Do you know how many startups secure funding from angel investors? 0.91%.

Meaning ~99% do not.

Instinctively, I’d be more interested in knowing what’s going wrong with them, but for this time, let’s see what the top 1% getting right.

Is it the idea? The timing? The traction? Or maybe knowing what investors want to see in the pitch deck?

As a consultant and VC analyst, I’ve been on both sides—worked with hundreds of entrepreneurs and reviewed almost a gazillion pitch decks for VCs.

And, to be honest: a lot of things need to be go right.

- Industry preference match

- Early signs of traction or demand

- Founder credibility

- Visible path to exit, and whatnot.

While you can’t control everything, what you can do is: present your idea clearly and show them what they want to see. That’s more than enough.

This article is me, telling you what investors want to see in your pitch deck, so you prepare the last pitch deck you’ll ever need. Let’s roll.

What investors want to see (at a glance)

Investors quickly make up their minds within the first few slides. If your pitch doesn’t immediately spark interest, you’ve already lost them.

Here’s exactly what they expect to see quickly:

- An idea that’s easy to understand

- A real, specific problem worth solving

- A solution that fits and stands out

- Signs of traction or customer interest

- A large, reachable market

- A credible team with the right experience

- A business model that works

- A funding ask tied to meaningful milestones

These are the non-negotiables. Hit them right, and you’ve got their attention. Miss them, and even a great idea can get ignored.

Let’s break each one down, starting with the most essential: A clear idea.

Slide-by-slide breakdown: What investors expect and how to deliver it

A pitch deck isn’t just a presentation—it’s a story investors are scanning for answers. Each slide has a purpose, and missing the mark on even one can break the flow.

Here’s how to get every slide right and deliver exactly what investors are looking for, one by one.

Slide 1: Problem.

I’ve seen time and again that people play it safe with the problem slide. It lists surface-level pain points or vague industry trends, but skips the emotional punch. The tension. The “this needs fixing now” moment.

That’s why the best advice I’ve ever heard about problem slides was “Don’t just explain the problem—make investors feel it.”

And here’s what investors expect to see:

- A pressing, clearly defined pain point that feels urgent and costly.

- Evidence that the problem is real, growing, and worth solving.

- A specific target audience that’s directly affected.

- Clear stakes: What happens if the problem isn’t solved?

- Just enough context or data to show credibility, not clutter.

- A setup that naturally leads into your solution slide.

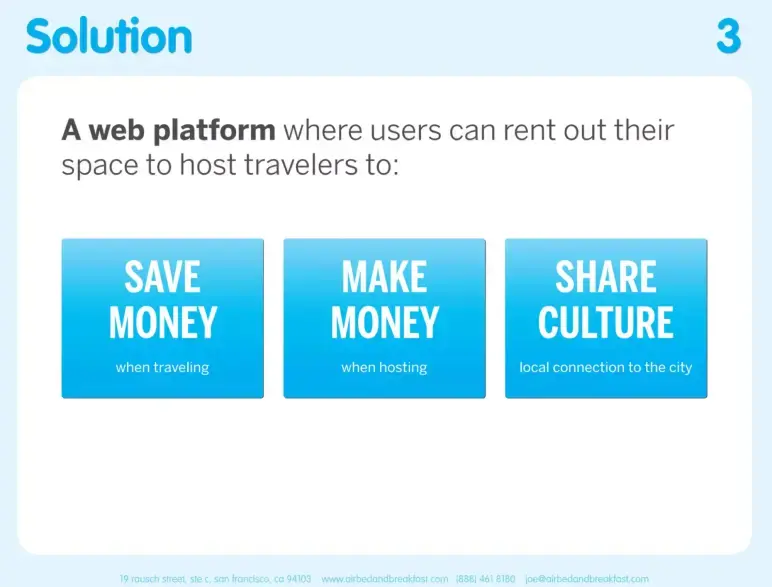

Slide 2: Solution

One of the biggest missteps I see? Founders are turning the solution slide into a product tour. Features, flows, dashboards; everything except what investors are looking for.

