The world-famous 80-20 rule– also known as the Pareto Principle– suggests that 80% of results come only from 20% of inputs. The same applies to business Key Performance Indicators aka KPIs as well.

No matter if you have thousands of business metrics in front of you, following only a few of them would affect the overall business success.

These metrics will maximize the profits & grow the business faster. These sets of “few metrics” are known as KPIs. KPIs are the best way to know how your business assets are being utilized over time.

If you’re a small business owner or a soon-to-be entrepreneur– and want to add KPIs to your business plan elements–this article is for you!

In this article, we’re going to give you a clear picture of what a KPI is and the best KPIs for a business that you can narrow down your focus on.

Things you’re going to learn about in this article:

What is a KPI

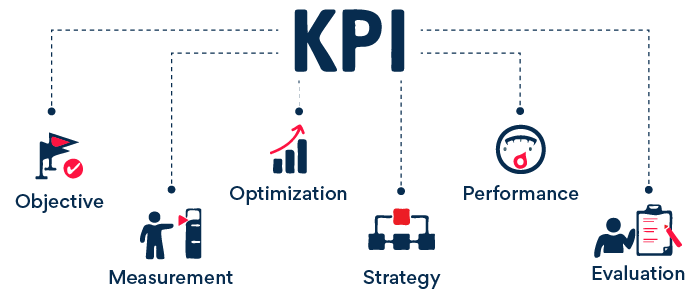

A Key Performance Indicator– as clear by its name– is a metric that is used to evaluate or estimate the performance of an event or a phenomenon. A KPI is strictly aligned with a particular goal.

It indicates how your course of action has turned out & resulted over a certain period. This is why a KPI helps you focus on a single aim at a time.

For example, suppose you have created a website for your business. You have been optimizing the website and adding content for 6 months.

You’re putting in all these efforts because you want to increase traffic on your website. Here your goal is: To bring traffic to your website.

Now, how would you decide whether your actions have given you fruitful results or have led your business to a path of no value?

That’s a no-brainer. You could analyze your performance by looking into your website’s analytics. You would, most certainly, search for the traffic your website has generated over the past 6 months.

Hence, “Website Traffic” becomes the Key Performance Indicator or KPI in this scenario.

Types of KPIs

KPIs can be of two kinds. Leading & Lagging.

1. Leading KPIs

Leading KPIs are the indicators of upcoming events or actions in the future. They’re calculated before the company starts to execute the plan.

Some examples of leading KPIs include the expected number of quarterly leads, cash flow forecasting, etc. Note that these KPIs depend on the business model, which may differ for every business.

For instance, leading KPIs for digital marketing agencies cannot be the same as those of manufacturing firms.

2. Lagging KPIs

Lagging KPIs are the exact opposite of those of Leading KPIs.

These are the indicators of the events in hindsight. Lagging KPIs tell you the results of your efforts and actions after they’re done.

Examples of Lagging KPIs are Net Profit, annual sales, etc.

Quick Summary:

- A KPI aka Key Performance Indicator is a system of measurement that demonstrates the state of a business & the developments towards a goal.

- KPIs are a subset of metrics. All KPIs are metrics but all metrics are not KPIs.

- There are two types of KPIs. Leading & Lagging.

Importance of KPIs: Why You Should Pay Attention to Your Business KPIs

Planning is easy. Sustaining with that plan until the goal is met is tough. Extremely tough, to be honest.

Stating the obvious– entrepreneurship comes with truckloads of responsibilities and challenges & keeps you on your toes. Wearing multiple hats and getting excited with new ideas can lead you to multiple distractions.

These distractions can shift your focus to the less result-bearing routes. And can hamper your business in the long run.

This is where KPIs help!

If you want to stick to your business goals without getting distracted by the millions of paths pulling you, you should get aligned with the essential KPIs even before starting the business.

Obsessing KPIs can help you achieve your yearly business objectives as no other metric would do.

Similar to the “Website Traffic” example discussed in the last section, there can be a KPI for every business objective. These essential indicators help you track progress, stick to the most important actions, & hone in on your business objectives.

A quick rundown on the importance of KPIs:

- KPIs help you stick to your business goals.

- They tell you where your efforts are paying off and where there are gaps that need to be worked out.

- KPIs help you calculate your growth in facts & figures instead of making guesses.

- KPIs are simple calculations that even small businesses can easily access without any heavy investment in data analysis.

Critical Small Business KPIs You Must Know Before Launching Your Business

The list of KPIs can vary from business to business. It mainly depends on the business type, size, industry, and goals. But it’s also true that every company has a mutual goal: GROWTH.

Thus, the set of KPIs that cover a broader perspective is somewhat similar for everyone. We’re going to discuss those KPIs in this section.

If you’re a soon-to-be entrepreneur or already own a business; grab a pen & paper, or an excel sheet whatever. Because we’re going to discuss a range of small business KPIs that can help you manage and grow your venture significantly.

Here we go!

1. Cash Flow Forecasting

This is a leading KPI. A healthy cash flow is essential for small businesses to run their day-to-day operations. Cash flow means the amount of money that flows between from and to.

In simple language, the money that flows in and out of a business is called the Cash Flow.

Even though this metric plays a critical role, 60% of small business owners say they don’t think they know enough about the finance or accounting of their business.

And being less in tune with your business finance can lead you to unfruitful results in the future.

This is why Cash Flow Forecasting for the upcoming month or quarter becomes so important for small businesses. Here’s how you can calculate it.

