Executive Summary

Stitchline Manufacturing Co., LLC is being established by Daniel Cortez to acquire Golden Stitch Apparel, Inc., a long-running cut-and-sew garment factory located in the LA Fashion District. The factory has operated since 1998 and continues to run with active clients, trained staff, and full equipment.

Before the acquisition, Cortez spent 12 years in production management experience and holds a strong background in sewing, QC, and equipment oversight. This experience allows a smooth ownership transition and supports steady operations. The acquisition plan assumes a transition with an experienced team, providing lenders with a stable base for growth.

Post-Acquisition Plan

After the acquisition, Daniel Cortez plans to retain all current employees and keep existing production lines active. He will also make targeted changes that improve efficiency, including upgrades to batch tracking, training, and digital systems. These steps are expected to reduce lead time from 5–7 weeks to around 3–4 weeks. The factory will be rebranded and positioned as a reliable partner for emerging and mid-size apparel brands that need consistent small-batch production.

Funding Structure

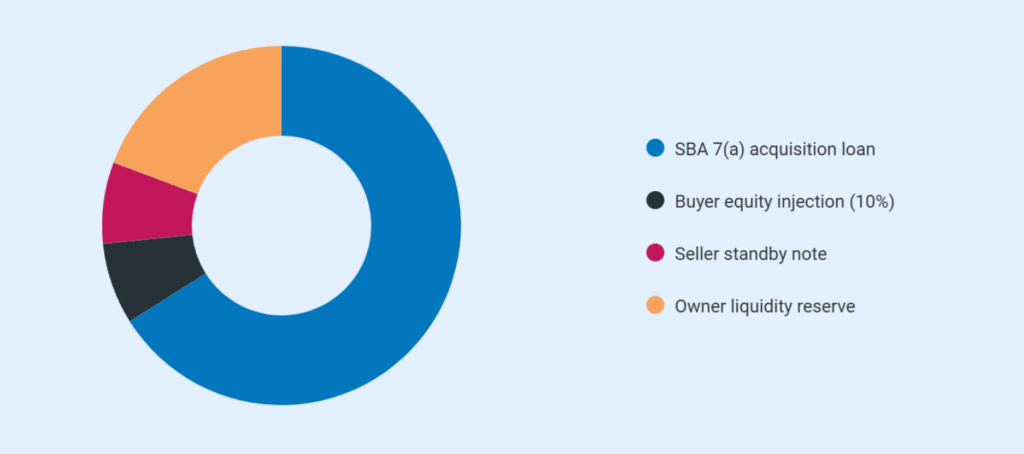

The acquisition of Golden Stitch Apparel, Inc. is structured around a total purchase price of $345,000. The transaction is financed through a combination of buyer equity, SBA debt, and seller financing, in compliance with SBA 7(a) acquisition guidelines.

The buyer will contribute a 10% cash equity injection of $34,500 at closing. The remaining purchase balance is funded through an SBA 7(a) acquisition loan of $310,500 and a seller standby note of $34,500, which is placed on full standby for the life of the SBA loan as required.

In addition to the acquisition financing, the owner will maintain a separate liquidity reserve of $90,600, held outside of operating funds. This reserve is not required for day-to-day operations but provides additional cash stability during the post-acquisition transition period.

SBA loan proceeds are used to acquire the business and support early operating needs, including a four-month working capital reserve, facility safety improvements, CAD software upgrades, and rebranding expenses. These funds support uninterrupted operations during the ownership transition and help stabilize production while improving turnaround times.

Market Position and Demand

Los Angeles is one of the largest apparel manufacturing hubs in the United States, with factories operating from permanent industrial locations across the city. These manufacturers serve apparel brands that value local production, faster turnaround times, and close coordination during sampling and production.

Within this market, apparel manufacturers operate at different scales, ranging from small-batch producers to larger operations that serve clients beyond the local market.

Golden Stitch Apparel represents a smaller, established segment of this same market. Operating from 4435 E. 12th Street, Unit C, Los Angeles, CA 90023, and in continuous operation since 1998, Golden Stitch focuses on small-batch cut-and-sew production for repeat clients. This segment remains in steady demand among brands that require reliability, shorter lead times, and controlled production runs.

This market structure supports Stitchline Manufacturing’s acquisition strategy, as demand exists across both small-batch and larger-scale operations within the Los Angeles apparel ecosystem.

Don’t spend weeks on your first draft

Complete your business plan in less than an hour

Workforce and Operational Base

Following the acquisition, Stitchline Manufacturing Co. will operate the factory using Golden Stitch’s existing workforce and production systems. Golden Stitch employs a trained team of 15 workers, including sewing operators, a cutter, a sample maker, a finisher, and office support staff. This team already understands the production standards, patterns, and stitching methods used in the facility.

Stitchline’s strategy is to retain the current workforce and follow their workflows to avoid disruption, while applying tighter scheduling, clearer job tracking, and improved quality oversight over time. Intake, production, quality checks, and dispatch processes are already in place and will continue under Stitchline’s management. This approach allows Stitchline to preserve output consistency, protect client relationships, and support steady business performance during and after the ownership transition.

