Bank loans are great—if you have weeks to wait and a strong credit history. But for most small businesses, that’s rarely the case.

Slow approvals and rigid requirements can make traditional loans feel out of reach and often frustrating.

But what if you could get all the funding you need without jumping through hoops?

Well, that’s exactly what we’ll be discussing in this blog—alternative business funding methods, aka, different ways to secure funds without the hassle of traditional loans.

Let’s dive right in.

What is alternative funding?

Alternative funding refers to non-traditional ways for businesses to raise capital outside of bank loans.

Since bank loans aren’t an option for every business—especially those with limited credit history, collateral, or a proven track record—alternative funding methods provide more accessible and flexible ways to raise capital.

Alternative methods can be offline, however, the most prominent options are online. This along with faster approvals and a simplified process makes alternative lending extremely accessible and lucrative for small businesses.

Why choose alternate funding over traditional loans?

Well, if your loan application is rejected, you might have no choice but to explore alternative financing methods to raise capital for your business.

However, even if you qualify for bank loans, alternative business funding can still be a better option due to the following:

- Less paperwork: Alternative financing requires minimal documentation—no more spending days or months gathering documents for your application

- Straightforward application: These methods follow a simplified application process requiring just pitch decks, a couple of financial statements, and a business plan at most

- Custom repayment terms: Many alternative funding options offer flexible repayment terms—allowing you to adjust payments based on your cash flow and sales cycle without disrupting operations

- Faster access to funds: Alternative lenders often process applications within 24 to 72 hours, offering instant access to cash when you need it the most

- Flexible eligibility requirements: Alternative lenders focus on cash flow, sales data, and business potential rather than just credit scores, making funding accessible to businesses with limited credit history

- Helps build business credit: Making regular repayments on alternative loans can help improve your business credit score, making it easier to qualify for larger loans in the future

10 alternative business funding options

Let’s now discuss the 10 alternative business funding options to fund your small business.

1. Term loans

Term loans are similar to bank loans but they’re offered by online lenders, credit unions, or fintech companies. These loans provide a lump sum amount that’s repaid in installments over a set period, usually ranging from 1 to 10 years.

Term loans have flexible eligibility criteria and are suitable for businesses with limited credit history and collateral. Here, the lenders look at your cash flow and sales data to make lending decisions instead of relying solely on credit scores.

Compared to bank loans, term loans offer simplified applications, less paperwork, and faster approval rates.

The only caveat is higher interest rates.

2. Business line of credit (LoC)

The business line of credit (LoC) functions similarly to a credit card. Here, a business can continuously borrow amounts up to a set limit and pay interest on the borrowed money.

It’s a revolving capital, meaning once you repay the borrowed amount, those funds become available to borrow again without having to reapply.

LoC funding is quite easy to acquire and has lower interest rates than credit cards. Such funding helps businesses manage cash flow and meet unexpected expenses without waiting for constant approvals.

Depending on the lender, a line of credit can have an APR (annual percentage rate) of 8% to 60%.

3. Community development finance institutions (CDFIs)

Community Development Financial Institutions (CDFIs) are funded by the federal government, banks, and individual investors to promote economic growth in low-income, disadvantaged areas.

Such institutions are very valuable for minority-owned businesses and more so for businesses that operate in rural areas. CDFIs charge lower interest rates. However, their approval process is extremely slow. This means you need to wait months before you get the funds in your account.

4. Grants

Grants are another efficient way to fund your business.

Here businesses can apply to different grant programs organized by government organizations, corporations, and non-profits.

Grants have strict eligibility criteria based on region, business type, and income category. Not to mention, their application process and the fund disbursal process are equally lengthy.

However, if qualified, businesses can use this debt-free capital to launch and scale their business operations.

5. Venture capitalists (VC) and angel investors

Highly innovative businesses can secure funding from VC firms and angel investors in exchange for equity.

These investors actively invest in disruptive businesses that show potential for higher returns, i.e. 10X-100X with a smooth exit plan.

