99% of U.S. businesses are small businesses, contributing 43.5% to the national GDP. Yet banks often view them as credit risks, especially newer businesses without major assets or those needing flexible terms.

SBA loans fill this gap by providing government guarantees that make lenders more willing to finance firms they would otherwise reject.

Though much talked about, SBA loans aren’t necessarily well-known. If you’re wondering “what is an SBA loan?“, this blog lays it out: How they work, who is eligible, what timeline expectations, and what the process entails.

Key Takeaways

- SBA loans are made by lenders, not the SBA itself. The SBA guarantees a portion of the loan.

- You have a variety of loan programs to choose from, such as 7(a), 504, or microloans.

- Most SBA loans require good credit, a clear business purpose, and a good business plan.

- If you prepare properly, you can increase your chances and make the process faster.

What is an SBA loan?

An SBA loan is a small business loan that is guaranteed by the U.S. Small Business Administration. You don’t borrow from the SBA, but rather, you apply to a traditional lender, such as a bank or credit union. The SBA guarantees a portion of the loan, which makes lenders feel more at ease saying yes.

That assurance allows you to qualify even if you’re a smaller company or do not qualify with the stringent bank lending standards. These loans can be for working capital, purchasing equipment, real estate, or bouncing back from a disaster.

If you’ve had difficulty getting approved for conventional loans, an SBA loan might be a more friendly alternative to obtain the financing your company requires.

Types of SBA Loans

The SBA provides several different loan programs, each intended for use in particular business contexts and financing requirements. Here’s a breakdown of the main programs below to help you decide which could be best for your company:

| Loan type | Purpose | Amount | Length | Interest | Best for |

|---|---|---|---|---|---|

| 7(a) | General working capital, equipment, real estate, startup costs, and refinancing | Up to $5 million | Up to 10 years (25 for real estate) | Variable or fixed (6%–10% typical) | Established businesses with broad funding needs |

| 504 | Large fixed assets like real estate or major equipment | Up to $5.5 million | 10 or 20 years (SBA portion) | Fixed on the SBA portion, market rate on the bank portion | Businesses buying property, renovating, or upgrading |

| Micro | Startup costs, inventory, equipment, supplies, and working capital | Up to $50,000 (avg. ~$13,000) | Up to 6 years | 8%–13% (varies by lender) | Startups, solo founders, or very small businesses |

| SBA disaster | Physical damage recovery, economic injury, and mitigation | Up to $2 million | Up to 30 years | Fixed, typically lower than other SBA loans | Businesses affected by natural disasters or emergencies |

1) SBA 7(a) loan program

The 7(a) program is the SBA’s flagship lending program and the most flexible option for small businesses. It’s designed for general business purposes when conventional financing isn’t available on reasonable terms. This program offers the broadest range of approved uses among all SBA loans.

What it covers: Working capital, equipment purchases, real estate acquisition, business acquisitions, debt refinancing, startup costs, inventory, and expansion funding.

| Loan structure and terms |

|---|

| Loan amounts: Up to $5 million |

| SBA guarantee: Up to 85% for loans under $150,000; up to 75% for larger loans |

| Repayment terms: Up to 10 years for working capital and equipment; up to 25 years for real estate |

| Interest rates: Variable or fixed rates based on the prime rate plus a margin |

| Down payment: Typically 10-15% depending on loan purpose and borrower qualifications |

2) SBA 504 loan program

The 504 program was created especially for large equipment and real estate purchases. To support long-term fixed assets, it combines owner equity, traditional bank financing, and SBA funding.

What it covers: upgrades to existing buildings, the purchase of commercial real estate, the construction of new facilities, and the acquisition of large equipment working capital, inventory, or debt consolidation.

| Loan structure and terms |

|---|

| Loan amounts: Up to $5.5 million (up to $5 million for standard projects) |

| Structure: Three-part financing – 50% conventional bank loan, 40% SBA debenture, 10% owner equity |

| Repayment terms: 10 or 20 years for the SBA portion |

| Interest rates: Fixed rates for the SBA debenture portion; market rates for the bank portion |

| Requirements: The business must occupy at least 51% of the property if purchasing real estate |

3) SBA microloans

Nonprofit community-based groups give out microloans, which are tiny, short-term loans. They are intended for very small firms, startups, and businesses in underserved communities.