Financial Outlook

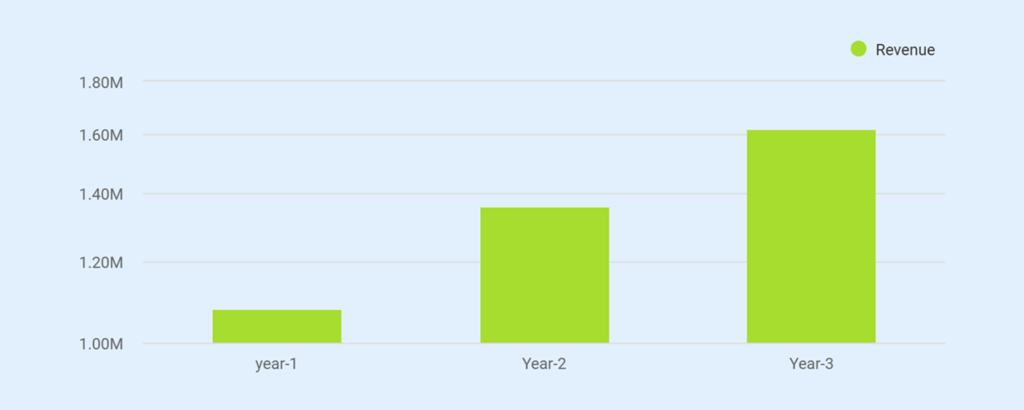

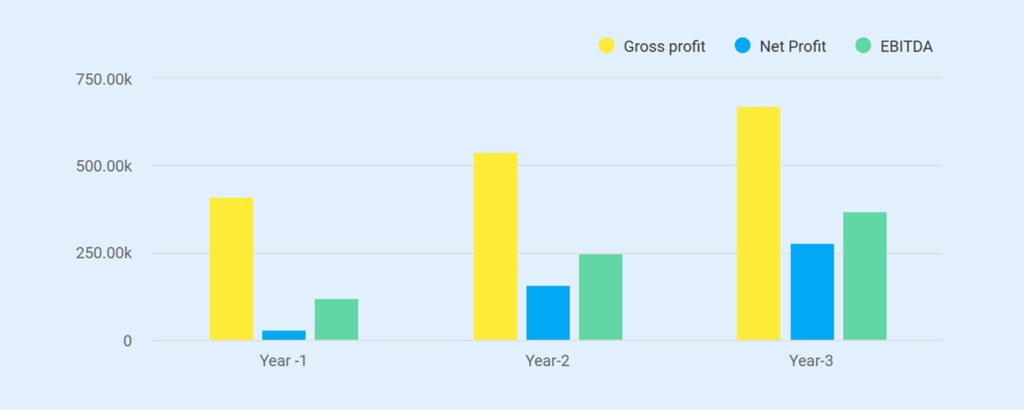

Revenue is projected to reach $1.08 million in Year 1 and grow to approximately $1.62 million by Year 3 as production scheduling improves and CAD upgrades reduce sampling delays and rework.

The projections assume full workforce retention, stable client demand, and improved utilization of existing capacity rather than price increases or expansion. Break-even is achieved in Year 1, supported by client deposits of 40–50% on orders and disciplined cost control, which together support stable cash flow and debt service coverage.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | $1,080,000 | $1,360,000 | $1,620,000 |

| Cost of Goods Sold | $670,000 | $820,000 | $950,000 |

| Gross Profit | $410,000 | $540,000 | $670,000 |

| Gross Margin | 38.0% | 39.7% | 41.4% |

| Operating Expenses | $290,000 | $292,300 | $302,500 |

Business Overview

Stitchline Manufacturing Co., LLC will operate from 4435 E. 12th Street, Unit C, Los Angeles, California. The facility is located in a well-known industrial area within the LA Fashion District East, which is widely known for high garment production activity.

The factory serves apparel brands that need small-batch, domestic cut-and-sew manufacturing with steady quality and reliable turnaround times. Operating as a California LLC provides a clear ownership structure, liability protection, and continuity for vendor and client relationships after the acquisition.

Background

The factory has operated continuously since 1998 under the name Golden Stitch Apparel, Inc. Over more than twenty years, the business has built a stable base of repeat clients, trained sewing operators, and established production processes.

The factory’s long operating history is supported by dependable output, consistent stitching standards, and a focus on short production runs for emerging and mid-size apparel brands. Its operating model has remained stable due to experienced staff, proven workflows, and long-term supplier relationships.

Ownership

Golden Stitch Apparel, Inc. is currently owned by Michael Alvarez, who has managed the factory through its existing phase of operations. Once the acquisition is completed, ownership of the business assets will transfer to Stitchline Manufacturing Co., LLC, a newly formed entity created to acquire and operate the factory.

