Once, when I ran a service-based software company, I made $80k in revenue in a quarter and still couldn’t pay myself.

The problem wasn’t income. It was the timing. Clients paid late. Expenses stacked up. And I didn’t have a system to see it coming.

That’s when I learned the importance of cash flow. The more I learned about cash flow forecasting, the more I applied it to Upmetrics.

Need help forecasting cash flow for your business? I’ve squeezed a few years of experience that I have curating this piece. I hope it helps you. Here you go.

What is cash forecasting?

Cash flow forecasting is a method of estimating a company’s future financial standing by predicting expected incoming and outgoing cash for a span of time, typically monthly or quarterly.

The reason for carrying out cash flow forecasting is that it lets the company stay liquid enough in order to finance its financial requirements and seize opportunities for growth. In simpler words, it aids in forecasting the amount of cash on hand the business will keep in its checking account.

But a forecast is only as good as the data behind it. So…

Before you forecast, set yourself up for accuracy

Most cash flow forecasts fall apart before they even begin. Not because the math is hard but because the prep gets skipped. If you want a forecast that actually helps with cash flow planning, you need clean numbers, reliable tools, and a method that matches how your business works.

What documents you actually need

Forecasting cash flow well starts with strong source material. Pull together these documents for the cleanest numbers:

- Your income statement, balance sheet, and cash flow statement

- Tax refunds and sales tax filings

- Full payroll data, including taxes and benefits

- Bank account records—especially opening/closing balances and loan info

- A list of receivables and payables, plus recurring outflows like utilities and license fees

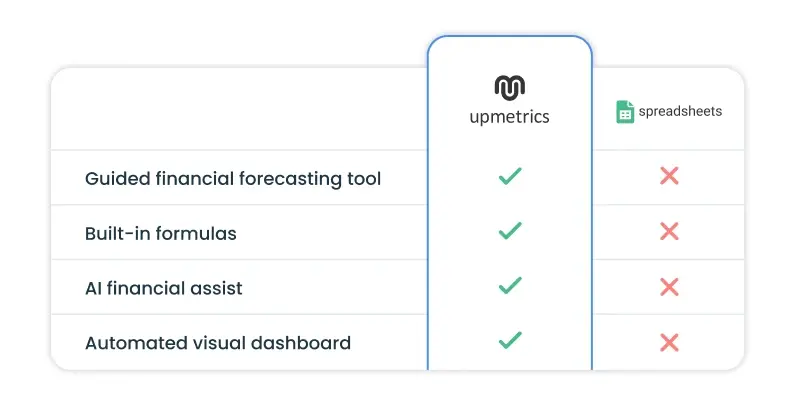

Spreadsheets vs. cash flow forecasting software

Nearly a decade ago, a spreadsheet was all you needed to forecast and manage cash flow. It was flexible with all those formulas but tedious and time-consuming at the same time.

Years went by, and it’s all the same story with spreadsheets. Cash flow forecasting software, on the other end, gives you the same visibility with less manual effort. It syncs with your data, handles the updates, and frees you up to focus on decisions.

Still confused about what to choose? You’ve got all the time in the world? Select spreadsheets. If not, let’s go with a decent forecasting tool.

Choose your method: Direct vs. indirect cash flow forecasting

The direct method tracks transactions like customer payments, bills, payroll, and rent. This gives you a pretty good idea of your monthly or weekly cash flow estimate, which is especially useful when finances are strained and every penny is valuable.

The indirect method starts with net income and adjusts for things that don’t actually land in your account, like non-cash expenditures, changes in receivables, and movement of inventory.

If you need visibility on cash for day-to-day decisions, go direct. If you’re reporting to investors or planning long-term scenarios across business units, indirect is probably your friend. Some businesses use both—one for clarity and one for compliance.

If you’re still deciding which forecasting method works best for your business, our breakdown of direct vs indirect cash flow will help.

How to forecast cash flow: Step-by-step

Let’s see how we can forecast cash flow for your business step by step.