By the time an investor reaches this slide, they’re thinking:

“The problem’s clear. Now tell me, how exactly are you solving it?”

Here’s their expectation:

| What Investors Expect | What It Means |

|---|---|

| Clear one-line explanation | A simple, jargon-free sentence that explains what your product does and who it helps. Investors should get it instantly. |

| Visual representation | A screenshot, sketch, or diagram that shows how the product works or looks. Helps investors visualize your solution. |

| Key differentiation | One clear point that shows why your solution is better or different. What gives you an edge in the market? |

| Scalability | Investors want to know if your solution can grow big and make money. |

Remember, your solution slide is the hero moment of your pitch. Keep it simple, just one or two sentences that show how your product solves the problem. Add a strong visual that brings it to life, like Airbnb’s early deck mentioned below. No buzzwords. Just clarity and impact.

Slide 3: Market size

The market size slide is easily one of the most overlooked and often wasted slides in a pitch deck,” says Richard Dulude, Co-founder at Underscore VC.

And honestly? He’s right.

Most founders either throw in a giant number they found on Google or skip the real thinking behind it. But here’s the thing, investors care about this slide. Not because they need to be wowed by billions, but because they want to know:

Is there enough room for this business to grow into something meaningful?

You don’t need to show a “$300B global opportunity” if you’re building for a specific niche. What you need is a clear and honest picture of your market, including who you’re serving, how many of them exist, and how much they’re willing to pay.

Here’s what investors expect in this slide:

- A credible breakdown of TAM, SAM, and SOM that makes logical sense.

- A focused target market that shows you know where you’ll start.

- Numbers backed by real data or sources, not assumptions.

- A visual that’s simple and easy to grasp in seconds.

- A clear takeaway that shows why this market is big enough—and why now is the right time to enter it.

Slide 4: Product

Investors want proof that your solution isn’t just a nice idea; it’s real, or at least taking shape. That’s what the product slide is for.

This is where you show what you’ve built and how it works. No fluff, no long explanations. Just enough for someone to understand what the product does and why it matters.

But here’s where a lot of founders miss the mark. I’ve seen people, instead of showing value, they list features. Instead of showing progress, they show complexity.

The number one mistake founders make on product slides is describing what it is, not what it does.

Here’s what investors expect to see:

- A simple product screenshot, demo image, or mockup

- A few bullet points showing what the product helps users achieve

- The current status: MVP, in beta, live, etc.

Prepare Your Pitch Deck in Less than an Hour with Our

AI Pitch Deck Generator

Plans starting from $14/month

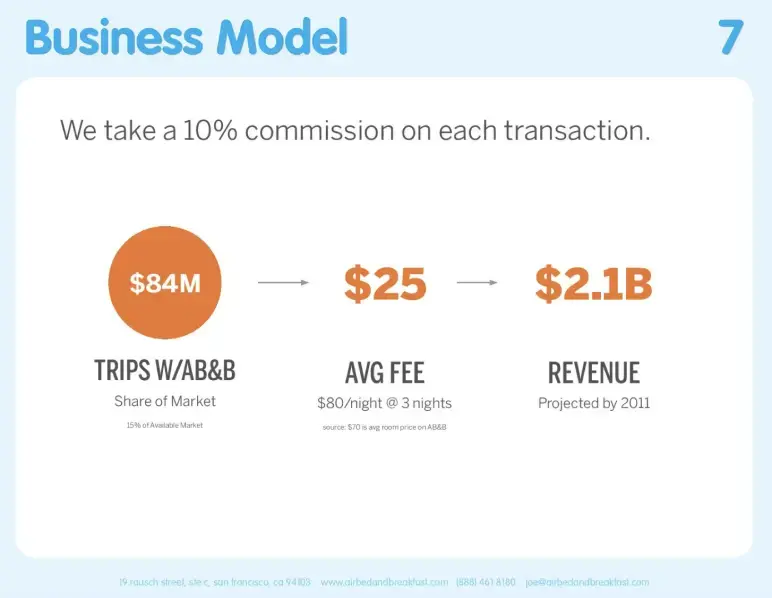

Slide 5: Business model

You know what makes investors lean forward? Knowing how you’re going to make money.