After the acquisition, Daniel Cortez, the new owner, will remain closely involved in day-to-day operations, especially during the first year. This approach supports production continuity, workforce stability, and protection of cash flow during the transition period.

Business Model

Golden Stitch Apparel, Inc. follows a straightforward small-batch manufacturing model:

- Receive client designs or tech packs

- Prepare patterns, samples, and grading as needed

- Produce short-run garment orders

- Complete finishing, quality checks, and delivery

Revenue is generated primarily from cut-and-sew production, with additional income from sampling, pattern development, grading, and select add-ons. Pricing for cut-and-sew production is charged on a per-unit basis, while sampling, pattern development, grading, and add-on services are priced as fixed per-service fees, not hourly. Most clients are repeat apparel brands that place ongoing production orders throughout the year.

Mission

To provide dependable, small-batch garment manufacturing with consistent quality, clear communication, and reliable turnaround times for apparel brands.

Vision

To strengthen the factory’s operational efficiency and transparency over time while maintaining its core production focus and experienced workforce.

Transition & Continuity Plan

The Golden Stitch Apparel factory will continue operating as usual during the ownership transition. Staffing levels, production workflows, equipment usage, and client servicing will remain the same at first so that existing clients and production schedules experience no disruption. Any updates, such as improved job tracking or CAD system upgrades, will be introduced gradually after operations stabilize.

The seller will assist during the handover by introducing Stitchline Manufacturing Co., LLC to vendors and clients and by explaining how scheduling, pricing, and production systems currently operate.

All existing employees will be retained so that stitch quality and daily output remain consistent. For the first 90 days, no major operational changes will be made while the new owner completes a full review of the factory’s routine.

Transition Timeline

| Step | Date | What Happens |

|---|---|---|

| Buyer–Seller LOI Signed | March 2026 | Agreement to proceed |

| SBA Application Submitted | April 2026 | Loan application filed |

| Lender Review + Facility Check | May 2026 | Financial and operational review |

| Final Purchase Closing | June 2026 | Ownership transfer completed |

| Systems & Training Updates | July 2026 | Internal improvements begin |

| Stabilization Period | Q3–Q4 2026 | Operations normalize under new ownership |

This timeline is designed to maintain uninterrupted production and protect existing client relationships.

Business Goals

Our main goal is to acquire the factory, keep production running on track, and improve operations gradually without changing the core manufacturing model that existing clients rely on. Further, we aim to:

- Maintain an average production volume of 6–8 small-batch runs per month in Year 1.

- Improve production scheduling and sampling efficiency through CAD system upgrades and digital job tracking.

- Gradually reduce average lead times from 5–7 weeks to 3–4 weeks as workflows improve.

- Strengthen relationships with repeat brand clients to support consistent reorders.

- Reach break-even in Year 1 as production and scheduling become more stable.

- Maintain a Debt Service Coverage Ratio above 1.25 before considering any expansion.

Our overall focus is to keep operations stable and reliable while guiding the factory toward steady, low-risk improvement.

A business plan shouldn’t take weeks

Market Analysis

Cut & Sew Apparel Manufacturing Market Context (California)

Los Angeles is the largest cut-and-sew apparel manufacturing hub in the United States, supporting small-batch and repeat production models. Many brands rely on local factories for shorter lead times, sample control, and flexible order volumes. This environment aligns directly with Golden Stitch’s focus on repeat orders and domestic production.

Market Size and Industry Structure

The market size of the Cut & Sew Apparel Manufacturing industry in California is $2.7 billion in 2026. As of 2026, the industry consists of 387 businesses statewide, reflecting a decline at an average annual rate of -3.1% from 2020 to 2025. Over the same period, the overall market size declined at an average annual rate of -0.3%, indicating gradual contraction rather than a sharp downturn.

Employment within the industry remains significant despite this decline. In 2026, the Cut & Sew Apparel Manufacturing industry in California employed 7,531 workers, reflecting a sizable but gradually declining workforce.

While employment levels have decreased over time, the industry continues to support an experienced base of apparel manufacturing labor, particularly in established production regions such as Los Angeles, where demand remains steady for small-batch and repeat production services.

Los Angeles Apparel Manufacturing Context

Los Angeles is the largest apparel manufacturing hub in the United States, supporting a dense network of small-batch and cut-and-sew factories. Many apparel brands rely on Los Angeles manufacturers for shorter lead times, in-person sample review, and smaller production runs. This regional demand aligns with Golden Stitch’s operating model, which focuses on repeat production orders rather than mass manufacturing.

Target Clients

At Stitchline Manufacturing Co., we focus on these target clients:

- Direct-to-consumer apparel brands that produce short-run and repeat styles

- Activewear and athleisure labels require consistent fit and quality control

- Fashion startups and designers needing sampling, pattern development, and small initial runs

- Corporate merchandise providers requiring controlled batch production

These clients value shorter lead times, local communication, and production flexibility, which aligns with Golden Stitch’s existing operating model.

