“How long does it take to get an SBA loan?”

I used to answer this question the same way everyone else does: “30-90 days.” Then I started noticing patterns: Some entrepreneurs got approved in 3 weeks while others waited 7 months for similar loan types, both with solid credit and detailed business plans.

That’s when I realized the timeline depends less on market timing and more on strategic preparation factors that most entrepreneurs overlook. The fastest approvals happen when specific conditions align, and most business owners unknowingly work against these factors.

So, instead of leaving you wondering… let me show you what controls your SBA loan timeline.

How long does it take to get an SBA loan? Quick answer

The timeline for securing an SBA loan typically ranges from 30-90 days, but this varies dramatically based on your preparation strategy and timing approach.

What determines your waiting time is loan type complexity, lender efficiency, documentation readiness, and, surprisingly, seasonal application volumes that most entrepreneurs never consider.

SBA loan timeline: From application to disbursement

Here’s the reality check most entrepreneurs need: The SBA loan process isn’t just one long waiting period. It has four distinct phases, each with its own timeline and potential bottlenecks.

Here’s what happens during each phase and where most people lose precious weeks without realizing it.

Stage 1: Pre-application phase (1–2 weeks)

In this stage, you’ll gather documents, finalize your business plan, and conduct an eligibility check. Most entrepreneurs rush through this phase, thinking it’s just paperwork. That approach backfires every time.

Businesses that breeze through later stages often start with an SBA business plan template to organize their narrative and documents the right way.

Stage 2: Application submission & lender review (1–3 weeks)

Once you submit your application, enter the lender’s internal vetting process. Here, lenders assess your credit, cash flow, projections, and how clearly your business plan explains your goals.

If anything’s missing or unclear, this is where the back-and-forth starts. The smart move is applying so complete and compelling that it practically reviews itself. When lenders have everything they need upfront, they move faster.

Stage 3: SBA review & approval (2–3 weeks)

Your application will now sit with the SBA for underwriting and final approval. This stage feels completely out of your direct control, and mostly it is.

However, the quality of your lender relationship directly impacts how smoothly this phase goes.

Experienced SBA lenders know how to position applications for faster SBA review. They understand the nuances that can make or break approval at this stage.

Stage 4: Loan closing & fund disbursement (1 week)

Here, you’ll sign documents and wait for a fund transfer. This should be the easiest stage, but I’ve seen deals delayed here due to last-minute documentation issues or coordination problems.

Here’s where entrepreneurial discipline pays off: Stay fully engaged during this phase. Quick responses and smooth operations demonstrate the leadership qualities lenders want to see funded. Remember, even at this final stage, you’re showcasing why you deserve this capital.

The 30-90 day average doesn’t tell the full story. Your timeline depends heavily on controllable factors: Strategic preparation, thorough documentation, and smart lender selection consistently produce faster approvals.

