Executive Summary

Blue Ridge Capital Partners, LP is a new hedge fund formed in 2026 to pursue a long/short equity strategy focused on Environmental, Social, and Governance (ESG)- aligned mid-cap companies. Based in Midtown Atlanta on Peachtree Street, the fund blends AI-driven screening with deep fundamental research to identify undervalued, sustainability-positive companies for long positions and overleveraged, ESG-declining firms for short exposure.

The fund is targeting an initial raise of $75 million, with $10 million already committed by the Ellison Family Office and discussions underway with the Emory University Endowment. The General Partner will contribute $5 million of its own capital, showing strong alignment with investors. Blue Ridge offers a 2% management fee and 20% performance allocation, subject to a 6% hurdle rate, and co-investment rights for early anchor investors.

Market Opportunity

The global hedge fund market is projected to $5.87 trillion in 2025 and is expected to almost double to $11.05 trillion by 2030. Within this, ESG-integrated strategies are one of the fastest-growing segments, with the U.S. ESG market already exceeding $6.5 trillion.

This creates a clear opportunity for investors to participate in a differentiated fund. Blue Ridge offers a unique combination of ESG-focused mid-cap long/short strategy, strong governance with GP capital committed alongside LPs, and a Southeast base that provides geographic diversification. These elements position Blue Ridge as a compelling investment for those seeking both attractive returns and responsible capital allocation.

Target Market

Blue Ridge will serve institutional limited partners that are actively diversifying into ESG-integrated hedge strategies:

- University Endowments seeking downside protection and alignment with sustainability commitments.

- Family Offices with generational wealth needs and interest in risk-managed equity exposure.

- Pensions and Foundations looking for disciplined regional managers to complement New York–based funds.

Leadership

Blue Ridge is led by three experienced partners with more than 45 years of combined asset management experience:

Matthew Greene, CIO (40%) – Former Invesco portfolio manager with a track record in ESG equity strategies.

Priya Desai, COO/CCO (35%) – Ex-BlackRock compliance officer with JD/MBA, overseeing regulation and investor reporting.

Robert Ellison, Head of Research (25%) – Former Bridgewater analyst and representative of the Ellison Family Office.

Mission Statement

Our mission is to deliver strong, risk-adjusted returns through an ESG-focused long/short equity strategy that combines advanced technology with disciplined research. We aim to serve institutional investors with transparency, governance, and alignment, while promoting responsible capital allocation that supports sustainable business practices.

Vision Statement

Blue Ridge aims to become the Southeast’s leading ESG-driven hedge fund, known for combining advanced technology, strong governance, and a regional advantage in serving institutional investors.

Financial Overview

The fund’s launch target is $75 million Assets Under Management (AUM), with a first close of $40 million expected in Q2 2026 and a final close by Q4 2026. Break-even is projected at $120 million within 24 months. Longer term, Blue Ridge expects to scale to $300 million and launch Fund II by 2029.

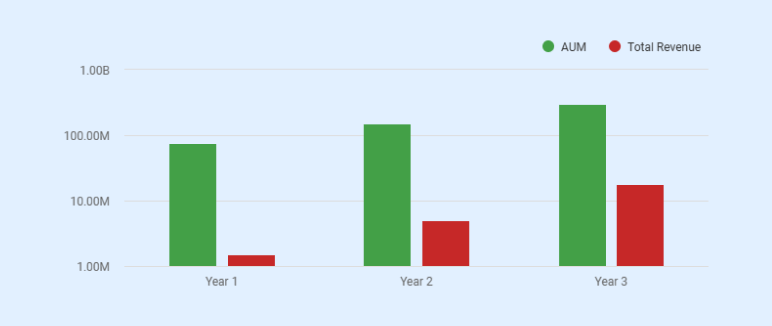

| Year | AUM (USD) | Total Revenue (USD) |

|---|---|---|

| 1 | $75,000,000 | $1,500,000 |

| 2 | $150,000,000 | $5,000,000 |

| 3 | $300,000,000 | $18,000,000 |

Funding Requirement

Blue Ridge Capital Partners is raising $75 million in limited partner commitments for Fund I. With anchor investors already secured and GP capital committed, early investors gain access to co-investment rights and a structure designed for strong alignment and institutional growth.

