Starting a business is like building a house!

You need a solid foundation to keep it long-lasting. Here, the solid foundation is choosing the right legal structure for the business.

Even Michael E. Gerber shared in his book The E-Myth that “The difference between the entrepreneur who succeeds and the one who fails is the legal structure they choose.“

While almost 86% of U.S. small businesses opt for sole proprietorships because it’s simplest, it’s necessary to assess your firm’s long-term goals before making a choice.

Let’s see how to choose the right business structure and the factors to consider, in this blog.

What is the legal structure of a business plan?

The legal structure of a business plan defines how a business is organized and recognized by law. It shows the type of ownership, such as whether the business is owned by an individual, partners, or shareholders.

This structure determines how the business will be taxed and how profits and losses are distributed. It also defines the level of personal liability the owners have for business debts. The business structure impacts the daily operations, financial decisions, and legal obligations of the business.

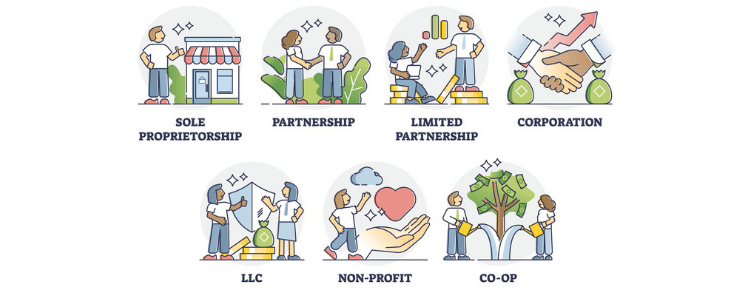

What are the different types of business structures?

All business legal structures come with their requirements and liabilities. Additionally, the type of structure you choose will also influence the business licenses and permits you’d need to operate legally.

So, let’s see each structure in detail to know more:

1. Sole proprietorship

A sole proprietorship business structure is the most common structure. As the name itself says, it’s owned solely by a single individual.

Here, the owner has complete control over the decisions of the business and is personally responsible for the liabilities. Also, the profit earned from this business is calculated in the owner’s tax return (generally on Schedule C—Form 1040) only.

Businesses on a small scale use this structure as it requires minimal legal formalities. It’s also affordable, easy to set up, and simple to exit (no paperwork or particular announcement is needed).

It also means the owner has unlimited personal liability for any debts or legal actions against the business. In short, in a sole proprietorship, your business isn’t a separate legal entity.

2. Partnerships

Partnership involves two or more people who agree on sharing the ownership of a business. This structure is also easy to set up.

There are two main types of famous partnerships:

- General partnerships – all the partners are personally liable and responsible for the business

- Limited partnerships – one or more partners might have limited liability and responsibilities whereas one will be a general partner with full liability and responsibilities.

For the partnership structure, a partnership agreement is advised rather than keeping everything oral.

When filing taxes, the profits and losses of partnership businesses are passed on to the partners. Each partner is then required to file the taxes using Form 1065. Generally, lawyers or professionals use this structure.

3. Corporations

A corporation is a formal structure where the owners and business are separate. The firm here is a separate business entity so it can own property, enter into contracts, file separate income tax forms, and do all other actions under its name.

As it’s a separate legal entity, it also protects the personal assets of the shareholders.

There are two types of corporations: C corporation and S corporation.

C corporations have no shareholder limit. But they face double taxation, with profits taxed at both the corporate level and as shareholder dividends. S corporations, conversely, avoid this double taxation but are limited to 100 shareholders.

Besides that, forming a corporation involves filing articles of incorporation, holding board meetings, voting, election of directors, and other important legal steps.

4. LLCs (Limited Liability Companies)

An LLC is a mixture of positives from both worlds (corporation and partnership). It’s a flexible structure with the limited liability of a corporation and the simplicity of partnership with tax benefits.

Setting up an LLC involves more paperwork and fees than a sole proprietorship or partnership, including filing Articles of Organization and creating an Operating Agreement. LLCs also need to follow state-specific rules.

Unlike an S Corporation, which is limited to 100 shareholders, an LLC can have unlimited members. However, setting up an LLC can be costly because it must register with the state. It also needs to hire an accountant and attorney to meet tax and legal requirements.