Market Trends

U.S.-based apparel manufacturing is receiving renewed attention by many brands as global sourcing has become harder to manage. Ongoing trade policy uncertainty, tariffs, and shipping delays have made overseas production less predictable, especially for brands producing smaller or repeat runs.

Industry research and fashion executive surveys consistently point to lead-time volatility and supply chain disruption as major operational challenges to cost planning and delivery schedules. This prompts brands to reduce exposure where possible.

In Los Angeles, this shift has translated into renewed interest in local cut-and-sew manufacturing. Industry coverage highlights that brands are returning to LA factories to gain tighter control over sampling, production timelines, and quality oversight, particularly for short-run and repeat styles.

Local manufacturing allows brands to review samples in person, adjust production quickly, and reduce inventory exposure by producing closer to demand. This environment directly supports Golden Stitch’s small-batch, repeat-order model, which prioritizes turnaround reliability, quality control, and close client coordination over large-volume manufacturing.

Competitive Analysis

In Los Angeles, Stitchline Manufacturing faces competition from both direct garment factories and indirect production alternatives. Each competitor serves apparel brands with different priorities and operates with its own strengths and limitations.

| Competitor | Type | What They Offer | Weakness / Note |

|---|---|---|---|

| Lefty Production Co. | Direct | Full-service apparel production, sampling, and development support for emerging brands | Higher pricing and longer lead times during peak demand |

| Indie Source | Direct | Guided production services, onboarding support, and brand development assistance | Higher cost structure and slower turnaround for repeat orders |

| The Evans Group | Direct | High-end, boutique-quality garment manufacturing with strong sample-making | Premium pricing and longer production timelines |

| Micro-Factories (Alameda St / 7th St) | Direct | Small cut-and-sew shops offering basic production at lower per-unit cost | Inconsistent quality, limited sampling, and scalability constraints |

| Overseas Manufacturers | Indirect | Large-scale production at lower unit costs | Long lead times, high minimum orders, limited flexibility |

| Freelance Sample Makers | Indirect | One-off samples and prototyping support | No capacity for repeat or scaled production |

| Small Workshops | Indirect | Informal production for very small runs | Limited quality control and operational reliability |

Differentiation Angle

Stitchline Manufacturing will retain the proven operating foundation of the acquired factory while introducing targeted improvements that address gaps in the local market:

- Retention of experienced sewing operators to preserve stitch quality and production consistency

- Reduced lead times through tighter scheduling and improved job tracking

- Clear, transparent per-unit costing to help brands plan margins and repeat orders

- Mid-production quality checks and updates to improve client visibility and confidence

- Optional fabric sourcing and finishing services to reduce vendor coordination for clients

This positioning allows Stitchline to operate between high-cost boutique studios and low-cost micro-factories, offering dependable small-batch production with predictable timelines and consistent quality.

Stop searching the internet for industry & market data

Get AI to bring curated insights to your workspace

Business Offerings

Core Manufacturing Services

Golden Stitch Apparel, Inc. has operated as a small-batch cut-and-sew garment manufacturer since 1998, serving emerging and mid-size apparel brands in the Los Angeles market. The factory’s existing service mix reflects long-standing client demand and proven production capability.

The acquired facility currently provides cut-and-sew production for short-run and repeat orders, typically ranging from 50 to 700 units per style. Core garment categories include:

- T-shirts and tanks

- Hoodies and sweatshirts

- Leggings and athletic wear

- Shorts, joggers, and lounge pants

- Light dresses and casual tops

Pricing is based on fabric type, construction complexity, and order volume. This production model supports repeat brand relationships rather than one-time or mass manufacturing runs.

After the acquisition, Stitchline Manufacturing Co., LLC will continue all existing production services without interruption, maintaining the same order sizes, garment categories, and production focus.

Pre-Production and Private-Label Support

Pre-production services have historically been part of Golden Stitch’s workflow, particularly for sampling and initial pattern execution. Under Stitchline, these services will remain in place and be more clearly structured to support consistent repeat production.

Pre-production services include:

- Pattern creation to convert designs into production-ready patterns

- Sample making to confirm fit, construction, and materials

- Size grading for short-run production

- Label sewing and packaging for private-label orders

These steps are integrated directly into the production process to reduce cutting and sewing errors and improve reliability across repeat orders.

Add-On Production Capabilities

In addition to core manufacturing, the Stitchline will continue to offer value-added services that reduce the need for brands to coordinate multiple vendors. Available add-ons include:

- Embroidery using an in-house Tajima four-head machine

- Heat press transfers

- Fabric sourcing support for local and specialty materials

- Limited brand development support through FIDM-connected partnerships

These services are intended to support existing clients and improve production efficiency rather than alter the factory’s operating model.

Equipment and Production Capacity

The acquisition includes a fully equipped production floor with industrial machines suited for small-batch manufacturing, including lockstitch, serger, coverstitch, cutting, embroidery, and finishing equipment.

