When I started reviewing business plans, the revenue slides always grabbed my attention. Every deck had that sharp upward curve, and it looked exciting.

But over time, I realized the founders who actually made it weren’t the ones with the boldest charts; they were the ones who had a budget that held up under pressure.

I remember one founder projecting $10M in revenue within two years. But when we asked how long their cash would last if sales dipped just 10%, they had no answer.

That silence told me everything. He wasn’t alone—29% of startups fail because they simply run out of money.

That’s what a budget is for. It proves you understand burn rate, runway, and how to adjust when reality doesn’t match the slide deck.

In this blog, I’ll show you how to design a budget that maps growth against runway, anticipates shocks, and answers the exact questions investors will ask in diligence.

Budgeting doesn’t mean restricting; it gives freedom.

I get why many founders think budgets are restrictive. On the surface, they feel like a list of “don’ts.” Like:

❌ Don’t hire ❌ Don’t spend on marketing ❌ Don’t take risk

In pitch rooms, I’ve seen founders focus only on their growth charts, brushing off budgets as ‘operational detail.’ To me, the budget isn’t the details.

It’s what gives you room to move, and with the right budgeting software, you can see those moves clearly. When I see a founder walk in with a clear grasp of burn rate and runway, I know they’ll make sharper bets.

They can explain, “Here’s what happens if we add two engineers,” or, “Here’s how long we last if revenue dips 10%.” That’s control. And control is what creates freedom. The founder who knows their numbers is the one who can say yes with confidence. As an investor, that’s the person I want to back.

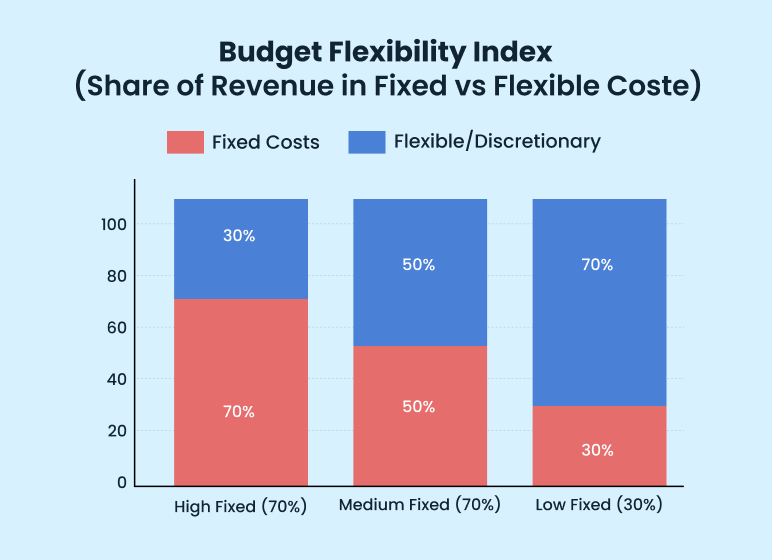

This chart here best presents the correlation between budget and flexibility:

What does a business budget look like (w/ example)

I don’t care how neat the budget looks on paper; I care about the reasoning behind it. Fixed costs, trade-offs, and buffers say far more about the business than polished formatting ever could.

Why? Truth be told, (almost) anybody can draw a revenue curve pointing skyward. The signal is in the details—your fixed costs, the trade-offs you’ve already made, and the cushion you’ve kept for when things don’t go to plan.

Let me make it real. Picture a neighborhood toy shop gearing up for the holiday season. Their budget might look something like this:

| Revenue | $50k expected from holiday sales |

|---|---|

| Fixed costs | $10k for rent and utilities |

| Variable costs | $20k for inventory to stock shelves |

| Profit cushion | $20k before taxes |

On paper, that looks great. But here’s what I’m really asking: What happens if sales come in at $40k instead of $50k? What if suppliers raise inventory prices by 15% right before November? Suddenly, that $20k cushion disappears.

A good budget doesn’t just say “we’ll be profitable”—it shows how resilient the business is when things don’t go to plan. That’s the detail that builds my confidence as an analyst.

