Executive Summary

SolidFrame Construction LLC is a single-member contracting business holding all required trade licenses and municipal registrations to serve homeowners, small landlords, and local business owners in Franklin County, Ohio. The company provides residential renovation services and light commercial interior build-outs with direct owner supervision on every project. Michael Turner, the sole owner, brings 8 years of construction experience to the business and manages all operations from estimating through project closeout.

Business Model and Operating Approach

SolidFrame Construction runs as a small, owner-led operation. We focus on renovation projects that typically fall within the range of $12,000 to $60,000. Most of the work comes from kitchen and bathroom remodels, basement finishing, flooring, drywall, and small commercial interior projects under 5,000 square feet.

Projects are priced as fixed-fee contracts, so clients know the cost upfront. Licensed subcontractors handle electrical, plumbing, and HVAC work. When roofing work is part of a larger renovation, that scope is also subcontracted to licensed roofers.

Michael Turner stays closely involved in every job. He typically manages 2-3 projects at a time and is on-site daily while work is in progress. This hands-on approach helps catch issues early, keep schedules on track, and maintain consistent quality. Many clients choose SolidFrame because they work directly with the owner instead of being passed between sales staff and project managers.

Market Position and Customer Base

The Columbus metro area, specifically Franklin County and adjacent suburbs, shows steady renovation demand. This is due to aging housing stock, ongoing maintenance needs, and tenant turnover cycles. We target established neighborhoods where homeowners invest in kitchen and bathroom updates rather than relocating. Small landlords provide repeat work across multiple properties. Insurance restoration projects and commercial tenant improvements supplement the residential base.

Geographic operations are limited to Franklin County and adjacent suburbs to maintain scheduling control and minimize travel inefficiencies. This containment supports the owner supervision model and prevents operational sprawl.

Capital Structure and Funding Request

SolidFrame Construction is capitalized with $160,000 in startup funding. Huntington National Bank is providing a $120,000 term loan for small businesses and contractor lending. Turner is contributing $40,000 in owner equity. The loan is secured by business assets, including work vehicles, tools, equipment, and trailers. The estimated collateral value, based on depreciable business assets, is approximately $95,000. A personal guarantee from Turner reinforces repayment commitment.

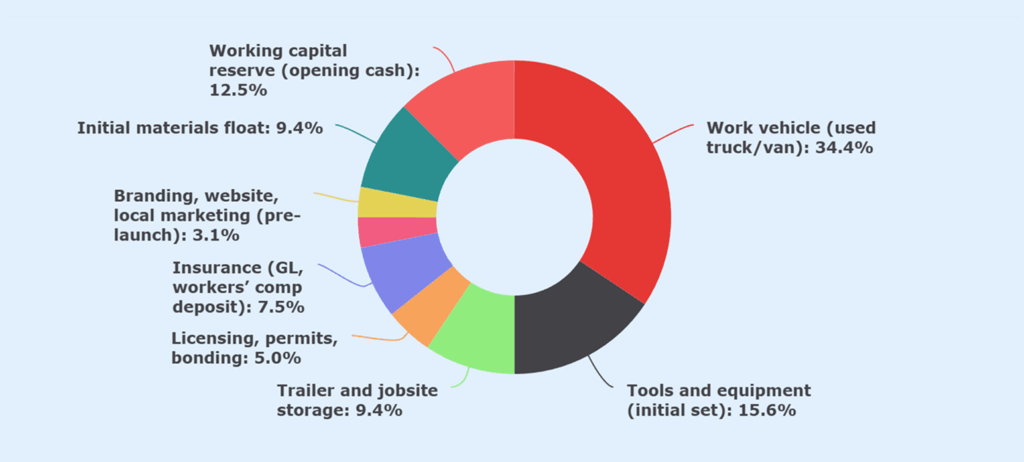

Startup capital is allocated to equipment acquisition ($95,000), licensing and insurance ($20,000), initial marketing ($5,000), materials float ($15,000), and working capital reserves ($20,000). This structure prioritizes durable assets and cash buffers over discretionary spending.

Financial Projections and Repayment Capacity

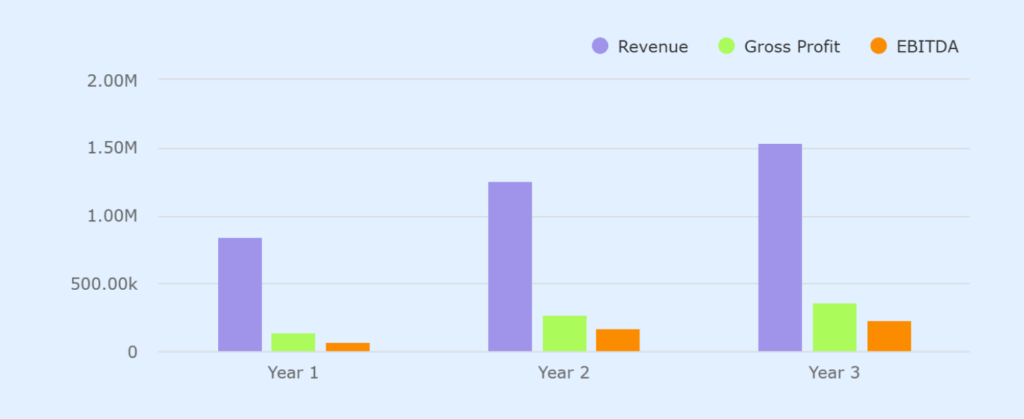

- Conservative revenue projections assume 2.5 projects monthly in Year 1 at $28,000 average, generating $840,000 annually.

- Year 2 increases to 3.5 projects monthly at $30,000 average for $1,260,000 revenue.

- Year 3 reaches 4.0 projects monthly at $32,000 average, producing $1,536,000 revenue.

These projections embed seasonal variations and assume growth through modest throughput increases and pricing discipline.

Operating cash flow covers principal in Year 1 and fully covers total debt service from Year 2 onward. After initial working capital build in Year 1, the business generates $8,200 in operating cash flow. Year 2 produces $152,100.

Year 3 reaches $224,900. Annual loan principal payments range from $15,000 to $19,000, well within cash generation capacity.

Break-even revenue is $441,600 annually. We exceed this threshold in Year 1 and operate with a substantial margin of safety in subsequent years. Turner delays owner compensation until late Year 2 to strengthen working capital and demonstrate cash flow stability before adding withdrawals.

Execution Readiness

All required licenses and registrations are in place. Insurance coverage includes general liability, workers’ compensation, and commercial auto policies. Equipment purchases are complete. Subcontractor relationships are established. Systems for estimating, invoicing, and collections are already in use. We are operationally ready to begin project execution immediately upon funding approval.

Investors hate amateur writing errors

Instantly improve your plan w/ our AI writing assistant

Company Description

SolidFrame Construction LLC is a single-member limited liability company registered in Ohio. Michael Turner owns 100% of the business and operates as the principal contractor. The company holds all required state trade licenses where applicable and maintains required municipal contractor registrations in Franklin County and the City of Columbus.

We operate from 2680 Industrial Drive, Suite 210, Columbus, OH 43228. This location provides administrative office space and secured storage access for tools and equipment. The address serves as the registered business location for licensing and insurance purposes.

