A flow of funds statement is a document created to examine the factors that led to changes in a company’s financial position between two balance sheets. It displays the movement of money in and out, i.e. funding sources and applications for a specific period.

In other words, the source and uses of funds statement explain where a company’s money came from and how the organization has put it to use in the past and how they will use the funds in the future. It is also one of the business plan elements.

It contains the cash inflows into the company, the cash received, the cash outflows from the company, or the money spent.

So, what purpose does it serve?

Mostly, lenders will ask for these statements when you apply for a business loan. It will also help investors understand where the funds have been used.

If sources and uses of funds statement are accurately prepared, it can communicate well with the readers, and hence, it is quite crucial to prepare compelling sources and uses of funds statement.

This article explains the sources and uses of funds statements and the step in creating the statements with examples.

What is the Sources and Uses of the Funds Statement?

A company’s sources and uses of funds is a statement that provides information on how much did the company raise the money and how they were applied to achieve the company’s goals.

The sources and use of funds statements reflect the impact of changes in the balance sheet contents on the organization’s cash-in-hand. These are the statements that also guide organizations in their short-term planning decisions that involve available funds.

These statements are widely used for

- For business loan purposes,

- Attracting investors, and

- Predicting the impact of changes in the balance sheet

The Sources and Uses of Funds have two parts,

- The first part is the sources from which the company gets its funds, and

- The second part is the uses, applications, or spending of the money

Let’s understand both sections of the statement in detail.

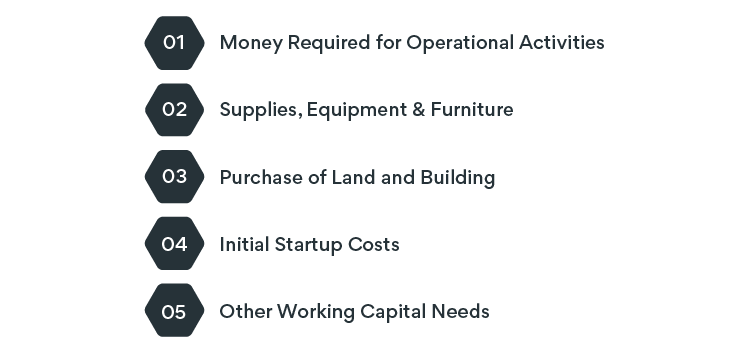

Uses of Funds

Often called the application of funds, the flow of funds statement reflects how an organization used the money it received from various sources. The use of funds can also be understood as cash outflow, since it is the money spent for various activities performed to achieve organizational goals.

It generally consists of the following components:

1. Money Required for Operational Activities

Organizations will need cash and working capital to run the business and perform day-to-day activities.

2. Opening Quantities of Supplies, Equipment, and Furniture

The opening balance of the supplies, equipment, and furniture tells us where the organization has already spent its money.

3. Purchase of Land and Building

The amount spent on acquiring land and building for business use is a huge capital expense and results in cash outflow.

4. Initial Startup Costs

These costs include rent, deposits paid for the rented building/apartment, machinery acquisition costs, initial payments for insurance, company setup costs, etc.

5. Other Working Capital Needs

These include other operating costs such as the rental expenses of the leased machinery, repairs and maintenance expenses, outsourcing costs, etc.

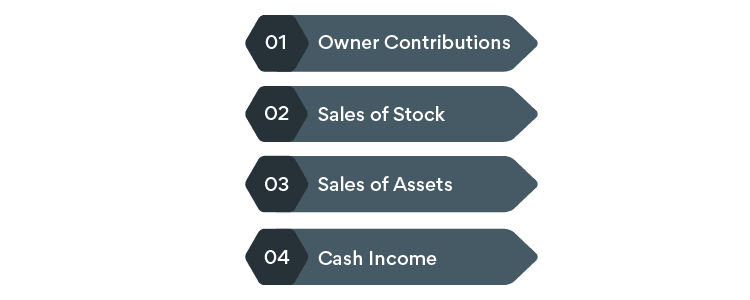

Sources of Funds

Businesses need capital or funding to run the operations and when the new business is set up, it requires sufficient funding to incur initial start-up costs.

Hence, the sources of funds also include the money your investors have given to you.

Below are the other elements of the sources of funds for most businesses.

1. Owner Contributions

Owners of the businesses bring specific amounts of capital to start the company and they also contribute more capital as and when needed from time to time.

2. Sales of Stock

It includes the sale of finished goods and any other inventory that will not be used by the company.

3. Sales of Assets

The assets that the companies sell due to the discontinuance of some of the operations or assets becoming non-operatable are another source of funds.

4. Cash Income

Any other cash income generated from the sale is also considered one of the sources of funds.

Funds statement’s uses

The following are prominent uses of funds:

- Adjusting operating net loss

- Purchase of non-current assets

- Repayment of either long-term or short-term debt, such as bank loans (debentures or bonds)

- Redeemable preference share redemption

- Payment of dividends in cash

Steps to Create the Sources and Uses of Funds Statement

One of the essential tasks of an organization in preparing the financial statements of the company would be to prepare the sources and uses of funds statement.

It is because the statement reflects the efficiency of the business in depicting how effectively funds were utilized from the available sources. Even if you want to fund, then you will need these fund statements in your business plan. If you are not aware of that, then worry not, visit our business plan app.

The uses of funds section are prepared first, and then the sources of funds.

Let’s learn how to prepare the uses of funds section of the sources and uses of the fund’s statement.

Steps to Create Uses of Funds

- Note down all the costs included in the uses of funds, such as plant and machinery, initial startup costs, suppliers and marketing expenses, and other working capital costs.

- Add all the numbers and make a total to name ‘total of startup costs’ as shown in the example below.

- Once you have added all the uses of funds costs, write an estimate of

- The capital costs required for purchasing the buildings, machinery, and vehicles and

- The working capital requirements to fund day-to-day operations.

While generating the uses of funds statement, focus on all the needs for the smooth and profitable functioning of the business rather than on the sources of funds.

Steps to Create Sources of Funds

- This section lists all the sources of funds, depicting where the money has come to fund the business.

- List the contributions received from the owners and the investors.

- Write the security that you offer for the loan you wish to secure.

- Any other sources of funds that you can use to fund the business in case you cannot pay the loan?

- It is also advisable to include all details concerning the contribution particulars.

Sample Sources and Uses of Funds Statement

While preparing the statement for sources and uses of funds, please note it has to be simple, and easy to understand. If you complicate the statement by adding difficult terms or complex numbers, readers may misinterpret the statement, and you may lose a potential investor or a bank loan.

Statement of Sources and Uses of Funds:

| Plant and Machinery Costs | 112,000 | Owners’ Contributions | 5,54,000 |

| Facilities Costs | 543,000 | Collateral | 67,000 |

| Suppliers and Marketing Costs | 90,600 | Home Equity | 31,000 |

| Other Startup Costs | 78,000 | Sale of Stocks | 198,400 |

| Total Startup Costs | 823,600 | Total Sources of Funds | 8,51,000 |

| Working Capital Required | 250,000 | Total to be Financed | 222,600 |

| Total Uses of Funds | 10,73,600 | Total Sources of Funds | 10,73,600 |

The Bottom Line

As you grow your business, you may need more funds to meet the business expansion costs, and hence, it is important not only the startup companies but the well-established businesses as well to craft a compelling statement of sources and uses of funds.

How Can We Help?

We can help you prepare the statement of sources and uses of funds faster and more accurately along with other reports such as financial statements, and ratio analysis to help you better understand the financial position of your company.

Request your free demo at Upmetrics ~ a business plan app to input only the minimum elements so that we can compute it for you.