Starting a business in New York is a great idea, for it has people of all kinds who are interested in all kinds of products and services. It’s really a buffet of customers. (Check out Sweet Pickle Books. You’re welcome.)

But obviously, there’s paperwork, licenses, taxes, and so many moving parts that it’s hard to know what comes first.

Don’t worry, though, this guide is here to make that journey easier for you.

- Where do you start?

- What requirements do you need?

- What steps should you follow?

I’ve covered all of that in this blog.

As a business consultant, I’ve spent years helping businesses in New York push through struggles and find their way to growth. Today, I’m sharing the same process and steps with you on how to start a business in New York.

They may not be an exact fit for every single business, but they’ll give you a clear direction, practical guidance, and a solid foundation to build on.

Ready? Let’s begin.

Insights: How is New York for business in 2026

Before we jump into the process of starting a business in New York, you should understand the city’s dynamics. It gives you the context to make smarter decisions and avoid costly mistakes.

Here’s a comprehensive insight into NewYork’s business environment:

| Category | Key Insights |

|---|---|

| Population | 19.8M total (Male: 9.63M, Female: 10.21M) |

| Workforce & Visitors | 65M people enter NYC every year for work & leisure |

| Registered Businesses | 570,214 active businesses (Taxable) |

| Top Industries | Finance, Medical, Media, Food, Fashion |

| Economic Power | Gross Metropolitan Product (GMP): $2.29 Million annually |

| Sales Tax Collections | $19B annually (indicator of strong consumer spending) |

| Per capita income | Highest in the nation $92,341 |

| Consumer Behavior | NYC customers purchase 5% more items per order |

New York’s numbers tell a clear story: The market is massive, the spending power is unmatched, and the opportunities are real, but so is the competition.

For entrepreneurs, this means two things:

1) If you get your positioning right, the city can multiply your growth faster than anywhere else in the U.S.

2) If you don’t, the same intensity can swallow you quickly.

The key is entering prepared, with a clear niche and solid execution. Thus, let’s step into the process to start a business in New York with the right execution. Remember, these aren’t ordinary steps you’ll find on a government website; they’re the real-world, consultant-tested steps.

10 Steps to Starting a Business in New York

Starting a business in New York State requires you to follow the right legal steps, understand the market, and make strategic choices that fit the city’s unique pace.

Thus, here’s a step-by-step guide to get started:

Step 1: Understand the market

It means digging deep into the business you’re about to start.

For example, you’re planning to open a coffee shop. There are plenty of coffee shops in New York already, so what will make yours stand out?

You find the answer by studying the market. Maybe you discover that most cafés in your neighborhood focus on quick grab-and-go customers. That insight could help you design a cozy space where people can sit, work, and spend more time. Which in turn means they’ll also spend more money.

So, ask yourself:

- Where are your customers? (Students, remote workers, and locals nearby)

- What do they really want? (A comfortable space, Wi-Fi, charging points, and good coffee)

- What gaps exist that no one’s filling? (An affordable café that feels like a mini coworking hub)

When you understand these things, every other step, legal setup, branding, even funding, becomes so much easier, because you’re building on solid ground.

Step 2: Plan your business

New York City moves fast, competition is everywhere, and without a plan, you’ll get lost before you even get started.

Your business plan doesn’t need to be a 50-page document, but it does need to answer the tough questions and give you direction. Here’s a simple guide our founder, Vinay, wrote on how to create a business plan that helps you move forward.

However, if you want to get started, here are a few things to take care of while building it:

- Be clear about your business model

- Identify your target customers

- Study your competition

- Outline your startup costs and funding

- Map out your marketing strategy

- Set short-term and long-term goals

I know there’s a lot to think about when putting together your business plan, but treat it as your safety net. A business plan is a guide that keeps you steady, especially in a state like New York.

Not very good at writing? Need help with your plan?

Write your business plan 10X faster with Upmetrics AI

Plans starting from $14/month

Step 3: Get the legal setup right

A legal structure serves as the foundation of your business, giving your company its identity. It shows whether you’re a sole proprietor, in a partnership, or running an LLC.

Moreover, business structure is important because it determines:

- How do you pay taxes

- The level of personal risk you take on

- How professional your business appears to banks, investors, and even clients.

Your legal structure choice will depend on your goals, risk tolerance, and funding needs. The common legal structures are Sole Proprietorship, Partnership, LLC (Limited Liability Company), Corporation (C-Corp or S-Corp), and Non-profit organization.

