Thinking about applying for an SBA loan? Smart move—it could be one of the most affordable ways to fund your business’s growth.

But here’s the thing: While SBA loans offer lower rates and longer terms, getting approved isn’t automatic. There’s a clear set of requirements you’ll need to meet.

In this guide, I’ll break down the complete SBA loan requirements, what it takes to qualify, and what lenders are really looking for—so you can prepare a winning application and avoid common mistakes.

Let’s get you loan-ready.

Need help securing an SBA loan?

Get matched with trusted SBA lenders through Upmetrics

Key Takeaways

- To get an SBA loan, you need a solid business plan, good credit, financial statements, legal documents, and possibly collateral.

- Your business must be U.S.-based, meet SBA size standards, show a genuine financing need, and have acceptable credit.

- Always align financials, double-check loan-specific forms, avoid document mismatches, and be upfront about debts.

- In this blog, you’ll walk through eligibility rules, documentation, credit score needs, loan types, approval tips, FAQs, and pro advice.

Eligibility criteria: Who can apply for an SBA loan?

First, not every business can apply for an SBA loan. There are some ground rules. The SBA only supports businesses that are officially registered and actively operating within the United States or its territories.

If someone’s running a nonprofit, or involved in speculative stuff like gambling, or anything illegal, they won’t even get through the door. That’s non-negotiable.

Now, let’s dive deeper into eligibility criteria to apply for an SBA loan:

1) Meet SBA standards

SBA loans have a few standards that lenders follow before approving loans to businesses. Hence, SBA loans aren’t for businesses that have easy access to other funds. The whole idea is to help businesses that have tried getting a regular bank loan or other financing but couldn’t find something fair or affordable.

When someone applies, they need to prove they’ve looked elsewhere and couldn’t find reasonable terms. It’s not about asking the SBA first—it’s about asking them when other options aren’t working out.

2) Owner’s investments

It’s what we call “skin in the game” in financial terms. Banks and the SBA both want to see that the business owner also invests personally as a sign of commitment. If you’re not willing to put your own money into your business, why should a lender bet on you?

Usually, they expect you to have invested a good portion of your own savings or assets into the business. It lowers their risk and shows you’re serious.

3) Size of your business

The SBA is built to help small businesses, but “small” means different things in different industries. In some sectors, a business with 500 employees is still considered small, while in others, the cap might be 50 people or a certain revenue figure.

It depends on what type of business you’re in. There’s actually a handy Size Standards Tool the SBA provides—you can punch in your industry and see if your business qualifies.

4) Acceptable credit and repayment ability

This one’s obvious, but important. A good credit history, both personal and business (if the business is established), matters. Plus, lenders will check if your business makes enough money to cover the loan payments. They’ll look at your cash flow, income statements, and financial forecasts.

So, in short, here’s what makes you eligible for an SBA business loan:

- Officially registered U.S.-based

- Small by SBA standards

- Unable to get fair financing elsewhere

- Personal investment in the business

- Decent credit with the ability to repay

SBA loan requirements: What you must prepare to get approved

If you’re planning to apply for an SBA loan, there’s a clear set of requirements you’ll need to prepare. Lenders don’t just hand out approvals; they carefully examine every aspect of your business to assess risk, repayment ability, and long-term viability.

Let’s walk through each requirement, what it means, how to fulfill it, and a few tips that will help you strengthen your application.

1) A comprehensive business plan

The very first thing lenders look at is your business plan. It’s where you explain your business’s story: What you do, how you’ll succeed, and how you’ll repay the loan.

Remember, a vague or half-done plan is the quickest way to get passed over. Hence, make sure you cover all the required aspects in your business plan. Here’s what you should include:

You can use SBA business plan templates or an AI tool to speed up the process and stay on track.

Remember, when applying for an SBA loan, your business plan should match the specific focus of the loan type. Lenders check if your intended use of funds aligns with the program’s purpose. For example:

For SBA 504 Loans: These are designed specifically for long-term, fixed-asset purchases like real estate, heavy machinery, or large equipment that will help grow your business over time.

For SBA CAPLines: These loans are built for short-term working capital needs, such as covering seasonal inventory purchases, payroll during peak periods, or managing large customer orders.

Need help finding the right SBA lender?

