Here’s something I wish more founders knew: A business plan for a loan is not the same as a business plan for investors.

Investors buy into your future. Lenders assess your present. I learned the hard way while working with SBA lenders and bank credit teams. Some plans looked perfect on paper, but they still didn’t move forward. Why? Because they weren’t built for how lenders think.

A loan-focused plan is about control—showing that you understand how money moves through your business and how safely it comes back.

But those aren’t just boxes to tick in one section of your plan; they’re threads that should run through every part of it.

Each chapter of your business plan should answer the lender’s unspoken question: “Can this founder handle borrowed money responsibly?” That’s what we’ll break down in this blog.

What do lenders and banks expect from your business plan?

When I review a business plan written for a loan, I’m not looking for perfection. It’s the control you have over your business for me. That’s exactly how lenders approach it, too. Your plan helps them gauge three things.

How:

- Comfortably can you repay debt?

- Disciplined is your management?

- Stable does your cash flow look under pressure?

From what I’ve seen across both SBA and bank-led loans, they focus on the same fundamentals but weigh them differently. SBA lenders often give more room to projections and management strength, while traditional banks lean harder on collateral, past performance, and cash coverage.

In either case, you must be clear about:

- Debt-repayment capacity backed by realistic cash flow and a healthy DSCR.

- A specific, traceable use of funds.

- Collateral or guarantees that show shared risk.

- Industry stability and management experience.

If you can make those points clear, your plan already answers a lender’s biggest questions.

The lender-focused business plan structure

Whether you’re writing a business plan for a lender or an investor, the basic structure stays the same. What changes is the purpose behind each section and the kind of information you emphasize.

For lenders, every part of the plan must prove financial control, repayment ability, and operational discipline. In other words, the format doesn’t change, but the story you’re telling does.

In my opinion, you should treat each section like a financial checkpoint. I mean, every section must prove something specific about control, cash flow, or repayment logic. The clearer you make that connection, the faster a lender can trust your plan.

So let me quickly break down what each section should really convey when you’re writing it for a lender:

- Executive summary: assess creditworthiness and repayment intent.

- Company overview: ownership, experience, risk mitigation.

- Market analysis: stability and revenue reliability.

- Products/services: margin predictability.

- Marketing & sales: realistic customer acquisition pipeline.

- Funding request: clarity on loan purpose and payback timeline.

- Financials: debt service coverage ratio, cash flow sufficiency.

- Appendix: verifiable evidence and collateral.

Now, on to the main section of the article:

How to write a business plan for a loan (bank-compliant plan)

I’ve distilled my years of writing and reviewing business plans into clear, practical steps you can actually use; the same structure and level of proof banks and SBA lenders expect before saying “yes.”

As we go, I’ll walk you through real examples I’ve worked on in Upmetrics, just so you can see how each section should look in practice. You don’t need to use a specific tool, whether it’s Upmetrics, Excel, or your own format; the principles stay the same.

1. Executive summary

The executive summary in your business plan will tell the lenders what your business does, how healthy it is, and why the loan you’re asking for makes financial sense.

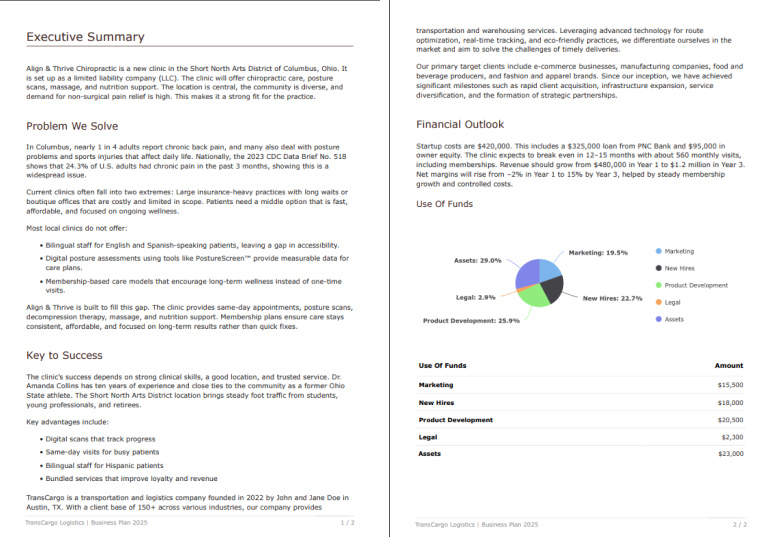

This is what an executive summary for a loan-oriented business plan should look like:

Usually, I treat this section as a confidence test. In a few paragraphs, you’re showing a lender that your business runs on logic. So it should answer three questions right away:

- What do you do, and how stable is it?