While each structure has its features and pros, in New York, most entrepreneurs prefer an LLC. Why? Because it offers Personal liability protection. What does that mean? Your personal assets (house, savings, car) aren’t at risk if your business runs into trouble.

Additionally, LLCs are flexible in taxation; you can choose to be taxed as a sole proprietorship, partnership, or even a corporation. It depends on what saves you more money.

If you want to start an LLC in New York, here’s the complete process with its cost:

| Process | Description | Fee |

|---|---|---|

| Choose a Name | Pick a unique name that meets New York’s rules. Check availability online. | Free |

| File Articles | File Articles of Organization (Form DOS-1336) with the NY Dept. of State. | $200 |

| Registered Agent | NY Secretary of State acts as your default agent, or you can appoint your own. | Included |

| Publication Rule | Publish your LLC info in 2 local newspapers for 6 weeks. Then file the certificate. | $1,000** + $50 filing |

| Get an EIN | Apply online at the IRS website to get your tax ID. | Free |

| Operating Agreement | Draft internal rules, ownership, and roles (recommended, not filed). | Free–Varies |

| Biennial Statement | File every 2 years to stay compliant. | $9 |

Step 4: Apply for a license and permit

The right licenses and permits keep your New York business legal, protected, and open for growth. You can’t afford to miss even one; otherwise, be ready to face fines, delays, or even a shutdown.

Thus, apply for business licensing and permits as soon as you’re ready with your business name and plan.

The official site for business licenses and permits in New York is the NY Business Express portal. It’s your one-stop place to search, apply, and track permits specific to your industry.

Moreover, to register your business in NY, you need a few common documents:

- Proof of business registration

- Employer Identification Number

- Proof of address

- Personal identification

- Any industry-specific certifications

Step 5: Open a bank account

After setting up your LLC and getting your licenses, the very first thing you should do is open a business bank account. Why?

Mixing personal and business money creates confusion when it comes to taxes, loans, and dealing with investors.

Here are the simple steps to open a bank account:

| Step | What to Do | Fee/Notes |

|---|---|---|

| Choose a Bank | Pick a national or local bank based on services & fees | Free to $50 minimum deposit |

| Apply | Online or in-person; schedule an appointment if needed | Varies by bank |

| Provide Documents | LLC papers, EIN, ID, Operating Agreement, business address | Required for approval |

| Deposit Funds | Make an opening deposit | $50–$500, depending on the bank |

| Set Up Tools | Online banking, merchant services, and bill pay | Usually included |

Step 6: Build a network & team

In New York, the right connections and people can move your business forward faster than money alone. This city is full of events, communities, and talent; you just need to know how to tap into it.

Here’s how you can start building your network and team:

Networking in NYC

- Attend local meetups, events, and industry conferences

- Join chambers of commerce, startup hubs, and coworking spaces

- Use LinkedIn and alumni groups to connect directly

- Always add value; don’t just ask for help, offer it too

- Show your expertise by posting content on social media

Building Your Team

- Start lean, hire for the most critical roles first

- Test with freelancers or consultants before going full-time

- Focus on cultural fit, not just skills

- Offer clear growth opportunities to keep talent motivated

When deciding where to meet people and which positions to hire, the most crucial thing is to behave consistently. Make time each week to follow up with people you’ve met, attend events, and make connections with potential partners.

Additionally, before hiring, explicitly identify roles and responsibilities while constructing your team. This expedites the onboarding process and ensures that everyone is immediately aware of their specific responsibilities.

Step 7: Marketing and brand building

There are countless ways to market in New York, including billboards, pamphlets, local events, subway posters, street ads, and, if funds permit, Times Square.

But social media is the best (and most economical) approach to develop your brand. The metropolis sets trends for the rest of the world, and New Yorkers are huge fans of social media. You can win offline here if you can win online.

The most used social media platforms in New York are Instagram, TikTok, YouTube, LinkedIn, and Facebook. Ensure to showcase your product on this platform to market and build your own brand.

Step 8: Fund your New York business

If you want to do business in New York, remember one thing: Capital is king. Having the right funds makes running and growing your business in an expensive state like New York much easier.

For example, you’re opening a small boutique. Before you sign the lease, calculate the following aspects:

- Startup costs

- Rent

- Renovations

- Inventory

- Initial salaries

Once the aforementioned costs have been determined, obtain your money from a combination of governmental grants, small company loans, and personal savings.