Business Legal Structure

Michael Turner has formed SolidFrame Construction as a single-member LLC. This structure provides liability protection while maintaining operational simplicity. Turner holds full decision-making authority over project selection, estimating, contract approval, and financial management.

The LLC operates as a pass-through entity for tax purposes. All profits and losses flow directly to Turner’s personal tax return. This structure avoids double taxation while preserving the liability shield between business operations and personal assets.

Service Focus and Market Position

| Service Category | Typical Project Size | Notes |

|---|---|---|

| Bathroom Remodels | $12k–$28k | Non-structural |

| Kitchen Remodels | $25k–$60k | Fixed-price |

| Basement Finishing | $15k–$45k | Permit-based |

| Commercial TI | Under 5,000 sq ft | Interior only |

SolidFrame Construction works with homeowners, small landlords, property managers, and local business owners. Jobs are limited to Franklin County and nearby suburbs. This keeps schedules tight and travel time reasonable.

Most projects fall between $25,000 and $35,000. Smaller jobs start around $15,000. Larger scopes can reach up to $60,000, but those are less common.

We specialize in kitchen and bathroom remodels, basement finishing, flooring, drywall, and exterior repairs. We also take on small commercial interior projects under 5,000 square feet.

Electrical, plumbing, HVAC, and roofing work are handled by licensed subcontractors when required. Turner coordinates these trades as part of the overall project scope.

| Project Acceptance Controls Checklist | |

|---|---|

| Control | Applied |

| Defined scope before contract | Yes |

| Fixed pricing before start | Yes |

| Subcontractor availability confirmed | Yes |

| Client deposit required | Yes |

| Materials funded before mobilization | Yes |

Explicit Business Exclusions

SolidFrame Construction doesn’t pursue large-scale infrastructure projects, heavy civil work, or new ground-up construction. The company doesn’t engage in speculative real estate development or property flipping. All work is performed under fixed-price contracts for external clients, not for company-owned properties.

We don’t perform structural engineering calculations or foundation work without hiring licensed professionals for those specific scopes. This limitation keeps our business within the boundaries of applicable licenses and reduces liability exposure.

| Excluded Work | Reason |

|---|---|

| Heavy civil/infrastructure | Outside license scope |

| Ground-up construction | Higher capital and timeline risk |

| Speculative development | Cash flow exposure |

| Structural engineering | Requires licensed professionals |

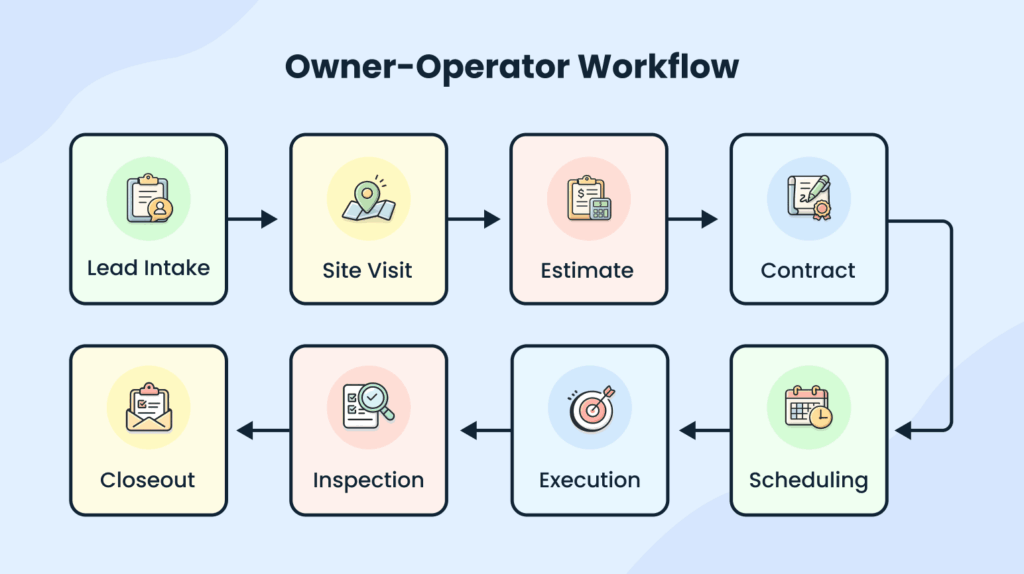

Owner-Operator Model

Turner manages all aspects of the business directly. He handles initial client contact, conducts site visits, prepares estimates, negotiates contracts, schedules subcontractors, supervises jobsites, manages inspections, and processes closeout documentation. The company limits active projects to maintain daily on-site supervision by the owner.

Turner works on jobsites daily rather than managing crews from an office. He performs some finishing work directly and coordinates with one full-time skilled laborer. The company doesn’t employ project managers, estimators, or administrative staff. Turner performs these functions himself with basic software tools and maintains direct communication with all clients and subcontractors.

This structure is designed to maintain predictable workloads, controlled overhead, and consistent execution quality, supporting stable cash flow and loan repayment.

Services & Pricing

SolidFrame Construction provides residential renovation services and light commercial interior build-outs. All work is performed under fixed-price contracts based on detailed scope definitions. We don’t accept time-and-materials arrangements except for approved change orders on existing contracts.

While project pricing ranges from $12,000-$60,000, the majority of contracted work falls between $25,000 and $35,000. This range represents kitchen and bathroom remodels, which form the core revenue base.

Core Service Categories

We focus on 4 primary service lines. Each represents a distinct project type with defined scope boundaries and pricing structures.

Kitchen Remodels

Kitchen renovations range from cabinet replacement and countertop installation to full layout reconfiguration. Projects include demolition, framing modifications, drywall repair, flooring installation, cabinet installation, countertop fabrication coordination, and finish painting. Electrical and plumbing work is subcontracted to licensed tradespeople. Structural modifications require engineer-stamped drawings before work begins. Kitchen projects typically range from $22,000 to $45,000, depending on size and material selections.

Bathroom Remodels

Bathroom renovations include tub and shower replacements, vanity installation, tile work, fixture upgrades, and ventilation improvements. Full bathroom projects cover demolition, substrate preparation, waterproofing, tile installation, fixture setting, and finish work. Plumbing and electrical modifications are coordinated through licensed subcontractors. Bathroom projects typically range from $12,000-$28,000 based on square footage and fixture quality.

Basement Finishing

Basement projects convert unfinished space into livable areas. Work includes framing, insulation, drywall installation, flooring, trim carpentry, and basic electrical rough-in coordination. The company doesn’t perform foundation waterproofing or structural foundation repairs. Egress window installation requires coordination with licensed window contractors and building inspectors. Basement finishing projects range from $18,000 to $40,000, depending on square footage and finish level.

| Dimension | Residential | Commercial Tenant Improvement |

|---|---|---|

| Typical Frequency | Primary | Occasional |

| Concurrent Limits | Multiple | One at a time |

| Inspection Complexity | Moderate | Higher |

| Acceptance Criteria | Standard | Selective |

Commercial Tenant Improvements

Small commercial projects under 5,000 square feet include office build-outs, retail interior renovations, and restaurant front-of-house remodels. Work includes demolition, framing, drywall, drop ceiling installation, flooring, painting, and fixture installation. All mechanical, electrical, plumbing, and fire suppression work is subcontracted to licensed commercial tradespeople. Projects require coordination with building owners, property managers, and municipal inspectors. Commercial projects range from $25,000 to $60,000 based on scope complexity.