Company Overview

Blue Ridge Capital Partners, LP, is a hedge fund based in Atlanta, Georgia. The fund is set up as a Delaware Limited Partnership (LP) with its General Partner, Blue Ridge GP, LLC, registered in Georgia. Our office is located at 1401 Peachtree Street NE, Suite 2200, in Midtown Atlanta’s Bank of America Plaza district. This location gives us access to major investors such as pensions, endowments, and family offices, while also being close to Atlanta’s growing finance talent pool.

The firm is owned and managed by three founding partners with deep experience in investment management:

Matthew Greene (Chief Investment Officer, 40% GP ownership)

Former portfolio manager at Invesco with a strong track record in ESG-tilted equity portfolios. He leads the investment committee and drives the fund’s overall strategy and risk management.

Priya Desai (Chief Operating & Compliance Officer, 35% GP ownership)

Former BlackRock compliance officer with JD/MBA credentials, leading regulatory oversight and investor reporting. She ensures all operations meet institutional standards and maintains transparency with LPs.

Robert Ellison (Head of Research, 25% GP ownership)

Former Bridgewater analyst, representing the Ellison Family Office, which has also committed $10 million as an anchor investor. He oversees the research team and develops proprietary ESG scoring models for the fund.

Together, they bring more than 45 years of experience in investing, compliance, and research. Their mix of skills gives the firm strong leadership and balance.

To launch the fund, Blue Ridge requires approximately $1.125 million in startup capital, funded through a $5 million GP commitment and early management fees. This will cover office setup, fund administration, legal and audit costs, compliance, and marketing. The fund is targeting $75 million AUM at launch, with early commitments already secured.

In its first three years, Blue Ridge Capital Partners aims to:

- Complete fundraising with a first close of $40M by Q2 2026 and final close of $75M by Q4 2026.

- Reach its break-even point at ~$120M AUM within 24 months.

- Build a portfolio of 35–45 long positions and 25–30 short positions across 8–10 sectors.

- Scale to $300M+ AUM by 2029 with the launch of Fund II.

- Establish itself as the Southeast’s leading ESG-focused hedge fund with institutional-level governance.

We have also set a timeline of milestones to guide our growth and keep us on track:

| Date | Milestone | Details |

|---|---|---|

| Q1 2026 | Fund Formation & Branding | Delaware LP filed; branding and ESG identity created. |

| Q2 2026 | First Close ($40M) | Early commitments from Ellison Family Office; discussions with Emory Endowment. |

| Q2 2026 | Office Lease Signing | Midtown Atlanta HQ secured; trading and research teams set up. |

| Q3 2026 | Service Providers Engaged | Goldman Sachs (Prime Broker), Citco (Admin), KPMG (Audit), Ropes & Gray (Legal). |

| Q4 2026 | Final Close ($75M) | Fund I raised and deployed into the first portfolio. |

| 2027 | Break-Even Target | $120M AUM reached, with management fees covering costs. |

| 2028–2029 | Fund II Preparation | Scale to $300M+ AUM and launch second fund. |

| 2030+ | Investor Exit Window | Possible sale to a large platform (Invesco, BlackRock) or RIA group. |

Market Analysis

Blue Ridge Capital Partners is entering the hedge fund market at a time of growing institutional demand for ESG-integrated strategies. As mentioned earlier, the global hedge fund market stood at $5.87 trillion in 2025 and is projected to nearly double to $11.05 trillion by 2030.

Investors continue to seek funds that combine alpha generation, disciplined governance, and differentiated strategies. While New York remains the primary hub, the Southeast is emerging as an underpenetrated but attractive market.

At the same time, the ESG-aligned investment segment in the U.S. exceeds $6.5 trillion, with limited partners increasingly seeking managers who not only follow ESG mandates but also integrate ESG risk factors directly into their investment decisions. This combination of capital scale, ESG adoption, and geographic opportunity forms the backdrop for Blue Ridge’s strategy.

Target Market

Blue Ridge is designed to serve institutional limited partners who are actively looking for ESG-integrated hedge strategies. Our focus groups include:

University Endowments

Endowments are seeking downside protection while aligning with long-term sustainability goals (e.g., Emory University). They prefer managers who can show both strong returns and responsible investing practices. For these institutions, Blue Ridge offers a balance of performance and ESG discipline that supports their mission-driven commitments.