Beginning cash: The amount of liquid money you have at the moment of calculation

Estimated Cash Inflows: The money you’re expecting to receive in a certain period of time. For example, the outstanding payment from the made sales.

Estimated Cash Outflows: Your business expenses and operational costs such as paying the vendors, resource costs, etc.

By calculating CFF, you can make your business decisions like whether you’re capable of investing in software or hiring an employee, etc.

2. DSO (Daily Sales Outstanding)

Just like Cash Flow Forecasting, this KPI is also extremely helpful for businesses in their early-stage. Especially the ones that are relatively lower on funding.

Such businesses often function as where customers don’t pay right away after a sale. DSO helps businesses improve and stabilize the cash flow in the system. It enables them to evaluate how quick and organized your business is at getting paid after every sale.

Here’s how to calculate DSO (Daily Sales Outstanding) for your business.

Accounts Receivable: The amount of outstanding money

Net Credit Sales: The number of sales whose payment is pending

A number of Days: Number of days since the sale was made.

By calculating your DSO scores, you can analyze if they’re decreasing or increasing with time– against the industry standards or your benchmarks.

This DSO metric will help you analyze

- If you’re targeting the right customers,

- If they’re satisfied with your product/service,

- Or if your invoice lifecycle system has some underlying issues.

3. Revenue Growth Rate

The amount of money earned by a company over a period of time is called “Business Revenue or Revenue” for that period.

Revenue and Profit are different metrics. Revenue includes all kinds of income without deducting the cost deduction.

Thus, the rate at which your business income grows over a certain time is called Revenue Growth Rate.

For instance, comparing your business’s last year’s revenue with the total income of this year will show you the annual revenue growth for this year.

How to calculate Revenue Growth Rate?

Suppose you’re calculating how much your revenue has increased/decreased in one year:

Maximizing revenue is one of the major goals of every business. By keeping a record of your revenue growth, you can keep up to date with your business. You can also use customer growth rate, which is a similar metric based on the same principle. With both KPIs, you can address the shortcomings and emphasize on the things that bring the most results.

4. Gross Profit Margin

Gross Profit Margin is different from calculating the Net Profit of a business.

Net Profit applies to businesses of all kinds. Whereas Gross Profit Margin is mostly applicable to businesses that sell products.

Gross Profit Margin tells you how much money you’re left with after paying the costs of the product that you’ve sold.

For example, suppose you own a footwear business and you’re buying your shoe collection from other external vendors. You buy a pair of shoes at $20 and you sell these shoes at $40.

Thus, your Gross Profit Margin would be 50%.

Here’s how you calculate it:

Gross Profit Margin = {(Selling price of shoes – Cost price of shoes) / (Selling price of shoes)} ✕ 100

= {($40 – $20) / $40} ✕ 100

= 50%

5. CAC (Customer Acquisition Cost)

This metric might not be important for your initial sales. But as you grow, it becomes essential to keep an eye on how much you’re spending to obtain a customer.

CAC includes calculating the costs of the entire conversion process from a lead into a customer.

Here’s how you can calculate Customer Acquisition Cost:

Sales expenses can include sales staff salaries, travel expenses (if any), sales software, etc.

Marketing expenses can include marketing campaign costs, marketing staff salaries, marketing software tools costs, etc.

CAC will help you oversee the expenses and the ROI of every investment in sales and marketing. You can also analyze if a particular strategy is giving you enough results or just burning your pocket with zero outcomes.

6. Net Promoter Score

This is one of the simplest KPIs of all. Net Promoter Score is a metric that shows if your existing customers like your product/service enough to recommend you to others.

You can calculate NPS by asking your customers this question:

“On a scale of 1-10, how likely would you recommend our company to others?”

Net Promoter Score is the simplest, cheapest, and yet one of the most important KPIs that can give you a wider perspective on your business.

- You would know how your customers perceive you. If they give you 0, this means your product/service has some serious underlying issues that you need to solve ASAP.

- If they give you an 8/9/10, this would work as the strongest marketing strategy– word of mouth– for your business.

Miscellaneous: Other KPIs that You Can Keep on Your Business Radar

Turnover

People often confuse Turnover with Revenue. But they’re very different from each other.

Revenue is strictly related to the money a business makes. Whereas Turnover is a metric that tells you the efficiency your company is utilizing its assets with. These assets might include inventory (goods, materials, or fixed assets), human resources (workforce), or cash.

There are three types of turnover:

Cash turnover: This tells you the number of times your business has spent cash or money within a certain period.

Inventory turnover: This tells you the rate at which your business inventory is replaced, used, and sold.

Employee turnover: It tells you about your employee retention which affects your overall business growth significantly.

CSAT Score

One of the most important Customers Service KPIs is the CSAT score. It’s the best way to evaluate the overall customer experience of your business. Similar to the Net Promoter Score, you can ask your customers directly if they’re satisfied with your service. This metric will help you assess the customer retention rate of your company. You can identify the loopholes and fix them to improve your net CSAT score.

Relative Market Share

Knowing the Relative Market Share of your business is an excellent way to find out where your business stands in the market. It helps you realize your authority in your industry market; against your competitors.

Before calculating the RMS, let’s see how you can calculate your market share in the industry.

By calculating your RMS, you can find out your closest competitor, learn the industry better, and help your (potential) investors see your company’s potential.

Conclusion

There can be millions of metrics and thousands of KPIs in your business. But you have to pick the ones that are useful for you.

Even in the KPIs provided in this article, your priority will change with time and your business objectives. While some KPIs will always be there, some will be altered.

But your goal should be to keep hitting the bullseye by sticking to your goals until you achieve them.