Looking at that toy shop budget, you might wonder: Isn’t this basically a forecast? Fair question. Founders mix the two up constantly. On the surface, they do look similar: rows of revenue, expenses, and a bottom line. But the way investors read them is very different.

How is the budget any different from the forecast?

At a glance, budgets and forecasts look similar—rows of revenue and expenses. But the difference between budget and forecast is in their purpose.

A budget is fixed. It lays out revenue targets, cost ceilings, and the profit cushion for the year. Its role is control: setting discipline around how money will be allocated and how growth will be funded.

On the other hand, forecasts shift as actual numbers come in. Revenue outperforms, or costs creep higher, and the forecast adjusts. Its role is adaptability: showing how assumptions evolve in real time.

Both have value, but the budget carries more weight. It proves whether a founder can set boundaries, commit resources, and run with financial discipline. The forecast only shows how they react when the ground moves.

Together, they reveal how a founder makes decisions when things are stable and when things are changing. That combination (discipline in planning and agility in execution) is exactly what gives investors confidence that the company can withstand the messy reality of building a business.

How should you create your business budget?

Building a budget isn’t as intimidating as most founders think. What you need is a simple, structured way to map revenue, costs, and cushion. That framework helps you make better decisions day to day.

Here’s the six-step process I recommend to every founder I work with. It’s the same framework I use when evaluating whether a business has its financial house in order.

Step 1: Estimate your revenue (monthly/annual)

Revenue is the foundation of a budget because it determines how much fuel the business has to work with. To estimate it properly, you need two things:

- Historical data (if available)

- Drivers (the inputs that actually create sales)

If you’re already operating, start with historical data from the past 12–24 months. But don’t just copy last year’s revenue into this year’s budget; look deeper.

- Which months consistently performed better?

- Were those spikes tied to seasonality, promotions, or one-time contracts?

- If sales dipped, was it because of customer churn, market conditions, or operational bottlenecks?

These are the questions analysts and investors ask, and answering them upfront makes your revenue line more credible.

For newer businesses, credibility comes from external references like competitor benchmarks, industry reports, or even small pilot results. But the key is breaking revenue into drivers:

Number of customers × Average spend × Frequency

That’s the same logic used when learning how to create financial projections for a business plan; you don’t just throw numbers on a slide, you connect them to the mechanics of the business.

This will show the investors and analysts that your projections aren’t arbitrary; they’re tied to the mechanics of the business model.

For example, a freelance designer shouldn’t just claim $10k per month. They should show: 5 projects × $2k each = $10k. Then they adjust for reality: December dips to 3 projects ($6k) because clients slow down, while January climbs to 6 projects ($12k) as demand returns.

| Month | Projects | Avg. Fee per Project | Revenue ($) | Notes |

|---|---|---|---|---|

| Standard | 5 | $2,000 | $10,000 | Typical monthly projection |

| December | 3 | $2,000 | $6,000 | Holiday slowdown, fewer gigs |

| January | 6 | $2,000 | $12,000 | Demand rebounds after the holidays |

That small adjustment is enough for investors to recognize your awareness of seasonality, which is far more convincing than a flat $10k across the board.

A revenue estimate built this way shows that the rest of the budget rests on logic. When the budget is held up under those conditions, it carries credibility with anyone evaluating it.

Step 2: List your fixed expenses

Fixed expenses are the non-negotiables of your budget. It could be rent, salaries, insurance, or software, so they show up every month, whether revenue does or not.

These are the first numbers I look at when reviewing a plan because they reveal your survival threshold (the minimum cash you need just to keep the lights on).

A question I often hear is:

How do I know if my fixed expenses are too high?

A good test is to compare them against projected revenue. If fixed costs eat 60–70% of your topline, you’ve left yourself very little margin to handle variable costs or downturns.

If they’re under 30%, you’ve got flexibility to reinvest or weather slow months. There’s no perfect number, but the ratio tells me if you’re running lean or overcommitted.

Another common mistake is misclassifying. Founders sometimes treat annual software renewals or payroll taxes as variable when they’re actually fixed. That underreporting makes the business look more agile on paper than it really is. When those hidden expenses hit, cash flow suddenly feels a lot tighter.