Family Offices

Family offices, especially those focused on generational wealth preservation, want steady, risk-managed equity exposure. They value direct access to fund managers and transparency in strategy. Blue Ridge’s Atlanta base and open approach provide the close partnership many family offices are looking for.

Pensions & Foundations

Pensions and foundations in the Southeast are looking for strong governance and local partners who can complement the larger New York-based managers they already use. By offering institutional-grade infrastructure and a regional presence, Blue Ridge positions itself as a trusted, accessible alternative that fits their long-term allocation needs.

Atlanta Advantage

Atlanta offers a unique mix of institutional capital and underserved hedge fund infrastructure. Compared to NYC or Boston, the city has fewer hedge funds but a significant pool of capital seeking direct GP access. Blue Ridge’s Midtown headquarters positions the firm to leverage:

- Access to Atlanta’s $40B+ institutional AUM from pensions, endowments, and foundations.

- Family offices in Buckhead and Midtown that prefer personal relationships with fund managers.

- A strong talent pipeline from Emory, Georgia Tech, and professionals with experience at Invesco, Morgan Stanley, and other leading firms.

This location creates a “big fish in a smaller pond” advantage—institutional-grade infrastructure with less head-to-head competition.

Competitive Landscape

Regional Competitors:

- Balentine (Atlanta): Large RIA (~$6B AUM) focused on wealth management, not hedge strategies.

- Invesco Private Capital (Atlanta HQ): Strong institutional reach, but primarily long-only funds.

- Montag & Caldwell (Atlanta): Equity-focused long-only growth manager, not ESG/long-short.

National Competitors:

- New York ESG Hedge Funds: Many emerging managers, but in a crowded capital-raising market.

- Large Multi-strats (Millennium, Citadel): Compete for institutional dollars, but lack focus on Southeastern LPs or the ESG niche.

Differentiation Strategy

Blue Ridge stands out by combining strategy, technology, governance, and regional focus. The fund’s ESG-aligned long/short mid-cap equity approach fills a gap between passive ESG funds and traditional hedge funds. Proprietary AI models hosted on AWS help the team spot ESG risk changes and identify short-term opportunities faster than manual research.

Governance is strengthened by tier-one service providers like Goldman Sachs, Citco, KPMG, and Ropes & Gray, giving investors institutional-level transparency and credibility—uncommon for a $75M launch. Finally, being Atlanta-based and Southeast-focused allows Blue Ridge to serve regional institutional investors who are underserved by New York or Boston managers, creating a clear local advantage.

Want to create a plan like this for your business?

Prepare your own plan in minutes using Upmetrics AI

Investment Strategy & Fund Products

Blue Ridge Capital Partners combines data-driven research with ESG-focused investing to help investors grow their capital over the long term. Our approach uses technology, careful risk management, and clear reporting to deliver strong performance and confidence.

Core Investment Philosophy

We follow a long/short equity strategy focused on mid-cap U.S. companies ($100M–$5B market cap), including environmental, social, and governance (ESG) factors in both long and short positions. Our idea is that the market often misprices ESG changes, giving us opportunities for consistent returns.

- Long Positions: Companies with improving ESG ratings, undervalued compared to peers, and positive catalysts like regulatory alignment, better capital efficiency, or strong sector trends.

- Short Positions: Companies that are overleveraged or losing ESG momentum, facing higher costs, penalties, or declining demand.

The fund keeps net market exposure between 40% and 60% to balance potential gains and risks.

Investment Process

Our investment process combines AI screening, research, risk rules, and portfolio building:

AI Screening: Our AWS-based model reviews Bloomberg, FactSet, and ESG data on 2,000+ mid-cap U.S. companies daily. It flags unusual ESG scores, leverage levels, or insider trading.

Research: Analysts check these names using Discounted Cash Flow (DCF), relative valuation, and sector comparisons, and score ESG impact using our framework.

Risk Management: Each position is capped at 2% of the fund, with stop-losses at –15%. The portfolio is spread across 8–10 sectors like energy transition, healthcare, financials, and consumer staples.

Portfolio Construction: Usually 35–45 long and 25–30 short positions, with a net beta of 0.3–0.6. Exit decisions happen if the investment thesis fails, ESG scores drop, or the target valuation is met.

