, and three-bedroom formats

These characteristics support continuous interest from professionals and small families seeking furnished housing that offers both comfort and convenience.

Supply Conditions

Supply in the furnished mid-term segment remains limited relative to overall rental inventory. Larger operators such as Landing, Blueground, and Reluxme serve parts of the market but focus on either hospitality-style stays or buildings with different layouts and pricing. Many multifamily buildings do not offer fully furnished units, leaving a clear opening for residential-style furnished housing with lease terms between six and twelve months.

The combination of high occupancy, population inflow, and limited furnished supply creates favorable conditions for UrbanHaven’s targeted offering.

Tenant Profile Alignment

The tenant groups targeted by UrbanHaven are consistent with long-established demand patterns in Charlotte:

- Working professionals aged 25 to 45

- Healthcare contractors assigned to nearby hospitals

- Corporate transferees who require temporary housing

- Small families navigating relocation timelines

- Couples who prefer to avoid furnishing costs

These groups seek housing that reduces transition friction and provides predictable monthly expenses. Furnished units with included utilities and Wi-Fi address these preferences directly.

Long-Term Outlook

The region’s employment base and sustained relocation activity suggest continued demand for mid-term furnished rentals. As companies expand and healthcare systems continue to rely on traveling staff, the need for stable, well-located furnished units is expected to remain strong. UrbanHaven’s focus on mid-term leasing reduces exposure to short-stay volatility and supports steady occupancy across market cycles.

Stop searching the internet for industry & market data

Get AI to bring curated insights to your workspace

Rental Services

Furnished Rental Housing Service

UrbanHaven Property Rentals, LLC provides fully furnished residential apartments designed for tenants who require mid-term housing with minimal setup requirements. Each unit will include furniture, décor, kitchenware, linens, appliances, utilities, Wi-Fi, and access to scheduled maintenance. The offering targets tenants who prioritize convenience, predictable monthly costs, and a residential environment suitable for extended stays.

Service Pricing:

- Included in monthly rent: $1,900 (1BR), $2,700 (2BR), $3,200 (3BR)

- Utilities + Wi-Fi included at no additional charge

- No onboarding fees

Lease & Occupancy Services

UrbanHaven operates as a service provider responsible for tenant onboarding, screening, placement, lease execution, and renewals. Service includes:

- Digital application and screening

- Electronic lease signing

- Renewal negotiation

- Month-11 renewal alerts

- Employer-approved extensions

Service Pricing:

- Application screening fee: $45 per applicant

- Lease processing: Included in rent

- Renewal fee: $0 to support retention

- Corporate extensions: $125 administrative fee

Corporate Housing Packages

Corporate clients receive a bundled service structure that supports employee relocations, long-term assignments, and contractor placements. Packages include:

- 6 to 12-month lease terms

- Consolidated monthly invoicing

- Turnkey unit readiness upon move-in

- Optional monthly housekeeping

- Support for bulk leasing of multiple units

These packages reduce administrative workload for employers and provide consistent occupancy for the property.

Service Pricing:

- Corporate rate premium: $150 per month per unit

- Bulk leasing discount: 3% for two units, 5% for three or more

- Corporate housekeeping add-on: $120 per visit

Mid-Term Leasing Structure

The leasing model focuses on durations of six to twelve months. This approach stabilizes occupancy, reduces turnover costs, and supports corporate and healthcare contracts that require predictable housing.

We specialize in lease durations between six and twelve months. This service model reduces turnover compared to short-stay rentals and supports tenants whose assignments or relocations have defined timeframes. Our components include:

- Screening and application processing

- Digital lease execution

- Renewal options for qualifying tenants

- Extension processing for employers and agencies

This structure matches the demand patterns of the Charlotte market and supports the loan’s repayment assumptions.

Service Pricing:

- Lease terms: 6-month lease: Standard rent + $150 monthly short-term premium. 9-month lease: Standard published rent (no premium). 12-month lease: Standard published rent

- Extension fee for employers or agencies: $125 administrative fee

- Early termination fee: One month’s rent

Housekeeping and Maintenance Add-ons

We offer optional monthly housekeeping delivered through a contracted vendor. We ensure routine maintenance. Repair requests are handled by a dedicated maintenance technician supported by an external service network. This allows tenants to maintain a comfortable living environment without managing service providers independently.

Service Pricing:

- Standard monthly housekeeping: $95 per visit

- Full housekeeping package (2 visits/month): $180 per month

- Turnover cleaning (paid by landlord): included in the $600/month vendor contract

- Linen refresh add-on: $25 per visit

Pet Program

All units are pet-friendly. Tenants with approved pets pay a one-time $400 pet fee to cover additional cleaning and wear. Allowing pets broadens the applicant pool, particularly among relocating families and long-term professionals.

