Can you really get a Small Business Administration (SBA) loan with a low credit score? Many entrepreneurs assume “not.” They believe that anything less than perfect credit slams the door on SBA financing.

One Reddit user even claimed, “The SBA won’t accept any loan applications unless your credit is 650 or higher,” echoing a common myth. The reality, however, is more nuanced.

While having good credit helps, bad credit doesn’t automatically disqualify you from SBA loans. In fact, the SBA itself notes that “even those with bad credit may qualify for startup funding”. The key is understanding how SBA loans work, what options exist for low-credit borrowers, and how to strengthen your application.

This step-by-step guide will debunk the myths, highlight real-world experiences, and walk you through practical strategies on how to get an SBA loan with bad credit.

Let’s dive in.

Key Takeaways

- You can still get an SBA loan even with bad credit. Programs like Microloans and Community Advantage specifically cater to borrowers with low credit scores.

- Multiple alternatives exist beyond traditional SBA loans. Options like MCAs, invoice factoring, and online lenders can bridge the gap when SBA loans seem out of reach.

- Your business plan, strong cash flow, solid collateral, relevant experience, and a well-crafted business plan can outweigh credit deficiencies in the lenders’ decision-making process.

- This comprehensive guide covers everything you need to succeed, from SBA loan options and approval tips to funding alternatives.

Can you really get an SBA loan with bad credit?

Yes! As I mentioned, having bad credit doesn’t slam every door shut.

It’s not easy, but it isn’t impossible either.

Sure, it matters like how your report card mattered back in school, but it’s not the whole story. Lenders look at the big picture.

They care about three main things:

- Can your business make money and pay the loan back?

- Do you have any collateral to offer in case things go sideways?

- Do you have enough experience to run this type of business?

The key is understanding that bad credit doesn’t automatically end your chances. It just means you need to work harder to improve your chances. You’ll need to find lenders who focus on the whole picture, not just your credit score. Community banks and credit unions are often more flexible than the big national banks.

So yeah—it’s tough, but you just need to show strength in other areas. If your score’s shaky, build your case with cash flow, craft a solid business plan, collateral, and experience. That’s how many of us still manage to pull it off. And you will too.

Bad credit is killing your funding dreams?

Let Us Connect You With Trusted SBA Partners

How SBA loans work (even if your credit isn’t perfect)

Let me break this down for you real simple, just like I wish someone had done for me years ago.

First thing you need to know: The SBA doesn’t hand you the money.

The Small Business Administration (SBA) is like a second-in-command for you at the bank. They don’t lend you a dime directly. What they do is promise the lender that if you can’t pay the loan back, they’ll cover a big chunk of it.

That makes banks and lenders more willing to take a chance on folks like you and me—even if our credit isn’t spotless.

Now, there are different types of SBA loans. But here are the main ones you should know:

1) SBA 7(a) loan

| Details | SBA 7(a) Loan |

|---|---|

| Loan Amount | Up to $5 million |

| Typical Credit Score | 620–650+ (exceptions possible) |

| Useful For | Working capital, buying a business, equipment, and refinancing debt |

| Who Lends It | SBA-approved banks, credit unions, and online lenders |

| Required Documents | Business plan, financial statements, tax returns (personal & business), personal credit report, business licenses |

This is the most common one. It’s like the Swiss army knife of loans. You can use it for buying equipment, working capital, or even buying a business. Loan amounts go up to $5 million.

Credit-wise, they usually want around a 650 score, but I’ve seen cases where folks with a 620 still got through because their business plan was solid and they had good cash flow.

2) SBA 504 loan

| Details | SBA 504 Loan |

|---|---|

| Loan Amount | Up to $5.5 million |

| Typical Credit Score | 650+ preferred (but not always strict) |

| Useful For | Buying real estate, large equipment, and property improvements |

| Who Lends It | SBA-approved banks + Certified Development Companies (CDCs) |

| Required Documents | Business financials, collateral details, personal financial statement, tax returns, business plan |

This one’s mainly for big stuff, like buying real estate or heavy equipment. The best part is that you can get lower down payments and longer repayment terms.

Same deal here: They prefer better credit, but if you have strong collateral (like the building you’re buying) and steady business income, they might overlook a rough credit report.

3) SBA Microloan

| Details | SBA Microloan |

|---|---|

| Loan Amount | Up to $50,000 |

| Typical Credit Score | 580–620+ (more flexible) |

| Useful For | Starting a business, small inventory, marketing, and minor equipment |

| Who Lends It | Non-profits, community lenders, SBA microlenders |

| Required Documents | Business plan, proof of income, personal credit report, tax returns, references (sometimes) |

These are small loans—up to $50,000. Good for startups or small businesses needing a little boost.