Fund Products

Blue Ridge Flagship Fund (Fund I)

Launch target $75M AUM, with 2% management fee and 20% performance fee above a 6% hurdle. Investors benefit from quarterly liquidity with a 90-day notice.

Family Office Sidecar Vehicle

Capacity $20M, focused on high-conviction long and short positions. No management fee is charged, only a 10% performance allocation. This vehicle is exclusive to anchor LPs and the Ellison Family Office, allowing them to co-invest alongside Fund I.

Seasonal Offerings

Blue Ridge also provides seasonal updates and events to keep investors involved throughout the year:

- Quarterly ESG Scorecards: Delivered with investor letters, these scorecards track how portfolio companies are performing on environmental, social, and governance metrics.

- Annual ESG Symposium: Hosted in Atlanta, this event brings LPs together with portfolio managers and company executives. Investors can discuss ESG initiatives, review fund strategy, and learn about emerging trends in the market.

These seasonal offerings give investors both regular updates and meaningful engagement, helping them understand fund performance and the impact of their investments beyond just financial returns.

Operations Plan

Running a hedge fund isn’t just about smart investing. It also requires reliable operations, trusted service providers, and a strong compliance culture. At Blue Ridge, we’ve built our infrastructure to match institutional standards from the very beginning, giving investors confidence that their capital is managed with transparency and care.

Trading Hours & Coverage

Our trading desk runs from 8 AM to 6 PM EST, focused on U.S. equities. To ensure we never miss market-moving events, our research team extends coverage globally through a partner in London. This setup allows us to monitor U.S. markets during the day and stay on top of Asia markets overnight, giving us 24/7 awareness of risks and opportunities.

Service Providers

We work with tier-one service providers that are globally recognized and trusted. Each plays a key role in keeping our operations smooth, transparent, and independently verified.

| Function | Provider | Role |

|---|---|---|

| Prime Broker / Custodian | Goldman Sachs | Custody, margin financing, trade settlement |

| Fund Administrator | Citco | NAV calculation, capital accounts, reporting |

| Auditor | KPMG | Annual audit of financial statements |

| Legal Counsel | Ropes & Gray LLP | Fund documentation, compliance, LP agreements |

| Banking Partner | Truist Bank | GP banking, payroll, operating accounts |

These providers ensure our investors know that every trade, report, and financial statement is backed by independent checks and world-class systems.

Compliance Framework

We believe compliance isn’t just a checkbox—it’s a culture. Our COO/CCO, with experience from BlackRock, leads the program with support from Ropes & Gray.

- All required filings—including SEC Reg D, Georgia Blue Sky, and NFA exemptions—are complete.

- Staff follow clear policies covering insider trading, personal trading, and a code of ethics, with quarterly attestations.

- Trades are reconciled daily, and quarterly compliance reports are reviewed by our LP Advisory Committee.

- Sensitive data is protected in a secure AWS cloud environment, with two-factor authentication and encrypted backups.

This structure ensures we meet not only the letter of the law but also the expectations of institutional investors.

Operations Workflow

Our workflows are designed to be accurate, reliable, and investor-friendly. When a trade is placed, it first goes through Bloomberg’s trading system. Goldman Sachs, our prime broker, then confirms and settles it. Finally, Citco reconciles the trade each day, ensuring everything matches.

At the end of each month, Citco calculates the fund’s net asset value (NAV), which our COO double-checks. Once a year, KPMG audits the financial statements to provide independent assurance.

For investors, capital calls and redemptions are handled on a quarterly schedule with 90 days’ notice, giving predictability and stability. Communication is clear and consistent: we provide quarterly letters with strategy insights and monthly performance estimates, all accessible through a secure LP portal.

In simple terms, this workflow makes sure trades are executed correctly, fund values are accurate, investor money is handled carefully, and reporting is completely transparent.