While investors’ capital is debt-free, they take a stake in your business. Meaning they would get rights in decision-making, profits, and even influence key strategies.

Now, if you want to acquire funding from investors, you need a persuasive pitch or a detailed actionable business plan demonstrating the potential of your business.

The idea? To convince investors that their capital is better invested in your business than in other opportunities.

6. Crowdfunding

Crowdfunding is a method of raising money from a large number of people to finance your business.

There are plenty of crowdfunding platforms that allow you to run crowdfunding campaigns in exchange for small rewards or a platform fee.

Some of the best crowdfunding platforms include:

In addition to funding, crowdfunding helps with product validation, brand recognition, and customer acquisition before the product launch. It’s one effective method for startups and small businesses with innovative products or strong community appeal.

However, raising funds through crowdfunding can take weeks and months at a time.

7. Peer-to-Peer lending

Peer-to-peer (P2P) lending functions through an online marketplace that brings borrowers and lenders together.

The borrower here is a business in need of funding, while the lender can be an angel investor, an individual, or a business looking to lend money.

While some of the P2P lending requires collateral, most of them lend money without any collateral. This means if you fail to repay the loan, the lender bears the loss.

This funding option helps businesses with zero credit history or traction acquire funding for their business. The application process is simple and the funds are disbursed almost immediately giving you instant access to capital.

8. Equipment loans

Equipment loans are specifically useful when businesses want to purchase equipment but don’t want to:

- Go through longer approval chains

- Exhaust their cash reserves

- Pledge additional collateral beyond the equipment itself

- Choose high-interest financing options

In this type of asset-based financing, the equipment serves as collateral. Meaning, that if you fail to repay the loan, your equipment will be used to recover the loan amount.

Such funds are approved faster than traditional loans and have comparatively lower interest rates than unsecured loans.

However, most equipment loans require a down payment of 10% to 30% of the equipment’s cost. This may be eliminated for businesses with limited cash reserves.

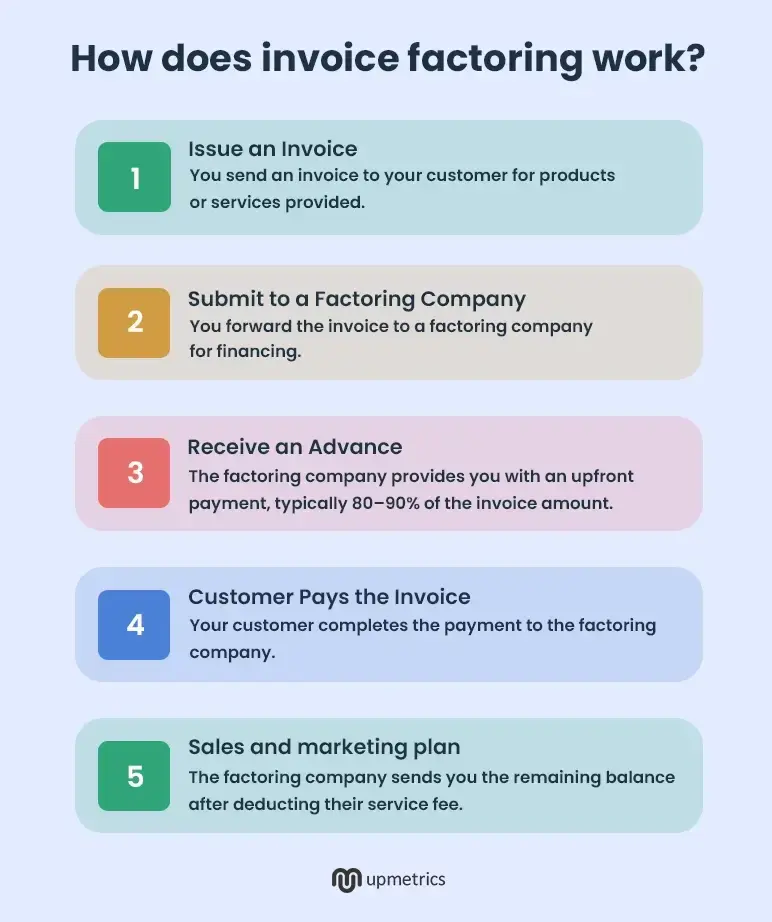

9. Invoice factoring

Invoice factoring is a type of financing where businesses sell their unpaid invoices to a third party at a discount to get immediate cash.

