I’ve seen it happen too many times: A small business owner gets excited about growth, pushes forward too fast, and suddenly the cracks start to show—missed deadlines, unhappy customers, and cash flow that can’t keep up. Growth isn’t just about ambition; it’s about readiness.

So, how do you know if you’re truly ready? Here’s a quick way to self-check:

✅ Signs you’re ready to grow:

- Steady and repeat customer

- Consistent cash flow with a healthy margin

- Workload that’s manageable but nearing capacity

⚠️ Signs you should pause and rethink:

- Running on thin margins

- Over-reliance on a single client or market

- Struggling to keep up with existing demand

Let’s say, for example, a bakery turning away orders because ovens are maxed out is ready to expand. But a freelancer already working 40+ hours and still missing deadlines? That’s a sign to pause and fix systems first.

In this blog, I’m going to tell you the fundamentals of growing your business. No fluff, just practical steps that move the needle.

Let’s dive in.

What doesn’t actually mean to grow your business?

“Growth for the sake of growth is the ideology of the cancer cell.” – Edward Abbey

That line hit me hard when I first came across it. Over the years, I thought “growth” meant more staff, more branches, more revenue—until I learned the hard way that not all growth is real. Sometimes, it’s just a shinier word for ‘more headaches.’

Here’s what doesn’t truly count as growth.

1) Hiring more people or opening more stores

I’ve seen colleagues rush to open a second location, driven by the myth that “this is what scaling looks like.” You know what happened? He doubled his rent, payroll, expenses… and didn’t double the profits. Growth isn’t about how many employees or stores you have—it’s about whether those people and places are making your business healthier.

2) Taking on big debt or equity

Banks love to hand out loans with glossy words like “business expansion.” Investors love to talk “scale.” But debt and equity aren’t growth—they’re pressure. I’ve seen fellow owners lose sleep (and ownership) just to chase an idea of growth that wasn’t sustainable.

If your systems, cash flow, and market demand aren’t rock-solid, debt and equity don’t accelerate growth—they magnify risk.

3) Expanding your product or service range

This one stings because I did it too soon. When my first shop was doing well, I rushed to add new products—thinking that variety would attract more customers. Instead, I ended up juggling too much, my team was overwhelmed, and worst of all, customers were confused about what we stood for.

Basically, adding new products can be growth, but only when your existing line is stable, profitable, and has systems that scale. Otherwise, you’re just overcomplicating your own business.

4) Boosting revenue (while profit margins shrink)

I’ll never forget the year we hit record-breaking revenue. I felt on top of the world—until my accountant pointed out my profit margin had slipped to the floor. More work, more stress, less money in my pocket. That’s not growth—that’s running on a hamster wheel. For a small business, true growth is measured in profitability and sustainability, not vanity metrics.

But how will you be able to do that? And what’s the right way to grow a small business?

That’s what you’ll explore in the next section. Let’s begin!