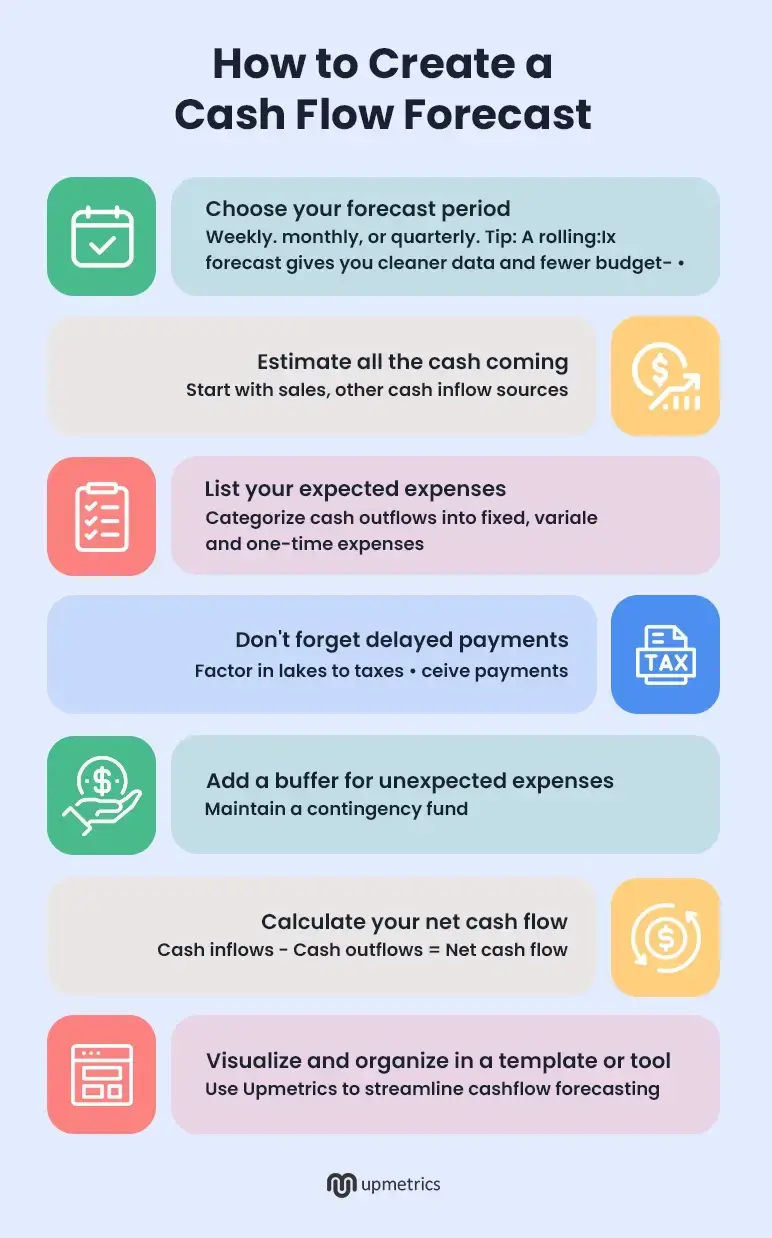

Step 1: Choose your forecast period

If you’ve been in business for a while, you’ve got useful data to lean on. That makes forecasting future cash flow easier. But if you’re new, don’t stress—early forecasts are based on educated guesses, and that’s totally fine. The key is to start somewhere and improve over time.

Choose a forecast period that fits how your business handles incoming cash and expenses. Weekly works if you move cash fast. Monthly is solid if things are more stable. Quarterly is ideal if your numbers don’t change much.

This isn’t a “set it and forget it” situation. Your cash flow forecast should shift as your business does.

Step 2: Estimate all the cash coming

To build a reliable cash flow forecast, start with your incoming cash. That’s not just sales—though they matter.

Other inflow sources include:

- Loan repayments from customers or partners

- Tax refunds and sales tax rebates

- Asset sales (equipment, property, etc.)

- Grants from government or private programs

- Capital added by founders or partners

- Royalties, franchise fees, and license fees

Once that’s mapped out, forecast your sales. Use your past data if you’ve got it. Next, review your payment cycles. Just because you closed a sale doesn’t mean you’re paid. If customers take 30–60 days to pay, you need to factor that delay into your forecast (more on that later).

Step 3: List your expected expenses

A good cash flow forecast doesn’t just measure what comes in. It gives equal weight to what goes out, and that starts by clearly classifying your cash outflows.

Use three core categories:

- Fixed business overhead expenses: Rent, wages, debt service

- Variable expenses: Utilities, production costs, and contract labor

- One-time expenditures: Asset purchases, tax-related payouts, licensing costs

Compare each category against incoming cash. This will give you a more accurate view of net income and help maintain the working capital balance.

Step 4: Don’t forget delayed payments

Sales are great. But let’s be clear. Just because you sent an invoice doesn’t mean cash is in your account. Some clients pay in 15 days. Others? More like 45. Your cash flow forecast should reflect how long money actually takes to arrive.

Go back and check:

- Your average collection time.

- Who’s always late, and by how much?

- Do certain times of year slow down how quickly you get paid?