Golden Stitch Apparel currently operates using an Optitex 2D CAD system. Post-acquisition upgrades are planned to improve sampling speed and pattern accuracy while keeping production capacity consistent with existing workflows.

Supplier Network

Established supplier relationships developed under Golden Stitch Apparel will be retained following the acquisition. Key suppliers include Pacific Coast Knitting, NCC Knitting, LA Trim Depot, and TexStyles Wholesale.

Working with local suppliers supports fast material sourcing, allows flexibility during production, and reduces delays between sampling and full production runs.

Marketing & Sales Strategy

Marketing for Stitchline is designed to support steady production volume rather than rapid lead growth. As a local manufacturing business, demand comes from visibility within the design community, referrals, and clear proof of work. The goal is to attract brands that are ready to produce, not to generate high volumes of casual inquiries.

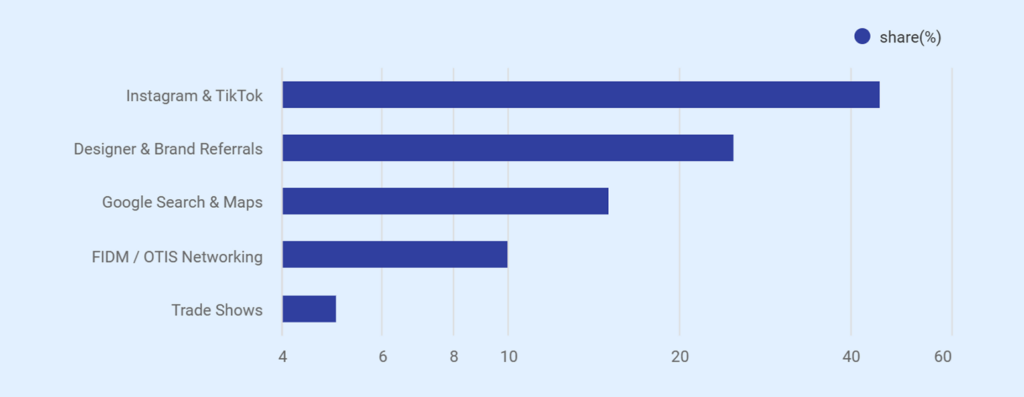

Client Source Overview

Most clients find local garment factories through a small number of repeatable channels. These channels already work for Golden Stitch and will be formalized after the acquisition.

- Social platforms such as Instagram and TikTok, where behind-the-scenes factory content builds trust

- Referrals from designers, brand owners, and existing clients

- Google Maps and local search from brands actively seeking nearby production

- Networking through FIDM, OTIS, and local fashion events

- Presence at industry shows such as the LA Textile Show

These channels focus on bringing in production requests that match the factory’s current capacity, allowing Stitchline Manufacturing to accept orders it can schedule and deliver on time with existing staff and equipment.

Marketing Channel Breakdown

| Channel | Approximate Share | Role in Sales |

|---|---|---|

| Instagram & TikTok | 45% | Visibility and trust-building |

| Designer & Brand Referrals | 25% | Repeat and higher-quality clients |

| Google Search & Maps | 15% | High-intent inbound leads |

| FIDM / OTIS Networking | 10% | Early-stage designers |

| Trade Shows | 5% | Industry visibility |

This mix reflects how designers actually choose manufacturing partners rather than broad advertising tactics.

Sales Process

Sales engagements at Stitchline Manufacturing follow a structured, production-driven process designed to qualify serious production inquiries and align orders with factory capacity.

Initial inquiries focus on confirming order type, estimated quantity, fabric requirements, and target delivery timeline. Once a style or tech pack is reviewed, we provide a production estimate covering unit cost, lead time, and delivery window. To confirm the order and secure production capacity, clients place a 40%–50% deposit, which allows materials to be ordered and the job to be scheduled.

As production moves through cutting, sewing, and finishing, clients receive updates at key stages. This process filters out low-commitment inquiries, reduces scheduling disruptions, and keeps the production floor focused on confirmed work.

Brand Visibility and Client Trust

Stitchline Manufacturing uses operational transparency to build client confidence rather than promotional marketing. Visual content focuses on real production activity, including machines in operation, samples being reviewed, and finished garments coming off the line.

Photos, short videos, and factory tours—both virtual and in person—are used during the sales process to show how work is handled on the floor and what clients can expect during production. This approach helps brands understand workflow, quality standards, and turnaround expectations before committing to an order.

By showing actual production conditions upfront, Stitchline reduces onboarding friction and sets clear expectations early in the client relationship.

Promotional Activities

Promotions are used sparingly and tied directly to production activity.

- Discount on a first production run to lower entry risk

- Free pattern evaluation for a limited number of new clients

- Reduced sample pricing for returning brands

These offers encourage commitment without pressuring capacity or lowering perceived value.