It’s not enough to have a great product; they want to see the engine behind the business. This is where your business model slide comes in. And no, it doesn’t need to be complicated. The simpler and clearer it is, the more confidence it builds.

So here’s what this slide should show, clearly and confidently:

- Who’s paying: Are they freelancers, marketplaces, or agencies?

- How much do they pay: Monthly subscription, per transaction, usage-based?

- How often: Monthly, annually, or one-time setup fee?

- Revenue potential: Even rough numbers are better than vague ambition.

- Scalability: Can this model grow without ballooning your costs?

Where I find founders often messing up is stuffing this slide with pricing tiers, charts, and fancy monetization ideas. But what investors want is clarity. A simple diagram or bullet list that shows who pays, what they pay, and how it scales.

Here’s one of the clearest business model slides I’ve come across—Airbnb’s early pitch deck. They nailed it, with a single, simple visual that said more than a hundred words ever could.

Slide 6: Traction

From an investor’s perspective, backing a startup with momentum is a much easier bet. They’re not just buying into a dream; they’re looking for signs it’s already turning into reality.

That’s where your traction slide comes in.

It should answer one core question:

“What have you achieved so far, and is it working?”

The best traction slides hit that answer fast, with a mix of:

- Growth metrics (users, revenue, retention)

- Real proof (testimonials, waitlists, customer logos)

- Product-market signals (usage spikes, repeat buyers, word-of-mouth)

And if you have revenue, even a little, don’t bury it. Cash is the king of traction. It tells investors that customers find enough value in your product to pay for it. That’s the clearest validation you can show.

You might get surprised, recent data shows that VCs are now spending 25–30% more time reviewing the traction slide, especially in early-stage pitch decks at the pre-seed and seed levels.

What does that mean? That means if this slide lands right, you’re already halfway to winning them over.

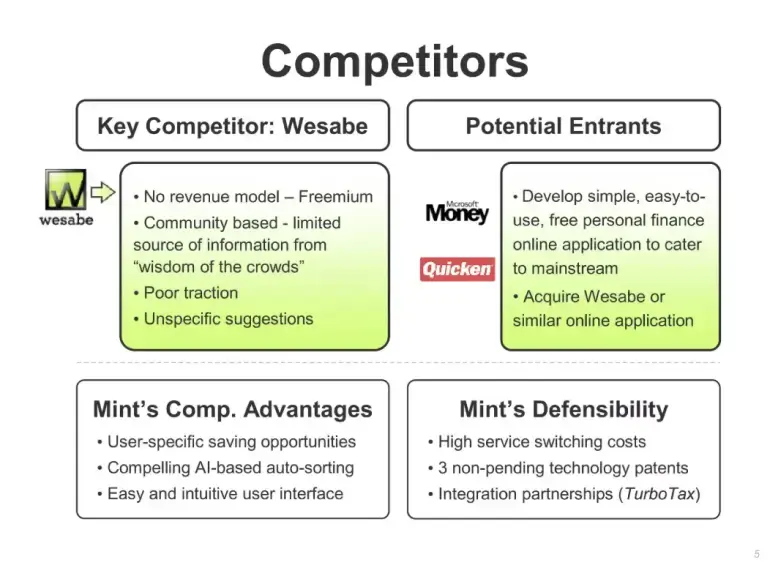

Slide 7: Competition

If there’s no competition, there’s no market.

And if there’s competition, investors want to know one thing—why you’re still worth betting on.

That’s exactly what this slide should prove.