- How much funding are you requesting and for what purpose?

- Can you comfortably repay it through cash flow?

When I help founders write this part, I tell them to lead with proof. Start with a quick summary of what the business sells, who it serves, and key performance data—revenue, margins, or growth rate. Then move straight into the funding details:

- Loan amount: The exact figure you’re requesting.

- Use of funds: Where the money will go and why it matters.

- Repayment plan: How debt fits into your existing cash flow.

For example:

“We operate three retail bakeries generating $720K in annual revenue with 18% profit margins. We’re seeking a $100,000 SBA 7(a) loan to expand production capacity. Our projected DSCR post-loan is 1.6x, ensuring stable repayment.”

2. Company overview

In a loan-focused business plan, the company overview is a section where lenders get to know who’s running the business. So it should cover the essentials like ownership, structure, experience, and how the company’s been built so far.

But let me tell you, it answers a deeper question: “Can this team manage borrowed money without losing control?” So, start with the basics:

- Business name

- Legal structure,

- Location, and

- Ownership breakdown.

Then, go beyond that. Lenders read between the lines here. So talk about your years in operation, prior experience, and milestones that show you can handle growth responsibly.

And I get why many founders ask, “What if we’re a new business?” That’s fine. Use your background to build trust. Mention previous roles, industry expertise, or even early wins that show you know the terrain. For example:

“BlueRidge Manufacturing LLC, founded in 2022 and based in Denver, CO, is owned by Dana Lee (60%) and Chris Patel (40%). Both bring over a decade of experience in industrial supply and closed the company’s first year with $450K in revenue and 20 recurring B2B clients.”

If I were reviewing this section, I would look for signs of control. Who makes the key decisions? Has this team worked together before? How do they handle challenges?

That’s why, for this section, I suggest you connect experience to outcomes, like maintaining healthy margins or scaling without external debt; it instantly builds lender confidence.

3. Market analysis

When it comes to a loan-focused business plan, the market analysis section should prove that your serviceable market is stable enough to support consistent revenue and loan repayment.

In a typical business plan, founders highlight how big the market is to show growth potential. But lenders care about a different question: Is this market dependable enough to keep cash flowing through repayment?

That’s why I always suggest grounding this section in credible data, not assumptions. Pull your figures from IBISWorld, the U.S. Census Bureau, or the Bureau of Labor Statistics (BLS).

Pair that data with your own signs of demand resilience: Repeat customers, long-term contracts, or consistent order volumes. Those details show you understand your market as well as how it behaves under pressure.

I was reading a FasterCapital analysis on credit market stability that made this point perfectly:

“Stable credit and market conditions are among the most critical factors influencing funding access for small businesses. Entrepreneurs operating in resilient, less-volatile markets not only secure financing faster but maintain stronger repayment performance over time.”

It’s exactly what I see in practice. When your market analysis proves you can survive dips, lenders stop worrying about your upside and start trusting your baseline.

And if your business faces cycles or seasonality, say tourism, retail, or agriculture, mention that too. I know it’s tempting to gloss over the dips, but lenders value transparency far more than perfection. Explain how you manage slow months, balance cash flow, or diversify demand.

When a lender finishes reading this section, they should feel that your market has enough predictability to make repayment a low-risk bet.

4. Products and services

Your products and services section is where you show what makes the plan dependable. Lenders already assume your offering works. What they want to know is whether it earns money consistently and holds margins under pressure.