Marketing Budget and Cost Control

Stitchline Manufacturing maintains a fixed monthly marketing budget of $2,400, aligned with current production capacity and order volume. Marketing spend is focused on channels that generate qualified production inquiries rather than broad brand exposure.

| Channel | Approx. Monthly Budget | Purpose |

|---|---|---|

| Digital Visibility & Local Search | $1,200 | Google Maps presence and limited paid search for apparel manufacturing-specific terms |

| Social Media Content Distribution (Instagram & TikTok) | $600 | Promotion of in-house factory footage and production updates |

| Industry Networking & Events | $400 | Participation in local fashion events and trade shows |

| Contingency & Testing | $200 | Short-term opportunities and seasonal demand shifts |

| Total Monthly Marketing Budget | $2,400 | Aligned with current production capacity |

Most marketing content is produced internally using factory footage, which keeps external content costs low. Spending levels are reviewed monthly and adjusted based on production backlog and available floor capacity to avoid generating excess demand beyond operational limits.

This approach supports repeat production relationships by prioritizing delivery reliability, clear communication, and consistent quality without driving demand beyond available factory capacity.

Operations Plan

Production Facility Layout and Workflow (Post-Acquisition)

After acquiring Golden Stitch Apparel, Stitchline Manufacturing will continue operating from the existing cut-and-sew facility. The factory is already configured for small-batch garment production, with defined areas for cutting, sewing, finishing, and packing. Production is scheduled by job rather than fixed runs, allowing garments to move through each stage based on order requirements. This setup supports daily operations and repeat orders without requiring changes to the physical layout.

Operating Schedule

Following the acquisition, Stitchline Manufacturing will maintain the facility’s established operating schedule to preserve workforce stability and production consistency.

- Monday to Friday: 7:00 AM – 6:00 PM

- Saturday: 8:00 AM – 1:00 PM (rush orders only)

This schedule allows full production cycles during the week while keeping limited weekend capacity available for urgent or time-sensitive orders.

Staffing Structure and Roles

Stitchline Manufacturing will retain the existing 15-person workforce acquired with Golden Stitch Apparel. This staffing structure reflects standard labor requirements for a factory of this size and supports small-batch and repeat production without adding unnecessary supervisory layers.

| Role | Headcount | Hourly Rate ($) | Core Responsibility |

|---|---|---|---|

| Sewing Machine Operators | 10 | $19.25–21.00 | Garment assembly and stitching |

| Lead Operator / Supervisor | 1 | $22.50 | Floor oversight and QC coordination |

| Cutter | 1 | $22.00 | Fabric cutting and preparation |

| Sample Maker | 1 | $24.00 | Samples and pattern execution |

| Finisher / Pressing | 1 | $17.00 | Trimming, steaming, and packaging |

| Office Manager | 1 | $19.00 | Admin, scheduling, documentation |

| Total Employees | 15 | – | – |

Retaining the current workforce allows Stitchline to preserve production knowledge, maintain stitch consistency, and avoid disruption during the ownership transition. No additional hiring is planned during the initial post-acquisition period.

Production Workflow Control and Expansion Approach

The acquired facility operates on a structured, batch-based production workflow that has been in place for several years. Orders are grouped into weekly production batches to balance machine usage, operator assignments, and delivery timelines. Each batch follows a defined sequence from cutting through sewing, finishing, and final preparation.

After acquiring Golden Stitch Apparel, Stitchline Manufacturing will keep the current production process and make small improvements over time. Growth will come from completing more production runs each month using the same space, machines, and 15-person team. Job tracking tools and the Optitex CAD upgrade will help reduce delays and rework, allowing the factory to take on more repeat orders without adding staff or expanding the facility for now.

Quality Control Practices

Quality control is performed in clear phases during production.

Phase 1: Start of Production

Operators check fabric, stitching setup, and garment measurements against the approved sample before production begins.

Phase 2: During Sewing

Operators monitor workmanship while sewing is in progress. Supervisors conduct spot checks to confirm quality standards are being followed.

Phase 3: Pre-Packing Inspection

Before packing, the production supervisor completes a final quality inspection after sewing is finished.

Garments are reviewed against approved samples and measurement tolerances. Any fit or production issues are corrected before shipment.

Stitchline Manufacturing will continue using this early-detection process after the acquisition. Operator responsibility and supervisor oversight remain key to maintaining quality, reducing rework, limiting material waste, and protecting delivery timelines.

Equipment Care and Maintenance

Reliable machine performance is essential to maintaining consistent output in a small-batch manufacturing environment. Stitchline Manufacturing will continue the preventive maintenance practices already in place at the facility.

Operators are responsible for daily cleaning and basic checks on assigned machines. Needles are replaced on a fixed schedule to protect stitch quality and prevent garment damage. Monthly machine calibration ensures accuracy and consistency across repeat production runs.

Maintenance contracts remain in place for critical equipment to support timely servicing and repairs, minimizing unexpected downtime during active production periods.

Compliance and Regulatory Controls

The facility operates under a defined compliance framework that Stitchline Manufacturing will continue to follow:

- Registered California garment manufacturer

- OSHA workplace safety compliance

- Fire safety and egress standards met

- Active workers’ compensation insurance

- Full wage documentation under the Garment Worker Protection Act

These controls reduce regulatory exposure, protect the workforce, and support lender confidence in ongoing operations.