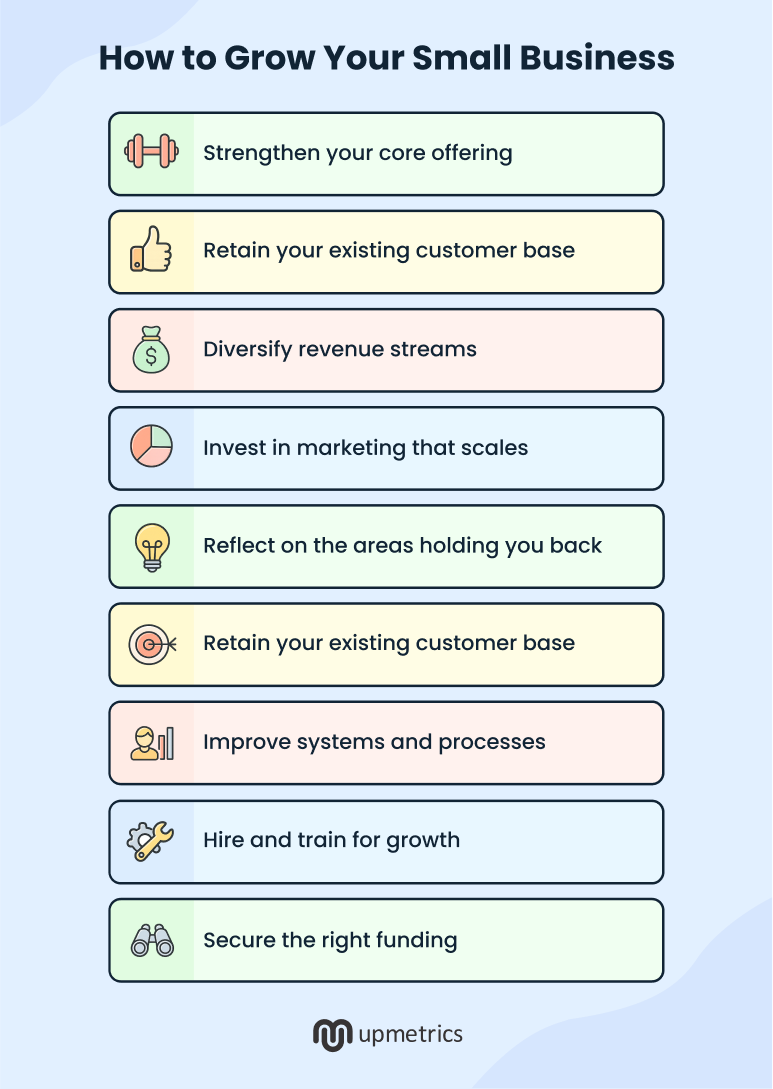

How to grow your small business? (The right way)

You know how you always feel, the need to do more as a business?

Add more products. Offer more services. Chase more customers. I’ve been there too, and let me tell you, more isn’t always better.

What helped me grow wasn’t chasing every new opportunity, but it was focusing on a handful of fundamentals. That made my business stronger year after year.

Let’s start with the first one and then move through the rest step by step.

1) Strengthen your core offering (don’t add new)

If you’re running a business, patience is your golden rule. Remember: “No seed grows the day you plant it. Neither does your business.” So instead of constantly chasing shiny new ideas or experimenting with random directions, focus on strengthening your core.

That means becoming the best at what you already do. Master your existing product or service before considering expansion, new investments, or entering new fields. Be the one who drives the market in your niche.

This idea sank in for me while I was reading the book “Profit from the Core.”

There’s one line in there: “Focus on your core.” Simple, but powerful. That quote captures the heart of the book, advising you to concentrate on your primary aspects to drive growth.

Here’s a small but powerful practice: Always look for gaps in the market and move quickly to fill them. Do that consistently, and you won’t just keep up with the market—you’ll lead it.

2) Reflect on the areas holding you back

Honestly, this is the part most business owners avoid, and I’ll admit, I used to do the same. But I don’t want you to make that mistake. If you truly want to grow, you’ve got to face the cracks in your business and fix them.

How? Start by asking yourself tough questions:

- What’s slowing me down right now?

- Is it poor cash flow management?

- Weak customer relationships?

- Ineffective marketing strategies?

- A broken sales process?

- Or maybe that one product that drains all your energy but barely makes a profit?

Remember, this doesn’t mean doing micro-management in each department; it’s about finding the cracks. For example, say your business makes $50,000 in sales a month.

Sounds great, right?

But if your expenses are $45,000 and most of your customers pay late, you’ll always be short on cash. On paper, it looks like growth, but in reality, you’re just surviving. Fixing that financial crack—by improving margins or tightening payment terms creates real room for growth.

The point is, reflection isn’t just about self-awareness—it’s about being brutally honest with what’s broken and having the discipline to fix it before chasing something new.

3) Retain your existing customer base (reduce churn)

Sounds familiar? I bet.

Many times, we sell to a customer once and feel satisfied—then we move on, with no follow-up, no second sales pitch, and no effort to share new insights.

And before we know it, we’re out there chasing new customers while the old ones quietly slip away.

I’ll be honest—I did this in my early days too. I’d spend my time running to new areas, trying to market to fresh faces, while completely forgetting about the customers I had already served. The result? Missed repeat business and wasted effort.

Before you run after new customers, pause and ask yourself: Am I doing enough to keep the ones I already have?

So, what can you do to retain customers and grow your business?

Start simple: Stay in touch. A quick call, a thank-you message, or checking in to see how they’re using your product goes a long way. People remember when you care.

Next, make them feel valued. Offer small loyalty perks, share useful updates, or give them early access to something new. When customers feel like insiders, they stick around.

Most importantly, listen. Ask for feedback, and use it to improve your product or service. Nothing builds trust like showing customers you take their input seriously.

4) Expand customer base

Once you’ve strengthened your core and learned how to retain existing customers, it’s time to think about expansion. Growth eventually means reaching more people, but here’s the catch: Don’t just chase any customers, chase the right ones.

