Acquiring the necessary licenses and permits is one of the key regulatory steps that every business must take to operate legally.

Simply registering a business isn’t enough—your industry, state, or county may require additional permits and licenses to ensure compliance.

Well, the thought of navigating through business licenses and permits might be overwhelming. However, this guide to business licenses and permits simplifies the process.

It covers the various licenses and permits you may need, how to apply for them, associated costs, and all the essential details to help you stay compliant.

But before that..

What are business licenses and permits?

If you’ve used the terms “license” and “permit” interchangeably, you’re not the first. However, they have distinct meanings.

A business license is a broad authorization that allows you to legally operate certain types of businesses. For example, a liquor license may allow you to sell liquor at your restaurant or bar.

Licenses often signify that the business owner has met specific qualifications or expertise requirements, i.e. licenses for psychologists, hairdressers, or doctors.

Permits, on the contrary, grant permission to run specific operations. Usually, a business permit is related to health, safety, or regulations, i.e. health permits for hospitals.

The following example further clarifies our understanding of licenses and permits.

Hospitals may need a health permit to ensure they meet public safety standards, while a psychologist working there will require a professional license to practice.

How are business licenses and permits different from business registration?

A business license or a permit allows an existing business to carry out its stated business activities. However, licenses and permits themselves don’t bring a business into existence. If you have a business idea, you first need to register a company.

If you want to start a business of your own in the US, you can register it as one of the three common business structures.

Sole proprietorship

This entity is for situations where you are your business’s sole owner, and no one else is involved in its operations. As you’re the only one responsible for every aspect of the business, any legal problems arising from it will be totally on you.

Limited Liability Corporation (LLC)

An LLC offers you personal protection from various kinds of business liabilities. Your assets will not be affected should any legal problems arise. However, LLCs require a lot of paperwork, and registering one may be time-consuming.

Limited Liability Partnership (LLP)

An LLP is a business structure where each partner enjoys limited liability, meaning they’re not personally liable for the negligence or misconduct of other partners. LLPs are often used by professionally licensed individuals, such as doctors, lawyers, and architects, offering them protection while allowing them to practice together.

Consulting a tax professional is the first step to deciding which business structure fits your business idea the best. Once your business is registered, you will need the relevant permits and licenses to carry out your business activities.

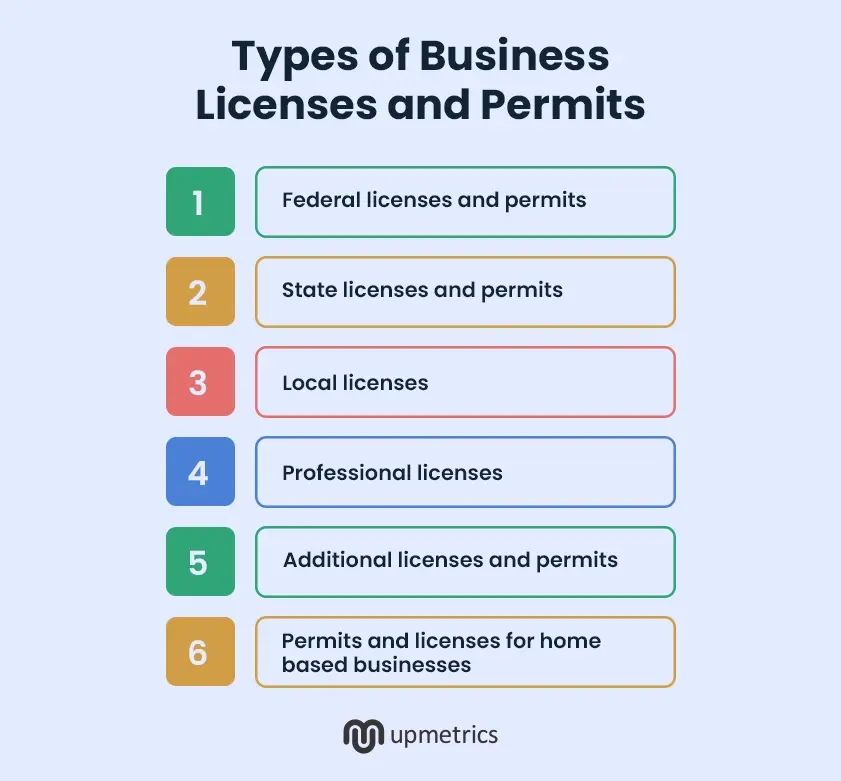

Types of business licenses and permits

If you’re a business owner or planning to become one, you’ll need a combination of business permits and licenses. Both are handed out by federal and state agencies, depending on their jurisdiction.

Whether you need a federal license, permit, or something handed out by state agencies, the answer depends on your business activity and location.

