If you’re reading this, you already know a low credit score makes it harder to get a loan.

What you’re probably trying to figure out is how to get a business loan with bad credit and still make it work. Can you move forward without wrecking your cash flow?

The answer is yes, but only if you stop chasing approvals and start thinking like a lender.

I’ve seen small business owners accept their first bad credit business loan, say yes, and regret it six months later when the repayment terms crushed their working capital.

That’s not what we’re doing here. This is about how to position yourself to get business funding that actually supports your growth, without locking you into bad terms.

Bad credit isn’t a label. It’s a risk score.

A credit score is just a number between 300 and 850 that tells lenders how risky you are. Your credit score isn’t a reflection of your potential as a founder.

The number (300–850) tells lenders how likely you are to repay. It’s based on your debt history, payment patterns, age of accounts, and any defaults or bankruptcies. The higher your score, the lower the risk. That’s all they see.

If your business is still new with limited business credit, light annual revenue, and not much operating history, lenders look at your personal credit history. If it’s above 600, some online lenders and alternative financing providers might consider you.

Below 580? Your options shrink fast. Below 500? That’s a bad credit score. For most traditional lenders, you won’t get past the first screen.

SBA loan programs, especially microloans, are a slight exception. They sometimes approve borrowers with fair credit if other fundamentals are strong. So…

How to get a business loan with bad credit?

Getting a loan with bad credit is possible, but it takes more than filling out applications. Lenders need to see stability somewhere, even if it’s not in your credit score.

That could be consistent income, a repayment plan that makes sense, or a well-built business plan that shows how the money will be used. The stronger those signals, the more likely you are to qualify, especially with nontraditional lenders.

Before you apply, check your credit score and understand what you’re walking in with. What happens next depends on how you position everything else.

Business loan options if you’ve got a bad credit

Let’s not waste time listing every type of loan that technically exists.

If you have a low credit score, you’re not getting a traditional bank loan. Not unless you’ve got substantial collateral, a co-signer who trusts you more than the lender does, or a long history with the bank.

And even then, it’s a maybe.

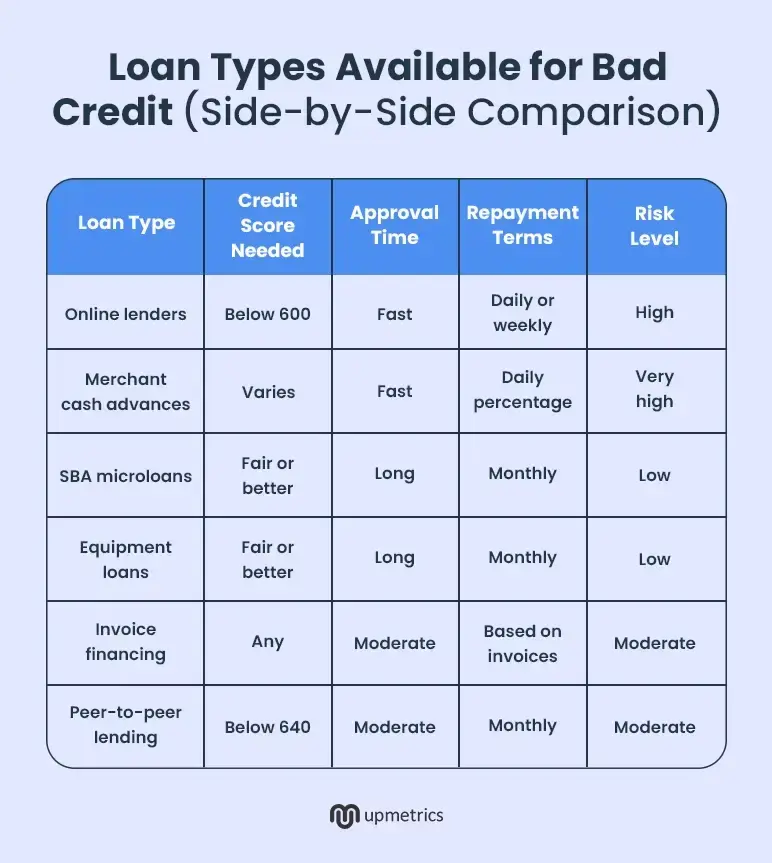

So, let’s talk about the business loan options that actually show up when your personal credit score is under 600 and what they really cost.

1. Online lenders

They’re fast. They don’t fixate on credit alone. They use bank statements, monthly revenue, and business activity to underwrite.

It’s not free. Shorter terms. Higher rates. Weekly or even daily repayments.

This is fine if you’ve got the cash flow to handle it. But if you’re already tight on margins, those fast loans can start closing doors.

2. Invoice financing

It cares about your clients’. If you’re B2B and billing companies with real credit, you can borrow against your invoices. You’ll give up a cut — sometimes more than you’d like — but you’re not putting your personal assets on the line.

3. Merchant cash advances

They’re also the most dangerous option on this list. If you need cash fast, they’ll hand it over. But they’ll take a fixed percentage of your daily sales until it’s repaid, plus fees.

Founders say yes to these when they run out of time. Six weeks later, they’re watching their cash flow bleed out before noon every day.

If you have other options, use them.

4. Equipment loans

If you’re buying something physical that the lender can repossess, they care more about the asset than your credit score.