Commercial projects are accepted selectively and limited to maintain the same owner-led supervision model used for residential work. We don’t accept multiple concurrent commercial projects.

Additional Services

The company performs flooring installation, drywall repair, exterior door and window replacement, deck repairs, and insurance damage restoration. These smaller projects typically range from $3,000 to $15,000. Standalone small projects are accepted selectively and scheduled around larger contracted work. The company doesn’t accept standalone roofing projects. Roofing scopes within larger renovations are subcontracted to licensed roofers.

| Service Type | Accepted As | Notes |

|---|---|---|

| Flooring/Drywall | Add-on or selective standalone | Scheduled around core jobs |

| Doors/Windows | Add-on | Permit-based |

| Deck Repairs | Add-on | No structural redesign |

| Roofing | Subcontracted only | No standalone roofing jobs |

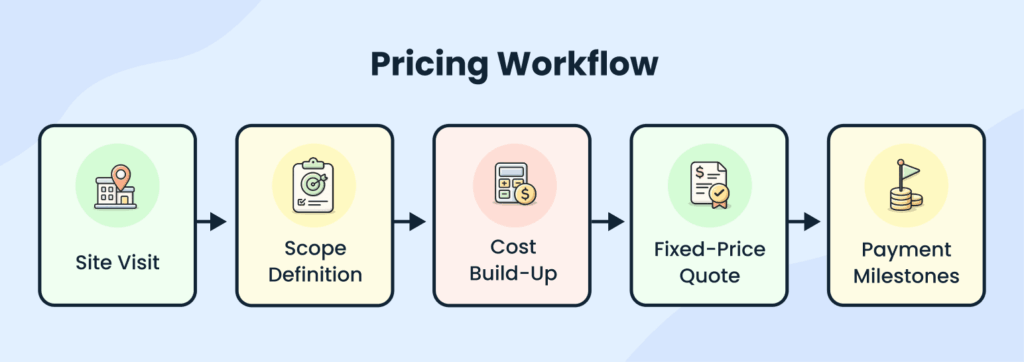

Pricing Methodology

All projects are priced on a fixed-price basis. Turner conducts an on-site visit, measures the space, reviews client specifications, and prepares a detailed scope of work. The estimate includes labor, materials, subcontractor costs, permits, disposal fees, and a contingency allowance. The contingency allowance is an internal cost buffer and isn’t presented as a discretionary client charge.

Pricing is reviewed periodically to reflect material costs, labor availability, and subcontractor rates. Deposits are required on all projects. Typical payment schedules include 30% at contract signing, 40% at substantial completion, and 30% at final inspection. The initial deposit is used to fund materials and mobilization, with the second payment tied to rough-in or mid-project completion, depending on scope.

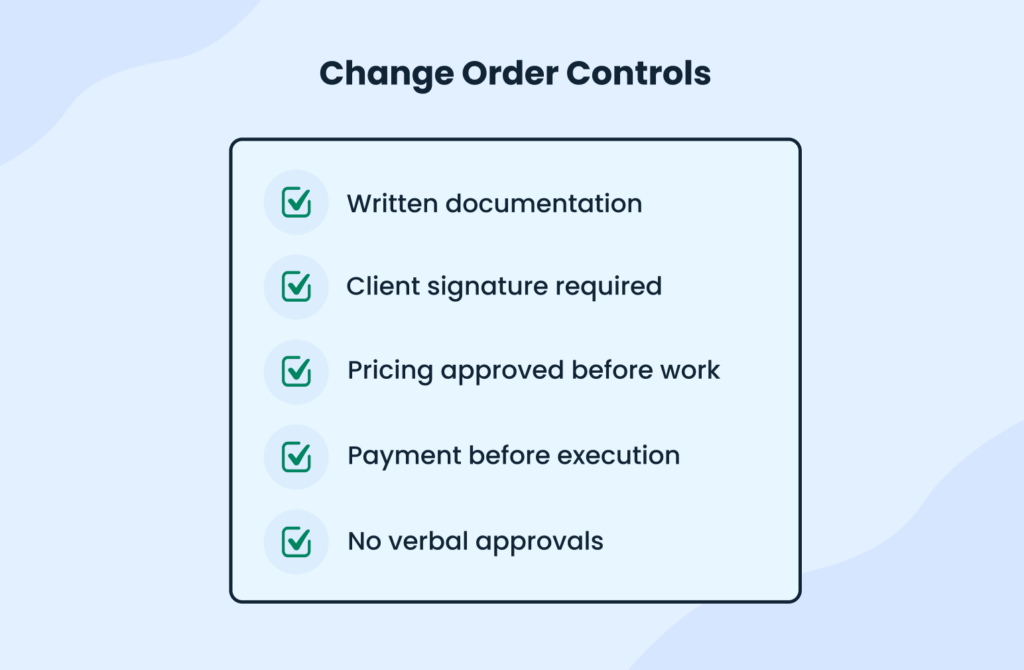

Change Order Controls

Scope changes requested after contract execution are processed through written change orders. Turner prepares a change order estimate showing additional labor, materials, and timeline impact. Change orders require the client’s signature before work proceeds. Change order payments are due before or concurrent with execution of the additional work.

The company doesn’t proceed with verbal change approvals. All modifications must be documented in writing with updated pricing and payment terms.

Service Exclusions

SolidFrame Construction doesn’t perform new construction, foundation work, structural engineering, or HVAC installation. The company doesn’t perform electrical service upgrades directly. Licensed electricians are engaged for all electrical scopes beyond minor fixture changes. These specialized scopes require licenses and insurance coverage beyond the company’s current structure.