Microloans are usually handled by non-profits and community lenders, and they’re a lot more flexible. I’ve seen people with credit scores under 600 land these because the lender cared more about the person’s hustle and plan than their credit score.

Types of SBA loans available for low-credit borrowers

Not every SBA loan works the same way, especially if your credit isn’t in great shape. Some SBA programs are naturally more forgiving to folks with low credit, and those are the ones you should focus on.

1) SBA Microloan

| Flexibility | ⭐ ⭐ ⭐ ⭐ Most forgiving for bad credit |

| Loan Amount | Up to $50,000 |

| Eligibility | Credit score 580+, must be a for-profit small business, business plan, and the ability to repay |

| Lenders | Non-profits, community-based lenders, SBA microlenders |

The SBA Microloan is perfect for new or very small businesses needing a modest loan. It’s highly credit-flexible, focusing more on your idea and local community impact than your credit score. Here are a few advantages of the SBA microloan:

- Most forgiving SBA loan for bad credit with fast approvals and business support

- Often comes with free business coaching

- Faster approvals through community lenders

- Great for startups and small expenses

2) Community advantage loan

| Flexibility | ⭐ ⭐ ⭐ Flexible for fair-to-poor credit |

| Loan Amount | Up to $350,000 |

| Eligibility | Credit score around 600+, must be a small business in an underserved market, with a solid business plan and financial projections |

| Lenders | SBA-approved mission-based lenders, Community Development Financial Institutions (CDFIs) |

The community advantage loan was built for entrepreneurs in disadvantaged or underserved areas. It offers larger amounts than Microloans and focuses on your business potential rather than just your credit report.

- Great option for growing businesses in underserved areas with flexible credit guidelines

- Lenders are more focused on your business plan and impact

- Good for business growth and expansions

- Helps build business credit for future loans

3) SBA 7(a) loan

| Flexibility | ⭐ ⭐ ⭐ Flexible for fair-to-poor credit |

| Loan Amount | Up to $350,000 |

| Eligibility | Credit score around 600+, must be a small business in an underserved market, with a solid business plan and financial projections |

| Lenders | SBA-approved mission-based lenders, Community Development Financial Institutions (CDFIs) |

The SBA 7(a) Loan is the most popular and versatile SBA loan, covering everything from buying a business to working capital. While credit scores matter, good cash flow, business experience, or collateral can help you qualify. Here are a few advantages of SBA 7(a) loans:

- Versatile use—equipment, working capital, buying a business

- Long repayment terms (up to 25 years)

- Low down payments (as little as 10%)

4) SBA 504 loan

| Flexibility | ⭐ ⭐ Moderate—credit is important, but strong assets can help |

| Loan Amount | Up to $5.5 million |

| Eligibility | Credit score 650+ preferred, must use for fixed assets (real estate, heavy equipment), and provide strong financials |

| Lenders | SBA-approved banks + Certified Development Companies (CDCs) |

The SBA 504 Loan is ideal for established businesses looking to purchase commercial property or major equipment. It’s less about your credit score and more about the strength of your business assets and ability to repay. The advantages are as follows:

- Perfect for acquiring property or equipment with low down payments and long terms

- Low down payments (10–20%)