It’s one of the few ways to get decent terms with a bad credit score, especially if the equipment has resale value. But don’t use this to fill a funding gap. Use it to buy the thing that helps you generate revenue.

5. SBA loans

Not the big 7(a) loans—those are tough with bad credit. But SBA loans, capped at $50K, are sometimes more flexible. If you’ve got a solid business plan, a history of paying business bills on time, and a path to repay, you might still qualify for the SBA loan.

They’re not fast or easy. But they’re often cheaper than what’s out there in the private market.

So yes, there are options. But every one of them comes with strings. And the worse your credit score, the more expensive those strings become.

This isn’t about finding any business loan lender that says yes. It’s about knowing what you’re agreeing to and when to stop chasing approvals and start shifting the conversation.

Credit score isn’t the only credibility measure: How should you shift the conversation

If you have a bad credit score, you can’t lead with it, so don’t.

Lead with what actually matters to most small business lenders:

Cash flow, consistency, and proof that your business works.

Lenders are in the risk business. Your job is to lower that risk, not by hiding your credit history but by showing that the rest of the picture tells a better story.

Start with cash flow.

Regular, steady income, even if it’s not huge, gets attention from many lenders.

It shows your small business is honest and functioning. And that’s what most online lenders care about more than your credit history.

So show them. And if you want that income to be taken seriously, you need to…

Back it up numbers that make sense

Lenders want evidence that your business works. Show them. Share business bank statements, monthly income, invoices—anything that proves cash is coming in. Even if you’re not profitable yet, numbers like revenue, breakeven point, and customer volume help lenders understand how you operate.

But income alone won’t close the deal. What really earns trust is when you…

Have a repayment plan that adds up

Most lenders, especially the ones offering credit check business loans, care a lot less about your story than your math.

So, give them a clear repayment plan. How much do you need? Why? What’s the return? How long until that return shows up in your annual revenue or cash flow?

If you’re unsure how to structure it, use a business planning tool like Upmetrics to map it out. It helps you build financial projections, lay out repayment timelines, and show lenders exactly how the loan makes sense.

The more precise you are, the more credible you look. Founders who can show lenders exactly how the money will be used and what it returns are in a stronger position to secure funding loans, even if they don’t meet the minimum credit score criteria.

But income alone won’t close the deal. Then, go one step further.

Make it easy for them to say yes even with your low credit scores

Trying to hide your poor credit score won’t work. One credit check or hard credit inquiry, and it’s all there.

So, lead from a position of strength by showing a solid business plan, real income, and a business that’s already moving. That’s what most financial institutions, credit unions, and online lenders care about, especially when offering business funding options to small businesses with credit issues.

Your business loan application should make it clear how the money will be used, how it helps cover real business expenses, and when they’ll get paid back.

Show you’ve thought it through. Bonus if you’ve already put in your personal savings or taken early steps to improve your financial health.

They don’t need perfection. They need confidence. And nothing kills that faster than the wrong move made under pressure. Which brings us to…

What not to do when you’re desperate for funding

The worst decisions happen when you’re backed into a corner. Your credit score is low, your options are limited, and when someone finally says yes—it’s tempting to take the deal.

But getting a loan isn’t the hard part. Living with it is. So,

1. Don’t take money just because it’s available

Fast money often comes with strings. Merchant cash advances, for example, can take 20% of your daily sales. It solves today’s problem but creates tomorrow’s cash flow crunch.

2. Don’t use the wrong loan for the wrong reason

Need payroll? Don’t use equipment financing just because it’s the only thing your credit score qualifies for. That mismatch leads to more problems down the line.

3. Don’t skip the fine print

Desperation makes it easy to miss hidden fees, balloon payments, or personal guarantees, especially risky when your credit score is already working against you.

Bad credit doesn’t mean you’ve lost all control. What matters is showing up with a plan, knowing your numbers, and choosing funding that actually fits.

So, what should I do if my credit score is holding me back?

You’ve presented the numbers, made your case and still, lenders say no. You don’t meet the minimum credit score, and multiple credit pulls are already on your report.

That’s when many business owners start reaching for anything that says yes. But if that “yes” comes with bad terms or high risk, it’s time to rethink the plan.

There are alternate funding options

Grants are one path, if you qualify, it’s non-dilutive and clean. Crowdfunding rewards strong storytelling, not strong credit. Peer-to-peer lenders may still consider you, and they’re often more flexible than banks.

And if none of those work?

Wait and rebuild.

Separate your business finances. Use a business credit card responsibly. Work with vendors that report to credit bureaus. Most importantly, stop applying blindly. Each application chips away at your score.

In 6–12 months, a better score unlocks better loan options. The goal isn’t just approval, it’s getting funding that actually helps you grow.

Final word: Bad credit doesn’t define your business

A low credit score isn’t the end of the road. It’s just one part of your file, not the whole story. You can still qualify for SBA loans, rebuild your personal credit, and get a good credit report over time.

Plenty of founders use that time to reset, avoid taking the wrong bad-credit business loan, and position themselves for better small business financing later.

Skip deals that only solve short-term panic. Whether it’s a credit check, a rejected business line, or a hit to your personal credit score, none of it defines your future.

Your business does.