What it covers: Working capital, inventory, supplies, furniture, fixtures, machinery, and equipment, but not real estate purchases or debt payments.

| Loan structure and terms |

|---|

| Loan amounts: Up to $50,000 (average loan size is around $13,000) |

| Repayment terms: Up to 6 years |

| Interest rates: Vary by intermediary lender, typically 8-13% |

| Collateral: Required for loans over $50,000 |

| Additional requirement: Many lenders require borrowers to complete business training or planning courses |

4) SBA disaster loans

SBA disaster loans help businesses recover from declared natural disasters, economic disasters, or other catastrophic events. These are direct loans from the SBA, not through banks.

What it covers: Physical damage to business property, economic injury caused by disasters, mitigation measures to prevent future disaster damage, and working capital needs during recovery periods.

| Loan structure and terms |

|---|

| Loan amounts: Up to $2 million for physical damage; up to $2 million for economic injury |

| Repayment terms: Up to 30 years, depending on the ability to pay |

| Interest rates: Fixed rates, typically lower than other SBA programs |

| Collateral: Required for loans over $25,000 |

| Eligibility: Business must be located in a declared disaster area and demonstrate disaster-related losses |

Need help with your application process?

Let us match you with a trusted SBA lender

Book a 30-Minute Free Strategy Call

Who is eligible for an SBA loan?

Not every firm can get an SBA loan. There are several prerequisites for the program to help real small businesses who need money. SBA loan requirements vary slightly by program, but there are core eligibility criteria every applicant must meet.

1) For-profit U.S.-based business

Your business must operate for profit and be physically located in the United States or its territories. Nonprofit organizations, passive investment companies, and businesses primarily engaged in speculation don’t qualify.

2) Must meet SBA size standards

The SBA defines “small business” differently in each industry, usually based on the number of workers or yearly revenue. Most retail enterprises qualify with fewer than 500 employees; however, manufacturing organizations can have up to 1,500. Check the SBA’s size standards to see if your business qualifies.

3) Good personal and business credit

Lenders normally seek personal credit scores of 680 or above, while some programs accept lower scores. In any case, your business should also have a track record of payments on schedule. New businesses rely more heavily on the owner’s personal credit history.

4) Demonstrated need for financing

You must show that you’ve tried to obtain financing elsewhere and either have been declined or offered unreasonable terms. The SBA doesn’t compete with conventional lenders, but it fills the gap when traditional financing isn’t available.

5) Funds must serve a sound business purpose

The loan proceeds must be used for legitimate business needs such as equipment, working capital, real estate, or business acquisition. Personal expenses, speculation, or debt to owners are prohibited uses.

Additional requirements may apply depending on the specific loan program and lender. Some businesses in certain industries (like gambling or lending) are automatically excluded from SBA programs.

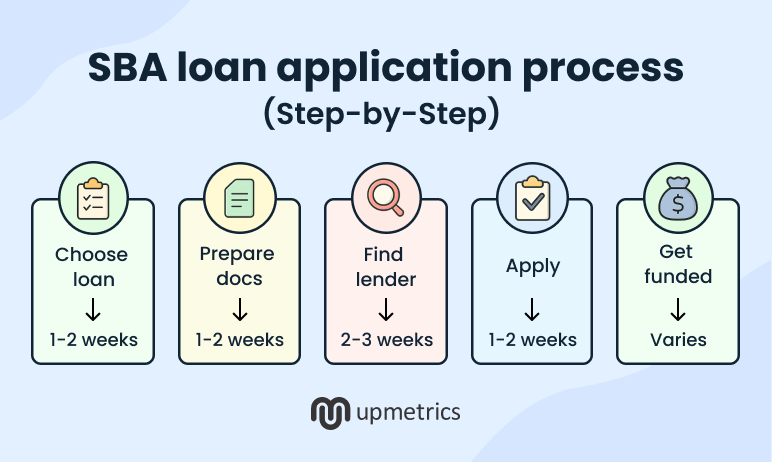

How to apply for an SBA loan?