Step 5: Add a buffer for unexpected expenses

No business is immune to the occasional curveball—be it unexpected repairs or sudden legal fees. Without a cash buffer, these can significantly impact your operations and growth.

To avoid financial disruption:

- Create a contingency fund: Set aside 10–20% of your monthly expenses for emergencies.

- Review past surprises: Use historical data to gauge a realistic reserve amount.

In supply chain disruptions, businesses such as Walmart have used their cash holdings in order to secure stock, ensuring uninterrupted product availability among customers.

Step 6: Calculate your net cash flow

Here comes the part where it all either makes sense—or doesn’t. Add up your inflows, subtract your cash outflows, and what you’re left with is… what you’re left with. 🤷

Use the basic formula:

Cash inflows – Cash outflows = Net cash flow

If it’s a positive cash flow, it’s good. If it’s negative, adjust it before it becomes a pattern. This is your cash position talking to you—listen.

Step 7: Visualize and organize in a template or tool

You’ve done the hard part. Now, make it easy to understand and keep your cash position visible at all times. Put everything into a proper tool or a clean template. Trying to analyze cash flow from five tabs and a calculator isn’t sustainable. You need something that:

- Lays it out clearly

- Helps you track actual vs. forecasted numbers

- Lets you tweak things fast when expenses shift

To make this easier, try using our cash flow calculator to plug in your numbers and track your projections. It’s built for small business owners who want clear numbers without the spreadsheet stress.

The step-by-step process works great—if you’ve got data. But for new businesses, there’s not much to work with. So…

How do you forecast cash flow for a new business?

Forecasting cash flow for a new business works a little differently. Since you’re just getting started, you don’t have past revenue reports, consistent expenses, or predictable payment timelines to lean on. That means the way you build your forecast, especially the first few steps, has to change.

Instead of pulling numbers from financial statements, work with educated guesses. Start by figuring out how much cash you have on hand right now. Then, think through how much you expect to bring in based on your pricing, market research, and early plans.

Also, be realistic about when that money will actually hit your account. Just because you make a sale doesn’t mean you get paid right away.

Because these numbers are all estimates, build at least three versions of your forecasts:

- Optimistic: If growth is fast and payments are timely

- Realistic: If things move slower than expected

- Conservative: If sales stall and costs increase

The steps are similar to what established businesses do, but the purpose is different. You’re not tracking performance; you’re pressure-testing your plan. And as soon as real numbers start coming in, update everything.

That’s how your forecast starts becoming more accurate over time. Even with limited data, business leaders can use forecasts to make informed decisions.

How do you forecast cash flow for a seasonal business?

If your business has seasonal swings, your cash flow forecast needs to account for the highs and lows. The process isn’t totally different. The cash position is just more sensitive to timing.

Instead of using one flat monthly estimate, break down your inflows and expenses based on seasonal trends. Your net income in July won’t match what you see in January, and that’s the point.

Say you run an online gifting store. Q4 might bring in 70% of your revenue because of the holiday rush—Black Friday, Cyber Monday, Christmas, or other seasonal events that drive gift buying. Your forecast needs to reflect that spike and the leaner months that follow.

A seasonal dip isn’t a problem—unless you didn’t plan for it. A proper forecast keeps surprises out of your bank.

Tips for an accurate cash flow forecast

Your cash position can change fast. A few wrong assumptions, and you’re in negative cash flow territory before you realize it. These tips help tighten your cash forecast and avoid that mess.

- Loop in cross-functional teams and get input from sales, operations, procurement, and finance for accurate forecasting.

- Don’t confuse cash flow with revenue because only cash flow shows what you can actually spend.

- Use real payment timing by tracking when cash hits or leaves your account to avoid short-term liquidity gaps—even if you’re technically profitable.

- Account for macro and operational shifts like product recalls, price changes, or vendor term updates, as they can impact your inflows or payment cycles.

- Test best-case, worst-case, and realistic cases, especially when exposed to market volatility, regulatory changes, or seasonal swings.

- Use automation to sync real-time bank data and ensure you’re working with the most recent data, not outdated figures.

- Tag and categorize transactions properly to improve visibility and help assess how specific activities like marketing campaigns or supplier shifts impact future cash flow and your overall cash position.

Bottom line

Cash forecasting plays a central role in any solid financial plan. It helps you track your cash position in real-time and make informed decisions about core business expenses, investments, and short-term obligations.

With automation, this process becomes less reactive and more reliable.

Upmetrics helps bring structure and consistency to that process with your cash position. It gives you the tools to build accurate forecasts, track changes over time, and adjust your planning based on actual performance. It’s designed to reduce friction so business decisions can happen based on data, not guesswork.