I’ve got a short story to tell—there was this keen entrepreneur named Max.

On a particularly sunny morning, he set out to analyze some complex datasets for financial modeling. Poor fellow started crushing numbers in Excel, hours turned into days, and his spreadsheet into a mess.

Don’t want your spreadsheets to turn into a mess like Max’s? Don’t worry, Max had to struggle, you won’t.

We’ve compiled a list of the best AI financial modeling software to help you make accurate financial models without any clutter.

Sounds like a plan? Let’s start by understanding how these tools are better than traditional spreadsheets.

You ready? Let’s dive right in.

Spreadsheets vs. AI financial model generators

We’ve been using spreadsheets in financial modeling for a long time now. While these sheets can be a powerful tool for financial forecasting and modeling, they’re intimidating, time-consuming, and frustrating at the same time.

On the other hand, AI financial model builders offer great features, are easy to use, and provide more accurate results. So are spreadsheets still the way to go or it’s time to march toward AI?

Worry not! Let’s compare and figure out what’s the best option for you.

Automation? Spreadsheets have limited automation options. You may need to manually enter data, formulas, and other elements into the sheet. In contrast, financial modeling software emphasize automation; automate manual and repetitive tasks to save time and reduce human errors.

What about collaborating with colleagues and co-workers? Although real-time collaboration is possible with spreadsheets, version control can still be a pain.

That’s not the case with AI financial model generators since changes and updates are tracked more efficiently.

Guesswork and predictive analysis? You enter data and formulas, and you can make financial models; that’s how spreadsheets work; there aren’t any machine learning algorithms for predictions.

However, AI modeling tools can analyze your historical financial information, identify trends, and predict future scenarios.

Even when considering the other essential aspects, be it result accuracy, scalability, integration features, and learning curve, AI financial modeling tools still find a place at the top.

Say goodbye to old-school excel sheets & templates

Make accurate financial models faster with AI

Plans starting from $14/month

Let’s cut to the chase and discuss the best AI financial modeling software.

Best AI financial model generators & tools (2026)

1. Upmetrics

Upmetrics is a modern, AI-powered financial modeling and forecasting software for startups and small business owners. It’s more than just a financial modeling tool; Upmetrics can help you create investment-ready business and financial plans as well as prepare financial budgets, statements, and visual reports.

In addition to providing an AI to build financial models, Upmetrics helps you create investment-ready business plans, financial budgets, statements, and visual reports.

While Upmetrics’ AI-powered revenue and expense stream suggestions take all the guesswork out of the equation, the AI business assistant walks by to help throughout the planning process.

It can read and comprehend your entire model and answer any questions you have regarding your finances, budgets, or anything else.

Here’s an overview of Upmetrics’ best features for more information:

Best Features:

- Custom 5-year financial projections.

- AI-powered baseline forecasts

- “what if” scenario analysis

- Automatic account mapping

- Monthly cash flow forecast

- Forecast vs. actual variance

Pricing:

| Plan | Premium | Professional |

|---|---|---|

| Pricing | $14 | $37 |

Say goodbye to old-school excel sheets & templates

Make accurate financial models faster with AI

Plans starting from $14/month

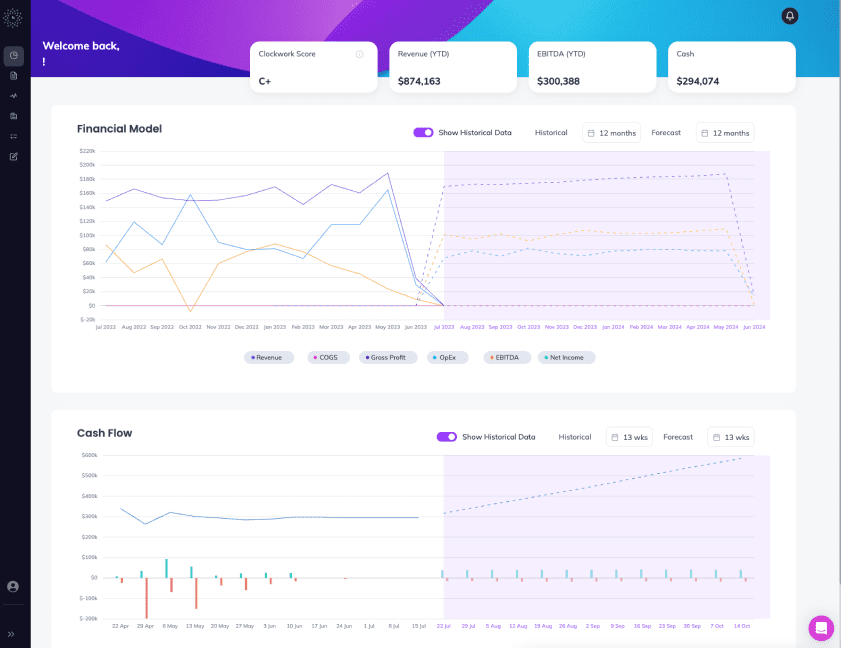

2. Clockwork AI

Clockwork is an AI-powered FP&A software for financial professionals and accounting firms committed to advisory services. They claim to be helping users save 10+ hours per client, per month spent on financial planning and accounting.

Clockwork gets the necessary information from the QuickBooks account and makes it useful in real-time. The tool is designed to meet rising client demand for advisory services and increase average revenue per client.

While the tool has incredible feature offerings, some users may find the platform a bit trickier to get started. Let’s learn more about Clockwork’s best features.

Best Features:

- Custom 5-year financial projections.

- AI-powered baseline forecasts

- “what if” scenario analysis

- Automatic account mapping

- Monthly cash flow forecast

- Forecast vs. actual variance

Limitations

- New users may experience a small learning curve.

- Pricing plans seem way too expensive for small businesses.

- Users can’t merge multi-company data without manual entry.

Pricing:

| Free | Insight | Predict | Ultimate |

|---|---|---|---|

| $0/month | $199/month | $499/month | $799/month |

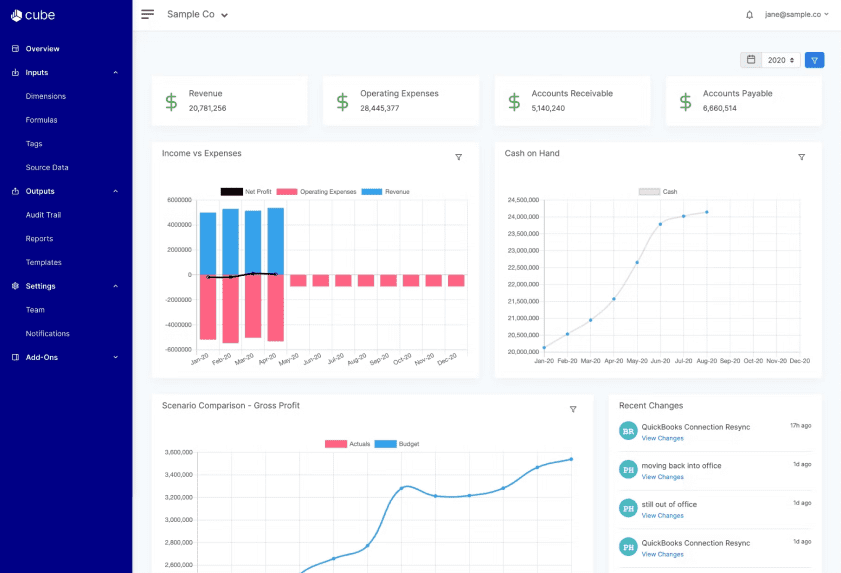

3. Cube Software

Cube Software is a flexible and scalable FP&A solution for entrepreneurs and business owners. It’s a top-rated solution for best ROI estimates, ease of use, and implementation.