One common mistake first-time applicants make is assuming the SBA handles the entire loan process. In reality, it’s the lenders, such as banks, credit unions, or nonprofits, who evaluate your application, decide whether to approve it, and issue the funds.

The SBA’s role is to support the loan, not to manage it directly. The process typically includes these key steps:

Step 1: Pick the appropriate SBA loan

Review the numerous loan choices to see which is most appropriate for your needs and business situation. Consider factors like the amount borrowed, the purpose of borrowing the funds, and the level of development of your business.

Step 2: Prepare a strong business plan and financial statements

Collect your financial accounts, tax returns, company strategy, and other records that show the profitability and ability to pay back your debt. Your chances of getting approved are greatly increased by being well-prepared at this point.

You can read about an SBA business plan template to ensure your structure, projections, and content align with lender expectations.

Step 3: Finding SBA-approved lenders

You can look for approved lenders in your area or use the SBA’s Lender Match tool to connect with lenders based on your loan requirements and business profile. Most major banks, credit unions, and community development financial institutions take part in SBA lending programs.

Step 4: Submit your application and undergo a review

Finish the lender’s application process, including both SBA forms and lender requirements. The processing time is usually several weeks to a few months, depending on the loan program and your application’s complexity.

The whole process, from application through funding, usually takes 30-90 days. Having all documentation in order initially can really reduce the timeframe and increase efficiency and your chances of approval.

Need help with your application process?

Let us match you with a trusted SBA lender

Book a 30-Minute Free Strategy Call

How long does it take to get an SBA Loan?

The answer is anywhere between 30-90 days. But it all depends on your preparation, the lender you choose, and the specific loan program. The SBA itself provides specific processing guidelines that can help set realistic expectations.

1) Document preparation: 1–2 weeks

According to the SBA’s own guidance, complete applications move faster through the system. This phase involves gathering three years of tax returns, financial statements, and business plans and completing SBA Form 1919.

2) Lender review: 2–3 weeks

The SBA tracks lender performance metrics, and processing times vary significantly. SBA Preferred Lenders (those with delegated authority) typically move faster since they can approve loans up to certain thresholds without SBA review.

3) SBA review (if applicable): 1–2 additional weeks

The SBA’s standard processing goal is 36 hours for Express loans and 5-10 business days for standard 7(a) loans, according to their loan processing procedures.

The SBA reports that the average processing time for 7(a) loans is approximately 30-90 days from complete application to funding.

Here’s what the official timelines don’t capture: Your preparation quality dramatically impacts speed. The SBA’s Lender Match tool can match you with lenders that work in your industry and loan size, which could speed up the process by weeks.

The fastest-funded entrepreneurs aren’t necessarily the ones with great credit.

Can startups or solo founders get SBA loans?

One common myth keeps new founders from applying: “SBA loans are only for established businesses.”

That’s just not the case.

The SBA is more interested in your potential to repay the loan and the quality of your business plan than in how long you’ve been in business. If you can demonstrate that your business idea is good and you’re ready, you’re in. Here are two SBA programs that work well for newer founders:

Microloans for smaller needs

These community-based loans target newer businesses specifically. With amounts up to $50,000, they’re designed for entrepreneurs who need modest funding to get started.

7(a) loans for larger ambitions

Startups regularly secure these loans by presenting solid business plans with clear market research and realistic financial projections. The loan size shouldn’t intimidate you, as it’s about matching your request to your actual needs.

But qualifying isn’t just about picking the right loan. It’s about showing you’re ready. Here’s what matters most:

- Strong personal credit: Aim for 680+; if it’s lower, explain the reason clearly in your application.

- Comprehensive business plan: Your plan stands in for your track record, so make it detailed and realistic.

- Right-sized funding request: Ask for an amount tied to a specific use with a clear return on investment.

Your startup status is simply a different conversation focused on potential rather than past performance. Solo founders and new businesses get SBA loans regularly when they understand what lenders need to see.