If you have money on hand before day one, you can pay for unanticipated costs like a delayed shipment or equipment maintenance. Getting more money also ensures that your business operations will continue without interruption.

By planning for startup costs upfront, you can avoid scrambling for money mid-month and keep your business running smoothly from the start.

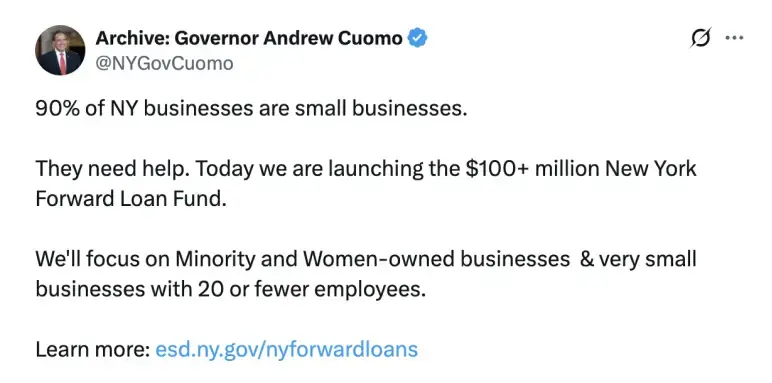

The good news? New York doesn’t just make things expensive; it also supports entrepreneurs, especially women and small businesses. The state and city governments offer small business grants, low-interest loans, and incentive programs to help startups get off the ground.

Pair that with private funding sources like angel investors, VCs, and crowdfunding, and you’ve got plenty of ways to raise capital.

Additionally, to give you more clarity on this, my team has put together a list of available grants in New York; make sure to check it out for reference.

In short, plan your finances well today so your business doesn’t stumble tomorrow.

Step 9: Understand business tax credits

Taxes in New York can feel overwhelming, but the good news is that there are tax credits that can actually save your business money. The trick is knowing which credits apply to you and how to claim them.

To make it easier, I’ve put together a quick table of popular New York business tax credits. This will help you get a glance at which ones might work for your business.

| Tax Credit | Who It’s For | Key Benefit | How to Claim |

|---|---|---|---|

| Excelsior Jobs Program | Businesses are creating new jobs in targeted industries | Up to 6.85% tax credit on qualified wages | Must meet job creation and investment requirements |

| Investment Tax Credit (ITC) | Businesses investing in machinery, equipment, or property | 5%–9% credit on eligible investments | Keep receipts and proof of purchase |

| Green Building & Energy Credits | Businesses installing energy-efficient equipment | Varies; reduces tax liability | Documentation of installation required |

| Research & Development (R&D) Credit | Companies developing new products or processes | 10%–20% credit on qualified R&D expenses | Track all R&D costs carefully |

| Hiring Incentive Credits | Businesses hiring veterans, local residents, or certain target groups | Tax credit per eligible employee | Must maintain hiring records for audit |

Let’s understand tax credit with an example. Let’s say you run a small coffee shop in Brooklyn and decide to hire two local veterans.

You could qualify for the Hiring Incentive Credit, which reduces your state taxes for each eligible employee. All you need to do is maintain proper hiring records and claim it when filing your taxes.

Here’s how you can go about it:

- Look up New York State business tax credits on the official state website.

- Read the requirements carefully; some credits are industry-specific.

- Payroll records, invoices, receipts, and proof of investments will usually be needed.

- Work with your accountant or use tax software to apply the credit correctly.

Step 10: Launch your business

It’s finally time!

Start modestly and avoid waiting for perfection. Inform people of your existence, launch your website or business, and start serving your first customers. In New York, if you take the initiative, word-of-mouth spreads swiftly.

To help you stay on course, here’s a basic launch checklist:

- Use of email, social media, or a small launch party.

- Ensure that delivery, billing, and payments all go without a hitch.

- Speak with your initial clients; they will advise you on what is and is not working.

Conclusion

From understanding the market to choosing business structure and licensing to fundraising, we discussed each step in detail. Now, it’s time to build your New York business and use these steps for a smooth process.

However, if you need a fast way to organize your ideas, Upmetrics lets you build a professional plan in minutes. With an AI business plan generator, you spend less time on paperwork and more on bringing your vision to life.

Cheers to your Big Apple dream!

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.