Using Cube for FP&A can help automate repetitive and manual workflows, reduce human errors, and improve team collaboration, resulting in more accurate results and intelligent business decisions.

Some of its key features include automated data consolidation, scenario analysis, multi-currency, and user-based controls. Let’s learn more about its best features, limitations, and pricing plans.

Best Features:

- Customizable dashboards.

- Unlimited multi-scenario planning.

- Monthly/quarterly forecasting.

- Organized and structured data.

- Configurable data hierarchy.

- Real-time collaboration features.

Limitations

- Lacks analytics, dashboards, and other comprehensive features.

- Slow processing speed during routine data fetches.

- Lack of flexibility while reporting in Excel.

Pricing:

| Cube Go | Cube Pro | Enterprise |

|---|---|---|

| $1500/month | $2800/month | Custom |

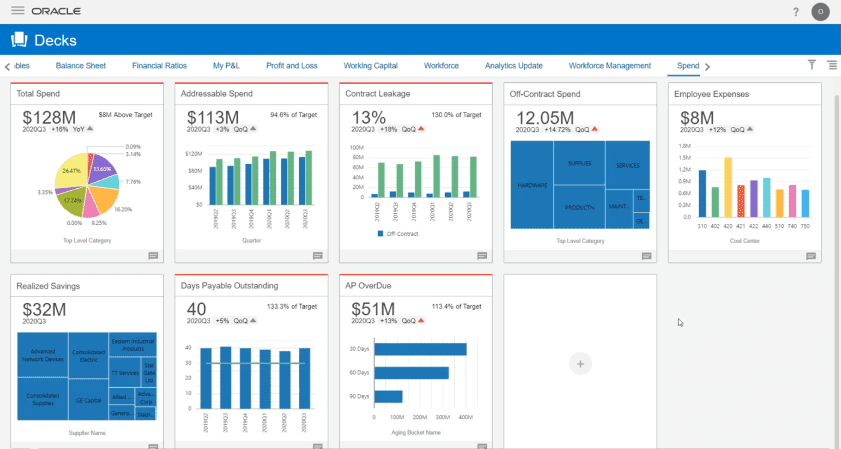

4. Oracle BI

Oracle BI is an FP&A solution that pairs with other Oracle products to deliver visual analytics and calculations for HR, sales, supply chain, and more. This platform utilizes machine learning and AI algorithms for more accurate financial predictions and better decision-making.

While the tool offers advanced and modern solutions to financial modeling, there could be a steep learning curve for non-Oracle users with a lackluster customer support team.

Here’s an extended list of Oracle’s feature offerings:

Best features:

- Powerful operational reporting

- Native access to big data sources

- Interactive and dynamic dashboards

- Ad-hoc reporting with predictive and profit analysis

- Offers remote storage & server ability.

Limitations

- Limited dashboard customizations.

- SMBs may find their pricing plans way too expensive.

- Some users have rated their customer support as poor.

Pricing

| Small business | Med-sized business | Large business |

|---|---|---|

| $10 to $50 user/month | $50 to $500/month | $500 to $10,000/month |

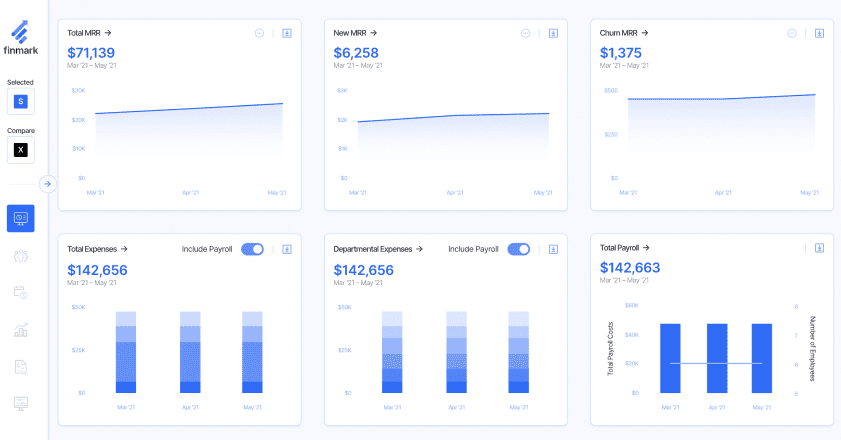

5. Finmark

Finmark is a financial planning solution for startups and SMBs. It helps entrepreneurs and financial professionals in data automation, analyzing business performance, and forecasting financials.