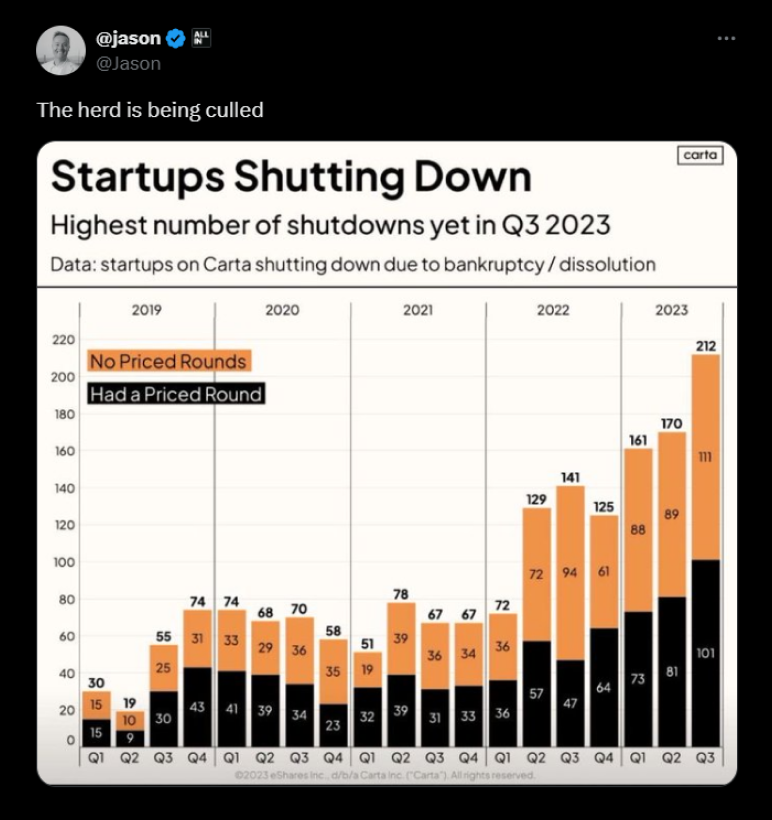

Back in 2023, I remember Jason Calacanis sharing Carta’s data on X showing how startup shutdowns hit their highest point in years. Most of those businesses failed because their margins couldn’t hold.

The chart is a good reminder that a strong business is built on unit economics that can survive turbulence.

So while describing your products, frame them around profitability. I like to break it down by unit economics, gross margins, and supply reliability.

How much does each unit cost to produce? What’s your average markup? Are your input costs stable? The more predictable your numbers, the easier it is for a lender to trust your repayment math.

Here is how you can write this section:

“Our top-selling skincare line carries a 62% gross margin and represents 45% of total revenue. Raw materials are secured through a 3-year contract with two domestic suppliers, insulating us from import volatility.”

Let me guess what you’re thinking right now—how much of the financial story belongs here? I’d say, ”only the essentials.” Leave the deeper numbers for the financial section. Here, your goal is to prove that your business model has a reliable core.

5. Marketing and sales strategy

If the products section proves what you sell, this section proves how it keeps selling. Lenders read your marketing and sales strategy as a forward-looking test of stability: Can this business keep generating cash once the loan hits the account?

So skip the fluff about “brand awareness” or “social media presence.” What matters here is conversion and cash. I like to map it out as a simple pipeline: prospect → conversion → retention. It shows exactly where revenue starts, how it matures, and whether it sticks.

A story that stuck with me came from a Founderpath interview with the team at Retention.com. They said,

“We focus on storytelling and filtering for qualified prospects through content—not just posting, but converting attention into leads.”

That’s the mindset you want to capture here. Here’s what to cover:

- Acquisition logic: Where do new customers come from, and what’s your average cost to get one?

- Conversion proof: What percentage of leads turn into paying customers?

- Retention strength: How many keep buying or renewing?

You’re probably wondering how detailed this needs to be. My rule: Show enough to prove your growth engine works under real conditions. For example:

“A $50K loan will fund expanded ad spend expected to increase monthly sales by 25%. The added revenue supports full repayment within 24 months while maintaining a DSCR of 1.5x.”

If you can, visualize your Revenue pipeline:

Prospect → Conversion → Repeat Purchase → Retention.

6. Operations and management

Lenders don’t just fund businesses; they fund operators. So don’t just list names and titles. Explain what risk each person helps reduce. If your COO manages supplier contracts, that lowers operational risk.

If your accountant handles cash reconciliation weekly, that cuts financial exposure. Each role is a small form of insurance in the lender’s eyes.