To make this concrete, let’s take an example of a freelance design studio. Each month, it faces three fixed expenses:

| Expense Type | Amount ($) |

|---|---|

| Rent | 2000 |

| Software | 500 |

| Insurance | 1500 |

| Total | 4000 |

That $4,000 is the minimum cost of keeping the studio running—paying for the office, design tools, and insurance, before spending a single dollar on marketing or project delivery.

If the studio projects $10,000 in monthly revenue, fixed costs already consume 40%. That seems fine, but if sales dip to $6,000, two-thirds of the money is swallowed by fixed bills. There’s very little left to handle the variable costs that actually drive growth.

This is why fixed expenses matter so much: They look predictable, but they can quietly limit flexibility. The leaner they are relative to revenue, the more room you have to reinvest or survive downturns.

Simplify budgeting & financial planning using Upmetrics

With Upmetrics, you can design accurate, realistic financial plans—without wrestling with complex spreadsheets.

The platform streamlines planning with built-in formulas and a visual dashboard. From revenue and expenses to cash flow, our AI-driven forecasting keeps your strategy precise, dynamic, and easy to manage.

- AI-Powered Forecasting: Get smart suggestions for revenue and expense streams. Built-in formulas handle the math so you don’t have to double-check calculations.

- Visual Dashboard: Turn raw data into clear charts and reports. See your entire financial picture at a glance.

- Scenario Planning: Model best-case, worst-case, and everything in between. Test “what if” situations to prepare for uncertainty.

- Plan vs. Actual Tracking: Connect with QuickBooks or Xero to compare projections against real performance and adjust instantly.

Step 3: List your variable expenses

If fixed expenses tell you the cost of staying open, variable expenses tell you the cost of making sales. These scale up and down with activity: Inventory, shipping, ad spend, sales commissions, and even customer support as volume grows.

The key isn’t about nailing exact numbers; it’s about capturing the ratio. Founders wonder: “Should I just budget a flat dollar amount for ads or inventory?” I’d say a better approach is to express them as a percentage of revenue. That way, if sales grow or shrink, the budget adjusts realistically.

Here’s an example of variable costs at different sales levels:

| Sales ($) | Inventory @ 40% | Gross Margin Left ($) |

|---|---|---|

| 8,000 | 3,200 | 4,800 |

| 10,000 | 4,000 | 6,000 |

| 12,000 | 4,800 | 7,200 |

This table shows why ratios are important. At $10,000 in sales, $4,000 immediately goes to inventory, leaving $6,000 before fixed costs. If sales dip to $8,000, the inventory cost shrinks, but so does the leftover margin.

And if sales grow to $12,000, the absolute profit grows, but only if the percentage holds. If inventory creeps up to 50%, those margins compress quickly.

This is where many budgets break down: Revenue doubles on paper, but variable costs are frozen as if they won’t change. Growth never comes free. Modeling variable expenses as percentages ensures your budget reflects reality and keeps you from mistaking busy months for profitable ones

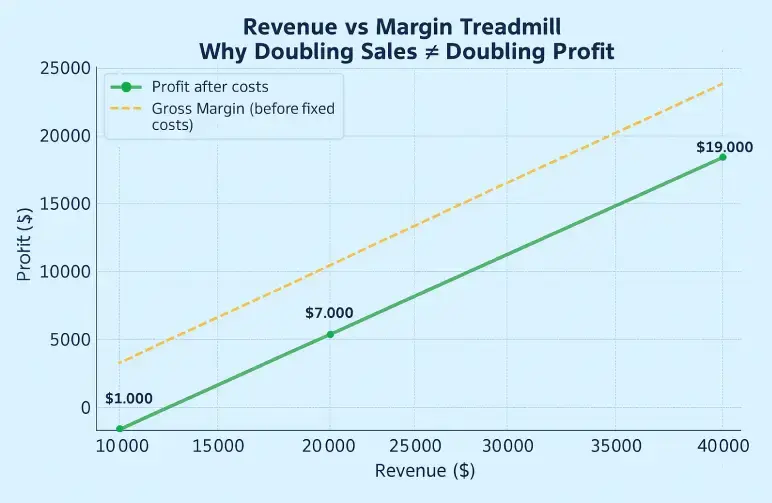

See how profits rise much more slowly than revenue when variable costs scale with sales.

