I hate it when people tag financial forecasting as “complex” and “overwhelming”.

(Coming from someone who used to feel the same way 🫣)

Most entrepreneurs think the same as you. Why?

A few plausible thoughts: confusing terminology, unclear processes, and a lot of guesswork.

But here’s the thing—I can teach you financial forecasting in 10 minutes.

Yes, seriously!

(Forget everything you’ve heard before; let’s start fresh.)

We’ll cover everything—charts, graphs, statements, everything.

To begin with, what is financial forecasting?

I have my own definition.

“It’s analyzing your financial past and present to predict the future.”

(You: I know that much, but…)

How to actually make accurate financial projections?

Well, It all boils down to answering these 5 questions.

- How do you make money?

- What does it cost to make or deliver your product/service?

- How much do your startup and daily operations cost?

- How many employees do you have, and what do you pay them?

- How much cash do you need to keep your business running?

Five questions represent revenue streams, cost of sales, startup expenses, personnel costs, and working capital.

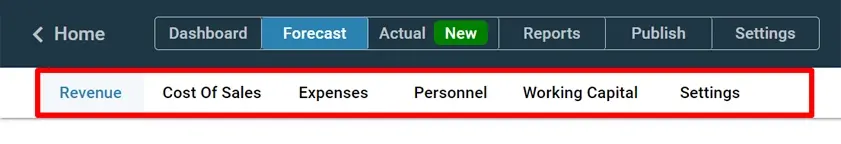

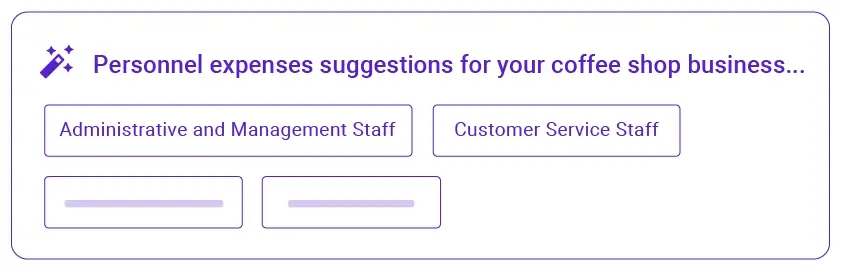

1. How do you make money? (revenue streams)

Think about all the ways your business brings in money.

This could be selling products, offering services, or even earning through partnerships.

If using Upmetrics, you can generate revenue streams using AI.

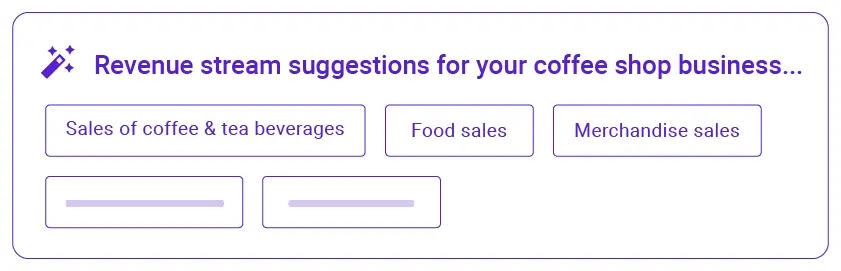

2. What does it cost to make or deliver your product/service?

Every product or service has a cost to produce or deliver.

Could be materials, manufacturing, packaging, or delivery.

This helps figure out how much you need to sell your product for to make a profit.

3. How much do your startup and daily operations cost?

Running a business involves spending on things like electricity, rent, supplies, and marketing.

These are your operational costs, critical for precise forecasts.

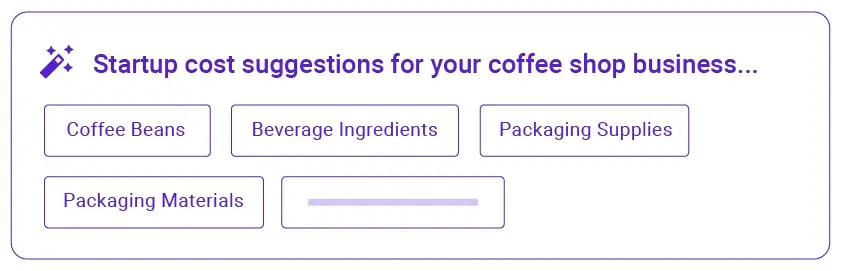

4. How many employees do you have, and what do you pay them?

Think about how many people work for you and what their salaries are.

How do you pay them (monthly, hourly)

This will further help you understand your payroll expenses.

6. How much cash do you need to keep your business running?

Your working capital is the money invested in your business.

This may include bank loans, funding received, owner investment, etc.

Accurately answer these questions, and you’re 90% there.

While it looks easy in theory, it’s more than that in practice.

Predictions.

This is where the entrepreneurs get stuck.

I can’t explain all the forecasting methods in detail, but here are some tips.

How to make financial predictions?

- Forecast based on sales growth rates for key financials.

- Assume consistent growth based on past trends.

- Average past periods for short-term predictions.

- Consider market trends and instabilities into account.

- Gather expert opinions to reach a forecast consensus.

- Use surveys and competition analysis to guide predictions without historical data.

Hope it’ll do the job.

(If not, you may consider using our AI research assist for predictions)

What about charts, statements, and visual reports?

Check your Upmetrics dashboard; you’ll have it already. (screenshot)

Additional tips for preparing financial projections:

- Plan for both the best and worst-case scenarios.

- Don’t over-optimize your financials.

- Keep it real—don’t over-optimize or get overly optimistic.

- Use historical data to guide your projections.

- Use a financial forecasting tool.

You may not be an expert, but you know just enough to prepare your forecasts using Upmetrics.

Hope that settles it.

If you’re still unsure, consider talking to our financial planning consultant.

Until next time,

Happy business planning 🙂