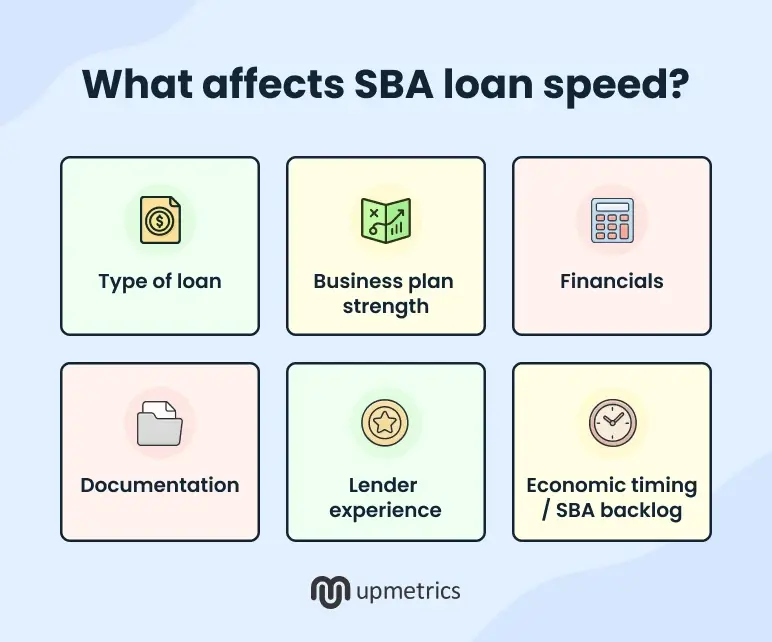

Factors that affect SBA loan approval time

According to recent data by Forbes, SBA loan approval rates vary significantly. The loan timeline doesn’t start the day you apply. It starts with how well you prepare. Similar businesses often experience vastly different approval times, and the difference usually comes down to how they handle six key factors:

1. Type of SBA loan (504 vs 7(a))

Your loan type sets the speed limit for everything that follows. I consistently see SBA 7(a) loans move faster because there are fewer moving parts—one lender, simple underwriting, and less red tape. These general-purpose loans usually take 30-60 days when everything’s prepared right.

SBA 504 loans often take longer due to their complexity. You’ll be dealing with two lenders (bank and Certified Development Company), plus more extensive property evaluations and job creation requirements. These typically range from 60-90 days, though complex real estate deals can extend beyond that.

If you qualify for both loan types, consider the 7(a) route for faster funding, though evaluate whether the 504’s potentially better long-term rates justify the extended timeline.

2. Your business plan

Your business plan isn’t just a document. It’s your first impression of working 24/7. I’ve watched lenders spend 10 minutes on a compelling plan that answers every question upfront, while weak plans trigger weeks of back-and-forth clarifications.

Applications move through lender review in days when the business plan demonstrates clear market understanding, realistic financial projections, and solid operational strategy. Weak business plans can add weeks to your timeline as lenders request clarifications and additional documentation.

The real power move? Building a business plan that doesn’t just describe your business but also demonstrates your strategic thinking and positions you as the entrepreneur they want to back.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

3. Business financials and creditworthiness

Clean financials accelerate everything. When your books are organized, your cash flow is predictable, and your credit profile is strong, underwriters move quickly through their analysis. They’re looking for red flags, and when they don’t find any, the process flows smoothly.

Messy financials create delays. Inconsistent revenue reporting, unexplained cash flow gaps, or credit issues force lenders to dig deeper. Each question they need to ask adds time to your approval process.

Businesses that invest in professional bookkeeping and credit optimization before applying consistently experience shorter timelines.

4. Documentation completeness

The biggest timeline killer isn’t credit scores or business models. It’s incomplete paperwork. Every missing document forces another communication round, potentially adding weeks to your approval process.

Smart applicants submit everything up front, even documents that seem optional. They include detailed explanations for anything that might raise questions. This front-loaded approach often cuts weeks off the approval process.

5. Lender’s experience with SBA loans

Preferred SBA lenders can approve loans internally without sending everything to the SBA for review. This can cut your timeline by 2-4 weeks compared to non-preferred lenders.

Experienced SBA lenders also know how to structure applications for the fastest approval. They understand SBA loan requirements intimately and can guide you away from common pitfalls that slow down processing.

Established SBA lenders have dedicated underwriting teams and streamlined processes that less experienced lenders lack.

6. Economic conditions and SBA backlog

Economic conditions create invisible bottlenecks that can double your timeline. I’ve seen disaster declarations trigger application floods that turn 45-day approvals into 4-month waits simply because everyone’s applying at once. Peak lending seasons also slow things down.

Understanding these cycles helps you time your application for optimal processing speed. Spring (March-May) and fall (September-November) typically see the highest application volumes, while late summer and winter months often have faster processing times.

So the answer to the question: How long does an SBA loan take depends on these factors. Each of them represents an opportunity to differentiate yourself from the competition. While others see obstacles, you can see strategic positioning opportunities.