Financial Plan

The financial plan presents the acquisition and operating cost structure for Stitchline Manufacturing Co., LLC, including purchase financing, working capital use, operating expenses, and projected cash flow. Financial statements are prepared to support SBA 7(a) lender review and reflect post-acquisition operations of the existing garment manufacturing facility.

Historical Financial Summary

Golden Stitch Apparel, Inc. (Pre-Acquisition)

The acquired factory has operated as a small-batch garment manufacturer for several years, generating consistent production-based revenue from repeat apparel brand clients. Historical performance reflects stable demand, established staffing levels, and predictable operating costs prior to acquisition.

| Description | Amount ($) |

|---|---|

| Historical annual revenue | 1,000,000 |

| Cost of goods sold (COGS) | 640,000 |

| Gross profit | 360,000 |

| Operating expenses | 300,000 |

| Net operating income | 60,000 |

These historical results demonstrate that Golden Stitch Apparel has operated profitably on a cash-flow basis, supporting debt service and ongoing operations.

This performance provides a stable foundation for Stitchline Manufacturing Co., LLC under new ownership, with projected improvements driven by scheduling efficiency, CAD upgrades, and tighter batch utilization rather than increased headcount or facility expansion.

Startup Costs

The startup costs reflect the full acquisition of an operating garment factory.

Amounts include the purchase price, required working capital, and post-acquisition upgrades. No expansion or speculative costs are included.

| Category | Amount ($) |

|---|---|

| Business purchase price | 345,000 |

| Working capital reserve (4 months) | 62,000 |

| Facility safety improvements | 18,600 |

| CAD system upgrade | 13,800 |

| Rebranding and signage | 9,400 |

| Insurance (first year) | 6,200 |

| SBA fees and closing costs | 9,700 |

| Legal and due diligence | 5,400 |

| Total Startup Costs | 470,100 |

Sources of Funds

| Source | Amount ($) |

|---|---|

| SBA 7(a) acquisition loan | 310,500 |

| Buyer equity injection (10%) | 34,500 |

| Seller standby note | 34,500 |

| Owner liquidity reserve | 90,600 |

| Total Sources of Funds | 470,100 |

Key Operating Assumptions

These assumptions drive all financial projections. They are based on the existing factory’s staffing, capacity, and production model. No headcount expansion or facility growth is assumed.

| Category | Assumption |

|---|---|

| Production model | Small-batch cut-and-sew |

| Capacity utilization | Y1: 55% • Y2: 68% • Y3: 78% |

| Gross margin | 38–41% |

| Employees | 15 retained |

| Owner salary | None (Years 1–3) |

| Marketing spend | 2,400 per month |

| Client deposits | 40–50% upfront |

| Loan terms | SBA 7(a), 10 years, Prime + 2.75% |

| Annual debt service | -52,000 |

| Break-even | Year 1 |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Revenue Model

Revenue is generated from repeat production orders and related services. Growth is driven by improved scheduling and utilization, not pricing changes. Service mix remains consistent across all years.

| Revenue Source | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Core garment production | 880,000 | 1,100,000 | 1,300,000 |

