Setting up a business is expensive.

Sometimes even after pouring your entire savings into business, you may need more to kickstart your business.

Well, it becomes essential in such situations to procure external funding like bank loans, to manage enough startup capital for the launch.

However, the question is: How do you get a startup business loan when your business doesn’t make any money? After all, banks won’t sanction loans if they don’t get concrete confidence in your business idea.

Well, let’s decode that with this blog post.

How to get a startup business loan with no money

Getting a bank loan when your business hasn’t generated a single penny is difficult. However, it’s not impossible.

People with no personal savings or revenue have managed to acquire loans for their startups. And you too can by following some of these steps:

1. Determine the type of business loan

As a first step, determine the loan type you should apply to.

Most bank loans have the pre-requisite eligibility criteria for revenues. Most naturally, you should avoid applying there.

However, there are certain types of business loans you may be perfectly eligible for:

- Microloans for up to $50,000

- Equipment loan to secure up to 100% equipment financing( equipment remains as collateral)

- Invoice financing, where your unpaid invoices act as collateral

- Invoice factoring, where the capital is provided against due receivables.

2. Prepare a business plan

The only way you can convince the lenders of your business potential (without making money) is through a business plan.

A business plan articulates your business concept, market opportunity, competitive landscape, business strategies, and financial projections offering a clear roadmap to make it a success.

If anything, a business plan proves that you have put in essential hard work and research to turn your idea into a feasible reality. It demonstrates the opportunity and financial sustainability, helping lenders make quick decisions.

Make Your Business Plan Faster and Easier with AI

Plans starting from $14/month

3. Determine your funding needs

Most businesses fail because they have insufficient capital to keep their business operational. To avoid that, calculate your startup costs and budget for all the expenses, fixed as well as variable.

Ideally, you should also be budgeting working capital for the first 3-6 months. This is because your business won’t generate revenue from the first month.

By seeking sufficient funding, you would have enough to keep your business operational till it starts generating revenue.

4. Detail your financial projections

A financial projection is the estimate of your company’s future financial position based on assumptions about its present position and historical performance.

Adding detailed financial projections in a business plan helps demonstrate the financial sustainability to the lenders. Something, that is essential if you want them to sanction your loans.

A lender would like to get an overview of sales, revenue, growth, and profitability of your business in the next 3-5 years. Along with this, they will ask for pro forma or detailed financial statements projecting your business’s growth over the next few years.

5. Outline your loan repayment plan

While approving the loan, the lending officer would also want to see your ability to repay the loan on time. To offer that assurance, include your loan repayment plan in your detailed forecasts. This will help win their confidence and ultimately a loan for yourself.

6. Get a collateral

Banks need assurance about your ability to repay the loans. And as promising as your projections may seem on paper, they aren’t enough to get a bank loan.

Before applying for a loan, arrange for some collateral. This could be your house, investments, or anything concrete that can be collateralized.

If not, get a personal guarantor to co-sign. In case you’re unable to pay your loan, this personal guarantor will repay your loans.

And that covers all the basics that might increase your chance of securing a startup loan for your business.

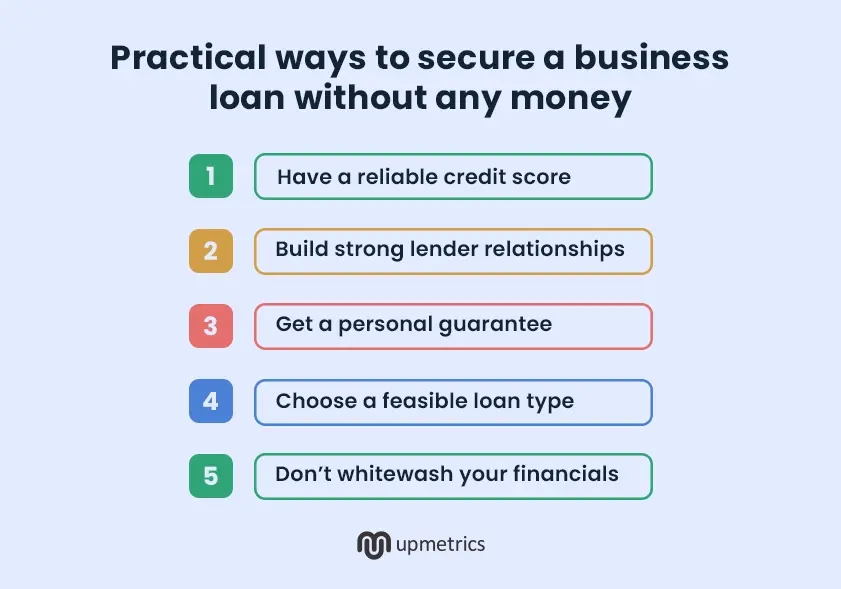

Practical ways to secure a business loan without any money

While we explored the basic essentials to help you get a business loan, we also have a few practical approaches to help you a step further.

1. Have a reliable credit score

Having a good personal credit score is important while seeking a business loan. This is extremely important to establish creditworthiness amongst lenders.

Even if you don’t have a credit score yet, it’s quite easy to build one. Start paying for your rent, utilities, and fuel using a credit card and pay the bills regularly to eventually improve your credit score.

That said, if you haven’t been paying your bills regularly, it’s going to affect your credit score and ultimately your ability to secure a loan.

2. Build strong lender relationships

Don’t wait till the end moment to build your relations with lenders and investors. Network and throw around positive words for your business from early on. This will build leverage for you when the need for a loan arises.

3. Get a personal guarantee

A quite risky move. However, if you’re 100 percent sure about your business go with it.

In personal guarantee, you pledge your personal assets and use them to repay your loan, in case you fail to generate profits. While this can help secure a loan, you must consult a financial advisor and understand its repercussions before pledging your assets.

4. Don’t whitewash your financials

Be transparent with your finances and your financial situation. Whitewashing the financial picture with brilliant revenue projections and unrealistic sales value won’t impress the lenders. In fact, they would sway away from your project.

Instead, choose transparency. Accept the gaps and weaknesses in your finances and instill their confidence in your ability to bridge the gaps or compensate for the same—to build a successful business.

Conclusion

Newly emerging startups and business enthusiasts rely on bank loans and investor funding to fuel their dream ventures. And while it may seem unrealistic to secure a bank loan without making any money, it’s quite possible.

A business plan makes it possible. A well-detailed business plan with thorough and realistic financial projections can go a long way in winning a lender’s confidence.

So, don’t let a lack of finances stop you from pursuing your dream venture. Build your business plan using Upmetrics today and submit your loan application to start your business as planned.