Service Pricing:

- One-time pet fee: $400 (from brief)

- No monthly pet rent

- Cleaning surcharge at move-out only if required: $75–$125

Competitor Overview

UrbanHaven competes with established furnished rental providers that operate within the Charlotte market:

These competitors focus on higher-density or hospitality-style furnished units. Some emphasize short-term stays, which introduces higher turnover and variable occupancy.

Competitive Positioning

UrbanHaven positions itself as a provider of residential-style furnished housing designed for stays of six to twelve months. Key advantages include:

- Residential apartment layouts rather than hospitality-style units

- Furnishings, utilities, Wi-Fi, and optional housekeeping included

- Mid-term lease terms that reduce turnover

- Pet-friendly units suitable for relocating families

- Proximity to Uptown, healthcare hubs, and South End business clusters

The focus on corporate and healthcare tenants supports predictable occupancy cycles and reduces exposure to seasonal demand.

Demand Alignment

The combination of stable tenant groups, strong market occupancy, and concentrated employment centers creates favorable conditions for long-term performance. Mid-term furnished rentals address a gap between short-stay hospitality units and traditional twelve-month unfurnished leases.

Operations

Daily Management

UrbanHaven Property Rentals, LLC operates on a structured management model designed to maintain unit quality, streamline tenant communication, and support consistent occupancy. Management hours run Monday through Friday, 9:00 AM to 6:00 PM, with weekend support available for urgent matters. Our core responsibilities include tenant onboarding, rent collection, maintenance coordination, vendor communication, and compliance management.

Staffing Model

We prefer a lean staffing structure that supports operational efficiency across six units:

| Role | Headcount | Compensation | Core Responsibility |

|---|---|---|---|

| CEO/Property Manager (Marcus Dillard) | 1 | $70,000/year | Oversees day-to-day operations, tenant relations, lease management, unit inspections, and vendor coordination. |

| CFO/Accounting Lead (Priya Desai) | 1 | $60,000/year | Manages financial tracking, reporting, loan servicing, bank documentation, and compliance filings. |

| Property Maintenance Technician (Part-Time) | 1 | $30,000/year | Handles routine repairs, preventive maintenance, and unit readiness. |

| Cleaning Crew (Outsourced) | 1 team | $600/month contract | Turnover and scheduled housekeeping. |

| Leasing Agent (Contract) | 1 | 6% of signed leases | Tenant sourcing during lease-up and vacancy periods. |

This structure maintains a balanced cost framework while ensuring timely service delivery.

Software Stack

We also run our company with the help of established software systems for accuracy and workflow consistency:

- Buildium for property, tenant, and accounting management

- QuickBooks Online for financial reporting and recordkeeping

- Zillow Rental Manager and Apartments.com for listings

- Google Workspace for document management and internal coordination

These systems allow UrbanHaven to manage leases, track maintenance, process payments, and maintain accurate financial records.

Compliance Requirements

UrbanHaven maintains all required licenses and permits for rental operations within Charlotte and the state of North Carolina. Compliance components include:

- City of Charlotte rental permit

- State business registration and landlord licensing

- Property insurance and umbrella liability coverage

- Adherence to local housing regulations and fair housing laws

Timely renewals, updated documentation, and routine legal reviews are how we ensure our business remains in good standing.

Operational Standards

Units are maintained to consistently high standards for cleanliness, safety, furnishings, and functionality. We have move-in checklists, quarterly inspections, and maintenance logs to support the longevity of assets and tenant satisfaction.

Maintenance Framework

UrbanHaven Property Rentals, LLC maintains a structured maintenance system centered on preventive care, rapid response capabilities, and consistent unit standards. Our framework includes:

- Routine inspections to identify wear, safety issues, and equipment performance

- Scheduled servicing of HVAC, plumbing, and electrical components

- Standardized repair protocols to ensure consistent quality across units

- Reserved maintenance funds to cover unexpected repairs and reduce downtime

The maintenance technician handles day-to-day tasks and coordinates specialized work through contracted providers when needed.