Most founders either ignore competitors or throw together a 2×2 matrix with “us” magically in the top right. But smart investors see through that in seconds.

Here’s what investors want to see:

- A list of your top 3–5 competitors, real ones, not just vague categories.

- Their strengths (yes, give them credit, show maturity).

- Your edge: Better UX, pricing, distribution, niche focus, tech, speed, or customer love.

Don’t make this about ‘who’s bigger.’ Make it about who’s solving the problem better.

To provide you with deeper insights, I have attached an example of Mint’s competitor slides:

Mint’s competitor slide works because it doesn’t just list who’s out there; it shows where the market is heading and how Mint plans to stay ahead. Instead of treating competitors as threats, it uses them as benchmarks to highlight how Mint delivers more long-term value to users.

Slide 8: Team

If there’s one thing investors care about as much as your product, it’s who’s building it.

Data shows that investors spend nearly 15% of their total time on the pitch deck just on the team slide.

That’s a big chunk for one slide. And it tells us something important: They’re not just skimming through your names and LinkedIn bios. They’re actively trying to figure out if you’re the ones who can pull this off.

So don’t waste this space with just headshots and job titles.

Instead, tell a quick story that builds confidence, provide what they expect:

- Relevant experience and qualification your employee carries

- Knowledge or accomplishments in your specific industry or market

- Past successes or notable achievements that build credibility

- Passion, dedication, and why this team is uniquely positioned to solve the problem

This slide isn’t about listing your resumes; it’s about proving you’re a mission-driven, battle-tested team with just the right skills for this specific challenge.

Slide 9: Financials

Think big or go home.

This slide isn’t about predicting the future; it’s about proving you’re building something that can scale. Here’s the truth: Investors aren’t just looking for unicorns anymore; they’re chasing decacorns ($10B+ companies).

That doesn’t mean your startup has to be there yet. But it does mean your financials should reflect big thinking, smart strategy, and a clear path to significant returns.

Here’s what investors like to see:

- 3–5 year projections that show growth potential—not wild guesses.

- A clear revenue model that makes sense given your market and pricing.

- Margins, burn rate, and cost breakdowns

- Realistic assumptions supported by data, not optimism.

- A sense of scale and ambition

Now, a serious note: This isn’t the place to drop made-up hockey stick numbers. Investors will do the math, and if things don’t add up, trust breaks fast. Show ambition, but keep it grounded in logic, data, and real strategy. That’s what earns credibility.

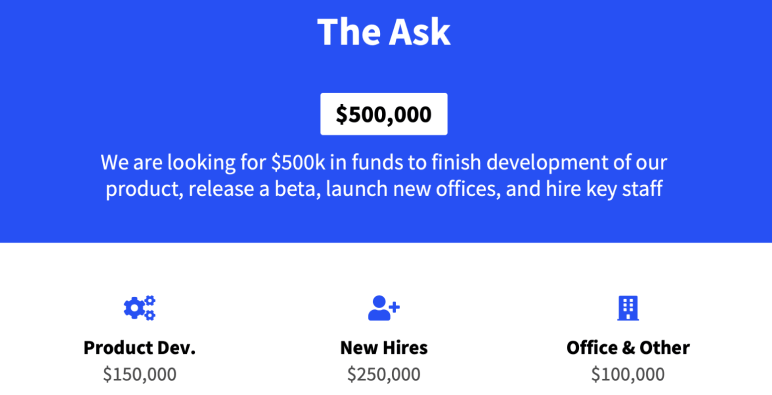

Slide 10: The ask

Every strong pitch ends with one thing: A clear ask.

Investors look for clarity, confidence, and a path to meaningful progress. But here’s what founders often get wrong:

They either ask for a vague round number with no plan behind it, or they throw in a complicated breakdown that’s hard to follow. If your Ask slide doesn’t feel grounded in strategy, investors will assume the rest of your plan isn’t either.