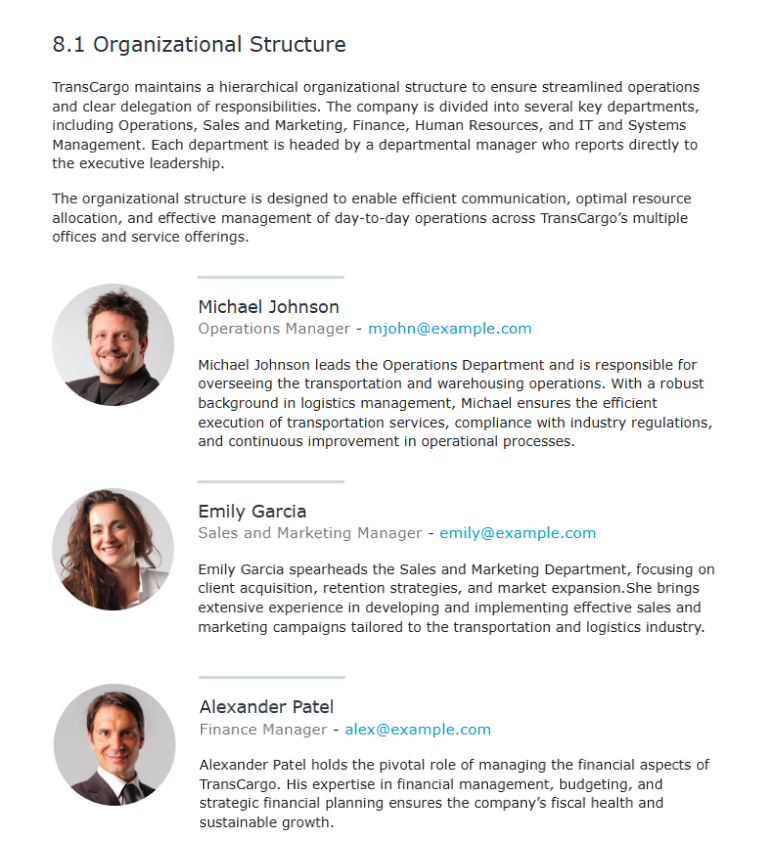

Here is how the operation and management section should look:

Each profile highlights what the person manages and what risk they mitigate—whether it’s financial stability, operational efficiency, or customer retention. Notice how even the HR and finance roles tie directly to outcomes that affect repayment.

You can follow this same approach. Keep bios concise (one or two sentences per person) but link each responsibility to measurable impact. For instance:

- “Reduced logistics delays by 12%, improving cash flow margins.”

- “Increased retention to 85%, securing predictable recurring revenue for loan servicing.”

If you work with external advisors—a CPA, bookkeeper, or compliance consultant—include them, too.

And if you’re small or early-stage, you can still show control through systems. Note how payroll runs, how inventory is tracked, or how you monitor compliance. Those operational habits speak volumes about management maturity.

7. Loan request and repayment plan

This section tells lenders exactly how much capital you need, what you’ll do with it, and how you plan to return it. Here, the lenders will look for two things: Precision and purpose. Precision in the amount you’re asking for, and purpose in how that money strengthens the business’s ability to repay.

To keep it lender-ready, structure it into four clear parts:

- How much do you need

- What it’s for (use-of-funds breakdown)

- Owner’s contribution (your share of the investment)

- How and when you’ll repay

Here is an example of how you can phrase it:

“We are seeking a $150,000 SBA 7(a) loan to fund equipment ($70,000), inventory ($50,000), and working capital ($30,000). The owner has already invested $40,000 in setup and operations. The loan will be repaid over 60 months through operating cash flow, maintaining a projected DSCR of 1.6x.”

But don’t stop at the numbers; context matters as much. Explain why each expense matters. If equipment expands output, say by how much. If inventory shortens delivery cycles, link that to sales growth or cash flow improvement.

Lenders think in cause and effect: How does this expense reduce risk or increase repayment confidence?

One of my clients, a small food manufacturer, did this beautifully. They broke their $120,000 loan into clear buckets: $60,000 for new packaging machinery that raised output by 25%, $30,000 for raw materials to meet larger orders, and $30,000 as a cash buffer for seasonal dips.

Because every dollar had a purpose (and the founders had invested their own savings, too), the lender could see repayment was built into the plan.

8. Financial projections

The financial projections section answers one question lenders always have: “Can this business comfortably repay the loan and still stay healthy?”

So prove the feasibility of your numbers here. Each of them should show that you understand your business’s financial rhythm—how revenue comes in, how expenses behave, and how cash moves over time.

I always recommend including at least three years of forecasts, covering:

- Profit & Loss (Income Statement) – to show profitability over time

- Cash Flow Statement – to prove liquidity and repayment capacity

- Balance Sheet – to demonstrate overall financial position

If you’re already thinking, “Do lenders really read all of this?”—not line by line. What they focus on are the assumptions that drive your numbers: Pricing, sales cycle, seasonality, and expense patterns. If you can explain what causes changes in revenue or margins, your projections will look credible.

