You have finally created that awesome product. It’s now time to sell.

At what cost?

This is the question that troubles most businesses.

Price your products too high and you see low sales. Price it too low and you struggle to make profits.

What’s the sweet spot to finding a balance between profitability and business sustenance?

The answer is a smart pricing strategy in your business plan. But how to decide on a pricing strategy for your products?

This article is your answer.

In this guide to creating the right pricing strategy, we cover everything you need to know about a pricing strategy from A to Z.

Let’s decode the recipe to a pricing strategy that brings in both: great profit margins and happy customers.

Key Takeaways

- A well-defined pricing strategy balances profitability with customer satisfaction and market competitiveness.

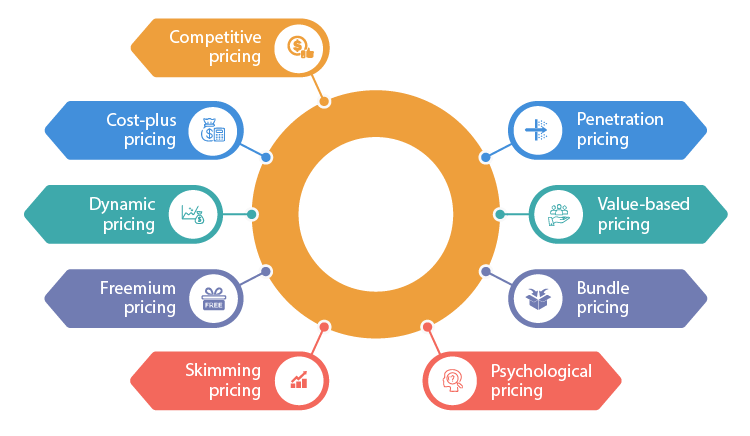

- Common strategies include cost-plus pricing, value-based pricing, penetration pricing, and skimming pricing.

- Selecting the right strategy involves analyzing costs, understanding customer value perception, and assessing competitor pricing.

What is a pricing strategy?

A pricing strategy is a model you use to decide the price of your products or services.

It is a critical component of your business plan, as it decides on how you:

- Make profits

- Compete against competitors

- Optimize conversion and lead generation

Creating the right pricing strategy means taking into account various factors such as market conditions, competition, production costs, perceived value to the customer, and so much more.

We agree it’s the hard part.

The main objective: Establish a price point that’s good enough to attract customers while also maintaining profitability for effective financial planning.

Why is pricing strategy critical to a business plan

A recent survey by Bain and Company found that roughly 85% of businesses are seeking an improvement in their pricing decision-making process. On the other hand, McKinsey contends that even a mere 1% increase in prices can result in an impressive 8% boost in profits.

Your business plan is a document that contains the goals of your company and how you plan to achieve them. A pricing strategy highlights how you will be making actual profits from your product offerings to achieve those goals.

The price you set reflects not only the value you assign to your brand’s products and customers but also serves as a pivotal factor that can either attract or deter potential buyers.

Let’s delve deeper into the benefits of the right pricing strategy in a business plan:

Establishes the road to profitability: Your pricing strategy determines your profit margins. By understanding your costs and competitors’ pricing, you can set a price that ensures profitability and sustainability for your business.

Enables better market positioning: An optimized pricing strategy helps you put your products and services in the correct price bracket. It guides your business and helps you decide which market position to occupy for the best chances of success.

Helps project demand: With a good pricing strategy, you can project and satisfy the demand for your product or service. Choosing the optimal pricing strategy (such as skimming, penetration, or value-based pricing) will help you manage demand fluctuations and optimize sales volume. This makes your business plan stronger.

Helps project ROI: You also get a rough idea regarding your sales goals with a strong pricing strategy based on competitor and marketing analysis.

Enhances chances for funding: If you’re a startup seeking funding, a strong and thoroughly analyzed pricing can highly strengthen to secure funding.

With an understanding of the criticality behind integrating a pricing strategy into your business plan, it’s now time to explore some real-world pricing strategies before you come to designing your own.

Choosing the best pricing strategy for your business

“You know you’re priced right when your customers complain—but buy anyway.” — John Harrison

You know what it is, and you know why you need it. But which strategy should you implement? What’s the best one for you?

Let’s get you out of all these conundrums with our comprehensive list of best pricing plan strategy examples.

Competitive pricing

The competitive pricing strategy involves setting your prices based on what your competitors are charging for similar products and services.

As such, it’s ideal for businesses venturing into markets that sell similar products such as groceries or retail stores.

Think of how airline prices for a particular destination all rise up together during holidays.

A competitive pricing strategy is used both in B2B and B2C sectors like communication services, retail stores, grocery, telecom market, and more.

Essentially, you can implement this strategy by:

- Setting your prices below competitors’

- Setting your prices similar to your competitors’

- Setting your prices a little above your competitors

What approach you choose depends on how well you know your market or customer. For instance, if you price your goods a bit lower, you may attract more customers. However, you must make sure not to attract big losses.

If you decide to set your product prices higher than your competitors, you’ll want to draw on some ideas from value-based pricing strategies that help clarify why you are charging more for your products. Are you offering better quality? Are you treating customers better?

