You might think your business is ready for a loan. Revenue’s steady. You’ve got a plan. Maybe even some traction.

All you need is $340,000 to take things to the next level.

But walk into the bank, and chances are, they shut the door on you.

Getting a loan has become harder than ever. In 2024, 48% of small business loan applications in the U.S. were denied—that’s 1 in every 2 applications getting rejected.

And it’s rarely because the business was weak. More often, it’s because the applicant didn’t know what the bank needed to see.

Having a great business plan helps, but it’s not enough. Banks lending you money want more—specific documents, credit history, financial details, and yes, personal guarantees.

So, what do you need for a business loan? I’ll help you with the answer in this blog so you won’t go around facing rejections. At least, not because of incomplete documentation or paperwork.

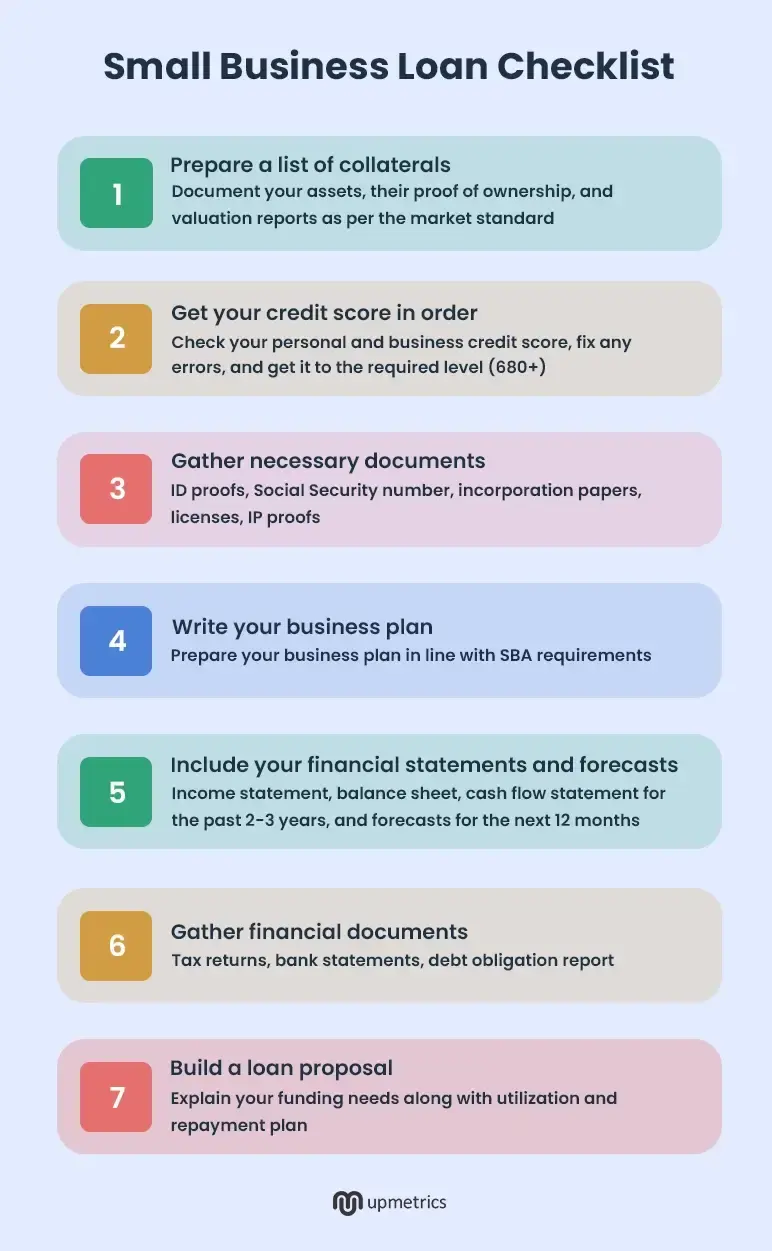

What do you need for a business loan? A thorough checklist

Stop wondering, “What do I need to get a business loan?” and follow this detailed checklist for your small business loan requirements:

1. Collateral and personal guarantee

Banks (or any lender for that instance) need something to fall back on.

