With millions of small businesses ready to be sold in the next decade or two, there are countless opportunities for eager buyers.

However, successful acquisitions aren’t guaranteed—70-90% of business acquisitions fail. (The horror!)

Don’t want to be part of this statistic? You need a solid business plan to ensure you make a wise investment. This plan helps you understand the business’s value, foresee potential risks, and set clear growth goals.

In this guide, we’ll cover creating a business plan for buying an existing business. Let’s dive in and make sure your next business purchase is a success!

Key Takeaways

- When acquiring an existing business, start by reviewing and understanding its current business plan.

- Assess the business’s performance, market position, and operational processes to identify areas for improvement.

- Develop a revised business plan that outlines your vision, strategies for growth, and plans for integrating changes.

Why do you need a plan for purchasing a business?

A business plan is crucial when buying an existing company because it provides a clear roadmap for growing the business. It helps you understand the value of the business and makes it easier to secure financing by showing you have a solid plan in place.

For example, Elon Musk’s purchase of X (formerly Twitter) for $44 billion was a major move, but poor planning led to the company losing 72% of its value, causing big losses for Musk and his investors. A well-thought-out business plan could have helped avoid some of these problems by identifying challenges and setting realistic growth goals.

A good business plan also highlights potential risks, sets clear goals, and ensures a smooth transition, making it more likely for the acquisition to be successful.

By planning, you not only secure financing but also reduce the chance of facing unexpected financial issues, just like what happened with X’s sudden drop in value.

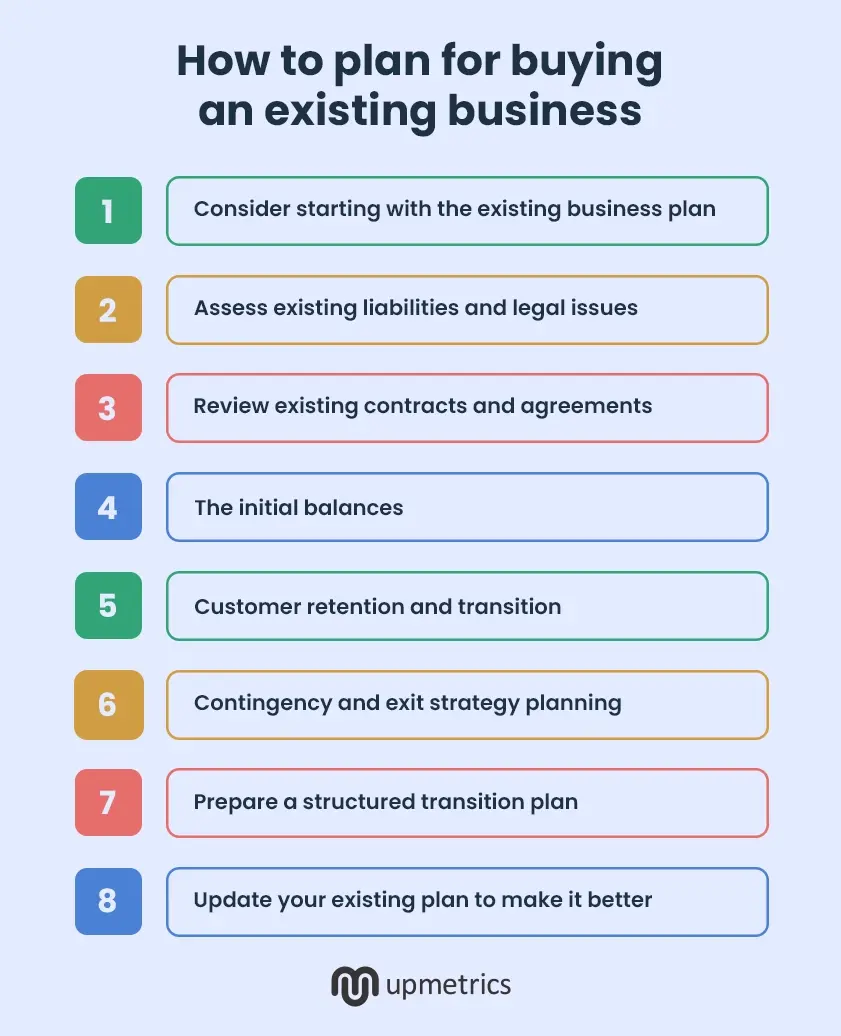

How to plan for buying an existing business

Planning to write an acquisition business plan is like taking a step back and evaluating every detail first. Here are 8 key steps to consider when planning to buy an existing business:

1. Consider starting with the existing business plan

Starting with the existing business plan of the company you want to purchase can provide you with a solid foundation for further planning.

This existing plan gives you a peek into the current strategies, goals, and operational processes of your potential new business. It ultimately helps you understand the target market, competitors, and other opportunities.

Additionally, it highlights existing growth opportunities and potential risks that the current management has identified, helping you to build on their insights.

For example, in 2011, HP acquired Autonomy Corporation for around $11 billion. However, not long after, HP claimed that Autonomy had inflated its financial numbers, leading to major legal disputes and a loss of $8.7 billion.