Finmark has two primary use cases—financial planning software for startup founders and SMBs and a strategic finance platform for mid-sized businesses.

The first emphasizes financial planning features for fundraising, while the latter focuses more on helping mid-sized businesses make the right financial decisions.

Let’s learn more about its best features, limitations, and pricing plans:

Best features:

- Real-time financial data analysis

- Multiple scenario analysis

- Real-time collaboration features

- financial forecasting features

- Centralized budgeting capabilities

- Automated hiring planning

Limitations

- New users may experience a steep learning curve at the beginning.

- Occasional inaccuracy in financial projections.

Pricing

Custom pricing plans start from $50/month.

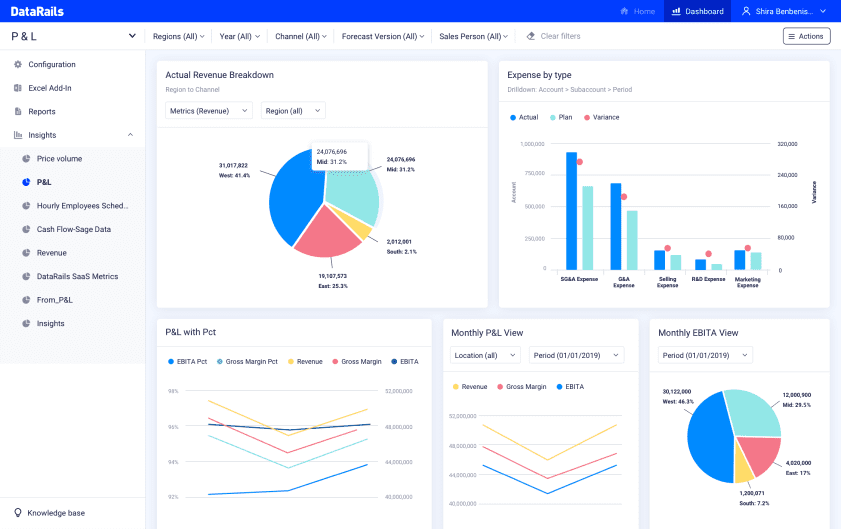

6. Datarails

Datarails has been a pioneer in financial planning and analysis solutions. They took AI automation in financial modeling to the next level with their recently launched FP&A Genius, a ChatGPT-style chatbot for finance teams and professionals.

Their FinanceOS allows users to keep working in the Excel environment, while automated consolidation and reporting help save time. Furthermore, automating repetitive tasks helps you focus more on strategic insights that drive business growth.

Let’s learn more about Datarails’ best features, limitations, and pricing plans:

Best features:

- Automated data consolidation

- Streamlined financial reporting

- business budgeting features

- AI-powered financial forecasting

- Scenario modeling

- Data visualization

Limitations

- Expensive pricing plans compared to other alternatives.

- There is a steep learning curve for new users to get used to the platform.

- There are occasional reports of slower customer response time in resolving technical issues.

- The knowledge base and training materials are too brief.

Pricing

There are no pricing details mentioned on their website. However, most online reviews have confirmed they are expensive compared to other comparable software.