The revenue doubles from $20k → $40k, but profit increases only modestly because 40% of every new dollar goes straight to variable costs.

This illustrates why growth feels like running in place—sales accelerate, but margins don’t keep pace.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $14/month

Step 4: Plan for one-off contingency expenses

Every business gets hit with costs it didn’t plan for. Equipment breaks, a lawyer sends a bigger bill than expected, or a system upgrade becomes unavoidable. These aren’t monthly line items, but they’re inevitable over a year.

If you’re running lean and haven’t budgeted for it, you’re running exposed. So, how much is enough for a contingency line?

There’s no perfect number, but I’ve found that 5–10% of total expenses covers most scenarios. Service businesses with light infrastructure can lean closer to 5%. Product-heavy or tech-reliant businesses are safer at 10%. What matters isn’t precision, it’s that the cushion is visible. That tells me you’re realistic about risk.

For example, a shop with $20,000 in monthly expenses that sets aside $1,000 might be fine when the coffee machine breaks. But if the point-of-sale system fails, that $1,000 won’t get them through. With $2,000 reserved, they at least have room to breathe.

| Total Monthly Expenses ($) | 5% Reserve ($) | 10% Reserve ($) |

|---|---|---|

| 20,000 | 1,000 | 2,000 |

As an analyst, I flag any plan that runs expenses to the dollar. Companies that leave no buffer rarely survive long enough to fix their assumptions. Those who plan for contingencies send a different signal; they’ve learned that uncertainty isn’t a bug in business, it’s the operating environment.

Step 5: Calculate your net income (budgeted profit)

Net income is the money left once revenue covers all expenses—fixed, variable, and contingency. It’s the line that tells you whether your budget produces a cushion or exposes a shortfall.

If you’ve ever prepared a financial plan for a startup business, you’ll recognize this step; it’s the point where the budget connects directly to the bigger financial story.

For example, say the projected revenue of a company is $10,000. Fixed costs are $4,000, variable costs add another $4,000, and contingency is $2,000. Subtracting those from revenue— $10,000 – ($4,000 + $4,000 + $2,000) —leaves $0. That’s breakeven.

Many founders see breakeven as a win. But from an analyst’s perspective, breakeven is fragile. It means there’s no buffer if assumptions shift. A 10% dip in sales or a modest increase in expenses immediately tips the business into a loss.

Even a slim profit margin raises tough questions: Is there enough left to reinvest in growth (like hiring, marketing, R&D) or does the company end up stuck in survival mode? Strong budgets aim for black ink and leave enough room to keep momentum.

This step is where I test resilience. Is the business relying on perfect execution, or does it have space to absorb shocks? A believable budget shows net income and proves that income can withstand real-world volatility.

Step 6: Integrate your budget into forecasts

A budget is your financial blueprint. But no blueprint survives contact with the real world unchanged. That’s where forecasts help. The forecast is your rolling update—taking actual results and adjusting expectations forward. Together, they show you what you planned and how you adapt when reality (you took into account) changes

But how often should you update?

At a minimum, review monthly. Quarterly is acceptable for slower-moving industries, but in startups, where conditions shift fast, waiting that long is risky.

Each review should ask: Did revenue meet expectations? Did expenses run higher than planned? What does that mean for cash runway?

Example: A retailer budgets $20,000 in July sales but only delivers $15,000. If the founder ignores that gap, the annual budget still looks intact on paper. But the truth is $5,000 has already vanished from the runway.

A forecast forces the trade-off: Do you increase marketing to make up lost ground, trim costs to protect cash, or reset targets so investors aren’t blindsided? Each choice tells me how the founder thinks under pressure.

Here’s the analyst’s lens: I don’t just care about whether you hit budget. I care about whether you respond when you don’t. A founder who updates forecasts shows they know their burn rate in real time and can make hard calls early.