Marketing efforts like a refund scheme, better customer experience, and more will play a crucial role in justifying the higher cost to customers.

Value-based pricing

The value-based pricing method works based on what your customers think the value of your product should be.

Thus, the price is dependent on what the customer is willing to pay (WTP price) for your product.

Depending on the value that you bring to your customers’ business or life, you get a chance to price your products much higher than the actual production cost.

Think of how a fine-dining restaurant sets its price. While it may seem exorbitant to some, patrons willing to throw in that amount happily visit such a place.

This technique is well used by B2C or B2B service providers, freelancers, and experts who teach a specific skill.

Apple, in particular, is notorious for using this strategy to demand excessive prices for products that are either only slightly better or equivalent to their counterparts.

Cost-plus pricing

The cost-plus pricing strategy pulls us away from a “willing to pay” towards a more business-centric approach. This strategy, aptly named markup pricing, involves taking into account the production cost and simply adding an extra dollar value to it.

Cost-plus pricing, in a nutshell:

My production costs + Markup price = My selling price.

If you plan to sell a product that costs you $100 to produce. Simply speaking, you now need to sell the product at a higher price to earn a profit.

If you want a 20% profit margin, you have to sell at $120. If you want a 15% profit margin, you sell at $115. Pretty easy, right?

With the cost-plus strategy, it becomes easy for you to get a rough draft regarding the profits you can generate depending on the volume of your sales.

So, let’s say you have a profit goal of $10000 and a profit margin of 20% with each product costing $100 to make.

Thus, your sales goal should be

$10000/$20 = 500

You need to sell 500 units to reach that goal.

Economy pricing

In the economy pricing strategy, you sell products at a bargain price, i.e. at the lowest price to get your potential customers to start buying your products.

While this method might seem quite similar to competitive pricing, there is a hidden catch.

Unlike competitive pricing, economy pricing targets those customers who may be okay with a slightly lower product quality or those who don’t care about brand image.

By sourcing cheaper supplies and streamlining features, you can offer extremely low prices for your goods while remaining profitable.

You might have noticed a retail chain’s cheaper alternative sugar packet stocked right beside the branded ones. Another great example includes generic drugs—they are priced lower because they come with lower production costs.

Premium pricing

The premium strategy is exactly the opposite of the economy pricing strategy. Instead of selling products at their cheapest, you hike up the price to give customers the essence of a luxury product.

Of course, companies do add some additional value to their products but the bulk of the pricing comes from the perception of the product as high-end by the customer.

Psychological pricing

The psychological pricing strategy plays with the psyche of your customers to make them want to buy your stuff.

For instance, one of the most popular and widely used techniques in this strategy is the 9-digit effect. It suggests that even though a product priced at $9.99 is essentially $10, customers perceive it as a better deal due to the presence of the “9” in the price.

Placing the target product next to an expensive alternative, giving good deals, tweaking your typography, and inducing FOMO (fear of missing out) are some other basic ways to subtly manipulate buyer psychology.

Dynamic pricing

Dynamic pricing goes by many names—surge pricing, demand pricing, or time-based pricing. And as the names suggest, it is a pricing strategy that is flexible in nature and is catered to adjust to the fluctuating market and customer demands.

Dynamic pricing lives and dies with your monitoring and analysis capabilities. You need to stay on top of various metrics like supply and demand, spatio-temporality, customer preferences, and more.

Penetration pricing

In this strategy, you enter the market with a low baseline price for your products. That attracts customers and you set up your market presence. This helps you pull customers away from competitors who demand higher prices for similar products. That’s what the penetration strategy is all about.

Do note that this strategy may not be always sustainable in the long run. This requires you to have a suitable plan in place once you establish a suitable foothold in the market.

Uber made great use of this strategy. They started with a customer-centric strategy where rides were cheaper than the competing taxi service.

Price skimming strategy

As a complete opposite to the penetration strategy, we have price skimming, where you start off with a high price and slowly bring it down.

Price skimming works best when you are stepping into a market where there’s not a lot of competition, focusing on a specific bunch of customers, and really highlighting the value of your product or service.

Of course, this comes with a hefty upfront investment in marketing and promotional campaigns.

Once more players start popping up in your market, you’ve got a chance to drop your prices a bit and snag a larger slice of the customer pie.