| Pattern and sampling services | 110,000 | 145,000 | 175,000 |

| Embroidery and add-on services | 90,000 | 115,000 | 145,000 |

| Total Revenue | 1,080,000 | 1,360,000 | 1,620,000 |

Profit and Loss Statement

| Category | Year 1 ($) | Year 2 ($) | Year 3($) |

|---|---|---|---|

| Revenue | 1,080,000 | 1,360,000 | 1,620,000 |

| Cost of goods sold (COGS) | 670,000 | 820,000 | 950,000 |

| Gross profit | 410,000 | 540,000 | 670,000 |

| Operating expenses | 290,000 | 292,300 | 302,500 |

| EBITDA | 120,000 | 247,700 | 367,500 |

| Interest + principal | 52,000 | 52,000 | 52,000 |

| Depreciation | 38,000 | 38,000 | 38,000 |

| Net profit | 30,000 | 157,700 | 277,500 |

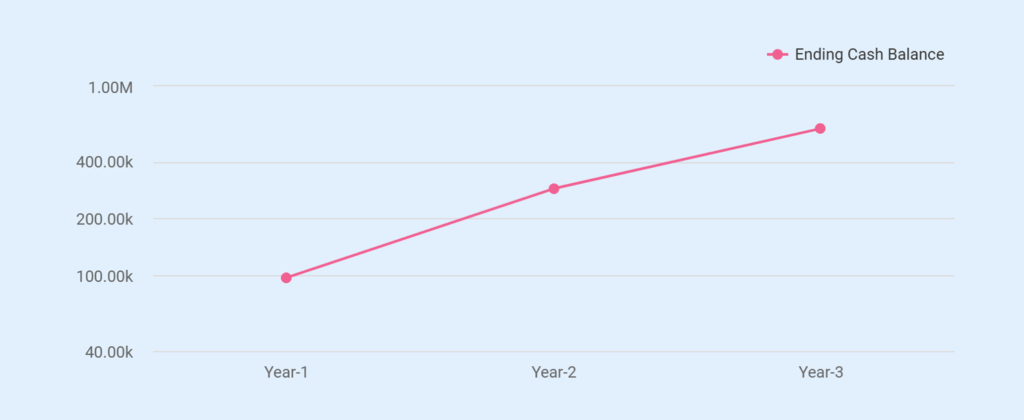

Cash Flow Projection

| Cash Flow Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Revenue collected | 1,080,000 | 1,360,000 | 1,620,000 |

| Cash Outflows | |||

| Direct labor and materials (COGS) | (670,000) | (820,000) | (950,000) |

| Operating expenses | (290,000) | (292,300) | (302,500) |

| Loan interest and principal | (52,000) | (52,000) | (52,000) |

| Capital improvements | (32,400) | (5,000) | (5,000) |

| Net cash flow | 35,600 | 190,700 | 310,500 |

| Beginning cash balance | 62,000 | 97,600 | 288,300 |

| Ending cash balance | 97,600 | 288,300 | 598,800 |

Don’t waste time using spreadsheets

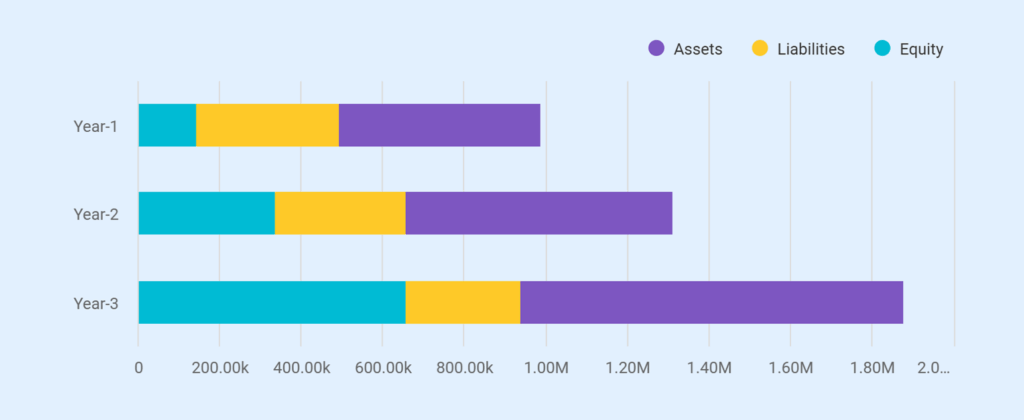

Balance Sheet

The balance sheet reflects an SBA asset-purchase transaction. Owner equity is recorded as paid-in capital. Retained earnings accumulate with no withdrawals.

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Assets | |||

| Cash | 97,600 | 288,300 | 598,800 |

| Accounts receivable | 18,000 | 22,000 | 28,000 |

| Inventory | 55,000 | 60,000 | 65,000 |

| Equipment (net) | 172,000 | 134,000 | 96,000 |

| CAD & improvements (net) | 32,400 | 32,400 | 32,400 |

| Goodwill & intangibles | 120,000 | 120,000 | 120,000 |

| Total Assets | 495,000 | 656,700 | 940,200 |

| Liabilities | |||

| Accounts payable | 32,000 | 35,000 | 38,000 |

| SBA loan balance | 286,000 | 250,000 | 210,000 |

| Seller standby note | 34,500 | 34,500 | 34,500 |

| Total Liabilities | 352,500 | 319,500 | 282,500 |

| Equity | |||

| Paid-in capital | 34,500 | 34,500 | 34,500 |

| Additional paid-in capital (owner contributions) | 78,000 | 115,000 | 158,000 |

| Retained earnings | 30,000 | 187,700 | 465,200 |

| Total Equity | 142,500 | 337,200 | 657,700 |

| Total Liabilities + Equity | 495,000 | 656,700 | 940,200 |

Break-Even Analysis

Break-even measures fixed cost coverage from gross contribution. It is calculated using steady-state operating expenses and margin. This reflects conservative utilization.

| Item | Amount |

|---|---|

| Annual fixed costs | $290,000 |

| Average gross margin | 38% |

| Break-even revenue (annual) | ~$763,000 |

| Break-even revenue (monthly) | ~$63,600 |

| Achieved | Year 1 |

Business Ratios

Ratios measure profitability, leverage, and repayment capacity. All ratios are calculated from projected statements. Benchmarks align with SBA manufacturing expectations.

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross margin | 38.0% | 39.7% | 41.4% |

| EBITDA margin | 11.1% | 18.2% | 22.7% |

| Net margin | 2.8% | 11.6% | 17.1% |

| Debt service coverage ratio | 1.30 | 2.10 | 2.90 |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.