Let Upmetrics connect you with trusted SBA partners

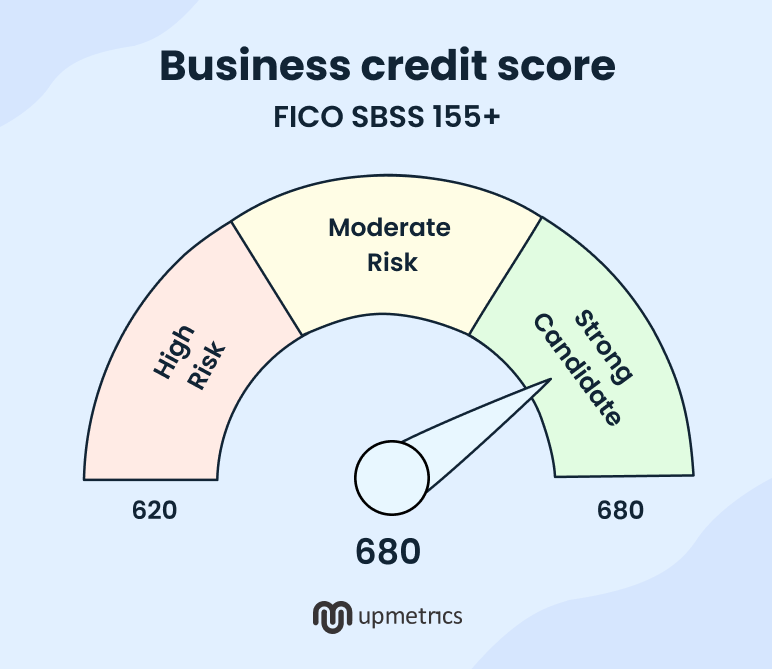

2) Strong credit history

Both your personal and business credit scores matter. Most lenders use them as a first filter to assess whether you manage finances responsibly.

Moreover, it signals that you’ve handled past financial obligations well, increasing their confidence that you’ll repay this loan on time, too.

Here’s what you should prepare yourself for:

- Aim for a personal credit score of 680+ for the best chances.

- Pull your credit reports (from Experian, Equifax, and TransUnion) and correct any errors before applying.

Business credit scores (if applicable) should also be in good shape. For business credit scores, you can use Dun & Bradstreet (D&B), Experian, or FICO’s Small Business Scoring Service (SBSS).

3) Financial statements and projections

Numbers tell your business’s real story. Lenders expect clear, updated financial records and realistic projections. You’ll need to prepare a comprehensive set of financial documents, which typically include:

- Balance sheets

- Profit & Loss (P&L) statements

- Cash flow statements

- 2-3 Year financial projections

Providing thorough and well-organized financial documents is crucial. It not only speeds up the review process but also gives the lender confidence in your managerial competence.

4) Collateral and personal guarantee

Most SBA loans will require collateral, though the extent depends on the loan size and the lender. Collateral is any asset (business or personal) that you pledge to secure the loan, which the lender could claim if you default.

Collateral typically includes:

- Business equipment – Physical tools, machinery, or technology your business owns and uses for operations.

- Real estate – Offices, buildings, warehouses, land or plots, or commercial offices.

- Inventory – Inventory includes the goods and materials your business holds to sell or use in production.

- Accounts receivable – Outstanding customer invoices, credit sales yet to be paid, and trade accounts where customers have agreed to pay at a later date

5) Industry experience and time in business

The SBA doesn’t have a strict “must be in business for X years” rule, but your experience in the industry matters a lot. However, your experience and business track record play a significant role in how lenders assess your application. Here’s how to approach this factor:

- Highlight your relevant experience, skills, or leadership roles in the same field.

- If you’re new, mention transferable skills or advisors and mentors you’re working with.

- If your team includes co-founders or key managers, include their experience and achievements they carry.

6) Legal documentation

Applying for an SBA loan entails a significant amount of paperwork. Beyond the business plan and financials, be ready to provide numerous documents that allow the lender and SBA to verify all aspects of your business. You’ll need to present official legal documents that prove your business is properly registered and legally allowed to operate.

Here’s what you need to gather and provide as a document:

- Business licenses and permits

- State and federal registrations

- Articles of incorporation or partnership agreements

- Ownership documents

- Commercial leases

- Insurance agreements

- Business plan

- Personal resume

- collateral documents

- Major contracts (if applicable)

For deeper insights, take a look at how STREAM, an educational academy, secured $500,000 through a well-prepared business plan with Upmetrics.