Take the Apple iPhone, for instance. They frequently employ a price-skimming strategy when they first release a new model. But once competitors like the Samsung Galaxy hit the market or they release newer models, Apple adjusts the price downward to maintain a competitive edge

Steps to design an ideal business pricing strategy

We covered a whole lot of potential pricing strategies that can make way into your business plan. However, you still need to decide which one is the most suitable for your business and how you can implement it. Let’s help you with that with some easy-to-follow steps:

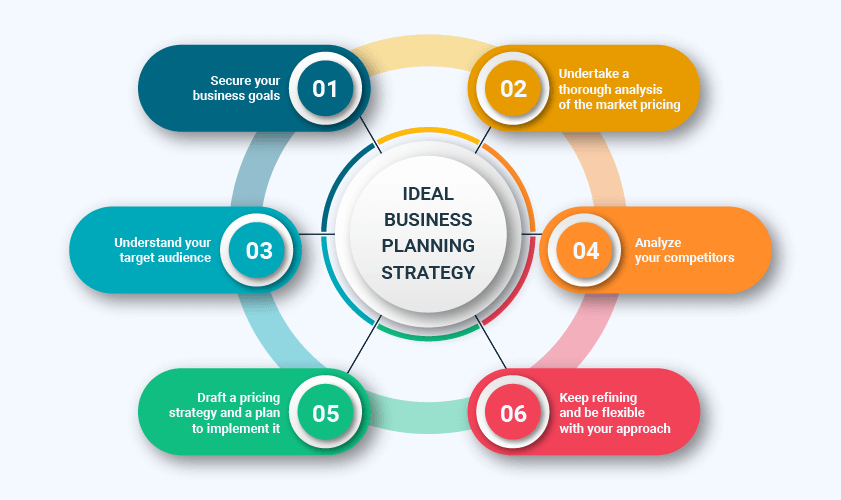

Step 1: Secure your business goals

The first and most important step is to understand what your business needs. You need to discern what your pricing should depend on.

Is it increasing profitability, improving cash flow, extending your market share, beating a competitor, reaching out to a new audience, or introducing a new product?

Your entire pricing strategy will depend on these factors. Choose wisely.

Step 2: Undertake a thorough analysis of the market pricing

Ensure that your pricing strategy is suitable for both internal affairs and market conditions.

For instance, if the market you choose is saturated, you must gear up for competition and go for something on the lines of a competitive pricing approach. On the flip side, if it’s a new market, you can go for a value-based pricing approach.

Step 3: Understand your target audience

Why should your customers purchase your products? What will they buy and how should you provide it to them? Is it a premium customer base? Or are you targeting price-sensitive customers?

These are essential questions you need to find the answer to. It is only by knowing your target audience and your Ideal Customer persona that you can initiate and maintain your sales.

Opening a fine-dine restaurant in a Tier-2 city? Value-based or premium pricing can work. Opening another cafe in a metro city? You’re in for competitive or economy pricing.

Step 4: Analyze your competitors

Identify at least three direct competitors and analyze how they structure their pricing. Take a look at whether they break down their pricing into components and offer significant discounts. This gives you a solid idea of how to price your own products.

Check if they bundle products or solutions with others. Look into value-based pricing, where clients pay a percentage of the perceived return on investment. When considering substitutes, think about what options customers might use and their costs.

Remember, sometimes the best solution is the decision to do nothing. Consider self-solutions or choosing not to address the issue, along with alternatives from indirect vendors.

Step 5: Draft a pricing strategy and a plan to implement it

Now that you have gathered enough info to design and draft your pricing strategy, this is the stage where you finalize everything and move on to the implementation stage. Depending on the above metrics, you can choose one of the aforementioned strategies.

We have already discussed the different pricing strategies. Pick one after you have thoroughly analyzed your market, competitors, production costs, and overarching business goals.

Here’s a quick cheat sheet for choosing and implementing the right strategy for you:

- Value pricing: Understand the value for your customers and their willingness to pay. Also, understand what alternatives they have.

- Competitive pricing: Set the price equal to what your competitors are charging and win the service game.

- Psychological pricing: Price products or services in a way that triggers action. For example, charging .99 instead of $1.00.

- Promotional pricing: Discounts over a period of time or one-time deals.

- Price skimming: Enter the market with a high price, but once your competitors follow, lower your cost and implement other pricing strategies.

- Economy pricing: Everyday low price with a focus on low manufacturing/delivery costs.

- Penetration pricing: Set a price artificially low to break into the market.

Step 6: Keep refining and be flexible with your approach

Don’t stress over finding the absolute perfect price. Instead, come up with a few options and give them a test run with your customers. You might be surprised to find that you can actually sell at a higher price than you thought with the right strategy.

But you won’t know until you try it out with potential customers. If the price doesn’t seem to work, take a look at any feedback you receive, tweak your pricing, and give it another shot

Tips to keep in mind:

- Try to Communicate with and understand your target customers. Know how much they can pay, what they are interested in, and how you can give them the best value. A good way is to use feedback forms.

- Always be flexible. If your pricing strategy doesn’t work, it’s time to research, experiment with different prices and adapt.

Bain and Company’s original research on pricing strategies also suggests useful tips. Make sure your sales staff is a part of your pricing and marketing strategy. If your pricing strategy is truly flexible that must also translate to better incentives for your sales team so they can sell more and sell better.

Get Started With Your Own Business Plan With Upmetrics

We just covered everything about pricing strategies. They are so critical to business planning as they help formulate your business goals, organize inventory plans, and increase your chances of achieving business goals.

However, there is so much more to a business plan than just pricing. If you want help creating a business plan from scratch, consider Upmetrics. It offers a collection of 400+ sample business plans for ideas and inspiration. Furthermore, AI assistance and automated financials make the process even easier for new users.

Interested? Try Upmetrics today!