You’ve got 10–15 slides to convince someone your idea is worth funding. That’s not a lot of room to get things wrong.

Even strong ideas fall flat when the pitch deck outline is off. The key numbers get buried, the slides bounce between topics, and the funding ask shows up without any lead-in.

You don’t need another generic list of “what to include.” You need to know what each slide is really for, why it matters, and how to make a pitch deck work, especially if you’re still figuring things out.

If you want a pitch deck outline that flows like a real pitch, you’re in the right place.

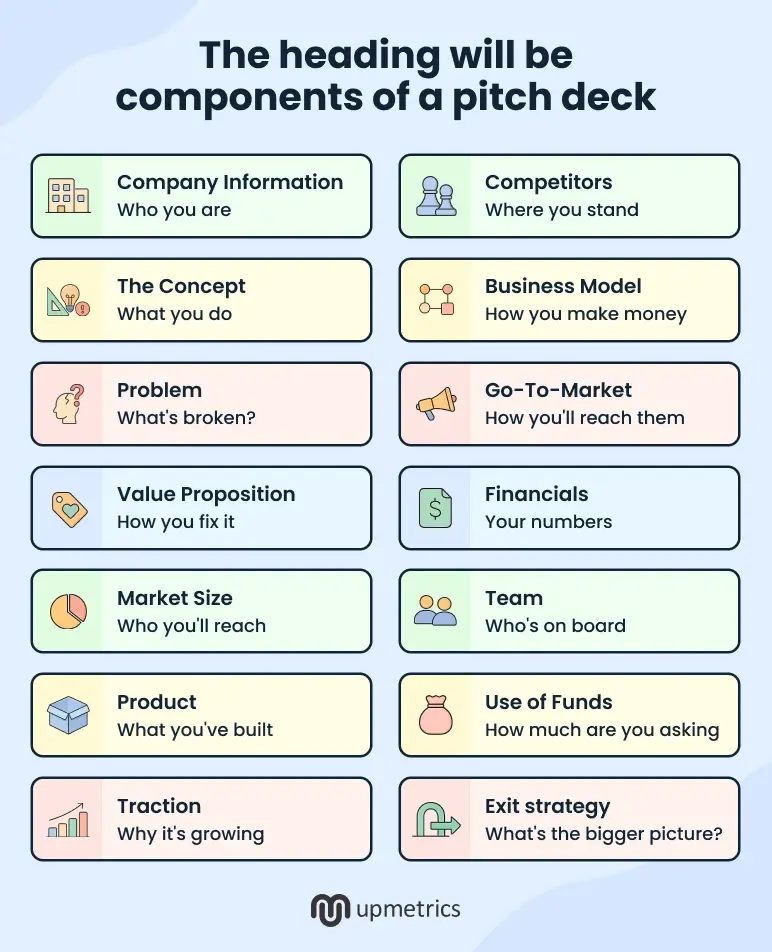

Pitch deck outline: Important components to include

Even if your product’s solid and your team is strong, a deck that misses context will frustrate investors. A strong investor pitch deck outline gives your story momentum. It builds trust from one slide to the next.

We’ll walk through each key section briefly and help you figure out what to show, when, and how, so you know exactly how to make a pitch deck that investors will take seriously.

1. Company information

Start with the basics: Your logo, your company name, and a one-line description that actually says what you do.

Add your contact info, too. Email and website are must-haves. If it’s a live deck, include your name and title. This slide is your business card, so make it clean, clear, and easy to remember.

2. The concept

Your concept slide should do one thing: Make your business idea make sense in under 10 words. Describe what your startup does, who it helps, and how.

If someone outside your niche can’t understand it, it’s too complex. Think clarity over cleverness.

3. Problem

Your problem slide should explain what isn’t working in the world today and who’s being affected. Don’t generalize and zero in on the users or customers who feel this pain the most.

The stronger the problem, the more believable your solution becomes. This slide is about friction, frustration, and unmet needs. Make it clear.

Make compelling pitch decks with our

AI Pitch Deck Generator

Plans starting from $14/month

4. Value proposition

You’ve set up the problem in the last slide. Now, show the fix in this one. Explain how your product solves it and, more importantly, why it solves it better than anything else out there.

Highlight the unique angle or insight you’re bringing. By the end of this slide, an investor should be able to tell that the business idea isn’t just another solution.

5. Market size

This slide answers one question: If things go well, how big can this get? Use basic segmentation (TAM/SAM/SOM) if you can, and show how you get from where you are to a meaningful slice of the pie.

Use real sources, avoid rounding up for drama, and make the path into the market believable.

6. Product

This slide is your proof of execution. If you’ve built something, show it. Screenshots, product mockups, a short video clip—anything that makes the product feel real and functional.

If you’re still pre-launch, show wireframes or a clickable prototype. Highlight the core feature or flow that solves the problem.

Make compelling pitch decks with our

AI Pitch Deck Generator

Plans starting from $14/month

7. Traction

Investors want to know if your idea is working. Use this slide to prove it. Include details like customer signups, engagement data, active pilots, or even user testimonials.

If it’s still early days, be honest, but include whatever signals you have that people care and are showing up.