Management Team

Blue Ridge Capital Partners’s staffing plan is designed to keep the structure lean, efficient, and fully aligned with investor interests.

| Role | Name / Headcount | Compensation Structure | Key Responsibility |

|---|---|---|---|

| Chief Investment Officer (CIO) | Matthew Greene | $350,000 base + 5% carry | Leads portfolio strategy and investment decisions |

| Chief Operating & Compliance Officer (COO/CCO) | Priya Desai | $275,000 base + 3% carry | Oversees operations, compliance, and risk controls |

| Head of Research | Robert Ellison | $250,000 base + 3% carry | Directs research and manages analyst team |

| Equity Analysts | 4 positions | $120,000 base + performance bonus | Sector-specific research and idea generation |

| Risk Manager | 1 position | $180,000 / year | Monitors exposures and enforces risk limits |

| Compliance Officer | 1 position | $140,000 / year | Supports regulatory filings and policy enforcement |

| Investor Relations Director | 1 position | $160,000 / year | Manages LP communications, roadshows, and reporting |

We also partner with Citco Fund Services to manage fund administration at an annual cost of $200,000. Citco handles NAV calculations, investor accounts, and reporting, giving our investors confidence that operations are transparent and audit-ready.

Marketing Plan

At Blue Ridge, our goal is to reach the right investors efficiently and clearly. We focus on building strong relationships with institutional LPs by combining in-person meetings, industry visibility, digital tools, and thoughtful incentives. Every marketing dollar is aimed at attracting investors who share our ESG-focused investment philosophy.

Marketing Channels

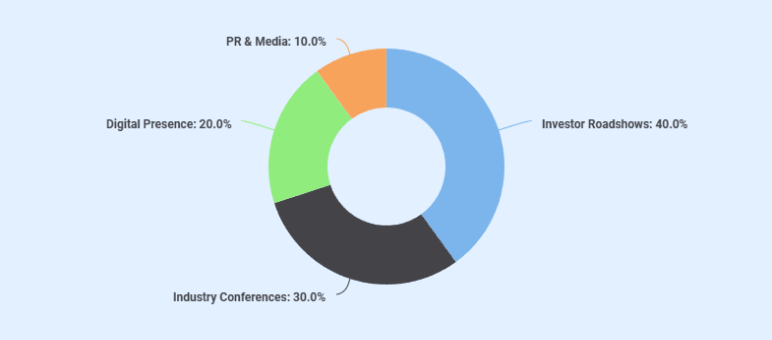

| Channel | Budget % | Amount (USD) | Purpose |

|---|---|---|---|

| Investor Roadshows (Boston, NY, Chicago) | 40% | $250,000 | Direct engagement with potential anchor LPs |

| Industry Conferences (SALT, GA Alternative Investment Summit) | 30% | $180,000 | Visibility among family offices, endowments, and institutional investors |

| Digital Presence (secure portal, ESG dashboards) | 20% | $120,000 | Real-time performance updates and investor access |

| PR & Media (Bloomberg, Institutional Investor features) | 10% | $60,000 | Build credibility and brand awareness |

Customer Acquisition Plan

Our acquisition strategy targets both anchor and secondary LPs:

- Year 1: Secure 5 anchor LPs with commitments exceeding $10M each.

- Year 2: Add 15 additional LPs contributing $2–5M each.

- Year 3: Expand outreach to 10 more LPs through referrals and industry connections, ensuring diversified capital sources.

Launch Promotions

To encourage early investors, Blue Ridge offers several benefits. Seed LPs receive co-investment rights in select opportunities, giving them a chance to invest alongside the fund. Management fees are discounted to 1.5% for the first $20 million raised, rewarding those who commit early. Additionally, early investors get priority access to ESG research reports and invitations to our annual ESG symposium, providing extra value beyond financial returns. These incentives are designed to align interests, build trust, and support a strong initial investor base.

Does your plan sound generic and template-like

Refine your plan to adapt to investor/lender interests

Financial Projections

Startup Costs

Blue Ridge requires ~$1.125m in startup capital before performance fees materialize. These costs are covered by the GP commit ($5M) and early management fees.

| Category | Amount ($) | Notes |

|---|---|---|

| Office Lease | $210,000 / year + $40,000 deposit | Midtown Atlanta HQ |

| Trading Desk Buildout | $350,000 | Bloomberg terminals, servers, compliance systems |

| Legal & Registration | $250,000 | Ropes & Gray fund docs, SEC filings, Blue Sky compliance |

