Run a business and it may feel like everyone has their hand in your pocket—suppliers, employees, landlords, and, of course, the taxes. With so much money moving in and out, it’s easy to lose track of what’s left.

That’s why you need a cash flow statement. Not only does it track the movement of your cash, but it guides you to make the most important decisions, such as:

- Should you invest in that shiny new equipment?

- Can you afford to bring on more staff?

- Is it the right time to take out a loan?

When used effectively, a cash flow statement ensures your business stays financially healthy and avoids running out of cash.

So with this blog post, let’s understand how to create a cash flow statement for a business plan with an example.

Let’s get started.

What is a cash flow statement (CFS)?

A cash flow statement is a key financial report that tracks the movement of money in and out of your business during a specific period.

It offers an answer to the most important question—do you have enough cash to run daily operations and meet short-term obligations?

A cash flow statement helps answer this question and offers a clear picture of your business’s liquidity and financial health. It shows exactly where your cash comes from, i.e. operations, investments, financing activities, and where it’s spent.

Why is a cash flow statement important?

A cash flow statement helps:

- Track liquidity: Shows how much cash you have available to pay bills, salaries, and other immediate expenses

- Make decisions: Helps decide whether it’s the right time to invest in new assets and growth ventures

- Determine operational health: Indicates whether core business operations generate enough cash to sustain the business

- Highlights the structural issues: Helps take timely actions by pinpointing problems such as slow collections or rising expenses

- Complements the other financial statements: Together with P&L and balance sheet, it offers a complete view of your business’s financial health

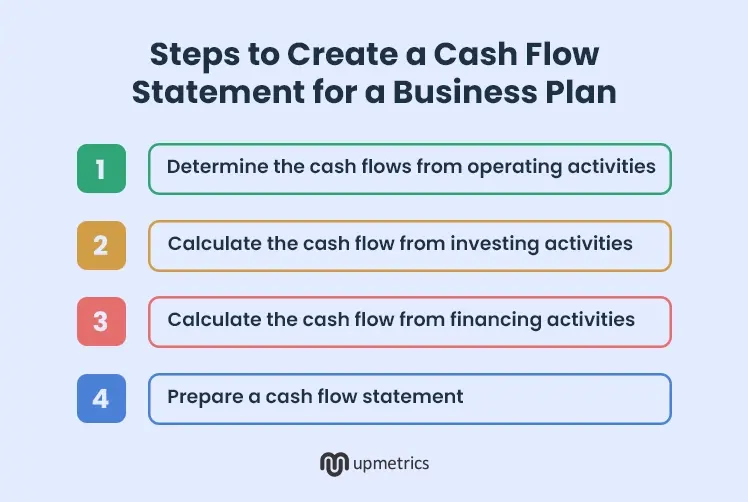

Steps to create a cash flow statement for a business plan

Let’s now walk through a step-by-step guide to creating a cash flow statement for your business.

1. Determine the cash flows from operating activities

Operating activities in the cash flow statement represent money movement from core business activities.

This includes cash inflow from the sales of goods and services and outflows for expenses such as payments to suppliers, salaries, rent, utilities, interests, income tax, and sales tax.

There are 2 ways to calculate your operating cash flow: Direct method and indirect method

Direct method

Operates on a simple principle where,

Operating cash flow = cash received – cash spent

or

Operating cash flow = cash received from customers – cash paid to suppliers – cash paid for operating expenses – taxes paid – interest paid

The direct method recognizes revenue and expenses only when money is received or paid. That is, account receivables/payables aren’t recorded as income/expense till the invoices are cleared.

To calculate your operating cash flow:

- Record all your cash receipts: Record money received as cash and in a bank account through the sales of your goods and services

- Record additional income: Record any interest or dividend received during the accounting period

- Record the payments made: Record your administrative, operating, and marketing expenses along with income tax and sales tax

- Subtract your outflows from inflows: Subtract the total expenses from income to get your operating cash flow

Example:

| Particulars | Amount |

|---|---|

| Cash received from sales of goods and services | $100,000 |

| Collections from accounts receivable | $20,000 |

| Interest received | $4,500 |

| Total received | 124,500 |

| Rent and utilities | $7,000 |

| Salaries and freelancer payments | $12,500 |

| Marketing expense | $3,000 |

| Interest paid | $5,600 |

| Income tax | $14,000 |

| Total paid | $42,100 |

| Operating cash flow | $82,400 |

This approach is pretty straightforward. However, here you need to keep track of every receipt and invoice to record your entry.

Indirect method

This method of calculating cash flow uses net income as a base and then adjusts for non-cash items and changes in working capital along the way.

Here, you don’t track every receipt and payment, however, follow a reverse method to arrive at your operating cash flow.