1. Federal licenses and permits

Federal agencies such as the Alcohol and Tobacco Tax and Trade Bureau and the US Department of Agriculture may hand out licenses and permits if any federal agency regulates your business activities.

For a complete list of agencies that provide licenses and permits for these business activities, visit the US Small Business Administration page dedicated to applying for licenses and permits. To ensure that you don’t violate any rules and regulations, you may take a good look at the list below.

- Agriculture: You’ll need an agriculture license if you handle animals, animal-derived products, plants, biotechnology, or biologics across US states.

- Alcohol: If you sell, service, import, or manufacture alcoholic beverages, you will need an alcohol license.

- Aviation: Licenses for businesses that deal with aircraft, transporting people and goods via air, and for entities that engage in aircraft maintenance.

- Commercial fisheries: If you plan to engage in commercial fishing in the deep sea, you will need this license.

- Firearms: This includes licenses for dealing with and selling firearms, explosives, and ammunition.

- Fish and wildlife: Permit and licenses for wildlife or fisheries-related activity.

- Maritime transportation: Permits for providing cargo and passenger transportation via the sea.

- Mining and drilling: Licenses for mining for oil, natural gas, mineral resources, etc.

- Nuclear energy: Any nuclear activity, whether fuel production or disposal of nuclear waste, will require licenses.

- Transportation and logistics: This license is necessary if your business handles large vehicles.

- Radio and TV broadcasting: Permits and licenses for mass communication-related activities that involve radio, TV, satellite, cable, etc.

2. State licenses and permits

State licenses and permits are handed out by non-Federal entities such as state authorities, city or county municipalities, and various other state government agencies.

These licenses and permits are given to business owners who intend to operate in certain business activities. States often control a more significant number of business activities than the federal government.

Some examples include:

- Auctions

- Construction

- Dry cleaning

- Farming

- Foodservice

- Retail sales

- Hospitality (hotels, motels, etc.)

- Vending machines

Additionally, certain industries such as healthcare, alcohol sales, and transportation may also require state-specific professional or operational licenses.

As the US consists of 50 states and several territories, it’s essential to research the kind of business permits and licenses you will need. Each state often has its own website or department dedicated to business licenses, such as the Department of Revenue or the Secretary of State’s office, where you can find detailed requirements.

An excellent place to start is your own state’s official website.

3. Local licenses

Most county and municipality-level permits and licenses come under state jurisdiction. Nevertheless, there are times when your business activities may come under specific laws, requiring additional permissions.

As a result, you’ll probably need to visit your county and city offices, including the county clerks and state tax offices. These offices can provide information on local business licenses that may cover areas like zoning, building safety, and health regulations.

This information may not always be available online, and you may physically have to visit the offices concerned.

4. Professional licenses

Alongside business licenses and permits, your profession may require an additional license to practice. These licenses are often handed down by specific professional bodies such as state-specific mental health boards, accounting boards, architecture boards, and legal associations.

It’s essential to thoroughly research the licensing requirements of your profession before starting a business, as many industries require both business and professional licenses.

Here are some examples:

- Accounting: The National Association of State Boards of Accountancy hands out licenses for accounting firms.

- Architecture: The National Council of Architectural Registration Boards gives away permits for practicing architects.

- Cosmetology and hairstyling: The National Interstate Council of State Boards of Cosmetology is responsible for the licensure of hairstylists and cosmetologists.

- Dental care and medical services: The American Dental Hygienists Association licenses dental hygienists, whereas the American Dental Association gives away licenses to dentists.

- Engineering: National Council of Examiners for Engineering and Land Surveying hands out licenses to land surveyors and engineers.

- Law: The American Bar Association is responsible for licensing attorneys.

- Pharmaceuticals: Sellers and makers of pharmaceutical products should apply for licenses at the National Association of Boards of Pharmacy.

In regulated professions, practicing without the necessary license can lead to severe penalties, including fines or even legal action.

5. Additional licenses and permits

There can be several non-professional licenses as well. These may be related to health, building, zoning, and the environment.

For example, if you start a business next to a protected park, you may need additional environmental clearances to ensure your activities don’t cause ecological damage.

We know it can get mighty complex and cumbersome, but thorough research will safeguard you against unforeseen penalties later.

Consulting local government agencies or legal experts can help ensure you meet all regulatory requirements and avoid costly delays or fines.

6. Permits and licenses for home-based businesses

Working from home can seem easiest and hassle-free until you realize you may need additional permits. If you plan to work from home or start an office in your house, you may need the following licenses and permits:

- Home occupation permit

- Zoning permit

- Fire Permit

- Sign Permit

- Special use permit

Additionally, certain states or localities may have more specific requirements, such as health permits for businesses preparing food at home or environmental permits if your business generates waste. Research your local regulations thoroughly to avoid penalties and ensure smooth operations.