Market Analysis

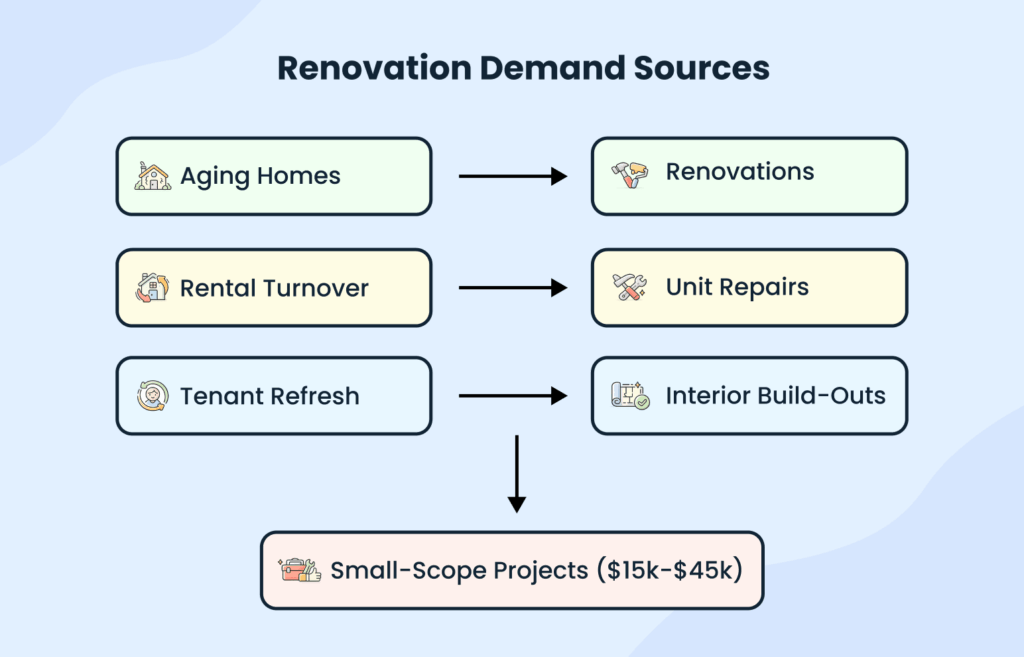

The Columbus metro construction market supports consistent demand for residential renovation and small commercial improvement work. This demand stems from predictable factors rather than cyclical growth trends. Aging housing stock, ongoing maintenance needs, and steady tenant turnover create reliable project pipelines for small contractors.

| Demand Driver | Why It Creates Stability |

|---|---|

| Aging housing stock (1950–1990) | Requires interior renovations and deferred maintenance |

| Ongoing maintenance needs | Work occurs regardless of economic cycles |

| Rental unit turnover | Predictable unit turns and repeat repairs |

| Tenant refresh cycles | Steady commercial interior improvements |

Why Demand Stability Matters More Than Market Size

SolidFrame Construction doesn’t need a large addressable market to succeed. We require approximately 30-40 projects annually to meet revenue targets and service debt obligations. Franklin County and adjacent suburbs contain a substantial inventory of homes built between 1950 and 1990 that now require interior renovations. Even a small market share provides sufficient volume.

Stability matters more than scale. The renovation market persists through economic cycles. Homeowners still address insurance claims, update kitchens and bathrooms, and complete deferred maintenance. Small landlords maintain rental properties to preserve tenant income. These needs continue regardless of broader economic conditions.

Large market opportunity attracts competition and creates pricing pressure. Smaller, stable demand allows established contractors to maintain pricing discipline and build referral networks without constant customer acquisition costs.

Local Market Characteristics

Franklin County’s housing stock built between 1950 and 1990 now requires kitchen and bathroom updates, basement finishing, and interior improvements. Homeowners in established neighborhoods invest in renovations rather than relocating due to mortgage rate lock-in and preference for existing school districts. Projects are geographically limited to Franklin County and adjacent suburbs to maintain scheduling control and minimize travel inefficiencies.

The rental property market drives consistent renovation demand. Small landlords owning 2-10 properties perform unit turns, address tenant damage, and complete deferred maintenance between leases. Property managers for larger portfolios contract repairs and improvements on behalf of building owners. Repeat work from landlords managing multiple properties creates predictable project pipelines.

Commercial tenant turnover generates steady interior build-out work. Retail spaces change tenants regularly. Office users modify layouts when renewing leases. Restaurant operators update dining areas to remain competitive. These projects continue even during periods of slower business formation.

Why Small-Scope Projects Reduce Volatility

Projects between $15,000 and $45,000 attract different customer behavior than large capital projects.

- Homeowners fund these projects from savings, home equity lines, or insurance proceeds rather than construction loans.

- Decision cycles are shorter.

- Approval processes involve fewer stakeholders.

Small projects allow faster starts and completions.

- A bathroom remodel takes 3-4 weeks.

- A kitchen renovation takes 6-8 weeks.

- Basement finishing runs 8-12 weeks.

This velocity allows us to maintain steady cash conversion and adapt quickly to demand fluctuations.

Larger projects create concentration risk.

- A single $200,000 project failing or delaying strains cash flow significantly.

- Four $50,000 projects spread risk across multiple clients and timelines.

- If one project experiences delays, the others continue generating cash flow.

Target Customer Segments

We serve 4 customer types, ranked by revenue contribution and reliability.

Primary: Homeowners in Established Neighborhoods

Homeowners aged 40-65 living in homes valued between $200,000 and $400,000 represent the core customer base. These clients invest in kitchens and bathrooms to improve daily living conditions or prepare homes for eventual sale. They research contractors carefully, check references, and value clear communication over the lowest price. Projects average $28,000 and close at reasonable margins. Referrals from completed projects generate new leads without acquisition costs.

Secondary: Small Landlords and Property Managers

Landlords owning multiple rental properties require consistent maintenance and turnover work. These clients prioritize fast timelines and reliable execution over design complexity. Projects tend to be smaller but repeat frequently. Property managers provide access to multiple properties under single relationships. Repeat work cycles create backlog visibility.

Tertiary: Insurance Restoration Work

Homeowners addressing water damage, fire damage, or storm damage through insurance claims need licensed contractors to coordinate repairs and navigate adjuster requirements. These projects move quickly once claims are approved, but require detailed documentation and scope adherence.

Opportunistic: Small Commercial Tenants

Local business owners occasionally require tenant improvements when opening locations or refreshing existing spaces. These projects offer higher revenue per project but involve more coordination and longer payment cycles. The company accepts commercial work selectively.

Competitive Landscape

The Columbus metro area contains hundreds of licensed contractors serving the residential renovation market. Competition includes solo operators, small firms with two to five employees, and regional companies with dedicated sales teams.

Many competitors pursue volume through sales-driven intake and crew deployment across multiple concurrent projects. This approach sacrifices direct owner involvement and creates quality control issues. Clients frequently complain about subcontractor quality, poor communication, and cost overruns when project managers replace owner supervision.

Why Owner Oversight Substitutes for Scale

SolidFrame Construction competes by offering Turner’s direct involvement on every project. Clients meet the owner during estimates and see him on site throughout execution. The company limits concurrent projects to maintain this supervision model. This approach cannot scale to dozens of projects, but succeeds by maintaining reputation, delivering predictable results, and converting satisfied clients into referral sources.

Marketing & Customer Acquisition

SolidFrame Construction acquires customers through relationship-driven channels rather than paid advertising campaigns. The marketing approach prioritizes referrals, local search visibility, and strategic partnerships with real estate professionals and property managers. Monthly marketing spend averages $1000, focused on maintaining online presence and supporting referral generation. Marketing efforts are intentionally limited to Franklin County and adjacent suburbs to align with operational capacity.

Primary Acquisition Channels

Referrals from Completed Projects

Past clients represent the most reliable lead source. Homeowners who experience direct owner involvement, clear communication, and on-time completion recommend Turner to neighbors, family members, and coworkers. Many completed projects generate one or more qualified referrals within six months.

Turner requests referrals explicitly at project closeout and provides business cards to satisfied clients. The company doesn’t offer referral fees or incentives. Organic recommendations carry more credibility than paid referral programs.

Google Business Profile and Local Search

We maintain an active Google Business Profile with project photos, client reviews, and contact information. Local homeowners searching for kitchen or bathroom contractors discover the business through map listings and organic search results.

Turner requests reviews from clients after final inspections. Positive reviews build credibility with prospects researching contractors online. The company responds to all reviews, both positive and negative, to demonstrate active engagement.