- Below-market, fixed interest rates

- Repayment terms up to 25 years

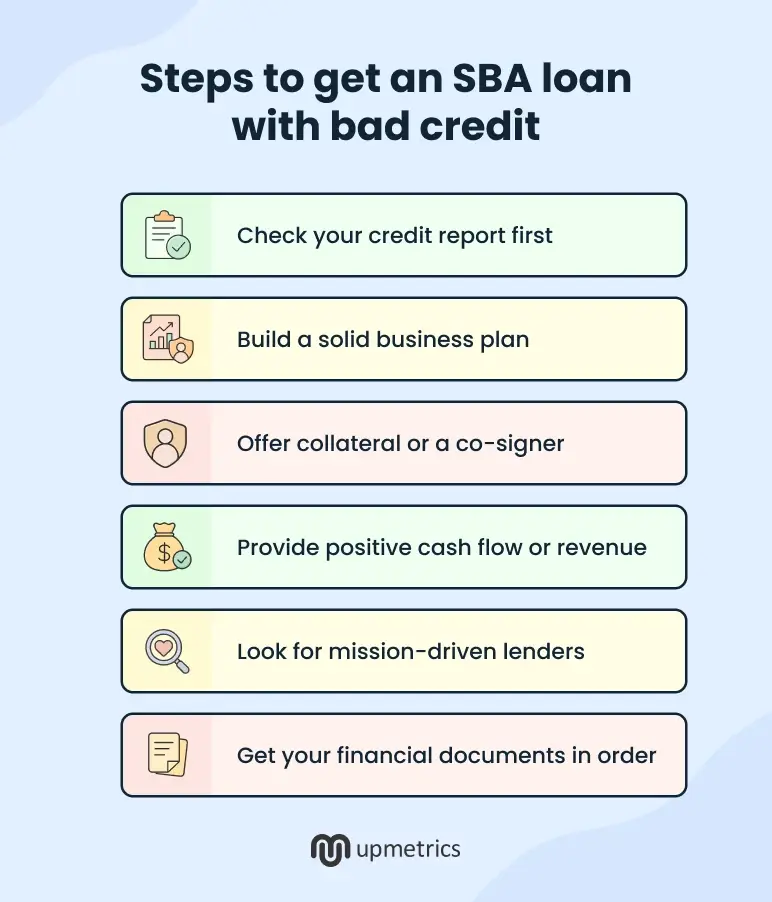

Steps to get an SBA loan with bad credit

Here’s exactly what you need to do to get an SBA loan, even with bad credit:

1) Check your credit report first

Before you go asking for money, you need to know where you stand. Pull your credit report—you can get a free one every year from places like AnnualCreditReport.com.

Look for mistakes: Wrong accounts, payments you did make but they marked late, or debts you already paid off. Get those fixed.

Why? Because even a few points up can make a big difference.

2) Build a solid business plan

Show lenders how your business makes money. Put together a simple but clear business plan that demonstrates:

- What your business is

- How you’ll make money

- Who your customers are

- What you’ll use the loan for

- How you’ll pay it back

Even if your credit’s weak, a great plan can make a lender think twice. You can use SBA business plan templates to get started, but make sure you customize everything to fit your specific situation and include real numbers that show you’ve done your homework.

Bad credit is killing your funding dreams?

Let Us Connect You With Trusted SBA Partners

3) Offer collateral or a co-signer

If your credit isn’t great, balance it out by offering something valuable—like equipment, a car, or property.

Or better yet, get a co-signer with stronger credit to back you up.

It’s like having a business partner with a strong track record standing beside you — it gives lenders more confidence in your application.

4) Provide positive cash flow or revenue

Lenders love businesses that show they’re making money.

Even if it’s not a lot, if you can prove that you’ve got steady cash coming in, it helps build their trust.

Show your income over the past 6–12 months—it doesn’t have to be perfect, just steady and heading in the right direction.

5) Look for mission-driven lenders

Not all lenders are cold-hearted banks. Some actually want to help people like you and me, especially those in tough spots.

Check out:

- CDFIs (Community Development Financial Institutions)

- SBA Microlenders

- Local nonprofit loan programs

They’re more flexible and focus on your business idea and your grit, not just your credit score.

6) Get your financial documents in order

This is the part most folks skip, and it bites them later.

Check if you have tax returns, bank statements, and income records ready. Clean, complete paperwork makes a huge difference. Messy or missing docs just give lenders a reason to say no.

What does approval look like with poor credit?

If your credit isn’t great, getting an SBA loan is tough—but not impossible. The truth is, most traditional banks get nervous when they see a credit score below 620–650. But here’s the part nobody tells you: SBA loans aren’t decided by credit score alone.

Lenders look at the full picture:

- Your business cash flow

- Collateral you can offer

- Business plan

- Industry potential

- And your plan for using the loan

How low credit score affect interest rates and loan terms?

Now, even if you get approved with bad credit, it’ll come at a price:

- Interest rates will be higher: If a borrower with good credit gets 10%, you might see 12–14% or even more.

- Loan terms may be shorter: Instead of a 10-year repayment, you might get 5–7 years to pay it off.

- You may need to offer more collateral or accept a lower loan amount than you originally asked for.

How do lenders assess “Creditworthiness”?

When lenders look at you, with poor credit, they aren’t just staring at that number. Here’s what they really check:

- Cash flow trends: Are you making money consistently?

- Collateral: Do you have business assets or personal property to back the loan?

- Business plan strength: Can you clearly show how this loan will help you grow and pay it back?

- Experience: Do you know your business and industry well enough to succeed?

- Debt-to-income ratio: Can your business handle this extra loan payment every month?