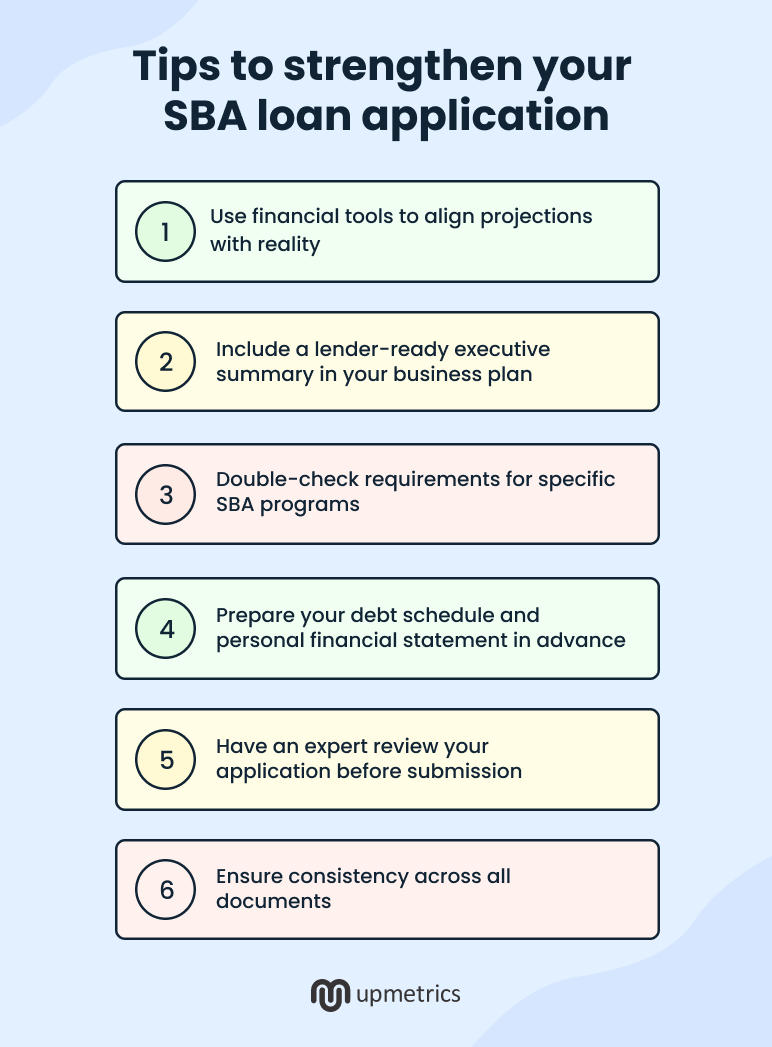

Tips to strengthen your SBA loan application

If you want to improve your chances of SBA loan approval, it’s not just about having a good business—it’s about presenting organized, accurate, and lender-ready documentation. Here are actionable tips to strengthen the key areas of your application:

1) Use financial tools to align projections with reality

Lenders will closely examine your financial projections. Make sure they are rooted in realistic assumptions and industry benchmarks. Consider using financial planning software (like Upmetrics or other forecasting tools) to double-check that your cash flow projections make sense.

A well-supported projection (with clear assumptions listed) shows the lender you’ve done your homework and instills confidence in your numbers. If possible, get an accountant’s review of your forecast to verify it’s reasonable.

2) Include a lender-ready executive summary in your business plan

Lenders are busy; a clear, direct executive summary gives them a quick understanding of your business, financial needs, and repayment plan. Start your business plan with a 1–2 page executive summary covering:

- Business name, industry, and history

- Loan amount requested and purpose

- How the loan will be repaid

- A snapshot of financial health

- Avoid jargon. Focus on clarity, simplicity, and directness.

For additional guidance, you should check out our blog, which offers essentials on preparing a business plan for a loan.

3) Double-check requirements for specific SBA programs

Different SBA loan types (7(a), 504, CAPLines) have unique paperwork. Missing a specific form or collateral detail can halt your application.

Hence, carefully review SBA Form numbers, collateral details (like CAPLines’ inventory records), and loan-specific addendums. Double-check requirements for the specific loan program you’re applying under before submission.

Here’s a quick reference table showing the documents typically required for different SBA loan types.

4) Prepare your debt schedule and personal financial statement in advance

Lenders assess your existing financial obligations and personal financial strength to gauge risk. Missing or incomplete debt and personal financial details can stall your file.

Before applying, prepare:

- A debt schedule listing each business loan, balance, monthly payment, interest rate, and maturity date.

- A personal financial statement summarizing your personal assets, liabilities, income, and expenses.

5) Have an expert review your application before submission

It’s easy to overlook minor mistakes or inconsistencies when you’re too close to your documents. An outside review can spot issues before a lender does.

Once your business plan and financial documents are prepared, have them reviewed by a business consultant experienced with SBA applications.

There are also AI-driven review tools that can scan your writing for clarity and professionalism. Whether human or AI, an external review can catch things like:

- Projections that don’t tie to your tax returns

- A section of your business plan that is confusing

- An important document you forgot to include

Fixing those before the lender ever sees your application can significantly strengthen your position.

6) Ensure consistency across all documents

This is a small but crucial tip: All the numbers and statements in your application should be consistent and tell a coherent story. Conflicting information between documents (like tax returns not matching your cash flow projections) signals carelessness and can lead to immediate underwriting delays.

Hence, before submission:

- Compare key figures across tax returns, financial statements, and your business plan

- Confirm the dates, business names, and ownership details are identical

- Use a checklist to track document versions and approval dates

A simple error in numbers or dates can trigger a lender’s request for clarification, costing you time and possibly damaging lender confidence.

Upmetrics can help you get SBA loan-ready

Securing an SBA loan isn’t easy, and understandably so. The process involves strict eligibility checks, detailed documentation, financial projections, and lender scrutiny at every step.

However, our SBA lending service would make things easier for you. Our team specializes in SBA funding support—helping you build a lender-ready business plan, prepare accurate financial projections, and connect with trusted SBA lenders.

With our AI-powered business plan builder and financial forecasting tools, you can easily create polished, professional loan documents tailored to SBA expectations. We review your materials, identify gaps, and help strengthen them before you apply.

From eligibility checks to final application reviews, our experts support you at every step, ensuring your SBA loan application is complete, accurate, and submission-ready.

Ready to secure your SBA loan? Get connected with our experts and let’s get you funded.