In my journey, I used to get excited about “any new lead.” But not every customer was a good fit. Some drained our time, pushed for discounts, and never returned. Real growth started when I became intentional about who we targeted—people who valued our product and were likely to stay long term.

So, how do you expand the right way?

- Happy customers are your best marketers; encourage them to bring in friends or colleagues.

- Do market analysis to understand where real demand exists.

- Maybe it’s social media, local events, or partnerships with other businesses—go where your potential customers already are.

- Use data and feedback to understand who benefits most from your product; the clearer your customer profile, the easier it is to reach more of them.

Here’s the beauty of it: When you expand with purpose, each new customer adds real value to your business instead of just being another number.

5) Diversify revenue streams

Here’s something I learned after years of running my business: Depending on just one source of income is risky.

One change in the market, one new competitor, or one bad season, and suddenly your “stable” business feels shaky. That’s where diversification comes in.

But let me be clear: I don’t mean jumping into random industries or adding services just for the sake of it. Real diversification is about building complementary revenue streams around your core.

For example, if you run a bakery, don’t rush into opening a restaurant right away. Instead, you could add catering services, sell baking kits online, or create workshops to teach baking. All of these tie back to your main strength, but give you multiple ways to earn.

Moreover, when sales of your bakery items slow down, these other connected offerings will keep your business running and give you fresh opportunities to grow.

Here’s a quick guide in table form to give you a clear overview of how you can expand within your core and what benefits it gives to your business:

| Business Type | How to Expand (within core) | Benefits |

|---|---|---|

| Ownership (Retail/Shop/Bakery, etc.) | Add complementary products, offer loyalty programs, and sell online. | More repeat sales, stronger customer loyalty, wider reach. |

| Service-Based (Salon, Coaching, Consultancy, etc.) | Introduce premium packages, add workshops, and create digital products. | Higher margins, new revenue without big costs, builds authority. |

| Industrial/Manufacturing | Offer maintenance contracts, sell spare parts, and expand to B2B clients. | Steady recurring income, deeper client relationships, long-term stability. |

Diversify smartly. Look for add-ons that complement your core business instead of distracting from it. Remember, don’t lose gold in search of diamonds.

6) Improve systems and processes (automate manual tasks)

Take this fundamental seriously. I’m going to help give you profitable advice. Growth isn’t just about selling more—it’s about running smarter.

I’ll be honest with you: I used to keep my entire business accounts on tiny slips of paper. Sometimes I’d snap a photo on my phone and save it there.

But when I needed it most, the slip was lost, or the photo was buried somewhere in my gallery. The result? Pure loss.

Don’t repeat my mistake, my friend. If you want your business to scale, you must improve your systems and processes—and whenever possible, make them automatic.

Whether it’s invoicing, inventory updates, scheduling, or customer reminders, systems can handle it better, faster, and without errors.

Think about it:

- Instead of chasing late payments, set up automated invoicing and reminders.

- Instead of manually tracking stock, use inventory software that updates in real time.

- Instead of sending the same email to 50 customers, use an email tool that personalizes and schedules it for you.

The benefit? You free up time, reduce mistakes, and focus your energy on strategy, sales, and customer relationships—the things that grow your business.

7) Invest in marketing that scales

It’s funny; I still remember recording a short video of my products and uploading it to YouTube. I was thrilled when it got 500–600 views… with zero likes. 😜 Joke apart, in my early days, I relied on social media here and there to grow my business.

But as demand increased, I realized I had to take it more seriously and start using it heavily. That shift from “random posting” to “consistent, scalable marketing” made all the difference.

Here’s the truth: If your marketing only works when you put in manual effort, it’s not sustainable. Scalable marketing is what keeps bringing in leads and customers even while you sleep.

Think digital ads that can be optimized, content marketing that keeps driving traffic for months, or referral programs that multiply on their own. These are assets, not just expenses.

So, before you spend on “one-off” marketing, ask yourself: Will this still work when I double my business? If the answer is no, it’s time to rethink.

However, if you’re running short on marketing ideas for your business, check out our blog on small business marketing ideas. It’s not filled with generic tips—it’s packed with practical strategies learned from real experience.

8) Hire and train for growth

If you’re still thinking, “I’ll handle management, finance, inventory, and even deliveries on my own,” you’re making a mistake. You can’t do everything alone, and you shouldn’t try because it’s one of the reasons businesses fail.