Contracted Vendors

UrbanHaven uses established third-party vendors selected for reliability, service quality, and familiarity with multifamily buildings:

| Vendor | Service | Contract Terms |

|---|---|---|

| Crescent Design & Build | Renovation work, finish upgrades, and interior design setup | Project-based agreement covering renovation scope. Fixed cost allocation tied to the $60,000 renovation and interior setup budget. Timeline commitment through August 2026. |

| Queen City MaidPro | Cleaning, turnover preparation, and optional tenant housekeeping | Recurring monthly service contract at $600 per month. Includes turnover cleaning and scheduled housekeeping. Service-level expectations tied to unit readiness timelines. |

| HomeServe Pro Network | Repair services for specialized maintenance tasks | Pay-per-service structure for specialized repairs. Integrated response protocols for urgent and non-urgent maintenance. Technician scheduling is coordinated through the property management software. |

| Rogers & Wilkes Realty Law | Legal support for compliance, contracts, and filings | Service billed per matter or hourly. Covers lease templates, compliance filings, and closing documentation. |

| Nationwide Commercial Rental Policy | Property insurance and liability coverage | Annual premium of $6,200 per year. Coverage includes property, liability, and landlord protections. |

These vendors support fast unit turnover, consistent presentation, and reduced service interruptions.

Service-Level Expectations

UrbanHaven maintains defined service expectations to support tenant satisfaction and operational stability:

- Response to non-emergency maintenance requests within 24 to 48 hours

- Completion of routine cleaning on scheduled cycles

- Unit turnover, cleaning, and staging completed within established timelines

- Compliance with safety, habitability, and inspection requirements

- Use of standardized materials and finishes to streamline ongoing repairs

Clear expectations reduce variability across units and create predictable operating performance.

Integration With Management

All vendor activity is integrated into our company’s property management system for scheduling, billing, documentation, and reporting. Maintenance logs, inspections, and vendor invoices are stored within the software stack, ensuring full traceability for financial reporting and lender oversight.

Investors hate amateur writing errors

Instantly improve your plan w/ our AI writing assistant

Marketing And Leasing Strategy

Channel Mix

We at UrbanHaven Property Rentals, LLC use a defined set of marketing channels that consistently attract qualified tenants for furnished mid-term rentals:

- Zillow, Apartments.com, and Furnished Finder, accounting for approximately 35% of tenant leads

- Corporate relocation networks such as ADP and Weichert, contributing an estimated 25%

- Website visibility and local search traffic, generating about 20%

- Paid social advertising on Facebook and Instagram targeting relocating professionals and remote workers, accounting for roughly 10%

- Realtor referral relationships, contributing the remaining 10%

This mix captures both individual renters and institutional clients.

Corporate Partnerships

Corporate tenants represent a core occupancy driver. UrbanHaven maintains relationships with relocation agencies, staffing firms, and employers who place employees in Charlotte for extended periods. Bulk leasing options are available for organizations that require multiple units across six to twelve months. Consolidated invoicing, unit readiness, and scheduled cleanings create a streamlined housing solution for employers.

Occupancy Strategy

The leasing strategy prioritizes long-term occupancy stability. The target is to maintain occupancy at or above 90 percent during the first year. Key components include:

- Accurate pricing based on unit size, amenities, and location

- Pre-leasing during renovation completion to reduce initial vacancy periods

- Standardized screening and application processes

- Renewal incentives for qualified tenants to extend stays

- Diversified tenant mix across corporate, healthcare, and professional segments

This approach supports predictable revenue and reduces turnover-related costs.

Promotions and Incentives

UrbanHaven offers targeted incentives to accelerate lease-up and secure reliable tenants:

- First-month free utilities for twelve-month leases

- Corporate bundle discounts for employers leasing two or more units

- Referral commissions for real estate agents who secure approved tenants

Promotions are used selectively to maintain overall rent integrity while supporting efficient absorption during the initial lease-up phase.

Leasing Process

The leasing cycle follows a defined workflow supported by property management software:

- Online listing publication and inquiry management

- Virtual and in-person tours

- Application processing and screening

- Digital lease execution

- Move-in coordination and unit readiness checks

This process minimizes administrative delays and ensures a consistent tenant onboarding experience.

Financial Plan

Startup Investment Summary

The initial investment supports property acquisition, renovation, furnishing, licensing, insurance, marketing, and working capital. Total project funding is structured as follows:

- Property acquisition down payment and closing costs

- Renovation and interior setup costs

- Furniture and appliance purchases

- Insurance, legal, and licensing expenses

- Marketing and staging for the initial lease-up

- Software and technology implementation

- Three-month working capital reserve

Total required investment: $920,000, funded by $230,000 in owner equity and $690,000 in bank financing.

Revenue Model/Forecast

UrbanHaven generates revenue through monthly rents for six fully furnished units. Gross potential rent from the established pricing structure totals $181,200 per year. Revenue projections based on occupancy and average rent per unit are year 1: $163,000 (90% occupancy), year 2: $181,000 (95% occupancy), year 3: $191,000 (96% occupancy).