If your business can’t repay the loan, they want a way to recover their money. One of the reasons (apart from federal regulations) why banks need collateral and personal guarantee to grant a loan.

This applies whether you’re applying through a traditional bank or a Small Business Administration (SBA) backed program.

Now, collateral can be anything valuable your business owns that you’re willing to offer the bank. Think of your,

- Business land

- Equipment and machinery

- Vehicles

- Inventory

- and even account receivables.

In case that’s not an option (or you don’t have enough assets to collateralize), here are different SBA options you should explore:

| Loan Type | Loan amount | Collateral requirements |

|---|---|---|

| Standard 7(a) loan | Up to $5 million | Collateral is required for loans over $500,000, and lenders must secure collateral to the maximum extent possible. However, they can’t decline the application based on insufficient collateral alone. |

| 7 (a) small loan | Up to $350,000 | No collateral is required for loans up to $50,000. |

| Express loan | Up to $500,000 | No collateral up to $50,000 |

| Export express loan | Up to $500,000 | No collateral up to $50,000. The policy changes beyond $25,000 |

| Export working capital loan | Up to $5 million | Collateral required. However, accounts receivables and inventory related to the export products are sufficient |

In addition to collateral, banks seek a personal guarantee. Here, the lender can go after your personal assets like a car and even your home—anything that can help them recover their loan.

However, personal guarantees can be limited or unlimited depending on the requirements and agreements of each bank.

Small business administration loans typically require an owner with at least a 20% stake to offer a personal guarantee, regardless of the loan type.

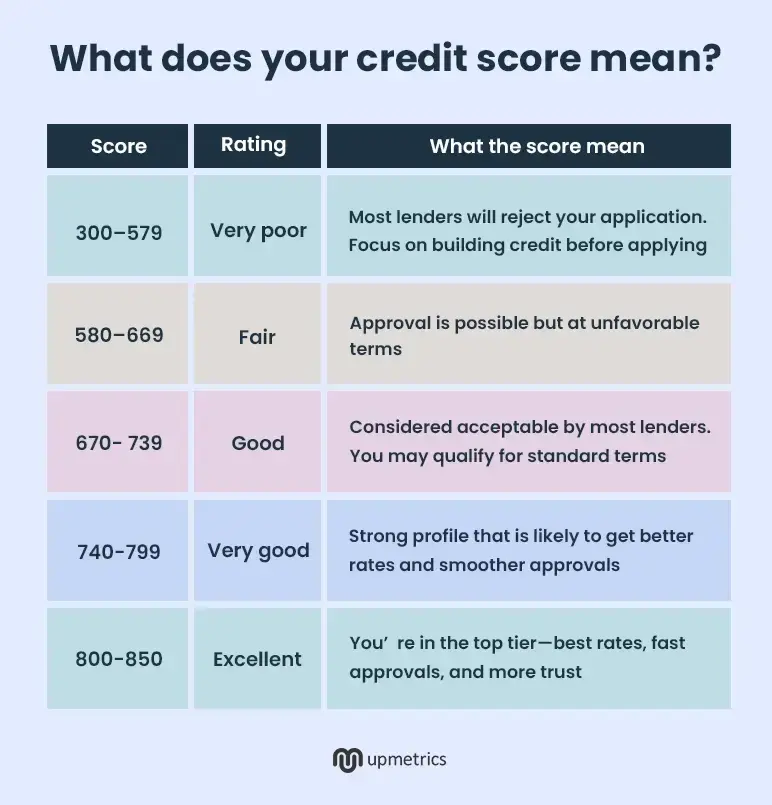

2. Personal and business credit scores

Banks will check your credit whenever you apply for a business loan. Yes, even your personal credit score.

It gives them insight into how you handle money—how much debt you carry, whether you pay on time, and how likely you are to default.