| Marketing Roadshow | $200,000 | Travel, conferences, LP pitch materials |

| Insurance | $75,000 | E&O + D&O coverage |

| Total Startup Costs | $1,125,000 | Funded via GP commit + management fees |

Revenue Forecast

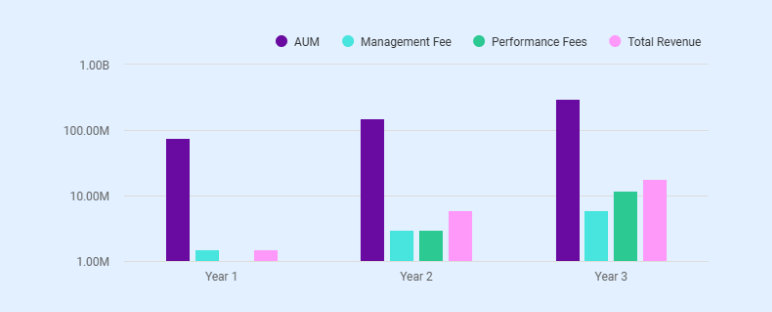

| Year | AUM ($) | Management Fee ($) | Performance Fees ($) | Total Revenue ($) |

|---|---|---|---|---|

| Year 1 | $75,000,000 | $1,500,000 | $0 | $1,500,000 |

| Year 2 | $150,000,000 | $3,000,000 | $3,000,000 | $6,000,000 |

| Year 3 | $300,000,000 | $6,000,000 | $12,000,000 | $18,000,000 |

Projected Profit & Loss (3-Year Annual)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Revenue | |||

| Management Fees | $1,500,000 | $3,000,000 | $6,000,000 |

| Performance Fees | $0 | $3,000,000 | $12,000,000 |

| Total Revenue | $1,500,000 | $6,000,000 | $18,000,000 |

| Operating Expenses | |||

| Office Lease & Buildout | $250,000 | $250,000 | $250,000 |

| Legal & Formation | $300,000 | $100,000 | $100,000 |

| Fund Administration | $100,000 | $120,000 | $150,000 |

| Audit & Tax | $75,000 | $85,000 | $95,000 |

| Compliance & Insurance | $100,000 | $110,000 | $120,000 |

| Marketing & Roadshows | $300,000 | $400,000 | $500,000 |

| Staffing & Salaries | — | $435,000 | $1,000,000 |

| Misc. / Contingency | — | — | $285,000 |

| Total Operating Exp. | $1,125,000 | $1,500,000 | $2,500,000 |

| Net Income | $400,000 | $4,500,000 | $15,500,000 |

Projected Balance Sheet (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Assets | |||

| Cash & Equivalents | $1,000,000 | $5,000,000 | $15,000,000 |

| Prepaid Expenses | $100,000 | $200,000 | $400,000 |

| Other Current Assets | $400,000 | $800,000 | $2,600,000 |

| Total Assets | $1,500,000 | $6,000,000 | $18,000,000 |

| Liabilities | |||

| Accounts Payable | $200,000 | $400,000 | $800,000 |

| Accrued Expenses | $300,000 | $600,000 | $1,200,000 |

| Total Liabilities | $500,000 | $1,000,000 | $2,000,000 |

| Equity | |||

| GP Commitment + Retained Earnings | $1,000,000 | $5,000,000 | $16,000,000 |

| Total Equity | $1,000,000 | $5,000,000 | $16,000,000 |

| Liabilities + Equity | $1,500,000 | $6,000,000 | $18,000,000 |

Projected Cash Flow (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Operating CF | |||