Here’s what they expect to see:

- A specific funding amount (not a vague round number)

- A high-level breakdown of how funds will be allocated (use a simple pie chart)

- Clear, achievable milestones that this funding will help reach

- Signs that you’ve thought ahead to the next round

“The goal isn’t to spend money, it’s to reduce risk and increase value.”So, here’s an example to help you frame your Ask slide the way investors want to see it:

Prepare Your Pitch Deck in Less than an Hour with Our

AI Pitch Deck Generator

Plans starting from $14/month

What different types of investors care about?

Let me tell you something most first-time founders don’t realize until it’s too late: Not all investors think alike. The pitch that impresses a seasoned VC might fall flat with an angel or confuse a family office. Each one has their lens, and your job is to learn how they see the world before you walk into that meeting.

Let me put it another way: Some investors back the dream, some bet on the team, and others are watching the spreadsheet. Angels might be sold the second they feel your passion.

VCs? They’ll scroll straight to your traction slide, hunting for hockey-stick curves. And accelerators? They’re like that tough coach—more interested in your coachability than your codebase.

So, how do you prepare for different investor mindsets? Here’s a quick cheat sheet to keep your pitch sharp, no matter who’s on the other side of the table.

| 🧑💼Investor Type | 🧠What They Focus On | 💡How to Pitch to Them | ⏱Avg. Deck Review Time |

|---|---|---|---|

| Angel Investors | Team strength, passion, and early signs of traction | Be human. Tell your story. Show why you are the one to solve this problem. | 2–3 minutes |

| Venture Capitalists | Market size, scalability, and exit potential | Lead with growth. Show traction, market size, and how you return 10x. | 3–4 minutes |

| Accelerators | Vision, clarity of problem, speed of execution | Show urgency, coachability, and hunger to build fast and iterate often. | Few weeks |

| Family Offices | Risk mitigation, stable returns, and reputation | Emphasize long-term plans, fundamentals, and team credibility. | Weeks or maybe months |

6 Common red flags that turn investors off

Before you hit send on your pitch deck, take a minute to run this quick self-check. These red flags can kill interest faster than you think:

1) No clear customer or problem

If investors can’t immediately understand who you’re solving for or what problem you’re tackling, they’ll lose interest. So, always lead with clarity; make the pain point obvious and urgent.

2) “We have no competition.”

This signals inexperience. Every problem has existing alternatives, even if they’re outdated or inefficient. That’s why it’s smarter to acknowledge them and explain how you’re better.

3) Traction slide missing or vague

Even early traction builds credibility. Investors want proof that people care. Hence, make sure to show any validation, pilot users, waitlists, or even strong feedback.

4) No real business model

If you don’t explain how you’ll make money, investors won’t guess it for you. Including even a basic revenue plan is better than leaving it blank.

5) Overly optimistic projections with no data

Big dreams are good, but they need backup. Wild projections without logic break trust. So, always ground your numbers in data, benchmarks, or real-world signals.

6) Team slide missing or irrelevant

Investors back people first, ideas second. They want to know you’ve got the right team. That’s why your team slide should prove you’re the ones to build this.

If any of these sound like your deck… fix them first. Investors don’t expect perfection, but they do expect clarity, focus, and realism.

Conclusion

If you’ve made it this far, you’re already ahead of most founders.

We’ve walked through what investors look for in pitch decks, from the team and traction to your ask slide and financials. You’ve seen the red flags to avoid, the green signals to aim for, and even how different investor types think. This isn’t just theory, it’s the stuff that gets founders funded.

Hopefully, this helped clear up the fog and gave you a real sense of how to shape your story. If you’re still figuring out how to organize everything, your slides, your numbers, your story—Upmetrics is a solid place to start.

Its AI pitch deck generator helps build compelling decks that land meetings. And if you’re also thinking long-term, it’s handy for writing your business plan too, without starting from scratch.

Whatever stage you’re at, take the time to get this right.

Good luck, you’ve got this.