That’s why budgets and forecasts should live side by side. One proves you can plan. The other proves you can steer.

How to review and manage your business budget?

Most founders think the hard part is making a budget. In reality, the hard part is what comes next, which is reviewing it and deciding how to respond when things don’t go to plan. Numbers on a spreadsheet won’t save your business unless you know how to act on them.

Over the years, I’ve noticed the same four scenarios repeat across companies. How you respond in those moments says more about your financial discipline than the budget itself. Here’s how I coach founders to handle the most common scenarios:

Scenario 1: You’re consistently over budget

What’s happening: Expenses run higher than planned every month.

What to do: First, don’t panic. Figure out why. Is it marketing spend creeping higher, supply costs inflating, or operational inefficiencies? Then decide if the overspend is a waste or growth.

If your ad spend is 20% higher but driving a 40% lift in sales, that’s not overspending—it’s under-budgeting for growth. In that case, update the budget to reflect reality instead of cutting back. But if payroll is ballooning without revenue gains, you need to course-correct.

For example, let’s say your ad spend is 20% over budget, but it’s also generating higher sales. Instead of slashing it, all you have to do is adjust the budget to reflect ROI.

Investors or analysts don’t mind seeing the overspending when it’s tied to measurable growth. What worries us is overspending with no link to outcomes.

Say goodbye to old-school Excel and spreadsheets

Compare your actual financials with your budget/ forecasts

Plans starting from $14/month

Scenario 2: Revenue is lower than expected

What’s happening: Sales are missing projections.

What to do: Go back to assumptions. Were your forecasts overly optimistic? Did you count on customer contracts that didn’t close? While you diagnose, protect the runway by pausing new hires, slowing marketing pushes, or cutting discretionary costs until revenue stabilizes.

Then rebuild your forecast to reflect the new baseline instead of waiting for a rebound that may not come.

For example, a café budgeted $30k/month but only made $25k. They paused hiring until sales picked up.

Missed revenue isn’t just a shortfall. It’s a test of how quickly you can pivot. Cutting burn responsibly while keeping growth drivers alive is what earns investor confidence.

Scenario 3: Unexpected expenses come up

What’s happening: Emergency expenses like equipment repairs, legal fees, and supply chain come up.

What to do: This is where your contingency line becomes important. If you’ve set aside 5–10% of expenses, use it. If you haven’t, you’ll need to cut non-essentials temporarily or dip into reserves. So it’s important to cover the expense as well as rebuild the buffer once cash flow allows.

For example, a retailer spent $5k fixing a broken freezer. They covered it with contingency and cut marketing for one month to balance out.

When I see a plan with no contingency, I assume the founder hasn’t lived through real-world operations yet. Surprises are part of the game, and smart budgets account for them.

Scenario 4: You’re under budget

What’s happening: You’ve spent less than expected.

What to do: Though underspending sounds like good news, it can be a double-edged sword. The question is: Are you being disciplined, or are you starving growth?

If your savings are coming from negotiating better supplier terms, great. But if they come from pulling back on marketing or product development, you may be under-investing in your own growth engine. Decide whether to reinvest savings into key areas or bank them to extend the runway.

For example, a SaaS startup spent $3k less than planned on development. They reinvested $1k into customer support and saved $2k for runway.

Being under budget can be as risky as overspending if it means you’re starving growth. The signal I look for is intentionality: Are you under budget because you’re disciplined, or because you’re missing opportunities?

The bottom line

Budgets don’t win points for creativity; they win points for clarity. What matters is showing how money flows, how much flexibility exists, and how you’ll respond when numbers shift.

The six steps covered create that clarity. Together, they give you a financial map that investors and operators alike can trust.

The value isn’t in the spreadsheet you’re using. It’s in the discipline of updating it, testing assumptions, and using it to guide decisions. That’s what shows you have control and your business has the credibility you claim.

If you want to streamline the process, Upmetrics can do more than connect budgets with forecasts. It lets you model best-case and worst-case scenarios, see how small cost changes affect runway, and compare actuals against your budget in real time.

But tools aside, the core principle remains: A budget is only as strong as the founder who works with it.