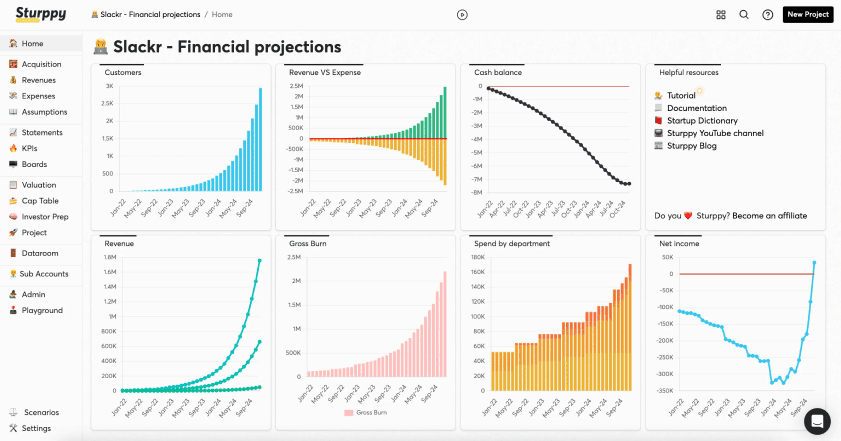

7. Sturppy

Sturrpy is a modern, powerful, and easy-to-use financial modeling and forecasting software for small to mid-sized businesses.

The best part about using Sturppy is it’s designed for early-stage startups, so anyone can build investment-ready financial models without any prior experience or expertise.

There are dozens of financial model templates, so you may use a template or build the entire thing from scratch. Let’s learn more about Sturppy’s best features, limitations, and pricing plans.

Best features:

- Financial model builder

- Hiring plan builder

- AI-drive financial planning

- Real-time collaboration features

- Export to Excel and save PNGs

- Graph color customizations

Limitations

- There is no live integration with accounting software like Xero and QuickBooks.

- There’s no free trial to try out its modeling feature.

- New users may experience a small learning curve.

Pricing:

| Founder | Consultant Pro | Agency Max |

|---|---|---|

| $147/month | $99/month | $199/month |

And that settles things for our top 7 list. Let’s head to understanding the benefits of AI-powered financial forecasting.

Benefits of AI-powered Financial Modeling

There are two groups of entrepreneurs in the market. While the first group is still figuring out what artificial intelligence means to them and how to implement it, the other group is vastly implementing AI to increase efficiency in business operations and save millions.

As Neil Hare mentioned in Forbes, there are AI tools for pretty much everything; it’s up to you how you use and make the most out of them.

While Neil talked about AI implementation in general, let’s make it specific to financial modeling. Benefits of AI-powered financial modeling.

Enhanced Predictive Capabilities

Predictive AI is the next big thing in the AI revolution. It can identify patterns, anticipate behavior, and predict future events based on statistical analysis and information.

When used for financial modeling and forecasting—AI can help you enhance your predictive capabilities and identify patterns that may not be apparent through traditional analysis methods, resulting in better and more accurate results.

Automation-led Efficiency

While AI and automation aren’t the same, they both can work together to help you increase efficiency while preparing financial models.

AI financial modeling tools can rapidly process and analyze data for quicker results compared to traditional financial modeling methods. You may also automate repetitive tasks like data entry and basic calculation, and focus on more important and complex tasks.

Increased Projection Accuracy

As I mentioned, AI algorithms are known for their efficiency and accuracy. They can significantly reduce common human errors in manual financial modeling, resulting in more accurate projections.

Come to think of it—these are the most important benefits of AI-powered financial modeling. Of course, there’s more to it, but we’re keeping it brief this time.

As we conclude the blog post, let’s see how Upmetrics can make all the difference when it’s down to AI-powered financial modeling.

Get Upmetrics for AI-powered Financial Modeling

We discussed how these tools are better than traditional spreadsheets, provided the top 7 list, and listed their benefits as well. That settles pretty much everything.

However, If you’re still in the figuring-out stage—I’d suggest trying Upmetrics.

Upmetrics is more than just an AI business planning software. From business planning to financial forecasting and modeling, Upmetrics has everything you need to get your business up and running.

So, what’s the wait? Get Upmetrics today!