Fact: People aren’t confused about the competition itself. They’re confused about how to explain it “well” in a business plan without sounding amateur.

There have always been these lingering questions:

- Whom do I include: big players? Small ones? Both?

- What level of detail is “enough”

- And, what dimensions matter to investors?

The default assumption is to include every competitor you can find and list everything about them. More details would make the section stronger, right?

Not quite. You don’t need hours of detailed research. You need relevant research. And in this guide, I’m sharing a fairly precise way to research your competition and present it compellingly in your business plan.

(Trust me, it doesn’t take that long as you think.)

Let’s get started.

What is a competitive analysis?

The formal definition is that a “competitive analysis” is the process of identifying and evaluating competitors to understand their strengths and weaknesses and to inform your business strategy.

Simply put, it shows: if not you, who else your customers can choose, what those competitors do well, whether they fall short, and where your business fits in that picture.

Don’t look at it just as a section of your plan, but a tool that helps you understand your position so you can make better decisions about pricing, positioning, and strategy.

Competitive framework: what to include vs. what to skip

I recently had a chat with our lead consultant, Kaylee. I asked her what founders are generally struggling with when it comes to the competitive analysis section, and she mentioned the question she consistently gets:

“I don’t know what to compare.”

Having a tentative competitive framework settles that concern. You need to establish criteria for comparing your business with other competitors.

To build your framework, consider factors that answer the specific questions about your competitors:

- Do they offer similar products or services?

- How are they priced?

- Do you serve the same customers?

It all boils down to a few factors. They remain more or less the same for all businesses:

- Product or service offerings or features

- Pricing

- Market share

- Positioning and message

- Target audience

- Distribution channels

- Customer service

- Strengths and weaknesses

The rest of everything is just NOISE. You don’t need years of company history, old milestones, product lists, or any industry stats.

Now that you know the basics of competitor analysis, let’s get to the core of this article.

Part 1: How to conduct a competitive analysis (w/ examples)

I’ve broken the entire process into two parts. First, we’ll understand how to conduct research: how to identify competitors, gather information, analyze competitors, etc. Then, in the second part, we’ll talk about writing and presenting the research into a business plan.

I’ll be using relevant examples of real-life businesses for the ease of explanation and to get the message across clearly.

1. Identify your competitors (direct + indirect)

Before you analyze anything, you need to identify your direct and indirect competitors. Direct competitors are those who provide similar products or services to those you do, whereas indirect competitors serve the same audience, solving the same problem, but with a different solution.

Examples:

- Two coffee shops in the same neighborhood (direct)

- A local boutique vs. an online retailer (indirect)

Having listed your key direct and indirect competitors gives you clarity on who you are competing against, which is great moving forward.

Note that you don’t stick with the same competitors for the rest of your life; these competitors may keep changing. So, be sure to keep revisiting this list.

What if I don’t have a competition?

That’s not a “good” space to be in. It means you’re wrong somewhere in your research or analysis. If there is demand, there is competition.

So if you think there’s a demand for a product or service like yours, there has to be competition. You just need to go back and research.

Try looking for indirect ones, remember: Netflix killed Blockbuster not as a direct rival (streaming vs. video rental stores) but as an indirect one that started with mail-order DVDs.

2. Gather information on your competitors

Next: once you know who your competitors are, it’s time to research and collect information on them. Focus on what truly matters. I don’t suggest spending hours finding all the minute details, which may not be helpful.

We’ve covered this briefly in the competitive framework section earlier. Gather details like what products or services they offer, how much they charge, and how they justify it, what pain points they address, and more.

But, where do I find this information?

With the internet and free AI tools available, it’s much easier to find these details. You can check their website, product review sites, local directories, and more. Here are a few sources you can rely on:

- Competitor websites

- App stores

- Google Reviews, Yelp, Trustpilot

- YouTube reviews

- Reddit threads

- LinkedIn pages

- Customer testimonials

- Pricing pages

- Social media

- Product demos

You don’t need private data. Public information is more than enough if you know what to look for.

3. Analyze each competitor (study their pricing and positioning)

I already mentioned getting pricing information in the previous section. But, since pricing and positioning are critical aspects of competitive analysis, we’re doing a separate, thorough analysis of the information.

Here’s what you should analyze in their pricing:

- The price itself

- The pricing model (subscription, one-time, or hourly fee)

- Whether the competitor is premium, mid-range, or budget

- How do they justify the price in their messaging

- What the price signals about quality and target market

Your competitors’ pricing strategy tells you who they want as customers and how they differentiate themselves. You also get an understanding of what a “normal” market is for your customers.

