If you’ve ever read investor feedback and thought, “But it’s obvious…”—this blog is for you. Because if it were obvious, they wouldn’t be asking.

You might be building something valuable. Maybe even brilliant. But pitch deck mistakes have a quiet way of smothering a good idea before it gets its chance.

Most of those mistakes are fixable. You just need to know where founders typically get it wrong. If you’re not clear on common pitch deck mistakes, this blog will walk you through them at every stage.

Better us than your next VC call. 👍

10+ Pitch deck mistakes to avoid (based on your investment stage)

What is a pitch deck? It’s a slideshow that business founders use to communicate a business idea or a startup to potential investors, partners, or customers. But you can’t use the same pitch from the idea stage all the way to Series A.

It has to change as you grow. At pre-seed, your deck should prove that the problem exists. It should show early wins and how you’ll get more at seed. Series A better explains what works and why it scales.

Each stage has its blind spots, so instead of a generic list, let us break down pitch deck mistakes by where your company is.

Pre-seed stage

This early on, no one expects perfect metrics. But they do expect clarity. These are the mistakes that make even a good idea hard to trust.

1) No real-world problem validation

Saying there’s a problem isn’t enough if your deck doesn’t show others feel it, too. When you’re close to the idea, it’s easy to forget that investors see it cold. They need something that proves the frustration is real and shared.

How to fix it: Add user quotes, quick stats, or screenshots showing you’ve asked around. People saying, “I’d use this,” carries more weight than you saying they should.

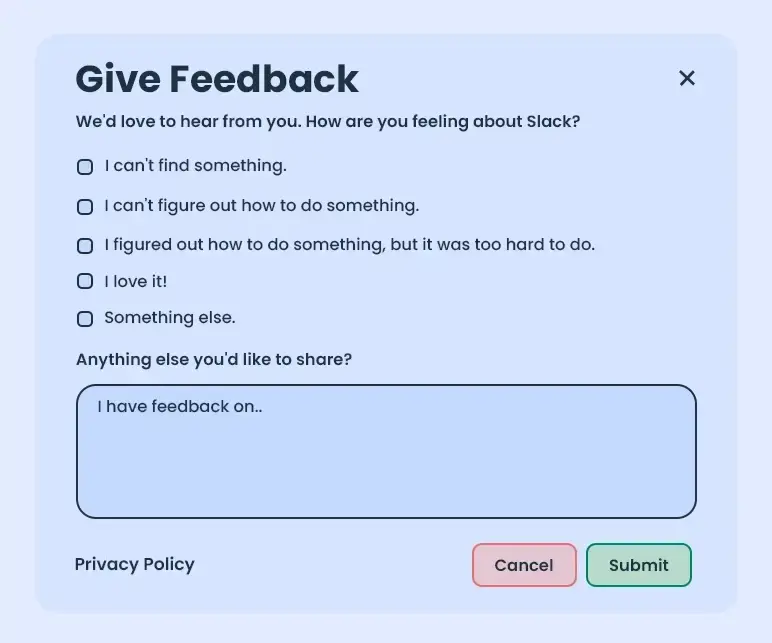

For example, Slack actively asks users what they want, what’s confusing, or what’s missing, right inside the app. It’s a simple way to gather validation and spot product gaps before they turn into churn.

2) Starting with the solution instead of the problem

Founders often jump straight into the product—screenshots, feature lists, roadmaps. And sure, it’s what you’ve spent the most time on. But investors are left playing catch-up when your deck opens with what it does and skips why it’s important.

How to fix it: Fix it by anchoring the product in context. Start with the user’s current reality, such as what they’re struggling with, why it’s costing them time or money, and what existing options fail to do. Then, bring your solution into that scene.

3) No defined target audience

It’s tempting to say your product works for “startups, agencies, students, and small businesses.” It sounds ambitious. It makes the market look big. But to investors, it says you haven’t done the hard part, which is figuring out who cares enough to pay.

How to fix it: Refocus the slide. Say who your first users are specifically and why they’ll say yes. That shows you’ve thought of demand, positioning, and reach. A defined audience makes everything else sharper, including how you grow.

4) Missing or unrealistic go-to-market plan

Founders often list marketing buzzwords in place of a real go-to-market plan. “We’ll post on social media.” “We’ll go viral.” “We’re planning a launch.” That tells investors one thing: There’s no actual or realistic plan to reach users.

How to fix it: Instead, outline something practical. Show where your early users are, what channels you’ll use to reach them, and how you’ll get feedback fast. You just need to show that you’ve thought past launch day.

Prepare Your Pitch Deck in Less than an Hour with Our

AI Pitch Deck Generator

Plans starting from $14/month

Seed stage

Seed investors know your numbers are small, but still expect them to make sense. If you’re not sure what a solid seed-stage deck looks like, reviewing some pitch deck examples can help clarify what to include and what to leave out.

These are the mistakes that turn early traction into red flags.

5) Showing vanity metrics instead of real traction

Founders want to show momentum, so they lead with big numbers of signups, downloads, and traffic spikes. It looks good until someone asks, “How many paid?” or “How many came back?” and there’s no answer. When those numbers don’t tie to engagement or revenue, investors see it as a red flag.

How to fix it: Start with the strongest signal, like paying users first, active users next, and signups afterward. And explain what happens next—what’s growing and what you’re doubling down on.

6) No repeatable growth strategy

You show a chart with a nice spike in users, but when someone asks where they came from… (long pause) there’s no clear answer. Early growth often comes from one-off moments like the press, a tweet, or a personal network. It feels like traction, but without a plan behind it, it’s hard to repeat.