8. Competitors

Use this slide to show your competitors. Include 3–5 relevant ones and compare them across 2–3 relevant dimensions like pricing, features, customer segment, speed, or anything else that makes sense.

You can use a quadrant chart, feature matrix, or side-by-side bullets.

9. Business model

This slide should explain exactly how your startup plans to make money. Who are your paying customers? What are they paying for? And how often?

Include your revenue streams, whether it’s subscriptions, one-time fees, licensing, commissions, or something else. If you have a pricing model, outline it briefly.

10. Go-To-Market

This slide should cover how you plan to find, reach, and convert your early customers.

Be specific about listing the channels you’ll use (e.g., paid ads, SEO, partnerships, outbound sales), your early experiments, and any data you already have, like conversion rates or CAC estimates. If you’re still testing, say that, but outline what you’re testing and why.

11. Financials

This slide needs to show your 3–5 year financial projections: revenue, expenses, burn rate, margins, and runway.

Though these are estimates, they should follow clear logic and tie back to everything else you’ve shown. Use simple charts or tables that are easy to read.

12. Team

This slide should show why your team is equipped to build and scale this business.

Keep it focused by adding names, roles, and quick hits on what makes each person relevant, like putting their startup experience, domain expertise, successful exits, or deep industry knowledge.

Make compelling pitch decks with our

AI Pitch Deck Generator

Plans starting from $14/month

13. Use of funds

In this slide, be specific about your ask. If you’re asking for $1M, show where that money goes.

Break it into major buckets like hiring, product development, marketing, or operations. Add percentages or rough dollar amounts, and tie each one to a milestone.

14. Vision & Exit

Wrap your pitch by showing where this is all heading. What’s the bigger picture? Maybe it’s an acquisition by a strategic player, maybe it’s going public, or maybe it’s building something category-defining. Give investors a reason to believe there’s a return ahead.

Need inspiration? Check out successful pitch deck examples to see how real startups used these slides.

If you’ve made it this far, you’ve seen how each slide plays a specific role. Now the question is: Why follow this exact structure? Turns out, there are good reasons not to reinvent the wheel.

Why consider following this pitch deck structure?

Because this structure has helped founders raise millions. It’s been used, tested, and refined by real startups, consultants, and pitch coaches to win actual investor checks.

89% of venture capitalists expect a pitch deck as part of the fundraising process. And they don’t want a freestyle. They want a story that flows in the order they’re used to:

- What’s the problem?

- What’s your solution?

- Do you have traction?

- Who’s running this?

- How much are you raising?

That’s exactly what this structure delivers.

It keeps investors focused, avoids common mistakes (like hiding your funding ask or jumping into product slides too early), and helps your story land, slide by slide.

Investors only spend 3 minutes and 44 seconds on average reviewing a deck. This format makes those minutes count by surfacing what they care about, fast. It’s worked before. It keeps working. Stick to it. It’s a proven way to structure your story when figuring out how to pitch investors.

Of course, not every founder has every slide nailed down, especially early on. That’s okay. There’s a smart way to handle what’s missing. (Read on.)

Don’t have all the info yet? Here’s what to do

You won’t have everything ready on day one. Most pitch decks from early-stage startups are a work in progress. That’s expected. But skipping slides or filling them with fluff doesn’t help. A better move is being honest, explaining where you are, and showing that there’s a plan.

Here’s what that looks like.

If you’re pre-product and pre-launch

You can’t show screenshots of a live product. Instead, show mockups, prototypes, or early wireframes in your product slide.

Have you spoken to 50 potential users? Built a waitlist? Landed a pilot with a barebones MVP? Include it. Focus on signs that show interest and momentum.

If you’re a solo founder

Highlight your own experience, domain know-how, or previous wins that make you the person to build this.

Then mention what comes next; maybe you’re hiring a technical lead post-funding or already working with advisors. Investors want to know you’re self-aware and thinking ahead.

If you have zero revenue (so far)

There’s no shame here; just make sure the Financials slide isn’t empty. Instead of revenue, show projections: Pricing, unit economics, and how those numbers come together.

Keep your assumptions clear. If you’ve got signed LOIs (Letter of Intent), pilot agreements, or beta signups, that’s worth showing, too.

This outline also helps avoid the most common pitch deck mistakes, like skipping traction or burying your ask.

As long as you’re clear about what’s missing and why, most investors will roll with it. A little structure can go a long way in making that easier.

Make compelling pitch decks with our

AI Pitch Deck Generator

Plans starting from $14/month

Download our free investor pitch deck template

To make that part easier, we’ve put together a free pitch deck template that follows this exact outline, slide by slide, prompt by prompt. You can download it, plug in your content, and refine it inside Upmetrics if you want help with editing, design, or AI tools.

The bottom line

If you’ve made it this far, you already understand more about pitch decks than most people trying to raise money with a half-finished file and a lot of hope.

But if you’re still unsure how to make pitch deck content flow well, Upmetrics helps shape each part for clarity. The AI pitch deck builder helps you write sharper, faster, and with fewer second guesses. It’s about making it clear, credible, and worth a second meeting.

You bring the idea. We help shape the pitch investors actually want to read. From structured slides to aligned financials, Upmetrics gives you the full setup to get pitch-ready so you can focus on pitching your plan to investors with clarity.