These insights will help you shape your messaging. For instance:

If every competitor is charging premium rates, and you enter as the budget option, your angle must be built around volume or speed, not luxury.

Want to Perform Competitive Analysis for your Business?

Discover your competition’s secrets effortlessly with our user-friendly and Free Competitor Analysis Generator!

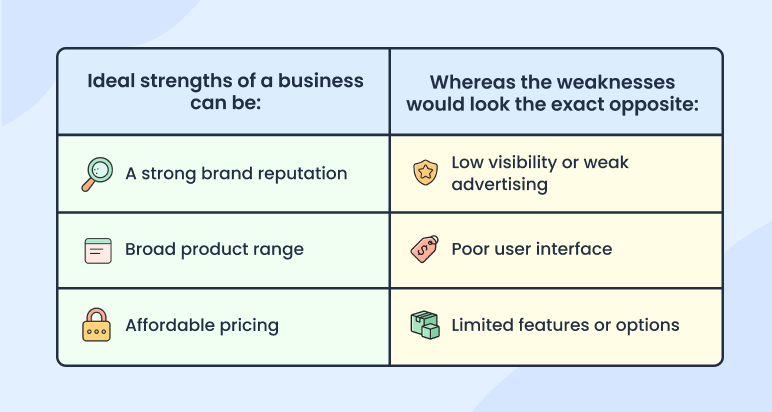

4. Break down their strengths and weaknesses

If you’ve collected information and analyzed pricing and positioning as mentioned in previous steps, by now you already know your competition.

Now, you can easily evaluate their strengths and weaknesses.

Note: it’s not about praising or criticizing them. If done correctly, this exercise will help you understand why customers choose them, what they are doing correctly, and where they fall short.

How do I actually identify strengths and weaknesses?

With all the information you have, it’s simple to list them. Don’t look at the internal factors you can’t verify; instead, you should focus on the factors that affect customers’ decisions.

Online reviews, testimonials, social media platforms, and online forums like Reddit/Quora are great places to get these insights.

5. Analyze the market gap (and opportunity)

The market gap is a tiny space between “what customers want” and “what competitors currently provide”. The gap, supposedly open for you to fill.

You need to define this space clearly and honestly.

Hold on: you don’t need to find something completely new. You need to find an angle, customer segment, or unmet need that others are not addressing well. That’s your opportunity.

For instance, you can look for patterns in customer complaints or bad reviews, such as slow delivery or onboarding, confusing pricing, lack of flexibility, complex processes, or anything that you can do better.

If you see multiple competitors receiving the same complaints, that pain point is your market opportunity.

6. Identify your competitive advantage

Your competitive advantage is simply the market gap you’re filling. You’ve already identified what competitors do well and where they fall short. Now, we just need to turn that into a practical reason a customer would pick you.

Focus on the angle that is both relevant and realistic for your business.

Examples of the kind of advantages that would work:

- You solve a specific pain point that competitors leave open

- You price more logically for the audience you target

- You deliver faster, smoother, or with less friction

Your list doesn’t need to be long. All you need is one solid, defensible pain point that ties directly to the opportunity you identified.

This part is something investors read closely as it shows how you plan to position yourself in the market.

With that, our research and analysis work is complete. Now, we have everything we need to write the competitive analysis section. Let’s move to the next part: writing and presenting these insights in your business plan.

Part 2: How to write your competitive analysis for your business plan

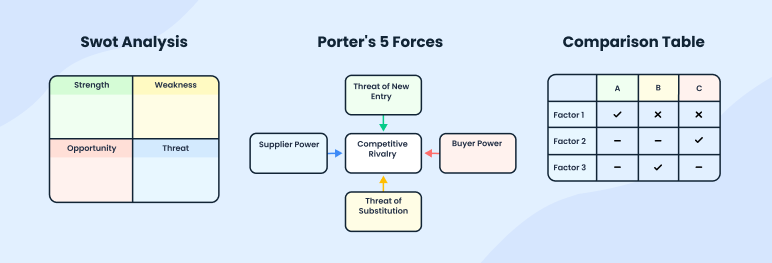

The competitive analysis section of a business plan is roughly 1-2 pages, consisting of details such as competitive landscape, direct-indirect competitors, competitive analysis frameworks (SWOT, Porter’s Five Forces), competitive advantage, and more.

How you structure and approach writing this section would depend on who’s reading the plan. That’s also our first step, so let’s get to it.