Monthly spending on Google local services ads averages $400 to $600. These ads improve visibility in local search results for service-specific queries within Franklin County. Lead quality from local services ads exceeds general web advertising because searchers have immediate project intent.

Realtor and Property Manager Relationships

Real estate agents recommend contractors to home buyers, addressing inspection repairs or planning post-purchase renovations. Turner cultivates relationships with agents in target neighborhoods through occasional coffee meetings and prompt response to client referrals.

Property managers overseeing rental portfolios require reliable contractors for tenant turns and building maintenance. These relationships develop through initial project performance and consistent availability. Property manager referrals generate repeat work across multiple properties.

The company doesn’t pay referral fees to realtors or property managers. Relationships are maintained through quality work and responsive communication rather than financial arrangements.

Secondary Channels

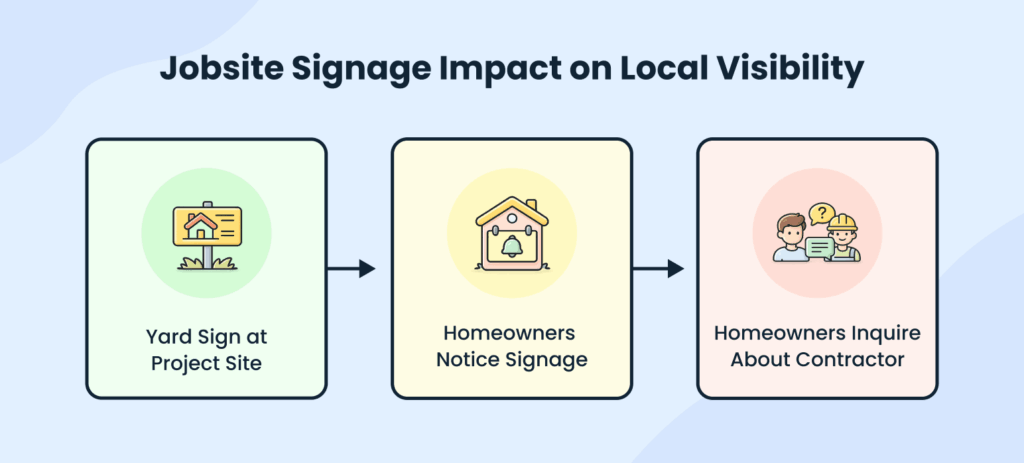

Jobsite Signage

Yard signs at active project sites generate neighborhood visibility. Homeowners notice renovation activity and inquire about contractors when planning their own projects. Signs include the company name, phone number, and website.

Local Networking and Trade Groups

Turner attends occasional Chamber of Commerce events and local trade association meetings. These gatherings provide visibility with business owners and create connections with complementary service providers such as real estate attorneys, home inspectors, and interior designers.

Online Presence

The company website provides basic information about services, displays licensing and insurance credentials, and offers contact forms for inquiries. The website reinforces legitimacy rather than driving high lead volume.

Lead Conversion Process

Inquiries come through phone calls, website contact forms, and Google Business messages. Turner responds within four hours during business days. Initial conversations cover project scope, timeline expectations, and budget ranges to qualify prospects before scheduling site visits.

Site visits occur within 3-5 business days of initial contact. Turner measures spaces, discusses client preferences, identifies potential complications, and establishes realistic budget expectations. Written estimates are delivered within 48 hours of site visits.

Conversion rates from estimate to signed contract average 35 to 40%. Projects are lost primarily due to price sensitivity or client indecision rather than competitive bids. Projects are rarely lost due to execution concerns or availability. Turner doesn’t reduce pricing to win projects but occasionally adjusts scope to meet client budgets.

The marketing approach is designed to generate a manageable volume of qualified inquiries consistent with the company’s project capacity. During slower seasonal periods, referral outreach and follow-ups with past clients help stabilize inbound inquiries. This model supports steady project flow without high customer acquisition costs.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you

Operations & Execution Plan

SolidFrame Construction operates as a lean, owner-supervised business with controlled overhead and predictable workflows. Turner manages all project phases directly from initial estimate through final closeout. Operations are structured to maintain quality control, manage cash efficiently, and limit concurrent project loads to sustainable levels.

Project Workflow

Lead Intake and Qualification

Prospects contact the company through phone, website, or referrals. Turner conducts an initial phone screening to determine project type, budget range, timeline expectations, and location. Projects outside Franklin County and adjacent suburbs are not pursued, ensuring geographical focus and operational efficiency. Prospects with unrealistic budgets or unclear scopes are educated on typical pricing before site visits are scheduled.

Site Visit and Estimate Preparation

Turner visits the property within 3-5 business days. He measures spaces, photographs existing conditions, discusses client preferences, and identifies structural or mechanical complications. Site visits typically last 45 to 90 minutes, depending on project complexity.

Estimates are based on standardized templates that are prepared for specific project requirements. Templates itemize:

- Labor

- Materials

- Subcontractor costs

- Permits

- Disposal fees

- Contingency buffers

Turner sources material pricing from regular suppliers and obtains subcontractor quotes for electrical, plumbing, and HVAC scopes. Estimates are delivered within 48 hours via email with line-item breakdowns.

Contract Execution and Scheduling

Signed contracts require 30% deposits before projects are scheduled. Deposits are put in immediately and used to order materials and secure subcontractor commitments. Projects are scheduled based on material lead times, subcontractor availability, and permit approval timelines.

We maintain a focus on delivering high-quality results by limiting active projects to 2-3 at a time, ensuring optimal owner supervision, and reducing rework risk. Typical scheduling allows 2-3 projects in active execution phases with 1-2 additional projects in permitting or material procurement stages.

Project Execution and Supervision

Turner visits each active jobsite daily to supervise work, address complications, coordinate subcontractor sequencing, and communicate progress to clients. The full-time skilled laborer works alongside Turner on demolition, framing, drywall, and finish carpentry. Part-time laborers are brought in for heavy demolition or material handling as needed.

Subcontractors are scheduled in logical sequences. Rough-in electrical and plumbing occurs after framing and before drywall. HVAC ductwork is coordinated with ceiling framing. Final electrical fixtures and plumbing trim-out occur after painting. Turner manages these transitions to prevent scheduling gaps or rework.

Materials are delivered to jobsites in phases to minimize theft risk and storage requirements. Cabinets and fixtures arrive one week before installation. Flooring materials acclimate on site for 3-5 days before installation. Appliances are delivered after final inspections to prevent damage during construction.

Inspection and Closeout

Municipal inspections are scheduled as work progresses. Rough-in inspections occur before drywall installation. Final inspections are scheduled after all finishing work is complete. Turner accompanies inspectors and addresses any deficiencies immediately.

Final walkthroughs with clients occur after inspections pass. Punch list items are completed within 3-5 business days. Final payments are collected after clients confirm satisfaction. Lien waivers are provided to clients after final payments clear.

Equipment and Tools Inventory

The company owns essential tools and equipment outright. No equipment financing or leasing obligations exist beyond the initial startup capital allocation.

Primary Equipment

The work vehicle is a used pickup truck purchased for $55,000. This truck transports tools, hauls materials, and serves as mobile storage for small equipment. Commercial auto insurance and regular maintenance costs are budgeted monthly.