Read more: This step-by-step process on how to get an SBA loan will walk you through everything from loan selection to final approval.

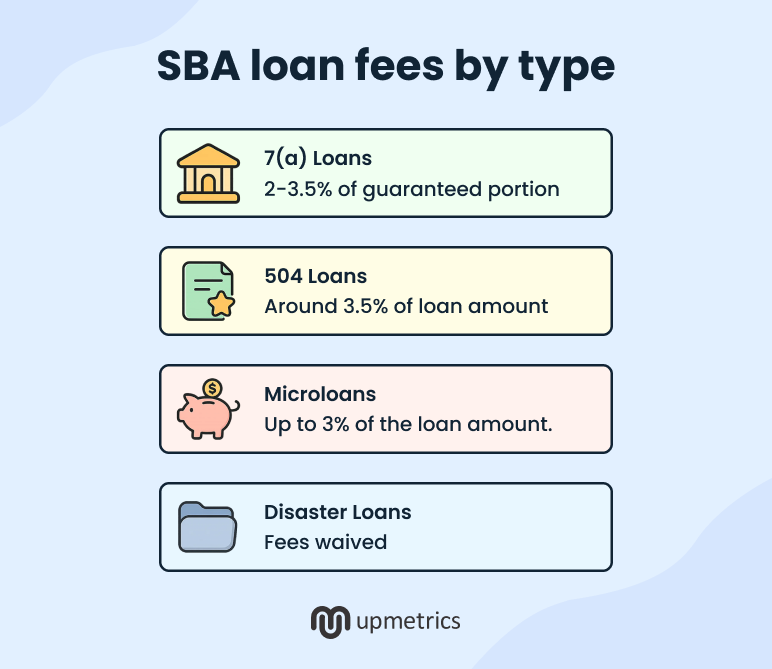

Do SBA loans have fees?

Yes, SBA loans come with fees, but it isn’t standardized across all SBA programs. Each loan type operates with its own fee structure, and understanding these differences can literally save you thousands.

7(a) program

You’ll pay 2% of the guaranteed portion for loans up to $150,000, 3% for loans between $150,001-$700,000, and escalating percentages for larger amounts. You only pay on the portion that the SBA guarantees, not your entire loan amount.

504 program

Since 504 loans combine three funding sources (bank loan, SBA debenture, and your equity), fees only apply to the SBA debenture portion, typically 40% of your total project cost. The math works differently, often resulting in lower overall fees for large real estate purchases.

Microloans

Many microloan programs have minimal SBA guarantee fees since community organizations administer them. However, these lenders may charge their own processing fees, so always ask for the complete picture.

Disaster loans

The SBA typically waives most fees for disaster loans. These programs prioritize business recovery over fee generation, making them genuinely accessible during crises.

Understanding fees is crucial for smart borrowing decisions, but there’s another conversation every entrepreneur needs to have before signing loan documents, which is…

What happens if I can’t repay an SBA loan?

If you can’t repay an SBA loan, the lender will try to work with you, usually through modified payment plans or temporary relief. But if those efforts don’t work, they have the right to seize any collateral you pledged, including equipment, property, or other business assets.

That’s when the SBA guarantees to reimburse the lender for the guaranteed portion of the unpaid balance.

When that occurs, the SBA takes over as your new creditor and will attempt to recover what it paid the lender. This may involve aggressive collection practices such as wage garnishment or the seizure of assets. In addition to that, your own personal credit will suffer a significant blow.

Defaults typically stay on your report for up to seven years, affecting your chances of getting future loans or even personal credit. None of this means SBA loans are a bad idea. It just means they should be taken seriously.

Upmetrics helps you get SBA-ready

Many founders get stuck during the SBA process because they submit plans that don’t match what lenders are trained to look for. A good idea isn’t enough; it has to be presented properly.

Upmetrics builds lender-ready business plans with clear assumptions, structured goals, and solid data. These are plans built for review.

The team also introduces you to lenders who understand your business model and funding range. That kind of alignment speeds things up and improves your chances of getting funded.

When your plan and your lender are both a fit, SBA approval starts feeling like a real possibility.