| Net Income | $400,000 | $4,500,000 | $15,500,000 |

| Depreciation & Non-Cash | $50,000 | $75,000 | $100,000 |

| Change in Working Capital | -$50,000 | -$75,000 | -$100,000 |

| Operating CF Total | $400,000 | $4,500,000 | $15,500,000 |

| Investing CF | |||

| Office Buildout | -$250,000 | -$100,000 | -$100,000 |

| IT & Systems | -$250,000 | -$400,000 | -$900,000 |

| Investing CF Total | -$500,000 | -$500,000 | -$1,000,000 |

| Financing CF | |||

| GP Commitment Inflow | $5,000,000 | $0 | $0 |

| Financing CF Total | $5,000,000 | $0 | $0 |

| Net Cash Flow | $4,900,000 | $4,000,000 | $14,500,000 |

| Ending Cash Balance | $4,900,000 | $8,900,000 | $23,400,000 |

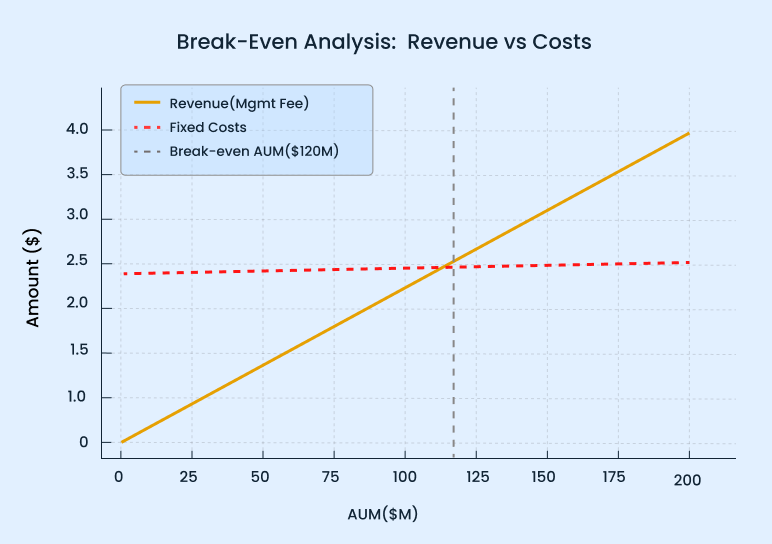

Break-even Analysis

- Operating costs: ≈ $2,400,000 per year

- Management Fee Rate: 2% of AUM.

- Break-even AUM: $2,400,000 ÷ 2% = $120,000,000

Business Ratios

| Ratio Type | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Profitability | |||

| Gross Margin % | 25.0% | 75.0% | 86.1% |

| Net Margin % | 26.7% | 75.0% | 86.1% |

| Return on Equity (ROE) % | 40.0% | 90.0% | 96.9% |

| Liquidity | |||

| Current Ratio (Assets / Liabilities) | 3.0x | 6.0x | 9.0x |

| Cash Ratio (Cash / Liabilities) | 2.0x | 5.0x | 7.5x |

| Efficiency | |||

| Operating Leverage (Revenue / Fixed Costs) | 1.25x | 4.0x | 7.2x |

Risk & Mitigation

At Blue Ridge, we know every hedge fund faces risks. What matters most is planning for them and showing investors how those risks are managed. Below are six key risks, the impact they may have, and the solutions we use to reduce them.

Market volatility

Impact: Big market shocks, like the 2020 pandemic or 2022 rate hikes, can cause sharp losses even in ESG mid-cap stocks. This may lead to drops in NAV, investor redemptions, and reputational damage.

Solution: Keep fund exposure between 40–60%, limit each stock to 2% of NAV, cut losses if a position falls 15%, and spread investments across 8–10 sectors.

Regulatory scrutiny

Impact: The SEC is tightening rules for private funds and ESG claims. This could lead to fines, reputation issues, or losing investor confidence.

Solution: Our COO/CCO is a former BlackRock compliance officer with a JD/MBA. We also retain Ropes & Gray for legal support, run compliance audits each quarter, and share clear ESG reports with LPs.

Operational failures

Impact: Mistakes in NAV calculations, trade settlements, or cybersecurity could create errors, misstatements, and loss of trust.

Solution: Citco manages NAV and investor accounts, Goldman Sachs oversees custody and settlement, AWS uses MFA and encrypted backups, and KPMG audits our operations every year.

Investor concentration

Impact: Depending too much on a few large LPs could be risky if one redeems. AUM may fall below break-even and hurt our reputation.

Solution: No single LP can hold more than 20% of the fund. We aim for five anchor LPs plus 10–15 smaller ones, with quarterly redemption gates to control outflows.

Talent retention

Impact: Losing key people could weaken the fund’s strategy, hurt credibility, and make it harder to raise Fund II.

Solution: Founders’ $5M GP commit stays locked until fund close, analysts and risk staff earn equity-linked pay, and our Investment Committee ensures decisions don’t rely on one person.

Fundraising risk

Impact: Missing the $75M launch target or staying under the $120M break-even mark could drag on fees, dilute GP ownership, and make it harder to keep staff.

Solution: Offer early LPs lower fees (1.5%) and co-investment rights, run a strong roadshow in key cities, and use GP capital to bridge operations until AUM grows.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.