These projections reflect stabilized performance across mid-term leases and diversified tenant segments.

Operating Expenses

Annual operating costs include:

- Property management, cleaning, insurance, and utilities: approximately $45,000

- Mortgage payments (principal and interest): approximately $60,000

- Maintenance reserve: approximately $10,000

The expense structure supports predictable cash flow and consistent unit conditions.

Loan Structure And Debt Coverage Logic

UrbanHaven is seeking a $690 000 investment property loan structured as:

- 20-year amortization

- 8.1% fixed rate for the first ten years

- Secured by the acquired property and a personal guarantee

- Serviced through rental income with documented operating margins

The combination of rental performance, conservative occupancy assumptions, and owner equity supports the loan’s servicing capacity.

Our stabilized revenue and controlled operating expenses create a favorable margin for debt servicing. Key factors include:

- Debt obligations of roughly $60,000 per year

- Net operating income that increases with occupancy and renewal stability

- A break-even occupancy of approximately 78%, equivalent to leasing five of six units at current pricing

This occupancy threshold is below the local rental market’s standard performance, supporting lower operating risk.

Net Operating Income and Cash Flow Stability

Revenue and stable operating costs create enough income to cover the loan and maintain reserves. As occupancy rises from Year 1 to Year 3, cash flow improves. That’s because vacancies decrease and more tenants renew their leases.

Break-Even Analysis

We will achieve break-even when net rental income covers all operating expenses and debt service. Under current pricing and expense assumptions, we expect our business to reach break-even at:

- Approximately 78% occupancy

- Monthly rental revenue of roughly $11,700

- Annualized threshold consistent with three-year revenue projections

The break-even point is aligned with the projected timeline for stabilization.

Net Operating Income (Three-Year Summary)

Projected NOI increases as occupancy stabilizes and renewal cycles extend tenant duration:

- Year 1 NOI: $22,000

- Year 2 NOI: $38,000

- Year 3 NOI: $45,000

Growth in NOI is driven by reduced vacancy periods, consistent demand from corporate and healthcare tenants, and controlled operating expenses.

Projected Profit & Loss Statement (3 YEARS)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Rental Revenue | $163,000 | $181,000 | $191,000 |

| Other Income (pet fees, cleaning add-ons) | $4,000 | $4,200 | $4,400 |

| Total Income | $167,000 | $185,200 | $195,400 |

| Operating Expenses | |||

| Utilities | $18,000 | $18,540 | $19,096 |

| Cleaning Contracts | $7,200 | $7,416 | $7,638 |

| Maintenance & Repairs | $10,000 | $10,300 | $10,609 |

| Insurance | $6,200 | $6,386 | $6,578 |

| Marketing | $3,600 | $3,708 | $3,819 |

| Property Management Software | $1,800 | $1,854 | $1,910 |

| General Admin | $8,000 | $8,240 | $8,487 |

| Total Operating Expenses | $54,800 | $56,444 | $58,137 |

| EBITDA | $112,200 | $128,756 | $137,263 |

| Depreciation | $21,818 | $21,818 | $21,818 |

| Interest Expense (approx.) | $55,890 | $53,320 | $50,700 |

| Total Deductions | $77,708 | $75,138 | $72,518 |

| Net Profit Before Taxes | $34,492 | $53,618 | $64,745 |

| Taxes (21%) | $7,243 | $11,260 | $13,596 |

| Net Income | $27,249 | $42,358 | $51,149 |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Financial Controls and Reporting

We manage finances through QuickBooks Online and property management software. Monthly reporting includes rent roll status, maintenance spending, vendor payments, and cash flow summaries. Quarterly financial reviews support loan servicing accuracy and compliance.

Funding Needed

UrbanHaven Property Rentals, LLC requires $920,000 in total project funding to acquire, renovate, furnish, and launch operations for the six-unit property at 1023 Kenilworth Avenue. The capital structure is designed to support acquisition, setup, compliance, and initial working capital without creating liquidity pressure during lease-up.

Capital Structure

Funding is divided into two components:

- Owner Equity: $230,000 contributed by the founders through savings and retained earnings from prior projects

- Bank Financing: $690,000 sought from First Citizens Bank as an investment property loan

This structure demonstrates borrower commitment and provides a clear equity cushion for the lender.