2. Assess existing liabilities and legal issues

When planning to acquire a business, one of the first things to do is to evaluate the target company’s existing liabilities and potential legal issues. It includes reviewing outstanding debts, pending lawsuits, tax obligations, and compliance with regulations.

As a Business attorney, Richard Harroch says, “You don’t want to inherit someone else’s legal problems.” Understanding these liabilities allows you to negotiate better company value, and contract terms, or decide if the acquisition is still a good deal.

Addressing these issues upfront can prevent costly legal battles or financial losses down the line.

3. Review existing contracts and agreements

When acquiring a business, reviewing all existing contracts and agreements is necessary. Reviewing them will help avoid potential conflicts and ensure a smooth transition. This review can also identify opportunities to renegotiate more favorable terms.

When reviewing an existing firm’s business plan for contracts and agreements, check the length of each contract.

Long contracts might lock you into unfavorable terms, while short ones can lead to frequent renegotiations. Look for details like renewal options, termination clauses, and penalty fees to understand potential risks and opportunities.

4. The initial balances

Conducting an initial financial check lets you understand the financial health of the business you want to buy. It involves reviewing financial statements like balance sheets, income statements, and cash flow statements to spot any issues like decreasing revenues or high debts.

This also helps you know if the business is profitable or sustainable in the long term and makes an informed decision about the purchase price.

Knowing the financial situation clearly allows you to negotiate better terms and ensures a successful acquisition.

5. Customer retention and transition

Keeping customers loyal during a business transition is a challenging task. Here, it’s important to communicate with customers about the acquisition and reassure them that products or services will remain the same or get better.

Offering special promotions or loyalty programs can help keep key customers. Make sure customer service stays high-quality and any changes are clearly explained.

By focusing on customer retention, you can reduce troubles and build trust during the transition.

For example, when Amazon bought Whole Foods in 2017, they let customers know their shopping experience would get better. By lowering prices and communicating well, Amazon kept existing customers happy and attracted new ones.

6. Contingency and exit strategy planning

Having a Plan B is necessary if things don’t go as expected. For example, you might need a plan for what to do if the business doesn’t perform as desired or if there are any merging difficulties.

It’s wise to think about an exit strategy that outlines how you could leave the business if needed. In this situation, whether to sell the company to someone else or by merging it with some other business.

These strategies help you prepare for unexpected situations, minimizing potential losses while protecting your assets and investment.

7. Prepare a structured transition plan

A structured transition plan is key for a smooth change in ownership. This plan should include timelines, key milestones, and responsibilities for all the parties involved.

According to various studies, 70-90% of acquisitions fail to achieve their desired outcomes due to poor transition plans.

A good transition plan can reduce disturbances, keep employees motivated, and ensure customers stay happy during the change in ownership.

8. Update your existing plan to make it better

After buying a business, try updating the company’s existing business plan. Review the original plan for areas to improve, such as expanding into new markets, launching new products, investing in new equipment, or enhancing operations.

Regular updates ensure the plan stays aligned with market conditions and business goals, supporting growth and adaptability.

Areas to focus on when updating an existing company’s business plan include:

- Market expansion

- Product innovation

- Operational improvements

- Risk management

- Financial forecasts

- Competitive analysis

- Alignment with goals

Mistakes to avoid while writing a business plan for buying a business

While planning for the business plan of an existing firm, a small mistake can also have major consequences. So, better avoid mistakes like:

Failing to personalize the business plan

Not customizing the business plan to your specific vision, objectives, or operational style is a mistake. Customize the plan to reflect the opportunities and weaknesses rather than just relying on or copying the existing firm’s business plan.

Underestimating customer feedback

Avoid overlooking the importance of understanding customer feedback and managing the business’s existing reputation. Include a strategy for collecting customer feedback, handling complaints, and improving customer perception during the transition.

Ignoring cash flow management

Not creating a detailed cash flow management plan, could lead to liquidity issues. So, develop a cash flow forecast to ensure the business maintains liquidity for day-to-day operations and avoid unexpected expenses. You can even hire a financial advisor or use proper financial forecasting software for the same.

Neglecting supplier and vendor relationships

Failing to review and build relationships with existing suppliers or vendors is a huge mistake. So, plan a meeting with key suppliers and renegotiate contracts to ensure favorable relationships and consistent supply chain management.

Lacking clear communication

Ensure the business plan includes a well-defined communication system for employees, customers, suppliers, and other stakeholders to avoid miscommunication and ensure smooth operations.

Also, the business plan should include clear strategies to keep everyone informed and engaged throughout the transition process as well as afterward.

Plan for your new business using Upmetrics

In summary, a solid business plan is necessary to ensure success and growth. But, still wondering how to craft one that covers everything? Or maybe you’re not sure where to begin?

That’s where Upmetrics comes in!

With Upmetrics you can directly import the existing business’s business plan and update it with its AI or as needed. So, why wait, create a winning business plan with Upmetrics today!