An enclosed trailer provides secure jobsite storage and additional material hauling capacity. The trailer was purchased for $15,000 and eliminates daily tool loading and unloading.

Core Tool Set

Power tools include table saws, miter saws, circular saws, drills, impact drivers, pneumatic nailers, and finishing sanders. Hand tools cover framing, finish carpentry, plumbing, and electrical coordination tasks. Jobsite safety equipment includes ladders, scaffolding, dust containment systems, and personal protective equipment.

Besides truck and trailer purchases, equipment and tool investments totaled $25,000 at startup. Additional specialty tools are rented as needed for specific projects rather than purchased. This approach keeps capital costs controlled and avoids storing rarely used equipment.

Subcontractor Bench Management

The company relies on licensed subcontractors for electrical, plumbing, HVAC, and roofing work. Turner maintains relationships with 2 to 3 subcontractors per trade to ensure availability and competitive pricing.

Subcontractors are selected based on:

- Licensing status

- Insurance coverage

- Responsiveness

- Quality of past work

New subcontractors are tested on smaller projects before being assigned to larger scopes.

Subcontractors submit quotes during the estimating phase. Quotes are incorporated into client estimates with a small markup for coordination. Subcontractors are provided with site access, project timelines, and scope drawings before work begins.

Subcontractor payments are processed after the second client payment milestone. Standard payment terms are 14-21 days post-invoice, with early payments prioritized for trusted partners. Prompt payment maintains strong relationships and ensures priority scheduling.

Job Cash Sequencing and Working Capital Discipline

Cash management follows strict sequencing to prevent shortfalls between client payments and vendor obligations.

Project Cash Flow Timing

The 30% deposit received at contract signing funds initial material purchases and reserves subcontractor availability. Materials are ordered only after deposits clear. The second client payment at 40% of the project value occurs at substantial completion and covers remaining material costs and subcontractor invoices. The final 30% payment at project closeout provides margin and working capital replenishment.

Supplier accounts are maintained on net-15 or net-30 terms to align payment timing with client payment milestones. Subcontractor invoices are submitted upon scope completion and paid within 14 to 21 days, typically after the second client payment arrives.

Materials Procurement Controls

High-value items such as cabinets, countertops, and appliances are ordered with 50% deposits from material allowances in client contracts. This prevents large cash outlays before client payments arrive.

The company maintains a $15,000 materials float for small purchases and unexpected needs. This float is replenished from project cash flow and maintained as a minimum working capital buffer.

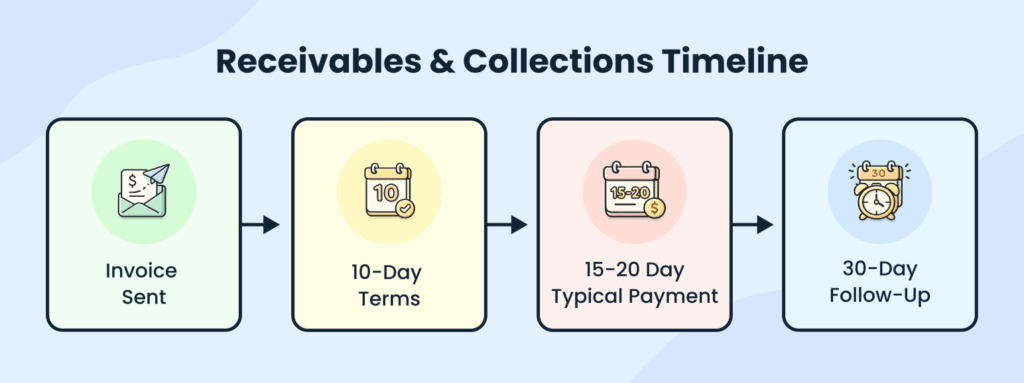

Collections and Receivables Management

Client invoices are sent immediately upon reaching payment milestones. Payment terms are net-30, but most clients pay within 15 to 20 days. Final payments are collected at project closeout before demobilizing from the jobsite.

Clients delaying final payments beyond 30 days receive phone follow-ups. Projects with payment disputes are resolved through scope documentation and contract review. Lien rights are preserved but rarely exercised.

Capacity Constraints and Scaling Approach

The owner-operator model creates natural capacity constraints. While growth will be gradual, we will focus on increasing project volume modestly through pricing adjustments, not through large-scale crew expansion. The business doesn’t plan to hire project managers or expand to multiple crews in the initial three-year period.

Seasonal slowdowns in winter months reduce project starts but allow equipment maintenance, subcontractor relationship development, and administrative catch-up. The financial model assumes lower winter throughput rather than forcing year-round consistency.

A business plan shouldn’t take weeks

Licensing, Compliance & Risk Management

Licensing and Registration

The company holds all required state trade licenses where applicable and maintains required municipal contractor registrations in Franklin County and the City of Columbus. Licensing requirements vary by trade and municipality. The company complies with all applicable registration and licensing requirements for each project scope. Registrations are renewed annually and kept current to avoid project delays or compliance violations.

Turner has completed OSHA-compliant safety training. Additional trade-specific licenses aren’t required as specialized work is subcontracted to appropriately licensed professionals.

Insurance Coverage

We carry comprehensive insurance coverage across multiple policies to protect against liability, property damage, and employee injury.

General Liability Insurance

Commercial general liability coverage provides $1 million per occurrence and $2 million aggregate limits. This policy covers property damage, bodily injury, and completed operations claims arising from construction activities. The policy is maintained through a commercial carrier with construction-specific expertise.

Workers Compensation Insurance

Workers’ compensation coverage is required for all employees, including full-time skilled laborers and part-time helpers. The policy covers medical expenses and lost wages if employees are injured on jobsites. Premium costs are calculated based on payroll and job classifications. Annual premium estimates are included in operating expense budgets.

Commercial Auto Insurance

The work vehicle and trailer are covered under commercial auto insurance with liability, collision, and comprehensive coverage. This policy protects against vehicle accidents, theft, and damage during the transport of tools and materials.

Professional Liability Insurance

The company doesn’t provide design or engineering services and therefore doesn’t carry professional liability exposure. Licensed professionals carry their own coverage when engaged for structural engineering, architectural design, or other professional services.

Bonding

The company maintains general contractor bonding as needed for specific projects. Bonding is obtained on a per-project basis when required by municipal regulations or commercial client contracts. Bond capacity covers individual project values up to $100,000. Bonding costs are included in project estimates when required by contract terms.

Permit Processes and Inspection Compliance

All projects requiring building permits are submitted to the relevant municipal authorities before commencing work. Turner prepares permit applications, submits plans and specifications, and schedules required inspections.

Rough-in inspections occur at prescribed phases before concealment work proceeds. Final inspections happen after completion of all finishing work. The company doesn’t proceed past inspection points without proper approvals. Failed inspections are corrected immediately and re-inspected before continuing work.

Permit fees vary by municipality and project scope. These costs are itemized in client estimates and paid from project deposits.

OSHA Safety Compliance

Jobsites are maintained in compliance with OSHA safety standards. Personal protective equipment is required for all workers. Ladders and scaffolding are inspected before use. Power tools include appropriate safety guards. Fall protection is used when working above six feet.