A score above 680 builds trust. Drop below 630, and you’ll find fewer lenders willing to work with you—or you’ll get stuck with smaller loan offers and higher rates.

If your business is established, lenders will also check your business credit score (on a scale of 1 to 100). A score above 75 is considered strong.

Now, you don’t get to ignore credit. It follows you forever.

So make sure you don’t mess up your credit score and build a healthy one by:

- Paying your bills on time—every time

- Keeping credit card balances low

- Avoiding too many credit inquiries before applying

- Checking your reports regularly with credit bureaus and fixing any errors

3. Personal and business details

Banks can’t lend money to just anyone. They need proof of who you are, what your business is, and that it’s real and legally set up.

So pull together a few documents that show identity, ownership, and basic business structure before applying for the loan.

Here are a couple of documents you will be required to submit:

- Government-issued ID: To validate your identity and ensure you’re a compliant citizen

- Social security number: It’s used to pull your personal credit report, payment history, and risk assessment

- Employer Identification Number (EIN): It’s your business’s social security number and is required for tax and loan forms

- Article of incorporation: Validates your business as a registered unit and outlines its legal structure

- Business licenses: All the essential licenses and permits necessary in your industry

- Partnership agreement: Necessary to understand profit distribution and liability of each partner in LLC and partnership

- Owner resume: Many banks still ask for your resume to evaluate the expertise you bring to the table

- IP documents: Necessary in cases of legally compliant and medical businesses

4. Business plan

Banks and even SBA would require you to submit a business plan for a loan application.

But, whether it should be detailed or lean depends specifically on the bank’s requirements.

While most banks still ask for a detailed business plan, they don’t require an extensive 100-page document. Just a plan that encapsulates key information regarding:

- Products and services

- Business strategies

- Vision, mission, and milestones

- Business goals

- Operations

- Marketing

- Financials

If you’re applying for a loan through SBA, it’s better to follow a business plan outline suggested by them.

However, if you’re leaning toward a lean plan, you can include supporting documents and charts in the appendix. This way, lenders can refer to the necessary information without going back and forth.

Say goodbye to confusing loan requirements

Build your lender-ready business plan faster with AI

Plans starting from $14/month

5. Financial statements and forecasts

Banks will require three primary financial statements, i.e., balance sheet, cash flow statement, and income statement, to offer a startup business loan.

Now, there are exceptions if yours is a fairly new business with no significant historical data. However, for higher-value loans, banks won’t grant a loan unless you have a proven record of success.

Here’s how banks analyze your financial statements to assess your creditworthiness:

- Cash flow statement: Assess the business’s cash position and determine if you have enough liquidity to pay off your loans on time

- Balance sheet: Gives a financial snapshot of your business by listing your business assets, liabilities, and equity

- Income statement: Helps evaluate operational, financial, and investment profitability of your business

You can get your financial statements audited by a CPA financial professional, however, that’s not mandatory.

But lenders will need financial projections to assess a business’s financial position in the next 12-36 months. So make sure to include reliable forecasts along with an explanation for assumptions in your documents.

6. Financial documents

Along with your core financial statements, banks also want to dig into the details. These extra documents give a fuller view of your business’s financial behavior.

- Business bank statements: Most bank requires you to submit bank statements (business, not personal) of the last 6-12 months to understand your spending patterns, account stability, and cash flow

- Business and personal tax returns: Confirms your tax liability to prevent any fraud

- Debt obligations: This is the list of your current and unpaid loans, leases, and lines of credit (LoC)—including monthly payments and balances

- Account receivables report: Especially when you are leveraging accounts receivables as collateral

- Revenue breakdown: Details where your income is coming from, i.e., which product, service, or location

- Key financial ratios: Banks need metrics like your DSCR (Debt Service Coverage Ratio) or current ratio to evaluate your ability to repay

- Insurance information: Insurance details of what happens in case of partner’s death before paying off the loan

7. Business loan proposal

Many banks ask for a separate loan proposal. It explains how much funding you need, what you’ll do with it, and how you plan to pay it back.