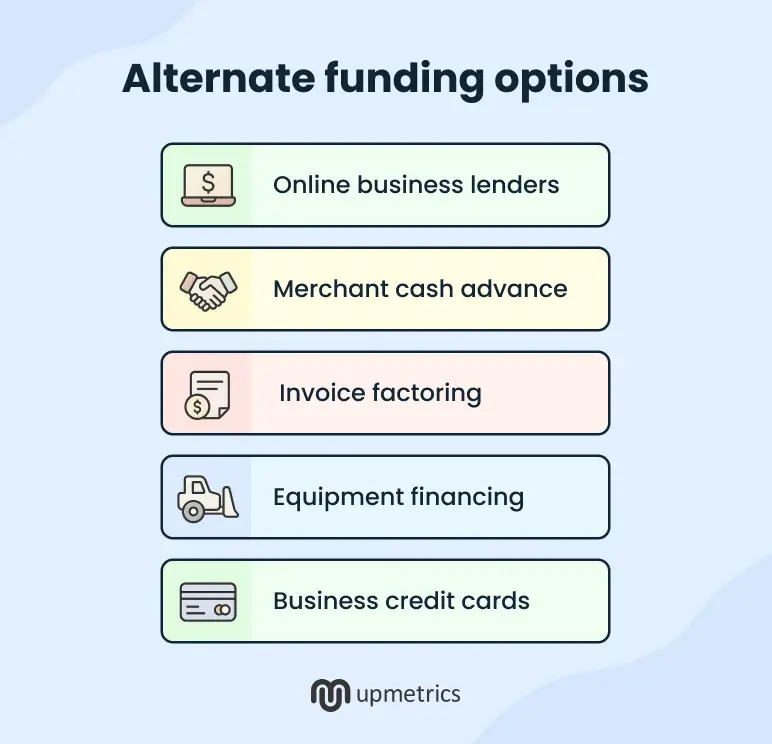

Consider alternate funding options

If an SBA loan feels out of reach right now, that doesn’t mean you’re out of options. There are other ways to get business funding—some faster, some riskier, but worth considering when you need cash to keep things moving.

Let’s break them down.

1) Online business lenders

Online lenders offer quick, unsecured business loans through simple applications without the strict requirements of traditional banks. They focus more on your cash flow than your credit score, making them a go-to for business owners with poor credit.

| Approval Time | 1–3 days |

| Interest Rates | 12% to 50% APR |

| Good For | Quick cash when SBA loans take too long |

| Risks | Higher rates and shorter repayment terms |

2) Merchant cash advance

A merchant cash advance gives you a lump sum in exchange for a percentage of your daily credit card sales. It’s fast but comes with hefty costs and should be a last resort.

| Approval Time | Same day or within 24 hours |

| Interest Rates | 40% to 100% APR equivalent |

| Good For | Fast cash for businesses with steady card sales |

| Risks | Daily repayments can drain cash flow quickly |

3) Invoice factoring

Invoice factoring lets you sell unpaid customer invoices to a factoring company in exchange for immediate cash. It’s a way to unlock money tied up in accounts receivable.

| Approval Time | 1–3 days |

| Interest Rates | 1%–5% of invoice value per month |

| Good For | B2B businesses waiting on slow-paying clients |

| Risks | Can get expensive if invoices stay unpaid for too long |

4) Equipment financing

This option allows you to finance new or used equipment by using the equipment itself as collateral. It’s a good way to upgrade tools or vehicles without tying up your working capital.

| Approval Time | 1–3 days |

| Interest Rates | 1%–5% of invoice value per month |

| Good For | B2B businesses waiting on slow-paying clients |

| Risks | Can get expensive if invoices stay unpaid for too long |

5) Business credit cards

A revolving line of credit you can use for everyday business expenses. It’s fast to get and flexible, though carrying a balance can get pricey.

| Approval Time | 2–5 days |

| Interest Rates | 8% to 30% APR |

| Good For | Buying machinery, vehicles, or business equipment |

| Risks | Lose equipment if you default on payments |

Need extra help?

Securing an SBA loan with bad credit is challenging but absolutely possible. We’ve busted the myth that it can’t be done. SBA programs like Microloans and Community Advantage are specifically designed for borrowers who need a second chance.

We’ve also shared alternative options for when traditional routes feel out of reach. And while navigating lender requirements, financial documents, and eligibility criteria can get overwhelming, you don’t have to figure it out alone.

That’s where a little expert SBA loan assistance makes a big difference. Whether you need help reviewing your documents, preparing a lender-ready business plan, or simply understanding what lenders expect, reliable guidance can save time and reduce stress.

You’ve already taken the first step by learning—now explore our SBA Loan Assistance services and move forward with confidence.