Use of Funds

Allocated project expenditures include:

| Category | Amount | Purpose |

|---|---|---|

| Property Acquisition | $800,000 | Covers down payment, purchase price components, and closing costs associated with acquiring the six-unit multifamily building at 1023 Kenilworth Avenue. |

| Renovation and Interior Setup | $60,000 | Includes painting, flooring, lighting upgrades, minor kitchen and bathroom improvements, and contractor labor. |

| Furniture and Appliances | $25,000 | Provides full furnishings for all six units, including beds, seating, décor, kitchenware, linens, and essential appliances. |

| Insurance, Legal, and Licensing | $8,000 | Covers property insurance, legal services, lease documentation, and required city and state licensing. |

| Marketing and Lease-Up | $7,000 | Allocated for professional photography, listing placement, advertising, and initial staging activities to support first-phase occupancy. |

| Software and Technology | $3,000 | Supports Buildium setup, QuickBooks Online integration, digital leasing systems, and document management tools. |

| Working Capital Reserve (3 months) | $17,000 | Provides operating liquidity to cover utilities, maintenance, vendor payments, and initial administrative expenses during the lease-up period. |

| Total | $920,000 |

Each category supports direct readiness of the units or ensures regulatory and operational compliance during launch.

Loan Terms Requested

UrbanHaven seeks an investment property loan under the following structure:

- Principal: $920,000 total project requirement, with $690,000 financed

- Term: 20 years, amortized

- Interest Rate: 8.1% fixed for the first ten years, adjustable thereafter

- Security: The acquired property plus a personal guarantee

- Bank: First Citizens Bank, Charlotte Uptown Branch

The fixed-rate period supports stable loan servicing during the initial years of operation and allows sufficient time to reach full stabilization.

Owner Equity Confirmation

Ownership is contributing $230,000 in equity sourced from savings and retained earnings from prior real estate projects. This equity commitment provides a clear liquidity cushion, reduces lender exposure, and supports the overall loan-to-value structure for the project.

Rationale for Loan Request

The loan supports an income-generating asset with:

- A defined rent roll backed by established pricing across six furnished units

- A conservative occupancy model with break-even at roughly 78 percent

- Strong market conditions for furnished mid-term rentals

- Experienced founders who bring operational and financial expertise

- A maintenance and vendor system designed for predictability and controlled expenses

The project’s financial structure aligns operating income with debt service, producing reliable margins under expected occupancy conditions.

Repayment Capacity

Projected revenue levels support the loan’s servicing requirements:

- Annual mortgage obligations of approximately $60,000

- Operating expenses held within predictable ranges

- Net operating income is strengthening as occupancy increases

- Occupancy targets that track below regional averages

These factors create a servicing profile that supports consistent repayment throughout the loan term.

Risk Assessment And Mitigation

We evaluate operational, financial, and market risks that could affect occupancy, cash flow stability, or loan servicing capacity. The assessment focuses on factors most relevant to a furnished mid-term rental model, including market performance, maintenance requirements, regulatory conditions, and financial sensitivity. Each identified risk is paired with structured mitigation practices already integrated into the company’s operations, vendor systems, and financial planning.

Market Rent Decline

A decrease in regional rental rates could compress revenue and affect net operating income.

Mitigation: UrbanHaven maintains flexible lease structures, allowing adjustment of pricing and terms to meet corporate and healthcare demand. Target segments exhibit lower price volatility due to employer-backed housing needs and assignment-driven stays.

Maintenance Overruns

Unexpected repair costs may impact operating margins.

Mitigation: A maintenance reserve equal to approximately two months of rent is allocated to cover unplanned repairs. The use of consistent materials, preventive inspections, and standardized vendor relationships reduces variability in repair work.

Vacancy Gaps

Periods of vacancy between tenants may temporarily reduce cash flow.

Mitigation: Multi-channel marketing, corporate partnerships, and relocation networks support consistent lead flow. The mid-term leasing model reduces turnover frequency, lowering exposure to vacancy cycles.

Regulatory or Licensing Changes

Adjustments to local housing standards, landlord requirements, or licensing rules could require operational changes or additional compliance steps.

Mitigation: UrbanHaven conducts regular reviews of city and state regulations in consultation with legal counsel. Documentation, permits, and renewals are maintained through a structured compliance calendar.

Operational Disruptions

Service delays from cleaning or maintenance vendors could affect unit readiness and tenant satisfaction.

Mitigation: The company maintains relationships with multiple service providers capable of supporting urgent requests. Performance tracking and documented service standards help ensure consistent delivery.

Financial Risk

Loan rate adjustments after the initial fixed period could affect debt service obligations.

Mitigation: Cash flow forecasting includes sensitivity ranges for potential rate changes. Renewal strategy, occupancy management, and controlled expenses support resilience during rate adjustments.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.