A loan proposal helps them understand if you are making a reasonable ask, have the means to pay that back, and have a foundation to grow your business.

A loan proposal can be attached to your business plan or included in your plan itself. However, it must outline the following details:

- Loan amount: Make a clear funding ask and explain how you arrived at that calculation

- Utilization plan: Where will you utilize the fund, i.e., towards inventory, machinery, business operations, or hiring

- Repayment plan: Provision for loan repayment with your monthly cash flow forecasts

That’s a round-up of all the requirements for a business loan. Small business owners can stick to this checklist and prepare their documents correctly for a loan application.

Things to evaluate before applying for a bank loan

Bank loans aren’t one of a kind. You need to evaluate certain things before you make your application:

- Do you need a loan or an LOC: A loan gives you a lump sum amount at a time while a line of credit works more like a business credit card—know which fits your need

- Check the eligibility rules: Every bank has its own rules, such as time in business, credit score, and revenue minimums—learn the eligibility rules before you apply

- Know what you are risking: Make sure you understand thoroughly what’s on the line in case you fail to pay a loan (be cautious with unlimited personal guarantee)

- Fix your credit score: Poor collateral can be managed with an exceptional credit score—so build one before applying for a large loan

- Evaluate the APR (annual percentage rate): Use a business loan calculator to evaluate the total cost of a loan over one year—perfect for a thorough understanding and comparing different loans

- Assess your repayment capability: Can you repay the loan timely without replenishing your working capital

- Get your paperwork in order: Tax returns, bank statements, financials, business plan—have them ready before applying

4 Common mistakes in acquiring a business loan and how to overcome them?

It’s much easier to get education loans worth thousands without a mortgage.

However, go to the same bank and ask for a business loan, and you’ll be handed a long list of documents, requirements, and personal risks to take on.

That’s the reality of acquiring a business loan. It has its own dimensions of challenges, and here’s how you overcome them (or pick a better route):

1. Approaching the wrong bank

Sometimes, you may have all the documentation and paperwork necessary for a bank application. A good credit score, sorted financials, debt within control, and even collateral. Yet, a bank may reject your application.

Reason?

You have an extremely niche business. Or they simply don’t fund the industry in which your business operates. (read, crypto, gaming, or cannabis)

What to do: Research banks that work with your industry, and if there are none, you can always choose alternative funding methods.

2. Lack of historical financial data

Fairly new businesses or pre-revenue startups won’t have the historical financial statements necessary for bank applications. They face more scrutiny and won’t get an easy pass.

What to do: Start with small microloans by SBA. Have an extremely strong personal credit, and instead of loans, check eligibility for business lines of credit

3. Pledging too many personal collaterals

If not business assets, you at least need personal assets to pledge for a loan. However, don’t risk your personal assets so much that you end up losing them as well as your business (in case of default).

What to do: Instead of traditional loans, take equipment loans (where equipment serves as collateral), working capital loans (to run business operations), or invoice factoring (selling your invoices to a third party at a discount). Take advantage of loans that don’t require you to pledge personal assets

4. Poorly written business plan

Business plans aren’t just a formality. In situations where your finances and business background aren’t strong, a business plan will instill the confidence necessary to bring lenders on board.

What to do: Spend considerable time understanding and planning your business and use tools like Upmetrics to write your business plan and build financial projections.

Conclusion

Your obsession with your business idea got you this far in your entrepreneur journey. Now, it’s time to get that necessary funding to turn your idea into reality.

But before you approach banks, prepare a checklist and gather all the documents necessary for application. At this point, you would also need your business plan, financial statements, and financial projections handy.

Upmetrics can help you build those documents. And, no, you don’t need any professional expertise to use this business planning tool.

With Upmetrics, you get industry-specific templates, an AI business plan generator, automated projections, and even business plan writing services.

So, get your documents in order, show the numbers that matter, and let your business speak for itself.