Subcontractors are required to maintain their own safety programs and provide proof of insurance before beginning work. Certificates of insurance are collected and verified before subcontractors begin work. Turner conducts jobsite safety walkthroughs daily to identify hazards and ensure compliance.

Lien Waiver Management

The company uses conditional and unconditional lien waivers to manage payment documentation. Subcontractors provide conditional lien waivers upon invoice submission and unconditional waivers upon payment. These documents protect clients from mechanics’ liens and provide clear payment records.

Turner provides final unconditional lien waivers to clients after receiving final payments. This documentation confirms that all project obligations are satisfied and prevents future lien claims.

Risk Mitigation Practices

Beyond insurance and compliance, the company employs operational practices to reduce risk exposure. Written contracts define scope boundaries clearly. Change orders document all modifications. Site photos are taken before, during, and after projects to document conditions. Client communications are confirmed in writing through email or text message.

These practices reduce dispute frequency, support claim defense, and limit uninsured exposure.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Management & Staffing

SolidFrame Construction operates under the direct management of Michael Turner, who handles all business functions from estimating through project closeout. The staffing structure is lean and designed to maintain owner oversight on every project while controlling labor costs and preserving operational flexibility.

Owner Background and Experience

Michael Turner brings 8 years of hands-on construction experience to the business. His background includes:

- Residential remodeling

- Insurance restoration work

- Light commercial tenant improvements

He has worked for local general contractors in roles that involved estimating, site supervision, subcontractor coordination, and client communication.

Turner’s prior experience includes:

- Kitchen and bathroom renovations

- Basement finishing

- Flooring installation

- Interior build-outs.

Prior experience included larger renovation projects, though the current business focuses on smaller, repeatable scopes. This experience provides familiarity with common complications, realistic timeline estimation, and subcontractor performance expectations.

His technical skills include finish carpentry, drywall installation, flooring, and basic framing. He reads construction plans, understands building codes, and navigates municipal permitting processes. This practical knowledge allows him to identify scope complications during estimates and solve problems during execution without relying on external consultants.

Owner Role and Responsibilities

| Responsibility Area | Specific Duties | Execution Approach | Risk Control |

|---|---|---|---|

| Client Engagement & Sales | Initial consultations, scope discussions, contract negotiation | Handled directly by the owner | Prevents misaligned expectations |

| Estimating & Pricing | Site measurement, estimate preparation, pricing approval | Owner-prepared using standardized templates | Reduces underbidding and scope errors |

| Procurement & Scheduling | Material ordering, subcontractor scheduling, timeline coordination | Deposits received before commitments | Aligns cash timing with execution |

| Jobsite Supervision | Daily site visits, quality control, trade sequencing, issue resolution | Owner on-site during active phases | Limits rework and delays |

| Client Communication | Progress updates, issue resolution, closeout coordination | Direct owner communication | Improves satisfaction and referrals |

| Inspections & Compliance | Inspection scheduling, inspector coordination, deficiency resolution | Owner accompanies inspectors | Prevents failed inspections |

| Billing & Collections | Invoicing, milestone billing, payment follow-up | Owner-managed, milestone-based | Protects cash flow |

| Administrative Management | Bookkeeping, licensing renewals, insurance, vendor management | Performed during off-site hours | Maintains operational focus |

| Financial Oversight | Expense tracking, cash flow monitoring, invoice management | Basic accounting software | Full financial visibility |

| Continuity Planning | Limited progress during short-term owner absence | No new scopes initiated | Controls execution risk |

Staffing Structure

The company employs one full-time skilled laborer who works alongside Turner on job sites. This individual performs demolition, framing, drywall installation, and finish carpentry under Turner’s direct supervision. The laborer is paid $24/hour for 40 hours/week across 50 weeks annually. Total annual compensation, including payroll taxes, is approximately $52,800.

Part-time labor is brought in as needed for heavy demolition, material handling, or additional manpower during time-sensitive phases. Part-time workers are paid $18-$20/hour and scheduled based on specific project needs. Annual part-time labor costs are estimated at 6% of revenue. This reflects limited use during demolition-heavy or time-sensitive phases rather than ongoing staffing.

The company doesn’t employ project managers, estimators, salespeople, or administrative staff. All functions are performed by Turner directly or handled by the skilled laborer under supervision.

Subcontractor Relationships

Licensed subcontractors handle electrical, plumbing, HVAC, and roofing work. These professionals are independent contractors, not employees. They maintain their own insurance, licensing, and equipment. Turner coordinates their schedules and oversees their work, but doesn’t supervise them as employees.

Subcontractor reliance allows us to scale scope selectively without increasing fixed payroll. Subcontractor costs are passed through to clients with modest coordination markups. These relationships are maintained through prompt payment, clear scope communication, and consistent work opportunities.

| Scope | Employees | Subcontractors |

|---|---|---|

| Demolition/Framing | Yes | No |

| Drywall/Finish | Yes | No |

| Electrical | No | Yes |

| Plumbing | No | Yes |

| HVAC | No | Yes |

| Roofing | No | Yes |

Compensation Structure and Owner Draw

The full-time skilled laborer receives hourly wages with no additional benefits beyond workers’ compensation coverage. No health insurance, retirement contributions, or paid time off is provided. This structure keeps labor costs predictable and limits fixed obligations.

Turner doesn’t draw an owner’s salary during Year 1. All business profits are retained to build working capital reserves and strengthen cash flow stability. Beginning in late Year 2, subject to sustained cash flow, Turner plans to draw $40,000 annually as owner compensation. This delayed draw allows the business to establish financial stability before adding owner withdrawals.

Hiring Plans

No additional hires are planned during the initial three-year period. The current structure supports the projected project volume without requiring additional permanent staff. If project volume increases beyond current capacity, Turner may add a second skilled laborer in Year 4 or beyond. No hiring decisions will be made based solely on backlog without demonstrated cash flow support.

The business prioritizes maintaining owner supervision capacity over crew expansion. Additional hires would only occur if Turner can maintain daily jobsite presence and quality oversight across all active projects.

Financial Plan

Financial Assumptions

The financial projections are based on a conservative operating case for a first-time, independent, owner-operated construction business in the Columbus, Ohio metro area.

Key assumptions include:

- Operating model: Fixed-price, project-based residential renovations and light commercial interior build-outs.

- Geographic scope: Franklin County and adjacent suburbs only.

- Owner compensation: No owner salary in Year 1. Limited draw begins in late Year 2. Full $40,000 annual draw in Year 3.

- Staffing: One full-time skilled laborer; part-time labor used selectively; licensed subcontractors for all specialty trades.

- Revenue driver: Completed projects/month multiplied by average revenue per project.

- Collections timing: Net-30 standard, with a conservative 45-day average collection period in Year 1, improving in later years.

- Seasonality: Winter slowdown is embedded in project volume rather than offset by marketing spend or price changes.

- Tax treatment: Financial statements are presented pre-tax for lending review.