In this arrangement, the factoring company pays you 80% to 90% of the invoice value upfront. Once your customer pays the invoice, the factor deducts their fee and sends you the remaining balance.

This financing method is quite useful for businesses that need to cover operational expenses and manage their cash flow. Businesses with longer payment cycles. However, since the factor takes over the collection process, it may affect customer relationships.

10. Pitch competitions

Pitch competitions are events where startups and small businesses present their business ideas to a panel of investors, industry experts, or judges. Here, depending on the competition, businesses can receive cash prizes, investment offers, or access to accelerator programs.

In addition to funding, pitch competitions offer exposure and networking opportunities. They’re particularly useful for early-stage startups who want to build credibility and attract future investors.

Pitch competitions can be extremely competitive and even if you beat the competition, there are many criteria you should match to win funding with this method.

Best practices for acquiring alternative business finance

To make the most of alternative funding options, it’s important to approach them strategically. Everything from choosing the right method to preparing for the funding process matters.

We have pinned down some of the best practices for acquiring alternative business finance:

Evaluate your needs

- Do you need capital to launch your business or do you just need a sufficient amount to manage the cash flow?

- Do you need funding to hyperscale your validated product or a short-term loan to buy new equipment?

The idea is to have crystal clarity regarding how much funding you need and why before you explore the funding options.

This will help filter out the options unsuited for you.

Research the funding options

Once you evaluate your funding needs, you need to figure out the funding option most suited to meet those needs.

You see, CDFIs won’t be helpful if you need $500,000 to fund your urban tech-centric business. Angel investors in this scenario are more suitable for you.

Similarly, if you need quick cash to manage short-term cash flow gaps, options like invoice factoring or a business line of credit might work best.

The idea is to understand what each option offers, how much it costs, and whether it aligns with your business goals and repayment capacity.

Educate yourself

Planning to present your idea to investors? Set parameters about how much stake you would give and the terms you’re comfortable with.

Similarly, if you’re acquiring a term loan—look beyond interest rates. For instance, some online lenders charge origination fees, prepayment penalties, or higher APRs for longer terms, which can significantly increase the overall cost if not understood properly.

The idea is to understand your chosen alternative finance thoroughly so you don’t get trapped by deals that seem too good to be true.

Research your lender

Whether you choose an angel investor, VC firm, fintech organization, or credit union—it’s important to research your lenders before approaching them.

Check their track record, reviews, and funding criteria to see if they align with your business model. Also, evaluate if they fund businesses in specific niches or segments so that you don’t approach an unfit lender for your needs.

Prepare for the application

Most lenders would require a well-detailed business plan, financial projections, and a pitch deck to understand the potential of your business. It’s important to have these documents handy such that they represent your business’s value proposition thoroughly.

Make sure your credit history and business accounts are in good shape since many lenders still review them even for alternative funding options.

Prepare your business planning documents with Upmetrics

Yes, alternative funding is less challenging and more accessible than traditional loans. However, securing funding isn’t just about choosing the right option—it’s about convincing lenders and investors to believe in your business idea.

Exactly why you need a well-crafted business plan or even a pitch deck. These documents convey the value of your business, your growth strategy, and your ability to manage funds effectively.

A clear and compelling business plan not only helps you build credibility but also increases your chances of securing funding on favorable terms.

And no building the pitch documents aren’t difficult. Especially when AI business planning tools like Upmetrics exist.

Upmetrics simplifies business planning and offers resources, a guided process, and tools to build investor-ready business plans in less than 10 minutes.

Take the first step and start your planning journey now.