Instead, hire and train people to grow your business faster. You might say, “But hiring is an expense, right?” Yes, it is. But it’s the kind of expense that pays you back by taking work off your plate.

Hiring isn’t just about keeping the business running—it’s about creating space for growth.

For example, if someone brings in orders for you, all you need to focus on is delivery. That frees up your energy to double down on what you do best and explore new opportunities that push the business forward.

Here’s a hack most people miss: Hiring alone isn’t enough. If you bring people on board but don’t train them, it’s like buying a car and never learning how to drive—you’ll just leave it parked.

A trained team doesn’t just work; they multiply your efforts. They understand your way of doing things, uphold your standards, and free you up to focus on strategy and growth.

9) Secure the right funding (don’t overraise)

Everything in life has a limit; whether it’s food, drink, or even funding. Many business owners believe that raising more money automatically means faster growth, but that’s not how it works.

Just like you should eat only as much as your body needs, you should raise only as much funding as your business truly requires.

Over-funding often leads to two problems: You give up too much control, and you spend more than necessary.

On the other hand, raising the right amount keeps you disciplined, focused, and aligned with your growth plan—helping you move forward step by step, without losing balance.

Instead of over-raising, ask yourself:

- What stage am I at right now?

- How much capital do I need to hit the next milestone?

- Can I stretch further with smarter systems, stronger sales, or partnerships before raising again?

Remember, the goal isn’t to raise the most; it’s to raise what’s right, at the right time, so your growth stays healthy and sustainable. If you’re not sure about how you need to fund, then create a business plan to secure funding. It will help you know exactly how much to raise and where to use it wisely.

How to expand your business (a few models to consider)

Once your business has achieved steady growth, the next step is to explore expansion models. But remember—not every model is right for every small business.

Here are a few practical paths (with pros, cons, and readiness cues) to consider:

1) Opening a new location

What It Means: This is the classic expansion move—setting up another branch or store to serve a fresh market.

Pros

- Strengthens local presence

- Reaches entirely new customer bases

Cons

- High upfront and operating costs

- Managing multiple locations can get messy

When You’re Ready

If your current location has a strong brand reputation, steady foot traffic, and customers you’re turning away because you’re at capacity, you might be ready to replicate that success.

2) E-commerce/Digital expansion

What it means: Taking your business online—whether that’s through a website, online marketplace, or offering digital products/services.

Pros

- Expands reach beyond your local area

- Scales without huge overhead costs

Cons

- Intense competition online

- Logistics like delivery, returns, and customer support can be tricky

When you’re ready

Think of a retail shop that adds an online store so customers from other cities can buy. If you have products that can ship easily or services you can digitize, this is a strong path.

3) Franchising or licensing

What it means: Allowing others to replicate your proven business model in new locations while you collect fees or royalties.

Pros

- Grows your brand quickly with less of your own capital

- Taps into other people’s local expertise

Cons

- You give up some control over operations

- Requires airtight systems and brand guidelines to maintain consistency

When you’re ready

If you’ve built a repeatable model (like a consultancy with standardized services or a café with a tested playbook), franchising can help scale without spreading yourself too thin.

4) New product or service lines

What It Means: Expanding what you sell by adding complementary products or services to your core offering.

Pros

- Diversifies your revenue streams

- Keeps customers coming back for more

Cons

- Can dilute focus and confuse your brand if done too soon

- Requires extra resources for development, marketing, and support

When you’re ready

If your existing offering is rock solid and customers are already asking for “what’s next,” it’s time. For example, a bakery might launch baking kits or weekend workshops.

5) Market expansion

What It Means: Reaching new demographics or entering different geographies.

Pros

- Unlocks fresh demand

- Expands your share of the market

Cons

- Requires research into new audiences

- May need rebranding or product tweaks to fit the new market

When you’re ready

A fitness studio offering classes tailored for seniors or expanding into a nearby city shows how to do this thoughtfully. You’re ready when your current market feels tapped out, but your systems can support wider reach.

Conclusion

You’re now better equipped to take the next step in growing your business. We covered practical ways to scale—whether through improving systems, diversifying revenue, or expanding into new markets.

If you’re looking to bring structure and clarity to your growth journey, tools like Upmetrics can help you. Its AI-powered business plan generator helps you craft a business plan effectively and within minutes, so that you can concentrate on your core.

Lastly, stay patient, stay focused, and keep building one smart step at a time. Here’s to your journey ahead—may it be full of learning, wins, and new opportunities.