To calculate your operating cash flow using the indirect method:

- Start with net income: Gather the net income calculated in your P&L statement

- Add non-cash expenses: Add depreciation and amortization to net income as a business hasn’t actually paid for these expenses

- Account for changes in current assets: Subtract if the current assets (accounts receivable & inventory) have increased, but add if the current assets have decreased

- Account for changes in current liabilities: Add if the current liabilities (account payable & sales tax payable) have increased, but subtract if the current liabilities have decreased

Example:

Artsy Studios is preparing its cash flow statement for Q2. They analyzed their financial data for the quarter and found the following figures:

- Net Income: $25,000

- Depreciation: $4,000

- Amortization: $1,000

- Accounts Receivable: Increased by $3,000

- Inventory: Decreased by $2,500

- Accounts Payable: Increased by $4,000

- Sales Tax Payable: Decreased by $1,000

To calculate operating cash flow using the indirect method:

| Particulars | Amount |

|---|---|

| Net income | $25000 |

| Add: Depreciation | $4,000 |

| Add: Amortization | $1,000 |

| Subtract: Increase in account receivables | $3000 |

| Add: Decrease in inventory | $2,500 |

| Add: Increase in accounts payable | $4,000 |

| Subtract: Decrease in sales tax payable | $1,000 |

| Net operating cash flow | $32,500 |

When the current assets like account receivables increase we subtract the value in cash flow as the cash remains tied up in the assets.

Similarly, when the current liabilities like accounts payable increase, we add the value to the cash flow statement, as we haven’t paid for these expenses yet.

Now, regardless of whether you choose a direct or indirect method, the process of calculating investing cash flow and financing cash flow remains the same.

2. Calculate the cash flow from investing activities

Investing activities in the cash flow statement track cash movement related to long-term assets and investments, i.e. sell or purchase of a new asset.

Here you calculate the cash inflow and outflow such as:

| Investing inflows | Investing outflows |

|---|---|

|

|

When you subtract your investing expenses from investing income, you get net cash from investment. That is,

Investing cash flow = cash inflows from the sale of assets – cash outflows for the purchase of assets

Example:

Artsy ltd. sold its old machinery at $3,000 and bought new machinery worth $20,000 in cash.

| Particulars | Amount |

|---|---|

| Sale of asset (profit) | $3,000 |

| Subtract: Purchase of an asset | $20,000 |

| Investing cash flow | ($17,000) |

3. Calculate the cash flow from financing activities

Financing activities in the cash flow statement reflect cash movement related to raising funds or repaying debts. Financing activity inflows and outflows usually include:

| Financing inflows | Financing outflows |

|---|---|

|

|

The difference between financing inflows and financing outflows will give you net cash from financing activities.

Example:

In the 3rd quarter of 2024, Slone Ltd. invested $50,000 in the business. During the same period, they repaid $8,000 from their previous loan and paid $4,000 as dividends.

| Particulars | Amount |

|---|---|

| Investment | $50,000 |

| Subtract: Loan repayment | $8,000 |

| Subtract: Dividend payment | $4,000 |

| Financing cash flow | $38,000 |

4. Prepare a cash flow statement

Now, you have all the elements necessary to prepare a cash flow statement.

As a first step, calculate the net cash flow of your business by adding your operating, investing, and financing cash flow. This will tell you how a business’s cash position has changed over a specific period.

You may get a positive or negative cash flow at this point. If it’s positive, you have more money coming in than going out. This opens up an opportunity to reinvest excess cash for business growth.

However, if it’s negative, it means the business has spent more money than it generated over a specific period. It may be due to various reasons, however, if your operating cash flow remains negative for a prolonged period, you must investigate.

Further, calculate the closing cash balance, i.e. money you have at the end of a specific period

Here’s a formula to calculate your closing cash balance:

There! You have your cash flow statement ready.

You can prepare a monthly, quarterly, or annual cash flow statement depending on your business needs.

Pro-tip

Spreadsheets can be daunting & time consuming

Choose Upmetrics for automated and AI-powered financial forecasts. With your financial assumptions, we will automatically generate your cash flow statement.

Example of a cash flow statement for a business plan

Check this example of a cash flow statement to understand its structure and format:

Tips for maintaining a positive cash flow

Sometimes your cash flow statement may reflect a negative cash flow, and that’s alright. This happens now and then due to planned investments or a temporary dip in revenue.

However, your business needs positive cash flow more often, so it can run its day-to-day operations smoothly and invest in growth ventures.

Well, we have a few tips to help you maintain positive cash flow in your business:

- Negotiate payment terms: Establish relations with suppliers and negotiate longer payment terms to help during tight periods.

- Regulate the receivables: Implement strict credit terms to clear due invoices on time.

- Regulate your operating expenses: Regularly review your expenses and prioritize spending on essential items.

- Manage your inventory smartly: Free up cash tied to stock by using just-in-time inventory systems.

- Maintain a cash reserve: Set aside a portion of profits as a contingency fund to handle emergencies or unexpected expenses.

- Plan for Seasonal Fluctuations: Adjust marketing and operational expenses based on seasonal trends.

- Monitor and adjust regularly: Lastly, review the CFS regularly to identify and address the issues early on.

Build your cash flow statement with Upmetrics

With this blog post, you’ve now gathered a clear understanding of how to build a cash flow statement.

But should you be spending time manually tracking your inflows and outflows on spreadsheets?

Well, you can. But there’s a better and easier way with Upmetrics.

Our financial forecasting tool helps you create all the key financial statements for your business plan without any complex formulas and calculations. You simply need to enter your projections on this guided tool and it will do the rest—calculations, structuring, and visual reporting.