That’s nearly all the licenses and permits you need to legally operate your business. However, are these licenses expensive? Let’s check.

What is the cost of a business license?

The cost of acquiring a business license varies significantly from a couple of hundred dollars to a few thousand dollars, i.e. anywhere between $50-$50,000 and more.

This is quite an open-ended range that changes depending on the type of your business and its location.

Let’s understand the business license fees through examples and categories:

1. General business license

The cost of acquiring a general business license is anywhere from $50 to $500. This cost is largely influenced by the state and city you will operate in.

For example, a general business license in Nevada may cost about $500, while in states like California it can range from $50 to $150.

However, for regulated industries like cannabis, energy, aviation, and broadcasting, the cost of a general license itself would be very high.

For instance, the initial application fee for marijuana cultivation businesses in Colorado is about $25,000. Upon the application acceptance, the license registration fee is an additional $75,000.

This shows that licensing costs can be exceptionally different for each business. Relying on general estimates wouldn’t help you budget for your costs.

2. Professional license

If we consider the cost of licenses for professionals, the costs again vary significantly. For instance, if the pilots were to acquire their aviation license, the costs could go as high as $100,000. However, the same for acquiring a CPA license can range anywhere from $2,500-$5,000.

That is to say, depending on the professional license you require, the costs would vary between a couple of thousand dollars.

3. Industry-specific permits

Lastly, you need to consider industry-specific permits or licenses your business requires. Depending on the regulatory requirements and the license in question, the costs would vary.

For instance, an alcohol license for a restaurant costs anywhere up to $40,000. Similarly, construction businesses would require a couple of safety and environmental protection permits. The costs for these can vary from $250-$5,000 depending upon the regulations.

In addition to these costs, you also need to account for the renewal fees and local permit costs for your business.

All in all, you need to have a thorough understanding of your industry so that you can efficiently budget for the licensing and registrations costs well in advance.

Where to get a business license?

As mentioned before, you need to visit the US Small Business Administration page to check if you need a federal license or permit. If you don’t, you may contact your state government’s website or offline offices to apply for the necessary licenses.

How long does it take to acquire a business license?

Unfortunately, there are no clear answers to this question. It truly depends on how complex your business activity is and where you’re making the applications and registrations.

Some states process licenses and permits quickly; you may get your documents in days. However, if you operate in a high-risk area such as nuclear technology, the federal government may take weeks to months to give you the licenses and permits you’re applying for.

Should you get your licenses before registering your business?

You could, in theory. However, it makes more sense to start a business and then apply for licenses and permits around the same time.

Will I need permits and licenses if I want to expand my business abroad?

Most definitely. You’ll need not only American licenses and permits but also the ones valid in the countries where you plan to engage in business activities.

What are the steps to getting a business license?

Let’s now walk you through a step-by-step process to acquire a business license.

1. Make a list of licenses

This is one of the most complex steps. You need to assess your business activities and the location where you plan to operate. Conduct research or seek external help. Make connections and telephone calls if the information is not available online. Finally, make a list of the licenses and permits you need.

2. Gather necessary documents

Every permit and license requires a little paperwork. This means documentation, evidence, and more paperwork. As a result, getting your hands dirty and keeping all the documents necessary in designated files and folders is essential. Keep digital copies of all your records too if needed.

3. Send your applications

Start making applications for your licenses one by one. The first step should be to register your business. However, if you are a professional, you will need a professional license even before you think of starting a business. Nevertheless, start applying for those permits and licenses.

4. Wait for the approval

The approval process can take anywhere from a week to a few months. You don’t have a choice but to wait patiently while the authorities evaluate your application.

Keep in touch with the authorities and ensure that they have everything to speed up the approval process.

5. Renew your licenses on time

Business owners often overlook license expiry dates and hence forget to renew their licenses and end up paying penalties. Late renewals may cost more, and you may also have to make fresh applications. To avoid these cumbersome scenarios, it’s best to set reminders and renew your licenses before they expire.

Once you have the license, use it to market yourself. Licenses establish trust and give your customers and clients the confidence to do business with you.

Act quickly and get your licenses and permits

Turning your dream project into a successful business is definitely an exciting endeavor.

However, to avoid getting yourself into legal trouble, ensure that you acquire all the essential licenses and permits.

Ideally, you should hire legal help to overlook all the compliance needs of your business. However, if you’re planning to save on your legal fees, educate yourself with the best available resources online and send over your applications quickly.

Once you send over your application, don’t wait. You possibly have a month till all your licenses and permits come along. This is the best time for you to put together your detailed business plan.

With the Upmetrics business planning app, you get all the resources, guidance, and tools to prepare your business and financial plans.

So what are you waiting for?

Get started now.