And since this is a loan-based plan, you need to call out one ratio upfront — the Debt Service Coverage Ratio (DSCR). It’s the metric lenders use to gauge repayment comfort.

DSCR = Net Operating Income ÷ Total Debt Service

A DSCR of 1.25x or above usually shows a safe buffer. It tells lenders you’re earning 25% more than you need to cover loan payments.

If your DSCR strengthens over time, highlight it.

“Projected DSCR improves from 1.3x in Year 1 to 1.7x by Year 3 as margins expand and debt reduces.”

Also, note when your cash flow turns positive relative to your repayment schedule. That simple detail tells lenders you understand timing.

If you’re confident about your story but unsure about the math, use Upmetrics’ financial forecasting services. It’s what I recommend when founders need forecasts that hold up with lenders—accurate, structured, and easy to defend.

9. Appendix

Here, you have to test everything you’ve claimed in the plan. Include whatever helps a lender confirm that your story checks out: Business licenses, contracts, collateral details, tax returns, leases, or letters of intent. Attach short bios or resumes if you’ve mentioned advisors or management credentials earlier.

I can’t stress this enough: Label everything clearly. Loan officers don’t have time to dig. A clean, numbered appendix tells them you run your business the same way you handle your documents—organized, transparent, and ready for review.

If your plan includes collateral, this is where you show it. Photos, appraisals, or ownership proofs all belong here. Same with signed contracts or purchase orders that validate projected revenue.

In my experience, a well-organized appendix often shortens loan processing time by weeks.

Tips to align your business plan with lender requirements

At this point, your plan should do one thing better than most make: A lender thinks less. When credit analysts read, they’re tracing risk. Every paragraph you write either reduces that risk or adds to it.

Over the years, I’ve learned that alignment is about rhythm—how your plan mirrors the way lenders process information. Here’s how that rhythm works in practice:

1) Lead with repayment clarity

Open your plan by linking how much you need, where it goes, and how you’ll pay it back. Vague intentions like “business expansion” slow reviews because lenders must guess what outcomes the money will fund. Replace them with specifics: “New packaging line to raise output by 20%” or “Working capital to stabilize inventory costs.”

2) Keep the structure lender-friendly

Lenders read in sequence—summary, operations, financials, appendix. A plan that follows that rhythm feels predictable, and predictability builds trust. Misplaced or repeated details suggest disorganization, which credit teams interpret as operational risk.

3) Check for financial consistency

If your growth projections say 25% but your staffing plan hasn’t changed, the math won’t hold. Reviewers spot those gaps immediately. Keep your story, operations, and numbers aligned to avoid the “unsupported assumptions” label that slows underwriting.

4) Interpret key ratios

Include DSCR, current ratio, and break-even point—but add one-line explanations. “DSCR 1.5x indicates 50% coverage above debt obligations.” Lenders read ratios as shorthand for risk control, and clear interpretation saves them recalculation time.

5) Anchor every claim in verifiable data

Lenders don’t need persuasion; they need confirmation. When you reference market stability, cite credible sources. Then connect those insights to your actual performance: Retention rates, long-term contracts, or average customer tenure. It shows you understand your market both statistically and operationally, which gives your plan depth beyond optimism.

6) Let projections follow the loan

If you’re asking for a five-year loan, your plan should walk that entire path. Forecast revenue, expenses, and repayment checkpoints for the full term. When the horizon ends before the loan does, it looks like you stopped planning. Full-term projections tell lenders you’ve thought through the lifecycle of both growth and debt.

Need help writing a bank-compliant business plan?

By now, you’d have realized how much precision matters while writing a business plan for a loan. In fact, only about one-third of small business applicants receive the full financing they request. Many plans fall short because the documentation doesn’t align with lender review standards.

That gap is fixable with the right tools and structure. If you’d rather not start from scratch, here are a few reliable ways to build a lender-ready plan:

- Use a lender-focused business plan template. Start with professional formats like Upmetrics’ business plan templates.

- If you’d like a deeper walkthrough, this guide on writing a detailed business plan covers each section step by step.

- For bigger loan requests, hiring a business plan professional can make a lot of difference.

- Use business planning software like Upmetrics to help you organize content, build projections, and export lender-ready documents — all in one place.

If your business is ready to grow and you want a plan that reads the way banks expect to see it, this is where to start.