Tips to speed up your SBA loan process

The fastest approvals don’t always go to the strongest businesses—they go to the smartest applicants who understand that speed comes from strategy, not just strong financials.

Here are the proven strategies that consistently accelerate SBA loan timelines:

1. Work with funding experts

Working with experienced SBA consultants gives you a major advantage. These experts understand how SBA lenders think, what red flags cause delays, and how to position your application to clear internal reviews faster.

At Upmetrics, we’ve developed a comprehensive approach to SBA loan preparation that addresses every factor lenders evaluate. Our SBA lending services help entrepreneurs navigate the entire process strategically, from initial planning through final approval.

2. Start with a lender experienced with SBA loans

Not all SBA-approved lenders are the same. The ones that handle high loan volumes have internal systems that speed up processing. Their underwriting teams know what SBA wants, so they can spot and fix issues early before they hold up your file.

You don’t need the biggest bank. You need one that consistently delivers SBA loans. Look for a track record of approvals, deep SBA knowledge, and strong communication. These are the lenders that move files through faster.

3. Ensure your business plan and financials are airtight

If your business plan clearly explains your business model, market fit, and financial outlook, it builds confidence and reduces the need for extra questions.

The same goes for your finances. Well-organized, accurate statements show lenders you’re ready. Gaps, errors, or unclear cash flow raise concerns that take time to resolve. Clean numbers lead to faster decisions.

If you’re not sure where to start, this guide on how to write a business plan for a loan breaks it down step by step.

4. Respond to documentation requests quickly

Lenders work on dozens of applications at once. When they reach out, a fast reply keeps your file active. A slow one can push it to the back of the line. Simple delays, even by a few days, can set you back weeks.

Smart founders prep for common requests ahead of time. If you have extra documents ready (like leases, contracts, or updated statements), submit them early. That kind of responsiveness keeps your timeline on track.

Timeline comparison: SBA vs. other small business loans

Not every loan takes 30-90 days. Depending on the lender and loan type, you might get funding in days or months. But fast doesn’t always mean better.

| Loan type | Approval time | Ideal for |

|---|---|---|

| SBA 7(a) | 30-90 days | Large amounts, low rates, long terms, ideal for established growth |

| Traditional bank | 14-45 days | Well-established businesses with strong credit |

| Online lenders | 1-7 days | Quick access for short-term capital needs |

| Microloans | 14-30 days | Startups and smaller funding requirements |

1. SBA 7(a) loans

It takes the longest, but also offers the best deal for most growing businesses: large funding amounts, low interest, and long repayment terms.

If you need capital for expansion, hiring, or major equipment and can afford to wait, this is the right call.

2. Traditional bank loans

These loans are quicker but harder to qualify for. Credit requirements are strict, and approval is never guaranteed. They’re best for established businesses with solid financials.

3. Online lenders

SBA loans from online lenders move fast, sometimes within 24 hours. That speed comes at a price: higher interest, shorter repayment windows, and smaller amounts. Useful for urgent needs or short-term cash flow gaps, but expensive if held too long.

4. Microloans

These loans work well for small, early-stage businesses. They’re easier to qualify for than SBA or bank loans, and funding usually lands in a few weeks.

If you’re deciding purely based on speed, online lenders win. But if you’re looking at total cost and long-term flexibility, SBA often offers more value, even with the extra wait.

Need help connecting with SBA lenders?

If you’re ready to apply for an SBA loan or are stuck waiting longer than expected, the right support can make all the difference.

At Upmetrics, we don’t just help you build strong financial forecasts and business plans. We have helped businesses like Stream Academy get SBA funding faster with lender-ready business plans that stand out.

We’ve built relationships with lenders who actually understand diverse business models and value well-prepared applications. Gone are the days of guessing which banks might be interested in getting lost in endless paperwork loops.

Our SBA lending experts help you prepare, apply, and get funded with fewer headaches and faster timelines.