1. Know who’s reading your plan

If your business plan is for internal use, you can be flexible with how you approach the structure and writing. But when writing for investors, lenders, or grant reviewers, you need to understand what they expect from this section. And then write accordingly.

For instance, investors might be more interested in knowing how you’re filling the market gap or how you have a strategy to differentiate. Whereas a lender might look at a viable business model and a stable position.

In either case, no one wants long descriptions and product histories. They want signs of competence, that:

- You know who your competition is,

- What are your threats?

- What can be your edge?

- And how can you compete?

If your competitive analysis does all that, it’s doing what it’s written for.

2. Provide an overview of your competitive landscape (and your position)

It’s the opening of your section. Start with a short summary that sets the context before you introduce your competitors. 1-2 quick paragraphs would generally be enough, unless you’re introducing a completely new market segment.

A good overview explains: the type of market you’re entering, the level of competition (crowded, moderate, niche), and a few players that shape customer expectations.

The goal is simple: provide a quick overview, so the rest of the section is easier to understand and follow.

3. Introduce your key competitors

After the overview, list your primary competitors with short, factual descriptions. You don’t need long paragraphs—a quick description with an overview of features, strengths, and weaknesses would be enough.

We’re giving context, not discussing the full profile, so we’re good.

Here’s an example, done in Upmetrics’ business plan builder.

Avoid long backstories, founding dates, or marketing claims. Use short sentences and bullets for precision and clarity of thought. The goal is to help the reader understand the players before you compare them.

You don’t need to list all the competitors; listing 3-5 relevant ones is enough. However, you can add a section underneath to discuss indirect competitors and substitute options customers prefer.

This ensures investors that you aren’t ignoring your indirect competitors.

4. Visualize your competitor analysis

A business plan, by its nature, is a long, text-heavy document (40-50 pages at times). Visuals make the document light and keep readers engaged. Plus, they help readers understand differences faster than text.

Select a format that aligns with the information you wish to present. You can use the SWOT Analysis Table, Porter’s five forces table, Comparison Table, Positioning Map, Feature/Attribution chart, or Matrix that shows who serves which segment.

If you’re using a tool like Upmetrics, you can choose any of these format/layout options from the existing building blocks. Simply drag and drop, and there you have it.

5. Close with your competitive edge

Finally, close this section by stating the specific reason customers would choose you over the other alternatives. This needs to be short, precise, and grounded in the gaps you identified earlier.

You need to explain: What will you do differently? Why does that difference matter? And how is it positioned against your competitors?

Something like, “We focus on beginners, a segment that current fitness studios overlook.”

By clarifying your position and focus, you instantly differentiate yourslIt’s obvious to have competition, and it’s good!

It’s obvious for any viable business to have some competition. Having competition means customers already care about the problem you’re solving. If you ask me, it’s the easiest way to validate demand.

It’s easy to think of having the entire market to yourself with no competition, but that’s simply not the case. Here’s why competition matters for your business to succeed:

Competition proves demand

If customers already pay for a solution, it means the problem is real. You are entering a market that already exists, and with people willing to pay for the solution, you don’t need to educate them about the problem or explain why they should consider an alternative solution.

Investors often prefer startups with confirmed market demand over an idea relying on untested behavior.

Competition helps define customer expectations

When you have an established competition, you already have insights into what customers think about their pricing, features, service quality, and delivery demand.

You know customer expectations and whether or not current players meet them. That’s a great starting point to figure out what your product must meet or exceed.

Competition validates your business model

If others are offering similar products or services, and still surviving means: the economics work, customers are willing to pay, and the business type can sustain itself. That’s a big relief or assurance if you look from an investor/lender perspective.

Don’t limit your competitive analysis to a section in your business plan — use it to guide your business

Competitive analysis is more than just a section in your business plan. It’s a tool you return to as your market shifts, and look up to for new insights.

So, don’t limit it to your business plan; use it to guide different business and strategic decisions. You can use this analysis to:

- Adjust pricing when the market shifts

- Refine your positioning as competitors update their messaging

- Spot new opportunities when others move up or down-market

- Improve operations by analyzing their strategies

- And, a lot more.

When you treat competitive analysis as an ongoing reference, not a formality, your decisions stay grounded and your strategy stays relevant.

I’m sure you now have everything you need to know to start writing your competitive strategy. If you need a comprehensive planning tool to support your process, Upmetrics can help.

It’s an AI-powered business planning platform with guided instructions, AI writing, research assist, building blocks, and forecasting features.

Let’s get to work and finish what you’ve already started.