Startup Costs and Use of Funds

| Category | Amount ($) |

|---|---|

| Work vehicle (used truck/van) | 55,000 |

| Tools and equipment (initial set) | 25,000 |

| Trailer and jobsite storage | 15,000 |

| Licensing, permits, bonding | 8,000 |

| Insurance (GL, workers’ comp deposit) | 12,000 |

| Office setup and software | 5,000 |

| Branding, website, local marketing (pre-launch) | 5,000 |

| Initial materials float | 15,000 |

| Working capital reserve (opening cash) | 20,000 |

| Total Startup Costs | 160,000 |

Approximately $95,000 of startup capital is allocated to depreciable fixed assets, with the balance used for insurance, licensing, materials, marketing, and working capital.

Funding Structure

| Source | Amount ($) |

|---|---|

| Bank term loan – Huntington National Bank | 120,000 |

| Owner cash contribution | 40,000 |

| Total Funding | 160,000 |

Revenue Forecast

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Average projects/month | 2.5 | 3.5 | 4.0 |

| Average revenue per project ($) | 28,000 | 30,000 | 32,000 |

| Annual Revenue ($) | 840,000 | 1,260,000 | 1,536,000 |

Don’t waste time using spreadsheets

Projected Profit & Loss Statement

| Revenue | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Construction Project Revenue | 840,000 | 1,260,000 | 1,536,000 |

| Total Revenue | 840,000 | 1,260,000 | 1,536,000 |

| Cost of Goods Sold (COGS) | 699,400 | 987,800 | 1,174,300 |

| Field Labor Wages + Payroll Burden | 52,800 | 54,400 | 56,000 |

| Part-Time/Helper Labor | 50,400 | 75,600 | 92,200 |

| Subcontractors (Licensed Trades) | 430,000 | 605,000 | 720,000 |

| Materials & Job Supplies | 121,000 | 189,000 | 230,000 |

| Equipment Rentals & Dump Fees | 20,000 | 26,000 | 30,000 |

| Operational Drag/Leakage (3%) | 25,200 | 37,800 | 46,100 |

| Gross Profit | 140,600 | 272,200 | 361,700 |

| Gross Margin | 16.70% | 21.60% | 23.50% |

| Operating Expenses | 74,000 | 100,500 | 127,000 |

| Vehicle Fuel & Maintenance | 22,000 | 24,000 | 26,000 |

| Insurance (GL, WC, Auto) | 18,000 | 19,000 | 20,000 |

| Office/Yard/Storage | 14,000 | 15,000 | 16,000 |

| Software, Phone, Admin | 8,000 | 8,500 | 9,000 |

| Marketing & Lead Generation | 12,000 | 14,000 | 16,000 |

| Owner Compensation | 0 | 20,000 | 40,000 |

| EBITDA | $66,,600 | $171,700 | $234,700 |

| EBITDA Margin | 7.90% | 13.60% | 15.30% |

| Depreciation | 20,000 | 20,000 | 20,000 |

| EBIT | 46,600 | 151,700 | 214,700 |

| Interest Expense | 8,400 | 7,600 | 6,800 |

| Net Income (Pre-Tax) | 38,200 | 144,100 | 207,900 |

Projected Cash Flow Statement

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| Operating Activities | |||

| Net Income (Pre-Tax) | 38,200 | 144,100 | 207,900 |

| Depreciation (non-cash) | 20,000 | 20,000 | 20,000 |

| Change in Accounts Receivable | -95,000 | -35,000 | -20,000 |

| Change in Inventory/Materials | -10,000 | -5,000 | -5,000 |

| Change in Accounts Payable | 40,000 | 25,000 | 20,000 |

| Change in Accrued Expenses | 15,000 | 3,000 | 2,000 |

| Net Cash from Operations (CFO) | 8,200 | 152,100 | 224,900 |

| Investing Activities | |||

| Capital Expenditures | -95,000 | 0 | -10,000 |

| Net Cash from Investing | -95,000 | 0 | -10,000 |

| Financing Activities | |||

| Loan Proceeds | 120,000 | 0 | 0 |

| Owner Capital Contribution | 40,000 | 0 | 0 |

| Loan Principal Repayment | -15,000 | -17,000 | -19,000 |

| Net Cash from Financing | 145,000 | -17,000 | -19,000 |

| Net Change in Cash | 58,200 | 135,100 | 195,900 |

| Beginning Cash | 20,000 | 78,200 | 213,300 |

| Ending Cash | 78,200 | 213,300 | 409,200 |

Projected Balance Sheet

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| Assets | |||

| Cash | 78,200 | 213,300 | 409,200 |

| Accounts Receivable | 95,000 | 130,000 | 150,000 |

| Inventory / Materials | 10,000 | 15,000 | 20,000 |

| Total Current Assets | 183,200 | 358,300 | 579,200 |

| Net Fixed Assets | 75,000 | 55,000 | 45,000 |

| Total Assets | 258,200 | 413,300 | 624,200 |

| Liabilities | |||

| Accounts Payable | 40,000 | 65,000 | 85,000 |

| Accrued Expenses | 15,000 | 18,000 | 20,000 |

| Current Loan Portion | 15,000 | 17,000 | 19,000 |

| Total Current Liabilities | 70,000 | 100,000 | 124,000 |

| Long-Term Loan | 105,000 | 88,000 | 69,000 |

| Total Liabilities | 175,000 | 188,000 | 193,000 |

| Equity | |||

| Owner Capital | 40,000 | 40,000 | 40,000 |

| Retained Earnings | 38,200 | 182,300 | 390,200 |

| Total Equity | 78,200 | 222,300 | 430,200 |

| Liabilities + Equity | 258,200 | 413,300 | 624,200 |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Break-Even Analysis

| Metric | Value |

|---|---|

| Monthly Fixed Costs | $6,167 |

| Contribution Margin | 16.70% |

| Base Monthly Break-Even Revenue | $36,800 |

| Annualized Break-Even Revenue | $441,600 |

Loan Structure Overview

The business is requesting a $120,000 bank term loan from Huntington National Bank, supported by a $40,000 owner cash contribution, for total startup funding of $160,000.

The loan is structured as a standard amortizing term loan with a multi-year repayment period. Principal and interest payments begin shortly after funding and are paid monthly. The loan is secured by business assets, including the work vehicle, tools, equipment, and trailer, with an estimated depreciable collateral value of approximately $95,000. A personal guarantee from the owner further supports repayment.

Repayment Source and Method

Loan repayment is funded entirely from operating cash flow, not asset sales or refinancing.

The business uses milestone-based billing, which creates predictable cash inflows throughout each project:

- 30% deposit at contract signing

- 40% payment at substantial completion

- 30% payment at project closeout

This structure ensures cash is collected before major labor and subcontractor costs are paid, reducing cash strain and supporting consistent loan payments.

Debt Service Coverage

Annual loan principal payments range from $15,000 to $19,000 over the projection period.

Operating cash flow exceeds these obligations in every year:

- Year 1: $8,200 in operating cash flow after working capital build

- Year 2: $152,100 in operating cash flow

- Year 3: $224,900 in operating cash flow

Debt service is covered even in the first year, when cash flow is intentionally conservative. Coverage improves materially in Years 2 and 3 as throughput stabilizes and working capital requirements normalize.

Financial Summary

The financial model reflects a conservative, execution-focused construction business with controlled labor, disciplined cash sequencing, and delayed owner compensation. The combination of milestone billing, limited concurrent projects, and low fixed overhead supports consistent cash generation and reliable debt service capacity without relying on aggressive growth assumptions.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.