5. Cooperatives

Cooperatives are formed by people or businesses in similar industries who come together to achieve common goals. These goals can include improving purchasing power or gaining better market access.

Here profits are distributed among members based on their participation, not on how many shares they own.

Forming a cooperative requires drafting and filing Articles of Incorporation, creating bylaws, and sticking to state-specific regulations.

Factors to consider before choosing a business structure

Choosing the business structure affects your taxes, personal liability, ownership, and more. So, it’s important to consider all such factors. Here’s the table of comparison for each structure along with which structure is suitable for whom and the ease of formation. Let’s dive in:

| Legal structure | Liability | Taxation | Ease of formation | Suitable for |

|---|---|---|---|---|

| Sole Proprietorship | Unlimited personal liability | Pass-through (personal tax) | Very easy | Small, low-risk businesses or freelancers |

| Partnership | Unlimited personal liability | Pass-through (personal tax) | Easy | Businesses with multiple owners sharing responsibility |

| LLC | Limited liability | Pass-through (default); can elect corporate tax | Moderate | Small to medium-sized businesses needing liability protection and tax flexibility |

| Corporation | Limited liability | Double taxation (corporate and personal) | Complex | Businesses planning to raise significant capital, go public, or have many shareholders |

| Cooperative | Limited liability | Pass-through (cooperative tax benefits) | Moderate to complex | Member-driven businesses like community organizations, retail co-ops, or credit unions |

Besides all the above factors, one other thing to consider is risk tolerance. Identify how much personal liability you’re willing to accept. If you want to protect personal assets then go for LLCs or corporations otherwise choose sole proprietorship or partnership.

Example of business structure in business plan

A well-chosen business structure will take your business a long way. Here are examples of how to write this section in your business plan:

Example 1

Business structure of GreenLeaf Organics (LLC)

Our business, GreenLeaf Organics, will be organized as a Limited Liability Company (LLC). This structure was chosen to provide the owners with personal liability protection while allowing for tax flexibility, where business income will pass through to the owners’ personal income taxes, avoiding corporate taxation.

As an LLC, GreenLeaf Organics will be owned and managed by two partners, Jane Doe and John Smith, who will both have equal ownership and decision-making authority. The LLC structure also offers us the ability to bring in additional members in the future, which aligns with our long-term growth strategy.

Example 2

Business structure of EcoClean Solutions (Sole Proprietorship)

EcoClean Solutions will operate as a Sole Proprietorship, owned and managed by Jane Doe. This structure was selected for its simplicity, allowing Jane to maintain full control over the business and make quick decisions. All profits will flow directly to her, and taxes will be reported on her personal income tax return.

However, as a sole proprietorship, there’s no separation between personal and business liabilities, meaning Jane will be personally responsible for any debts or legal obligations. While this structure is ideal for the early stages of the business due to low startup costs and ease of operation, there’s potential to transition to a more complex structure.

Example 3

Business structure of BrightTech Innovations (C Corporation)

BrightTech Innovations will be established as a Corporation (C Corp). This business structure was selected to facilitate our goal of raising substantial capital through equity financing. As a C Corporation, BrightTech Innovations can issue multiple classes of stock, making it an attractive option for venture capitalists and other investors.

The C Corporation structure provides strong liability protection for our shareholders, ensuring that their personal assets remain separate from the business’s liabilities. Additionally, this structure allows for unlimited growth potential, as there’s no cap on the number of shareholders.

While C Corporations are subject to double taxation—where both corporate profits and shareholder dividends are taxed—this structure aligns with our long-term strategy of scaling the business and eventually pursuing an Initial Public Offering (IPO). The ability to retain earnings within the company will also support ongoing research and development efforts without immediately distributing profits to shareholders.

Conclusion

Choosing the right legal structure is necessary for the long-term success of your business. We hope this blog has helped you choose the right structure.

Once you’ve made your decision, including it in the detailed business plan is the next essential move.

Upmetrics can help you seamlessly create a well-structured business plan that syncs with your goals and business structure.

So why wait? Start your business journey with Upmetrics today.