How to fix it: List the actual channels you’re testing. Share early conversion data or CAC if you have it. If not, just be honest about what you’re learning and where the next 100 users are supposed to come from. The goal is to show you’re building a system.

A look at Uber’s early pitch deck reveals how they articulated a scalable growth strategy by focusing on urban markets and leveraging technology to streamline ride-hailing, providing a clear roadmap for expansion.

7) Asking for money without a clear plan

You say you’re raising $500K “to grow the business.” That’s the whole slide. There’s no breakdown of how the money will be used, no timeline, and no explanation of what that capital is supposed to accomplish. To an investor, it feels like a placeholder number, something chosen for roundness, not for strategy.

How to fix it: Build a simple breakdown that shows how the funds map to specific activities: Hiring, product development, marketing, operations, or whatever is important for your next milestone.

8) No revenue thinking (Yet)

Some founders avoid discussing revenue early because they think it might limit the story. They worry that naming a price too soon could make the idea seem small or that a rough business model might sound unpolished. Others haven’t figured it out yet and assume skipping until later is fine.

How to fix it: You don’t need a full pricing model or five-year revenue forecast. Just show you’ve asked the right questions: Who pays? What are they paying for? How and when does that start? Even a simple plan like charging SMBs $20/month after beta shows you’re thinking beyond the build phase.

Series A stage

At this stage, the product is built, the early traction is real, and the focus shifts to economics, scale, and execution. Here’s where strong startups get tripped up.

9) Not showing unit economics or LTV/CAC

Some founders focus so much on top-line growth that they leave out whether that growth is sustainable. But by Series A, investors are looking for efficiency. They want to know if each new customer is worth the cost of acquiring them and how long it takes to make that spend back.

How to fix it: Include early CAC, rough LTV, and a payback estimate. Add context, like what’s changed, what you’re testing, and how it’s trending. Even directional data builds trust that you’re managing growth with your eyes open.

10) Skipping the team structure and hiring roadmap

Some founders introduce the core team but stop short of explaining how the company plans to scale beyond them. At earlier stages, that’s fine. But at Series A, investors expect a view into what comes next: Which roles are important, where the gaps are, and how the team will grow with the business.

How to fix it: Add a lightweight org roadmap. It doesn’t have to be a full headcount plan, just a slide that shows the roles you’re prioritizing, what problems those hires will solve, and how this round of funding supports it. If you’ve already made key hires or have offers out, include that too.

11) Overly rosy financial projections without justification

Some founders present financial projections that show a dramatic leap, like 10x revenue in 18 months, big numbers, and fast timelines without any explanation of how it happens.

It’s usually a response to pressure. Founders want to look ambitious, so they aim high. But without clear assumptions, those projections feel made up.

How to fix it: Keep it simple, but back it up. What’s driving the growth, like new hires, CAC improvements, and expanded sales channels? Even rough assumptions show that you’re thinking through the path. Investors expect logic. Give them a model they can question, not one they’ll immediately ignore.

12) No plan for expansion or scale

A lot of founders stay focused on present-day wins. The product is live, early users are happy, and things are steady. But if the deck doesn’t point to what comes next, it feels incomplete, especially in Series A. At this stage, a forward-looking view is the whole point.

How to fix it: Add a slide that talks about what’s ahead. That could be new features, new pricing tiers, or even new geographies. Series A is about proving you’re built to grow. Execution is important, but vision closes the round.

Before you pitch, do these last-minute checks

You’ve told the story, pulled the numbers, and built the slides. Now, give it a last read. If you’re still wondering whether your structure or flow holds up, it helps to review a few pitch deck examples. They give you a benchmark for what investors actually respond to and what to avoid.

Sometimes, it’s the little oversights like typos, layout, and missing context that trip things up. Catching them now keeps your pitch focused and credible.

Keep it under 15–20 slides

Keep it under 20 slides. If your deck is longer, review each one and ask if it earns its place. Core content should focus on traction, market, model, team, and the ask. Extra slides belong in an appendix or follow-up materials.

Clean up the visuals

Look for simple mistakes such as typos, uneven fonts, awkward spacing, and stretched logos. Consistency across your slides shows attention to detail. A clean deck makes it easier to focus on what’s important.

Make the key numbers obvious

Your most important metrics should stand out without effort. Highlight revenue, CAC, user growth, or runway in a way that doesn’t require scanning fine print. If someone misses your traction or asks, the slide isn’t working.

Check every stat and graph

Cross-check every stat, label, and chart. Numbers should match across slides, charts should reflect real trends, and any claim should be defensible. A single error can make the whole deck feel questionable.

Get a fresh pair of eyes

Ask one person who hasn’t helped create the deck to look at it. Their job isn’t to rewrite but to flag confusion, missing context, or weak logic. If they pause on a slide or ask a basic question, that’s a sign that something needs tightening.

Once these basics are handled, your pitch has a much better shot at landing.

If you’re still piecing together how to make pitch deck slides flow logically, these checks give you a solid starting point. Though the small fixes won’t save a weak idea, they can make a strong one easier to trust.

Build the perfect pitch deck with Upmetrics

You’ve probably seen bad pitch decks before. Maybe you’ve even built one. That’s fine; it’s part of the process.

However, an AI pitch deck generator can help you turn your business ideas into sharp, investor-ready slides. It writes your content, fills in the structure, and gets your deck pitch-ready in no time. From connecting the business model to outlining the slides, the tools make the structure clear and the work faster.